Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 21/11/2025

Table of Contents

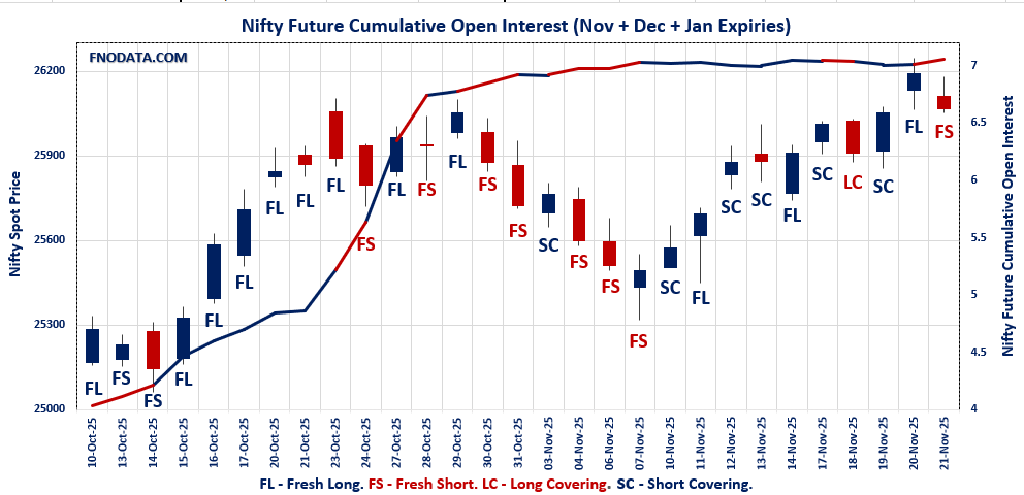

NIFTY’s Open Interest Volume Analysis shows a decisive fresh short build: Despite a modest price decline (-0.47%), combined open interest surged by +4.03% with increased volume, signaling aggressive positioning for downward moves in December contracts.

November futures exhibit clear long covering: November OI drops sharply (-15.51%) on rising volume, confirming bulls start booking profits near expiry.

December futures witness massive fresh short accumulation: December open interest rose +60.62% with volume up as well, indicating new aggressive short selling for the post-expiry period.

Options PCR gives cautious signals: Monthly put-call ratio eases from 1.518 down to 0.963, reflecting bearish option bets, while volume PCR rises to 1.067, indicating increased option market activity.

Max pain zone holds near 26050: Concentrated open interest in call and put options around this level points to a key support-resistance band, critical for positioning this week.

BankNIFTY and FINNIFTY mirror similar dynamics: Both indices see fresh shorts building in December and long covering in near months, confirming a broad-based short-term correction.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26068.15 (-0.473%)

Combined = November + December + January

Combined Fut Open Interest Change: 4.03%

Combined Fut Volume Change: 25.70%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 40% Previous 26%

NIFTY NOVEMBER Future closed at: 26077.5 (-0.547%)

November Fut Premium 9.35 (Decreased by -19.3 points)

November Fut Open Interest Change: -15.51%

November Fut Volume Change: 29.75%

November Fut Open Interest Analysis: Long Covering

NIFTY DECEMBER Future closed at: 26269.2 (-0.540%)

December Fut Premium 201.05 (Decreased by -18.7 points)

December Fut Open Interest Change: 60.62%

December Fut Volume Change: 18.38%

December Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.963 (Decreased from 1.518)

Put-Call Ratio (Volume): 1.067

Max Pain Level: 26050

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26100

Highest PUT Addition: 22800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58867.7 (-0.809%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.60%

Combined Fut Volume Change: 129.86%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 40% Previous 26%

BANKNIFTY NOVEMBER Future closed at: 58869 (-0.892%)

November Fut Premium 1.3 (Decreased by -50 points)

November Fut Open Interest Change: -18.7%

November Fut Volume Change: 121.0%

November Fut Open Interest Analysis: Long Covering

BANKNIFTY DECEMBER Future closed at: 59233.2 (-0.880%)

December Fut Premium 365.5 (Decreased by -45.8 points)

December Fut Open Interest Change: 59.88%

December Fut Volume Change: 168.05%

December Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.870 (Decreased from 1.232)

Put-Call Ratio (Volume): 1.016

Max Pain Level: 58800

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 59000

Highest PUT Addition: 58400

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27566.15 (-1.060%)

Combined = November + December + January

Combined Fut Open Interest Change: 4.1%

Combined Fut Volume Change: 52.1%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 30% Previous 18%

FINNIFTY NOVEMBER Future closed at: 27587.6 (-1.069%)

November Fut Premium 21.45 (Decreased by -2.8 points)

November Fut Open Interest Change: -11.56%

November Fut Volume Change: 51.93%

November Fut Open Interest Analysis: Long Covering

FINNIFTY DECEMBER Future closed at: 27731.1 (-1.101%)

December Fut Premium 164.95 (Decreased by -13.5 points)

December Fut Open Interest Change: 75.44%

December Fut Volume Change: 52.41%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.752 (Decreased from 1.330)

Put-Call Ratio (Volume): 0.977

Max Pain Level: 27600

Maximum CALL Open Interest: 27800

Maximum PUT Open Interest: 27300

Highest CALL Addition: 27800

Highest PUT Addition: 27550

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13851.35 (-1.007%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.52%

Combined Fut Volume Change: 99.17%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 62% Previous 22%

MIDCPNIFTY NOVEMBER Future closed at: 13848.6 (-1.133%)

November Fut Discount -2.75 (Decreased by -17.8 points)

November Fut Open Interest Change: -51.45%

November Fut Volume Change: 62.62%

November Fut Open Interest Analysis: Long Covering

MIDCPNIFTY DECEMBER Future closed at: 13942.7 (-0.938%)

December Fut Discount 91.35 (Increased by 8.9 points)

December Fut Open Interest Change: 190.23%

December Fut Volume Change: 172.34%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.849 (Decreased from 1.102)

Put-Call Ratio (Volume): 0.932

Max Pain Level: 13850

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13300

Highest CALL Addition: 14000

Highest PUT Addition: 13600

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 85,231.92 (-0.468%)

SENSEX Monthly Future closed at: 85,362.40 (-0.476%)

Premium: 130.48 (Decreased by -7.29 points)

Open Interest Change: 8.79%

Volume Change: -44.15%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (27/11/2025) Option Analysis

Put-Call Ratio (OI): 0.735 (Decreased from 1.453)

Put-Call Ratio (Volume): 1.023

Max Pain Level: 85400

Maximum CALL OI: 88500

Maximum PUT OI: 80000

Highest CALL Addition: 88500

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,766.05 Cr.

DIIs Net BUY: ₹ 3,161.61 Cr.

FII Derivatives Activity

| FII Trading Stats | 21.11.25 | 20.11.25 | 19.11.25 |

| FII Cash (Provisional Data) | -1,766.05 | 283.65 | 1,580.72 |

| Index Future Open Interest Long Ratio | 11.57% | 12.36% | 12.24% |

| Index Future Volume Long Ratio | 48.00% | 51.80% | 52.35% |

| Call Option Open Interest Long Ratio | 51.94% | 52.91% | 51.30% |

| Call Option Volume Long Ratio | 49.91% | 50.35% | 50.40% |

| Put Option Open Interest Long Ratio | 62.44% | 57.95% | 57.49% |

| Put Option Volume Long Ratio | 50.55% | 50.24% | 49.31% |

| Stock Future Open Interest Long Ratio | 60.64% | 60.82% | 60.58% |

| Stock Future Volume Long Ratio | 49.82% | 50.09% | 51.05% |

| Index Futures | Long Covering | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Long | Long Covering |

| FinNifty Options | Long Covering | Long Covering | Fresh Long |

| MidcpNifty Futures | Long Covering | Long Covering | Long Covering |

| MidcpNifty Options | Fresh Long | Long Covering | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Short Covering | Fresh Long |

| Stock Options | Short Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (27/11/2025)

The SENSEX index closed at 85231.92. The SENSEX weekly expiry for NOVEMBER 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.735 against previous 1.453. The 88500CE option holds the maximum open interest, followed by the 87000CE and 85500CE options. Market participants have shown increased interest with significant open interest additions in the 88500CE option, with open interest additions also seen in the 85500CE and 89000CE options. On the other hand, open interest reductions were prominent in the 85700PE, 82500PE, and 81500PE options. Trading volume was highest in the 85500PE option, followed by the 85500CE and 85000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 27-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85231.92 | 0.735 | 1.453 | 1.023 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 85,75,100 | 32,12,380 | 53,62,720 |

| PUT: | 63,00,280 | 46,66,000 | 16,34,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 88500 | 5,86,920 | 4,92,660 | 42,96,260 |

| 87000 | 4,98,680 | 2,05,560 | 63,74,860 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88500 | 5,86,920 | 4,92,660 | 42,96,260 |

| 85500 | 4,89,400 | 3,20,640 | 1,68,27,140 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 91700 | 7,440 | -10,920 | 63,480 |

| 84000 | 34,060 | -5,820 | 82,860 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 4,89,400 | 3,20,640 | 1,68,27,140 |

| 85400 | 2,13,840 | 1,74,480 | 1,04,53,740 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,55,700 | 2,33,500 | 19,62,120 |

| 85000 | 4,38,160 | 26,780 | 1,35,99,000 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,55,700 | 2,33,500 | 19,62,120 |

| 85500 | 3,75,280 | 90,120 | 1,68,87,800 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85700 | 71,280 | -1,18,300 | 33,33,240 |

| 82500 | 1,85,840 | -50,180 | 22,89,480 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,75,280 | 90,120 | 1,68,87,800 |

| 85000 | 4,38,160 | 26,780 | 1,35,99,000 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 26068.15. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.963 against previous 1.518. The 27000CE option holds the maximum open interest, followed by the 26500CE and 26200CE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 26200CE and 26150CE options. On the other hand, open interest reductions were prominent in the 26200PE, 26000PE, and 25900PE options. Trading volume was highest in the 26100PE option, followed by the 26100CE and 26200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,068.15 | 0.963 | 1.518 | 1.067 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,27,42,400 | 13,40,22,525 | 3,87,19,875 |

| PUT: | 16,63,91,850 | 20,35,00,125 | -3,71,08,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,42,00,050 | 29,07,300 | 11,04,327 |

| 26,500 | 1,37,81,775 | 21,24,975 | 20,52,219 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 91,44,600 | 52,05,450 | 56,00,834 |

| 26,200 | 1,24,07,400 | 48,47,400 | 55,46,486 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,850 | 13,30,950 | -2,46,675 | 3,52,313 |

| 25,000 | 9,40,875 | -1,62,525 | 7,737 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 91,44,600 | 52,05,450 | 56,00,834 |

| 26,200 | 1,24,07,400 | 48,47,400 | 55,46,486 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,10,58,150 | -37,79,250 | 51,21,521 |

| 25,000 | 1,04,56,500 | -6,88,575 | 10,04,687 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 13,07,250 | 9,84,525 | 66,131 |

| 25,700 | 87,44,925 | 7,76,400 | 13,08,283 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 37,05,225 | -40,03,875 | 31,13,008 |

| 26,000 | 1,10,58,150 | -37,79,250 | 51,21,521 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 66,36,450 | -18,80,175 | 70,39,338 |

| 26,000 | 1,10,58,150 | -37,79,250 | 51,21,521 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58867.7. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.870 against previous 1.232. The 60000CE option holds the maximum open interest, followed by the 59000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 59200CE and 59100CE options. On the other hand, open interest reductions were prominent in the 59000PE, 58000PE, and 59300PE options. Trading volume was highest in the 59000PE option, followed by the 59000CE and 59100CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,867.70 | 0.870 | 1.232 | 1.016 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,90,44,725 | 1,53,95,170 | 36,49,555 |

| PUT: | 1,65,63,400 | 1,89,69,545 | -24,06,145 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 15,43,465 | 3,48,075 | 2,94,731 |

| 59,000 | 14,46,130 | 5,33,715 | 6,84,378 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,46,130 | 5,33,715 | 6,84,378 |

| 59,200 | 7,85,120 | 4,65,430 | 3,85,086 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 6,63,670 | -1,64,395 | 68,654 |

| 56,000 | 1,09,060 | -54,600 | 1,967 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,46,130 | 5,33,715 | 6,84,378 |

| 59,100 | 5,84,465 | 3,72,505 | 3,90,368 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,19,365 | -1,54,910 | 1,18,049 |

| 58,000 | 12,13,310 | -3,15,525 | 2,48,951 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,400 | 4,30,325 | 2,08,670 | 1,39,410 |

| 52,000 | 1,91,380 | 1,07,555 | 14,511 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 9,84,410 | -4,67,285 | 7,31,188 |

| 58,000 | 12,13,310 | -3,15,525 | 2,48,951 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 9,84,410 | -4,67,285 | 7,31,188 |

| 58,900 | 5,24,370 | -45,115 | 3,71,323 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27566.15. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.752 against previous 1.330. The 27800CE option holds the maximum open interest, followed by the 27900CE and 27700CE options. Market participants have shown increased interest with significant open interest additions in the 27800CE option, with open interest additions also seen in the 27700CE and 27600CE options. On the other hand, open interest reductions were prominent in the 27500PE, 27100PE, and 27000PE options. Trading volume was highest in the 27800CE option, followed by the 27600PE and 27700CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,566.15 | 0.752 | 1.330 | 0.977 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,18,275 | 10,98,630 | 6,19,645 |

| PUT: | 12,91,810 | 14,60,940 | -1,69,130 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 2,57,465 | 1,74,330 | 48,929 |

| 27,900 | 1,99,485 | 18,005 | 20,533 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 2,57,465 | 1,74,330 | 48,929 |

| 27,700 | 1,09,655 | 77,545 | 20,846 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 55,965 | -13,390 | 2,857 |

| 28,700 | 23,530 | -6,305 | 1,271 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 2,57,465 | 1,74,330 | 48,929 |

| 27,700 | 1,09,655 | 77,545 | 20,846 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 93,535 | 6,045 | 7,224 |

| 27,000 | 87,555 | -19,955 | 7,344 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,550 | 35,815 | 17,420 | 11,489 |

| 26,600 | 40,105 | 15,730 | 3,139 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 66,625 | -98,930 | 19,734 |

| 27,100 | 21,840 | -20,020 | 1,869 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 57,980 | -3,055 | 29,313 |

| 27,500 | 66,625 | -98,930 | 19,734 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13851.35. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.849 against previous 1.102. The 14000CE option holds the maximum open interest, followed by the 13300PE and 13500PE options. Market participants have shown increased interest with significant open interest additions in the 14000CE option, with open interest additions also seen in the 13900CE and 14150CE options. On the other hand, open interest reductions were prominent in the 68500PE, 70000PE, and 72000PE options. Trading volume was highest in the 13900PE option, followed by the 14000CE and 13900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,851.35 | 0.849 | 1.102 | 0.932 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,35,00,760 | 1,03,64,200 | 31,36,560 |

| PUT: | 1,14,59,420 | 1,14,22,320 | 37,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 19,68,680 | 5,76,380 | 90,556 |

| 14,200 | 10,01,420 | 2,80,840 | 45,430 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 19,68,680 | 5,76,380 | 90,556 |

| 13,900 | 8,30,760 | 5,00,640 | 67,156 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,450 | 2,52,560 | -55,020 | 3,887 |

| 14,500 | 8,23,340 | -50,820 | 19,140 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 19,68,680 | 5,76,380 | 90,556 |

| 13,900 | 8,30,760 | 5,00,640 | 67,156 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 11,84,680 | 29,120 | 15,425 |

| 13,500 | 11,39,040 | -87,500 | 25,952 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 7,23,800 | 2,32,540 | 19,089 |

| 13,700 | 6,29,860 | 84,980 | 40,648 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,74,300 | -1,79,340 | 30,436 |

| 14,050 | 1,40,700 | -1,41,680 | 3,161 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 5,90,520 | 74,900 | 96,841 |

| 13,800 | 7,36,400 | -38,360 | 58,313 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Market shifts toward cautious bearishness with heavy December short build: Open Interest Volume Analysis signals a tactical pause in the uptrend, with short-term traders aggressively building downside hedge positions.

Actionable trading strategy: Consider short-side trades near resistance levels around max pain (26050–26100). Avoid chasing breakouts upward unless strong volume and open interest confirm sustained momentum.

Sector rotation to watch: Banks and financials remain volatile but could offer swing trade opportunities as short-building intensifies.

Monitor option PCR and volume for early reversal signs: A rebound in PCR over 1 combined with OI decreases may hint at trend reversals.

Stay agile and protective: The Open Interest Volume Analysis suggests tactical reactions to market swings and prudent risk management during this expiry week.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.