Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 8/12/2025

Table of Contents

Monday’s Open Interest Volume Analysis for 8/12/2025 flips the script hard—broad fresh short buildup across combined NIFTY, BANKNIFTY, FINNIFTY, and MIDCPNIFTY futures with hefty OI spikes amid red closes, screaming bearish conviction as weekend gains evaporate fast. Volumes mostly backed the action too, pointing to real money piling into downside bets while premiums crumbled.

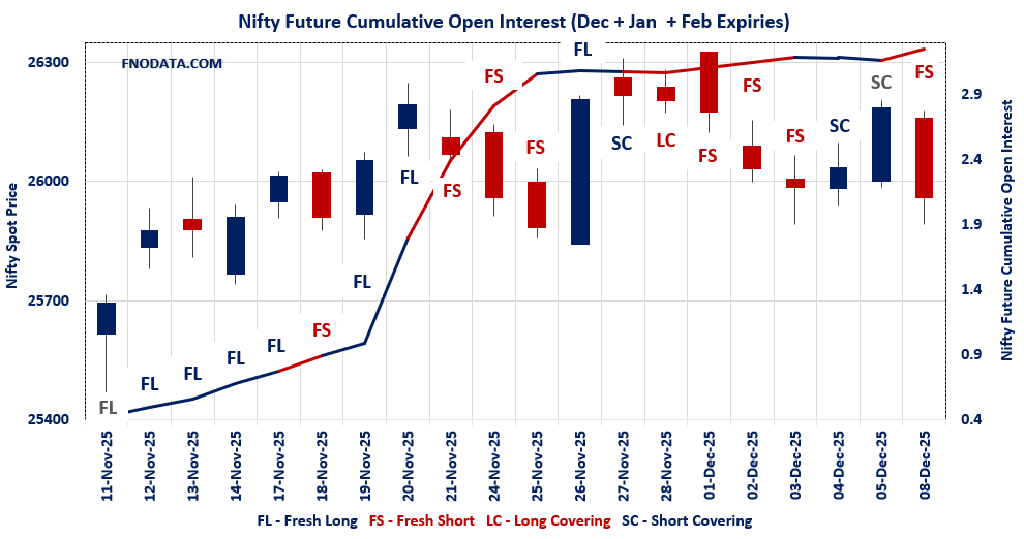

NIFTY futures combined OI surged 8.45% on fresh shorts with 14.03% volume rise; paired with -0.863% spot drop, this shows aggressive selling kicking in post-Friday rally, targeting 26000 max pain as gravity pulls harder.

BANKNIFTY’s massive 18.32% OI jump on fresh shorts despite -13.06% volume dip confirms bear reload after covering—reasoning: banks led the bleed at -0.901%, with low volume hinting cautious but firm conviction.

FINNIFTY combined OI up 3.6% fresh shorts and flat -1.8% volume aligns with -0.698% decline; steady premium build suggests shorts layering for sustained pressure below 27800.

MIDCPNIFTY OI climbed 4.67% on fresh shorts backed by 46.69% volume explosion amid -1.670% plunge—sharpest move flags midcap vulnerability, premium crush fueling breakdown bets.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25960.55 (-0.863%)

Combined = December + January + February

Combined Fut Open Interest Change: 8.45%

Combined Fut Volume Change: 14.03%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 9%

NIFTY DECEMBER Future closed at: 26064.7 (-1.020%)

December Fut Premium 104.15 (Decreased by -42.6 points)

December Fut Open Interest Change: 8.49%

December Fut Volume Change: 11.73%

December Fut Open Interest Analysis: Fresh Short

NIFTY JANUARY Future closed at: 26236.8 (-0.967%)

January Fut Premium 276.25 (Decreased by -30.4 points)

January Fut Open Interest Change: 6.70%

January Fut Volume Change: 42.36%

January Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (9/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.480 (Decreased from 1.239)

Put-Call Ratio (Volume): 1.039

Max Pain Level: 26000

Maximum CALL Open Interest: 26200

Maximum PUT Open Interest: 25900

Highest CALL Addition: 26100

Highest PUT Addition: 25750

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.092 (Decreased from 1.138)

Put-Call Ratio (Volume): 0.924

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 26200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59238.55 (-0.901%)

Combined = December + January + February

Combined Fut Open Interest Change: 18.32%

Combined Fut Volume Change: -13.06%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 11% Previous 12%

BANKNIFTY DECEMBER Future closed at: 59553 (-0.837%)

December Fut Premium 314.45 (Increased by 36.05 points)

December Fut Open Interest Change: 19.9%

December Fut Volume Change: -13.9%

December Fut Open Interest Analysis: Fresh Short

BANKNIFTY JANUARY Future closed at: 59871.6 (-0.865%)

January Fut Premium 633.05 (Increased by 16.05 points)

January Fut Open Interest Change: 4.19%

January Fut Volume Change: -1.02%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.875 (Decreased from 1.044)

Put-Call Ratio (Volume): 1.040

Max Pain Level: 59500

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 59500

Highest CALL Addition: 59500

Highest PUT Addition: 58700

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27687.15 (-0.698%)

Combined = December + January + February

Combined Fut Open Interest Change: 3.6%

Combined Fut Volume Change: -1.8%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 2% Previous 2%

FINNIFTY DECEMBER Future closed at: 27827.6 (-0.671%)

December Fut Premium 140.45 (Increased by 6.75 points)

December Fut Open Interest Change: 3.27%

December Fut Volume Change: -1.64%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY JANUARY Future closed at: 28009.3 (-0.652%)

January Fut Premium 322.15 (Increased by 11.05 points)

January Fut Open Interest Change: 22.22%

January Fut Volume Change: -7.14%

January Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.805 (Increased from 0.783)

Put-Call Ratio (Volume): 1.295

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27800

Highest CALL Addition: 27800

Highest PUT Addition: 27800

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13764.7 (-1.670%)

Combined = December + January + February

Combined Fut Open Interest Change: 4.67%

Combined Fut Volume Change: 46.69%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 3% Previous 3%

MIDCPNIFTY DECEMBER Future closed at: 13794.65 (-1.844%)

December Fut Premium 29.95 (Decreased by -25.4 points)

December Fut Open Interest Change: 4.57%

December Fut Volume Change: 41.39%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY JANUARY Future closed at: 13870.35 (-1.832%)

January Fut Premium 105.65 (Decreased by -25.1 points)

January Fut Open Interest Change: 6.17%

January Fut Volume Change: 156.65%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.817 (Decreased from 0.850)

Put-Call Ratio (Volume): 0.809

Max Pain Level: 14000

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 14000

Highest CALL Addition: 14000

Highest PUT Addition: 13100

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,102.69 (-0.711%)

SENSEX Monthly Future closed at: 85,504.35 (-0.729%)

Premium: 401.66 (Decreased by -18.02 points)

Open Interest Change: -5.43%

Volume Change: -28.82%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (9/12/2025) Option Analysis

Put-Call Ratio (OI): 0.579 (Decreased from 1.214)

Put-Call Ratio (Volume): 1.177

Max Pain Level: 85300

Maximum CALL OI: 85500

Maximum PUT OI: 83000

Highest CALL Addition: 85500

Highest PUT Addition: 84900

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 655.59 Cr.

DIIs Net BUY: ₹ 2,542.49 Cr.

FII Derivatives Activity

| FII Trading Stats | 8.12.25 | 5.12.25 | 4.12.25 |

| FII Cash (Provisional Data) | -655.59 | -438.9 | -1,944.19 |

| Index Future Open Interest Long Ratio | 12.07% | 13.75% | 12.50% |

| Index Future Volume Long Ratio | 27.76% | 52.71% | 29.24% |

| Call Option Open Interest Long Ratio | 46.06% | 50.68% | 48.18% |

| Call Option Volume Long Ratio | 49.40% | 50.34% | 49.71% |

| Put Option Open Interest Long Ratio | 64.44% | 60.29% | 63.89% |

| Put Option Volume Long Ratio | 50.36% | 49.82% | 50.00% |

| Stock Future Open Interest Long Ratio | 61.52% | 61.74% | 61.70% |

| Stock Future Volume Long Ratio | 48.41% | 51.79% | 53.70% |

| Index Futures | Fresh Short | Fresh Long | Fresh Short |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Long | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Short | Fresh Short | Long Covering |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Fresh Short | Fresh Long | Short Covering |

| FinNifty Options | Fresh Long | Short Covering | Short Covering |

| MidcpNifty Futures | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Options | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Fresh Long | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (11/12/2025)

The SENSEX index closed at 85102.69. The SENSEX weekly expiry for DECEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.579 against previous 1.214. The 85500CE option holds the maximum open interest, followed by the 86000CE and 88000CE options. Market participants have shown increased interest with significant open interest additions in the 85500CE option, with open interest additions also seen in the 88000CE and 86000CE options. On the other hand, open interest reductions were prominent in the 82500PE, 85700PE, and 85300PE options. Trading volume was highest in the 85000PE option, followed by the 85500PE and 85500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 11-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85102.69 | 0.579 | 1.214 | 1.177 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,82,26,080 | 85,07,020 | 97,19,060 |

| PUT: | 1,05,58,300 | 1,03,29,840 | 2,28,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 13,23,640 | 10,12,080 | 2,10,30,640 |

| 86000 | 12,99,400 | 7,63,860 | 1,81,83,940 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 13,23,640 | 10,12,080 | 2,10,30,640 |

| 88000 | 11,66,420 | 7,71,100 | 66,73,300 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88600 | 2,00,660 | -78,540 | 14,58,720 |

| 91000 | 1,35,460 | -28,520 | 10,42,520 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 13,23,640 | 10,12,080 | 2,10,30,640 |

| 86000 | 12,99,400 | 7,63,860 | 1,81,83,940 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,53,600 | 22,280 | 70,42,700 |

| 85000 | 6,98,220 | 49,300 | 2,53,57,440 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84900 | 2,89,920 | 1,75,180 | 1,28,32,600 |

| 84500 | 6,52,580 | 1,43,340 | 1,43,28,200 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,49,480 | -2,22,640 | 43,77,460 |

| 85700 | 1,45,100 | -1,47,900 | 82,86,520 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 6,98,220 | 49,300 | 2,53,57,440 |

| 85500 | 4,37,700 | -55,380 | 2,27,75,180 |

NIFTY Weekly Expiry (9/12/2025)

The NIFTY index closed at 25960.55. The NIFTY weekly expiry for DECEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.480 against previous 1.239. The 26200CE option holds the maximum open interest, followed by the 26100CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 26200CE and 26000CE options. On the other hand, open interest reductions were prominent in the 26000PE, 26100PE, and 26050PE options. Trading volume was highest in the 26000PE option, followed by the 26100CE and 25900PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,960.55 | 0.480 | 1.239 | 1.039 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 26,84,18,250 | 14,79,31,200 | 12,04,87,050 |

| PUT: | 12,89,28,300 | 18,32,97,300 | -5,43,69,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 2,43,18,675 | 1,44,11,850 | 76,78,064 |

| 26,100 | 2,31,09,750 | 1,84,43,175 | 86,36,467 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 2,31,09,750 | 1,84,43,175 | 86,36,467 |

| 26,200 | 2,43,18,675 | 1,44,11,850 | 76,78,064 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,400 | 14,89,875 | -6,23,250 | 2,10,720 |

| 27,250 | 5,51,625 | -2,91,150 | 1,32,874 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 2,31,09,750 | 1,84,43,175 | 86,36,467 |

| 26,200 | 2,43,18,675 | 1,44,11,850 | 76,78,064 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,07,60,475 | 25,650 | 83,23,442 |

| 25,800 | 93,70,950 | -4,61,025 | 45,80,961 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,750 | 65,75,850 | 10,53,525 | 27,56,239 |

| 25,700 | 77,56,050 | 9,20,100 | 28,46,922 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,52,025 | -97,66,725 | 96,63,854 |

| 26,100 | 31,98,375 | -72,87,225 | 77,19,779 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,52,025 | -97,66,725 | 96,63,854 |

| 25,900 | 1,07,60,475 | 25,650 | 83,23,442 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25960.55. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.092 against previous 1.138. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 26000CE and 26200CE options. On the other hand, open interest reductions were prominent in the 26700CE, 26800CE, and 25400PE options. Trading volume was highest in the 26000PE option, followed by the 26500CE and 26000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,960.55 | 1.092 | 1.138 | 0.924 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,70,28,175 | 5,37,10,950 | 33,17,225 |

| PUT: | 6,22,81,650 | 6,11,20,225 | 11,61,425 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 70,04,350 | 2,32,675 | 86,249 |

| 26,000 | 69,93,100 | 7,88,225 | 97,536 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 58,67,925 | 16,81,125 | 1,04,353 |

| 26,000 | 69,93,100 | 7,88,225 | 97,536 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 13,46,625 | -9,35,925 | 55,094 |

| 26,800 | 17,55,525 | -7,23,900 | 56,429 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 58,67,925 | 16,81,125 | 1,04,353 |

| 26,000 | 69,93,100 | 7,88,225 | 97,536 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 73,79,600 | -1,63,175 | 1,28,398 |

| 25,000 | 50,29,700 | 29,025 | 48,298 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 30,53,250 | 3,96,225 | 58,560 |

| 25,500 | 45,05,325 | 3,31,500 | 71,523 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 9,87,975 | -3,69,300 | 24,411 |

| 24,500 | 14,05,350 | -1,74,825 | 16,062 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 73,79,600 | -1,63,175 | 1,28,398 |

| 25,500 | 45,05,325 | 3,31,500 | 71,523 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59238.55. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.875 against previous 1.044. The 59500PE option holds the maximum open interest, followed by the 60000CE and 59500CE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 60000CE and 59600CE options. On the other hand, open interest reductions were prominent in the 58500CE, 60000PE, and 59000PE options. Trading volume was highest in the 59500PE option, followed by the 60000CE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,238.55 | 0.875 | 1.044 | 1.040 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,51,57,440 | 1,34,98,160 | 16,59,280 |

| PUT: | 1,32,65,400 | 1,40,89,815 | -8,24,415 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,87,080 | 2,13,920 | 1,34,938 |

| 59,500 | 14,28,875 | 4,10,270 | 1,33,976 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 14,28,875 | 4,10,270 | 1,33,976 |

| 60,000 | 14,87,080 | 2,13,920 | 1,34,938 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 6,80,890 | -1,44,025 | 18,883 |

| 63,500 | 1,45,775 | -36,330 | 13,413 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,87,080 | 2,13,920 | 1,34,938 |

| 59,500 | 14,28,875 | 4,10,270 | 1,33,976 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,17,105 | -47,810 | 1,81,194 |

| 59,000 | 12,16,915 | -1,28,345 | 1,13,681 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,700 | 1,67,755 | 40,950 | 20,623 |

| 60,300 | 85,750 | 40,565 | 4,945 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 6,37,665 | -1,38,215 | 69,794 |

| 59,000 | 12,16,915 | -1,28,345 | 1,13,681 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,17,105 | -47,810 | 1,81,194 |

| 59,000 | 12,16,915 | -1,28,345 | 1,13,681 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27687.15. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.805 against previous 0.783. The 28200CE option holds the maximum open interest, followed by the 27800PE and 27500PE options. Market participants have shown increased interest with significant open interest additions in the 27800PE option, with open interest additions also seen in the 27800CE and 29050CE options. On the other hand, open interest reductions were prominent in the 28000PE, 27600CE, and 29000CE options. Trading volume was highest in the 27800PE option, followed by the 28000CE and 27800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,687.15 | 0.805 | 0.783 | 1.295 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,61,925 | 5,55,685 | 6,240 |

| PUT: | 4,52,270 | 4,35,175 | 17,095 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 1,06,730 | 3,900 | 649 |

| 28,000 | 52,585 | -8,450 | 1,744 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 37,180 | 15,470 | 1,738 |

| 29,050 | 34,645 | 7,475 | 258 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 8,905 | -18,265 | 531 |

| 29,000 | 22,425 | -16,380 | 1,007 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 52,585 | -8,450 | 1,744 |

| 27,800 | 37,180 | 15,470 | 1,738 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 92,755 | 54,730 | 3,684 |

| 27,500 | 61,100 | -3,835 | 788 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 92,755 | 54,730 | 3,684 |

| 26,100 | 18,460 | 6,305 | 168 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 27,495 | -18,850 | 1,209 |

| 26,000 | 22,165 | -5,265 | 460 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 92,755 | 54,730 | 3,684 |

| 28,000 | 27,495 | -18,850 | 1,209 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13764.7. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.817 against previous 0.850. The 14000CE option holds the maximum open interest, followed by the 14000PE and 14500CE options. Market participants have shown increased interest with significant open interest additions in the 14000CE option, with open interest additions also seen in the 13800CE and 13100PE options. On the other hand, open interest reductions were prominent in the 66900PE, 69000PE, and 69000CE options. Trading volume was highest in the 14000CE option, followed by the 14400CE and 14500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,764.70 | 0.817 | 0.850 | 0.809 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 81,70,120 | 73,31,800 | 8,38,320 |

| PUT: | 66,72,400 | 62,29,860 | 4,42,540 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,84,120 | 2,87,560 | 24,027 |

| 14,500 | 8,66,600 | -34,580 | 17,568 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,84,120 | 2,87,560 | 24,027 |

| 13,800 | 2,88,120 | 1,83,680 | 7,941 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,350 | 87,360 | -1,28,520 | 3,708 |

| 14,800 | 4,58,780 | -95,620 | 6,686 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,84,120 | 2,87,560 | 24,027 |

| 14,400 | 4,72,500 | 91,560 | 18,248 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,23,300 | -34,580 | 17,245 |

| 13,000 | 6,48,060 | 91,000 | 8,716 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 4,90,000 | 1,60,860 | 4,592 |

| 13,000 | 6,48,060 | 91,000 | 8,716 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 2,04,260 | -68,740 | 9,035 |

| 13,700 | 2,80,140 | -58,940 | 14,829 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,23,300 | -34,580 | 17,245 |

| 13,800 | 3,56,720 | 27,440 | 15,586 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Actionable Plays

NIFTY: Lean short or buy 26000 puts on bounces; PCR drop to 0.480 signals call defense but OI flood warns against longs—target 25900 PUT OI cluster, stop above 26200.

BANKNIFTY: Heavy short OI buildup suits 59500 put spreads; skip longs till covering emerges, trail shorts if volume rebounds confirming unwind.

FINNIFTY/MIDCPNIFTY: Ride short momentum—short futures or 27800/14000 puts; MIDCPNIFTY’s volume surge gives edge for bigger moves, exit on OI stall.

General: PCR shifts (NIFTY 0.480 OI, BANKNIFTY 0.875) show call bias but futures dominate bearish—hedge longs, scale shorts with 1:2 RR into weekly expiry.

In sum, this Open Interest Volume Analysis yells “bear market resumption”—fresh shorts everywhere mean downside bias till covering flips it; play defensive, watch max pain pins, and comment your short targets below!

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.