Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 24/11/2025

Table of Contents

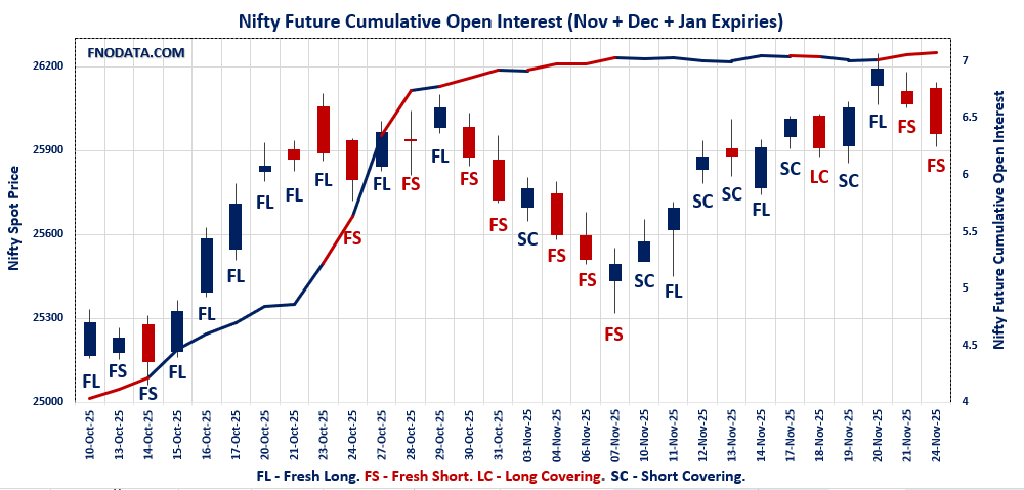

NIFTY’s Open Interest Volume Analysis indicates fresh short positioning ahead: Combined futures open interest rises moderately (+1.89%) even as prices pull back (-0.42%), signaling that traders are increasingly building new short exposures as the month-end approaches.

November futures show sharp long unwinding: November open interest plunges (-24.91%) with declining volume, confirming that short covering is terminating while longs are exiting near expiry.

December futures display aggressive fresh short build-up: December contract OI surges +43.37% on rising volume, reflecting active bearish bets for the near to mid-term.

Options put-call ratio dips sharply: Monthly PCR drops from 0.963 to 0.65, indicating reduced put buying, though volume PCR remains above 1, suggesting notable futures and options activity but cautious sentiment.

Max pain stabilizes near current price at 26000–26050: High concentration of option OI and volume near this level is drawing price action, forming critical support-resistance balance for traders to monitor.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25959.5 (-0.417%)

Combined = November + December + January

Combined Fut Open Interest Change: 1.89%

Combined Fut Volume Change: 5.30%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 56% Previous 40%

NIFTY NOVEMBER Future closed at: 25996.4 (-0.311%)

November Fut Premium 36.9 (Increased by 27.55 points)

November Fut Open Interest Change: -24.91%

November Fut Volume Change: -15.44%

November Fut Open Interest Analysis: Long Covering

NIFTY DECEMBER Future closed at: 26170.7 (-0.375%)

December Fut Premium 211.2 (Increased by 10.15 points)

December Fut Open Interest Change: 43.37%

December Fut Volume Change: 46.33%

December Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.650 (Decreased from 0.963)

Put-Call Ratio (Volume): 1.081

Max Pain Level: 26000

Maximum CALL Open Interest: 26100

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26100

Highest PUT Addition: 25850

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58835.35 (-0.055%)

Combined = November + December + January

Combined Fut Open Interest Change: -4.76%

Combined Fut Volume Change: -17.60%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 52% Previous 40%

BANKNIFTY NOVEMBER Future closed at: 58871.8 (0.005%)

November Fut Premium 36.45 (Increased by 35.15 points)

November Fut Open Interest Change: -23.9%

November Fut Volume Change: -33.9%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY DECEMBER Future closed at: 59244.8 (0.020%)

December Fut Premium 409.45 (Increased by 43.95 points)

December Fut Open Interest Change: 24.70%

December Fut Volume Change: 13.12%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.839 (Decreased from 0.870)

Put-Call Ratio (Volume): 1.008

Max Pain Level: 58800

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 59300

Highest PUT Addition: 57900

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27498.65 (-0.245%)

Combined = November + December + January

Combined Fut Open Interest Change: 3.6%

Combined Fut Volume Change: -24.4%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 40% Previous 30%

FINNIFTY NOVEMBER Future closed at: 27525.9 (-0.224%)

November Fut Premium 27.25 (Increased by 5.8 points)

November Fut Open Interest Change: -10.68%

November Fut Volume Change: -33.40%

November Fut Open Interest Analysis: Long Covering

FINNIFTY DECEMBER Future closed at: 27668.8 (-0.225%)

December Fut Premium 170.15 (Increased by 5.2 points)

December Fut Open Interest Change: 36.00%

December Fut Volume Change: -4.07%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.766 (Increased from 0.752)

Put-Call Ratio (Volume): 0.954

Max Pain Level: 27600

Maximum CALL Open Interest: 27700

Maximum PUT Open Interest: 27700

Highest CALL Addition: 27700

Highest PUT Addition: 27700

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13738.5 (-0.815%)

Combined = November + December + January

Combined Fut Open Interest Change: -0.77%

Combined Fut Volume Change: -56.47%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 71% Previous 62%

MIDCPNIFTY NOVEMBER Future closed at: 13754.55 (-0.679%)

November Fut Premium 16.05 (Increased by 18.8 points)

November Fut Open Interest Change: -23.47%

November Fut Volume Change: -51.84%

November Fut Open Interest Analysis: Long Covering

MIDCPNIFTY DECEMBER Future closed at: 13840.3 (-0.734%)

December Fut Premium 101.8 (Increased by 10.45 points)

December Fut Open Interest Change: 12.66%

December Fut Volume Change: -62.63%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.829 (Decreased from 0.849)

Put-Call Ratio (Volume): 1.047

Max Pain Level: 13800

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 13800

Highest PUT Addition: 13650

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 84,900.71 (-0.389%)

SENSEX Monthly Future closed at: 85,106.25 (-0.300%)

Premium: 205.54 (Increased by 75.06 points)

Open Interest Change: -7.26%

Volume Change: -38.88%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (27/11/2025) Option Analysis

Put-Call Ratio (OI): 0.594 (Decreased from 0.735)

Put-Call Ratio (Volume): 1.087

Max Pain Level: 85200

Maximum CALL OI: 85500

Maximum PUT OI: 85000

Highest CALL Addition: 85500

Highest PUT Addition: 84300

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,171.75 Cr.

DIIs Net BUY: ₹ 4,512.87 Cr.

FII Derivatives Activity

| FII Trading Stats | 24.11.25 | 21.11.25 | 20.11.25 |

| FII Cash (Provisional Data) | -4,171.75 | -1,766.05 | 283.65 |

| Index Future Open Interest Long Ratio | 14.48% | 11.57% | 12.36% |

| Index Future Volume Long Ratio | 53.64% | 48.00% | 51.80% |

| Call Option Open Interest Long Ratio | 50.18% | 51.94% | 52.91% |

| Call Option Volume Long Ratio | 49.79% | 49.91% | 50.35% |

| Put Option Open Interest Long Ratio | 62.02% | 62.44% | 57.95% |

| Put Option Volume Long Ratio | 50.03% | 50.55% | 50.24% |

| Stock Future Open Interest Long Ratio | 61.34% | 60.64% | 60.82% |

| Stock Future Volume Long Ratio | 51.17% | 49.82% | 50.09% |

| Index Futures | Fresh Long | Long Covering | Short Covering |

| Index Options | Fresh Short | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Long | Fresh Short | Short Covering |

| Nifty Options | Fresh Short | Fresh Long | Fresh Long |

| BankNifty Futures | Short Covering | Long Covering | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Short Covering | Fresh Long |

| FinNifty Options | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Futures | Fresh Long | Long Covering | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Long Covering |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Long Covering | Short Covering |

| Stock Options | Long Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (27/11/2025)

The SENSEX index closed at 84900.71. The SENSEX weekly expiry for NOVEMBER 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.594 against previous 0.735. The 85500CE option holds the maximum open interest, followed by the 88000CE and 87500CE options. Market participants have shown increased interest with significant open interest additions in the 85500CE option, with open interest additions also seen in the 87500CE and 88000CE options. On the other hand, open interest reductions were prominent in the 88500CE, 80000PE, and 88100CE options. Trading volume was highest in the 85300PE option, followed by the 85500CE and 85000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 27-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84900.71 | 0.594 | 0.735 | 1.087 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,39,92,680 | 85,75,100 | 54,17,580 |

| PUT: | 83,12,860 | 63,00,280 | 20,12,580 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 11,15,460 | 6,26,060 | 1,82,71,920 |

| 88000 | 8,25,240 | 3,72,280 | 41,89,920 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 11,15,460 | 6,26,060 | 1,82,71,920 |

| 87500 | 7,17,620 | 4,02,740 | 40,07,700 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88500 | 3,58,380 | -2,28,540 | 37,61,320 |

| 88100 | 46,320 | -45,040 | 5,29,260 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 11,15,460 | 6,26,060 | 1,82,71,920 |

| 85300 | 4,97,660 | 2,97,880 | 1,45,53,780 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,21,420 | 83,260 | 1,60,25,840 |

| 85500 | 4,81,620 | 1,06,340 | 1,27,65,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84300 | 2,49,280 | 1,86,560 | 39,61,780 |

| 83000 | 3,89,780 | 1,74,880 | 43,63,800 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,07,240 | -48,460 | 15,70,140 |

| 79000 | 76,360 | -33,340 | 3,83,200 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85300 | 1,83,840 | 17,260 | 1,91,83,480 |

| 85000 | 5,21,420 | 83,260 | 1,60,25,840 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25959.5. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.650 against previous 0.963. The 26100CE option holds the maximum open interest, followed by the 26200CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 26150CE and 26300CE options. On the other hand, open interest reductions were prominent in the 24500PE, 27500CE, and 25000PE options. Trading volume was highest in the 26100PE option, followed by the 26100CE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,959.50 | 0.650 | 0.963 | 1.081 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 21,78,25,725 | 17,27,42,400 | 4,50,83,325 |

| PUT: | 14,15,73,450 | 16,63,91,850 | -2,48,18,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 2,08,73,550 | 1,17,28,950 | 89,73,294 |

| 26,200 | 1,76,28,975 | 52,21,575 | 63,19,284 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 2,08,73,550 | 1,17,28,950 | 89,73,294 |

| 26,150 | 1,19,54,175 | 61,89,600 | 57,38,847 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 62,84,925 | -31,09,050 | 4,55,638 |

| 27,000 | 1,22,12,475 | -19,87,575 | 11,15,796 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 2,08,73,550 | 1,17,28,950 | 89,73,294 |

| 26,200 | 1,76,28,975 | 52,21,575 | 63,19,284 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,39,525 | -11,18,625 | 77,30,208 |

| 25,500 | 98,69,100 | 13,08,225 | 11,64,052 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,850 | 55,02,900 | 15,41,325 | 24,04,356 |

| 25,500 | 98,69,100 | 13,08,225 | 11,64,052 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 29,70,525 | -32,87,400 | 2,50,216 |

| 25,000 | 77,32,350 | -27,24,150 | 8,06,828 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 54,54,900 | -11,81,550 | 91,82,469 |

| 26,000 | 99,39,525 | -11,18,625 | 77,30,208 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58835.35. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.839 against previous 0.870. The 60000CE option holds the maximum open interest, followed by the 59000CE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 59300CE option, with open interest additions also seen in the 58800CE and 60200CE options. On the other hand, open interest reductions were prominent in the 61500CE, 62000CE, and 50000PE options. Trading volume was highest in the 59000PE option, followed by the 59200CE and 59000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,835.35 | 0.839 | 0.870 | 1.008 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,92,32,360 | 1,90,44,725 | 1,87,635 |

| PUT: | 1,61,26,740 | 1,65,63,400 | -4,36,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 13,89,045 | -1,54,420 | 4,54,234 |

| 59,000 | 13,63,390 | -82,740 | 9,26,666 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 11,67,670 | 4,41,560 | 8,03,409 |

| 58,800 | 5,14,290 | 3,09,890 | 2,00,473 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,500 | 6,48,970 | -2,25,540 | 92,462 |

| 62,000 | 7,43,960 | -2,02,685 | 82,136 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,200 | 9,19,135 | 1,34,015 | 10,35,027 |

| 59,000 | 13,63,390 | -82,740 | 9,26,666 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 13,02,980 | 89,670 | 3,71,822 |

| 58,500 | 12,74,945 | 78,330 | 5,82,828 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,900 | 3,01,735 | 1,20,890 | 95,328 |

| 58,700 | 4,23,220 | 1,06,085 | 4,36,697 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 4,36,205 | -1,61,700 | 11,455 |

| 58,400 | 3,05,375 | -1,24,950 | 2,26,900 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 10,60,570 | 76,160 | 12,03,075 |

| 59,200 | 2,54,030 | 50,400 | 7,64,892 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27498.65. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.766 against previous 0.752. The 27700CE option holds the maximum open interest, followed by the 27800CE and 27900CE options. Market participants have shown increased interest with significant open interest additions in the 27700CE option, with open interest additions also seen in the 27700PE and 27750CE options. On the other hand, open interest reductions were prominent in the 27800CE, 29000CE, and 26700PE options. Trading volume was highest in the 27700CE option, followed by the 27600PE and 27500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,498.65 | 0.766 | 0.752 | 0.954 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,14,280 | 17,18,275 | 96,005 |

| PUT: | 13,90,025 | 12,91,810 | 98,215 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 2,01,630 | 91,975 | 95,311 |

| 27,800 | 1,91,685 | -65,780 | 52,177 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 2,01,630 | 91,975 | 95,311 |

| 27,750 | 1,11,865 | 65,585 | 46,041 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 1,91,685 | -65,780 | 52,177 |

| 29,000 | 55,120 | -37,505 | 2,494 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 2,01,630 | 91,975 | 95,311 |

| 27,800 | 1,91,685 | -65,780 | 52,177 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 1,21,160 | 79,365 | 41,446 |

| 27,000 | 1,01,920 | 14,365 | 10,363 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 1,21,160 | 79,365 | 41,446 |

| 27,100 | 66,950 | 45,110 | 6,271 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 28,925 | -32,825 | 4,071 |

| 25,500 | 38,285 | -20,930 | 1,307 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 67,925 | 9,945 | 68,672 |

| 27,500 | 72,475 | 5,850 | 55,614 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13738.5. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.829 against previous 0.849. The 14000CE option holds the maximum open interest, followed by the 14100CE and 13500PE options. Market participants have shown increased interest with significant open interest additions in the 13800CE option, with open interest additions also seen in the 14100CE and 13850CE options. On the other hand, open interest reductions were prominent in the 68000PE, 71500CE, and 72000CE options. Trading volume was highest in the 13800PE option, followed by the 13900CE and 14000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,738.50 | 0.829 | 0.849 | 1.047 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,42,86,300 | 1,35,00,760 | 7,85,540 |

| PUT: | 1,18,48,200 | 1,14,59,420 | 3,88,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 14,09,240 | -5,59,440 | 1,30,753 |

| 14,100 | 11,82,720 | 4,04,040 | 48,701 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 10,16,820 | 6,01,440 | 85,641 |

| 14,100 | 11,82,720 | 4,04,040 | 48,701 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 14,09,240 | -5,59,440 | 1,30,753 |

| 14,150 | 1,74,580 | -2,41,220 | 25,198 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 9,76,500 | 1,45,740 | 1,39,481 |

| 14,000 | 14,09,240 | -5,59,440 | 1,30,753 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 11,25,460 | -13,580 | 39,519 |

| 13,300 | 9,78,600 | -2,06,080 | 24,064 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,650 | 4,61,440 | 2,52,980 | 41,047 |

| 13,700 | 8,48,540 | 2,18,680 | 1,08,499 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 3,74,080 | -2,16,440 | 75,181 |

| 14,000 | 6,60,660 | -2,13,640 | 14,962 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 9,11,400 | 1,75,000 | 1,62,644 |

| 13,700 | 8,48,540 | 2,18,680 | 1,08,499 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Market is tactically shifting towards cautious bearishness: Open Interest Volume Analysis shows traders increasing short bets while clearing long positions, setting a risk-off tone for the immediate term.

Actionable strategy: Lean into short trades on rallies near 26000–26100 with protective stops; stay nimble given the high volatility context during expiry week.

Sector attention: BankNIFTY and FINNIFTY both mirror similar patterns of long covering and fresh shorts, implying wider market caution and potential sector rotations.

Monitor PCR and OI changes for reversal clues: An uptick in put-call ratio or decline in December open interest could signal the short-term bottom for a bounce.

Maintain disciplined risk management: Use max pain levels and option open interest concentration as your guideposts for stop loss and targets in volatile conditions.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.