Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 2/01/2026

Table of Contents

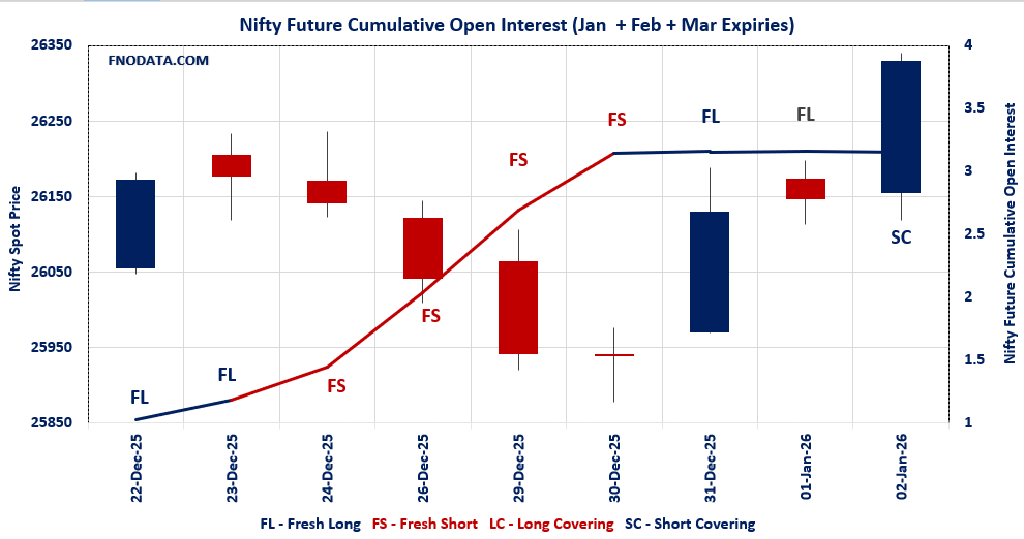

Markets powered higher today with NIFTY ripping 0.70% on explosive volume return, and this Open Interest Volume Analysis across combined futures (Jan+Feb+Mar) captures pure bullish fireworks—short covering in NIFTY meets aggressive fresh longs everywhere else as institutions vote confidence for Q1 rally.

NIFTY combined futures roar with short covering: -1.36% OI drop on +106% volume surge confirms bears folding fast, January leading unwind while February adds longs—momentum intact.

BANKNIFTY longs go ballistic: +5.70% combined OI explosion with volume doubling screams fresh positioning, February +13.19% seals banking leadership.

MIDCPNIFTY steals thunder: +16.35% combined OI blast on +161% volume marks midcaps surging back aggressively—January +16.63% is monster.

SENSEX flips bullish: +13.14% combined OI confirms fresh long conviction across benchmark.

PCR defensive but rallying: NIFTY weekly spikes to 1.668 yet price powers higher—max pain 26,300 suggests pinning potential amid put protection.

Premium decay fuels longs: Sharp theta bleed ignored by bulls piling in—classic strong hands signal.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26328.55 (0.696%)

Combined = January + February + March

Combined Fut Open Interest Change: -1.36%

Combined Fut Volume Change: 106.21%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 10% Previous 9%

NIFTY JANUARY Future closed at: 26455.4 (0.628%)

January Fut Premium 126.85 (Decreased by -17 points)

January Fut Open Interest Change: -2.15%

January Fut Volume Change: 104.64%

January Fut Open Interest Analysis: Short Covering

NIFTY FEBRUARY Future closed at: 26591.5 (0.585%)

February Fut Premium 262.95 (Decreased by -27.4 points)

February Fut Open Interest Change: 2.46%

February Fut Volume Change: 136.29%

February Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (6/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.668 (Increased from 1.122)

Put-Call Ratio (Volume): 0.903

Max Pain Level: 26300

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27900

Highest PUT Addition: 26300

NIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.067 (Increased from 1.040)

Put-Call Ratio (Volume): 1.139

Max Pain Level: 26200

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 26100

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60150.95 (0.736%)

Combined = January + February + March

Combined Fut Open Interest Change: 5.70%

Combined Fut Volume Change: 104.74%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 8% Previous 7%

BANKNIFTY JANUARY Future closed at: 60341 (0.643%)

January Fut Premium 190.05 (Decreased by -54 points)

January Fut Open Interest Change: 4.7%

January Fut Volume Change: 95.9%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY FEBRUARY Future closed at: 60691.2 (0.681%)

February Fut Premium 540.25 (Decreased by -29 points)

February Fut Open Interest Change: 13.19%

February Fut Volume Change: 271.35%

February Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.144 (Increased from 1.098)

Put-Call Ratio (Volume): 0.839

Max Pain Level: 59600

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59500

Highest CALL Addition: 60300

Highest PUT Addition: 60000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13984 (1.014%)

Combined = January + February + March

Combined Fut Open Interest Change: 16.35%

Combined Fut Volume Change: 161.17%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 3%

MIDCPNIFTY JANUARY Future closed at: 14065.15 (1.194%)

January Fut Premium81.15 (Increased by 25.6 points)

January Fut Open Interest Change: 16.63%

January Fut Volume Change: 165.14%

January Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY FEBRUARY Future closed at: 14131.95 (1.177%)

February Fut Premium147.95 (Increased by 24.05 points)

February Fut Open Interest Change: 3.52%

February Fut Volume Change: 86.96%

February Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.048 (Decreased from 1.157)

Put-Call Ratio (Volume): 0.841

Max Pain Level: 13900

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13800

Highest CALL Addition: 14000

Highest PUT Addition: 14000

SENSEX Monthly Expiry (29/01/2026) Future

SENSEX Spot closed at: 85,762.01 (0.673%)

SENSEX Monthly Future closed at: 86,206.70 (0.536%)

Premium: 444.69 (Decreased by -114.06 points)

Open Interest Change: 13.14%

Volume Change: 2.41%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (8/01/2026) Option Analysis

Put-Call Ratio (OI): 1.323 (Increased from 0.891)

Put-Call Ratio (Volume): 0.782

Max Pain Level: 85600

Maximum CALL OI: 87000

Maximum PUT OI: 83000

Highest CALL Addition: 87000

Highest PUT Addition: 85500

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 289.80 Cr.

DIIs Net BUY: ₹ 677.38 Cr.

FII Derivatives Activity

| FII Trading Stats | 2.01.26 | 1.01.26 | 31.12.25 |

| FII Cash (Provisional Data) | 289.8 | -3,268.60 | -3,597.38 |

| Index Future Open Interest Long Ratio | 11.41% | 9.43% | 8.86% |

| Index Future Volume Long Ratio | 72.05% | 59.15% | 46.12% |

| Call Option Open Interest Long Ratio | 54.05% | 50.85% | 50.93% |

| Call Option Volume Long Ratio | 50.48% | 50.01% | 50.49% |

| Put Option Open Interest Long Ratio | 56.65% | 61.52% | 62.84% |

| Put Option Volume Long Ratio | 49.51% | 49.75% | 49.93% |

| Stock Future Open Interest Long Ratio | 63.26% | 63.28% | 63.42% |

| Stock Future Volume Long Ratio | 50.11% | 47.84% | 54.22% |

| Index Futures | Short Covering | Fresh Long | Fresh Short |

| Index Options | Fresh Short | Fresh Short | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Fresh Short |

| Nifty Options | Fresh Short | Fresh Short | Fresh Long |

| BankNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Fresh Short |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Short Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Short | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (8/01/2026)

The SENSEX index closed at 85762.01. The SENSEX weekly expiry for JANUARY 8, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.323 against previous 0.891. The 83000PE option holds the maximum open interest, followed by the 85500PE and 87000CE options. Market participants have shown increased interest with significant open interest additions in the 85500PE option, with open interest additions also seen in the 83000PE and 87000CE options. On the other hand, open interest reductions were prominent in the 85300CE, 85200CE, and 85100CE options. Trading volume was highest in the 85500PE option, followed by the 85500CE and 85600CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 08-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85762.01 | 1.323 | 0.891 | 0.782 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 89,08,940 | 43,28,000 | 45,80,940 |

| PUT: | 1,17,84,200 | 38,57,580 | 79,26,620 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 7,00,280 | 4,75,000 | 69,03,900 |

| 87500 | 5,40,400 | 1,73,480 | 53,10,800 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 7,00,280 | 4,75,000 | 69,03,900 |

| 93000 | 4,05,660 | 4,04,540 | 12,23,740 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85300 | 93,040 | -1,72,460 | 65,99,040 |

| 85200 | 39,300 | -1,02,940 | 30,01,340 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 4,27,340 | -30,140 | 1,77,57,500 |

| 85600 | 1,94,700 | 90,600 | 1,71,74,500 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 9,57,300 | 5,43,260 | 43,43,260 |

| 85500 | 8,70,920 | 6,08,280 | 1,89,65,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 8,70,920 | 6,08,280 | 1,89,65,700 |

| 83000 | 9,57,300 | 5,43,260 | 43,43,260 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 700 | -40 | 40 |

| 91000 | 1,240 | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 8,70,920 | 6,08,280 | 1,89,65,700 |

| 85600 | 4,19,860 | 4,00,960 | 1,57,78,300 |

NIFTY Weekly Expiry (6/01/2026)

The NIFTY index closed at 26328.55. The NIFTY weekly expiry for JANUARY 6, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.668 against previous 1.122. The 26000PE option holds the maximum open interest, followed by the 26200PE and 26100PE options. Market participants have shown increased interest with significant open interest additions in the 26300PE option, with open interest additions also seen in the 26200PE and 26250PE options. On the other hand, open interest reductions were prominent in the 26200CE, 26150CE, and 26400CE options. Trading volume was highest in the 26300CE option, followed by the 26300PE and 26200PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 06-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,328.55 | 1.668 | 1.122 | 0.903 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,06,31,150 | 13,57,33,325 | -51,02,175 |

| PUT: | 21,79,18,480 | 15,22,45,080 | 6,56,73,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,20,48,595 | 18,19,025 | 7,49,552 |

| 26,500 | 1,16,50,860 | 30,36,540 | 36,10,886 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 43,82,885 | 33,67,260 | 1,28,583 |

| 26,500 | 1,16,50,860 | 30,36,540 | 36,10,886 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 37,25,865 | -85,82,405 | 43,87,922 |

| 26,150 | 11,88,135 | -45,26,340 | 15,92,474 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 82,58,900 | -11,61,745 | 73,45,358 |

| 26,250 | 26,85,930 | -23,81,405 | 46,50,550 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,76,86,565 | 25,21,220 | 18,71,859 |

| 26,200 | 1,59,65,365 | 1,09,12,135 | 50,00,192 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 1,32,95,685 | 1,15,62,590 | 52,17,279 |

| 26,200 | 1,59,65,365 | 1,09,12,135 | 50,00,192 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 38,05,230 | -23,23,685 | 8,76,154 |

| 25,100 | 25,58,270 | -15,21,585 | 3,30,410 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 1,32,95,685 | 1,15,62,590 | 52,17,279 |

| 26,200 | 1,59,65,365 | 1,09,12,135 | 50,00,192 |

NIFTY Monthly Expiry (27/01/2026)

The NIFTY index closed at 26328.55. The NIFTY monthly expiry for JANUARY 27, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.067 against previous 1.040. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26100PE option, with open interest additions also seen in the 26500CE and 26800CE options. On the other hand, open interest reductions were prominent in the 25500PE, 25800PE, and 26200CE options. Trading volume was highest in the 26000PE option, followed by the 26500CE and 27000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,328.55 | 1.067 | 1.040 | 1.139 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,91,92,920 | 3,80,57,110 | 11,35,810 |

| PUT: | 4,18,23,340 | 3,95,96,505 | 22,26,835 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 51,66,460 | 2,02,995 | 77,172 |

| 26,000 | 40,41,635 | -4,40,765 | 30,768 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 38,39,940 | 6,26,990 | 95,667 |

| 26,800 | 21,41,165 | 5,37,875 | 37,059 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 15,31,010 | -5,01,605 | 49,401 |

| 26,000 | 40,41,635 | -4,40,765 | 30,768 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 38,39,940 | 6,26,990 | 95,667 |

| 27,000 | 51,66,460 | 2,02,995 | 77,172 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 63,00,645 | 4,67,545 | 99,036 |

| 25,000 | 30,34,070 | 25,740 | 29,495 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 26,99,255 | 9,50,560 | 53,475 |

| 26,400 | 13,67,925 | 5,05,180 | 37,247 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 26,56,615 | -5,58,870 | 47,051 |

| 25,800 | 12,62,690 | -5,57,635 | 44,016 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 63,00,645 | 4,67,545 | 99,036 |

| 26,200 | 22,35,480 | 1,06,665 | 63,929 |

BANKNIFTY Monthly Expiry (27/01/2026)

The BANKNIFTY index closed at 60150.95. The BANKNIFTY monthly expiry for JANUARY 27, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.144 against previous 1.098. The 59500PE option holds the maximum open interest, followed by the 59500CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 60000PE option, with open interest additions also seen in the 59000PE and 60100PE options. On the other hand, open interest reductions were prominent in the 59700CE, 59000CE, and 59700PE options. Trading volume was highest in the 60000CE option, followed by the 60000PE and 60500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,150.95 | 1.144 | 1.098 | 0.839 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,05,10,440 | 94,91,550 | 10,18,890 |

| PUT: | 1,20,26,130 | 1,04,26,170 | 15,99,960 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 14,48,310 | -42,690 | 27,088 |

| 60,000 | 12,14,610 | -17,400 | 1,73,141 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,300 | 1,52,190 | 85,800 | 40,706 |

| 65,000 | 2,62,650 | 82,980 | 15,342 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,700 | 1,15,680 | -87,540 | 19,566 |

| 59,000 | 3,44,070 | -63,900 | 10,431 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,14,610 | -17,400 | 1,73,141 |

| 60,500 | 3,85,860 | 60,330 | 74,330 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,11,750 | 50,190 | 58,800 |

| 60,000 | 11,67,390 | 4,53,960 | 1,46,249 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 11,67,390 | 4,53,960 | 1,46,249 |

| 59,000 | 11,25,750 | 2,13,930 | 62,990 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,700 | 2,66,580 | -61,650 | 33,830 |

| 57,000 | 3,92,070 | -52,050 | 23,978 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 11,67,390 | 4,53,960 | 1,46,249 |

| 59,000 | 11,25,750 | 2,13,930 | 62,990 |

MIDCPNIFTY Monthly Expiry (27/01/2026)

The MIDCPNIFTY index closed at 13984. The MIDCPNIFTY monthly expiry for JANUARY 27, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.048 against previous 1.157. The 14000CE option holds the maximum open interest, followed by the 14500CE and 13800PE options. Market participants have shown increased interest with significant open interest additions in the 14000PE option, with open interest additions also seen in the 14000CE and 14200CE options. On the other hand, open interest reductions were prominent in the 69000CE, 58000CE, and 58000PE options. Trading volume was highest in the 14000CE option, followed by the 14300CE and 14500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,984.00 | 1.048 | 1.157 | 0.841 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 56,32,080 | 40,87,200 | 15,44,880 |

| PUT: | 59,00,280 | 47,27,880 | 11,72,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,90,880 | 2,90,280 | 19,886 |

| 14,500 | 6,54,960 | 1,22,760 | 14,820 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,90,880 | 2,90,280 | 19,886 |

| 14,200 | 5,01,240 | 2,70,480 | 12,687 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 3,42,840 | -70,920 | 4,000 |

| 13,700 | 2,07,600 | -37,680 | 1,022 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,90,880 | 2,90,280 | 19,886 |

| 14,300 | 2,36,400 | 87,240 | 16,350 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 6,04,920 | 75,960 | 7,410 |

| 13,000 | 5,81,280 | -38,880 | 6,680 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 5,38,680 | 3,42,840 | 14,315 |

| 13,900 | 2,97,000 | 2,01,600 | 10,283 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,24,920 | -1,07,520 | 13,842 |

| 12,800 | 3,00,120 | -54,120 | 2,911 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 5,38,680 | 3,42,840 | 14,315 |

| 13,500 | 4,24,920 | -1,07,520 | 13,842 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis verdict: Bulls stampeding higher: Short covering + fresh longs dominate combined books everywhere—2026 rally accelerating hard.

Actionable momentum trades: Buy NIFTY/BANKNIFTY pullbacks to 26,300/60,000 with 26,200/59,800 stops targeting 26,800/61,000—MIDCPNIFTY offers explosive alpha.

Sector rocket ships: Load midcaps/BANKS heaviest; trail SENSEX longs loosely—breadth perfect.

Monday trigger: Volume sustain + OI growth = 27,000 dream; PCR 1.8+ pullback signal—ride aggressively but book half profits at targets!

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]