Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 27/11/2025

Table of Contents

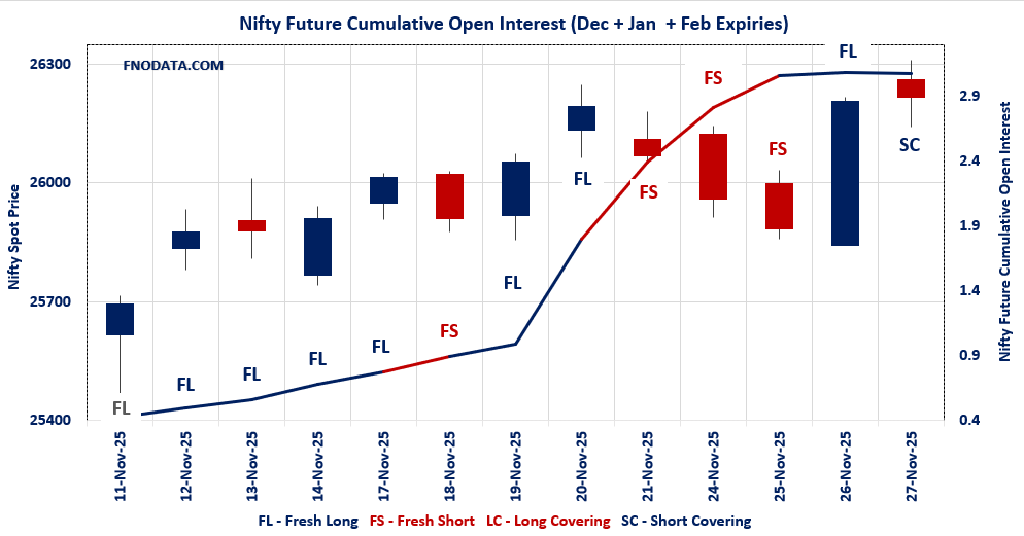

NIFTY’s Open Interest Volume Analysis shows cautious short covering: Combined futures open interest fell slightly (-0.71%) while volumes decreased (-31%), and prices were nearly flat (+0.04%), indicating traders are closing short positions amid reduced trading activity.

December futures reflect modest fresh long accumulation: December OI rose by 2.33% with prices holding firm, suggesting selective fresh buying in the near-month contract despite overall market consolidation.

January futures continue moderate long build-up: January OI climbed modestly (+0.85%) with a slight price increase, showing continued interest in longer-term upside potential.

Options put-call ratio remains elevated: Weekly PCR decreased from 1.553 to 1.137 signaling easing bearishness, while monthly PCR remains high at 1.229, reflecting some persistent cautiousness from options traders.

Max pain stable near 26,000–26,200: Call and put open interest clusters at these strikes keep price action range-bound near this level, forming a tactical battleground as expiry approaches.

BankNIFTY and FINNIFTY reflect similar dynamics: BankNIFTY shows fresh long buildup (+7.44% OI), while FINNIFTY also adds longs (+3.9%), indicating broad-based index strength outside NIFTY’s short-covering phase.

MIDCPNIFTY sees long unwinding: Combined OI drops (-1.1%), volume declines, suggesting mixed sectoral sentiment with fresh shorts emerging in some midcap segments.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26215.55 (0.039%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.71%

Combined Fut Volume Change: -31.08%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 7% Previous 6%

NIFTY DECEMBER Future closed at: 26390.9 (0.037%)

November Fut Premium 175.35 (Decreased by -0.55 points)

November Fut Open Interest Change: -1.34%

November Fut Volume Change: -33.21%

November Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26548.7 (0.081%)

December Fut Premium 333.15 (Increased by 11.15 points)

December Fut Open Interest Change: 2.33%

December Fut Volume Change: -11.52%

December Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (2/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.137 (Decreased from 1.553)

Put-Call Ratio (Volume): 0.967

Max Pain Level: 26200

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26600

Highest PUT Addition: 26250

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.229 (Decreased from 1.253)

Put-Call Ratio (Volume): 1.238

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27400

Highest PUT Addition: 25800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59737.3 (0.352%)

Combined = December + January + February

Combined Fut Open Interest Change: 7.44%

Combined Fut Volume Change: -14.43%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 9% Previous 8%

BANKNIFTY DECEMBER Future closed at: 60031.8 (0.359%)

November Fut Premium 294.5 (Increased by 5.35 points)

November Fut Open Interest Change: 6.9%

November Fut Volume Change: -15.4%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY JANUARY Future closed at: 60359.2 (0.353%)

December Fut Premium 621.9 (Increased by 3.35 points)

December Fut Open Interest Change: 10.41%

December Fut Volume Change: -14.07%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.170 (Increased from 1.148)

Put-Call Ratio (Volume): 0.898

Max Pain Level: 59100

Maximum CALL Open Interest: 58500

Maximum PUT Open Interest: 58500

Highest CALL Addition: 60000

Highest PUT Addition: 60000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27946.2 (0.528%)

Combined = December + January + February

Combined Fut Open Interest Change: 3.9%

Combined Fut Volume Change: -30.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 1% Previous 0%

FINNIFTY DECEMBER Future closed at: 28099.8 (0.550%)

November Fut Premium 153.6 (Increased by 7.1 points)

November Fut Open Interest Change: 3.70%

November Fut Volume Change: -30.86%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY JANUARY Future closed at: 28216.1 (0.512%)

December Fut Premium 269.9 (Decreased by -2.9 points)

December Fut Open Interest Change: 50.00%

December Fut Volume Change: 200.00%

December Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.060 (Decreased from 1.075)

Put-Call Ratio (Volume): 1.062

Max Pain Level: 27900

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 28000

Highest CALL Addition: 28000

Highest PUT Addition: 28000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 14075.9 (0.475%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.10%

Combined Fut Volume Change: -26.33%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 1% Previous 1%

MIDCPNIFTY DECEMBER Future closed at: 14159.8 (0.318%)

November Fut Premium 83.9 (Decreased by -21.7 points)

November Fut Open Interest Change: -1.05%

November Fut Volume Change: -27.28%

November Fut Open Interest Analysis: Short Covering

MIDCPNIFTY JANUARY Future closed at: 14218.05 (0.310%)

December Fut Premium 142.15 (Decreased by -22.7 points)

December Fut Open Interest Change: -6.56%

December Fut Volume Change: -6.91%

December Fut Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.051 (Decreased from 1.055)

Put-Call Ratio (Volume): 0.908

Max Pain Level: 14000

Maximum CALL Open Interest: 15000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 15000

Highest PUT Addition: 14100

SENSEX Monthly Expiry (4/12/2025) Future

SENSEX Spot closed at: 85,720.38 (0.130%)

SENSEX Monthly Future closed at: 86,310.30 (0.137%)

Premium: 589.92 (Increased by 6.98 points)

Open Interest Change: 19.32%

Volume Change: 22.31%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (27/11/2025) Option Analysis

Put-Call Ratio (OI): 0.995 (Decreased from 1.161)

Put-Call Ratio (Volume): 1.062

Max Pain Level: 85600

Maximum CALL OI: 89000

Maximum PUT OI: 82000

Highest CALL Addition: 89000

Highest PUT Addition: 82000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,255.20 Cr.

DIIs Net BUY: ₹ 3,940.87 Cr.

FII Derivatives Activity

| FII Trading Stats | 27.11.25 | 26.11.25 | 25.11.25 |

| FII Cash (Provisional Data) | -1,255.20 | 4,778.03 | 785.32 |

| Index Future Open Interest Long Ratio | 18.56% | 17.19% | 15.07% |

| Index Future Volume Long Ratio | 56.41% | 55.12% | 43.58% |

| Call Option Open Interest Long Ratio | 51.28% | 51.38% | 45.89% |

| Call Option Volume Long Ratio | 50.01% | 50.86% | 49.93% |

| Put Option Open Interest Long Ratio | 60.29% | 57.59% | 67.73% |

| Put Option Volume Long Ratio | 50.39% | 48.93% | 50.09% |

| Stock Future Open Interest Long Ratio | 61.51% | 61.88% | 61.58% |

| Stock Future Volume Long Ratio | 46.25% | 53.23% | 50.14% |

| Index Futures | Fresh Long | Fresh Long | Long Covering |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Fresh Short | Fresh Long | Long Covering |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Short Covering | Fresh Long | Long Covering |

| BankNifty Options | Fresh Long | Fresh Short | Long Covering |

| FinNifty Futures | Short Covering | Short Covering | Short Covering |

| FinNifty Options | Fresh Long | Fresh Long | Short Covering |

| MidcpNifty Futures | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Long Covering |

| Stock Futures | Fresh Short | Fresh Long | Short Covering |

| Stock Options | Fresh Short | Fresh Short | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (4/12/2025)

The SENSEX index closed at 85720.38. The SENSEX weekly expiry for DECEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.995 against previous 1.161. The 89000CE option holds the maximum open interest, followed by the 82000PE and 85000PE options. Market participants have shown increased interest with significant open interest additions in the 89000CE option, with open interest additions also seen in the 82000PE and 89500CE options. On the other hand, open interest reductions were prominent in the 85000CE, 85100CE, and 84500CE options. Trading volume was highest in the 86000CE option, followed by the 85500PE and 86000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85720.38 | 0.995 | 1.161 | 1.062 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 42,82,260 | 16,78,740 | 26,03,520 |

| PUT: | 42,61,760 | 19,49,400 | 23,12,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 3,98,160 | 3,34,380 | 10,51,780 |

| 87500 | 3,20,180 | 1,48,340 | 8,83,900 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 3,98,160 | 3,34,380 | 10,51,780 |

| 89500 | 2,36,840 | 2,20,500 | 4,74,920 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 69,180 | -20,840 | 2,16,320 |

| 85100 | 11,200 | -4,700 | 24,840 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 2,99,740 | 1,71,960 | 27,48,540 |

| 87000 | 2,71,940 | 1,43,800 | 15,69,120 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 3,95,160 | 2,82,340 | 9,77,580 |

| 85000 | 3,64,960 | 87,580 | 18,75,440 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 3,95,160 | 2,82,340 | 9,77,580 |

| 85500 | 3,36,080 | 1,87,600 | 22,32,980 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81100 | 2,940 | -20 | 5,340 |

| 77200 | 100 | – | 20 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,36,080 | 1,87,600 | 22,32,980 |

| 86000 | 1,89,180 | 1,28,060 | 20,23,460 |

NIFTY Weekly Expiry (2/12/2025)

The NIFTY index closed at 26215.55. The NIFTY weekly expiry for DECEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.137 against previous 1.553. The 26000PE option holds the maximum open interest, followed by the 26500CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26600CE option, with open interest additions also seen in the 26300CE and 26400CE options. On the other hand, open interest reductions were prominent in the 26100PE, 26000PE, and 25200PE options. Trading volume was highest in the 26300CE option, followed by the 26200PE and 26200CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,215.55 | 1.137 | 1.553 | 0.967 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,37,39,825 | 10,44,56,625 | 3,92,83,200 |

| PUT: | 16,34,98,725 | 16,22,47,350 | 12,51,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,06,37,775 | 26,90,100 | 21,87,275 |

| 26,300 | 93,16,800 | 41,82,375 | 38,04,603 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 83,88,450 | 45,25,950 | 12,60,773 |

| 26,300 | 93,16,800 | 41,82,375 | 38,04,603 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 40,19,175 | -10,61,850 | 3,23,054 |

| 26,100 | 38,07,900 | -8,46,525 | 7,44,688 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 93,16,800 | 41,82,375 | 38,04,603 |

| 26,200 | 70,91,700 | 5,47,575 | 29,88,972 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,53,64,275 | -15,07,425 | 19,52,920 |

| 25,000 | 96,78,000 | -6,25,125 | 5,63,318 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 26,13,450 | 12,61,050 | 22,11,217 |

| 25,100 | 35,91,525 | 12,40,050 | 2,54,599 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 83,60,325 | -15,12,000 | 18,47,702 |

| 26,000 | 1,53,64,275 | -15,07,425 | 19,52,920 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 74,72,550 | 2,41,425 | 33,87,587 |

| 26,300 | 33,55,650 | 7,07,250 | 25,13,663 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26215.55. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.229 against previous 1.253. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 27400CE option, with open interest additions also seen in the 27000CE and 25800PE options. On the other hand, open interest reductions were prominent in the 26000PE, 26000CE, and 25500PE options. Trading volume was highest in the 26000PE option, followed by the 27000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,215.55 | 1.229 | 1.253 | 1.238 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,70,42,500 | 4,60,53,475 | 9,89,025 |

| PUT: | 5,77,93,625 | 5,76,84,900 | 1,08,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 70,79,025 | 3,40,075 | 89,878 |

| 26,000 | 59,90,500 | -4,64,700 | 38,609 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,400 | 7,99,425 | 4,76,850 | 17,964 |

| 27,000 | 70,79,025 | 3,40,075 | 89,878 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 59,90,500 | -4,64,700 | 38,609 |

| 26,200 | 18,89,625 | -2,56,650 | 39,920 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 70,79,025 | 3,40,075 | 89,878 |

| 26,500 | 31,91,250 | -48,075 | 63,899 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,13,525 | -5,86,750 | 90,351 |

| 25,000 | 47,07,050 | -19,625 | 48,372 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 15,43,050 | 2,81,625 | 26,273 |

| 25,700 | 21,12,750 | 2,63,925 | 18,882 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,13,525 | -5,86,750 | 90,351 |

| 25,500 | 41,87,925 | -2,88,825 | 59,334 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,13,525 | -5,86,750 | 90,351 |

| 25,500 | 41,87,925 | -2,88,825 | 59,334 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59737.3. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.170 against previous 1.148. The 58500PE option holds the maximum open interest, followed by the 58500CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 60000PE option, with open interest additions also seen in the 60000CE and 59700PE options. On the other hand, open interest reductions were prominent in the 59500CE, 59000CE, and 55500PE options. Trading volume was highest in the 60000CE option, followed by the 59500PE and 60000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,737.30 | 1.170 | 1.148 | 0.898 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,08,52,510 | 1,03,19,145 | 5,33,365 |

| PUT: | 1,27,00,000 | 1,18,46,840 | 8,53,160 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 12,91,290 | -15,680 | 5,624 |

| 60,000 | 9,72,930 | 1,89,560 | 1,25,137 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 9,72,930 | 1,89,560 | 1,25,137 |

| 65,000 | 3,48,740 | 78,435 | 16,030 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 4,75,510 | -80,815 | 72,945 |

| 59,000 | 6,52,540 | -70,315 | 19,288 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 9,72,930 | 1,89,560 | 1,25,137 |

| 59,700 | 1,41,400 | 26,320 | 73,477 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 20,60,660 | 48,965 | 40,004 |

| 59,000 | 11,70,820 | 19,565 | 65,402 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 6,56,705 | 2,95,085 | 81,786 |

| 59,700 | 2,38,700 | 1,56,590 | 74,290 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 2,53,745 | -62,790 | 10,884 |

| 59,400 | 2,01,040 | -21,245 | 21,549 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 7,12,950 | 11,305 | 93,547 |

| 60,000 | 6,56,705 | 2,95,085 | 81,786 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27946.2. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.060 against previous 1.075. The 28000CE option holds the maximum open interest, followed by the 28000PE and 27700PE options. Market participants have shown increased interest with significant open interest additions in the 28000CE option, with open interest additions also seen in the 28000PE and 27900PE options. On the other hand, open interest reductions were prominent in the 27800CE, 27600PE, and 27600CE options. Trading volume was highest in the 28000CE option, followed by the 28000PE and 27900PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,946.20 | 1.060 | 1.075 | 1.062 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,14,955 | 1,27,530 | 87,425 |

| PUT: | 2,27,890 | 1,37,150 | 90,740 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 39,780 | 32,760 | 2,666 |

| 29,000 | 23,660 | 8,970 | 747 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 39,780 | 32,760 | 2,666 |

| 29,600 | 16,185 | 9,230 | 457 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 6,825 | -3,185 | 326 |

| 27,600 | 4,355 | -975 | 45 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 39,780 | 32,760 | 2,666 |

| 28,500 | 12,155 | 9,035 | 962 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 30,810 | 27,560 | 2,433 |

| 27,700 | 29,640 | 3,575 | 768 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 30,810 | 27,560 | 2,433 |

| 27,900 | 14,105 | 10,595 | 1,974 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 5,330 | -1,625 | 144 |

| 28,500 | 910 | -65 | 33 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 30,810 | 27,560 | 2,433 |

| 27,900 | 14,105 | 10,595 | 1,974 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 14075.9. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.051 against previous 1.055. The 15000CE option holds the maximum open interest, followed by the 13000PE and 14000PE options. Market participants have shown increased interest with significant open interest additions in the 15000CE option, with open interest additions also seen in the 14100PE and 14100CE options. On the other hand, open interest reductions were prominent in the 70200CE, 64500CE, and 64500CE options. Trading volume was highest in the 14000PE option, followed by the 14000CE and 14100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 14,075.90 | 1.051 | 1.055 | 0.908 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 32,68,440 | 27,18,940 | 5,49,500 |

| PUT: | 34,34,060 | 28,67,760 | 5,66,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 6,02,700 | 2,06,640 | 5,718 |

| 14,000 | 3,93,540 | 1,960 | 9,196 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 6,02,700 | 2,06,640 | 5,718 |

| 14,100 | 2,39,680 | 1,22,920 | 8,405 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 85,960 | -25,340 | 790 |

| 13,950 | 23,240 | -23,660 | 431 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 3,93,540 | 1,960 | 9,196 |

| 14,100 | 2,39,680 | 1,22,920 | 8,405 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,04,420 | 82,320 | 4,110 |

| 14,000 | 4,41,840 | 32,760 | 10,689 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 2,10,000 | 1,44,340 | 7,508 |

| 13,300 | 2,63,480 | 1,22,360 | 4,590 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,950 | 36,540 | -32,620 | 1,477 |

| 13,200 | 2,14,760 | -13,160 | 2,228 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 4,41,840 | 32,760 | 10,689 |

| 14,100 | 2,10,000 | 1,44,340 | 7,508 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Market is in a mixed phase but leaning towards long bias beyond near-term: Open Interest Volume Analysis suggests tactical short covering with modest fresh long positions, especially seen in December and January futures.

Actionable feedback: Traders should focus on buying on dips near max pain and major OI strikes around 26,000–26,200. Use options as a guide for risk management, with tight stops below these levels.

Sector rotation: Favor BankNIFTY and FINNIFTY for bullish plays, while exercising caution in midcap spaces like MIDCPNIFTY where sentiment appears less settled.

Watch PCR trends for clarity: A gradual decrease in PCR combined with steady or rising OI supports incremental bullish positioning; a reversal could prompt more cautious trades.

Maintain nimble trading: As expiry nears, Open Interest Volume Analysis points to range-bound action with occasional bursts—diligent monitoring of OI and volume changes remains key for profitable setups.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.