Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 25/11/2025

Table of Contents

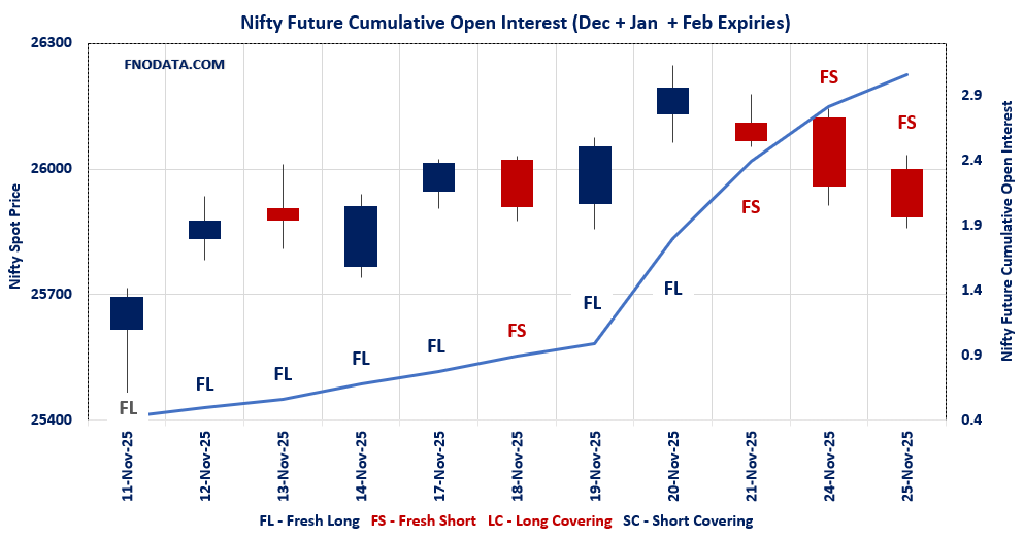

Open Interest Volume Analysis points to aggressive fresh short build: NIFTY 50 fell around 0.3% even as combined futures OI jumped by 24.37%, clearly signalling that traders are adding new bearish positions rather than exiting old ones.

Structure across DEC–JAN is uniformly bearish: Both December and January futures closed lower with strong OI additions (roughly 24–27%), showing that shorts are being built across multiple expiries and not just near-month noise.

Premiums cooling despite shorts rising: Futures premiums have fallen sharply across all three indices while OI rises, which typically reflects expectation of further downside or at least capped upside in the near term.

Options still anchor price around 26,000: Weekly and monthly option data show max pain parked at 26,000 with matching max call/put OI, so the market may oscillate around this zone while shorts try to push below support pockets.

Banking and financial indices echo the same message: BANKNIFTY, FINNIFTY and even SENSEX are showing fresh short build-ups on rising OI and volume, suggesting this is a broad, index-wide risk-off move rather than stock-specific weakness.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25884.8 (-0.288%)

Combined = November + December + January

Combined Fut Open Interest Change: 24.37%

Combined Fut Volume Change: -7.08%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 6% Previous 6%

NIFTY DECEMBER Future closed at: 26055.4 (-0.441%)

November Fut Premium 170.6 (Decreased by -40.6 points)

November Fut Open Interest Change: 24.22%

November Fut Volume Change: -9.89%

November Fut Open Interest Analysis: Fresh Short

NIFTY JANUARY Future closed at: 26234.6 (-0.470%)

December Fut Premium 349.8 (Decreased by -49.3 points)

December Fut Open Interest Change: 26.82%

December Fut Volume Change: 52.42%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (2/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.733 (Increased from 0.728)

Put-Call Ratio (Volume): 0.794

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 25400

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.237 (Decreased from 1.291)

Put-Call Ratio (Volume): 0.850

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 26000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58820.3 (-0.026%)

Combined = November + December + January

Combined Fut Open Interest Change: 30.92%

Combined Fut Volume Change: 26.98%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 7% Previous 9%

BANKNIFTY DECEMBER Future closed at: 59139.6 (-0.178%)

November Fut Premium 319.3 (Decreased by -90.15 points)

November Fut Open Interest Change: 33.4%

November Fut Volume Change: 29.2%

November Fut Open Interest Analysis: Fresh Short

BANKNIFTY JANUARY Future closed at: 59505.8 (-0.146%)

December Fut Premium 685.5 (Decreased by -71.75 points)

December Fut Open Interest Change: 6.61%

December Fut Volume Change: -5.70%

December Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.068 (Decreased from 1.163)

Put-Call Ratio (Volume): 0.968

Max Pain Level: 58500

Maximum CALL Open Interest: 58500

Maximum PUT Open Interest: 58500

Highest CALL Addition: 59000

Highest PUT Addition: 59000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27409.4 (-0.325%)

Combined = November + December + January

Combined Fut Open Interest Change: 68.9%

Combined Fut Volume Change: 112.7%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 0% Previous 0%

FINNIFTY DECEMBER Future closed at: 27551.2 (-0.425%)

November Fut Premium 141.8 (Decreased by -28.35 points)

November Fut Open Interest Change: 69.12%

November Fut Volume Change: 113.68%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY JANUARY Future closed at: 27682.8 (-0.340%)

December Fut Premium 273.4 (Decreased by -5.25 points)

December Fut Open Interest Change: 0.00%

December Fut Volume Change: -100.00%

December Fut Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.730 (Decreased from 1.047)

Put-Call Ratio (Volume): 0.943

Max Pain Level: 27500

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27500

Highest PUT Addition: 27500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13806.7 (0.496%)

Combined = November + December + January

Combined Fut Open Interest Change: 28.14%

Combined Fut Volume Change: 95.84%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 1% Previous 1%

MIDCPNIFTY DECEMBER Future closed at: 13900 (0.431%)

November Fut Premium 93.3 (Decreased by -8.5 points)

November Fut Open Interest Change: 28.16%

November Fut Volume Change: 98.54%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY JANUARY Future closed at: 13971.25 (0.404%)

December Fut Premium 164.55 (Decreased by -12 points)

December Fut Open Interest Change: 26.97%

December Fut Volume Change: -7.87%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.928 (Increased from 0.925)

Put-Call Ratio (Volume): 0.949

Max Pain Level: 13900

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14300

Highest PUT Addition: 13000

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 84,587.01 (-0.369%)

SENSEX Monthly Future closed at: 84,702.30 (-0.475%)

Premium: 115.29 (Decreased by -90.25 points)

Open Interest Change: -9.26%

Volume Change: 47.49%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (27/11/2025) Option Analysis

Put-Call Ratio (OI): 0.611 (Increased from 0.594)

Put-Call Ratio (Volume): 0.880

Max Pain Level: 85200

Maximum CALL OI: 85000

Maximum PUT OI: 84000

Highest CALL Addition: 85000

Highest PUT Addition: 84000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 785.32 Cr.

DIIs Net BUY: ₹ 3,912.47 Cr.

FII Derivatives Activity

| FII Trading Stats | 25.11.25 | 24.11.25 | 21.11.25 |

| FII Cash (Provisional Data) | 785.32 | -4,171.75 | -1,766.05 |

| Index Future Open Interest Long Ratio | 15.07% | 14.48% | 11.57% |

| Index Future Volume Long Ratio | 43.58% | 53.64% | 48.00% |

| Call Option Open Interest Long Ratio | 45.89% | 50.18% | 51.94% |

| Call Option Volume Long Ratio | 49.93% | 49.79% | 49.91% |

| Put Option Open Interest Long Ratio | 67.73% | 62.02% | 62.44% |

| Put Option Volume Long Ratio | 50.09% | 50.03% | 50.55% |

| Stock Future Open Interest Long Ratio | 61.58% | 61.34% | 60.64% |

| Stock Future Volume Long Ratio | 50.14% | 51.17% | 49.82% |

| Index Futures | Long Covering | Fresh Long | Long Covering |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Long Covering | Fresh Long | Fresh Short |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Long Covering | Short Covering | Long Covering |

| BankNifty Options | Long Covering | Fresh Long | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Short | Short Covering |

| FinNifty Options | Short Covering | Fresh Short | Long Covering |

| MidcpNifty Futures | Long Covering | Fresh Long | Long Covering |

| MidcpNifty Options | Short Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Long Covering | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Short Covering | Long Covering |

| Stock Options | Long Covering | Long Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (27/11/2025)

The SENSEX index closed at 84587.01. The SENSEX weekly expiry for NOVEMBER 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.611 against previous 0.594. The 85000CE option holds the maximum open interest, followed by the 85500CE and 86000CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 84000PE and 86000CE options. On the other hand, open interest reductions were prominent in the 85500PE, 90000CE, and 80000PE options. Trading volume was highest in the 85000CE option, followed by the 85000PE and 84900PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 27-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84587.01 | 0.611 | 0.594 | 0.880 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,26,99,280 | 1,39,92,680 | 87,06,600 |

| PUT: | 1,38,78,500 | 83,12,860 | 55,65,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 15,44,400 | 11,58,840 | 2,87,77,540 |

| 85500 | 14,51,800 | 3,36,340 | 1,72,55,720 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 15,44,400 | 11,58,840 | 2,87,77,540 |

| 86000 | 13,84,800 | 7,67,920 | 1,37,96,340 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 90000 | 3,37,480 | -1,23,000 | 25,80,040 |

| 91500 | 86,300 | -84,380 | 4,65,220 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 15,44,400 | 11,58,840 | 2,87,77,540 |

| 85500 | 14,51,800 | 3,36,340 | 1,72,55,720 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 13,66,060 | 9,05,220 | 1,42,67,880 |

| 83000 | 11,28,220 | 7,38,440 | 58,27,520 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 13,66,060 | 9,05,220 | 1,42,67,880 |

| 83000 | 11,28,220 | 7,38,440 | 58,27,520 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 1,61,920 | -3,19,700 | 27,57,720 |

| 80000 | 2,97,380 | -1,09,860 | 17,72,720 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,24,840 | 3,420 | 2,77,97,600 |

| 84900 | 1,69,260 | 12,300 | 1,81,56,500 |

NIFTY Weekly Expiry (2/12/2025)

The NIFTY index closed at 25884.8. The NIFTY weekly expiry for DECEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.733 against previous 0.728. The 26000CE option holds the maximum open interest, followed by the 26500CE and 26200CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26500CE and 25400PE options. On the other hand, open interest reductions were prominent in the 26200PE, 27600CE, and 26400PE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 26200CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,884.80 | 0.733 | 0.728 | 0.794 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,50,07,025 | 4,91,64,675 | 3,58,42,350 |

| PUT: | 6,23,27,475 | 3,58,05,300 | 2,65,22,175 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,30,250 | 41,13,750 | 6,75,031 |

| 26,500 | 60,66,225 | 33,59,250 | 3,70,748 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,30,250 | 41,13,750 | 6,75,031 |

| 26,500 | 60,66,225 | 33,59,250 | 3,70,748 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 14,27,775 | -32,400 | 41,374 |

| 27,300 | 7,74,450 | -975 | 38,578 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,30,250 | 41,13,750 | 6,75,031 |

| 26,200 | 58,58,250 | 25,54,575 | 4,51,057 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,69,725 | 18,69,300 | 6,53,946 |

| 25,500 | 46,08,450 | 23,33,400 | 2,58,675 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 39,81,600 | 28,10,100 | 1,79,408 |

| 25,500 | 46,08,450 | 23,33,400 | 2,58,675 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 12,42,000 | -1,38,225 | 91,353 |

| 26,400 | 1,87,350 | -30,900 | 9,175 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,69,725 | 18,69,300 | 6,53,946 |

| 25,900 | 27,33,900 | 14,34,525 | 4,12,388 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25884.8. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.237 against previous 1.291. The 26000PE option holds the maximum open interest, followed by the 26000CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26500CE and 26000PE options. On the other hand, open interest reductions were prominent in the 27000CE, 24000PE, and 27200CE options. Trading volume was highest in the 27000CE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,884.80 | 1.237 | 1.291 | 0.850 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,29,27,450 | 3,86,99,725 | 42,27,725 |

| PUT: | 5,31,20,775 | 4,99,43,750 | 31,77,025 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 64,57,600 | 11,28,725 | 69,399 |

| 27,000 | 58,23,400 | -6,66,425 | 89,621 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 64,57,600 | 11,28,725 | 69,399 |

| 26,500 | 41,07,975 | 10,50,525 | 73,371 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 58,23,400 | -6,66,425 | 89,621 |

| 27,200 | 6,18,525 | -62,325 | 16,601 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 58,23,400 | -6,66,425 | 89,621 |

| 26,500 | 41,07,975 | 10,50,525 | 73,371 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,76,775 | 6,86,075 | 87,218 |

| 25,000 | 45,59,225 | 1,41,600 | 32,623 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,76,775 | 6,86,075 | 87,218 |

| 26,200 | 21,00,975 | 6,37,500 | 38,210 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 39,70,175 | -1,79,025 | 17,658 |

| 24,500 | 15,55,275 | -41,700 | 15,008 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,76,775 | 6,86,075 | 87,218 |

| 26,200 | 21,00,975 | 6,37,500 | 38,210 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 58820.3. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.068 against previous 1.163. The 58500PE option holds the maximum open interest, followed by the 58500CE and 59000CE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 59000PE and 60000CE options. On the other hand, open interest reductions were prominent in the 55200PE, 55200PE, and 64500PE options. Trading volume was highest in the 59000PE option, followed by the 59000CE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,820.30 | 1.068 | 1.163 | 0.968 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 80,20,870 | 60,05,045 | 20,15,825 |

| PUT: | 85,63,345 | 69,84,810 | 15,78,535 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 12,88,280 | 28,665 | 9,479 |

| 59,000 | 8,25,510 | 3,67,920 | 63,795 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 8,25,510 | 3,67,920 | 63,795 |

| 60,000 | 6,38,785 | 1,70,345 | 34,786 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,800 | 1,540 | -315 | 22 |

| 56,400 | 805 | -105 | 19 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 8,25,510 | 3,67,920 | 63,795 |

| 60,000 | 6,38,785 | 1,70,345 | 34,786 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 19,10,475 | 87,710 | 26,219 |

| 59,000 | 7,89,740 | 2,07,830 | 71,266 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 7,89,740 | 2,07,830 | 71,266 |

| 58,000 | 6,06,725 | 1,12,700 | 20,511 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,200 | 2,660 | -665 | 65 |

| 55,200 | 2,660 | -665 | 65 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 7,89,740 | 2,07,830 | 71,266 |

| 58,500 | 19,10,475 | 87,710 | 26,219 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27409.4. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.730 against previous 1.047. The 27500CE option holds the maximum open interest, followed by the 27500PE and 27600CE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 27500PE and 27600CE options. On the other hand, open interest reductions were prominent in the 25700CE, 25700CE, and 25700CE options. Trading volume was highest in the 27500PE option, followed by the 27500CE and 27600CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,409.40 | 0.730 | 1.047 | 0.943 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 31,265 | 13,975 | 17,290 |

| PUT: | 22,815 | 14,625 | 8,190 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 10,660 | 6,435 | 317 |

| 27,600 | 6,370 | 2,210 | 124 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 10,660 | 6,435 | 317 |

| 27,600 | 6,370 | 2,210 | 124 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 10,660 | 6,435 | 317 |

| 27,600 | 6,370 | 2,210 | 124 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 9,685 | 3,120 | 447 |

| 27,000 | 3,445 | 1,300 | 59 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 9,685 | 3,120 | 447 |

| 27,000 | 3,445 | 1,300 | 59 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 9,685 | 3,120 | 447 |

| 27,400 | 1,235 | 1,170 | 69 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13806.7. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.928 against previous 0.925. The 13000PE option holds the maximum open interest, followed by the 14500CE and 13500PE options. Market participants have shown increased interest with significant open interest additions in the 13000PE option, with open interest additions also seen in the 14300CE and 14000CE options. On the other hand, open interest reductions were prominent in the 72500PE, 72500PE, and 72500PE options. Trading volume was highest in the 13000PE option, followed by the 14500CE and 14000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,806.70 | 0.928 | 0.925 | 0.949 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,57,840 | 10,21,860 | 7,35,980 |

| PUT: | 16,31,420 | 9,45,280 | 6,86,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 3,44,400 | 99,260 | 3,947 |

| 14,000 | 3,11,220 | 1,16,340 | 3,401 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 1,97,260 | 1,53,580 | 1,672 |

| 14,000 | 3,11,220 | 1,16,340 | 3,401 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 64,120 | -2,100 | 717 |

| 13,850 | 9,660 | -700 | 64 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 3,44,400 | 99,260 | 3,947 |

| 14,000 | 3,11,220 | 1,16,340 | 3,401 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,68,440 | 2,33,940 | 4,523 |

| 13,500 | 3,15,140 | 58,800 | 2,368 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,68,440 | 2,33,940 | 4,523 |

| 14,000 | 2,14,060 | 73,500 | 2,267 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 5,740 | -140 | 7 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,68,440 | 2,33,940 | 4,523 |

| 13,800 | 1,05,000 | 67,760 | 2,449 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Bias is now clearly downside with room for tactical bounces only: Given the Open Interest Volume Analysis, treating every sharp intraday rise as a potential shorting opportunity rather than chasing longs is a more data-aligned approach.

Actionable feedback for index traders: Look to initiate or add to shorts closer to 26,000–26,100 on NIFTY futures with tight, pre-defined stops, and avoid naked bottom-fishing until combined OI starts to contract meaningfully with price stability.

Use options to define risk instead of leverage: Bear put spreads or call credit spreads around the 26,000–26,500 band can express a bearish view while capping risk if shorts are suddenly squeezed.

Watch for the first real sign of short-covering: A day where price closes flat-to-positive while combined OI drops notably (rather than rises) will be an early signal that the downside may be tiring out.

Stay flexible, not stubborn: As long as Open Interest Volume Analysis continues to show rising OI on down days, respect the short trend; when that pattern breaks, be ready to quickly lighten shorts and rotate towards range or reversal trades.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.