Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 15/12/2025

Table of Contents

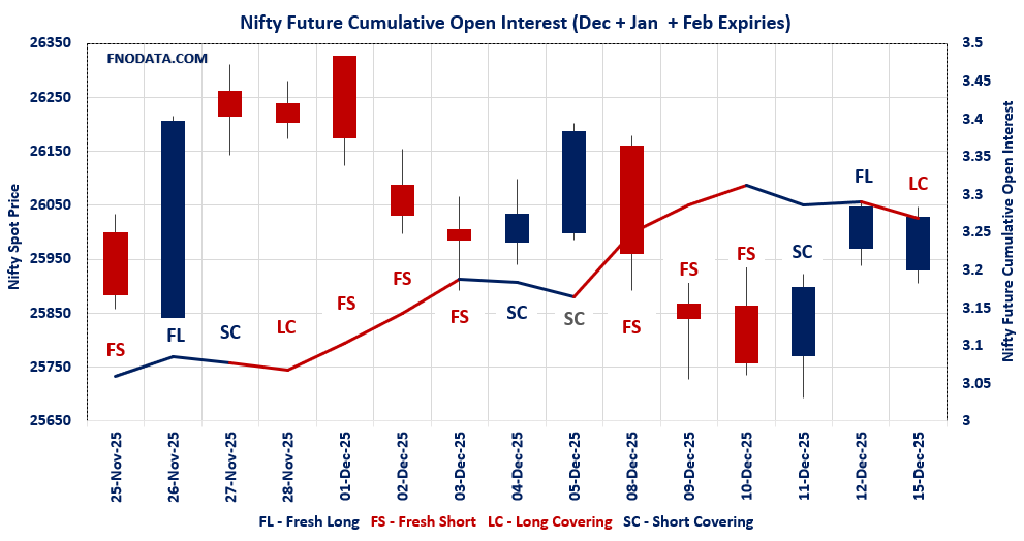

NIFTY combined futures signal long covering fatigue: -2.19% OI drop on -5% volume with flat price action screams profit booking from recent bulls, December leading the unwind while January sneaks in fresh shorts.

Premiums eroding across contracts: Both months saw sharp premium compression despite minor downside, telling us bulls are getting cheaper entry but conviction feels thin.

PCR spikes bearish across options: Weekly at 1.236, monthly 1.083—put buying dominates with max pain glued to 26,000, traders prepping defense or fresh shorts.

BANKNIFTY barely moves needle: Near-flat -0.07% combined OI drop shows light short covering, no fireworks—banks in wait-and-watch mode.

MIDCPNIFTY flips aggressive: +0.44% combined OI amid volume crash marks fresh shorts piling in, midcaps losing steam after last week’s heroics.

SENSEX tilts cautious: +1.24% combined OI hints at shorts nibbling, aligning with broader index hesitation.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26027.3 (-0.075%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.19%

Combined Fut Volume Change: -4.89%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 11% Previous 10%

NIFTY DECEMBER Future closed at: 26108.7 (-0.140%)

December Fut Premium 81.4 (Decreased by -17.05 points)

December Fut Open Interest Change: -2.62%

December Fut Volume Change: -5.76%

December Fut Open Interest Analysis: Long Covering

NIFTY JANUARY Future closed at: 26268.7 (-0.121%)

January Fut Premium 241.4 (Decreased by -12.05 points)

January Fut Open Interest Change: 1.45%

January Fut Volume Change: 8.98%

January Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (16/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.236 (Increased from 1.169)

Put-Call Ratio (Volume): 0.988

Max Pain Level: 26000

Maximum CALL Open Interest: 26200

Maximum PUT Open Interest: 25900

Highest CALL Addition: 26100

Highest PUT Addition: 25900

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.083 (Increased from 1.056)

Put-Call Ratio (Volume): 1.101

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26400

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59461.8 (0.121%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.07%

Combined Fut Volume Change: -8.73%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 12% Previous 12%

BANKNIFTY DECEMBER Future closed at: 59678 (0.034%)

December Fut Premium 216.2 (Decreased by -51.65 points)

December Fut Open Interest Change: -0.5%

December Fut Volume Change: -5.7%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY JANUARY Future closed at: 59984.8 (0.039%)

January Fut Premium 523 (Decreased by -48.45 points)

January Fut Open Interest Change: 2.42%

January Fut Volume Change: -40.34%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.935 (Increased from 0.898)

Put-Call Ratio (Volume): 0.944

Max Pain Level: 59500

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59500

Highest CALL Addition: 59500

Highest PUT Addition: 59500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13862.6 (-0.328%)

Combined = December + January + February

Combined Fut Open Interest Change: 0.44%

Combined Fut Volume Change: -69.35%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 4% Previous 4%

MIDCPNIFTY DECEMBER Future closed at: 13907.75 (-0.480%)

December Fut Premium 45.15 (Decreased by -21.4 points)

December Fut Open Interest Change: 0.16%

December Fut Volume Change: -70.78%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY JANUARY Future closed at: 13985.45 (-0.446%)

January Fut Premium 122.85 (Decreased by -16.95 points)

January Fut Open Interest Change: 8.08%

January Fut Volume Change: -32.53%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.028 (Increased from 0.995)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 13900

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13500

Highest CALL Addition: 14000

Highest PUT Addition: 13500

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,213.36 (-0.064%)

SENSEX Monthly Future closed at: 85,401.95 (-0.134%)

Premium: 188.59 (Decreased by -60.1 points)

Open Interest Change: 1.24%

Volume Change: -10.91%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (18/12/2025) Option Analysis

Put-Call Ratio (OI): 1.065 (Increased from 1.015)

Put-Call Ratio (Volume): 0.952

Max Pain Level: 85100

Maximum CALL OI: 87500

Maximum PUT OI: 85000

Highest CALL Addition: 87500

Highest PUT Addition: 85000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,468.32 Cr.

DIIs Net BUY: ₹ 1,792.25 Cr.

FII Derivatives Activity

| FII Trading Stats | 15.12.25 | 12.12.25 | 11.12.25 |

| FII Cash (Provisional Data) | -1,468.32 | -1,114.22 | -2,020.94 |

| Index Future Open Interest Long Ratio | 10.63% | 10.09% | 11.45% |

| Index Future Volume Long Ratio | 56.10% | 42.40% | 52.23% |

| Call Option Open Interest Long Ratio | 49.77% | 50.73% | 48.46% |

| Call Option Volume Long Ratio | 49.87% | 50.37% | 50.00% |

| Put Option Open Interest Long Ratio | 59.13% | 60.27% | 62.40% |

| Put Option Volume Long Ratio | 49.93% | 49.89% | 49.61% |

| Stock Future Open Interest Long Ratio | 61.61% | 61.91% | 61.91% |

| Stock Future Volume Long Ratio | 46.29% | 50.81% | 54.28% |

| Index Futures | Short Covering | Long Covering | Fresh Long |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Short Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Long | Long Covering | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Long Covering |

| FinNifty Options | Fresh Long | Long Covering | Short Covering |

| MidcpNifty Futures | Long Covering | Long Covering | Fresh Long |

| MidcpNifty Options | Long Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Short |

| Stock Futures | Fresh Short | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (18/12/2025)

The SENSEX index closed at 85213.36. The SENSEX weekly expiry for DECEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.065 against previous 1.015. The 85000PE option holds the maximum open interest, followed by the 87500CE and 82000PE options. Market participants have shown increased interest with significant open interest additions in the 87500CE option, with open interest additions also seen in the 85000PE and 85500CE options. On the other hand, open interest reductions were prominent in the 85300PE, 88000CE, and 79000PE options. Trading volume was highest in the 85000PE option, followed by the 85000CE and 85200CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85213.36 | 1.065 | 1.015 | 0.952 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,16,11,320 | 82,45,960 | 33,65,360 |

| PUT: | 1,23,63,360 | 83,65,740 | 39,97,620 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87500 | 7,85,320 | 4,28,480 | 46,46,200 |

| 87000 | 6,56,740 | 1,72,040 | 52,97,200 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87500 | 7,85,320 | 4,28,480 | 46,46,200 |

| 85500 | 6,19,860 | 2,89,820 | 1,67,86,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 5,36,480 | -62,700 | 33,90,720 |

| 87700 | 86,680 | -16,820 | 6,46,740 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,57,280 | 1,66,020 | 2,28,61,480 |

| 85200 | 4,40,180 | 99,520 | 2,20,20,580 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,47,940 | 3,26,000 | 2,95,42,800 |

| 82000 | 7,01,420 | 1,46,280 | 42,33,820 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,47,940 | 3,26,000 | 2,95,42,800 |

| 84900 | 4,99,480 | 2,72,680 | 1,63,30,040 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85300 | 2,02,240 | -68,440 | 97,74,840 |

| 79000 | 73,420 | -61,060 | 8,53,500 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,47,940 | 3,26,000 | 2,95,42,800 |

| 85200 | 3,89,800 | 48,640 | 1,79,46,720 |

NIFTY Weekly Expiry (16/12/2025)

NIFTY Weekly Expiry (16/12/2025)

The NIFTY index closed at 26027.3. The NIFTY weekly expiry for DECEMBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.236 against previous 1.169. The 25900PE option holds the maximum open interest, followed by the 26000PE and 26200CE options. Market participants have shown increased interest with significant open interest additions in the 25900PE option, with open interest additions also seen in the 25950PE and 26100CE options. On the other hand, open interest reductions were prominent in the 25000PE, 25200PE, and 27000CE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 25900PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 16-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,027.30 | 1.236 | 1.169 | 0.988 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,28,82,000 | 15,29,57,850 | 99,24,150 |

| PUT: | 20,12,96,625 | 17,88,60,000 | 2,24,36,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,42,36,875 | 45,62,700 | 45,71,083 |

| 26,100 | 1,35,63,225 | 51,95,925 | 75,75,168 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,35,63,225 | 51,95,925 | 75,75,168 |

| 26,200 | 1,42,36,875 | 45,62,700 | 45,71,083 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 79,80,150 | -17,47,125 | 6,96,439 |

| 26,800 | 50,23,350 | -16,36,275 | 8,32,873 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,09,71,150 | 22,03,350 | 1,12,39,104 |

| 26,100 | 1,35,63,225 | 51,95,925 | 75,75,168 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,75,73,175 | 60,82,575 | 86,15,541 |

| 26,000 | 1,58,67,150 | 27,31,425 | 1,01,61,669 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,75,73,175 | 60,82,575 | 86,15,541 |

| 25,950 | 1,26,24,975 | 57,52,950 | 77,89,589 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 90,17,475 | -32,22,450 | 11,48,012 |

| 25,200 | 46,02,975 | -18,17,700 | 10,89,534 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,58,67,150 | 27,31,425 | 1,01,61,669 |

| 25,900 | 1,75,73,175 | 60,82,575 | 86,15,541 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26027.3. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.083 against previous 1.056. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25700PE option, with open interest additions also seen in the 26400CE and 25900PE options. On the other hand, open interest reductions were prominent in the 25800PE, 26500CE, and 29000CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,027.30 | 1.083 | 1.056 | 1.101 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,92,95,675 | 5,87,27,650 | 5,68,025 |

| PUT: | 6,42,23,325 | 6,19,90,125 | 22,33,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 71,00,925 | -54,025 | 55,415 |

| 26,000 | 70,15,000 | 3,06,925 | 1,18,685 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 35,63,775 | 4,10,625 | 50,670 |

| 26,000 | 70,15,000 | 3,06,925 | 1,18,685 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 52,07,100 | -5,17,800 | 95,976 |

| 29,000 | 10,12,225 | -1,18,450 | 4,076 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,15,000 | 3,06,925 | 1,18,685 |

| 26,500 | 52,07,100 | -5,17,800 | 95,976 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,74,325 | 3,09,550 | 1,48,337 |

| 25,000 | 52,27,250 | -11,875 | 35,958 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 34,74,450 | 13,09,200 | 71,095 |

| 25,900 | 20,07,300 | 3,25,050 | 83,113 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 27,95,325 | -5,73,975 | 77,565 |

| 26,200 | 23,67,150 | -84,825 | 23,323 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,74,325 | 3,09,550 | 1,48,337 |

| 25,900 | 20,07,300 | 3,25,050 | 83,113 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59461.8. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.935 against previous 0.898. The 59500PE option holds the maximum open interest, followed by the 59500CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 59500PE option, with open interest additions also seen in the 59500CE and 59000PE options. On the other hand, open interest reductions were prominent in the 50000PE, 60000CE, and 58800CE options. Trading volume was highest in the 59500CE option, followed by the 59500PE and 59000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,461.80 | 0.935 | 0.898 | 0.944 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,59,49,210 | 1,53,48,820 | 6,00,390 |

| PUT: | 1,49,11,240 | 1,37,79,700 | 11,31,540 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,38,110 | 2,02,370 | 1,61,247 |

| 60,000 | 14,59,465 | -39,235 | 1,14,075 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,38,110 | 2,02,370 | 1,61,247 |

| 60,500 | 6,05,885 | 80,080 | 53,588 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,59,465 | -39,235 | 1,14,075 |

| 58,800 | 79,135 | -31,360 | 5,357 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,38,110 | 2,02,370 | 1,61,247 |

| 60,000 | 14,59,465 | -39,235 | 1,14,075 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,14,115 | 2,28,445 | 1,50,881 |

| 59,000 | 15,14,275 | 1,94,565 | 1,20,414 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,14,115 | 2,28,445 | 1,50,881 |

| 59,000 | 15,14,275 | 1,94,565 | 1,20,414 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 2,07,095 | -50,785 | 11,874 |

| 56,900 | 33,810 | -12,600 | 4,769 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,14,115 | 2,28,445 | 1,50,881 |

| 59,000 | 15,14,275 | 1,94,565 | 1,20,414 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13862.6. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.028 against previous 0.995. The 13500PE option holds the maximum open interest, followed by the 14500CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 13500PE option, with open interest additions also seen in the 13000PE and 14000CE options. On the other hand, open interest reductions were prominent in the 68000CE, 68000PE, and 68500PE options. Trading volume was highest in the 13800PE option, followed by the 14000CE and 13900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,862.60 | 1.028 | 0.995 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 90,14,040 | 91,58,240 | -1,44,200 |

| PUT: | 92,67,300 | 91,11,900 | 1,55,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 9,49,480 | -56,280 | 7,291 |

| 14,000 | 9,26,240 | 93,940 | 14,369 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,26,240 | 93,940 | 14,369 |

| 14,300 | 5,62,800 | 64,120 | 8,253 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 8,20,260 | -85,400 | 2,474 |

| 14,525 | 6,440 | -66,500 | 818 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,26,240 | 93,940 | 14,369 |

| 13,900 | 3,52,100 | 27,580 | 12,736 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 11,47,020 | 2,53,540 | 9,677 |

| 13,000 | 9,35,060 | 1,27,960 | 6,014 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 11,47,020 | 2,53,540 | 9,677 |

| 13,000 | 9,35,060 | 1,27,960 | 6,014 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 2,48,080 | -1,23,480 | 7,368 |

| 13,900 | 3,26,340 | -71,680 | 11,417 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 5,11,560 | -71,400 | 16,257 |

| 13,900 | 3,26,340 | -71,680 | 11,417 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis reads consolidation city: Long covering dominates NIFTY/BANKNIFTY combined books while MIDCPNIFTY shorts emerge—expect 25,900-26,100 range till expiry dust settles.

Actionable edge—play the range, skip directionals: Sell premium with 26,000 iron condors or strangles; nibble NIFTY calls on 25,900 dips with tight 25,800 stops—theta your friend this week.

Sector call: Light up BANKNIFTY for relative safety, fade MIDCPNIFTY shorts; watch PCR above 1.3 as short-squeeze warning.

Tomorrow trigger: Volume spike + OI unwind = upside leg; fresh shorts on flat price = 25,700 retest—size small, expiry volatility bites hard.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]