Turning Complex Derivative Data into Clear Market Insights

Decoding Critical F&O Market Signals: Will Nifty Defend 24,800 Amid Bearish Shifts?

Table of Contents

The F&O market signals on 17th June 2025 revealed mounting bearish pressure as Nifty futures slid 0.51% to 24,868.80, with spot closing below 24,850 (-0.37%) amid aggressive call writing at 25,000 and a PCR (OI) slump to 0.836. BankNifty futures mirrored the weakness, dropping 0.59% to 55,780.80 as its PCR (OI) collapsed to 0.685, reflecting relentless call accumulation at 56,000. While MIDCPNIFTY’s PCR (OI) held at 1.045, its premium crash (-40.1 points) and -0.82% futures decline signaled midcap exhaustion. Let’s dissect these F&O market signals shaping June’s volatile expiry.

NSE & BSE F&O Market Signals

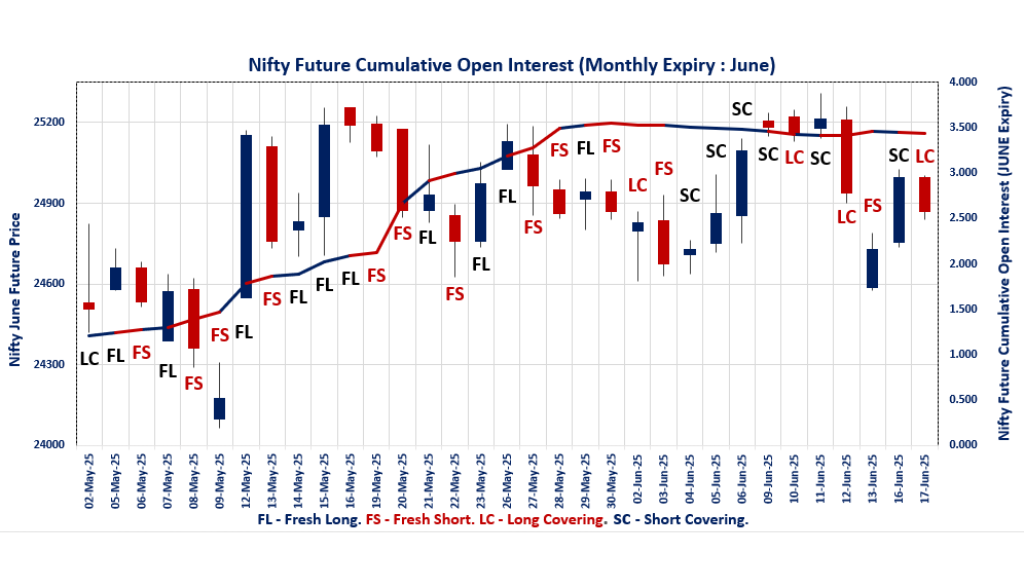

NIFTY JUNE Future

NIFTY Spot closed at: 24,853.40 (-0.37%)

NIFTY JUNE Future closed at: 24,868.80 (-0.51%)

Premium: 15.4 (Decreased by -34.3 points)

Open Interest Change: -1.5%

Volume Change: -31.5%

NIFTY Weekly Expiry (19/06/2025) Option Analysis

Put-Call Ratio (OI): 0.836 (Decreased from 1.111)

Put-Call Ratio (Volume): 0.872

Max Pain Level: 24850

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24000

NIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.978 (Decreased from 1.032)

Put-Call Ratio (Volume): 0.860

Max Pain Level: 24900

Maximum CALL OI: 26000

Maximum PUT OI: 24500

Highest CALL Addition: 26100

Highest PUT Addition: 24400

BANKNIFTY JUNE Future

BANKNIFTY Spot closed at: 55,714.15 (-0.41%)

BANKNIFTY JUNE Future closed at: 55,780.80 (-0.59%)

Premium: 66.65 (Decreased by -100.85 points)

Open Interest Change: -0.9%

Volume Change: -36.8%

BANKNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.685 (Decreased from 0.785)

Put-Call Ratio (Volume): 0.912

Max Pain Level: 56000

Maximum CALL OI: 56000

Maximum PUT OI: 56000

Highest CALL Addition: 56000

Highest PUT Addition: 54000

FINNIFTY JUNE Future

FINNIFTY Spot closed at: 26,451.65 (-0.39%)

FINNIFTY JUNE Future closed at: 26,474.60 (-0.61%)

Premium: 22.95 (Decreased by -58.2 points)

Open Interest Change: -2.1%

Volume Change: -22.9%

FINNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.681 (Decreased from 0.701)

Put-Call Ratio (Volume): 1.011

Max Pain Level: 26500

Maximum CALL OI: 27000

Maximum PUT OI: 26500

Highest CALL Addition: 26500

Highest PUT Addition: 26500

MIDCPNIFTY JUNE Future

MIDCPNIFTY Spot closed at: 13,039.75 (-0.52%)

MIDCPNIFTY JUNE Future closed at: 13,040.65 (-0.82%)

Premium: 0.9 (Decreased by -40.1 points)

Open Interest Change: -1.3%

Volume Change: -11.7%

MIDCPNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 1.045 (Decreased from 1.177)

Put-Call Ratio (Volume): 0.936

Max Pain Level: 13000

Maximum CALL OI: 14000

Maximum PUT OI: 13000

Highest CALL Addition: 13200

Highest PUT Addition: 12600

SENSEX Weekly Expiry (24/06/2025) Future

SENSEX Spot closed at: 81,583.30 (-0.26%)

SENSEX Weekly Future closed at: 81,575.95 (-0.39%)

Discount: -7.35 (Decreased by -107.55 points)

Open Interest Change: 24.2%

Volume Change: 18.3%

SENSEX Weekly Expiry (24/06/2025) Option Analysis

Put-Call Ratio (OI): 0.667 (Decreased from 0.828)

Put-Call Ratio (Volume): 0.704

Max Pain Level: 81500

Maximum CALL OI: 84000

Maximum PUT OI: 75000

Highest CALL Addition: 85000

Highest PUT Addition: 75000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 1,482.77 Cr

DIIs Net Buy: ₹ 8,207.19 Cr

FII Derivatives Activity

| FII Trading Stats | 17.06.25 | 16.06.25 | 13.06.25 |

| FII Cash (Provisional Data) | 1,482.77 | -2,539.42 | -1,263.52 |

| Index Future Open Interest Long Ratio | 20.90% | 20.21% | 19.07% |

| Index Future Volume Long Ratio | 53.05% | 53.15% | 44.90% |

| Call Option Open Interest Long Ratio | 59.06% | 58.62% | 59.03% |

| Call Option Volume Long Ratio | 50.14% | 49.98% | 50.05% |

| Put Option Open Interest Long Ratio | 60.19% | 58.69% | 60.81% |

| Put Option Volume Long Ratio | 50.27% | 49.72% | 49.89% |

| Stock Future Open Interest Long Ratio | 62.03% | 62.29% | 62.03% |

| Stock Future Volume Long Ratio | 47.31% | 53.92% | 46.19% |

| Index Futures | Short Covering | Fresh Long | Fresh Short |

| Index Options | Short Covering | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Short Covering |

| Nifty Options | Short Covering | Fresh Short | Fresh Short |

| BankNifty Futures | Short Covering | Short Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Short Covering |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Short Covering | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Fresh Long | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & BSE F&O market Trends : Options Insights

NIFTY Weekly Expiry (19/06/2025)

The NIFTY index closed at 24853.4. The NIFTY weekly expiry for JUNE 19, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.836 against previous 1.111. The 26000CE option holds the maximum open interest, followed by the 24000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24900CE and 24850CE options. On the other hand, open interest reductions were prominent in the 22800PE, 24900PE, and 23500PE options. Trading volume was highest in the 24900CE option, followed by the 24900PE and 24800PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 19-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,853.40 | 0.836 | 1.111 | 0.872 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,02,44,575 | 12,21,67,275 | 2,80,77,300 |

| PUT: | 12,56,26,800 | 13,57,57,275 | -1,01,30,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,03,27,875 | 8,28,675 | 6,46,536 |

| 25,500 | 98,06,175 | 15,98,100 | 10,71,391 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 94,73,400 | 40,57,275 | 21,73,521 |

| 24,900 | 69,20,775 | 30,17,250 | 26,86,402 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 12,54,600 | -5,00,700 | 1,48,613 |

| 24,600 | 8,85,975 | -1,66,500 | 78,353 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 69,20,775 | 30,17,250 | 26,86,402 |

| 25,000 | 94,73,400 | 40,57,275 | 21,73,521 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 99,26,400 | 11,16,450 | 6,75,619 |

| 23,500 | 82,07,925 | -15,29,775 | 4,92,147 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 99,26,400 | 11,16,450 | 6,75,619 |

| 23,700 | 30,66,375 | 10,24,650 | 2,77,842 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 78,21,225 | -38,19,675 | 5,80,857 |

| 24,900 | 39,95,925 | -17,08,050 | 23,62,551 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 39,95,925 | -17,08,050 | 23,62,551 |

| 24,800 | 62,19,600 | -7,89,450 | 22,47,287 |

SENSEX Weekly Expiry (24/06/2025)

The SENSEX index closed at 81583.3. The SENSEX weekly expiry for JUNE 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.667 against previous 0.828. The 84000CE option holds the maximum open interest, followed by the 85000CE and 75000PE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 84000CE and 75000PE options. On the other hand, open interest reductions were prominent in the 81800PE, 82300CE, and 86800CE options. Trading volume was highest in the 84000CE option, followed by the 85000CE and 81500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 24-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81583.3 | 0.667 | 0.828 | 0.704 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 27,25,780 | 8,75,949 | 18,49,831 |

| PUT: | 18,16,980 | 7,25,540 | 10,91,440 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,27,500 | 2,76,880 | 12,47,120 |

| 85000 | 3,61,480 | 2,91,180 | 10,29,600 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 3,61,480 | 2,91,180 | 10,29,600 |

| 84000 | 4,27,500 | 2,76,880 | 12,47,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82300 | 13,260 | -840 | 60,600 |

| 86800 | 1,720 | -700 | 5,900 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,27,500 | 2,76,880 | 12,47,120 |

| 85000 | 3,61,480 | 2,91,180 | 10,29,600 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 2,45,800 | 2,16,320 | 4,73,160 |

| 81500 | 1,51,200 | 93,220 | 9,67,600 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 2,45,800 | 2,16,320 | 4,73,160 |

| 81500 | 1,51,200 | 93,220 | 9,67,600 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81800 | 11,080 | -2,620 | 1,13,540 |

| 79100 | 3,600 | -260 | 22,380 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 1,51,200 | 93,220 | 9,67,600 |

| 81600 | 76,660 | 65,940 | 5,88,640 |

NIFTY Monthly Expiry (26/06/2025)

The NIFTY index closed at 24853.4. The NIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.978 against previous 1.032. The 26000CE option holds the maximum open interest, followed by the 25000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 26000CE and 24400PE options. On the other hand, open interest reductions were prominent in the 27000CE, 24500PE, and 25000PE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24900PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,853.40 | 0.978 | 1.032 | 0.860 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,95,14,325 | 6,32,57,275 | 62,57,050 |

| PUT: | 6,80,16,975 | 6,52,81,350 | 27,35,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,28,750 | 6,56,150 | 1,10,424 |

| 25,000 | 60,53,100 | 3,96,075 | 1,53,123 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 15,31,050 | 7,32,825 | 33,173 |

| 26,000 | 70,28,750 | 6,56,150 | 1,10,424 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 27,35,825 | -3,89,350 | 20,874 |

| 25,500 | 48,77,550 | -2,10,075 | 1,11,822 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 60,53,100 | 3,96,075 | 1,53,123 |

| 24,900 | 22,25,625 | 5,62,875 | 1,14,517 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 54,31,500 | -2,62,275 | 1,27,564 |

| 24,000 | 46,35,125 | 54,475 | 74,688 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 16,78,050 | 6,54,900 | 57,766 |

| 24,900 | 25,87,800 | 4,95,300 | 1,20,594 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 54,31,500 | -2,62,275 | 1,27,564 |

| 25,000 | 40,67,875 | -2,29,325 | 97,338 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 54,31,500 | -2,62,275 | 1,27,564 |

| 24,900 | 25,87,800 | 4,95,300 | 1,20,594 |

BANKNIFTY Monthly Expiry (26/06/2025)

The BANKNIFTY index closed at 55714.15. The BANKNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.685 against previous 0.785. The 56000CE option holds the maximum open interest, followed by the 56000PE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 56000CE option, with open interest additions also seen in the 54000PE and 55800CE options. On the other hand, open interest reductions were prominent in the 55500PE, 40500PE, and 55900PE options. Trading volume was highest in the 56000CE option, followed by the 56000PE and 55800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,714.15 | 0.685 | 0.785 | 0.912 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,50,18,755 | 2,21,67,549 | 28,51,206 |

| PUT: | 1,71,26,010 | 1,73,96,250 | -2,70,240 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 24,59,280 | 3,51,240 | 2,17,829 |

| 57,000 | 16,28,835 | 1,01,745 | 1,00,441 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 24,59,280 | 3,51,240 | 2,17,829 |

| 55,800 | 4,31,340 | 1,91,370 | 1,08,149 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 4,89,360 | -77,580 | 18,051 |

| 61,000 | 8,51,490 | -54,180 | 31,537 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 24,59,280 | 3,51,240 | 2,17,829 |

| 55,800 | 4,31,340 | 1,91,370 | 1,08,149 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 19,96,680 | 13,110 | 1,91,807 |

| 55,000 | 12,82,110 | -65,220 | 1,03,726 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,72,530 | 2,12,520 | 71,358 |

| 50,500 | 2,89,380 | 88,620 | 15,577 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,87,640 | -1,31,580 | 1,12,537 |

| 40,500 | 2,13,180 | -1,10,730 | 13,724 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 19,96,680 | 13,110 | 1,91,807 |

| 55,800 | 3,04,050 | 10,920 | 1,29,808 |

FINNIFTY Monthly Expiry (26/06/2025)

The FINNIFTY index closed at 26451.65. The FINNIFTY monthly expiry for JUNE 26, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.681 against previous 0.701. The 26500PE option holds the maximum open interest, followed by the 27000CE and 28500CE options. Market participants have shown increased interest with significant open interest additions in the 26500PE option, with open interest additions also seen in the 26500CE and 26700CE options. On the other hand, open interest reductions were prominent in the 26300PE, 24500PE, and 29500CE options. Trading volume was highest in the 26500PE option, followed by the 26500CE and 26300PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,451.65 | 0.681 | 0.701 | 1.011 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,44,920 | 14,33,250 | 1,11,670 |

| PUT: | 10,51,895 | 10,05,160 | 46,735 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,58,470 | 6,370 | 2,099 |

| 28,500 | 1,21,485 | 23,270 | 1,449 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 92,495 | 42,315 | 5,972 |

| 26,700 | 57,785 | 24,895 | 2,217 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 78,195 | -13,650 | 595 |

| 28,700 | 35,620 | -9,490 | 542 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 92,495 | 42,315 | 5,972 |

| 26,600 | 24,245 | 1,300 | 3,102 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,58,860 | 69,485 | 7,981 |

| 24,500 | 67,145 | -16,575 | 743 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,58,860 | 69,485 | 7,981 |

| 26,450 | 42,575 | 12,610 | 1,764 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 59,605 | -20,280 | 3,586 |

| 24,500 | 67,145 | -16,575 | 743 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,58,860 | 69,485 | 7,981 |

| 26,300 | 59,605 | -20,280 | 3,586 |

MIDCPNIFTY Monthly Expiry (26/06/2025)

The MIDCPNIFTY index closed at 13039.75. The MIDCPNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.045 against previous 1.177. The 13000PE option holds the maximum open interest, followed by the 14000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13200CE option, with open interest additions also seen in the 13100CE and 12600PE options. On the other hand, open interest reductions were prominent in the 67000CE, 69000CE, and 66900PE options. Trading volume was highest in the 13000PE option, followed by the 13100PE and 13100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,039.75 | 1.045 | 1.177 | 0.936 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 61,57,200 | 54,54,240 | 7,02,960 |

| PUT: | 64,32,480 | 64,21,560 | 10,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,76,080 | 58,560 | 7,000 |

| 13,500 | 6,47,160 | 32,640 | 14,849 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,18,560 | 1,15,800 | 17,528 |

| 13,100 | 2,41,440 | 74,760 | 17,722 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 1,52,160 | -10,680 | 596 |

| 13,000 | 4,74,600 | -8,400 | 9,333 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 2,41,440 | 74,760 | 17,722 |

| 13,200 | 4,18,560 | 1,15,800 | 17,528 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,01,280 | -67,800 | 20,733 |

| 12,500 | 6,00,720 | 8,520 | 9,358 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 2,83,200 | 64,920 | 4,670 |

| 11,000 | 2,22,360 | 33,840 | 864 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,01,280 | -67,800 | 20,733 |

| 10,000 | 56,280 | -47,280 | 631 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,01,280 | -67,800 | 20,733 |

| 13,100 | 2,17,200 | -2,280 | 18,896 |

Conclusion: What the Future & Option Chain Analysis Tells Us

The 17th June F&O data underscores a market at a critical juncture: Nifty’s 24,800–24,850 support zone faces a litmus test, with a break below risking a slide to 24,750–24,600. BankNifty’s 56,000 max pain and 54,500 put additions suggest resistance at 56,200–56,500, while MIDCPNIFTY’s 13,000 support and FINNIFTY’s 26,500 max pain hint at selective sectoral plays. Traders should hedge with 24,800 puts and 55,500 BankNifty straddles, tracking FED policy cues and global volatility. As institutional activity converges, F&O market signals—PCR erosion, max pain clusters, and premium decay—will dictate whether bulls reclaim control or bears extend their grip.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]