Turning Complex Derivative Data into Clear Market Insights

In-depth Analysis on NSE Futures and Options for 07 May 2025

Table of Contents

NSE Futures and Options market on 07 May 2025 offered a cautiously optimistic outlook, with slight gains in spot levels accompanied by falling open interest—indicating Short-Covering rather than fresh long build-up. NIFTY’s weekly PCR (OI) rose, suggesting increased PUT writing at higher levels, while the premium narrowed, hinting at cautious bullish conviction. BANKNIFTY displayed similar cues, with a drop in OI despite a price uptick, showing short-covering instead of new positions. MIDCPNIFTY stood out once again with rising prices, volume, and open interest—indicating fresh bullish interest. Let’s break down what these subtle but critical movements mean for your trading strategy ahead of expiry.

NSE futures and options Trends

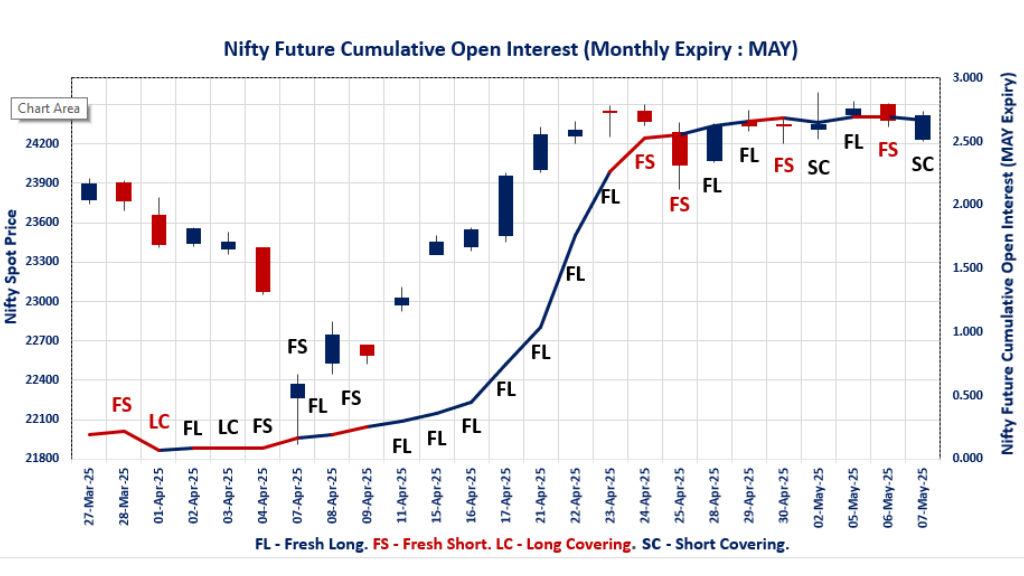

NIFTY MAY Future

NIFTY Spot closed at: 24,414.40 (0.14%)

NIFTY MAY Future closed at: 24,461.40 (0.12%)

Premium: 47 (Decreased by -4.8 points)

Open Interest Change: -2.7%

Volume Change: 53.1%

NIFTY Weekly Expiry (8/05/2025) Option Analysis

Put-Call Ratio (OI): 0.872 (Increased from 0.784)

Put-Call Ratio (Volume): 0.814

Max Pain Level: 24400

Maximum CALL OI: 24500

Maximum PUT OI: 24300

Highest CALL Addition: 24400

Highest PUT Addition: 24300

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.343 (Decreased from 1.390)

Put-Call Ratio (Volume): 1.149

Max Pain Level: 24200

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 26200

Highest PUT Addition: 21800

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 54,610.90 (0.63%)

BANKNIFTY MAY Future closed at: 54,671.00 (0.57%)

Premium: 60.1 (Decreased by -31.5 points)

Open Interest Change: -7.6%

Volume Change: 27.5%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.826 (Increased from 0.816)

Put-Call Ratio (Volume): 0.825

Max Pain Level: 54500

Maximum CALL OI: 63000

Maximum PUT OI: 54000

Highest CALL Addition: 54000

Highest PUT Addition: 54000

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,165.65 (0.76%)

FINNIFTY MAY Future closed at: 26,198.30 (0.78%)

Premium: 32.65 (Increased by 7.05 points)

Open Interest Change: -1.6%

Volume Change: 14.6%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.761 (Decreased from 0.779)

Put-Call Ratio (Volume): 0.783

Max Pain Level: 26200

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 28500

Highest PUT Addition: 26100

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,217.65 (1.93%)

MIDCPNIFTY MAY Future closed at: 12,249.80 (2.11%)

Premium: 32.15 (Increased by 20.85 points)

Open Interest Change: 3.5%

Volume Change: 22.0%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.085 (Increased from 1.051)

Put-Call Ratio (Volume): 0.963

Max Pain Level: 12150

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 13200

Highest PUT Addition: 11500

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,585.86 Cr

DIIs Net Buy: ₹ 2,378.49 Cr

FII Derivatives Activity

| FII Trading Stats | 7.05.25 | 6.05.25 | 5.05.25 |

| FII Cash (Provisional Data) | 2,585.86 | 3,794.52 | 497.79 |

| Index Future Open Interest Long Ratio | 50.14% | 49.23% | 48.51% |

| Index Future Volume Long Ratio | 53.70% | 53.88% | 53.49% |

| Call Option Open Interest Long Ratio | 50.98% | 51.28% | 49.89% |

| Call Option Volume Long Ratio | 49.95% | 50.42% | 49.25% |

| Put Option Open Interest Long Ratio | 49.56% | 50.18% | 46.61% |

| Put Option Volume Long Ratio | 49.89% | 50.81% | 48.91% |

| Stock Future Open Interest Long Ratio | 65.50% | 65.14% | 65.26% |

| Stock Future Volume Long Ratio | 53.36% | 49.65% | 53.96% |

| Index Futures | Short Covering | Fresh Long | Fresh Long |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Long Covering | Fresh Long | Fresh Long |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Long | Long Covering | Long Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Short | Short Covering | Fresh Short |

| FinNifty Options | Fresh Long | Short Covering | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Long Covering | Fresh Short |

| Stock Futures | Fresh Long | Short Covering | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE Options Analysis | Options Insights

NIFTY Weekly Expiry (8.05.2025)

The NIFTY index closed at 24414.4. The NIFTY weekly expiry for May 8, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.872 against previous 0.784. The 24500CE option holds the maximum open interest, followed by the 24400CE and 24300PE options. Market participants have shown increased interest with significant open interest additions in the 24300PE option, with open interest additions also seen in the 24350PE and 24400CE options. On the other hand, open interest reductions were prominent in the 26100CE, 25500CE, and 25800CE options. Trading volume was highest in the 24400CE option, followed by the 24500CE and 24400PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 08-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,414.40 | 0.872 | 0.784 | 0.814 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,96,54,000 | 18,81,25,350 | 15,28,650 |

| PUT: | 16,53,55,200 | 14,74,18,650 | 1,79,36,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,85,90,700 | 5,93,025 | 66,79,610 |

| 24,400 | 1,50,24,750 | 31,72,200 | 95,83,749 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,50,24,750 | 31,72,200 | 95,83,749 |

| 24,700 | 72,46,050 | 13,69,875 | 25,19,496 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 77,48,325 | -35,07,000 | 4,80,391 |

| 25,500 | 72,49,800 | -26,79,075 | 7,11,897 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,50,24,750 | 31,72,200 | 95,83,749 |

| 24,500 | 1,85,90,700 | 5,93,025 | 66,79,610 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,28,67,675 | 50,83,650 | 57,90,305 |

| 24,400 | 1,09,13,700 | 16,20,600 | 63,56,962 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,28,67,675 | 50,83,650 | 57,90,305 |

| 24,350 | 73,42,875 | 33,28,275 | 55,26,980 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 52,64,700 | -14,45,550 | 7,31,869 |

| 20,500 | 23,14,050 | -12,87,225 | 2,51,240 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,09,13,700 | 16,20,600 | 63,56,962 |

| 24,300 | 1,28,67,675 | 50,83,650 | 57,90,305 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24414.4. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.343 against previous 1.390. The 24000PE option holds the maximum open interest, followed by the 24500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 26200CE option, with open interest additions also seen in the 26000CE and 26100CE options. On the other hand, open interest reductions were prominent in the 24000PE, 24500PE, and 24300PE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,414.40 | 1.343 | 1.390 | 1.149 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,80,56,125 | 3,68,96,400 | 11,59,725 |

| PUT: | 5,10,91,275 | 5,12,86,275 | -1,95,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,14,375 | -1,29,975 | 65,040 |

| 25,000 | 41,02,950 | -20,325 | 77,374 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 6,56,550 | 4,26,300 | 14,249 |

| 26,000 | 24,31,800 | 4,18,500 | 35,954 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,14,375 | -1,29,975 | 65,040 |

| 24,600 | 6,43,350 | -85,575 | 11,559 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 41,02,950 | -20,325 | 77,374 |

| 24,500 | 43,14,375 | -1,29,975 | 65,040 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 68,84,175 | -3,58,950 | 71,206 |

| 23,000 | 42,27,675 | 71,175 | 43,579 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 21,800 | 7,15,575 | 2,00,700 | 8,682 |

| 23,500 | 36,24,900 | 1,48,425 | 35,195 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 68,84,175 | -3,58,950 | 71,206 |

| 24,500 | 30,45,150 | -2,25,000 | 64,575 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 68,84,175 | -3,58,950 | 71,206 |

| 24,500 | 30,45,150 | -2,25,000 | 64,575 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 54610.9. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.826 against previous 0.816. The 63000CE option holds the maximum open interest, followed by the 54000PE and 53000PE options. Market participants have shown increased interest with significant open interest additions in the 54000PE option, with open interest additions also seen in the 54000CE and 63000CE options. On the other hand, open interest reductions were prominent in the 53500PE, 53000CE, and 55000PE options. Trading volume was highest in the 54000PE option, followed by the 54500PE and 54500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,610.90 | 0.826 | 0.816 | 0.825 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,23,39,290 | 2,23,39,830 | -540 |

| PUT: | 1,84,63,140 | 1,82,25,879 | 2,37,261 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 29,79,090 | 1,39,590 | 1,22,560 |

| 60,000 | 12,62,580 | 7,680 | 71,353 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 6,87,090 | 3,24,600 | 63,127 |

| 63,000 | 29,79,090 | 1,39,590 | 1,22,560 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 5,35,620 | -2,43,870 | 19,951 |

| 59,000 | 8,33,790 | -87,510 | 63,309 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 4,23,450 | 4,140 | 1,72,663 |

| 55,000 | 10,32,690 | 20,010 | 1,45,174 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,61,300 | 3,56,280 | 1,81,723 |

| 53,000 | 13,36,530 | -34,830 | 1,05,303 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,61,300 | 3,56,280 | 1,81,723 |

| 54,500 | 6,23,670 | 97,470 | 1,78,338 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 10,57,770 | -3,39,420 | 83,176 |

| 55,000 | 8,02,650 | -1,18,560 | 58,290 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,61,300 | 3,56,280 | 1,81,723 |

| 54,500 | 6,23,670 | 97,470 | 1,78,338 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26165.65. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.761 against previous 0.779. The 29500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 28500CE option, with open interest additions also seen in the 27500CE and 26100PE options. On the other hand, open interest reductions were prominent in the 29500CE, 29500CE, and 26600PE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 27000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,165.65 | 0.761 | 0.779 | 0.783 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,25,700 | 9,93,980 | 31,720 |

| PUT: | 7,80,975 | 7,74,215 | 6,760 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,61,850 | -15,535 | 1,521 |

| 27,000 | 1,42,675 | -7,410 | 3,224 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,500 | 63,570 | 30,030 | 1,893 |

| 27,500 | 55,510 | 27,105 | 1,501 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,61,850 | -15,535 | 1,521 |

| 29,500 | 1,61,850 | -15,535 | 1,521 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,990 | -15,535 | 3,247 |

| 27,000 | 1,42,675 | -7,410 | 3,224 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,27,400 | 3,575 | 4,252 |

| 25,500 | 60,710 | -10,140 | 963 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 38,935 | 13,390 | 1,636 |

| 21,500 | 6,695 | 6,240 | 178 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 9,880 | -13,390 | 421 |

| 25,500 | 60,710 | -10,140 | 963 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,27,400 | 3,575 | 4,252 |

| 25,000 | 60,320 | -8,190 | 1,704 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 12217.65. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.085 against previous 1.051. The 12000PE option holds the maximum open interest, followed by the 11500PE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 11500PE option, with open interest additions also seen in the 12100PE and 12200PE options. On the other hand, open interest reductions were prominent in the 66100PE, 66500CE, and 66500PE options. Trading volume was highest in the 12000PE option, followed by the 12200CE and 12500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,217.65 | 1.085 | 1.051 | 0.963 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 44,05,440 | 41,92,920 | 2,12,520 |

| PUT: | 47,79,240 | 44,08,320 | 3,70,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 3,80,880 | -44,520 | 10,333 |

| 13,500 | 3,73,920 | -32,760 | 3,176 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 2,12,160 | 46,080 | 2,796 |

| 12,500 | 2,85,120 | 41,880 | 16,162 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 3,80,880 | -44,520 | 10,333 |

| 12,000 | 3,32,400 | -41,400 | 11,585 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,81,160 | 30,480 | 17,633 |

| 12,500 | 2,85,120 | 41,880 | 16,162 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,93,960 | -34,200 | 23,764 |

| 11,500 | 5,35,800 | 90,480 | 10,265 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 5,35,800 | 90,480 | 10,265 |

| 12,100 | 2,42,040 | 65,400 | 12,088 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,93,960 | -34,200 | 23,764 |

| 11,000 | 3,59,520 | -19,440 | 10,217 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,93,960 | -34,200 | 23,764 |

| 12,200 | 2,91,240 | 61,200 | 12,348 |

Conclusion : Key Takeaways from Today’s NIFTY Futures and Options

In summary, the F&O landscape for May 7 shows a market cautiously stepping forward. The contraction in futures premiums for NIFTY and BANKNIFTY, combined with falling OI, suggests that the upward movement is driven more by short-covering than conviction buying. NIFTY highest CALL-PUT open interest additions at 24,400 – 24,300 with Max-Pain at 24,400 suggesting tight range for today’s weekly expiry. Highest CALL open interest at 24,500 suggests absolute roof. Weakness below 24,300 should target 24,000; which is the max PUT open interest level for monthly expiry. Highest PUT addition in monthly expiry was at 21,800; which should be a cautious flag. For BANKNIFTY; 54,000 continues to be the most important levels with highest PUT open interest. With mixed signals in PCR and shifting Max Pain levels, traders should be alert to sudden shifts in sentiment—especially as expiry pressures begin to tighten. Keeping a close watch on strike-specific activity will be key in navigating the next move.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]

[…] Check Last Week;s Trading on Day before Expiry (7/5/25). […]

Fantastic website. A lot of helpful info here. I am sending it to several pals ans also sharing in delicious.

And of course, thanks in your effort!

my blog – block number message prank

WD