Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 31/12/2025

Table of Contents

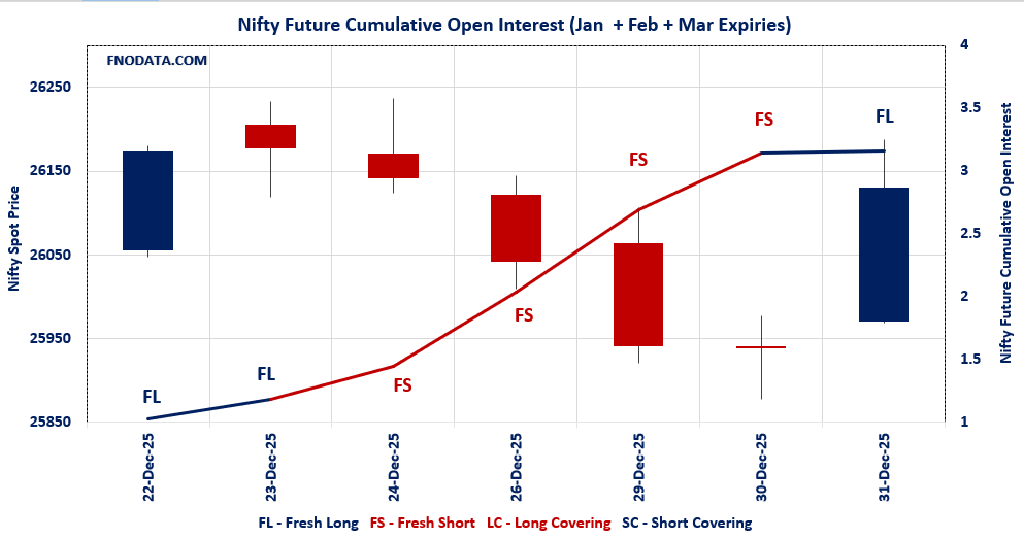

Markets capped 2025 with a solid 0.74% rally on NIFTY, and this Open Interest Volume Analysis across the fresh combined futures (January+February+March) reveals bullish conviction building post-expiry—short covering and fresh longs dominating as institutions position for the new year kickoff.

NIFTY combined futures turn bullish decisively: +1.68% OI bump despite -30% volume drop with strong upside confirms fresh long positioning—January/February both adding longs methodically.

BANKNIFTY longs accelerate: +7.88% combined OI growth shows banking sector conviction strengthening, February leading at +14.52%—year-end rotation complete.

MIDCPNIFTY joins risk-on party: +0.38% combined OI with volume up signals fresh long bias emerging, February +14.81% confirms midcap participation.

SENSEX short relief: -4.07% combined OI drop on volume surge marks covering, aligning with broad bullish flows.

PCR turns defensive across board: NIFTY weekly 1.354, monthly 1.070—put buying ramps with max pain 26,100-26,000 as smart money protects gains.

Consistent long bias everywhere: All major indices showing fresh long or covering action in combined books—textbook year-end bullish setup.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26129.6 (0.735%)

Combined = January + February + March

Combined Fut Open Interest Change: 1.68%

Combined Fut Volume Change: -30.32%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 9% Previous 8%

NIFTY JANUARY Future closed at: 26296.3 (0.680%)

January Fut Premium 166.7 (Decreased by -13.25 points)

January Fut Open Interest Change: 0.49%

January Fut Volume Change: -33.81%

January Fut Open Interest Analysis: Fresh Long

NIFTY FEBRUARY Future closed at: 26438 (0.684%)

February Fut Premium 308.4 (Decreased by -11.15 points)

February Fut Open Interest Change: 4.09%

February Fut Volume Change: -6.67%

February Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (6/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.354 (Increased from 0.755)

Put-Call Ratio (Volume): 0.872

Max Pain Level: 26100

Maximum CALL Open Interest: 26400

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26400

Highest PUT Addition: 26000

NIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.070 (Increased from 1.010)

Put-Call Ratio (Volume): 0.997

Max Pain Level: 26100

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26700

Highest PUT Addition: 25800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59581.85 (0.694%)

Combined = January + February + March

Combined Fut Open Interest Change: 7.88%

Combined Fut Volume Change: -0.55%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 7% Previous 6%

BANKNIFTY JANUARY Future closed at: 59883.6 (0.499%)

January Fut Premium 301.75 (Decreased by -113.2 points)

January Fut Open Interest Change: 6.5%

January Fut Volume Change: -2.7%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY FEBRUARY Future closed at: 60222.6 (0.491%)

February Fut Premium 640.75 (Decreased by -116.2 points)

February Fut Open Interest Change: 14.52%

February Fut Volume Change: 1.47%

February Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.092 (Increased from 1.008)

Put-Call Ratio (Volume): 0.873

Max Pain Level: 59500

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59500

Highest CALL Addition: 62000

Highest PUT Addition: 59500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13777.25 (1.293%)

Combined = January + February + March

Combined Fut Open Interest Change: 0.38%

Combined Fut Volume Change: 8.24%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 2%

MIDCPNIFTY JANUARY Future closed at: 13841.3 (1.242%)

January Fut Premium 64.05 (Decreased by -6.05 points)

January Fut Open Interest Change: -0.16%

January Fut Volume Change: 7.22%

January Fut Open Interest Analysis: Short Covering

MIDCPNIFTY FEBRUARY Future closed at: 13915.8 (1.278%)

February Fut Premium 138.55 (Decreased by -0.3 points)

February Fut Open Interest Change: 14.81%

February Fut Volume Change: 17.02%

February Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.082 (Decreased from 1.169)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 13800

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14400

Highest PUT Addition: 13800

SENSEX Monthly Expiry (29/01/2026) Future

SENSEX Spot closed at: 85,220.60 (0.644%)

SENSEX Monthly Future closed at: 85,815.55 (0.557%)

Premium: 594.95 (Decreased by -70.07 points)

Open Interest Change: -4.07%

Volume Change: 52.60%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (1/01/2026) Option Analysis

Put-Call Ratio (OI): 1.345 (Increased from 0.727)

Put-Call Ratio (Volume): 0.892

Max Pain Level: 85200

Maximum CALL OI: 85500

Maximum PUT OI: 85000

Highest CALL Addition: 85700

Highest PUT Addition: 85000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,597.38 Cr.

DIIs Net BUY: ₹ 6,759.64 Cr.

FII Derivatives Activity

| FII Trading Stats | 31.12.25 | 30.12.25 | 29.12.25 |

| FII Cash (Provisional Data) | -3,597.38 | -3,844.02 | -2,759.89 |

| Index Future Open Interest Long Ratio | 8.86% | 8.84% | 13.65% |

| Index Future Volume Long Ratio | 46.12% | 46.04% | 44.12% |

| Call Option Open Interest Long Ratio | 50.93% | 47.19% | 49.33% |

| Call Option Volume Long Ratio | 50.49% | 50.08% | 49.97% |

| Put Option Open Interest Long Ratio | 62.84% | 68.16% | 61.73% |

| Put Option Volume Long Ratio | 49.93% | 50.15% | 49.99% |

| Stock Future Open Interest Long Ratio | 63.42% | 63.15% | 62.20% |

| Stock Future Volume Long Ratio | 54.22% | 53.98% | 49.82% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Long | Short Covering | Fresh Short |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Long | Short Covering | Fresh Long |

| BankNifty Futures | Fresh Long | Long Covering | Short Covering |

| BankNifty Options | Fresh Long | Short Covering | Long Covering |

| FinNifty Futures | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Options | Fresh Long | Short Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Long Covering | Fresh Long |

| MidcpNifty Options | Fresh Long | Long Covering | Long Covering |

| NiftyNxt50 Futures | Fresh Long | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Long Covering | Long Covering |

| Stock Futures | Fresh Long | Short Covering | Long Covering |

| Stock Options | Fresh Short | Short Covering | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/01/2026)

The SENSEX index closed at 85220.6. The SENSEX weekly expiry for JANUARY 1, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.345 against previous 0.727. The 85000PE option holds the maximum open interest, followed by the 85500CE and 84900PE options. Market participants have shown increased interest with significant open interest additions in the 85000PE option, with open interest additions also seen in the 84900PE and 84800PE options. On the other hand, open interest reductions were prominent in the 85000CE, 84800CE, and 84700CE options. Trading volume was highest in the 85500CE option, followed by the 85000PE and 85300CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85220.6 | 1.345 | 0.727 | 0.892 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,85,56,260 | 2,15,68,100 | 69,88,160 |

| PUT: | 3,84,18,160 | 1,56,74,300 | 2,27,43,860 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 23,01,200 | 8,09,740 | 14,50,74,020 |

| 86000 | 22,73,800 | 8,51,400 | 6,53,00,000 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85700 | 13,66,560 | 8,65,460 | 7,13,45,020 |

| 86000 | 22,73,800 | 8,51,400 | 6,53,00,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 9,23,500 | -6,29,400 | 10,54,03,560 |

| 84800 | 2,23,460 | -4,39,420 | 4,73,57,200 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 23,01,200 | 8,09,740 | 14,50,74,020 |

| 85300 | 14,16,880 | 6,78,600 | 12,39,04,340 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 27,80,780 | 23,41,000 | 13,17,80,100 |

| 84900 | 22,74,260 | 20,69,860 | 10,03,06,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 27,80,780 | 23,41,000 | 13,17,80,100 |

| 84900 | 22,74,260 | 20,69,860 | 10,03,06,700 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83800 | 5,08,560 | -1,81,700 | 93,76,300 |

| 83600 | 3,07,980 | -17,180 | 61,72,480 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 27,80,780 | 23,41,000 | 13,17,80,100 |

| 84800 | 18,44,060 | 14,02,320 | 11,23,04,760 |

NIFTY Weekly Expiry (6/01/2026)

The NIFTY index closed at 26129.6. The NIFTY weekly expiry for JANUARY 6, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.354 against previous 0.755. The 26000PE option holds the maximum open interest, followed by the 26100PE and 25900PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26100PE and 26050PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25900CE, and 25950CE options. Trading volume was highest in the 26000PE option, followed by the 26100CE and 26000CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 06-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,129.60 | 1.354 | 0.755 | 0.872 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,62,31,265 | 7,42,45,210 | 2,19,86,055 |

| PUT: | 13,02,64,030 | 5,60,37,475 | 7,42,26,555 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 76,87,550 | 43,61,695 | 14,55,528 |

| 26,500 | 68,99,295 | 26,10,920 | 13,31,868 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 76,87,550 | 43,61,695 | 14,55,528 |

| 26,600 | 56,92,505 | 27,24,150 | 8,24,822 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 43,86,980 | -25,26,030 | 29,79,908 |

| 25,900 | 10,86,540 | -10,63,790 | 5,59,181 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 41,48,040 | -37,115 | 33,18,093 |

| 26,000 | 43,86,980 | -25,26,030 | 29,79,908 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,35,86,690 | 87,38,730 | 39,91,397 |

| 26,100 | 79,70,105 | 58,14,770 | 25,00,347 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,35,86,690 | 87,38,730 | 39,91,397 |

| 26,100 | 79,70,105 | 58,14,770 | 25,00,347 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 31,460 | -3,315 | 337 |

| 27,100 | 7,215 | -455 | 28 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,35,86,690 | 87,38,730 | 39,91,397 |

| 26,100 | 79,70,105 | 58,14,770 | 25,00,347 |

NIFTY Monthly Expiry (27/01/2026)

The NIFTY index closed at 26129.6. The NIFTY monthly expiry for JANUARY 27, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.070 against previous 1.010. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26700CE option, with open interest additions also seen in the 25800PE and 25700PE options. On the other hand, open interest reductions were prominent in the 26500CE, 26000CE, and 26100CE options. Trading volume was highest in the 26000PE option, followed by the 26500CE and 26000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,129.60 | 1.070 | 1.010 | 0.997 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,66,54,540 | 3,65,99,550 | 54,990 |

| PUT: | 3,92,15,995 | 3,69,49,185 | 22,66,810 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 46,81,040 | 2,11,250 | 77,900 |

| 26,000 | 46,13,115 | -7,53,480 | 89,071 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 26,45,045 | 12,99,090 | 52,194 |

| 26,800 | 14,65,555 | 2,51,745 | 31,408 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 30,85,615 | -8,46,560 | 90,152 |

| 26,000 | 46,13,115 | -7,53,480 | 89,071 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 30,85,615 | -8,46,560 | 90,152 |

| 26,000 | 46,13,115 | -7,53,480 | 89,071 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 58,71,060 | 31,915 | 1,24,891 |

| 25,500 | 31,68,165 | -2,96,400 | 63,203 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 17,94,650 | 6,25,820 | 41,188 |

| 25,700 | 14,24,995 | 3,70,305 | 39,202 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 31,68,165 | -2,96,400 | 63,203 |

| 26,300 | 11,14,490 | -2,30,620 | 39,287 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 58,71,060 | 31,915 | 1,24,891 |

| 26,100 | 19,24,065 | -1,61,850 | 63,523 |

BANKNIFTY Monthly Expiry (27/01/2026)

The BANKNIFTY index closed at 59581.85. The BANKNIFTY monthly expiry for JANUARY 27, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.092 against previous 1.008. The 59500PE option holds the maximum open interest, followed by the 59500CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 59500PE option, with open interest additions also seen in the 59400PE and 62000CE options. On the other hand, open interest reductions were prominent in the 59100CE, 59000CE, and 61000CE options. Trading volume was highest in the 60000CE option, followed by the 59500PE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,581.85 | 1.092 | 1.008 | 0.873 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 87,80,130 | 70,88,280 | 16,91,850 |

| PUT: | 95,88,870 | 71,48,430 | 24,40,440 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,06,300 | 10,980 | 1,00,361 |

| 60,000 | 10,21,050 | 1,10,220 | 1,19,237 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 6,01,050 | 1,66,020 | 45,202 |

| 61,500 | 4,03,140 | 1,40,700 | 46,750 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,100 | 49,680 | -61,560 | 13,572 |

| 59,000 | 4,07,370 | -29,010 | 29,470 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 10,21,050 | 1,10,220 | 1,19,237 |

| 59,500 | 15,06,300 | 10,980 | 1,00,361 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 17,83,440 | 2,43,720 | 1,09,917 |

| 59,000 | 8,73,540 | 1,50,570 | 76,861 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 17,83,440 | 2,43,720 | 1,09,917 |

| 59,400 | 2,26,950 | 1,70,190 | 53,005 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 1,91,370 | -16,680 | 14,392 |

| 55,300 | 9,600 | -13,890 | 2,354 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 17,83,440 | 2,43,720 | 1,09,917 |

| 59,000 | 8,73,540 | 1,50,570 | 76,861 |

MIDCPNIFTY Monthly Expiry (27/01/2026)

The MIDCPNIFTY index closed at 13777.25. The MIDCPNIFTY monthly expiry for JANUARY 27, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.082 against previous 1.169. The 14000CE option holds the maximum open interest, followed by the 13000PE and 13500PE options. Market participants have shown increased interest with significant open interest additions in the 13800PE option, with open interest additions also seen in the 14400CE and 14000CE options. On the other hand, open interest reductions were prominent in the 66400CE, 66400CE, and 66400CE options. Trading volume was highest in the 14000CE option, followed by the 13800CE and 13700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,777.25 | 1.082 | 1.169 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 36,47,520 | 22,24,800 | 14,22,720 |

| PUT: | 39,45,120 | 25,99,800 | 13,45,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 5,88,240 | 2,07,960 | 17,160 |

| 14,500 | 4,28,880 | 2,04,840 | 9,063 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,400 | 2,51,760 | 2,34,960 | 7,484 |

| 14,000 | 5,88,240 | 2,07,960 | 17,160 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 57,240 | -70,320 | 2,638 |

| 13,500 | 1,03,320 | -46,080 | 3,155 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 5,88,240 | 2,07,960 | 17,160 |

| 13,800 | 4,14,720 | 1,93,680 | 15,946 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,79,960 | -1,03,200 | 10,431 |

| 13,500 | 5,45,040 | 43,680 | 10,387 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,43,040 | 3,12,000 | 14,968 |

| 13,300 | 3,13,080 | 1,86,840 | 6,163 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,79,960 | -1,03,200 | 10,431 |

| 14,000 | 1,68,840 | -12,120 | 2,527 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 3,27,000 | 1,13,280 | 14,983 |

| 13,800 | 4,43,040 | 3,12,000 | 14,968 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis screams 2026 bullish start: Fresh longs dominate combined futures across NIFTY, BANKNIFTY, MIDCPNIFTY while SENSEX covers—risk appetite roaring back.

Actionable New Year trades: Buy NIFTY/BANKNIFTY dips to 26,000 with 25,900 stops targeting 26,500; bull call spreads 26,100/26,400 perfect—momentum loves chasers.

Sector power: Load BANKNIFTY heaviest, rotate MIDCPNIFTY longs; skip SENSEX directionals till volume confirms.

January 2nd trigger: Volume explosion + OI continuation = 26,800 path clear; PCR spike above 1.4 = tactical pullback—ride the wave but trail profits tight!

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]