Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 26/11/2025

Table of Contents

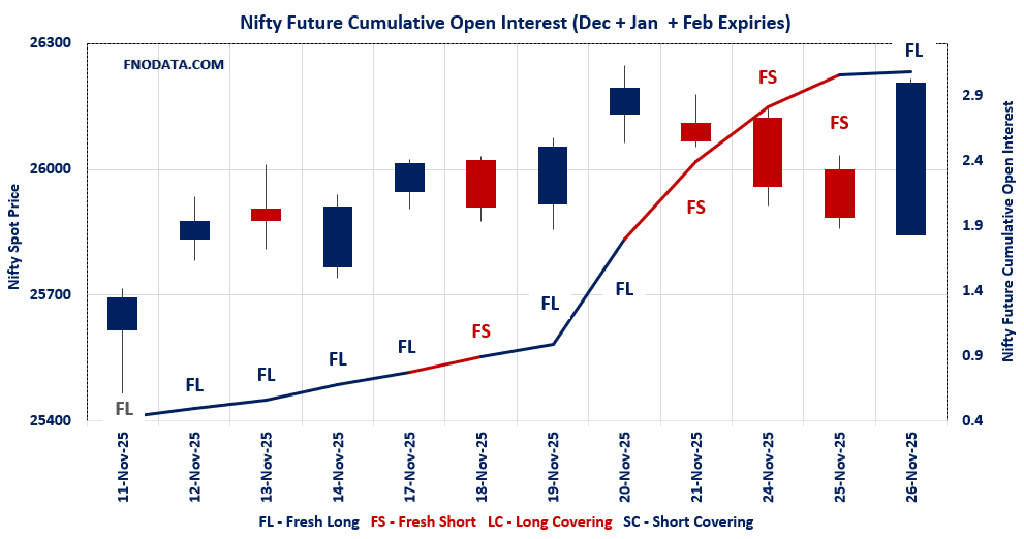

NIFTY 50 had a classic “price up with OI up” day in the combined November–December–January pack, with spot gaining over 1.2% while combined futures open interest climbed 2.59% and volume rose nearly 19%. This Open Interest Volume Analysis points to genuine fresh long build-up rather than just a short-covering bounce.

Both December and January futures closed higher with positive OI change, confirming that new money is coming in on the long side across near and far expiries. Rising premiums with rising price and OI strengthen the case for a bullish continuation bias in the short term.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26205.3 (1.238%)

Combined = November + December + January

Combined Fut Open Interest Change: 2.59%

Combined Fut Volume Change: 18.53%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 6% Previous 6%

NIFTY DECEMBER Future closed at: 26381.2 (1.250%)

November Fut Premium 175.9 (Increased by 5.3 points)

November Fut Open Interest Change: 2.28%

November Fut Volume Change: 19.66%

November Fut Open Interest Analysis: Fresh Long

NIFTY JANUARY Future closed at: 26527.3 (1.116%)

December Fut Premium 322 (Decreased by -27.8 points)

December Fut Open Interest Change: 0.85%

December Fut Volume Change: -16.33%

December Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (2/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.553 (Increased from 0.733)

Put-Call Ratio (Volume): 0.831

Max Pain Level: 26150

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26700

Highest PUT Addition: 26000

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.253 (Increased from 1.237)

Put-Call Ratio (Volume): 1.088

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59528.05 (1.203%)

Combined = November + December + January

Combined Fut Open Interest Change: 9.59%

Combined Fut Volume Change: 6.56%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 8% Previous 7%

BANKNIFTY DECEMBER Future closed at: 59817.2 (1.146%)

November Fut Premium 289.15 (Decreased by -30.15 points)

November Fut Open Interest Change: 8.5%

November Fut Volume Change: 0.5%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY JANUARY Future closed at: 60146.6 (1.077%)

December Fut Premium 618.55 (Decreased by -66.95 points)

December Fut Open Interest Change: 15.79%

December Fut Volume Change: 94.72%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.148 (Increased from 1.068)

Put-Call Ratio (Volume): 0.912

Max Pain Level: 59000

Maximum CALL Open Interest: 58500

Maximum PUT Open Interest: 58500

Highest CALL Addition: 62000

Highest PUT Addition: 59500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27799.5 (1.423%)

Combined = November + December + January

Combined Fut Open Interest Change: 5.8%

Combined Fut Volume Change: -1.8%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 0% Previous 0%

FINNIFTY DECEMBER Future closed at: 27946 (1.433%)

November Fut Premium 146.5 (Increased by 4.7 points)

November Fut Open Interest Change: 5.65%

November Fut Volume Change: -1.99%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY JANUARY Future closed at: 28072.3 (1.407%)

December Fut Premium 272.8 (Decreased by -0.6 points)

December Fut Open Interest Change: 100.00%

December Fut Volume Change: #DIV/0!

December Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.075 (Increased from 0.730)

Put-Call Ratio (Volume): 0.895

Max Pain Level: 27700

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27700

Highest PUT Addition: 27700

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 14009.3 (1.467%)

Combined = November + December + January

Combined Fut Open Interest Change: -2.25%

Combined Fut Volume Change: -38.41%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 1% Previous 1%

MIDCPNIFTY DECEMBER Future closed at: 14114.9 (1.546%)

November Fut Premium 105.6 (Increased by 12.3 points)

November Fut Open Interest Change: -2.37%

November Fut Volume Change: -40.02%

November Fut Open Interest Analysis: Short Covering

MIDCPNIFTY JANUARY Future closed at: 14174.15 (1.452%)

December Fut Premium 164.85 (Increased by 0.3 points)

December Fut Open Interest Change: 4.58%

December Fut Volume Change: 85.47%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.055 (Increased from 0.928)

Put-Call Ratio (Volume): 0.847

Max Pain Level: 14000

Maximum CALL Open Interest: 15000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 15000

Highest PUT Addition: 14000

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 85,609.51 (1.209%)

SENSEX Monthly Future closed at: 85,601.95 (1.062%)

Discount: -7.56 (Decreased by -122.85 points)

Open Interest Change: -4.98%

Volume Change: 45.11%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (27/11/2025) Option Analysis

Put-Call Ratio (OI): 1.691 (Increased from 0.611)

Put-Call Ratio (Volume): 0.881

Max Pain Level: 85500

Maximum CALL OI: 87000

Maximum PUT OI: 85000

Highest CALL Addition: 87000

Highest PUT Addition: 85000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 4,778.03 Cr.

DIIs Net BUY: ₹ 6,247.93 Cr.

FII Derivatives Activity

| FII Trading Stats | 26.11.25 | 25.11.25 | 24.11.25 |

| FII Cash (Provisional Data) | 4,778.03 | 785.32 | -4,171.75 |

| Index Future Open Interest Long Ratio | 17.19% | 15.07% | 14.48% |

| Index Future Volume Long Ratio | 55.12% | 43.58% | 53.64% |

| Call Option Open Interest Long Ratio | 51.38% | 45.89% | 50.18% |

| Call Option Volume Long Ratio | 50.86% | 49.93% | 49.79% |

| Put Option Open Interest Long Ratio | 57.59% | 67.73% | 62.02% |

| Put Option Volume Long Ratio | 48.93% | 50.09% | 50.03% |

| Stock Future Open Interest Long Ratio | 61.88% | 61.58% | 61.34% |

| Stock Future Volume Long Ratio | 53.23% | 50.14% | 51.17% |

| Index Futures | Fresh Long | Long Covering | Fresh Long |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Long | Long Covering | Fresh Long |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Long | Long Covering | Short Covering |

| BankNifty Options | Fresh Short | Long Covering | Fresh Long |

| FinNifty Futures | Short Covering | Short Covering | Fresh Short |

| FinNifty Options | Fresh Long | Short Covering | Fresh Short |

| MidcpNifty Futures | Long Covering | Long Covering | Fresh Long |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Long Covering | Fresh Long |

| Stock Futures | Fresh Long | Short Covering | Short Covering |

| Stock Options | Fresh Short | Long Covering | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (27/11/2025)

The SENSEX index closed at 85609.51. The SENSEX weekly expiry for NOVEMBER 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.691 against previous 0.611. The 85000PE option holds the maximum open interest, followed by the 83000PE and 84000PE options. Market participants have shown increased interest with significant open interest additions in the 85000PE option, with open interest additions also seen in the 83000PE and 85500PE options. On the other hand, open interest reductions were prominent in the 85000CE, 84800CE, and 85200CE options. Trading volume was highest in the 86000CE option, followed by the 85500CE and 85000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 27-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85609.51 | 1.691 | 0.611 | 0.881 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,41,63,000 | 2,26,99,280 | 14,63,720 |

| PUT: | 4,08,49,960 | 1,38,78,500 | 2,69,71,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 21,93,120 | 8,88,740 | 2,03,31,100 |

| 86500 | 17,98,180 | 7,37,440 | 3,87,98,340 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 21,93,120 | 8,88,740 | 2,03,31,100 |

| 86500 | 17,98,180 | 7,37,440 | 3,87,98,340 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 3,92,820 | -11,51,580 | 3,78,89,800 |

| 84800 | 1,16,320 | -4,31,780 | 1,20,57,260 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 17,68,380 | 3,83,580 | 11,72,53,880 |

| 85500 | 10,96,360 | -3,55,440 | 11,28,43,460 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 33,10,900 | 27,86,060 | 9,66,38,460 |

| 83000 | 26,46,300 | 15,18,080 | 2,16,73,220 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 33,10,900 | 27,86,060 | 9,66,38,460 |

| 83000 | 26,46,300 | 15,18,080 | 2,16,73,220 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 86500 | 40,180 | -20,760 | 2,57,700 |

| 79300 | 1,700 | -1,340 | 18,720 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 33,10,900 | 27,86,060 | 9,66,38,460 |

| 85500 | 16,57,600 | 14,95,680 | 7,22,40,780 |

NIFTY Weekly Expiry (2/12/2025)

The NIFTY index closed at 26205.3. The NIFTY weekly expiry for DECEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.553 against previous 0.733. The 26000PE option holds the maximum open interest, followed by the 25000PE and 26100PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26100PE and 26200PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25900CE, and 25950CE options. Trading volume was highest in the 26200CE option, followed by the 26000PE and 26100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,205.30 | 1.553 | 0.733 | 0.831 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,44,56,625 | 8,50,07,025 | 1,94,49,600 |

| PUT: | 16,22,47,350 | 6,23,27,475 | 9,99,19,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 79,47,675 | 18,81,450 | 16,25,702 |

| 27,000 | 73,19,025 | 20,40,150 | 10,66,582 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 51,04,425 | 20,92,350 | 7,32,180 |

| 27,000 | 73,19,025 | 20,40,150 | 10,66,582 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 50,81,025 | -20,49,225 | 15,20,172 |

| 25,900 | 9,86,475 | -12,95,625 | 4,50,469 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 65,44,125 | 6,85,875 | 27,04,799 |

| 26,100 | 46,54,425 | -1,70,400 | 21,37,509 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,68,71,700 | 1,19,01,975 | 24,00,390 |

| 25,000 | 1,03,03,125 | 59,13,375 | 5,46,913 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,68,71,700 | 1,19,01,975 | 24,00,390 |

| 26,100 | 98,72,325 | 77,99,325 | 20,18,320 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 4,87,875 | -46,050 | 99,511 |

| 27,500 | 3,300 | -225 | 32 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,68,71,700 | 1,19,01,975 | 24,00,390 |

| 26,100 | 98,72,325 | 77,99,325 | 20,18,320 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26205.3. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.253 against previous 1.237. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000PE and 25700PE options. On the other hand, open interest reductions were prominent in the 26500CE, 24800PE, and 24000PE options. Trading volume was highest in the 26000PE option, followed by the 27000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,205.30 | 1.253 | 1.237 | 1.088 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,60,53,475 | 4,29,27,450 | 31,26,025 |

| PUT: | 5,76,84,900 | 5,31,20,775 | 45,64,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 67,38,950 | 9,15,550 | 1,02,065 |

| 26,000 | 64,55,200 | -2,400 | 75,254 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 67,38,950 | 9,15,550 | 1,02,065 |

| 28,000 | 31,68,725 | 4,01,825 | 24,881 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 32,39,325 | -8,68,650 | 77,526 |

| 25,900 | 3,57,675 | -1,06,800 | 11,359 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 67,38,950 | 9,15,550 | 1,02,065 |

| 26,500 | 32,39,325 | -8,68,650 | 77,526 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 77,00,275 | 6,23,500 | 1,05,932 |

| 25,000 | 47,26,675 | 1,67,450 | 50,344 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 77,00,275 | 6,23,500 | 1,05,932 |

| 25,700 | 18,48,825 | 6,14,250 | 34,500 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 14,35,650 | -2,68,200 | 24,952 |

| 24,000 | 38,43,675 | -1,26,500 | 17,864 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 77,00,275 | 6,23,500 | 1,05,932 |

| 25,500 | 44,76,750 | 1,02,600 | 61,831 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59528.05. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.148 against previous 1.068. The 58500PE option holds the maximum open interest, followed by the 58500CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 59500PE option, with open interest additions also seen in the 59000PE and 59400PE options. On the other hand, open interest reductions were prominent in the 59000CE, 58900CE, and 59200CE options. Trading volume was highest in the 59500CE option, followed by the 59000PE and 59500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,528.05 | 1.148 | 1.068 | 0.912 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,03,19,145 | 80,20,870 | 22,98,275 |

| PUT: | 1,18,46,840 | 85,63,345 | 32,83,495 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 13,06,970 | 18,690 | 13,688 |

| 60,000 | 7,83,370 | 1,44,585 | 93,804 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 6,95,450 | 1,84,800 | 59,777 |

| 59,500 | 5,56,325 | 1,60,650 | 1,09,915 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 7,22,855 | -1,02,655 | 62,922 |

| 58,900 | 44,205 | -30,835 | 8,948 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 5,56,325 | 1,60,650 | 1,09,915 |

| 60,000 | 7,83,370 | 1,44,585 | 93,804 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 20,11,695 | 1,01,220 | 56,864 |

| 59,000 | 11,51,255 | 3,61,515 | 1,08,579 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 7,01,645 | 3,95,500 | 1,06,506 |

| 59,000 | 11,51,255 | 3,61,515 | 1,08,579 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,900 | 8,750 | -2,660 | 662 |

| 53,900 | 1,715 | -1,575 | 100 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 11,51,255 | 3,61,515 | 1,08,579 |

| 59,500 | 7,01,645 | 3,95,500 | 1,06,506 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27799.5. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.075 against previous 0.730. The 27500PE option holds the maximum open interest, followed by the 27700PE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 27700PE option, with open interest additions also seen in the 27500PE and 27800PE options. On the other hand, open interest reductions were prominent in the 27600CE, 27400CE, and 25000PE options. Trading volume was highest in the 27700PE option, followed by the 27700CE and 27500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,799.50 | 1.075 | 0.730 | 0.895 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,27,530 | 31,265 | 96,265 |

| PUT: | 1,37,150 | 22,815 | 1,14,335 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 20,345 | 9,685 | 907 |

| 27,700 | 16,835 | 15,080 | 1,286 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 16,835 | 15,080 | 1,286 |

| 29,000 | 14,690 | 14,690 | 442 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 5,330 | -1,040 | 677 |

| 27,400 | 910 | -260 | 30 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 16,835 | 15,080 | 1,286 |

| 27,500 | 20,345 | 9,685 | 907 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 26,195 | 16,510 | 1,192 |

| 27,700 | 26,065 | 25,285 | 1,391 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 26,065 | 25,285 | 1,391 |

| 27,500 | 26,195 | 16,510 | 1,192 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 585 | -130 | 30 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 26,065 | 25,285 | 1,391 |

| 27,500 | 26,195 | 16,510 | 1,192 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 14009.3. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.055 against previous 0.928. The 13000PE option holds the maximum open interest, followed by the 14000PE and 15000CE options. Market participants have shown increased interest with significant open interest additions in the 14000PE option, with open interest additions also seen in the 15000CE and 13200PE options. On the other hand, open interest reductions were prominent in the 63000PE, 63000PE, and 63000CE options. Trading volume was highest in the 14000CE option, followed by the 14000PE and 14500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 14,009.30 | 1.055 | 0.928 | 0.847 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 27,18,940 | 17,57,840 | 9,61,100 |

| PUT: | 28,67,760 | 16,31,420 | 12,36,340 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 3,96,060 | 1,93,480 | 5,934 |

| 14,000 | 3,91,580 | 80,360 | 15,471 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 3,96,060 | 1,93,480 | 5,934 |

| 14,700 | 1,82,420 | 1,33,980 | 4,029 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 1,05,000 | -22,260 | 866 |

| 13,800 | 75,740 | -20,160 | 1,647 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 3,91,580 | 80,360 | 15,471 |

| 14,500 | 3,48,740 | 4,340 | 8,926 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,22,100 | -46,340 | 6,510 |

| 14,000 | 4,09,080 | 1,95,020 | 9,920 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 4,09,080 | 1,95,020 | 9,920 |

| 13,200 | 2,27,920 | 1,69,540 | 4,002 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,22,100 | -46,340 | 6,510 |

| 12,500 | 88,200 | -9,660 | 1,187 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 4,09,080 | 1,95,020 | 9,920 |

| 13,900 | 2,05,380 | 1,16,620 | 6,816 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Weekly and monthly options data further back the bulls: PCR (OI) has jumped to 1.553 for the weekly expiry and 1.253 for the monthly, with max pain sitting around 26,150–26,000. Heavy put writing at 26,000 suggests traders are now defending this zone as a key support.

BANKNIFTY and FINNIFTY are fully aligned with this risk-on tone, showing strong combined fresh long activity and higher prices, which adds breadth and credibility to the index-wide up-move. MIDCPNIFTY is seeing short covering in the combined book plus fresh longs in longer-dated contracts, hinting at improving risk appetite even in the broader market.

SENSEX futures are still in short-covering mode, not yet in outright long build-up, but the price jump with falling OI fits a “late-to-the-party” unwind that often accompanies the early phase of an up-leg. Overall, Open Interest Volume Analysis now favours a buy-on-dips approach, with 26,000 on NIFTY acting as a logical line in the sand for tight, tactical stop-loss placement.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.