Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 26/12/2025

Table of Contents

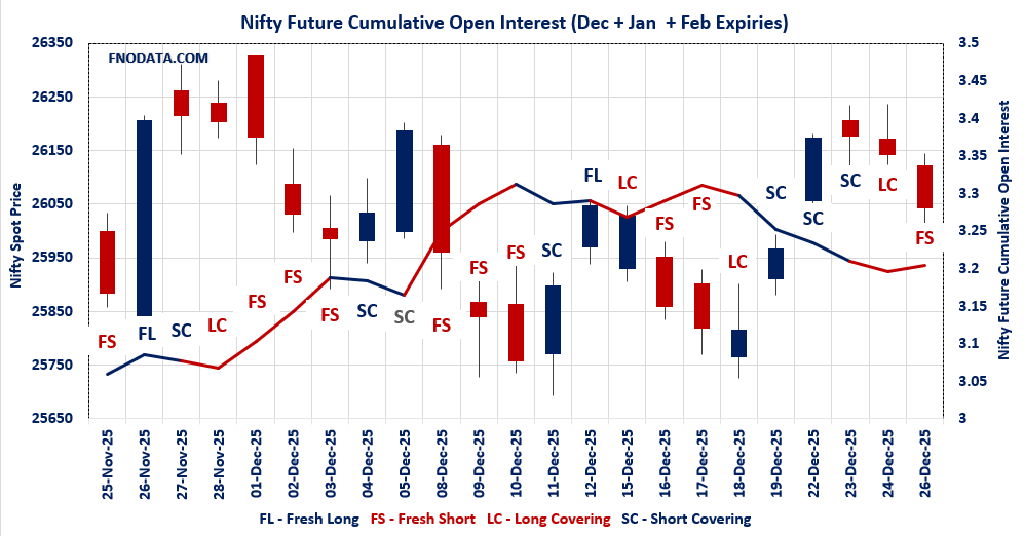

NIFTY slipped 0.38% today, and the combined futures Open Interest Volume Analysis clearly shows the baton fully passing from expiring December to January—with December seeing heavy long covering and January getting loaded with aggressive fresh shorts.

In the combined NIFTY futures pack, OI was up 0.82% while volume more than doubled (+107%), a classic “price down + OI up + big volume” = fresh short build-up signal at an index level, even though December alone shows clean long unwinding.

BANKNIFTY told the same story in a louder tone: combined OI fell -5.8% (long covering), but that’s almost entirely December getting squared off, while January OI spiked over 70% with strong volumes—your Open Interest Volume Analysis here says “new bearish positioning is concentrated in the next series, not in the expiring one.”

MIDCPNIFTY mirrored this structure: combined OI up 0.76% with mild negative price, December OI crushed (-37%) and January exploding (+200%+) on rising volume—clear sign that fresh shorts are migrating into January just as December longs are being taken off.

On the options side, sharp drops in PCR for NIFTY, BANKNIFTY and MIDCPNIFTY (OI PCRs down to 0.66–0.65 range) show calls now dominating the open interest, which usually aligns with a near-term bearish or at least capped-upside setup, especially with max pain sitting almost exactly at current NIFTY levels around 26,050.

SENSEX futures added nearly 10% OI with prices down and premium rising—another textbook fresh short signal that supports the broader index-level bear bias your Open Interest Volume Analysis is throwing up.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26042.3 (-0.382%)

Combined = December + January + February

Combined Fut Open Interest Change: 0.82%

Combined Fut Volume Change: 107.13%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 38% Previous 24%

NIFTY DECEMBER Future closed at: 26060.2 (-0.431%)

December Fut Premium 17.9 (Decreased by -13.1 points)

December Fut Open Interest Change: -17.56%

December Fut Volume Change: 80.12%

December Fut Open Interest Analysis: Long Covering

NIFTY JANUARY Future closed at: 26234.5 (-0.446%)

January Fut Premium 192.2 (Decreased by -17.6 points)

January Fut Open Interest Change: 70.53%

January Fut Volume Change: 162.99%

January Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.662 (Decreased from 0.913)

Put-Call Ratio (Volume): 0.965

Max Pain Level: 26050

Maximum CALL Open Interest: 26200

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26100

Highest PUT Addition: 26050

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59011.35 (-0.291%)

Combined = December + January + February

Combined Fut Open Interest Change: -5.80%

Combined Fut Volume Change: 21.07%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 40% Previous 23%

BANKNIFTY DECEMBER Future closed at: 59065.8 (-0.316%)

December Fut Premium 54.45 (Decreased by -14.95 points)

December Fut Open Interest Change: -26.4%

December Fut Volume Change: -11.7%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY JANUARY Future closed at: 59439.4 (-0.374%)

January Fut Premium 428.05 (Decreased by -50.95 points)

January Fut Open Interest Change: 70.20%

January Fut Volume Change: 151.19%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.656 (Decreased from 0.693)

Put-Call Ratio (Volume): 0.960

Max Pain Level: 59100

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59000

Highest CALL Addition: 59000

Highest PUT Addition: 58900

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13722.85 (-0.653%)

Combined = December + January + February

Combined Fut Open Interest Change: 0.76%

Combined Fut Volume Change: -6.61%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 48% Previous 16%

MIDCPNIFTY DECEMBER Future closed at: 13732.25 (-0.518%)

December Fut Premium 9.4 (Increased by 18.8 points)

December Fut Open Interest Change: -37.02%

December Fut Volume Change: -40.63%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 13787.4 (-0.666%)

January Fut Premium 64.55 (Decreased by -2.2 points)

January Fut Open Interest Change: 206.60%

January Fut Volume Change: 116.67%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.645 (Decreased from 0.870)

Put-Call Ratio (Volume): 0.814

Max Pain Level: 13800

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13800

Highest PUT Addition: 13700

SENSEX Monthly Expiry (29/01/2026) Future

SENSEX Spot closed at: 85,041.45 (-0.430%)

SENSEX Monthly Future closed at: 85,693.05 (-0.399%)

Premium: 651.6 (Increased by 24.15 points)

Open Interest Change: 9.85%

Volume Change: 11.09%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (1/01/2026) Option Analysis

Put-Call Ratio (OI): 0.577 (Decreased from 0.826)

Put-Call Ratio (Volume): 1.107

Max Pain Level: 85200

Maximum CALL OI: 88000

Maximum PUT OI: 83000

Highest CALL Addition: 86000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 317.56 Cr.

DIIs Net BUY: ₹ 1,772.56 Cr.

FII Derivatives Activity

| FII Trading Stats | 26.12.25 | 24.12.25 | 23.12.25 |

| FII Cash (Provisional Data) | -317.56 | -1,721.26 | -1,794.80 |

| Index Future Open Interest Long Ratio | 11.06% | 12.44% | 12.77% |

| Index Future Volume Long Ratio | 45.11% | 51.75% | 69.49% |

| Call Option Open Interest Long Ratio | 49.47% | 49.88% | 51.28% |

| Call Option Volume Long Ratio | 49.90% | 49.79% | 49.79% |

| Put Option Open Interest Long Ratio | 62.13% | 60.38% | 60.83% |

| Put Option Volume Long Ratio | 50.52% | 50.46% | 50.07% |

| Stock Future Open Interest Long Ratio | 62.30% | 62.12% | 62.04% |

| Stock Future Volume Long Ratio | 50.25% | 49.93% | 50.88% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Short | Long Covering |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Long Covering | Short Covering | Long Covering |

| BankNifty Options | Fresh Long | Long Covering | Fresh Short |

| FinNifty Futures | Fresh Short | Short Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Long | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Long Covering | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Short Covering | Fresh Long |

| Stock Options | Short Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/01/2026)

The SENSEX index closed at 85041.45. The SENSEX weekly expiry for JANUARY 1, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.577 against previous 0.826. The 88000CE option holds the maximum open interest, followed by the 85500CE and 83000PE options. Market participants have shown increased interest with significant open interest additions in the 83000PE option, with open interest additions also seen in the 86000CE and 85300CE options. On the other hand, open interest reductions were prominent in the 85600PE, 85400PE, and 85800PE options. Trading volume was highest in the 85000PE option, followed by the 85200PE and 85300PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85041.45 | 0.577 | 0.826 | 1.107 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,08,89,040 | 37,11,640 | 71,77,400 |

| PUT: | 62,86,000 | 30,65,700 | 32,20,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 7,29,260 | 3,67,880 | 37,01,780 |

| 85500 | 7,17,340 | 3,20,980 | 1,08,87,640 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 6,24,020 | 4,04,800 | 79,86,760 |

| 85300 | 4,36,580 | 3,90,720 | 1,10,69,500 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88400 | 27,200 | -3,800 | 4,85,560 |

| 83100 | 460 | -300 | 500 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85200 | 4,17,280 | 3,84,040 | 1,11,64,960 |

| 85300 | 4,36,580 | 3,90,720 | 1,10,69,500 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 6,40,960 | 4,05,900 | 33,57,420 |

| 85000 | 4,98,720 | 2,06,560 | 1,93,00,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 6,40,960 | 4,05,900 | 33,57,420 |

| 84000 | 4,45,240 | 2,97,360 | 57,42,240 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85600 | 74,240 | -36,200 | 19,43,040 |

| 85400 | 1,55,760 | -19,880 | 87,17,880 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,98,720 | 2,06,560 | 1,93,00,700 |

| 85200 | 2,39,120 | 1,92,940 | 1,59,07,780 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26042.3. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.662 against previous 0.913. The 26200CE option holds the maximum open interest, followed by the 26100CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 26050CE and 26200CE options. On the other hand, open interest reductions were prominent in the 26200PE, 26150PE, and 25000PE options. Trading volume was highest in the 26100PE option, followed by the 26100CE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,042.30 | 0.662 | 0.913 | 0.965 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 21,11,20,050 | 15,88,69,225 | 5,22,50,825 |

| PUT: | 13,97,06,250 | 14,50,77,800 | -53,71,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,91,52,150 | 57,38,700 | 29,67,019 |

| 26,100 | 1,54,90,200 | 1,10,35,125 | 47,59,734 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,54,90,200 | 1,10,35,125 | 47,59,734 |

| 26,050 | 81,53,475 | 71,90,625 | 25,58,831 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,650 | 19,39,050 | -7,95,300 | 3,35,117 |

| 28,000 | 32,01,700 | -6,29,875 | 79,971 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,54,90,200 | 1,10,35,125 | 47,59,734 |

| 26,200 | 1,91,52,150 | 57,38,700 | 29,67,019 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,49,55,425 | -2,99,775 | 43,44,687 |

| 25,000 | 82,32,400 | -21,88,750 | 4,22,619 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,050 | 64,04,625 | 30,45,975 | 38,90,699 |

| 25,950 | 56,81,100 | 23,23,650 | 19,24,963 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 39,12,300 | -35,82,750 | 16,63,798 |

| 26,150 | 16,31,775 | -23,45,400 | 21,02,675 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 60,02,850 | -11,65,875 | 49,61,378 |

| 26,000 | 1,49,55,425 | -2,99,775 | 43,44,687 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59011.35. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.656 against previous 0.693. The 59500CE option holds the maximum open interest, followed by the 60000CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 59200CE and 59100CE options. On the other hand, open interest reductions were prominent in the 59500CE, 59300PE, and 59500PE options. Trading volume was highest in the 59000PE option, followed by the 59100PE and 59000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,011.35 | 0.656 | 0.693 | 0.960 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,20,24,615 | 2,07,22,160 | 13,02,455 |

| PUT: | 1,44,38,865 | 1,43,64,070 | 74,795 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 20,99,265 | -3,11,395 | 3,81,679 |

| 60,000 | 20,86,490 | 95,445 | 2,39,092 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,89,260 | 4,12,230 | 4,37,600 |

| 59,200 | 9,98,830 | 3,94,135 | 3,74,711 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 20,99,265 | -3,11,395 | 3,81,679 |

| 60,300 | 2,31,280 | -1,09,690 | 47,546 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,89,260 | 4,12,230 | 4,37,600 |

| 59,100 | 6,69,235 | 3,63,615 | 3,89,113 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,00,560 | 20,650 | 6,76,040 |

| 58,500 | 10,82,655 | 96,005 | 2,24,224 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,900 | 5,48,450 | 2,52,385 | 3,11,672 |

| 58,600 | 3,48,320 | 1,56,170 | 1,10,333 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 2,16,685 | -2,34,500 | 1,42,823 |

| 59,500 | 8,85,395 | -2,29,215 | 1,06,085 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,00,560 | 20,650 | 6,76,040 |

| 59,100 | 4,39,005 | 1,24,425 | 4,52,888 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13722.85. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.645 against previous 0.870. The 14000CE option holds the maximum open interest, followed by the 14500CE and 13800CE options. Market participants have shown increased interest with significant open interest additions in the 13800CE option, with open interest additions also seen in the 14000CE and 14100CE options. On the other hand, open interest reductions were prominent in the 69300CE, 68500CE, and 66000PE options. Trading volume was highest in the 13800CE option, followed by the 13800PE and 13900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,722.85 | 0.645 | 0.870 | 0.814 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,71,00,020 | 1,34,06,820 | 36,93,200 |

| PUT: | 1,10,36,480 | 1,16,64,380 | -6,27,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 22,82,420 | 5,77,080 | 75,019 |

| 14,500 | 13,24,120 | 2,48,360 | 21,794 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 12,19,120 | 6,03,960 | 1,10,981 |

| 14,000 | 22,82,420 | 5,77,080 | 75,019 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,250 | 1,30,340 | -92,680 | 5,990 |

| 13,900 | 11,89,160 | -91,840 | 94,284 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 12,19,120 | 6,03,960 | 1,10,981 |

| 13,900 | 11,89,160 | -91,840 | 94,284 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,82,580 | -4,900 | 12,814 |

| 13,700 | 9,90,500 | 2,55,080 | 79,264 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 9,90,500 | 2,55,080 | 79,264 |

| 13,650 | 2,85,600 | 1,52,040 | 23,613 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 3,97,320 | -3,92,700 | 1,07,267 |

| 13,900 | 4,38,060 | -3,85,000 | 24,852 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 3,97,320 | -3,92,700 | 1,07,267 |

| 13,700 | 9,90,500 | 2,55,080 | 79,264 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Put together, the combined data says this isn’t just expiry noise; it’s a deliberate rollover into shorts for January, with rising volume confirming that institutions are actively pressing the downside rather than passively carrying longs.

Actionable takeaway: treat 26,050–26,200 on NIFTY as a sell-on-rise zone while these January shorts are building; structure trades via bear call spreads or light futures shorts with tight stops above 26,250, and only flip to a bullish stance if future OI in January starts unwinding on up-moves instead of increasing.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]