Turning Complex Derivative Data into Clear Market Insights

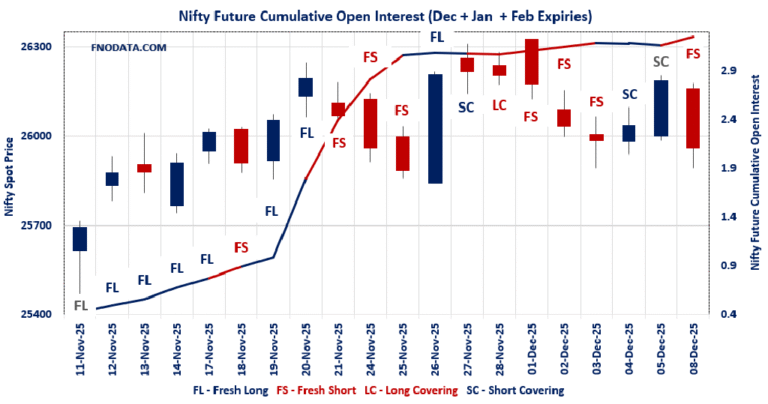

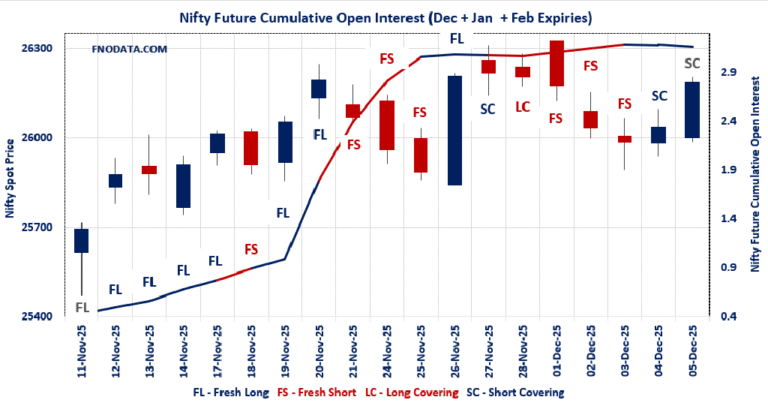

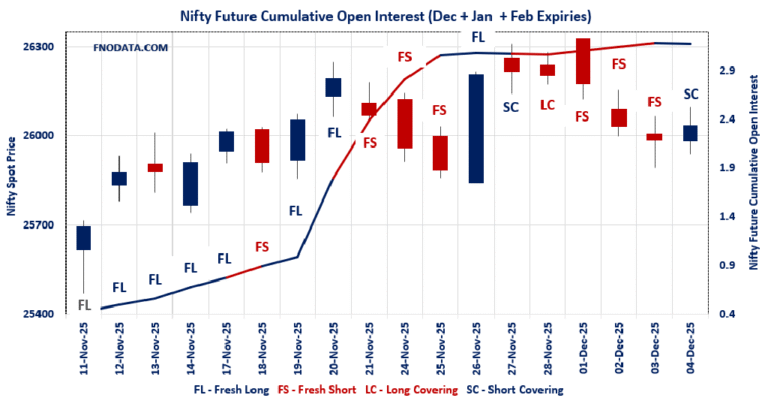

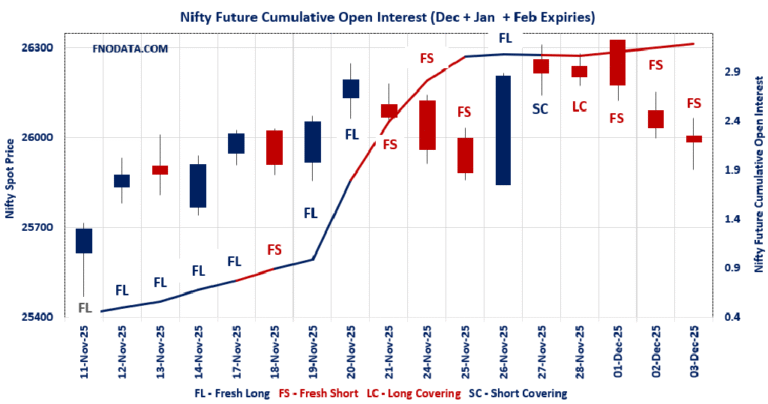

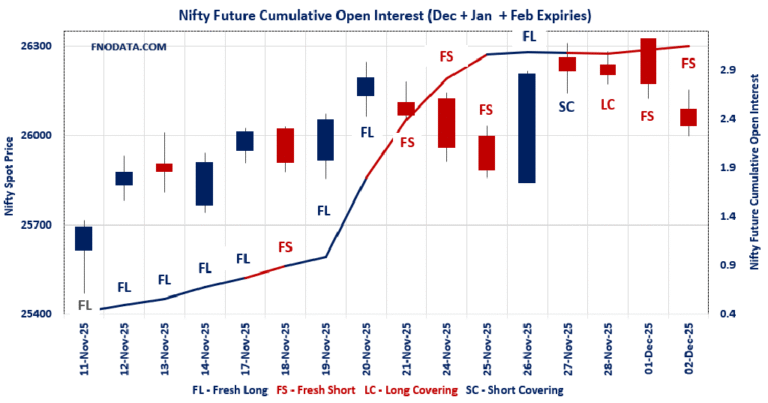

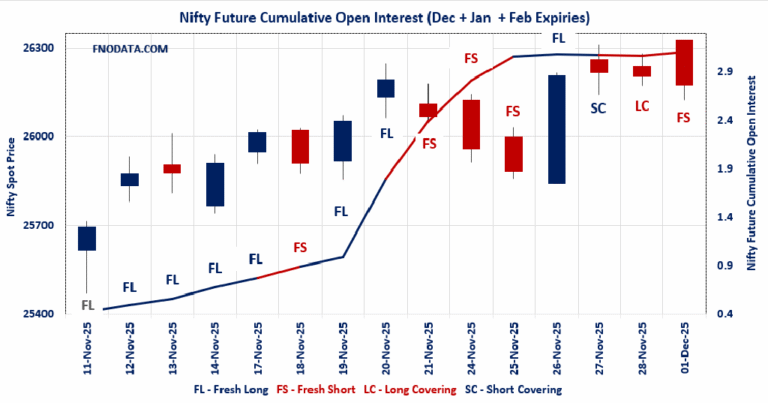

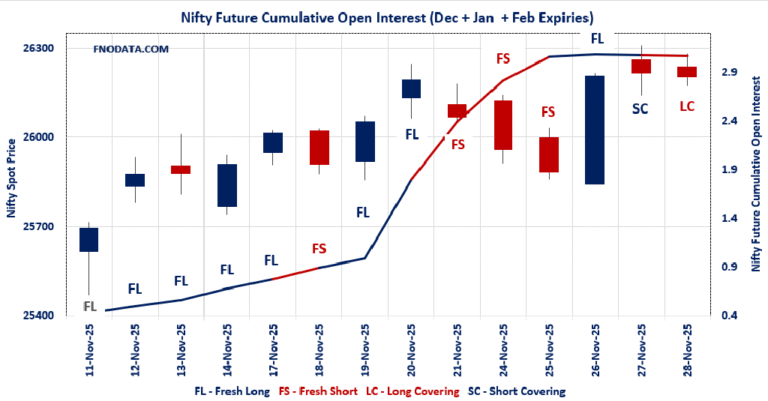

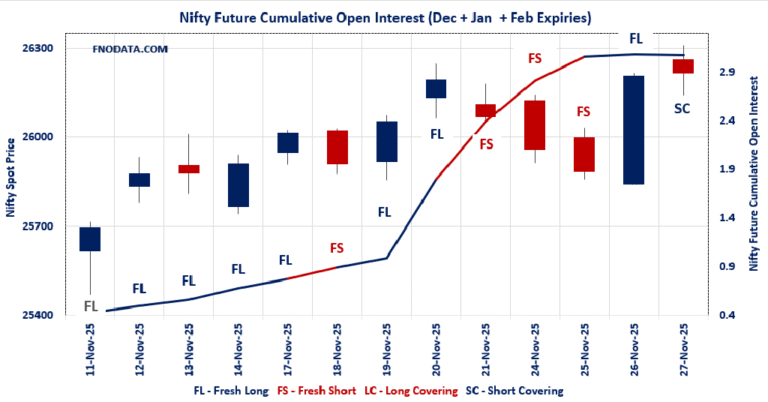

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/12/2025

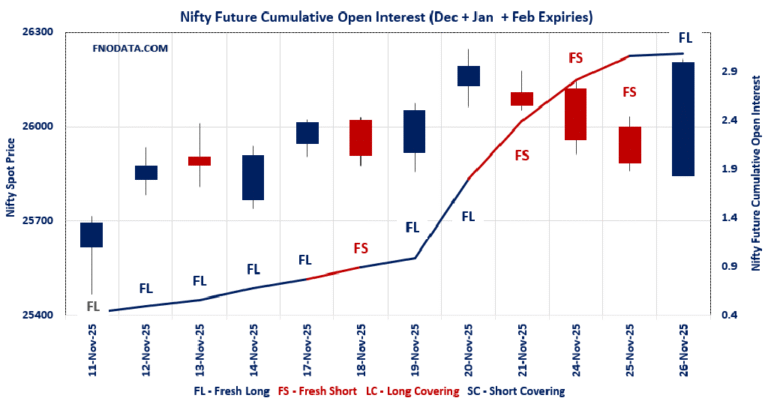

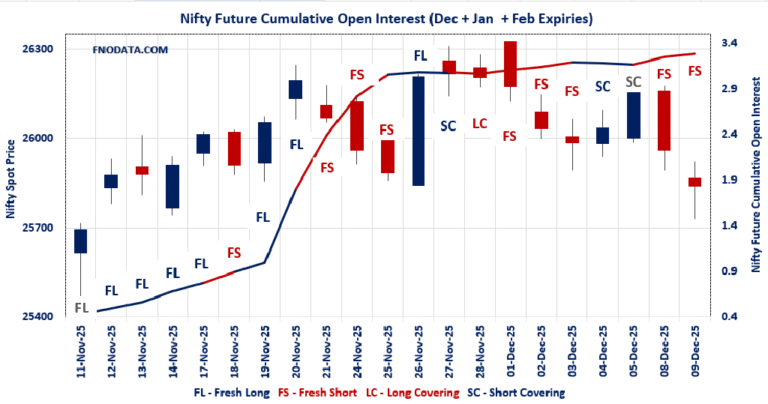

NIFTY’s Open Interest Volume Analysis screams fresh short buildup: Combined futures OI jumped 3.63% with modest volume uptick (3.60%), but spot dipped 0.47%—classic “price down, OI up” signaling bears piling in aggressively across December and January contracts. Premiums oddly holding…