Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 29/12/2025

Table of Contents

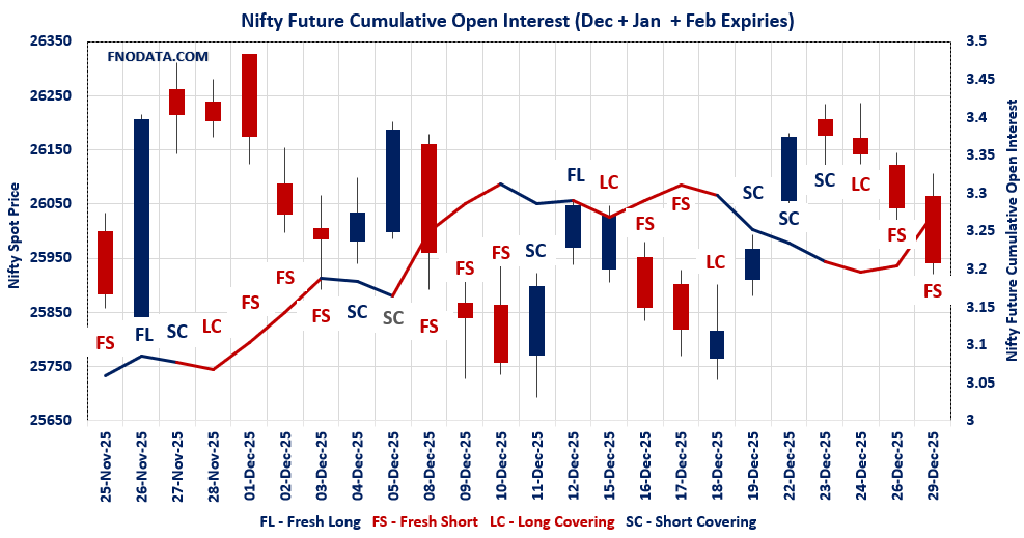

Markets shed 0.39% today as NIFTY tested support, and this Open Interest Volume Analysis across combined futures paints a crystal-clear picture of aggressive short positioning taking hold—December longs are getting crushed while January shorts explode with conviction.

NIFTY combined futures scream fresh shorts: +6.84% OI surge on +31% volume with price down 0.39% is textbook bear signal—December covering (-28.64%) masks January’s massive +71.83% short buildup.

BANKNIFTY covering hides the bear shift: -4.35% combined OI looks benign, but January +41.54% shorts on rising volume reveal the real positioning—rollover complete.

MIDCPNIFTY shorts dominate: +7.83% combined OI explosion despite price drop confirms bears loading up heavily, January +45% seals the conviction.

SENSEX joins the party: +8.53% OI with volume up confirms broad short reload across benchmarks.

Options PCR collapses bullish: NIFTY at 0.565, all indices showing call dominance—max pain clusters 26,000 suggest bears defending from here.

Rollover acceleration tells truth: 58%+ across board means institutions have fully rotated into January shorts—year-end positioning locked.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25942.1 (-0.385%)

Combined = December + January + February

Combined Fut Open Interest Change: 6.84%

Combined Fut Volume Change: 31.42%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 58% Previous 38%

NIFTY DECEMBER Future closed at: 25957.2 (-0.395%)

December Fut Premium 15.1 (Decreased by -2.8 points)

December Fut Open Interest Change: -28.64%

December Fut Volume Change: 8.59%

December Fut Open Interest Analysis: Long Covering

NIFTY JANUARY Future closed at: 26121.3 (-0.431%)

January Fut Premium 179.2 (Decreased by -13 points)

January Fut Open Interest Change: 71.83%

January Fut Volume Change: 61.06%

January Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.565 (Decreased from 0.662)

Put-Call Ratio (Volume): 1.090

Max Pain Level: 26000

Maximum CALL Open Interest: 26100

Maximum PUT Open Interest: 25900

Highest CALL Addition: 26000

Highest PUT Addition: 25900

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58932.35 (-0.134%)

Combined = December + January + February

Combined Fut Open Interest Change: -4.35%

Combined Fut Volume Change: 10.56%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 58% Previous 40%

BANKNIFTY DECEMBER Future closed at: 58947.2 (-0.201%)

December Fut Premium 14.85 (Decreased by -39.6 points)

December Fut Open Interest Change: -33.6%

December Fut Volume Change: 3.2%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY JANUARY Future closed at: 59342.4 (-0.163%)

January Fut Premium 410.05 (Decreased by -18 points)

January Fut Open Interest Change: 41.54%

January Fut Volume Change: 18.71%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.664 (Increased from 0.656)

Put-Call Ratio (Volume): 0.922

Max Pain Level: 59000

Maximum CALL Open Interest: 59000

Maximum PUT Open Interest: 59000

Highest CALL Addition: 59000

Highest PUT Addition: 58800

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13651.45 (-0.520%)

Combined = December + January + February

Combined Fut Open Interest Change: 7.83%

Combined Fut Volume Change: -33.73%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 64% Previous 48%

MIDCPNIFTY DECEMBER Future closed at: 13660.3 (-0.524%)

December Fut Premium 8.85 (Decreased by -0.55 points)

December Fut Open Interest Change: -25.18%

December Fut Volume Change: -36.46%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 13698.35 (-0.646%)

January Fut Premium 46.9 (Decreased by -17.65 points)

January Fut Open Interest Change: 45.13%

January Fut Volume Change: -31.61%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.614 (Decreased from 0.645)

Put-Call Ratio (Volume): 0.913

Max Pain Level: 13700

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 13700

Highest PUT Addition: 13550

SENSEX Monthly Expiry (29/01/2026) Future

SENSEX Spot closed at: 84,695.54 (-0.407%)

SENSEX Monthly Future closed at: 85,395.90 (-0.347%)

Premium: 700.36 (Increased by 48.76 points)

Open Interest Change: 8.53%

Volume Change: 34.38%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (1/01/2026) Option Analysis

Put-Call Ratio (OI): 0.496 (Decreased from 0.577)

Put-Call Ratio (Volume): 1.140

Max Pain Level: 85200

Maximum CALL OI: 87000

Maximum PUT OI: 83000

Highest CALL Addition: 85000

Highest PUT Addition: 84700

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,759.89 Cr.

DIIs Net BUY: ₹ 2,643.85 Cr.

FII Derivatives Activity

| FII Trading Stats | 29.12.25 | 26.12.25 | 24.12.25 |

| FII Cash (Provisional Data) | -2,759.89 | -317.56 | -1,721.26 |

| Index Future Open Interest Long Ratio | 13.65% | 11.06% | 12.44% |

| Index Future Volume Long Ratio | 44.12% | 45.11% | 51.75% |

| Call Option Open Interest Long Ratio | 49.33% | 49.47% | 49.88% |

| Call Option Volume Long Ratio | 49.97% | 49.90% | 49.79% |

| Put Option Open Interest Long Ratio | 61.73% | 62.13% | 60.38% |

| Put Option Volume Long Ratio | 49.99% | 50.52% | 50.46% |

| Stock Future Open Interest Long Ratio | 62.20% | 62.30% | 62.12% |

| Stock Future Volume Long Ratio | 49.82% | 50.25% | 49.93% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Long Covering | Short Covering |

| BankNifty Options | Long Covering | Fresh Long | Long Covering |

| FinNifty Futures | Fresh Short | Fresh Short | Short Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Long | Fresh Long | Short Covering |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Long Covering | Long Covering |

| NiftyNxt50 Options | Long Covering | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Short Covering | Short Covering |

| Stock Options | Long Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/01/2026)

The SENSEX index closed at 84695.54. The SENSEX weekly expiry for JANUARY 1, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.496 against previous 0.577. The 87000CE option holds the maximum open interest, followed by the 85000CE and 85500CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 87000CE and 84700PE options. On the other hand, open interest reductions were prominent in the 85500PE, 85200PE, and 85300PE options. Trading volume was highest in the 85000PE option, followed by the 84800PE and 85000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84695.54 | 0.496 | 0.577 | 1.140 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,58,70,820 | 1,08,89,040 | 49,81,780 |

| PUT: | 78,69,460 | 62,86,000 | 15,83,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 10,99,820 | 5,23,060 | 53,39,740 |

| 85000 | 10,35,220 | 6,30,980 | 2,05,28,400 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 10,35,220 | 6,30,980 | 2,05,28,400 |

| 87000 | 10,99,820 | 5,23,060 | 53,39,740 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 86200 | 2,60,700 | -46,000 | 36,63,280 |

| 86700 | 1,92,820 | -37,160 | 20,39,000 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 10,35,220 | 6,30,980 | 2,05,28,400 |

| 85200 | 6,30,360 | 2,13,080 | 1,29,42,080 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 6,61,740 | 20,780 | 42,96,760 |

| 82000 | 6,15,900 | 3,42,900 | 44,05,640 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84700 | 5,56,660 | 4,18,120 | 1,87,30,400 |

| 82000 | 6,15,900 | 3,42,900 | 44,05,640 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 2,83,340 | -1,21,220 | 25,69,280 |

| 85200 | 1,58,500 | -80,620 | 94,65,500 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,95,560 | -3,160 | 2,37,44,040 |

| 84800 | 2,75,460 | 1,34,840 | 2,05,55,860 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25942.1. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.565 against previous 0.662. The 26100CE option holds the maximum open interest, followed by the 26000CE and 26200CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25950CE and 26100CE options. On the other hand, open interest reductions were prominent in the 26000PE, 26050PE, and 27000CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 25950PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,942.10 | 0.565 | 0.662 | 1.090 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 22,89,46,175 | 21,11,20,050 | 1,78,26,125 |

| PUT: | 12,92,40,125 | 13,97,06,250 | -1,04,66,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 2,14,75,275 | 59,85,075 | 59,60,751 |

| 26,000 | 2,10,81,400 | 99,07,100 | 71,60,625 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,10,81,400 | 99,07,100 | 71,60,625 |

| 25,950 | 87,43,350 | 75,01,875 | 38,30,494 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,20,84,300 | -29,61,150 | 9,92,044 |

| 26,550 | 28,78,950 | -24,13,200 | 6,04,669 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,10,81,400 | 99,07,100 | 71,60,625 |

| 26,100 | 2,14,75,275 | 59,85,075 | 59,60,751 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,04,84,400 | 33,21,600 | 69,77,916 |

| 26,000 | 1,02,39,450 | -47,15,975 | 83,10,980 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,04,84,400 | 33,21,600 | 69,77,916 |

| 25,850 | 64,89,975 | 26,51,400 | 38,08,019 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,02,39,450 | -47,15,975 | 83,10,980 |

| 26,050 | 20,88,450 | -43,16,175 | 45,87,857 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,02,39,450 | -47,15,975 | 83,10,980 |

| 25,950 | 72,27,750 | 15,46,650 | 71,59,906 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 58932.35. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.664 against previous 0.656. The 59000CE option holds the maximum open interest, followed by the 59500CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 58800PE and 58900CE options. On the other hand, open interest reductions were prominent in the 62000CE, 60000CE, and 59500PE options. Trading volume was highest in the 59000CE option, followed by the 58800PE and 58900PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,932.35 | 0.664 | 0.656 | 0.922 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,19,07,825 | 2,20,24,615 | -1,16,790 |

| PUT: | 1,45,52,615 | 1,44,38,865 | 1,13,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 21,22,680 | 8,33,420 | 13,48,632 |

| 59,500 | 19,51,635 | -1,47,630 | 5,25,843 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 21,22,680 | 8,33,420 | 13,48,632 |

| 58,900 | 6,02,070 | 4,09,920 | 7,12,540 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 7,56,735 | -3,63,195 | 93,656 |

| 60,000 | 18,39,880 | -2,46,610 | 3,07,945 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 21,22,680 | 8,33,420 | 13,48,632 |

| 59,100 | 8,71,605 | 2,02,370 | 8,06,093 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,47,220 | -53,340 | 10,06,411 |

| 58,500 | 13,02,805 | 2,20,150 | 5,59,542 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,800 | 10,24,695 | 6,23,105 | 11,26,939 |

| 58,700 | 6,26,500 | 2,82,800 | 6,76,046 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 6,79,280 | -2,06,115 | 53,320 |

| 59,100 | 2,38,245 | -2,00,760 | 3,38,465 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,800 | 10,24,695 | 6,23,105 | 11,26,939 |

| 58,900 | 8,19,735 | 2,71,285 | 10,16,366 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13651.45. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.614 against previous 0.645. The 14000CE option holds the maximum open interest, followed by the 14100CE and 13900CE options. Market participants have shown increased interest with significant open interest additions in the 13700CE option, with open interest additions also seen in the 13750CE and 13650CE options. On the other hand, open interest reductions were prominent in the 70500CE, 70000CE, and 64000PE options. Trading volume was highest in the 13700PE option, followed by the 13700CE and 13650PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,651.45 | 0.614 | 0.645 | 0.913 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,65,92,100 | 1,71,00,020 | -5,07,920 |

| PUT: | 1,01,92,700 | 1,10,36,480 | -8,43,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 21,09,100 | -1,73,320 | 71,274 |

| 14,100 | 11,56,120 | -57,120 | 34,682 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 10,76,880 | 6,58,000 | 1,61,073 |

| 13,750 | 6,62,900 | 3,51,540 | 1,44,664 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 6,78,300 | -6,45,820 | 16,973 |

| 14,400 | 3,92,840 | -5,53,560 | 14,857 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 10,76,880 | 6,58,000 | 1,61,073 |

| 13,750 | 6,62,900 | 3,51,540 | 1,44,664 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,90,640 | 1,09,200 | 57,468 |

| 13,600 | 7,74,620 | 91,000 | 1,03,137 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 3,52,520 | 2,05,940 | 43,237 |

| 13,525 | 2,25,820 | 1,65,480 | 15,363 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,88,660 | -4,93,920 | 15,922 |

| 13,700 | 7,31,780 | -2,58,720 | 1,81,109 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 7,31,780 | -2,58,720 | 1,81,109 |

| 13,650 | 3,23,960 | 38,360 | 1,50,404 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis verdict: Bears fully in control: Combined futures across NIFTY, MIDCPNIFTY, SENSEX loaded with fresh shorts while January contracts explode—downside conviction crystal clear.

Actionable year-end trades: Short NIFTY rallies to 26,100 with 26,200 stops targeting 25,700; bear call spreads 26,000/26,200 perfect—BANKNIFTY shorts offer best risk/reward.

Skip longs entirely: Even covering looks tactical, not bullish—wait for OI unwind on upside volume before flipping.

Tomorrow’s make-or-break: Volume confirmation of shorts = 25,600 path open; PCR spike + OI drop = trap squeeze—size tiny ahead of expiry, institutions drive everything now.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]