Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 22/12/2025

Table of Contents

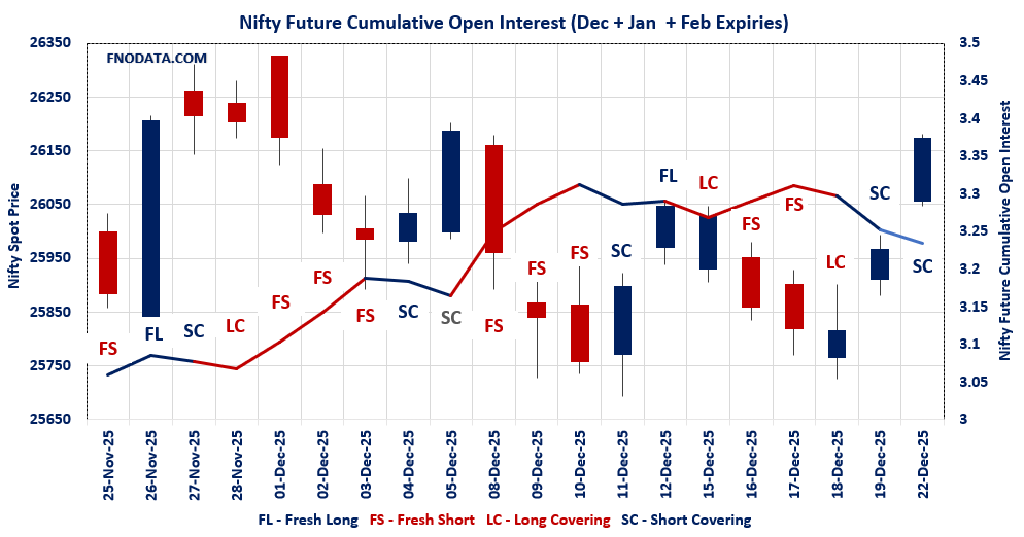

Markets roared back today with NIFTY surging 0.79% on heavy short covering, and this Open Interest Volume Analysis across combined futures confirms the bears got squeezed hard—massive unwind fueling the upside while fresh longs signal potential Santa rally extension into year-end.

NIFTY combined futures explode with short covering: -1.89% OI drop amid light volume signals aggressive bear exit, December hammered -4.63% while January piles fresh longs (+19.33%)—bulls rotating forward aggressively.

Premiums tanking across contracts: Sharp theta bleed despite rally shows shorts paying dearly, classic covering fireworks.

PCR spikes defensive big time: Weekly at 1.640, monthly 1.131—put frenzy with max pain 26,150-26,050 screams protection buying after the bounce.

BANKNIFTY joins the unwind party: -4.33% combined OI plunge confirms broad short squeeze, January longs adding fuel.

MIDCPNIFTY long conviction shines: +0.92% combined OI marks fresh positioning, January +20.23% leads midcap rotation.

SENSEX massive relief: -19.02% OI shed aligns with index euphoria, discount widening signals real covering.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26172.4 (0.793%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.89%

Combined Fut Volume Change: -9.98%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 16% Previous 13%

NIFTY DECEMBER Future closed at: 26197.9 (0.645%)

December Fut Premium 25.5 (Decreased by -38.1 points)

December Fut Open Interest Change: -4.63%

December Fut Volume Change: -23.27%

December Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26377.4 (0.716%)

January Fut Premium 205 (Decreased by -18.6 points)

January Fut Open Interest Change: 19.33%

January Fut Volume Change: 88.49%

January Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (23/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.640 (Increased from 1.126)

Put-Call Ratio (Volume): 1.042

Max Pain Level: 26150

Maximum CALL Open Interest: 26200

Maximum PUT Open Interest: 26100

Highest CALL Addition: 26150

Highest PUT Addition: 26100

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.131 (Increased from 1.071)

Put-Call Ratio (Volume): 1.144

Max Pain Level: 26050

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26100

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59304 (0.397%)

Combined = December + January + February

Combined Fut Open Interest Change: -4.33%

Combined Fut Volume Change: -23.03%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 17% Previous 16%

BANKNIFTY DECEMBER Future closed at: 59435 (0.344%)

December Fut Premium 131 (Decreased by -31.2 points)

December Fut Open Interest Change: -5.6%

December Fut Volume Change: -25.4%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY JANUARY Future closed at: 59800.6 (0.311%)

January Fut Premium 496.6 (Decreased by -49.4 points)

January Fut Open Interest Change: 2.58%

January Fut Volume Change: -9.71%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.797 (Increased from 0.737)

Put-Call Ratio (Volume): 0.916

Max Pain Level: 59300

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59000

Highest CALL Addition: 59400

Highest PUT Addition: 59300

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13971.65 (0.788%)

Combined = December + January + February

Combined Fut Open Interest Change: 0.92%

Combined Fut Volume Change: -26.61%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 7% Previous 6%

MIDCPNIFTY DECEMBER Future closed at: 13992 (0.787%)

December Fut Premium 20.35 (Decreased by 0 points)

December Fut Open Interest Change: -0.30%

December Fut Volume Change: -36.73%

December Fut Open Interest Analysis: Short Covering

MIDCPNIFTY JANUARY Future closed at: 14082.9 (0.885%)

January Fut Premium 111.25 (Increased by 14.25 points)

January Fut Open Interest Change: 20.23%

January Fut Volume Change: 24.81%

January Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.211 (Increased from 1.071)

Put-Call Ratio (Volume): 1.123

Max Pain Level: 13925

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14500

Highest PUT Addition: 14000

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,567.48 (0.751%)

SENSEX Monthly Future closed at: 85,528.15 (0.605%)

Discount: -39.33 (Decreased by -123.82 points)

Open Interest Change: -19.02%

Volume Change: -14.63%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (24/12/2025) Option Analysis

Put-Call Ratio (OI): 1.472 (Increased from 1.034)

Put-Call Ratio (Volume): 0.959

Max Pain Level: 85400

Maximum CALL OI: 85500

Maximum PUT OI: 85000

Highest CALL Addition: 85500

Highest PUT Addition: 85500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 457.34 Cr.

DIIs Net BUY: ₹ 4,058.22 Cr.

FII Derivatives Activity

| FII Trading Stats | 22.12.25 | 19.12.25 | 18.12.25 |

| FII Cash (Provisional Data) | -457.34 | 1,830.89 | 595.78 |

| Index Future Open Interest Long Ratio | 11.39% | 8.82% | 8.17% |

| Index Future Volume Long Ratio | 73.73% | 64.89% | 48.11% |

| Call Option Open Interest Long Ratio | 52.71% | 50.74% | 48.16% |

| Call Option Volume Long Ratio | 50.42% | 50.50% | 50.05% |

| Put Option Open Interest Long Ratio | 57.02% | 59.24% | 63.01% |

| Put Option Volume Long Ratio | 49.82% | 49.63% | 49.86% |

| Stock Future Open Interest Long Ratio | 61.83% | 61.74% | 61.25% |

| Stock Future Volume Long Ratio | 50.69% | 54.25% | 52.05% |

| Index Futures | Short Covering | Short Covering | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Short Covering | Short Covering | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Long Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Short Covering |

| FinNifty Options | Fresh Short | Short Covering | Long Covering |

| MidcpNifty Futures | Fresh Short | Fresh Long | Fresh Long |

| MidcpNifty Options | Fresh Short | Short Covering | Long Covering |

| NiftyNxt50 Futures | Long Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (24/12/2025)

The SENSEX index closed at 85567.48. The SENSEX weekly expiry for DECEMBER 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.472 against previous 1.034. The 85000PE option holds the maximum open interest, followed by the 85500PE and 84000PE options. Market participants have shown increased interest with significant open interest additions in the 85500PE option, with open interest additions also seen in the 85400PE and 85300PE options. On the other hand, open interest reductions were prominent in the 85000CE, 84900CE, and 85100CE options. Trading volume was highest in the 85500CE option, followed by the 85400CE and 85400PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 24-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85567.48 | 1.472 | 1.034 | 0.959 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,02,21,600 | 91,63,080 | 10,58,520 |

| PUT: | 1,50,49,160 | 94,71,020 | 55,78,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 7,77,360 | 3,68,360 | 2,77,01,660 |

| 87000 | 7,74,360 | 1,33,520 | 50,04,720 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 7,77,360 | 3,68,360 | 2,77,01,660 |

| 86500 | 6,19,860 | 2,26,460 | 76,09,180 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 3,34,760 | -4,31,500 | 50,98,620 |

| 84900 | 66,220 | -2,65,920 | 14,35,220 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 7,77,360 | 3,68,360 | 2,77,01,660 |

| 85400 | 3,19,920 | 1,38,500 | 2,49,68,520 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 10,94,440 | 1,47,560 | 1,60,31,300 |

| 85500 | 8,79,620 | 8,14,200 | 2,35,12,800 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 8,79,620 | 8,14,200 | 2,35,12,800 |

| 85400 | 5,98,960 | 5,61,420 | 2,46,44,680 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,44,160 | -1,07,080 | 38,78,420 |

| 83600 | 93,440 | -55,820 | 13,15,780 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85400 | 5,98,960 | 5,61,420 | 2,46,44,680 |

| 85500 | 8,79,620 | 8,14,200 | 2,35,12,800 |

NIFTY Weekly Expiry (23/12/2025)

The NIFTY index closed at 26172.4. The NIFTY weekly expiry for DECEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.640 against previous 1.126. The 26100PE option holds the maximum open interest, followed by the 26000PE and 25900PE options. Market participants have shown increased interest with significant open interest additions in the 26100PE option, with open interest additions also seen in the 26150PE and 26050PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25950CE, and 26050CE options. Trading volume was highest in the 26100PE option, followed by the 26150CE and 26100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,172.40 | 1.640 | 1.126 | 1.042 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,38,28,975 | 14,51,41,350 | -2,13,12,375 |

| PUT: | 20,31,36,750 | 16,34,59,875 | 3,96,76,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,05,96,150 | 7,64,325 | 55,02,964 |

| 26,300 | 1,00,95,900 | 33,24,450 | 30,81,287 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,150 | 84,10,800 | 45,77,700 | 58,84,062 |

| 26,300 | 1,00,95,900 | 33,24,450 | 30,81,287 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 40,09,425 | -89,44,800 | 19,15,420 |

| 25,950 | 9,21,375 | -41,22,000 | 4,01,746 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,150 | 84,10,800 | 45,77,700 | 58,84,062 |

| 26,100 | 53,32,050 | -26,15,475 | 57,25,985 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,69,11,075 | 1,50,59,850 | 64,59,195 |

| 26,000 | 1,60,98,075 | 66,60,225 | 35,16,987 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,69,11,075 | 1,50,59,850 | 64,59,195 |

| 26,150 | 1,01,27,700 | 98,12,625 | 42,77,509 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 31,39,650 | -26,82,075 | 5,90,251 |

| 25,650 | 36,60,675 | -22,79,325 | 5,02,599 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,69,11,075 | 1,50,59,850 | 64,59,195 |

| 26,150 | 1,01,27,700 | 98,12,625 | 42,77,509 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26172.4. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.131 against previous 1.071. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26100PE and 26200PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25900CE, and 26100CE options. Trading volume was highest in the 26200CE option, followed by the 26000PE and 26100PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,172.40 | 1.131 | 1.071 | 1.144 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,63,25,425 | 6,69,73,200 | 93,52,225 |

| PUT: | 8,63,06,650 | 7,17,54,975 | 1,45,51,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 90,38,925 | 23,43,150 | 1,40,438 |

| 26,000 | 74,70,850 | -10,38,725 | 1,49,015 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 90,38,925 | 23,43,150 | 1,40,438 |

| 26,800 | 31,43,175 | 15,48,075 | 77,561 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 74,70,850 | -10,38,725 | 1,49,015 |

| 25,900 | 15,77,550 | -4,94,625 | 41,996 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 46,72,125 | 11,64,675 | 2,88,319 |

| 26,500 | 50,93,850 | 1,70,700 | 1,96,341 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,01,64,125 | 17,12,750 | 2,70,431 |

| 25,000 | 72,73,525 | 15,55,975 | 1,16,071 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 35,53,200 | 20,37,000 | 2,38,926 |

| 26,200 | 37,62,900 | 19,12,275 | 1,80,101 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 24,39,900 | -3,50,250 | 1,11,665 |

| 25,350 | 3,72,225 | -3,43,125 | 28,781 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,01,64,125 | 17,12,750 | 2,70,431 |

| 26,100 | 35,53,200 | 20,37,000 | 2,38,926 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59304. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.797 against previous 0.737. The 59500CE option holds the maximum open interest, followed by the 60000CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 59300PE option, with open interest additions also seen in the 57500PE and 59400CE options. On the other hand, open interest reductions were prominent in the 59000CE, 59100CE, and 55500PE options. Trading volume was highest in the 59300PE option, followed by the 59500CE and 59300CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,304.00 | 0.797 | 0.737 | 0.916 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,91,28,680 | 1,96,96,275 | -5,67,595 |

| PUT: | 1,52,54,970 | 1,45,18,715 | 7,36,255 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,00,220 | 98,140 | 1,60,335 |

| 60,000 | 17,62,460 | -20,440 | 94,055 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,400 | 4,74,705 | 1,11,230 | 93,470 |

| 59,500 | 19,00,220 | 98,140 | 1,60,335 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 8,62,575 | -2,59,035 | 72,901 |

| 59,100 | 2,53,820 | -1,46,335 | 49,543 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,00,220 | 98,140 | 1,60,335 |

| 59,300 | 5,17,510 | 16,240 | 1,57,785 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,07,525 | 9,100 | 1,13,451 |

| 59,500 | 12,97,065 | 95,025 | 1,14,215 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 3,85,525 | 1,56,030 | 1,70,844 |

| 57,500 | 7,07,665 | 1,14,240 | 32,951 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 2,47,375 | -1,22,955 | 14,989 |

| 56,000 | 5,84,185 | -50,015 | 28,506 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 3,85,525 | 1,56,030 | 1,70,844 |

| 59,500 | 12,97,065 | 95,025 | 1,14,215 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13971.65. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.211 against previous 1.071. The 13000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 14000PE option, with open interest additions also seen in the 13900PE and 13000PE options. On the other hand, open interest reductions were prominent in the 68000CE, 67500PE, and 66000PE options. Trading volume was highest in the 14000CE option, followed by the 14100CE and 14000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,479.85 | 0.601 | 0.654 | 0.379 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,36,005 | 9,11,950 | 2,24,055 |

| PUT: | 6,82,760 | 5,96,570 | 86,190 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 2,03,840 | 74,035 | 13,911 |

| 27,700 | 1,62,305 | 1,13,230 | 18,673 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 1,62,305 | 1,13,230 | 18,673 |

| 27,500 | 2,03,840 | 74,035 | 13,911 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 73,190 | -14,820 | 3,365 |

| 28,200 | 55,120 | -6,630 | 641 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 1,62,305 | 1,13,230 | 18,673 |

| 27,500 | 2,03,840 | 74,035 | 13,911 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,33,250 | 38,610 | 6,190 |

| 27,300 | 58,370 | 2,795 | 1,321 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,33,250 | 38,610 | 6,190 |

| 27,400 | 45,305 | 11,115 | 3,367 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 18,590 | -5,850 | 788 |

| 27,100 | 15,860 | -3,900 | 521 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,33,250 | 38,610 | 6,190 |

| 27,400 | 45,305 | 11,115 | 3,367 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis screams bullish momentum: Short covering dominates combined books everywhere while January longs explode—26,000 support holds firm.

Actionable Santa plays: Buy NIFTY 26,200 calls or bull call spreads targeting 26,500; roll shorts higher across board—holiday theta acceleration favors longs.

Sector rocket fuel: Load MIDCPNIFTY/BANKNIFTY for year-end pops; fade any 26,000 tests with tight stops.

Tuesday trigger: Continued OI unwind = 26,500 path open; fresh shorts test support—position ahead of thin volumes, but momentum loves chasing strength here.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]