Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 13/11/2025

Table of Contents

NIFTY’s Open Interest Volume Analysis points to tactical short covering: Combined open interest edges lower (-0.30%) as prices stay flat to slightly positive, revealing institutional traders are unwinding shorts after a brief bullish push.

Divergence between contracts: Near-month November futures show long covering, while December contracts jump (+6.89% OI) despite lower prices—signaling selective fresh shorts building further out even as immediate pressure eases.

Option chain signals mixed undertones: Weekly PCR (Open Interest) drops from 1.308 to 1.057, hinting at waning put writing and return of call writers near high strikes; monthly PCR nudges up to 1.005, reflecting a neutral-to-defensive stance around 25900 max pain.

Max pain and major additions form a tight trading band: Most active strikes, highest additions, and pain levels frame support and resistance zones between 25800–25900, suggesting the index could stay range-bound with intraday volatility.

Volume remains muted, confirming hesitation: Slight volume dip and open interest shuffle show that aggressive directional trades are absent, with institutions waiting for clearer signals.

NSE & BSE F&O Market Signals

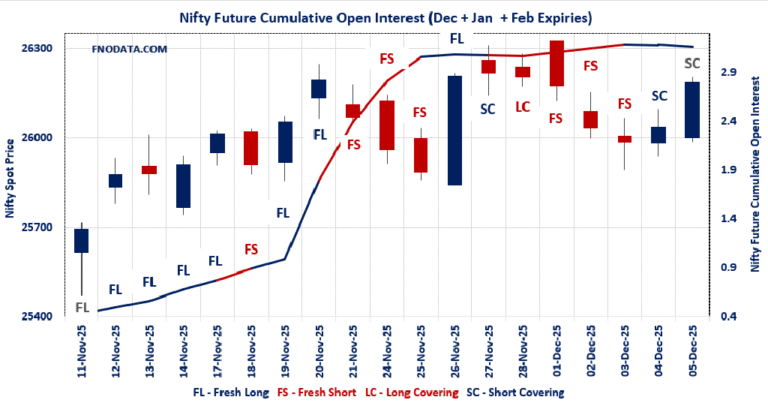

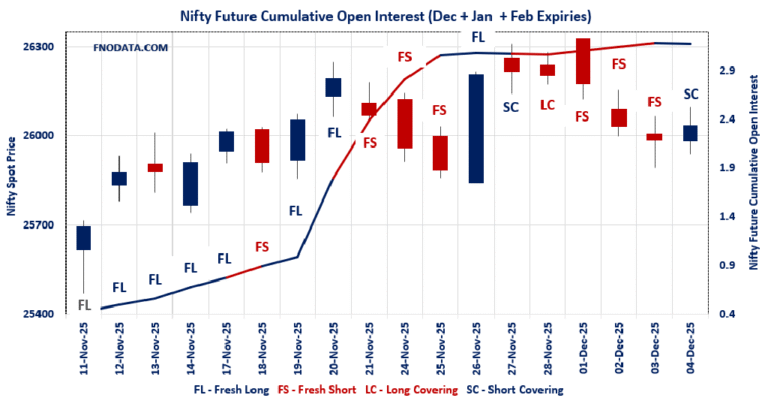

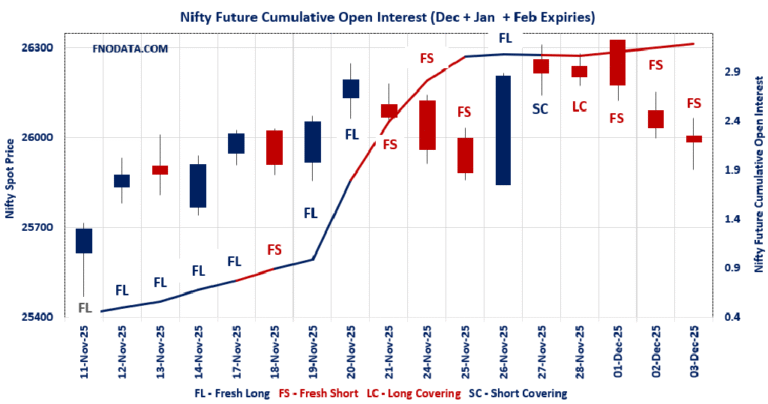

NIFTY Future analysis

NIFTY Spot closed at: 25879.15 (0.013%)

Combined = November + December + January

Combined Fut Open Interest Change: -0.30%

Combined Fut Volume Change: -1.60%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 10% Previous 9%

NIFTY NOVEMBER Future closed at: 25953.8 (-0.124%)

November Fut Premium 74.65 (Decreased by -35.65 points)

November Fut Open Interest Change: -0.99%

November Fut Volume Change: -1.85%

November Fut Open Interest Analysis: Long Covering

NIFTY DECEMBER Future closed at: 26134.9 (-0.111%)

December Fut Premium 255.75 (Decreased by -32.45 points)

December Fut Open Interest Change: 6.89%

December Fut Volume Change: -2.51%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (18/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.057 (Decreased from 1.308)

Put-Call Ratio (Volume): 0.899

Max Pain Level: 25900

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 25000

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.005 (Increased from 0.978)

Put-Call Ratio (Volume): 0.943

Max Pain Level: 25900

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26300

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58381.95 (0.184%)

Combined = November + December + January

Combined Fut Open Interest Change: -6.98%

Combined Fut Volume Change: 11.28%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 11% Previous 10%

BANKNIFTY NOVEMBER Future closed at: 58535 (0.020%)

November Fut Premium 153.05 (Decreased by -95.5 points)

November Fut Open Interest Change: -8.6%

November Fut Volume Change: 10.2%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY DECEMBER Future closed at: 58888.8 (0.036%)

December Fut Premium 506.85 (Decreased by -86.1 points)

December Fut Open Interest Change: 5.79%

December Fut Volume Change: 22.24%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.938 (Increased from 0.927)

Put-Call Ratio (Volume): 0.870

Max Pain Level: 58200

Maximum CALL Open Interest: 58500

Maximum PUT Open Interest: 58500

Highest CALL Addition: 58500

Highest PUT Addition: 54500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27396.15 (0.215%)

Combined = November + December + January

Combined Fut Open Interest Change: -2.8%

Combined Fut Volume Change: 1.7%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 4% Previous 4%

FINNIFTY NOVEMBER Future closed at: 27476 (0.060%)

November Fut Premium 79.85 (Decreased by -42.3 points)

November Fut Open Interest Change: -2.88%

November Fut Volume Change: 6.98%

November Fut Open Interest Analysis: Short Covering

FINNIFTY DECEMBER Future closed at: 27622 (0.025%)

December Fut Premium 225.85 (Decreased by -51.8 points)

December Fut Open Interest Change: 0.00%

December Fut Volume Change: -46.43%

December Fut Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.826 (Decreased from 0.875)

Put-Call Ratio (Volume): 0.701

Max Pain Level: 27400

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27800

Highest PUT Addition: 25500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13826.6 (-0.208%)

Combined = November + December + January

Combined Fut Open Interest Change: -0.92%

Combined Fut Volume Change: -71.30%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 3% Previous 3%

MIDCPNIFTY NOVEMBER Future closed at: 13867.85 (-0.524%)

November Fut Premium 41.25 (Decreased by -44.25 points)

November Fut Open Interest Change: -1.32%

November Fut Volume Change: -73.05%

November Fut Open Interest Analysis: Long Covering

MIDCPNIFTY DECEMBER Future closed at: 13928.65 (-0.440%)

December Fut Premium 102.05 (Decreased by -32.7 points)

December Fut Open Interest Change: 12.58%

December Fut Volume Change: -18.22%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.177 (Decreased from 1.207)

Put-Call Ratio (Volume): 1.188

Max Pain Level: 13700

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 14300

Highest PUT Addition: 13500

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 84,478.67 (0.014%)

SENSEX Monthly Future closed at: 84,771.05 (-0.117%)

Premium: 292.38 (Decreased by -111.06 points)

Open Interest Change: -4.65%

Volume Change: 27.97%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (20/11/2025) Option Analysis

Put-Call Ratio (OI): 0.919 (Decreased from 1.115)

Put-Call Ratio (Volume): 1.013

Max Pain Level: 84500

Maximum CALL OI: 88000

Maximum PUT OI: 80000

Highest CALL Addition: 88000

Highest PUT Addition: 84500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 383.68 Cr.

DIIs Net BUY: ₹ 3,091.87 Cr.

FII Derivatives Activity

| FII Trading Stats | 13.11.25 | 12.11.25 | 11.11.25 |

| FII Cash (Provisional Data) | -383.68 | -1,750.03 | -803.22 |

| Index Future Open Interest Long Ratio | 11.74% | 11.98% | 12.68% |

| Index Future Volume Long Ratio | 55.16% | 45.66% | 43.89% |

| Call Option Open Interest Long Ratio | 50.86% | 50.98% | 50.14% |

| Call Option Volume Long Ratio | 50.00% | 50.18% | 50.33% |

| Put Option Open Interest Long Ratio | 60.88% | 59.97% | 64.04% |

| Put Option Volume Long Ratio | 50.35% | 49.48% | 49.79% |

| Stock Future Open Interest Long Ratio | 61.11% | 60.94% | 60.50% |

| Stock Future Volume Long Ratio | 51.06% | 54.00% | 49.70% |

| Index Futures | Short Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Short Covering | Short Covering | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Long | Long Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Short | Long Covering |

| FinNifty Options | Short Covering | Short Covering | Short Covering |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Options | Short Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Short |

| Stock Futures | Short Covering | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (20/11/2025)

The SENSEX index closed at 84478.67. The SENSEX weekly expiry for NOVEMBER 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.919 against previous 1.115. The 88000CE option holds the maximum open interest, followed by the 80000PE and 84500PE options. Market participants have shown increased interest with significant open interest additions in the 88000CE option, with open interest additions also seen in the 84500PE and 80000PE options. On the other hand, open interest reductions were prominent in the 84200CE, 85400PE, and 83200CE options. Trading volume was highest in the 84500PE option, followed by the 85000CE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 20-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84478.67 | 0.919 | 1.115 | 1.013 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 33,90,860 | 15,12,340 | 18,78,520 |

| PUT: | 31,16,380 | 16,86,360 | 14,30,020 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 3,77,500 | 2,49,420 | 10,64,640 |

| 84500 | 2,18,900 | 1,12,680 | 18,40,780 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 3,77,500 | 2,49,420 | 10,64,640 |

| 84500 | 2,18,900 | 1,12,680 | 18,40,780 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84200 | 9,000 | -4,120 | 82,440 |

| 83200 | 6,200 | -980 | 2,260 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 1,86,260 | 59,160 | 20,99,760 |

| 84500 | 2,18,900 | 1,12,680 | 18,40,780 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,07,660 | 1,19,340 | 8,33,440 |

| 84500 | 2,66,760 | 1,36,180 | 22,30,940 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 2,66,760 | 1,36,180 | 22,30,940 |

| 80000 | 3,07,660 | 1,19,340 | 8,33,440 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85400 | 2,340 | -2,680 | 16,700 |

| 76400 | 860 | -60 | 420 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 2,66,760 | 1,36,180 | 22,30,940 |

| 84000 | 2,04,840 | 20,800 | 14,31,800 |

NIFTY Weekly Expiry (18/11/2025)

The NIFTY index closed at 25879.15. The NIFTY weekly expiry for NOVEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.057 against previous 1.308. The 27000CE option holds the maximum open interest, followed by the 25000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 25000PE and 24500PE options. On the other hand, open interest reductions were prominent in the 25350PE, 25550PE, and 25600PE options. Trading volume was highest in the 26000CE option, followed by the 25900PE and 25900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 18-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,879.15 | 1.057 | 1.308 | 0.899 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,28,90,950 | 9,31,89,975 | 2,97,00,975 |

| PUT: | 12,99,54,375 | 12,18,83,100 | 80,71,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,08,70,725 | 42,63,075 | 5,71,803 |

| 26,000 | 92,40,600 | 24,09,375 | 35,05,921 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,08,70,725 | 42,63,075 | 5,71,803 |

| 26,900 | 44,35,275 | 28,11,825 | 4,32,544 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 23,18,400 | -7,65,600 | 9,85,129 |

| 25,700 | 13,27,875 | -5,69,475 | 2,51,739 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 92,40,600 | 24,09,375 | 35,05,921 |

| 25,900 | 59,89,575 | 15,40,200 | 26,50,850 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 94,11,900 | 33,41,250 | 5,53,984 |

| 24,500 | 79,13,100 | 30,88,725 | 3,75,605 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 94,11,900 | 33,41,250 | 5,53,984 |

| 24,500 | 79,13,100 | 30,88,725 | 3,75,605 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,350 | 16,90,425 | -10,54,800 | 2,92,109 |

| 25,550 | 21,23,550 | -9,76,875 | 4,56,921 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 58,88,700 | 7,61,925 | 30,08,825 |

| 25,800 | 68,80,950 | -7,27,125 | 23,37,395 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25879.15. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.005 against previous 0.978. The 26000CE option holds the maximum open interest, followed by the 27000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26300CE option, with open interest additions also seen in the 25700PE and 25900PE options. On the other hand, open interest reductions were prominent in the 26400CE, 26000CE, and 24950PE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 25700PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,879.15 | 1.005 | 0.978 | 0.943 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,94,77,050 | 4,78,57,875 | 16,19,175 |

| PUT: | 4,97,01,975 | 4,68,15,375 | 28,86,600 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 56,45,625 | -3,79,425 | 2,37,430 |

| 27,000 | 47,87,775 | 2,74,125 | 68,916 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 27,43,200 | 6,56,250 | 1,35,615 |

| 26,200 | 34,56,075 | 4,43,625 | 1,23,950 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 14,73,150 | -4,66,275 | 95,641 |

| 26,000 | 56,45,625 | -3,79,425 | 2,37,430 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 56,45,625 | -3,79,425 | 2,37,430 |

| 26,500 | 37,27,500 | 1,04,025 | 1,42,432 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 43,30,575 | 1,99,350 | 85,366 |

| 26,000 | 40,27,575 | 2,52,525 | 1,72,829 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 24,05,775 | 4,64,250 | 1,48,093 |

| 25,900 | 20,37,825 | 4,56,450 | 1,45,198 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,950 | 1,85,550 | -1,56,375 | 11,419 |

| 23,800 | 3,91,350 | -1,13,550 | 7,062 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 40,27,575 | 2,52,525 | 1,72,829 |

| 25,700 | 24,05,775 | 4,64,250 | 1,48,093 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58381.95. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.938 against previous 0.927. The 58500CE option holds the maximum open interest, followed by the 58500PE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 58500CE option, with open interest additions also seen in the 54500PE and 63500CE options. On the other hand, open interest reductions were prominent in the 58000CE, 58300CE, and 57600PE options. Trading volume was highest in the 58500CE option, followed by the 58500PE and 59000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,381.95 | 0.938 | 0.927 | 0.870 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,54,09,835 | 1,55,07,870 | -98,035 |

| PUT: | 1,44,56,190 | 1,43,70,860 | 85,330 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 16,44,510 | 1,28,345 | 2,30,160 |

| 60,000 | 11,44,080 | -4,060 | 78,865 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 16,44,510 | 1,28,345 | 2,30,160 |

| 63,500 | 1,26,035 | 73,255 | 5,334 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 10,99,840 | -2,37,545 | 67,086 |

| 58,300 | 2,45,560 | -57,540 | 71,606 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 16,44,510 | 1,28,345 | 2,30,160 |

| 59,000 | 10,71,840 | 57,365 | 1,49,105 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 15,98,975 | 44,345 | 2,00,134 |

| 58,000 | 14,62,265 | -18,935 | 1,12,894 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 3,23,470 | 1,01,990 | 18,400 |

| 46,000 | 1,37,900 | 58,170 | 6,209 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,600 | 2,88,575 | -50,330 | 18,445 |

| 57,000 | 11,79,500 | -39,025 | 51,318 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 15,98,975 | 44,345 | 2,00,134 |

| 58,000 | 14,62,265 | -18,935 | 1,12,894 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27396.15. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.826 against previous 0.875. The 26000PE option holds the maximum open interest, followed by the 27500CE and 27800CE options. Market participants have shown increased interest with significant open interest additions in the 27800CE option, with open interest additions also seen in the 25500PE and 29500CE options. On the other hand, open interest reductions were prominent in the 25000PE, 25300PE, and 28600CE options. Trading volume was highest in the 27500CE option, followed by the 27400CE and 27300PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,396.15 | 0.826 | 0.875 | 0.701 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,14,740 | 6,70,280 | 44,460 |

| PUT: | 5,90,590 | 5,86,690 | 3,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 82,160 | -4,940 | 3,817 |

| 27,800 | 69,160 | 51,090 | 2,081 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 69,160 | 51,090 | 2,081 |

| 29,500 | 26,585 | 9,945 | 223 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,600 | 39,715 | -5,720 | 217 |

| 27,700 | 37,180 | -5,655 | 1,335 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 82,160 | -4,940 | 3,817 |

| 27,400 | 34,060 | -3,445 | 3,600 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 83,005 | -4,030 | 368 |

| 26,500 | 46,085 | 130 | 309 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 32,825 | 20,670 | 436 |

| 27,400 | 30,030 | 7,215 | 2,195 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 15,665 | -9,945 | 710 |

| 25,300 | 9,555 | -6,760 | 254 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 44,460 | 6,825 | 2,830 |

| 27,500 | 45,500 | -2,405 | 2,790 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13826.6. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.177 against previous 1.207. The 13500PE option holds the maximum open interest, followed by the 14000CE and 13300PE options. Market participants have shown increased interest with significant open interest additions in the 14300CE option, with open interest additions also seen in the 13500PE and 14400CE options. On the other hand, open interest reductions were prominent in the 71000CE, 70000CE, and 70000PE options. Trading volume was highest in the 14000CE option, followed by the 13800PE and 13900PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,826.60 | 1.177 | 1.207 | 1.188 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 78,54,420 | 79,19,100 | -64,680 |

| PUT: | 92,48,260 | 95,62,280 | -3,14,020 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,39,400 | 30,800 | 19,496 |

| 14,500 | 6,09,280 | 18,200 | 9,025 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 5,25,280 | 1,55,400 | 7,550 |

| 14,400 | 5,39,000 | 1,07,100 | 7,407 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,93,920 | -2,50,040 | 7,291 |

| 14,200 | 5,31,440 | -90,160 | 9,648 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,39,400 | 30,800 | 19,496 |

| 13,900 | 3,51,540 | 7,840 | 14,508 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 10,70,160 | 1,27,820 | 15,014 |

| 13,300 | 8,85,220 | -78,540 | 7,158 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 10,70,160 | 1,27,820 | 15,014 |

| 13,400 | 8,43,640 | 58,940 | 5,362 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 7,16,940 | -1,24,880 | 18,879 |

| 12,500 | 4,39,180 | -1,06,120 | 2,289 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 7,16,940 | -1,24,880 | 18,879 |

| 13,900 | 2,28,760 | -25,620 | 15,807 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Short covering is the dominant short-term theme but fresh selling persists in out-month contracts: Today’s Open Interest Volume Analysis pins market sentiment as neutral, with a defensive bias until shorts unwind further.

Actionable feedback: Tactically trade in defined ranges (25800–25900) and use option pain levels for support/resistance—avoid chasing momentum, and switch to longs only if December OI reverses.

Sector cues: Watch FINNIFTY and MIDCPNIFTY—fresh short spikes in midcaps support range trading or selective short setups until long build-up resumes.

Monitor PCR and OI for next move: A decisive break above 1.05 PCR (monthly) with positive OI could kickstart a fresh uptrend—until then, maintain a nimble approach.

Stay patient: Open Interest Volume Analysis points toward sideways trading and stock-specific action, with best results for those who manage risk and adapt quickly to market rotation.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]