Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 19/12/2025

Table of Contents

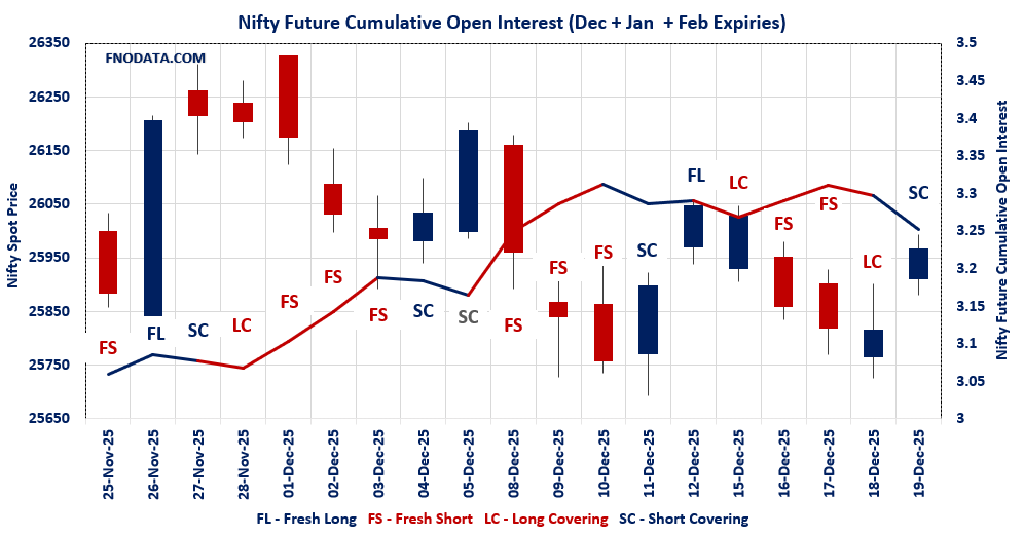

Markets closed the week strong with NIFTY jumping 0.58% on broad short covering, and this Open Interest Volume Analysis across combined futures tells a clear relief story—bears blinking hard after the selloff while selective fresh longs peek out for next week.

Opening (Bullet Points)

NIFTY combined futures unleash massive short covering: -4.39% OI plunge on light -6.5% volume drop with solid upside confirms bears exiting in droves, December leading at -5.5% while January adds fresh longs cautiously.

Premiums compressing despite rally: Both contracts bleeding theta fast, typical end-of-week unwind where shorts pay the price for wrong-footed bets.

PCR turns defensive: Weekly spikes to 1.126, monthly 1.071—put buying surges with max pain at 25,950-26,000, traders protecting recent gains.

BANKNIFTY follows suit: -2.12% combined OI drop shows steady short unwind, January longs building—banks exhaling after pressure.

FINNIFTY mixed but tilted long: Flat +0.2% combined OI hints fresh positioning, January shorts offset by December covering.

MIDCPNIFTY/SENSEX pure relief: Light covering across boards aligns with index bounce, no aggressive bets yet.

Breadth solidifies: Midcaps and SENSEX join the party, suggesting risk appetite returning selectively.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25966.4 (0.584%)

Combined = December + January + February

Combined Fut Open Interest Change: -4.39%

Combined Fut Volume Change: -6.51%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 13% Previous 12%

NIFTY DECEMBER Future closed at: 26030 (0.577%)

December Fut Premium 63.6 (Decreased by -1.45 points)

December Fut Open Interest Change: -5.50%

December Fut Volume Change: -8.65%

December Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26190 (0.541%)

January Fut Premium 223.6 (Decreased by -9.95 points)

January Fut Open Interest Change: 4.72%

January Fut Volume Change: 26.57%

January Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (23/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.126 (Increased from 0.677)

Put-Call Ratio (Volume): 0.982

Max Pain Level: 25950

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25900

Highest CALL Addition: 26200

Highest PUT Addition: 25900

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.071 (Increased from 1.018)

Put-Call Ratio (Volume): 1.037

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59069.2 (0.265%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.12%

Combined Fut Volume Change: -26.24%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 16% Previous 13%

BANKNIFTY DECEMBER Future closed at: 59231.4 (0.266%)

December Fut Premium 162.2 (Increased by 0.85 points)

December Fut Open Interest Change: -5.3%

December Fut Volume Change: -29.9%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY JANUARY Future closed at: 59615.2 (0.263%)

January Fut Premium 546 (Increased by 0.25 points)

January Fut Open Interest Change: 21.94%

January Fut Volume Change: 7.64%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.737 (Increased from 0.693)

Put-Call Ratio (Volume): 0.923

Max Pain Level: 59100

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59000

Highest CALL Addition: 59200

Highest PUT Addition: 59000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13862.35 (0.853%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.17%

Combined Fut Volume Change: -11.74%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 6% Previous 6%

MIDCPNIFTY DECEMBER Future closed at: 13882.7 (0.764%)

December Fut Premium 20.35 (Decreased by -11.9 points)

December Fut Open Interest Change: -0.04%

December Fut Volume Change: -11.22%

December Fut Open Interest Analysis: Short Covering

MIDCPNIFTY JANUARY Future closed at: 13959.35 (0.787%)

January Fut Premium 97 (Decreased by -8.2 points)

January Fut Open Interest Change: -1.84%

January Fut Volume Change: -16.79%

January Fut Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.071 (Increased from 0.925)

Put-Call Ratio (Volume): 0.938

Max Pain Level: 13850

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13600

Highest CALL Addition: 14500

Highest PUT Addition: 13600

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 84,929.36 (0.530%)

SENSEX Monthly Future closed at: 85,013.85 (0.464%)

Premium: 84.49 (Decreased by -55.3 points)

Open Interest Change: -9.17%

Volume Change: -55.76%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (18/12/2025) Option Analysis

Put-Call Ratio (OI): 1.034 (Increased from 0.748)

Put-Call Ratio (Volume): 0.960

Max Pain Level: 85000

Maximum CALL OI: 85000

Maximum PUT OI: 85000

Highest CALL Addition: 85000

Highest PUT Addition: 85000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 1,830.89 Cr.

DIIs Net BUY: ₹ 5,722.89 Cr.

FII Derivatives Activity

| FII Trading Stats | 19.12.25 | 18.12.25 | 17.12.25 |

| FII Cash (Provisional Data) | 1,830.89 | 595.78 | 1,171.71 |

| Index Future Open Interest Long Ratio | 8.82% | 8.17% | 8.16% |

| Index Future Volume Long Ratio | 64.89% | 48.11% | 32.08% |

| Call Option Open Interest Long Ratio | 50.74% | 48.16% | 47.79% |

| Call Option Volume Long Ratio | 50.50% | 50.05% | 49.76% |

| Put Option Open Interest Long Ratio | 59.24% | 63.01% | 64.19% |

| Put Option Volume Long Ratio | 49.63% | 49.86% | 49.92% |

| Stock Future Open Interest Long Ratio | 61.74% | 61.25% | 61.10% |

| Stock Future Volume Long Ratio | 54.25% | 52.05% | 48.84% |

| Index Futures | Short Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Short Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Long Covering | Short Covering | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Short Covering | Fresh Short |

| FinNifty Options | Short Covering | Long Covering | Short Covering |

| MidcpNifty Futures | Fresh Long | Fresh Long | Short Covering |

| MidcpNifty Options | Short Covering | Long Covering | Long Covering |

| NiftyNxt50 Futures | Fresh Long | Fresh Long | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (24/12/2025)

The SENSEX index closed at 84929.36. The SENSEX weekly expiry for DECEMBER 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.034 against previous 0.748. The 85000PE option holds the maximum open interest, followed by the 85000CE and 82000PE options. Market participants have shown increased interest with significant open interest additions in the 85000PE option, with open interest additions also seen in the 84900PE and 82000PE options. On the other hand, open interest reductions were prominent in the 84400CE, 84600CE, and 84500CE options. Trading volume was highest in the 85000CE option, followed by the 85000PE and 84900PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 24-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84929.36 | 1.034 | 0.748 | 0.960 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 91,63,080 | 49,17,740 | 42,45,340 |

| PUT: | 94,71,020 | 36,80,360 | 57,90,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 7,66,260 | 3,61,060 | 3,26,77,720 |

| 87000 | 6,40,840 | 3,03,700 | 51,11,480 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 7,66,260 | 3,61,060 | 3,26,77,720 |

| 87000 | 6,40,840 | 3,03,700 | 51,11,480 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84400 | 55,900 | -1,15,480 | 7,08,740 |

| 84600 | 68,220 | -1,08,860 | 24,16,440 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 7,66,260 | 3,61,060 | 3,26,77,720 |

| 84900 | 3,32,140 | 2,51,220 | 1,82,25,860 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 9,46,880 | 6,72,900 | 3,12,23,200 |

| 82000 | 6,51,240 | 3,83,820 | 42,25,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 9,46,880 | 6,72,900 | 3,12,23,200 |

| 84900 | 5,48,500 | 5,22,320 | 2,56,06,180 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 3,700 | -1,400 | 6,060 |

| 77200 | 400 | -600 | 3,500 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 9,46,880 | 6,72,900 | 3,12,23,200 |

| 84900 | 5,48,500 | 5,22,320 | 2,56,06,180 |

NIFTY Weekly Expiry (23/12/2025)

The NIFTY index closed at 25966.4. The NIFTY weekly expiry for DECEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.126 against previous 0.677. The 25900PE option holds the maximum open interest, followed by the 26000CE and 25800PE options. Market participants have shown increased interest with significant open interest additions in the 25900PE option, with open interest additions also seen in the 25950PE and 26000PE options. On the other hand, open interest reductions were prominent in the 25900CE, 25800CE, and 25850CE options. Trading volume was highest in the 26000CE option, followed by the 25900PE and 25950CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,966.40 | 1.126 | 0.677 | 0.982 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,51,41,350 | 16,26,30,000 | -1,74,88,650 |

| PUT: | 16,34,59,875 | 11,01,04,575 | 5,33,55,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,29,54,225 | 1,75,875 | 69,41,204 |

| 26,200 | 98,31,825 | 23,39,100 | 21,45,679 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 98,31,825 | 23,39,100 | 21,45,679 |

| 27,900 | 29,92,500 | 8,55,450 | 1,41,968 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 48,95,850 | -54,32,925 | 44,47,992 |

| 25,800 | 20,32,275 | -39,30,375 | 11,66,603 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,29,54,225 | 1,75,875 | 69,41,204 |

| 25,950 | 50,43,375 | -9,83,325 | 53,80,882 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,30,96,950 | 94,06,800 | 61,35,378 |

| 25,800 | 1,06,09,875 | 39,09,975 | 29,81,594 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,30,96,950 | 94,06,800 | 61,35,378 |

| 25,950 | 79,24,350 | 68,56,275 | 52,22,492 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 43,80,300 | -7,30,875 | 6,10,023 |

| 25,400 | 56,04,525 | -4,65,225 | 5,96,663 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,30,96,950 | 94,06,800 | 61,35,378 |

| 25,950 | 79,24,350 | 68,56,275 | 52,22,492 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25966.4. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.071 against previous 1.018. The 26000CE option holds the maximum open interest, followed by the 26000PE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000PE and 25700PE options. On the other hand, open interest reductions were prominent in the 25900CE, 25600PE, and 25800CE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 25900PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,966.40 | 1.071 | 1.018 | 1.037 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,69,73,200 | 6,49,56,975 | 20,16,225 |

| PUT: | 7,17,54,975 | 6,60,94,450 | 56,60,525 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 85,09,575 | -1,86,725 | 2,97,425 |

| 27,000 | 66,95,775 | 10,84,400 | 65,483 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 66,95,775 | 10,84,400 | 65,483 |

| 26,400 | 28,34,550 | 4,81,200 | 1,06,054 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 20,72,175 | -5,69,625 | 1,24,479 |

| 25,800 | 13,08,525 | -4,48,050 | 53,098 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 85,09,575 | -1,86,725 | 2,97,425 |

| 26,100 | 31,12,800 | -4,31,250 | 1,70,353 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 84,51,375 | 10,49,875 | 2,69,609 |

| 25,000 | 57,17,550 | 4,17,175 | 68,948 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 84,51,375 | 10,49,875 | 2,69,609 |

| 25,700 | 27,90,150 | 8,03,850 | 1,12,192 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 18,16,725 | -5,17,875 | 97,813 |

| 25,200 | 15,22,200 | -1,85,925 | 55,199 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 84,51,375 | 10,49,875 | 2,69,609 |

| 25,900 | 32,56,800 | 7,95,600 | 1,99,391 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59069.2. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.737 against previous 0.693. The 59500CE option holds the maximum open interest, followed by the 60000CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 59000PE option, with open interest additions also seen in the 56000PE and 59200CE options. On the other hand, open interest reductions were prominent in the 64000CE, 61000CE, and 59000CE options. Trading volume was highest in the 59000PE option, followed by the 59000CE and 59100PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,069.20 | 0.737 | 0.693 | 0.923 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,96,96,275 | 2,03,19,065 | -6,22,790 |

| PUT: | 1,45,18,715 | 1,40,85,495 | 4,33,220 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 18,02,080 | -30,765 | 1,31,864 |

| 60,000 | 17,82,900 | -8,015 | 93,669 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,200 | 5,53,315 | 65,975 | 1,22,713 |

| 59,300 | 5,01,270 | 56,175 | 1,05,528 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 64,000 | 4,04,075 | -1,58,410 | 9,859 |

| 61,000 | 8,82,315 | -81,340 | 41,724 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 11,21,610 | -67,305 | 2,49,152 |

| 59,100 | 4,00,155 | 7,805 | 1,33,955 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,98,425 | 1,14,905 | 2,81,677 |

| 59,500 | 12,02,040 | -57,260 | 71,942 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,98,425 | 1,14,905 | 2,81,677 |

| 56,000 | 6,34,200 | 85,050 | 35,702 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 12,02,040 | -57,260 | 71,942 |

| 58,000 | 9,65,090 | -43,330 | 69,754 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,98,425 | 1,14,905 | 2,81,677 |

| 59,100 | 2,86,020 | 39,550 | 1,38,150 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13862.35. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.071 against previous 0.925. The 14500CE option holds the maximum open interest, followed by the 14000CE and 13600PE options. Market participants have shown increased interest with significant open interest additions in the 13600PE option, with open interest additions also seen in the 13800PE and 13200PE options. On the other hand, open interest reductions were prominent in the 68000CE, 70000CE, and 67300PE options. Trading volume was highest in the 13800CE option, followed by the 13800PE and 14000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,862.35 | 1.071 | 0.925 | 0.938 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 93,68,940 | 1,02,02,920 | -8,33,980 |

| PUT: | 1,00,37,300 | 94,38,940 | 5,98,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,73,520 | 57,260 | 9,237 |

| 14,000 | 10,02,820 | -1,29,220 | 29,403 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,73,520 | 57,260 | 9,237 |

| 14,100 | 6,68,360 | 37,240 | 11,124 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,63,820 | -1,85,640 | 48,336 |

| 13,700 | 2,63,060 | -1,37,900 | 10,436 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,63,820 | -1,85,640 | 48,336 |

| 14,000 | 10,02,820 | -1,29,220 | 29,403 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 9,94,840 | 3,32,920 | 16,265 |

| 13,000 | 9,84,200 | -76,440 | 14,194 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 9,94,840 | 3,32,920 | 16,265 |

| 13,800 | 5,47,400 | 2,29,460 | 29,988 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 8,18,580 | -1,98,800 | 21,243 |

| 13,100 | 4,87,480 | -1,39,580 | 6,683 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 5,47,400 | 2,29,460 | 29,988 |

| 13,500 | 8,18,580 | -1,98,800 | 21,243 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis signals short-term bounce resumption: Aggressive covering dominates combined books everywhere, January longs add upside fuel—25,900 holds as key support.

Actionable weekend setup: Buy NIFTY dips to 25,950 with 25,800 stops targeting 26,200; roll short puts higher or sell 26,000 calls—theta decay accelerates into holidays.

Sector winners: Lean BANKNIFTY/MIDCPNIFTY for longs, light FINNIFTY exposure; skip outright shorts till PCR extremes.

Monday watch: Fresh OI buildup upside confirms leg higher; renewed shorts test 25,800—position ahead of thin volumes, but trail profits tight.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]