Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 2/12/2025

Table of Contents

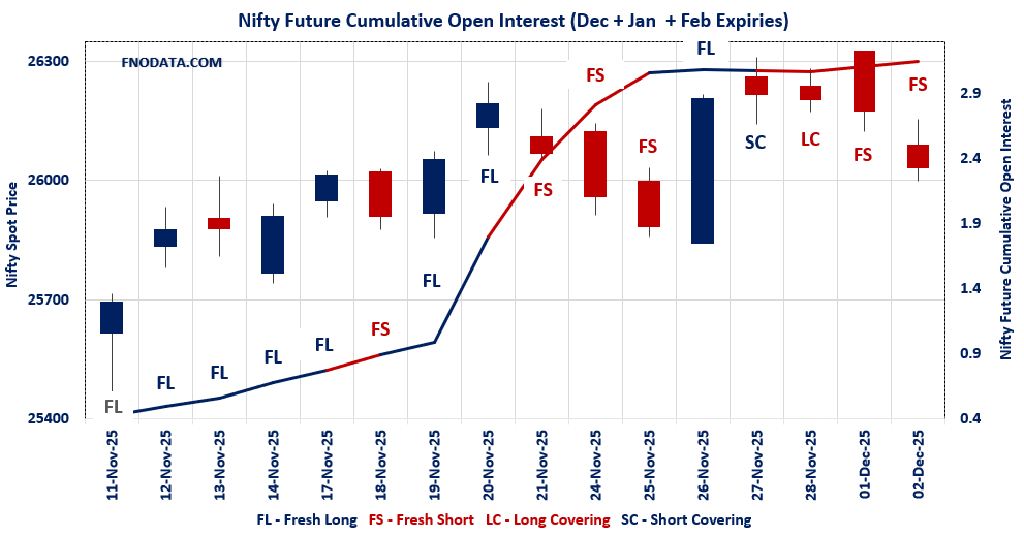

The combined open interest and volume analysis for NIFTY futures across December to February shows a rise in fresh short positions, signaling growing caution among traders despite slight volume upticks.

In contrast, BANKNIFTY and FINNIFTY futures reflect long unwinding with decreased open interest and volume, hinting that bulls may be pausing or exiting.

Put-call ratios for the key expiries suggest a balanced to mildly bearish bias, with the maximum pain zone staying close to current index levels, which can act as a magnet for price action.

This combined view points to a market poised for potential consolidation or downside pressure in the near term in NIFTY.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26032.2 (-0.548%)

Combined = December + January + February

Combined Fut Open Interest Change: 3.98%

Combined Fut Volume Change: 4.27%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 8% Previous 7%

NIFTY DECEMBER Future closed at: 26213 (-0.462%)

December Fut Premium 180.8 (Increased by 21.85 points)

December Fut Open Interest Change: 3.49%

December Fut Volume Change: 4.12%

December Fut Open Interest Analysis: Fresh Short

NIFTY JANUARY Future closed at: 26388.7 (-0.432%)

January Fut Premium 356.5 (Increased by 29.15 points)

January Fut Open Interest Change: 7.63%

January Fut Volume Change: -2.67%

January Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (9/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.725 (Decreased from 0.913)

Put-Call Ratio (Volume): 0.796

Max Pain Level: 26100

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26100

Highest PUT Addition: 26000

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.159 (Decreased from 1.186)

Put-Call Ratio (Volume): 0.933

Max Pain Level: 26100

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26200

Highest PUT Addition: 26200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59273.8 (-0.683%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.31%

Combined Fut Volume Change: -14.26%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 10% Previous 10%

BANKNIFTY DECEMBER Future closed at: 59665.4 (-0.415%)

December Fut Premium 391.6 (Increased by 158.95 points)

December Fut Open Interest Change: -1.6%

December Fut Volume Change: -13.0%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY JANUARY Future closed at: 60047.6 (-0.408%)

January Fut Premium 773.8 (Increased by 161.55 points)

January Fut Open Interest Change: -0.57%

January Fut Volume Change: -28.87%

January Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.991 (Decreased from 1.092)

Put-Call Ratio (Volume): 1.049

Max Pain Level: 59200

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 58500

Highest CALL Addition: 59500

Highest PUT Addition: 50000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27565.25 (-0.896%)

Combined = December + January + February

Combined Fut Open Interest Change: -7.7%

Combined Fut Volume Change: -30.1%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 1% Previous 1%

FINNIFTY DECEMBER Future closed at: 27763.2 (-0.633%)

December Fut Premium 197.95 (Increased by 72.35 points)

December Fut Open Interest Change: -7.95%

December Fut Volume Change: -31.37%

December Fut Open Interest Analysis: Long Covering

FINNIFTY JANUARY Future closed at: 27809.5 (-0.912%)

January Fut Premium 244.25 (Decreased by -6.65 points)

January Fut Open Interest Change: 25.00%

January Fut Volume Change: 500.00%

January Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.760 (Decreased from 0.821)

Put-Call Ratio (Volume): 1.031

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27800

Highest PUT Addition: 27500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13990.5 (-0.398%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.40%

Combined Fut Volume Change: 156.26%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 2% Previous 2%

MIDCPNIFTY DECEMBER Future closed at: 14032.75 (-0.561%)

December Fut Premium 42.25 (Decreased by -23.15 points)

December Fut Open Interest Change: -1.64%

December Fut Volume Change: 163.73%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 14103.85 (-0.536%)

January Fut Premium 113.35 (Decreased by -20 points)

January Fut Open Interest Change: 11.73%

January Fut Volume Change: 12.74%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.908 (Decreased from 0.964)

Put-Call Ratio (Volume): 1.005

Max Pain Level: 14000

Maximum CALL Open Interest: 15000

Maximum PUT Open Interest: 14000

Highest CALL Addition: 14100

Highest PUT Addition: 14000

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,138.27 (-0.588%)

SENSEX Monthly Future closed at: 85,806.25 (-0.479%)

Premium: 667.98 (Increased by 91.03 points)

Open Interest Change: 9.39%

Volume Change: -0.97%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (4/12/2025) Option Analysis

Put-Call Ratio (OI): 0.637 (Decreased from 0.637)

Put-Call Ratio (Volume): 0.984

Max Pain Level: 85300

Maximum CALL OI: 86000

Maximum PUT OI: 83000

Highest CALL Addition: 86000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,642.30 Cr.

DIIs Net BUY: ₹ 4,645.94 Cr.

FII Derivatives Activity

| FII Trading Stats | 2.12.25 | 1.12.25 | 28.11.25 |

| FII Cash (Provisional Data) | -3,642.30 | -1,171.31 | -3,795.72 |

| Index Future Open Interest Long Ratio | 15.91% | 18.84% | 18.70% |

| Index Future Volume Long Ratio | 29.72% | 50.90% | 48.99% |

| Call Option Open Interest Long Ratio | 48.26% | 49.43% | 49.78% |

| Call Option Volume Long Ratio | 49.99% | 49.95% | 49.73% |

| Put Option Open Interest Long Ratio | 65.89% | 61.44% | 61.21% |

| Put Option Volume Long Ratio | 50.18% | 50.08% | 50.42% |

| Stock Future Open Interest Long Ratio | 61.86% | 61.38% | 61.48% |

| Stock Future Volume Long Ratio | 55.40% | 49.11% | 49.69% |

| Index Futures | Fresh Short | Short Covering | Fresh Short |

| Index Options | Short Covering | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Long Covering |

| Nifty Options | Short Covering | Fresh Long | Fresh Long |

| BankNifty Futures | Long Covering | Short Covering | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Long Covering | Long Covering | Long Covering |

| FinNifty Options | Fresh Long | Fresh Long | Fresh Long |

| MidcpNifty Futures | Fresh Long | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Fresh Short | Fresh Short |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (4/12/2025)

The SENSEX index closed at 85138.27. The SENSEX weekly expiry for DECEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.637 against previous 0.637. The 86000CE option holds the maximum open interest, followed by the 88000CE and 87000CE options. Market participants have shown increased interest with significant open interest additions in the 86000CE option, with open interest additions also seen in the 85500CE and 83000PE options. On the other hand, open interest reductions were prominent in the 89000CE, 85700PE, and 85600PE options. Trading volume was highest in the 85300PE option, followed by the 85000PE and 85500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85138.27 | 0.637 | 0.637 | 0.984 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,82,14,360 | 1,65,93,280 | 1,16,21,080 |

| PUT: | 1,79,62,020 | 1,05,71,220 | 73,90,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 22,16,820 | 9,48,480 | 1,83,04,220 |

| 88000 | 18,45,880 | 7,83,480 | 81,47,560 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 22,16,820 | 9,48,480 | 1,83,04,220 |

| 85500 | 12,37,440 | 8,88,540 | 2,15,41,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 7,88,600 | -3,21,560 | 51,74,740 |

| 88200 | 2,04,180 | -1,33,500 | 13,10,060 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 12,37,440 | 8,88,540 | 2,15,41,220 |

| 86000 | 22,16,820 | 9,48,480 | 1,83,04,220 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 13,75,540 | 7,92,280 | 53,39,900 |

| 84500 | 13,27,240 | 6,77,620 | 1,41,58,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 13,75,540 | 7,92,280 | 53,39,900 |

| 84500 | 13,27,240 | 6,77,620 | 1,41,58,860 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85700 | 1,43,380 | -2,04,180 | 52,49,660 |

| 85600 | 1,69,960 | -1,98,440 | 72,95,820 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85300 | 4,34,400 | 2,31,180 | 2,28,03,420 |

| 85000 | 10,24,200 | 4,06,860 | 2,21,08,580 |

NIFTY Weekly Expiry (9/12/2025)

The NIFTY index closed at 26032.2. The NIFTY weekly expiry for DECEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.725 against previous 0.913. The 27000CE option holds the maximum open interest, followed by the 26200CE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 26200CE and 27500CE options. On the other hand, open interest reductions were prominent in the 26300PE, 26600PE, and 26500PE options. Trading volume was highest in the 26000PE option, followed by the 26100PE and 26200CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,032.20 | 0.725 | 0.913 | 0.796 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,68,21,850 | 4,69,02,900 | 4,99,18,950 |

| PUT: | 7,01,90,175 | 4,28,28,525 | 2,73,61,650 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 66,36,450 | 28,46,475 | 2,32,645 |

| 26,200 | 64,90,950 | 35,59,425 | 4,30,219 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 47,16,000 | 37,82,475 | 4,25,453 |

| 26,200 | 64,90,950 | 35,59,425 | 4,30,219 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,100 | 150 | – | 1 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 64,90,950 | 35,59,425 | 4,30,219 |

| 26,100 | 47,16,000 | 37,82,475 | 4,25,453 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 63,72,375 | 17,99,250 | 2,20,000 |

| 26,000 | 54,72,525 | 28,30,425 | 5,53,087 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,72,525 | 28,30,425 | 5,53,087 |

| 25,000 | 54,52,425 | 24,70,200 | 1,45,781 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 11,98,650 | -6,86,250 | 1,21,004 |

| 26,600 | 1,30,650 | -66,075 | 4,719 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,72,525 | 28,30,425 | 5,53,087 |

| 26,100 | 34,04,475 | 17,79,600 | 4,54,984 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26032.2. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.159 against previous 1.186. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26200PE option, with open interest additions also seen in the 26200CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25900PE, 27000CE, and 24000PE options. Trading volume was highest in the 26000PE option, followed by the 27000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,032.20 | 1.159 | 1.186 | 0.933 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,29,88,450 | 5,07,73,625 | 22,14,825 |

| PUT: | 6,14,26,050 | 6,02,27,750 | 11,98,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 73,78,750 | -2,63,450 | 87,920 |

| 26,000 | 62,08,150 | 4,03,175 | 48,195 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 25,56,450 | 5,19,825 | 43,032 |

| 26,000 | 62,08,150 | 4,03,175 | 48,195 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 73,78,750 | -2,63,450 | 87,920 |

| 26,900 | 9,69,975 | -1,54,875 | 20,594 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 73,78,750 | -2,63,450 | 87,920 |

| 26,500 | 39,03,600 | 1,76,325 | 62,315 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,67,050 | 2,40,450 | 99,455 |

| 25,000 | 46,52,100 | -60,075 | 25,046 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 32,24,475 | 5,33,925 | 47,666 |

| 25,500 | 45,64,425 | 2,65,800 | 38,401 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 9,54,600 | -2,86,200 | 19,689 |

| 24,000 | 37,35,975 | -1,71,875 | 18,115 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,67,050 | 2,40,450 | 99,455 |

| 26,200 | 32,24,475 | 5,33,925 | 47,666 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59273.8. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.991 against previous 1.092. The 58500PE option holds the maximum open interest, followed by the 60000CE and 58500CE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 59800CE and 60000CE options. On the other hand, open interest reductions were prominent in the 60000PE, 59500PE, and 59000PE options. Trading volume was highest in the 59500PE option, followed by the 60000CE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,273.80 | 0.991 | 1.092 | 1.049 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,33,62,535 | 1,23,78,930 | 9,83,605 |

| PUT: | 1,32,43,820 | 1,35,11,895 | -2,68,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 13,48,270 | 87,185 | 1,11,219 |

| 58,500 | 12,90,940 | 2,170 | 3,277 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 5,66,860 | 1,31,110 | 93,227 |

| 59,800 | 3,32,850 | 1,09,795 | 42,642 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 6,82,710 | -19,040 | 20,831 |

| 64,500 | 1,08,185 | -15,715 | 5,319 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 13,48,270 | 87,185 | 1,11,219 |

| 59,500 | 5,66,860 | 1,31,110 | 93,227 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 21,03,675 | -8,715 | 31,529 |

| 59,000 | 11,83,560 | -49,070 | 74,138 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 2,35,830 | 63,420 | 6,362 |

| 57,300 | 90,860 | 40,425 | 4,302 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 6,89,325 | -1,13,680 | 45,685 |

| 59,500 | 6,95,835 | -59,990 | 1,52,735 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 6,95,835 | -59,990 | 1,52,735 |

| 59,000 | 11,83,560 | -49,070 | 74,138 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27565.25. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.760 against previous 0.821. The 28200CE option holds the maximum open interest, followed by the 27500PE and 27500PE options. Market participants have shown increased interest with significant open interest additions in the 27500PE option, with open interest additions also seen in the 27800CE and 28900CE options. On the other hand, open interest reductions were prominent in the 28300CE, 27900PE, and 27700PE options. Trading volume was highest in the 27500PE option, followed by the 27600PE and 28100CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,565.25 | 0.760 | 0.821 | 1.031 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,86,525 | 3,95,135 | 91,390 |

| PUT: | 3,69,525 | 3,24,480 | 45,045 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 81,965 | 8,385 | 1,495 |

| 28,000 | 60,580 | 5,785 | 1,249 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 39,520 | 27,625 | 1,397 |

| 28,900 | 21,905 | 19,565 | 442 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,300 | 8,775 | -21,255 | 641 |

| 27,500 | 17,290 | -3,510 | 494 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,100 | 24,440 | 3,055 | 2,269 |

| 28,200 | 81,965 | 8,385 | 1,495 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 60,580 | 30,745 | 5,001 |

| 28,000 | 37,960 | -2,535 | 293 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 60,580 | 30,745 | 5,001 |

| 27,600 | 14,105 | 7,735 | 2,278 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 11,570 | -11,700 | 295 |

| 27,700 | 17,875 | -8,645 | 1,514 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 60,580 | 30,745 | 5,001 |

| 27,600 | 14,105 | 7,735 | 2,278 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13990.5. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.908 against previous 0.964. The 14000PE option holds the maximum open interest, followed by the 15000CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 14100CE option, with open interest additions also seen in the 14000PE and 14000CE options. On the other hand, open interest reductions were prominent in the 69900PE, 69100CE, and 68900PE options. Trading volume was highest in the 14000PE option, followed by the 14300CE and 14000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,990.50 | 0.908 | 0.964 | 1.005 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 53,64,100 | 41,09,140 | 12,54,960 |

| PUT: | 48,68,920 | 39,62,280 | 9,06,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 7,21,420 | -33,600 | 4,549 |

| 14,000 | 7,17,080 | 2,83,920 | 11,897 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 5,68,400 | 3,36,420 | 10,921 |

| 14,000 | 7,17,080 | 2,83,920 | 11,897 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 7,21,420 | -33,600 | 4,549 |

| 14,900 | 58,380 | -18,620 | 1,102 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 4,28,680 | 1,14,940 | 14,291 |

| 14,000 | 7,17,080 | 2,83,920 | 11,897 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,71,540 | 2,93,440 | 24,821 |

| 13,500 | 6,25,100 | 1,14,800 | 8,235 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,71,540 | 2,93,440 | 24,821 |

| 14,100 | 3,74,920 | 1,94,180 | 10,635 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,250 | 7,280 | -15,120 | 165 |

| 13,850 | 20,300 | -6,300 | 481 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,71,540 | 2,93,440 | 24,821 |

| 14,100 | 3,74,920 | 1,94,180 | 10,635 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Traders should weigh the fresh short interest in NIFTY combined futures as a sign to be cautious on long positions and consider hedging or short strategies if confirmation appears.

The long covering observed in BANKNIFTY and FINNIFTY segments suggests monitoring these indices for possible near-term consolidations or pullbacks before new bullish setups emerge.

Watch the put-call ratio shifts and max pain levels for both weekly and monthly expiries to gauge support/resistance zones and option market sentiment.

Volume changes aligned with open interest shifts provide clues on the strength of these moves; increased volume with fresh shorts in NIFTY warns of stronger bearish momentum.

Overall, the “Open Interest Volume Analysis” encourages a strategic, risk-managed approach with focus on short-term market signals and option expiry dynamics to navigate the current uncertain market phase effectively.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.