Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 14/11/2025

Table of Contents

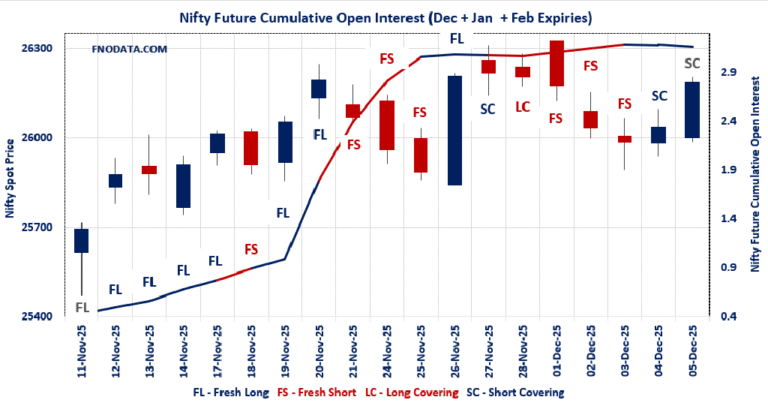

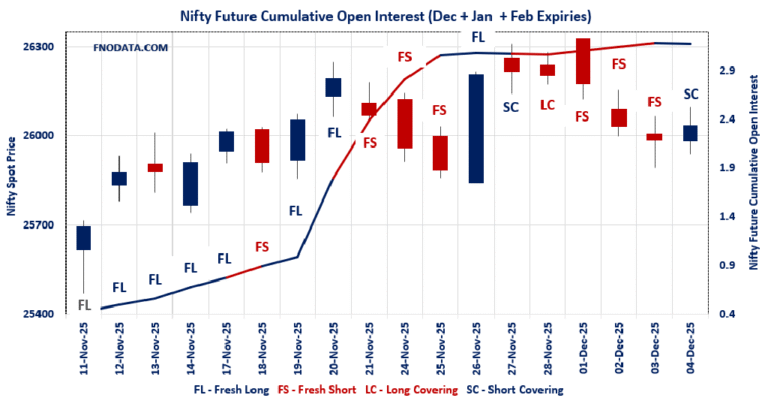

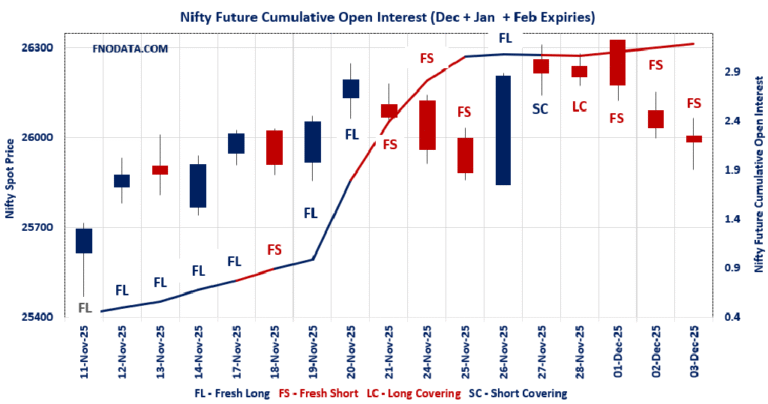

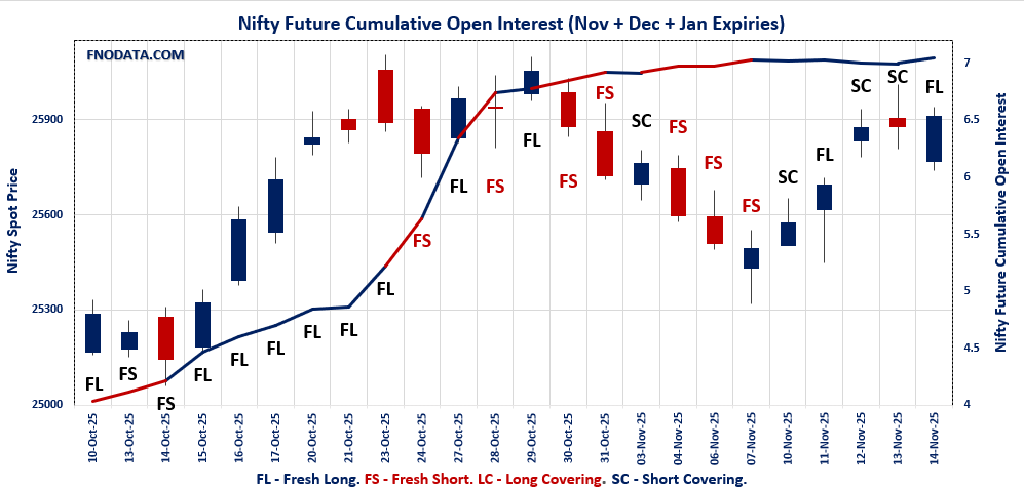

NIFTY’s Open Interest Volume Analysis shows a clear shift to bullishness: Combined open interest surges (+5.10%) on gentle price gains, marking aggressive fresh long build-up across key contracts.

November and December contracts diverge: November futures see fresh shorts (+4.35% OI and mild price focus), while December OI jumps (+11.39%) with stable prices—bulls are positioning for strength in out-month series.

Option data gets defensive: Weekly and monthly PCR both fall below 1 (0.81 weekly, 0.974 monthly), showing heightened call writing and suggesting upsides are being capped for now.

Max pain and OI additions set precise trading bands: Action clusters at 25850–25900, meaning short-term support and resistance levels are defined around these strikes.

Volume jumps confirm trader conviction: Sharp increase in combined futures volume (+53.35%) hints that institutions and active participants are confident about this fresh long run.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25910.05 (0.119%)

Combined = November + December + January

Combined Fut Open Interest Change: 5.10%

Combined Fut Volume Change: 53.35%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 10% Previous 10%

NIFTY NOVEMBER Future closed at: 25951.4 (-0.009%)

November Fut Premium 41.35 (Decreased by -33.3 points)

November Fut Open Interest Change: 4.35%

November Fut Volume Change: 56.19%

November Fut Open Interest Analysis: Fresh Short

NIFTY DECEMBER Future closed at: 26137.8 (0.011%)

December Fut Premium 227.75 (Decreased by -28 points)

December Fut Open Interest Change: 11.39%

December Fut Volume Change: 38.04%

December Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (18/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.810 (Decreased from 1.057)

Put-Call Ratio (Volume): 0.913

Max Pain Level: 25850

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 25700

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.974 (Decreased from 1.005)

Put-Call Ratio (Volume): 0.931

Max Pain Level: 25900

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 25900

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58517.55 (0.232%)

Combined = November + December + January

Combined Fut Open Interest Change: -0.48%

Combined Fut Volume Change: 7.20%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 11% Previous 11%

BANKNIFTY NOVEMBER Future closed at: 58644.4 (0.187%)

November Fut Premium 126.85 (Decreased by -26.2 points)

November Fut Open Interest Change: -0.7%

November Fut Volume Change: 11.4%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY DECEMBER Future closed at: 58985.4 (0.164%)

December Fut Premium 467.85 (Decreased by -39 points)

December Fut Open Interest Change: 0.38%

December Fut Volume Change: -18.75%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.919 (Decreased from 0.938)

Put-Call Ratio (Volume): 0.870

Max Pain Level: 58300

Maximum CALL Open Interest: 58500

Maximum PUT Open Interest: 58500

Highest CALL Addition: 58500

Highest PUT Addition: 58500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27491.85 (0.349%)

Combined = November + December + January

Combined Fut Open Interest Change: 6.5%

Combined Fut Volume Change: -13.4%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 4% Previous 4%

FINNIFTY NOVEMBER Future closed at: 27546.2 (0.255%)

November Fut Premium 54.35 (Decreased by -25.5 points)

November Fut Open Interest Change: 6.81%

November Fut Volume Change: -14.86%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY DECEMBER Future closed at: 27694.7 (0.263%)

December Fut Premium 202.85 (Decreased by -23 points)

December Fut Open Interest Change: 0.00%

December Fut Volume Change: 13.33%

December Fut Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.814 (Decreased from 0.826)

Put-Call Ratio (Volume): 0.924

Max Pain Level: 27400

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 27000

Highest CALL Addition: 27600

Highest PUT Addition: 25500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13865.25 (0.280%)

Combined = November + December + January

Combined Fut Open Interest Change: 1.68%

Combined Fut Volume Change: 14.26%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 4% Previous 3%

MIDCPNIFTY NOVEMBER Future closed at: 13933.8 (0.476%)

November Fut Premium 68.55 (Increased by 27.3 points)

November Fut Open Interest Change: 0.91%

November Fut Volume Change: 13.35%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY DECEMBER Future closed at: 13995.7 (0.481%)

December Fut Premium 130.45 (Increased by 28.4 points)

December Fut Open Interest Change: 29.51%

December Fut Volume Change: 29.37%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.226 (Increased from 1.177)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 13700

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 13900

Highest PUT Addition: 13800

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 84,562.78 (0.100%)

SENSEX Monthly Future closed at: 84,816.35 (0.053%)

Premium: 253.57 (Decreased by -38.81 points)

Open Interest Change: 3.43%

Volume Change: -26.87%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (20/11/2025) Option Analysis

Put-Call Ratio (OI): 0.755 (Decreased from 0.919)

Put-Call Ratio (Volume): 0.985

Max Pain Level: 84400

Maximum CALL OI: 88000

Maximum PUT OI: 80000

Highest CALL Addition: 88000

Highest PUT Addition: 81000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,968.22 Cr.

DIIs Net BUY: ₹ 8,461.47 Cr.

FII Derivatives Activity

| FII Trading Stats | 14.11.25 | 13.11.25 | 12.11.25 |

| FII Cash (Provisional Data) | -4,968.22 | -383.68 | -1,750.03 |

| Index Future Open Interest Long Ratio | 11.18% | 11.74% | 11.98% |

| Index Future Volume Long Ratio | 36.53% | 55.16% | 45.66% |

| Call Option Open Interest Long Ratio | 50.90% | 50.86% | 50.98% |

| Call Option Volume Long Ratio | 50.03% | 50.00% | 50.18% |

| Put Option Open Interest Long Ratio | 61.74% | 60.88% | 59.97% |

| Put Option Volume Long Ratio | 50.24% | 50.35% | 49.48% |

| Stock Future Open Interest Long Ratio | 61.05% | 61.11% | 60.94% |

| Stock Future Volume Long Ratio | 49.33% | 51.06% | 54.00% |

| Index Futures | Fresh Short | Short Covering | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Fresh Long | Long Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Options | Long Covering | Short Covering | Short Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Short Covering | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Short | Short Covering | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (20/11/2025)

The SENSEX index closed at 84562.78. The SENSEX weekly expiry for NOVEMBER 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.755 against previous 0.919. The 88000CE option holds the maximum open interest, followed by the 80000PE and 84000PE options. Market participants have shown increased interest with significant open interest additions in the 88000CE option, with open interest additions also seen in the 81000PE and 80000PE options. On the other hand, open interest reductions were prominent in the 84800PE, 84600PE, and 83200CE options. Trading volume was highest in the 84000PE option, followed by the 84500CE and 84200PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 20-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84562.78 | 0.755 | 0.919 | 0.985 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 96,48,160 | 33,90,860 | 62,57,300 |

| PUT: | 72,83,720 | 31,16,380 | 41,67,340 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 10,85,960 | 7,08,460 | 68,97,720 |

| 86000 | 4,40,780 | 2,43,580 | 1,00,12,600 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 10,85,960 | 7,08,460 | 68,97,720 |

| 87300 | 2,72,400 | 2,58,860 | 15,13,820 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83200 | 5,280 | -920 | 10,460 |

| 82500 | 54,040 | -360 | 9,680 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 4,03,440 | 1,84,540 | 1,63,86,240 |

| 85000 | 4,35,860 | 2,49,600 | 1,32,78,020 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 6,17,760 | 3,10,100 | 47,41,160 |

| 84000 | 4,67,900 | 2,63,060 | 2,05,47,180 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 4,27,900 | 3,25,640 | 55,88,520 |

| 80000 | 6,17,760 | 3,10,100 | 47,41,160 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84800 | 33,420 | -23,620 | 14,30,120 |

| 84600 | 1,18,020 | -7,700 | 31,37,220 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,67,900 | 2,63,060 | 2,05,47,180 |

| 84200 | 2,85,500 | 2,42,820 | 1,55,72,000 |

NIFTY Weekly Expiry (18/11/2025)

The NIFTY index closed at 25910.05. The NIFTY weekly expiry for NOVEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.810 against previous 1.057. The 27000CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000CE and 25800CE options. On the other hand, open interest reductions were prominent in the 24000PE, 23500PE, and 24500PE options. Trading volume was highest in the 25800PE option, followed by the 26000CE and 25900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 18-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,910.05 | 0.810 | 1.057 | 0.913 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,77,71,350 | 12,28,90,950 | 6,48,80,400 |

| PUT: | 15,20,98,650 | 12,99,54,375 | 2,21,44,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,81,64,250 | 72,93,525 | 12,54,424 |

| 26,000 | 1,36,10,550 | 43,69,950 | 67,18,773 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,81,64,250 | 72,93,525 | 12,54,424 |

| 26,000 | 1,36,10,550 | 43,69,950 | 67,18,773 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 7,70,550 | -1,12,650 | 1,14,962 |

| 25,400 | 2,67,750 | -1,10,175 | 29,197 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,36,10,550 | 43,69,950 | 67,18,773 |

| 25,900 | 80,08,125 | 20,18,550 | 63,57,724 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,12,10,475 | 17,98,575 | 11,12,800 |

| 25,500 | 87,49,350 | 9,66,525 | 32,55,582 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 79,56,150 | 32,85,975 | 54,67,121 |

| 25,750 | 44,46,375 | 21,45,600 | 51,36,864 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 41,52,225 | -13,04,100 | 4,14,717 |

| 23,500 | 24,71,925 | -10,56,750 | 1,49,612 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 83,60,475 | 14,79,525 | 84,51,037 |

| 25,700 | 79,56,150 | 32,85,975 | 54,67,121 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25910.05. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.974 against previous 1.005. The 26000CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25900CE and 25900PE options. On the other hand, open interest reductions were prominent in the 26300CE, 23500PE, and 26050PE options. Trading volume was highest in the 26000CE option, followed by the 25800PE and 25800CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,910.05 | 0.974 | 1.005 | 0.931 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,03,00,975 | 4,94,77,050 | 1,08,23,925 |

| PUT: | 5,87,58,075 | 4,97,01,975 | 90,56,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,75,350 | 20,29,725 | 3,55,503 |

| 27,000 | 53,13,225 | 5,25,450 | 95,061 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,75,350 | 20,29,725 | 3,55,503 |

| 25,900 | 34,03,200 | 15,37,575 | 2,20,169 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 21,97,800 | -5,45,400 | 1,47,932 |

| 26,050 | 3,30,600 | -37,500 | 35,757 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,75,350 | 20,29,725 | 3,55,503 |

| 25,800 | 30,03,300 | 10,50,900 | 2,29,206 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 52,26,300 | 11,98,725 | 1,49,272 |

| 25,000 | 44,64,000 | 1,33,425 | 1,57,345 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 33,20,550 | 12,82,725 | 1,91,538 |

| 25,800 | 38,13,825 | 12,70,125 | 2,60,976 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 8,44,350 | -1,53,600 | 16,190 |

| 26,050 | 1,89,600 | -45,450 | 8,139 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 38,13,825 | 12,70,125 | 2,60,976 |

| 25,900 | 33,20,550 | 12,82,725 | 1,91,538 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58517.55. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.919 against previous 0.938. The 58500CE option holds the maximum open interest, followed by the 58500PE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 58500CE option, with open interest additions also seen in the 61500CE and 58500PE options. On the other hand, open interest reductions were prominent in the 58000CE, 55500PE, and 58200CE options. Trading volume was highest in the 58500CE option, followed by the 58500PE and 58000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,517.55 | 0.919 | 0.938 | 0.870 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,60,23,700 | 1,54,09,835 | 6,13,865 |

| PUT: | 1,47,19,880 | 1,44,56,190 | 2,63,690 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 19,33,295 | 2,88,785 | 2,40,699 |

| 60,000 | 12,32,665 | 88,585 | 84,541 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 19,33,295 | 2,88,785 | 2,40,699 |

| 61,500 | 5,33,225 | 1,75,385 | 31,658 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 8,56,520 | -2,43,320 | 86,562 |

| 58,200 | 2,23,510 | -46,270 | 77,932 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 19,33,295 | 2,88,785 | 2,40,699 |

| 59,000 | 11,64,065 | 92,225 | 1,37,217 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 17,31,030 | 1,32,055 | 1,57,464 |

| 58,000 | 14,55,055 | -7,210 | 1,49,900 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 17,31,030 | 1,32,055 | 1,57,464 |

| 54,000 | 4,84,610 | 1,02,725 | 26,999 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 3,10,380 | -48,370 | 26,514 |

| 58,400 | 1,74,475 | -44,660 | 97,228 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 17,31,030 | 1,32,055 | 1,57,464 |

| 58,000 | 14,55,055 | -7,210 | 1,49,900 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27491.85. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.814 against previous 0.826. The 27500CE option holds the maximum open interest, followed by the 27800CE and 27000PE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 27600CE and 29500CE options. On the other hand, open interest reductions were prominent in the 26000PE, 28600CE, and 28700CE options. Trading volume was highest in the 27500CE option, followed by the 27400CE and 27300PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,491.85 | 0.814 | 0.826 | 0.924 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,85,295 | 7,14,740 | -29,445 |

| PUT: | 5,58,025 | 5,90,590 | -32,565 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 85,670 | 3,510 | 3,540 |

| 27,800 | 63,115 | -6,045 | 1,759 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 40,365 | 8,060 | 883 |

| 29,500 | 32,825 | 6,240 | 170 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,600 | 17,030 | -22,685 | 574 |

| 28,700 | 8,190 | -17,745 | 555 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 85,670 | 3,510 | 3,540 |

| 27,400 | 37,050 | 2,990 | 3,227 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 47,125 | 3,120 | 1,197 |

| 25,500 | 46,605 | 13,780 | 377 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 46,605 | 13,780 | 377 |

| 27,400 | 36,140 | 6,110 | 3,078 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 44,655 | -38,350 | 1,095 |

| 27,300 | 35,425 | -9,035 | 3,081 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 35,425 | -9,035 | 3,081 |

| 27,400 | 36,140 | 6,110 | 3,078 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13865.25. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.226 against previous 1.177. The 13500PE option holds the maximum open interest, followed by the 14000CE and 13800PE options. Market participants have shown increased interest with significant open interest additions in the 13900CE option, with open interest additions also seen in the 13800PE and 14200CE options. On the other hand, open interest reductions were prominent in the 70000CE, 69800PE, and 69800CE options. Trading volume was highest in the 13800PE option, followed by the 14000CE and 13900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,865.25 | 1.226 | 1.177 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 83,77,320 | 78,54,420 | 5,22,900 |

| PUT: | 1,02,74,740 | 92,48,260 | 10,26,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,15,740 | -23,660 | 22,206 |

| 14,200 | 7,08,400 | 1,76,960 | 13,637 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 5,34,100 | 1,82,560 | 20,744 |

| 14,200 | 7,08,400 | 1,76,960 | 13,637 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 2,89,100 | -2,36,180 | 10,971 |

| 14,400 | 4,87,060 | -51,940 | 7,686 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,15,740 | -23,660 | 22,206 |

| 13,900 | 5,34,100 | 1,82,560 | 20,744 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 11,45,480 | 75,320 | 11,043 |

| 13,800 | 8,98,660 | 1,81,720 | 34,021 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 8,98,660 | 1,81,720 | 34,021 |

| 13,900 | 3,99,140 | 1,70,380 | 16,626 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 1,19,420 | -81,060 | 1,301 |

| 13,300 | 8,78,360 | -6,860 | 5,270 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 8,98,660 | 1,81,720 | 34,021 |

| 13,900 | 3,99,140 | 1,70,380 | 16,626 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Fresh longs lead, but headwinds remain from option sellers: Open Interest Volume Analysis confirms bullish intent in NIFTY and FINNIFTY, but falling PCR warns that call writers may hold the upper hand for the next few sessions.

Actionable feedback: Favor long trades on dips into 25850–25900 zone and shift stop-losses closer to support. However, avoid over-positioning; wait for PCR to trend upward for momentum breakout.

Sector cues: MIDCPNIFTY and SENSEX also display strong fresh long build-up, offering attractive opportunities for swing and positional trades.

Watch option strikes for reversals: If call OI unwinds or PCR rises above 1, aggressive long entry may be justified.

Keep risk in check: Open Interest Volume Analysis highlights the importance of flexible trading—scale up only as buying strength persists and option resistance fades.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.