Turning Complex Derivative Data into Clear Market Insights

What’s Brewing in NSE Futures and Options? Derivatives Breakdown for 06 May 2025

Table of Contents

NSE futures and options market action on 06 May 2025 revealed sharp undercurrents, with bearish pressure weighing heavily across key indices like BANKNIFTY, FINNIFTY, and MIDCPNIFTY. Despite low changes in open interest, futures premiums shrank significantly, indicating unwinding of long positions and rising caution. The drop in Put-Call Ratios (OI) for most indices, coupled with aggressive PUT writing near lower strikes, highlights a defensive stance ahead of the weekly expiry. Meanwhile, MIDCPNIFTY stood out with a surge in OI and volume, pointing to fresh short build-up. In this blog, we decode what these F&O signals mean for traders and investors eyeing short-term trends.

NSE futures and options Trends

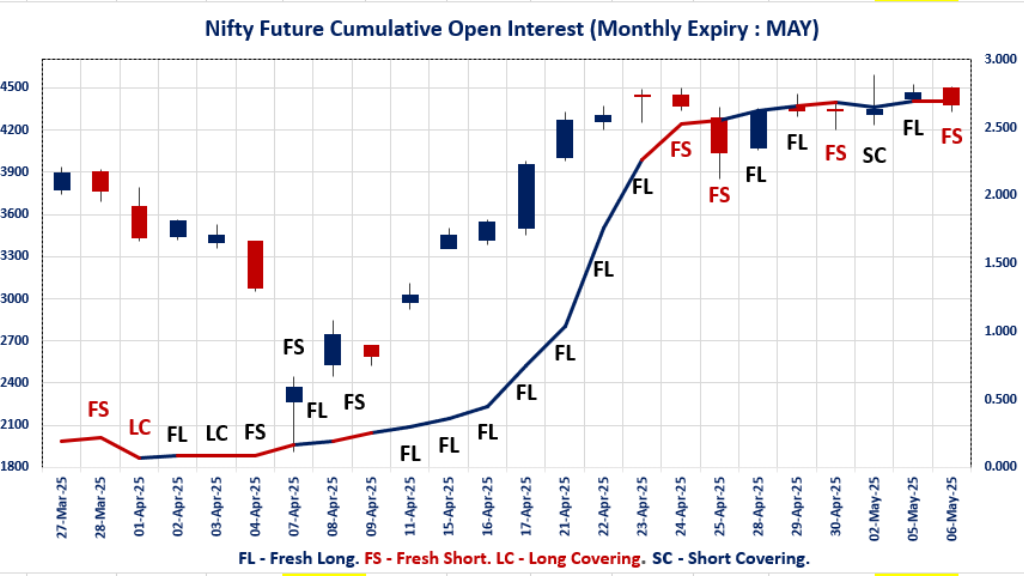

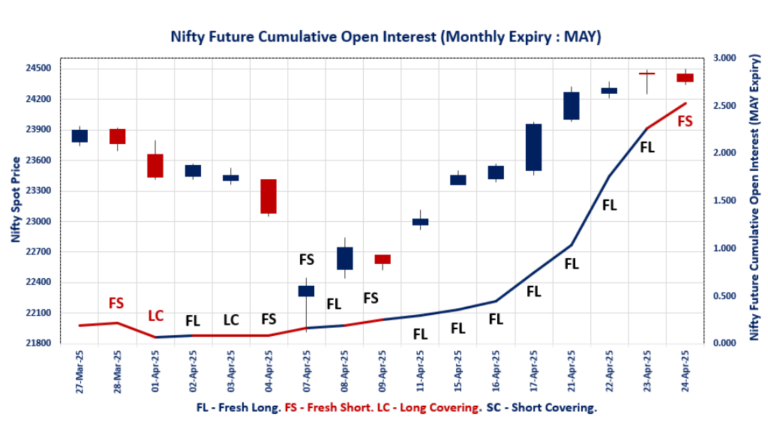

NIFTY MAY Future

NIFTY Spot closed at: 24,379.60 (-0.33%)

NIFTY MAY Future closed at: 24,431.40 (-0.50%)

Premium: 51.8 (Decreased by -40.75 points)

Open Interest Change: 0.1%

Volume Change: -14.5%

NIFTY Weekly Expiry (8/05/2025) Option Analysis

Put-Call Ratio (OI): 0.784 (Decreased from 0.811)

Put-Call Ratio (Volume): 0.994

Max Pain Level: 24400

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 24400

Highest PUT Addition: 23500

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.390 (Increased from 1.373)

Put-Call Ratio (Volume): 1.178

Max Pain Level: 24200

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 26200

Highest PUT Addition: 24000

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 54,271.40 (-1.18%)

BANKNIFTY MAY Future closed at: 54,363.00 (-1.30%)

Premium: 91.6 (Decreased by -69.5 points)

Open Interest Change: -6.0%

Volume Change: 9.0%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.825 (Decreased from 0.892)

Put-Call Ratio (Volume): 0.938

Max Pain Level: 54500

Maximum CALL OI: 63000

Maximum PUT OI: 53500

Highest CALL Addition: 54500

Highest PUT Addition: 53500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 25,969.00 (-0.75%)

FINNIFTY MAY Future closed at: 25,994.60 (-0.96%)

Premium: 25.6 (Decreased by -56.1 points)

Open Interest Change: -0.9%

Volume Change: 35.8%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.779 (Decreased from 0.786)

Put-Call Ratio (Volume): 1.201

Max Pain Level: 26200

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 25500

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 11,985.90 (-2.09%)

MIDCPNIFTY MAY Future closed at: 11,997.20 (-2.40%)

Premium: 11.3 (Decreased by -38.2 points)

Open Interest Change: 6.4%

Volume Change: 44.1%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.051 (Decreased from 1.073)

Put-Call Ratio (Volume): 1.018

Max Pain Level: 12100

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 12000

Highest PUT Addition: 12000

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 3,794.52 Cr

DIIs Net Sell: ₹ 1,397.68 Cr

FII Derivatives Activity

| FII Trading Stats | 6.05.25 | 5.05.25 | 2.05.25 |

| FII Cash (Provisional Data) | 3,794.52 | 497.79 | 2,769.81 |

| Index Future Open Interest Long Ratio | 49.23% | 48.51% | 47.37% |

| Index Future Volume Long Ratio | 53.88% | 53.49% | 51.33% |

| Call Option Open Interest Long Ratio | 51.28% | 49.89% | 53.21% |

| Call Option Volume Long Ratio | 50.42% | 49.25% | 49.09% |

| Put Option Open Interest Long Ratio | 50.18% | 46.61% | 51.65% |

| Put Option Volume Long Ratio | 50.81% | 48.91% | 49.65% |

| Stock Future Open Interest Long Ratio | 65.14% | 65.26% | 64.85% |

| Stock Future Volume Long Ratio | 49.65% | 53.96% | 49.93% |

| Index Futures | Fresh Long | Fresh Long | Fresh Long |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Fresh Long |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Long Covering | Long Covering | Long Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Short | Fresh Short |

| FinNifty Options | Short Covering | Long Covering | Fresh Short |

| MidcpNifty Futures | Fresh Long | Long Covering | Short Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Short Covering | Long Covering |

| NiftyNxt50 Options | Long Covering | Fresh Short | Fresh Long |

| Stock Futures | Short Covering | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE Options Analysis | Options Insights

NIFTY Weekly Expiry (8.05.2025)

The NIFTY index closed at 24379.6. The NIFTY weekly expiry for May 8, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.784 against previous 0.811. The 24500CE option holds the maximum open interest, followed by the 24400CE and 26100CE options. Market participants have shown increased interest with significant open interest additions in the 24400CE option, with open interest additions also seen in the 24500CE and 24450CE options. On the other hand, open interest reductions were prominent in the 26000CE, 24500PE, and 24800CE options. Trading volume was highest in the 24400PE option, followed by the 24400CE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 08-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,379.60 | 0.784 | 0.811 | 0.994 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,81,25,350 | 17,39,44,650 | 1,41,80,700 |

| PUT: | 14,74,18,650 | 14,10,57,600 | 63,61,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,79,97,675 | 52,54,350 | 28,22,601 |

| 24,400 | 1,18,52,550 | 63,58,425 | 34,82,695 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,18,52,550 | 63,58,425 | 34,82,695 |

| 24,500 | 1,79,97,675 | 52,54,350 | 28,22,601 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,62,550 | -30,16,425 | 6,65,949 |

| 24,800 | 68,09,850 | -12,87,075 | 9,13,866 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,18,52,550 | 63,58,425 | 34,82,695 |

| 24,500 | 1,79,97,675 | 52,54,350 | 28,22,601 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 99,65,550 | 10,25,100 | 9,26,952 |

| 24,400 | 92,93,100 | 12,33,000 | 41,95,304 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 58,78,425 | 16,61,925 | 3,89,243 |

| 23,000 | 73,62,675 | 13,16,025 | 4,30,519 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 40,73,925 | -23,88,375 | 20,67,543 |

| 21,500 | 37,51,725 | -12,37,350 | 2,06,148 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 92,93,100 | 12,33,000 | 41,95,304 |

| 24,350 | 40,14,600 | 11,18,025 | 20,69,303 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24379.6. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.390 against previous 1.373. The 24000PE option holds the maximum open interest, followed by the 24500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 24500PE and 26200CE options. On the other hand, open interest reductions were prominent in the 23600PE, 25000PE, and 25600CE options. Trading volume was highest in the 24000PE option, followed by the 24500PE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,379.60 | 1.390 | 1.373 | 1.178 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,68,96,400 | 3,57,35,775 | 11,60,625 |

| PUT: | 5,12,86,275 | 4,90,62,975 | 22,23,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 44,44,350 | 1,35,675 | 50,758 |

| 25,000 | 41,23,275 | 1,33,875 | 46,641 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 2,30,250 | 2,30,250 | 4,522 |

| 24,400 | 10,10,625 | 1,68,075 | 18,602 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 4,00,800 | -80,400 | 8,694 |

| 26,000 | 20,13,300 | -65,550 | 22,169 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 44,44,350 | 1,35,675 | 50,758 |

| 25,000 | 41,23,275 | 1,33,875 | 46,641 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 72,43,125 | 10,39,200 | 61,559 |

| 23,000 | 41,56,500 | -51,600 | 28,264 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 72,43,125 | 10,39,200 | 61,559 |

| 24,500 | 32,70,150 | 3,92,400 | 55,004 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 4,57,725 | -2,09,925 | 9,370 |

| 25,000 | 12,79,575 | -80,700 | 9,612 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 72,43,125 | 10,39,200 | 61,559 |

| 24,500 | 32,70,150 | 3,92,400 | 55,004 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 54271.4. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.825 against previous 0.892. The 63000CE option holds the maximum open interest, followed by the 53500PE and 53000PE options. Market participants have shown increased interest with significant open interest additions in the 53500PE option, with open interest additions also seen in the 54500CE and 63000CE options. On the other hand, open interest reductions were prominent in the 53000PE, 55000PE, and 53000CE options. Trading volume was highest in the 63000CE option, followed by the 54500PE and 54000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,271.40 | 0.825 | 0.892 | 0.938 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,23,39,830 | 2,07,34,479 | 16,05,351 |

| PUT: | 1,84,33,020 | 1,84,92,480 | -59,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 28,39,500 | 1,65,720 | 2,22,275 |

| 60,000 | 12,54,900 | 14,670 | 74,007 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 4,19,310 | 2,23,410 | 87,426 |

| 63,000 | 28,39,500 | 1,65,720 | 2,22,275 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 7,79,490 | -1,03,500 | 9,857 |

| 59,500 | 3,63,090 | -55,860 | 32,947 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 28,39,500 | 1,65,720 | 2,22,275 |

| 55,000 | 10,12,680 | 1,51,020 | 1,15,047 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 13,97,190 | 3,90,600 | 67,109 |

| 53,000 | 13,71,360 | -2,64,870 | 1,02,018 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 13,97,190 | 3,90,600 | 67,109 |

| 50,000 | 11,37,330 | 1,46,550 | 61,103 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 13,71,360 | -2,64,870 | 1,02,018 |

| 55,000 | 9,21,210 | -1,84,560 | 1,17,318 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 5,26,200 | 41,580 | 1,46,628 |

| 54,000 | 11,05,020 | -69,060 | 1,23,924 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 25969. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.779 against previous 0.786. The 29500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 26000CE and 26100CE options. On the other hand, open interest reductions were prominent in the 27000CE, 25000PE, and 26200PE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 27000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,969.00 | 0.779 | 0.786 | 1.201 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,93,980 | 9,76,235 | 17,745 |

| PUT: | 7,74,215 | 7,67,000 | 7,215 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,77,385 | 2,600 | 1,051 |

| 27,000 | 1,50,085 | -9,100 | 1,992 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,525 | 10,335 | 2,391 |

| 26,100 | 25,220 | 6,500 | 600 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,50,085 | -9,100 | 1,992 |

| 27,500 | 28,405 | -3,510 | 481 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,525 | 10,335 | 2,391 |

| 27,000 | 1,50,085 | -9,100 | 1,992 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,23,825 | 2,925 | 5,501 |

| 25,500 | 70,850 | 10,465 | 1,047 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 70,850 | 10,465 | 1,047 |

| 24,000 | 34,190 | 6,435 | 336 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 68,510 | -7,865 | 1,273 |

| 26,200 | 37,635 | -7,085 | 1,447 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,23,825 | 2,925 | 5,501 |

| 26,200 | 37,635 | -7,085 | 1,447 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 11985.9. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.051 against previous 1.073. The 12000PE option holds the maximum open interest, followed by the 11500PE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12000PE option, with open interest additions also seen in the 12000CE and 13500CE options. On the other hand, open interest reductions were prominent in the 63000PE, 66000CE, and 66000CE options. Trading volume was highest in the 12000PE option, followed by the 12200CE and 12200PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,985.90 | 1.051 | 1.073 | 1.018 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 41,92,920 | 38,77,200 | 3,15,720 |

| PUT: | 44,08,320 | 41,59,320 | 2,49,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,25,400 | -26,880 | 7,219 |

| 13,500 | 4,06,680 | 84,000 | 3,505 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 3,73,800 | 1,23,120 | 7,329 |

| 13,500 | 4,06,680 | 84,000 | 3,505 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 2,43,240 | -51,000 | 8,414 |

| 12,300 | 1,86,840 | -45,720 | 7,732 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,50,680 | -11,640 | 12,273 |

| 12,500 | 2,43,240 | -51,000 | 8,414 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,28,160 | 1,42,200 | 18,114 |

| 11,500 | 4,45,320 | 24,960 | 7,566 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,28,160 | 1,42,200 | 18,114 |

| 10,000 | 1,73,880 | 60,360 | 2,405 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,30,040 | -57,840 | 11,415 |

| 12,300 | 1,27,920 | -27,480 | 4,877 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,28,160 | 1,42,200 | 18,114 |

| 12,200 | 2,30,040 | -57,840 | 11,415 |

Conclusion:

In conclusion, the derivatives setup for May 6, 2025, clearly reflects heightened market caution. The falling premiums in NIFTY, BANKNIFTY, and FINNIFTY futures alongside steady to falling PCR values underscore a risk-off mood. The sharp OI build-up in MIDCPNIFTY amid a steep price fall suggests bearish bets are gaining traction in the mid-cap segment. Even though Max Pain levels remain near spot zones, lack of aggressive long positioning signals a wait-and-watch approach from market participants. Aggressive PUT OI built-up at 23,500 in Weekly Option and suggests near-term bearish-bias. BANKNIFTY witnessed highest PUT addition at 53,500 level. Traders should brace for volatility in the coming sessions, especially with key strike additions pointing to shifting support and resistance zones.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]