Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 7/11/2025

Table of Contents

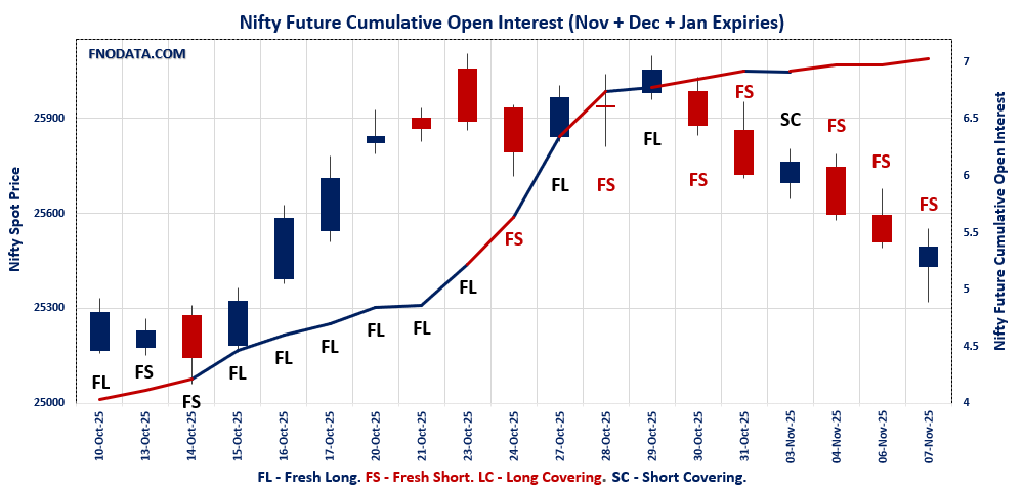

NIFTY’s Open Interest Volume Analysis flags aggressive fresh short buildup: Combined open interest jumps 5.4% while price stays soft, confirming repeated short-side attempts across November and December futures.

Near- and far-month contracts echo the bearish signal: Open interest rises 5% to 10% in both November and December, paired with declining premiums and no price lift—classic conditions for persistent shorting.

Options sentiment offers mild support at max pain: Weekly PCR rises to 0.884 (from 0.627), suggesting some put writing, but monthly PCR slips under 1, showing call writers still dominate.

Max pain and option additions tighten support-resistance zones: Most active strikes and highest additions cluster at 25500–25800; open interest now defines a trading range where sellers retain control on rallies.

Volatility and volume spike: Surge in combined futures volume (+52.9%) amplifies the conviction behind fresh shorts—institutions are committing real capital to the trade.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25492.3 (-0.1%)

Combined = November + December + January

Combined Fut Open Interest Change: 5.4%

Combined Fut Volume Change: 52.9%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 8% Previous 8%

NIFTY NOVEMBER Future closed at: 25589.2 (-0.1%)

November Fut Premium 96.9 (Decreased by -20.6 points)

November Fut Open Interest Change: 5.0%

November Fut Volume Change: 52.9%

November Fut Open Interest Analysis: Fresh Short

NIFTY DECEMBER Future closed at: 25780.2 (-0.1%)

December Fut Premium 287.9 (Decreased by -9.5 points)

December Fut Open Interest Change: 10.6%

December Fut Volume Change: 53.3%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (11/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.884 (Increased from 0.627)

Put-Call Ratio (Volume): 0.933

Max Pain Level: 25500

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25300

Highest CALL Addition: 25500

Highest PUT Addition: 25300

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.952 (Decreased from 1.045)

Put-Call Ratio (Volume): 0.846

Max Pain Level: 25800

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 25200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 57876.8 (0.6%)

Combined = November + December + January

Combined Fut Open Interest Change: -1.7%

Combined Fut Volume Change: 78.6%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 9%

BANKNIFTY NOVEMBER Future closed at: 58181.6 (0.5%)

November Fut Premium 304.8 (Decreased by -27.75 points)

November Fut Open Interest Change: -1.6%

November Fut Volume Change: 77.8%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY DECEMBER Future closed at: 58541 (0.5%)

December Fut Premium 664.2 (Decreased by -35.55 points)

December Fut Open Interest Change: -6.0%

December Fut Volume Change: 73.5%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.911 (Increased from 0.781)

Put-Call Ratio (Volume): 0.931

Max Pain Level: 58000

Maximum CALL Open Interest: 58000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 58500

Highest PUT Addition: 58500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27238.75 (0.8%)

Combined = November + December + January

Combined Fut Open Interest Change: -6.5%

Combined Fut Volume Change: -10.9%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 3% Previous 2%

FINNIFTY NOVEMBER Future closed at: 27382 (0.7%)

November Fut Premium 143.25 (Decreased by -6.75 points)

November Fut Open Interest Change: -6.8%

November Fut Volume Change: -14.2%

November Fut Open Interest Analysis: Short Covering

FINNIFTY DECEMBER Future closed at: 27550.2 (0.7%)

December Fut Premium 311.45 (Decreased by -3.95 points)

December Fut Open Interest Change: 6.3%

December Fut Volume Change: 150.0%

December Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.911 (Increased from 0.847)

Put-Call Ratio (Volume): 0.641

Max Pain Level: 27300

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 25500

Highest CALL Addition: 28500

Highest PUT Addition: 27000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13446.75 (0.5%)

Combined = November + December + January

Combined Fut Open Interest Change: 2.7%

Combined Fut Volume Change: 30.5%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 3%

MIDCPNIFTY NOVEMBER Future closed at: 13472 (0.4%)

November Fut Premium 25.25 (Decreased by -11.8 points)

November Fut Open Interest Change: 2.7%

November Fut Volume Change: 32.6%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY DECEMBER Future closed at: 13533.2 (0.4%)

December Fut Premium 86.45 (Decreased by -12.25 points)

December Fut Open Interest Change: 2.8%

December Fut Volume Change: -4.1%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.033 (Increased from 0.932)

Put-Call Ratio (Volume): 1.103

Max Pain Level: 13450

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 13800

Highest PUT Addition: 13300

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 83,216.28 (-0.11%)

SENSEX Monthly Future closed at: 83,663.30 (-0.15%)

Premium: 447.02 (Decreased by -32.07 points)

Open Interest Change: 3.9%

Volume Change: -21.4%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (13/11/2025) Option Analysis

Put-Call Ratio (OI): 1.123 (Increased from 0.706)

Put-Call Ratio (Volume): 0.974

Max Pain Level: 83300

Maximum CALL OI: 87000

Maximum PUT OI: 82000

Highest CALL Addition: 83000

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 4,581.34 Cr.

DIIs Net BUY: ₹ 6,674.77 Cr.

FII Derivatives Activity

| FII Trading Stats | 7.11.25 | 6.11.25 | 4.11.25 |

| FII Cash (Provisional Data) | 4,581.34 | -3,263.21 | -1,067.01 |

| Index Future Open Interest Long Ratio | 13.22% | 14.29% | 15.22% |

| Index Future Volume Long Ratio | 33.16% | 44.57% | 38.66% |

| Call Option Open Interest Long Ratio | 50.55% | 48.94% | 50.80% |

| Call Option Volume Long Ratio | 50.19% | 49.71% | 50.33% |

| Put Option Open Interest Long Ratio | 62.66% | 63.55% | 66.55% |

| Put Option Volume Long Ratio | 50.18% | 50.01% | 50.76% |

| Stock Future Open Interest Long Ratio | 60.51% | 60.76% | 60.91% |

| Stock Future Volume Long Ratio | 48.27% | 49.22% | 44.10% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Short Covering | Long Covering | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Short | Long Covering |

| FinNifty Options | Long Covering | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Short | Long Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (13/11/2025)

The SENSEX index closed at 83216.28. The SENSEX weekly expiry for NOVEMBER 13, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.123 against previous 0.706. The 87000CE option holds the maximum open interest, followed by the 82000PE and 78000PE options. Market participants have shown increased interest with significant open interest additions in the 78000PE option, with open interest additions also seen in the 82000PE and 83000PE options. On the other hand, open interest reductions were prominent in the 83500PE, 83400PE, and 83800PE options. Trading volume was highest in the 83000PE option, followed by the 82800PE and 83500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 13-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83216.28 | 1.123 | 0.706 | 0.974 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 81,52,200 | 44,64,540 | 36,87,660 |

| PUT: | 91,58,200 | 31,51,020 | 60,07,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 6,85,000 | 2,12,500 | 51,54,780 |

| 83500 | 4,88,840 | 95,860 | 1,63,73,140 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 3,36,140 | 2,56,920 | 1,56,30,440 |

| 87000 | 6,85,000 | 2,12,500 | 51,54,780 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85800 | 63,640 | -2,540 | 10,20,600 |

| 88400 | 1,460 | -80 | 34,460 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 4,88,840 | 95,860 | 1,63,73,140 |

| 83000 | 3,36,140 | 2,56,920 | 1,56,30,440 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,44,340 | 3,76,900 | 1,02,98,320 |

| 78000 | 5,18,880 | 4,79,580 | 30,12,400 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 5,18,880 | 4,79,580 | 30,12,400 |

| 82000 | 5,44,340 | 3,76,900 | 1,02,98,320 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 3,02,600 | -46,340 | 49,18,960 |

| 83400 | 1,28,640 | -23,400 | 46,48,640 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,90,640 | 3,06,520 | 1,99,68,080 |

| 82800 | 3,23,340 | 2,80,860 | 1,64,41,840 |

NIFTY Weekly Expiry (11/11/2025)

The NIFTY index closed at 25492.3. The NIFTY weekly expiry for NOVEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.884 against previous 0.627. The 26000CE option holds the maximum open interest, followed by the 25300PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25300PE option, with open interest additions also seen in the 25400PE and 25350PE options. On the other hand, open interest reductions were prominent in the 26050CE, 26300CE, and 25700PE options. Trading volume was highest in the 25400PE option, followed by the 25500CE and 25300PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 11-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,492.30 | 0.884 | 0.627 | 0.933 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,42,03,375 | 18,37,62,075 | 4,41,300 |

| PUT: | 16,28,61,000 | 11,51,90,925 | 4,76,70,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,50,97,200 | 24,34,275 | 17,71,701 |

| 25,700 | 1,05,92,700 | -1,61,100 | 34,02,606 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 83,06,550 | 38,30,550 | 69,84,961 |

| 25,400 | 36,95,250 | 29,93,700 | 49,83,176 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,050 | 30,96,450 | -21,44,550 | 7,73,767 |

| 26,300 | 53,05,875 | -15,46,200 | 11,78,374 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 83,06,550 | 38,30,550 | 69,84,961 |

| 25,400 | 36,95,250 | 29,93,700 | 49,83,176 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,19,33,625 | 64,38,150 | 59,71,937 |

| 25,000 | 1,13,05,950 | 26,90,175 | 18,90,283 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,19,33,625 | 64,38,150 | 59,71,937 |

| 25,400 | 1,06,17,825 | 48,91,050 | 71,38,508 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 14,69,025 | -15,22,650 | 3,77,633 |

| 25,550 | 18,22,125 | -12,42,975 | 18,30,766 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,06,17,825 | 48,91,050 | 71,38,508 |

| 25,300 | 1,19,33,625 | 64,38,150 | 59,71,937 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25492.3. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.952 against previous 1.045. The 26000CE option holds the maximum open interest, followed by the 25000PE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25500CE and 25200PE options. On the other hand, open interest reductions were prominent in the 25300PE, 25800PE, and 26900CE options. Trading volume was highest in the 26000CE option, followed by the 25000PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,492.30 | 0.952 | 1.045 | 0.846 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,73,81,025 | 4,36,65,975 | 37,15,050 |

| PUT: | 4,51,26,675 | 4,56,50,100 | -5,23,425 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,46,500 | 8,28,525 | 1,46,423 |

| 27,000 | 38,89,350 | 2,325 | 38,709 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,46,500 | 8,28,525 | 1,46,423 |

| 25,500 | 25,44,600 | 7,97,400 | 1,14,914 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 5,23,275 | -2,42,700 | 15,166 |

| 26,200 | 25,41,150 | -1,86,375 | 55,650 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,46,500 | 8,28,525 | 1,46,423 |

| 25,500 | 25,44,600 | 7,97,400 | 1,14,914 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,59,225 | -1,23,300 | 1,27,719 |

| 26,000 | 41,05,800 | -2,35,500 | 26,606 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 22,07,475 | 4,78,650 | 44,557 |

| 25,500 | 39,15,750 | 3,58,275 | 1,12,457 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 11,48,925 | -10,42,275 | 65,397 |

| 25,800 | 20,34,900 | -3,06,525 | 28,252 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,59,225 | -1,23,300 | 1,27,719 |

| 25,500 | 39,15,750 | 3,58,275 | 1,12,457 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 57876.8. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.911 against previous 0.781. The 58000CE option holds the maximum open interest, followed by the 58000PE and 58500CE options. Market participants have shown increased interest with significant open interest additions in the 58500PE option, with open interest additions also seen in the 58500CE and 57500PE options. On the other hand, open interest reductions were prominent in the 57000CE, 58000PE, and 57700CE options. Trading volume was highest in the 58000CE option, followed by the 57500PE and 58000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,876.80 | 0.911 | 0.781 | 0.931 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,43,14,755 | 1,46,53,730 | -3,38,975 |

| PUT: | 1,30,38,095 | 1,14,48,010 | 15,90,085 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,29,500 | -58,590 | 1,69,406 |

| 58,500 | 13,41,480 | 2,76,395 | 1,22,440 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 13,41,480 | 2,76,395 | 1,22,440 |

| 58,800 | 2,39,715 | 45,290 | 21,238 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 5,55,905 | -2,92,985 | 46,130 |

| 57,700 | 1,19,000 | -58,905 | 61,253 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,29,500 | -58,590 | 1,69,406 |

| 58,500 | 13,41,480 | 2,76,395 | 1,22,440 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,16,935 | -2,03,210 | 1,46,846 |

| 57,000 | 12,70,290 | 1,71,080 | 1,26,462 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 9,66,560 | 5,01,445 | 47,547 |

| 57,500 | 7,33,250 | 1,73,110 | 1,63,167 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,16,935 | -2,03,210 | 1,46,846 |

| 57,600 | 1,63,765 | -49,560 | 68,737 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 7,33,250 | 1,73,110 | 1,63,167 |

| 58,000 | 15,16,935 | -2,03,210 | 1,46,846 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27238.75. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.911 against previous 0.847. The 27500CE option holds the maximum open interest, followed by the 28500CE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 28500CE option, with open interest additions also seen in the 27000PE and 28400CE options. On the other hand, open interest reductions were prominent in the 29000CE, 27300CE, and 26000PE options. Trading volume was highest in the 27300CE option, followed by the 27000PE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,238.75 | 0.911 | 0.847 | 0.641 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,67,160 | 7,27,870 | -60,710 |

| PUT: | 6,07,815 | 6,16,200 | -8,385 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 87,880 | -14,755 | 3,595 |

| 28,500 | 86,775 | 47,905 | 1,590 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,500 | 86,775 | 47,905 | 1,590 |

| 28,400 | 15,470 | 11,180 | 449 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 48,360 | -52,195 | 2,243 |

| 27,300 | 41,925 | -47,255 | 7,672 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 41,925 | -47,255 | 7,672 |

| 27,500 | 87,880 | -14,755 | 3,595 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 69,615 | 10,140 | 607 |

| 27,000 | 55,835 | 17,940 | 4,329 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 55,835 | 17,940 | 4,329 |

| 25,500 | 69,615 | 10,140 | 607 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 37,635 | -34,320 | 1,483 |

| 26,700 | 15,795 | -11,440 | 467 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 55,835 | 17,940 | 4,329 |

| 27,300 | 29,575 | -2,015 | 1,599 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13446.75. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.033 against previous 0.932. The 14000CE option holds the maximum open interest, followed by the 13500CE and 13500PE options. Market participants have shown increased interest with significant open interest additions in the 13300PE option, with open interest additions also seen in the 13100PE and 13400PE options. On the other hand, open interest reductions were prominent in the 70500PE, 70000CE, and 69800CE options. Trading volume was highest in the 13300PE option, followed by the 13400CE and 13000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,446.75 | 1.033 | 0.932 | 1.103 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 66,54,200 | 65,73,280 | 80,920 |

| PUT: | 68,72,880 | 61,27,100 | 7,45,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,88,540 | -85,960 | 13,379 |

| 13,500 | 7,61,180 | 29,820 | 17,007 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,05,300 | 84,420 | 9,768 |

| 13,400 | 5,40,960 | 68,460 | 18,500 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,88,540 | -85,960 | 13,379 |

| 14,400 | 2,25,820 | -45,360 | 2,377 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 5,40,960 | 68,460 | 18,500 |

| 13,500 | 7,61,180 | 29,820 | 17,007 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 7,31,080 | 49,280 | 9,041 |

| 13,400 | 7,25,900 | 93,940 | 16,652 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 7,00,980 | 2,18,120 | 22,040 |

| 13,100 | 3,93,680 | 1,07,380 | 5,544 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,25,800 | -1,45,600 | 17,468 |

| 12,200 | 1,00,660 | -12,600 | 1,111 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 7,00,980 | 2,18,120 | 22,040 |

| 13,000 | 6,25,800 | -1,45,600 | 17,468 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Bearish bias holds firm across the index complex: Open Interest Volume Analysis across NIFTY, SENSEX, and BANKNIFTY reflects a consistent short-heavy environment, with only selective signs of short covering in financials and midcaps.

Actionable feedback for traders: Short rallies against max pain zones (25500–25800) and respect signal from low monthly PCR—avoid premature long bets until sustained short unwinding appears in OI and PCR climbs above 1.

Sector cues for rotation: If FINNIFTY volume stabilizes and open interest turns positive, shift focus to possible rebounds in banking and finance; for now, stick to defensive, tactical profit-taking.

Risk management: Use option max pain and volume spikes for setting stops and targets; with volatility up, avoid oversized positions.

Stay tactical: Open Interest Volume Analysis keeps favoring a defensive posture and quick trade setups—wait for a decisive shift before assuming trend reversal.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]