Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 20/11/2025

Table of Contents

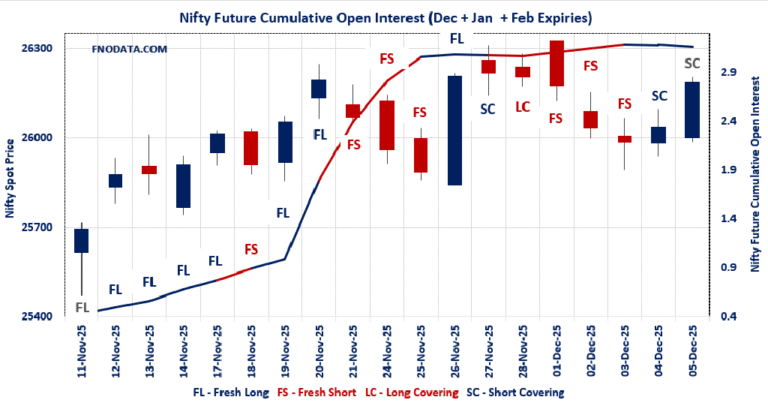

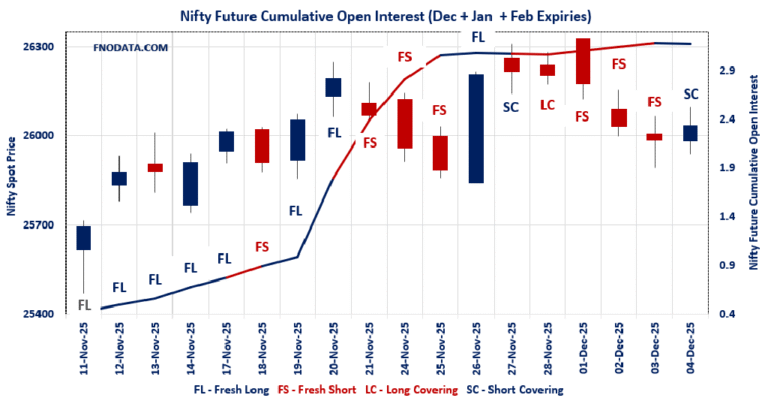

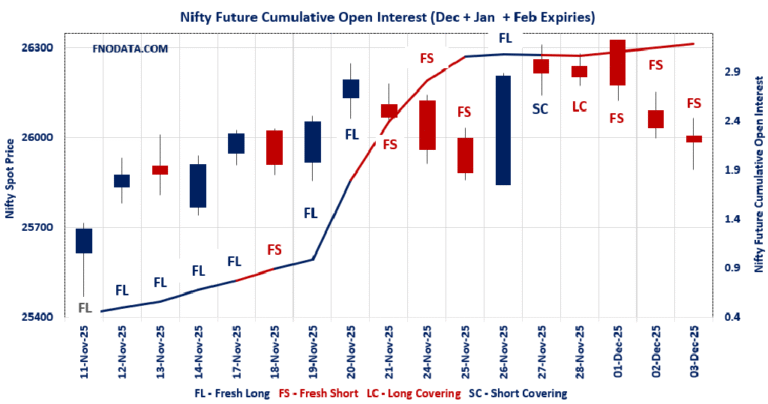

NIFTY’s Open Interest Volume Analysis signals powerful bullish intent: Combined open interest rises (+0.66%) alongside a sharp spike in volume (+70.53%) and the index up +0.54%, confirming aggressive fresh long additions as the market targets higher levels.

November expiry contracts reflect rapid short covering: November open interest drops (-13%) and volume rises, showing bears are rushing to exit positions while bulls drive prices toward new highs.

December futures show a massive influx of new longs: December OI surges (+88.2%) with towering volume (+242%), indicating big institutional bets are being built for the post-expiry trend.

Options landscape decisively bullish: Monthly PCR rockets from 1.28 to 1.52, with highest PUT additions near 26200, anchoring support and reflecting optimism for more gains.

Max pain rises to 26100, aligning with index momentum: Heavy open interest in call and put options at this strike builds a clear magnet for the expiry and gives traders a reference to manage risk.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26192.15 (0.535%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.66%

Combined Fut Volume Change: 70.53%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 26% Previous 15%

NIFTY NOVEMBER Future closed at: 26220.8 (0.575%)

November Fut Premium 28.65 (Increased by 10.3 points)

November Fut Open Interest Change: -13.00%

November Fut Volume Change: 31.14%

November Fut Open Interest Analysis: Short Covering

NIFTY DECEMBER Future closed at: 26411.9 (0.603%)

December Fut Premium 219.75 (Increased by 18.7 points)

December Fut Open Interest Change: 88.21%

December Fut Volume Change: 242.34%

December Fut Open Interest Analysis: Fresh Long

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.518 (Increased from 1.281)

Put-Call Ratio (Volume): 0.956

Max Pain Level: 26100

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27500

Highest PUT Addition: 26200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59347.7 (0.222%)

Combined = November + December + January

Combined Fut Open Interest Change: 3.85%

Combined Fut Volume Change: -14.49%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 26% Previous 20%

BANKNIFTY NOVEMBER Future closed at: 59399 (0.290%)

November Fut Premium 51.3 (Increased by 39.95 points)

November Fut Open Interest Change: -3.8%

November Fut Volume Change: -21.9%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY DECEMBER Future closed at: 59759 (0.292%)

December Fut Premium 411.3 (Increased by 42.15 points)

December Fut Open Interest Change: 38.07%

December Fut Volume Change: 8.13%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.232 (Increased from 1.196)

Put-Call Ratio (Volume): 0.991

Max Pain Level: 58900

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 59500

Highest PUT Addition: 59300

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27861.35 (0.787%)

Combined = November + December + January

Combined Fut Open Interest Change: 1.6%

Combined Fut Volume Change: 97.5%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 18% Previous 8%

FINNIFTY NOVEMBER Future closed at: 27885.6 (0.807%)

November Fut Premium 24.25 (Increased by 5.55 points)

November Fut Open Interest Change: -9.27%

November Fut Volume Change: 71.07%

November Fut Open Interest Analysis: Short Covering

FINNIFTY DECEMBER Future closed at: 28039.8 (0.795%)

December Fut Premium 178.45 (Increased by 3.55 points)

December Fut Open Interest Change: 123.53%

December Fut Volume Change: 208.51%

December Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.330 (Increased from 1.075)

Put-Call Ratio (Volume): 0.819

Max Pain Level: 27700

Maximum CALL Open Interest: 27900

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27900

Highest PUT Addition: 27900

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13992.2 (-0.060%)

Combined = November + December + January

Combined Fut Open Interest Change: -12.82%

Combined Fut Volume Change: 212.82%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 22% Previous 5%

MIDCPNIFTY NOVEMBER Future closed at: 14007.25 (-0.131%)

November Fut Premium 15.05 (Decreased by -10 points)

November Fut Open Interest Change: -28.49%

November Fut Volume Change: 140.92%

November Fut Open Interest Analysis: Long Covering

MIDCPNIFTY DECEMBER Future closed at: 14074.65 (-0.197%)

December Fut Premium 82.45 (Decreased by -19.45 points)

December Fut Open Interest Change: 321.02%

December Fut Volume Change: 697.17%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.102 (Decreased from 1.202)

Put-Call Ratio (Volume): 1.054

Max Pain Level: 13900

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 14200

Highest PUT Addition: 14050

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 85,632.68 (0.524%)

SENSEX Monthly Future closed at: 85,770.45 (0.613%)

Premium: 137.77 (Increased by 76.29 points)

Open Interest Change: -24.52%

Volume Change: 90.95%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (27/11/2025) Option Analysis

Put-Call Ratio (OI): 1.453 (Increased from 1.085)

Put-Call Ratio (Volume): 1.144

Max Pain Level: 85000

Maximum CALL OI: 87000

Maximum PUT OI: 85000

Highest CALL Addition: 90000

Highest PUT Addition: 85500

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 283.65 Cr.

DIIs Net BUY: ₹ 824.46 Cr.

FII Derivatives Activity

| FII Trading Stats | 20.11.25 | 19.11.25 | 18.11.25 |

| FII Cash (Provisional Data) | 283.65 | 1,580.72 | -728.82 |

| Index Future Open Interest Long Ratio | 12.36% | 12.24% | 12.16% |

| Index Future Volume Long Ratio | 51.80% | 52.35% | 50.97% |

| Call Option Open Interest Long Ratio | 52.91% | 51.30% | 49.05% |

| Call Option Volume Long Ratio | 50.35% | 50.40% | 49.62% |

| Put Option Open Interest Long Ratio | 57.95% | 57.49% | 63.67% |

| Put Option Volume Long Ratio | 50.24% | 49.31% | 50.47% |

| Stock Future Open Interest Long Ratio | 60.82% | 60.58% | 60.52% |

| Stock Future Volume Long Ratio | 50.09% | 51.05% | 46.60% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Short Covering | Short Covering | Long Covering |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Long Covering |

| FinNifty Options | Long Covering | Fresh Long | Fresh Short |

| MidcpNifty Futures | Long Covering | Long Covering | Long Covering |

| MidcpNifty Options | Long Covering | Fresh Long | Short Covering |

| NiftyNxt50 Futures | Long Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Short Covering | Fresh Long | Long Covering |

| Stock Options | Short Covering | Short Covering | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (27/11/2025)

The SENSEX index closed at 85632.68. The SENSEX weekly expiry for NOVEMBER 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.453 against previous 1.085. The 85000PE option holds the maximum open interest, followed by the 84000PE and 87000CE options. Market participants have shown increased interest with significant open interest additions in the 85500PE option, with open interest additions also seen in the 85000PE and 85700PE options. On the other hand, open interest reductions were prominent in the 85000CE, 84800CE, and 85200CE options. Trading volume was highest in the 85500PE option, followed by the 85500CE and 85000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 27-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85632.68 | 1.453 | 1.085 | 1.144 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 32,12,380 | 16,54,240 | 15,58,140 |

| PUT: | 46,66,000 | 17,94,660 | 28,71,340 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 2,93,120 | 1,28,400 | 10,93,260 |

| 89000 | 2,09,920 | 1,39,020 | 6,49,020 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 90000 | 2,00,280 | 1,77,080 | 5,36,560 |

| 89000 | 2,09,920 | 1,39,020 | 6,49,020 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 87,180 | -37,440 | 6,12,320 |

| 84800 | 31,120 | -23,340 | 71,800 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 1,68,760 | 96,580 | 18,82,700 |

| 86000 | 1,81,980 | 75,140 | 14,81,080 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,11,380 | 2,22,440 | 17,13,920 |

| 84000 | 2,95,340 | 1,58,720 | 13,88,640 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 2,85,160 | 2,49,400 | 19,13,920 |

| 85000 | 4,11,380 | 2,22,440 | 17,13,920 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82800 | 22,680 | -10,020 | 1,11,700 |

| 73100 | 140 | -20 | 160 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 2,85,160 | 2,49,400 | 19,13,920 |

| 85000 | 4,11,380 | 2,22,440 | 17,13,920 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 26192.15. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.518 against previous 1.281. The 26000PE option holds the maximum open interest, followed by the 25900PE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 26200PE option, with open interest additions also seen in the 26100PE and 26150PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25050PE, and 26100CE options. Trading volume was highest in the 26200CE option, followed by the 26100CE and 26100PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,192.15 | 1.518 | 1.281 | 0.956 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,40,22,525 | 12,55,05,225 | 85,17,300 |

| PUT: | 20,35,00,125 | 16,07,21,925 | 4,27,78,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,16,56,800 | 12,71,475 | 13,36,153 |

| 27,000 | 1,12,92,750 | 16,42,425 | 10,16,556 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 90,79,575 | 19,21,425 | 5,07,002 |

| 26,700 | 53,93,850 | 17,53,800 | 5,82,184 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,87,225 | -44,86,575 | 10,10,188 |

| 26,100 | 39,39,150 | -17,88,900 | 25,16,582 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 75,60,000 | 5,01,375 | 26,14,422 |

| 26,100 | 39,39,150 | -17,88,900 | 25,16,582 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,48,37,400 | 25,34,025 | 18,71,326 |

| 25,900 | 1,22,80,275 | 6,65,925 | 11,49,507 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 77,09,100 | 56,70,375 | 17,04,498 |

| 26,100 | 85,16,625 | 54,95,700 | 22,61,009 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,050 | 7,63,800 | -20,19,900 | 1,76,001 |

| 24,300 | 9,65,250 | -5,52,075 | 1,34,193 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 85,16,625 | 54,95,700 | 22,61,009 |

| 26,000 | 1,48,37,400 | 25,34,025 | 18,71,326 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 59347.7. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.232 against previous 1.196. The 58000PE option holds the maximum open interest, followed by the 59000PE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 59300PE option, with open interest additions also seen in the 59500PE and 59400PE options. On the other hand, open interest reductions were prominent in the 58500CE, 58500PE, and 58400PE options. Trading volume was highest in the 59200CE option, followed by the 59300CE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,347.70 | 1.232 | 1.196 | 0.991 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,53,95,170 | 1,57,56,510 | -3,61,340 |

| PUT: | 1,89,69,545 | 1,88,50,720 | 1,18,825 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 11,95,390 | 43,785 | 2,05,000 |

| 59,000 | 9,12,415 | -1,56,765 | 1,80,146 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 8,30,970 | 1,69,890 | 2,49,372 |

| 59,400 | 3,49,265 | 1,66,845 | 1,69,781 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 8,28,065 | -2,52,700 | 32,920 |

| 59,000 | 9,12,415 | -1,56,765 | 1,80,146 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,200 | 3,19,690 | -76,860 | 2,65,817 |

| 59,300 | 5,52,720 | 48,440 | 2,64,070 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,28,835 | -58,590 | 1,22,783 |

| 59,000 | 14,51,695 | 83,860 | 2,21,621 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 4,28,855 | 2,73,560 | 1,70,352 |

| 59,500 | 4,39,950 | 2,43,075 | 1,05,073 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 13,47,850 | -2,21,655 | 1,66,893 |

| 58,400 | 2,21,655 | -1,79,165 | 40,610 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,51,695 | 83,860 | 2,21,621 |

| 59,200 | 3,76,635 | 23,625 | 1,93,602 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27861.35. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.330 against previous 1.075. The 27900CE option holds the maximum open interest, followed by the 27500PE and 27000PE options. Market participants have shown increased interest with significant open interest additions in the 27900CE option, with open interest additions also seen in the 27900PE and 27500PE options. On the other hand, open interest reductions were prominent in the 27800CE, 28350CE, and 28200CE options. Trading volume was highest in the 27800CE option, followed by the 27900CE and 28000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,861.35 | 1.330 | 1.075 | 0.819 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,98,630 | 13,13,975 | -2,15,345 |

| PUT: | 14,60,940 | 14,12,255 | 48,685 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 1,81,480 | 1,61,265 | 21,412 |

| 29,000 | 86,060 | 2,080 | 2,887 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 1,81,480 | 1,61,265 | 21,412 |

| 28,500 | 70,200 | 31,785 | 1,984 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 83,135 | -1,61,070 | 27,414 |

| 28,350 | 14,690 | -95,225 | 2,855 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 83,135 | -1,61,070 | 27,414 |

| 27,900 | 1,81,480 | 1,61,265 | 21,412 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,65,555 | 32,890 | 9,508 |

| 27,000 | 1,07,510 | 8,840 | 5,742 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 53,625 | 51,805 | 3,370 |

| 27,500 | 1,65,555 | 32,890 | 9,508 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,100 | 41,860 | -43,095 | 2,092 |

| 26,500 | 74,295 | -32,955 | 3,519 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,65,555 | 32,890 | 9,508 |

| 27,600 | 61,035 | 22,360 | 8,525 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13992.2. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.102 against previous 1.202. The 14000CE option holds the maximum open interest, followed by the 13500PE and 13300PE options. Market participants have shown increased interest with significant open interest additions in the 14050PE option, with open interest additions also seen in the 14200CE and 13500PE options. On the other hand, open interest reductions were prominent in the 73000CE, 70000PE, and 69500CE options. Trading volume was highest in the 14200CE option, followed by the 14100CE and 14000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,992.20 | 1.102 | 1.202 | 1.054 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,03,64,200 | 1,01,56,720 | 2,07,480 |

| PUT: | 1,14,22,320 | 1,22,08,280 | -7,85,960 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 13,92,300 | -52,220 | 38,244 |

| 14,500 | 8,74,160 | 1,28,520 | 14,950 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,200 | 7,20,580 | 1,81,860 | 40,300 |

| 14,050 | 2,67,260 | 1,51,760 | 18,673 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,400 | 5,58,460 | -1,70,100 | 11,170 |

| 13,500 | 2,27,500 | -1,22,640 | 1,232 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,200 | 7,20,580 | 1,81,860 | 40,300 |

| 14,100 | 6,31,540 | 51,380 | 38,532 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 12,26,540 | 1,78,220 | 14,735 |

| 13,300 | 11,55,560 | 1,67,160 | 9,958 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,050 | 2,82,380 | 2,32,820 | 20,036 |

| 13,500 | 12,26,540 | 1,78,220 | 14,735 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 7,74,760 | -2,68,380 | 25,341 |

| 13,000 | 6,00,740 | -1,74,580 | 6,908 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 10,53,640 | 80,360 | 38,319 |

| 13,800 | 7,74,760 | -2,68,380 | 25,341 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Bulls tighten their grip as shorts exit rapidly and new longs pile into December series: Open Interest Volume Analysis shows strong conviction for upside, likely to drive a trending market if volume remains high.

Actionable feedback: Favor buying on dips toward 26100–26200; use max pain and fresh PUT additions as stop and re-entry zones for long trades.

Sector notes: FINNIFTY also participates in the long build-up, while a sharp rise in BankNIFTY OI suggests further strength in financials.

Stay alert for profit booking near expiry: With such rapid shifts, watch OI and PCR for signs of exhaustion—if December OI stops rising or PCR dips, lock in profits or tighten stops quickly.

Embrace momentum: The current Open Interest Volume Analysis supports riding the bullish wave, as long as contracts, PCR, and volume all point up.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.