Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 28/11/2025

Table of Contents

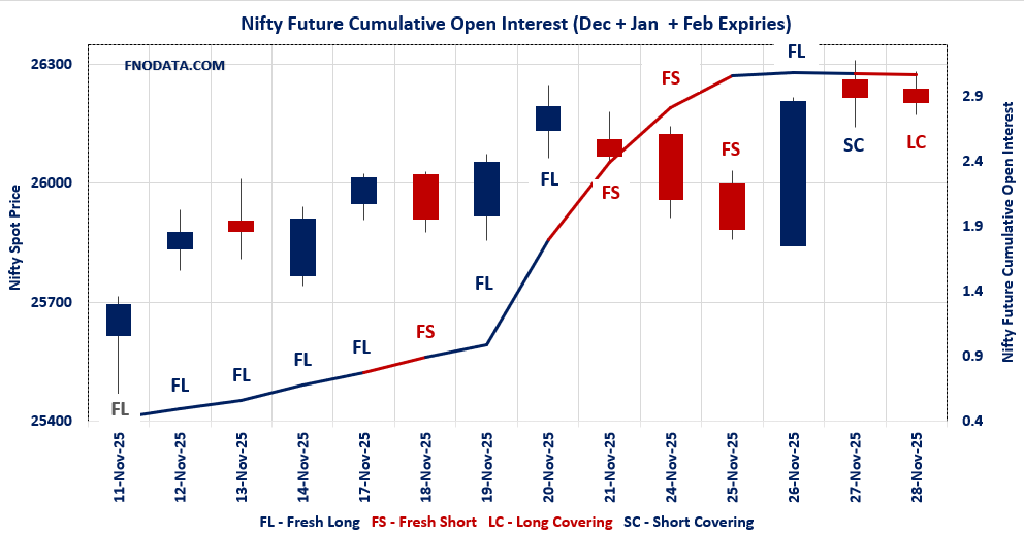

NIFTY’s Open Interest Volume Analysis signals long covering amid low conviction: Combined futures OI dipped -0.96% with sharp volume drop (-39%), on a flat price day (-0.05%), showing traders booking profits from recent longs rather than adding fresh bets.

December futures lead the unwind: Near-month OI fell -1.41% despite premium expansion, indicating profit-taking in the front contract as bulls pause after yesterday’s rally.

January futures buck trend with fresh longs: Longer-dated OI up +3.03% hints at some optimism for December onwards, but low volume (-53%) suggests selective positioning, not broad enthusiasm.

Options PCR eases slightly bearish: Weekly PCR at 1.123 (down from 1.137) and monthly at 1.205 show put interest cooling, with max pain steady at 26,000–26,200 as key pivot.

BANKNIFTY bucks the caution with fresh longs: Combined OI +2.76% on falling volume points to banking sector resilience, contrasting NIFTY’s unwind.

FINNIFTY and MIDCPNIFTY join profit-taking: Both show long covering (-0.2% and -1.22% OI), reflecting broader market hesitation outside largecaps.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26202.95 (-0.048%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.96%

Combined Fut Volume Change: -39.03%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 7% Previous 7%

NIFTY DECEMBER Future closed at: 26387.4 (-0.013%)

November Fut Premium 184.45 (Increased by 9.1 points)

November Fut Open Interest Change: -1.41%

November Fut Volume Change: -37.50%

November Fut Open Interest Analysis: Long Covering

NIFTY JANUARY Future closed at: 26550.1 (0.005%)

December Fut Premium 347.15 (Increased by 14 points)

December Fut Open Interest Change: 3.03%

December Fut Volume Change: -53.22%

December Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (2/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.123 (Decreased from 1.137)

Put-Call Ratio (Volume): 1.035

Max Pain Level: 26200

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26400

Highest PUT Addition: 26200

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.205 (Decreased from 1.229)

Put-Call Ratio (Volume): 1.343

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 25900

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59752.7 (0.026%)

Combined = December + January + February

Combined Fut Open Interest Change: 2.76%

Combined Fut Volume Change: -48.58%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 9% Previous 9%

BANKNIFTY DECEMBER Future closed at: 60068.2 (0.061%)

November Fut Premium 315.5 (Increased by 21 points)

November Fut Open Interest Change: 2.5%

November Fut Volume Change: -48.1%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY JANUARY Future closed at: 60419.4 (0.100%)

December Fut Premium 666.7 (Increased by 44.8 points)

December Fut Open Interest Change: 4.21%

December Fut Volume Change: -52.55%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.178 (Increased from 1.170)

Put-Call Ratio (Volume): 1.090

Max Pain Level: 59200

Maximum CALL Open Interest: 58500

Maximum PUT Open Interest: 58500

Highest CALL Addition: 60000

Highest PUT Addition: 59000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27890.25 (-0.200%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.2%

Combined Fut Volume Change: -44.5%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 1% Previous 1%

FINNIFTY DECEMBER Future closed at: 28053.1 (-0.166%)

November Fut Premium 162.85 (Increased by 9.25 points)

November Fut Open Interest Change: -0.40%

November Fut Volume Change: -44.30%

November Fut Open Interest Analysis: Long Covering

FINNIFTY JANUARY Future closed at: 28155.1 (-0.216%)

December Fut Premium 264.85 (Decreased by -5.05 points)

December Fut Open Interest Change: 33.33%

December Fut Volume Change: -66.67%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.847 (Decreased from 1.060)

Put-Call Ratio (Volume): 0.750

Max Pain Level: 28000

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 28000

Highest CALL Addition: 28200

Highest PUT Addition: 28200

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 14043.7 (-0.229%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.22%

Combined Fut Volume Change: -57.24%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 2% Previous 1%

MIDCPNIFTY DECEMBER Future closed at: 14125.35 (-0.243%)

November Fut Premium 81.65 (Decreased by -2.25 points)

November Fut Open Interest Change: -1.36%

November Fut Volume Change: -56.78%

November Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 14195.3 (-0.160%)

December Fut Premium 151.6 (Increased by 9.45 points)

December Fut Open Interest Change: 6.69%

December Fut Volume Change: -66.34%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.014 (Decreased from 1.051)

Put-Call Ratio (Volume): 0.939

Max Pain Level: 14000

Maximum CALL Open Interest: 15000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14800

Highest PUT Addition: 13000

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,706.67 (-0.016%)

SENSEX Monthly Future closed at: 86,350.50 (0.047%)

Premium: 643.83 (Increased by 53.91 points)

Open Interest Change: 7.49%

Volume Change: -46.69%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (4/12/2025) Option Analysis

Put-Call Ratio (OI): 0.902 (Decreased from 0.995)

Put-Call Ratio (Volume): 0.914

Max Pain Level: 85700

Maximum CALL OI: 89000

Maximum PUT OI: 85500

Highest CALL Addition: 87200

Highest PUT Addition: 84500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,795.72 Cr.

DIIs Net BUY: ₹ 4,148.48 Cr.

FII Derivatives Activity

| FII Trading Stats | 28.11.25 | 27.11.25 | 26.11.25 |

| FII Cash (Provisional Data) | -3,795.72 | -1,255.20 | 4,778.03 |

| Index Future Open Interest Long Ratio | 18.70% | 18.56% | 17.19% |

| Index Future Volume Long Ratio | 48.99% | 56.41% | 55.12% |

| Call Option Open Interest Long Ratio | 49.78% | 51.28% | 51.38% |

| Call Option Volume Long Ratio | 49.73% | 50.01% | 50.86% |

| Put Option Open Interest Long Ratio | 61.21% | 60.29% | 57.59% |

| Put Option Volume Long Ratio | 50.42% | 50.39% | 48.93% |

| Stock Future Open Interest Long Ratio | 61.48% | 61.51% | 61.88% |

| Stock Future Volume Long Ratio | 49.69% | 46.25% | 53.23% |

| Index Futures | Fresh Short | Fresh Long | Fresh Long |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Long Covering | Fresh Short | Fresh Long |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Long | Short Covering | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Short Covering | Short Covering |

| FinNifty Options | Fresh Long | Fresh Long | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Fresh Short | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (4/12/2025)

The SENSEX index closed at 85706.67. The SENSEX weekly expiry for DECEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.902 against previous 0.995. The 85500PE option holds the maximum open interest, followed by the 84500PE and 89000CE options. Market participants have shown increased interest with significant open interest additions in the 84500PE option, with open interest additions also seen in the 87200CE and 87700CE options. On the other hand, open interest reductions were prominent in the 84000CE, 80100PE, and 84300CE options. Trading volume was highest in the 85800PE option, followed by the 86000CE and 85800CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85706.67 | 0.902 | 0.995 | 0.914 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 96,06,260 | 42,82,260 | 53,24,000 |

| PUT: | 86,62,740 | 42,61,760 | 44,00,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 5,63,160 | 1,65,000 | 36,22,260 |

| 86000 | 5,46,680 | 2,46,940 | 1,92,11,440 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87200 | 3,50,700 | 2,87,880 | 34,93,500 |

| 87700 | 3,04,860 | 2,78,880 | 22,85,720 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 38,180 | -4,020 | 11,760 |

| 84300 | 3,360 | -1,780 | 2,740 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 5,46,680 | 2,46,940 | 1,92,11,440 |

| 85800 | 3,59,840 | 2,35,040 | 1,71,11,400 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 6,06,460 | 2,70,380 | 1,14,94,080 |

| 84500 | 5,90,420 | 3,88,280 | 48,69,220 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 5,90,420 | 3,88,280 | 48,69,220 |

| 84000 | 5,26,460 | 2,73,960 | 40,97,040 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80100 | 720 | -2,440 | 17,620 |

| 86700 | 4,900 | -440 | 37,100 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85800 | 3,34,120 | 2,51,100 | 1,93,87,120 |

| 85700 | 2,82,160 | 1,78,060 | 1,60,38,980 |

NIFTY Weekly Expiry (2/12/2025)

The NIFTY index closed at 26202.95. The NIFTY weekly expiry for DECEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.123 against previous 1.137. The 26000PE option holds the maximum open interest, followed by the 26500CE and 26300CE options. Market participants have shown increased interest with significant open interest additions in the 26400CE option, with open interest additions also seen in the 26200PE and 26500CE options. On the other hand, open interest reductions were prominent in the 26600CE, 25700PE, and 25100PE options. Trading volume was highest in the 26200PE option, followed by the 26300CE and 26250CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,202.95 | 1.123 | 1.137 | 1.035 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,20,08,850 | 14,37,39,825 | 1,82,69,025 |

| PUT: | 18,18,78,600 | 16,34,98,725 | 1,83,79,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,35,88,275 | 29,50,500 | 27,30,923 |

| 26,300 | 1,22,24,025 | 29,07,225 | 57,66,167 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 1,12,80,525 | 39,78,150 | 30,32,139 |

| 26,500 | 1,35,88,275 | 29,50,500 | 27,30,923 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 69,30,300 | -14,58,150 | 13,56,814 |

| 27,500 | 55,55,700 | -7,39,350 | 2,87,953 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 1,22,24,025 | 29,07,225 | 57,66,167 |

| 26,250 | 68,91,225 | 18,30,600 | 51,23,719 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,70,03,400 | 16,39,125 | 26,13,352 |

| 26,100 | 1,10,36,850 | 26,76,525 | 30,55,902 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,09,49,025 | 34,76,475 | 69,33,627 |

| 26,100 | 1,10,36,850 | 26,76,525 | 30,55,902 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 60,73,725 | -13,94,625 | 5,77,781 |

| 25,100 | 24,96,300 | -10,95,225 | 3,13,285 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,09,49,025 | 34,76,475 | 69,33,627 |

| 26,250 | 39,32,775 | 13,19,325 | 46,75,231 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26202.95. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.205 against previous 1.229. The 27000CE option holds the maximum open interest, followed by the 26000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 25900PE and 26800CE options. On the other hand, open interest reductions were prominent in the 26000CE, 26400PE, and 27000PE options. Trading volume was highest in the 27000CE option, followed by the 26000PE and 26200PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,202.95 | 1.205 | 1.229 | 1.343 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,86,60,000 | 4,70,42,500 | 16,17,500 |

| PUT: | 5,86,51,750 | 5,77,93,625 | 8,58,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 74,16,825 | 3,37,800 | 56,715 |

| 26,000 | 59,13,900 | -76,600 | 19,231 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 74,16,825 | 3,37,800 | 56,715 |

| 26,800 | 14,95,725 | 2,53,575 | 15,104 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 59,13,900 | -76,600 | 19,231 |

| 26,700 | 8,87,925 | -66,450 | 14,587 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 74,16,825 | 3,37,800 | 56,715 |

| 26,500 | 34,04,775 | 2,13,525 | 35,176 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,32,375 | 18,850 | 51,184 |

| 25,000 | 46,56,100 | -50,950 | 26,237 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 11,58,225 | 2,82,000 | 15,142 |

| 24,200 | 4,13,400 | 1,49,475 | 4,039 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 8,80,125 | -67,500 | 21,467 |

| 27,000 | 13,56,650 | -66,975 | 5,974 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,32,375 | 18,850 | 51,184 |

| 26,200 | 25,06,725 | -4,575 | 36,240 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59752.7. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.178 against previous 1.170. The 58500PE option holds the maximum open interest, followed by the 59000PE and 58500CE options. Market participants have shown increased interest with significant open interest additions in the 59000PE option, with open interest additions also seen in the 60000CE and 59500PE options. On the other hand, open interest reductions were prominent in the 59200CE, 59300PE, and 58400PE options. Trading volume was highest in the 60000CE option, followed by the 59700PE and 59800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,752.70 | 1.178 | 1.170 | 1.090 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,13,33,550 | 1,08,52,510 | 4,81,040 |

| PUT: | 1,33,51,140 | 1,27,00,000 | 6,51,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 12,91,080 | -210 | 1,224 |

| 60,000 | 10,84,790 | 1,11,860 | 1,04,823 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 10,84,790 | 1,11,860 | 1,04,823 |

| 59,700 | 1,97,855 | 56,455 | 67,833 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,200 | 69,475 | -24,430 | 3,205 |

| 58,000 | 2,03,910 | -12,915 | 1,142 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 10,84,790 | 1,11,860 | 1,04,823 |

| 59,700 | 1,97,855 | 56,455 | 67,833 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 20,61,745 | 1,085 | 42,490 |

| 59,000 | 12,97,975 | 1,27,155 | 48,239 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,97,975 | 1,27,155 | 48,239 |

| 59,500 | 7,70,490 | 57,540 | 75,745 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 1,84,240 | -21,315 | 12,601 |

| 58,400 | 85,540 | -13,510 | 4,411 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,700 | 2,29,285 | -9,415 | 85,468 |

| 59,800 | 2,44,510 | 47,460 | 80,165 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27890.25. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.847 against previous 1.060. The 28200CE option holds the maximum open interest, followed by the 28000CE and 28000PE options. Market participants have shown increased interest with significant open interest additions in the 28200CE option, with open interest additions also seen in the 28200PE and 28100CE options. On the other hand, open interest reductions were prominent in the 27700PE, 28050CE, and 28800CE options. Trading volume was highest in the 28200CE option, followed by the 28000CE and 28500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,890.25 | 0.847 | 1.060 | 0.750 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,68,680 | 2,14,955 | 1,53,725 |

| PUT: | 3,12,455 | 2,27,890 | 84,565 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 91,000 | 84,565 | 5,537 |

| 28,000 | 51,155 | 11,375 | 2,229 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 91,000 | 84,565 | 5,537 |

| 28,100 | 19,565 | 14,560 | 1,237 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,050 | 4,355 | -1,040 | 259 |

| 28,800 | 10,400 | -650 | 145 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 91,000 | 84,565 | 5,537 |

| 28,000 | 51,155 | 11,375 | 2,229 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 39,520 | 8,710 | 1,723 |

| 27,800 | 32,370 | 8,060 | 1,489 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 20,085 | 18,005 | 488 |

| 26,500 | 13,845 | 13,260 | 242 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 27,495 | -2,145 | 633 |

| 27,300 | 3,445 | -455 | 87 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 17,290 | 3,185 | 2,059 |

| 28,000 | 39,520 | 8,710 | 1,723 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 14043.7. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.014 against previous 1.051. The 15000CE option holds the maximum open interest, followed by the 13000PE and 14000PE options. Market participants have shown increased interest with significant open interest additions in the 14800CE option, with open interest additions also seen in the 13000PE and 15000CE options. On the other hand, open interest reductions were prominent in the 70800CE, 70800CE, and 70800PE options. Trading volume was highest in the 14000PE option, followed by the 14100CE and 14100PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 14,043.70 | 1.014 | 1.051 | 0.939 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 36,85,080 | 32,68,440 | 4,16,640 |

| PUT: | 37,36,740 | 34,34,060 | 3,02,680 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 6,79,000 | 76,300 | 4,274 |

| 14,000 | 4,07,680 | 14,140 | 5,415 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,800 | 3,79,120 | 1,28,520 | 4,807 |

| 15,000 | 6,79,000 | 76,300 | 4,274 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 2,13,920 | -25,760 | 7,775 |

| 13,900 | 83,860 | -2,100 | 187 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 2,13,920 | -25,760 | 7,775 |

| 14,000 | 4,07,680 | 14,140 | 5,415 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,89,540 | 85,120 | 2,379 |

| 14,000 | 4,80,760 | 38,920 | 8,049 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,89,540 | 85,120 | 2,379 |

| 13,300 | 3,03,380 | 39,900 | 1,987 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 1,64,080 | -45,920 | 6,953 |

| 13,900 | 1,85,080 | -7,420 | 1,758 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 4,80,760 | 38,920 | 8,049 |

| 14,100 | 1,64,080 | -45,920 | 6,953 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Overall sentiment: Consolidation after rally, watch for fresh direction: Open Interest Volume Analysis reveals long covering with thin volumes, suggesting bulls need stronger conviction for upside continuation.

Actionable trades: Buy dips to 26,000 support with stops below; avoid aggressive longs until combined OI turns positive on rising volume—ideal for range-bound option selling (e.g., iron condors 26,000-26,500).

Sector picks: Lean into BANKNIFTY fresh longs for relative strength plays; stay light on FINNIFTY/MIDCPNIFTY amid covering.

Key trigger to watch: Reversal if tomorrow’s OI builds on price upside—signals sustained rally; persistent covering warns of pullback to 25,900.

Risk rule: Scale positions small in this low-volume environment; use PCR drop below 1.0 as green light for adding longs confidently.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.