Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 15/07/2025

Table of Contents

The Open Interest Volume Analysis for 15th July 2025 shows the market trying to shake off its recent weakness but still stuck in a battle zone. Nifty July futures closed at 25,265.60, up 0.39%, but with open interest drifting lower by 0.3% and volume down 18%, signaling more of a short-covering bounce than a strong new trend. The premium narrowed further, and weekly option data shows the Put-Call Ratio (OI) climbing to 0.76 from dangerously oversold levels, thanks to heavy put additions at 25,200. Max pain for the weekly expiry has shifted slightly upward to 25,200—which is also where the highest put open interest sits, making this zone the market’s latest center of gravity. On the monthly front, the PCR has nudged above 1 for the first time in days, but with the highest call and put additions both at 25,200, traders are clearly jockeying for position around the same range. BankNifty also participated in the bounce, with a 0.4% future gain and a healthy 3% OI add, while new open interest at 56,500+ hints at selective risk-taking ahead of results season.

MIDCPNIFTY and FINNIFTY reflected sectoral divergence—midcaps led by a 1.3% spot rally, while FINNIFTY wound up just 0.45% higher but with rising OI and a still-cautious 0.86 PCR, showing that financial traders prefer hedged bets for now. SENSEX futures soared in both open interest (+44.8%) and volume (+182%), but all major indices still saw premium contraction, a sign that traders remain wary of chasing the market higher without seeing a clear breakout first.

NSE & BSE F&O Market Signals

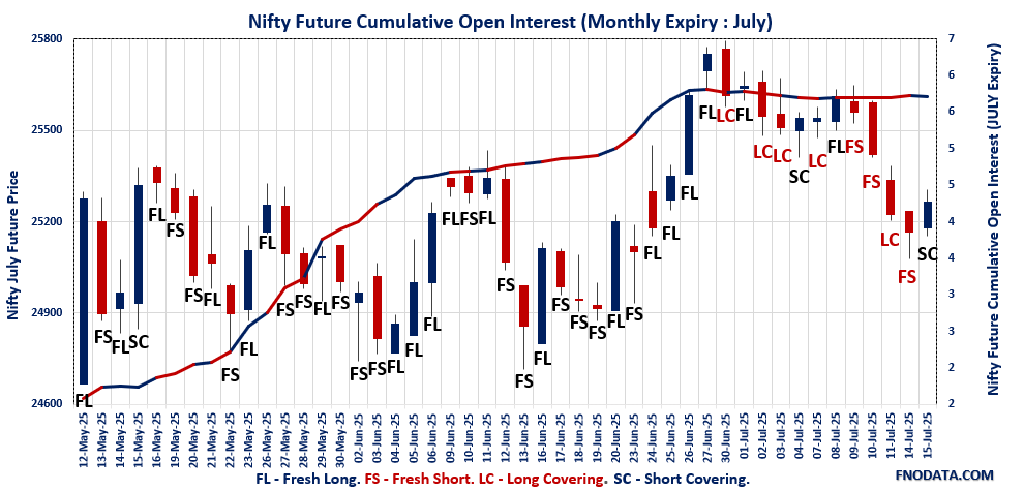

NIFTY JULY Future

NIFTY Spot closed at: 25,195.80 (0.45%)

NIFTY JULY Future closed at: 25,265.60 (0.39%)

Premium: 69.8 (Decreased by -15.4 points)

Open Interest Change: -0.3%

Volume Change: -18.0%

NIFTY Weekly Expiry (17/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.760 (Increased from 0.542)

Put-Call Ratio (Volume): 0.805

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 25200

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.024 (Increased from 1.018)

Put-Call Ratio (Volume): 0.897

Max Pain Level: 25250

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25200

Highest PUT Addition: 25200

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 57,006.65 (0.43%)

BANKNIFTY JULY Future closed at: 57,232.60 (0.40%)

Premium: 225.95 (Decreased by -11.3 points)

Open Interest Change: 3.0%

Volume Change: 25.6%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.846 (Increased from 0.810)

Put-Call Ratio (Volume): 0.805

Max Pain Level: 56800

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 58500

Highest PUT Addition: 56500

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,928.95 (0.47%)

FINNIFTY JULY Future closed at: 27,032.40 (0.45%)

Premium: 103.45 (Decreased by -5.5 points)

Open Interest Change: 1.8%

Volume Change: 3.8%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.863 (Increased from 0.745)

Put-Call Ratio (Volume): 1.090

Max Pain Level: 27000

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27600

Highest PUT Addition: 26900

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,342.05 (1.31%)

MIDCPNIFTY JULY Future closed at: 13,380.10 (1.27%)

Premium: 38.05 (Decreased by -4.7 points)

Open Interest Change: 0.1%

Volume Change: -24.7%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.925 (Increased from 0.817)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 13300

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14200

Highest PUT Addition: 13300

SENSEX Weekly Expiry (22/07/2025) Future

SENSEX Spot closed at: 82,570.91 (0.39%)

SENSEX Weekly Future closed at: 82,707.95 (0.30%)

Premium: 137.04 (Decreased by -67.05 points)

Open Interest Change: 44.8%

Volume Change: 182.7%

SENSEX Weekly Expiry (22/07/2025) Option Analysis

Put-Call Ratio (OI): 0.857 (Increased from 0.779)

Put-Call Ratio (Volume): 0.798

Max Pain Level: 82500

Maximum CALL OI: 82500

Maximum PUT OI: 82500

Highest CALL Addition: 82500

Highest PUT Addition: 82500

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 120.47 Cr

DIIs Net BUY: ₹ 1,555.03 Cr

FII Derivatives Activity

| FII Trading Stats | 15.07.25 | 14.07.25 | 11.07.25 |

| FII Cash (Provisional Data) | 120.47 | -1,614.32 | -5,104.22 |

| Index Future Open Interest Long Ratio | 18.67% | 18.31% | 20.22% |

| Index Future Volume Long Ratio | 48.54% | 31.76% | 29.02% |

| Call Option Open Interest Long Ratio | 50.42% | 48.90% | 50.63% |

| Call Option Volume Long Ratio | 50.27% | 49.65% | 49.43% |

| Put Option Open Interest Long Ratio | 59.71% | 60.11% | 62.13% |

| Put Option Volume Long Ratio | 50.01% | 49.63% | 50.27% |

| Stock Future Open Interest Long Ratio | 62.88% | 62.87% | 62.92% |

| Stock Future Volume Long Ratio | 50.29% | 50.00% | 47.10% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Short | Fresh Short | Short Covering |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Long | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Short | Short Covering | Fresh Long |

| Stock Futures | Fresh Long | Fresh Short | Long Covering |

| Stock Options | Fresh Short | Short Covering | Short Covering |

NSE & BSE Option market Trends : Options Insights

NIFTY weekly Expiry (17/07/2025)

The NIFTY index closed at 25195.8. The NIFTY weekly expiry for JULY 17, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.760 against previous 0.542. The 26000CE option holds the maximum open interest, followed by the 25500CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25200PE option, with open interest additions also seen in the 25100PE and 25150PE options. On the other hand, open interest reductions were prominent in the 25100CE, 25800CE, and 26500CE options. Trading volume was highest in the 25200CE option, followed by the 25200PE and 25100PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 17-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,195.80 | 0.760 | 0.542 | 0.805 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,55,59,725 | 18,18,96,600 | -1,63,36,875 |

| PUT: | 12,58,64,925 | 9,85,64,850 | 2,73,00,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,24,56,375 | 13,92,150 | 9,99,703 |

| 25,500 | 1,18,39,725 | -5,80,725 | 17,60,060 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,24,56,375 | 13,92,150 | 9,99,703 |

| 25,200 | 97,36,350 | 8,72,100 | 42,27,434 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 28,81,575 | -27,93,225 | 23,39,162 |

| 25,800 | 61,58,025 | -23,60,250 | 11,48,194 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 97,36,350 | 8,72,100 | 42,27,434 |

| 25,300 | 85,65,150 | -14,23,425 | 28,79,771 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,05,05,550 | 18,69,375 | 21,42,686 |

| 25,200 | 89,82,825 | 57,96,975 | 34,13,762 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 89,82,825 | 57,96,975 | 34,13,762 |

| 25,100 | 84,89,475 | 37,04,850 | 31,83,370 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 62,36,100 | -13,71,375 | 4,40,339 |

| 24,100 | 11,14,500 | -10,86,825 | 1,78,126 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 89,82,825 | 57,96,975 | 34,13,762 |

| 25,100 | 84,89,475 | 37,04,850 | 31,83,370 |

SENSEX weekly Expiry (15/07/2025)

The SENSEX index closed at 82570.91. The SENSEX weekly expiry for JULY 22, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.857 against previous 0.779. The 82500PE option holds the maximum open interest, followed by the 82500CE and 85000CE options. Market participants have shown increased interest with significant open interest additions in the 82500PE option, with open interest additions also seen in the 82500CE and 85000CE options. On the other hand, open interest reductions were prominent in the 82200CE, 89900CE, and 81100CE options. Trading volume was highest in the 82500PE option, followed by the 82500CE and 85000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 22-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82570.91 | 0.857 | 0.779 | 0.798 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 27,31,340 | 7,78,869 | 19,52,471 |

| PUT: | 23,40,700 | 6,06,420 | 17,34,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,13,260 | 2,48,220 | 15,77,280 |

| 85000 | 2,98,760 | 2,15,360 | 10,72,620 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,13,260 | 2,48,220 | 15,77,280 |

| 85000 | 2,98,760 | 2,15,360 | 10,72,620 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82200 | 8,540 | -680 | 71,240 |

| 89900 | 1,920 | -640 | 3,940 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,13,260 | 2,48,220 | 15,77,280 |

| 85000 | 2,98,760 | 2,15,360 | 10,72,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 4,10,580 | 3,44,380 | 16,97,620 |

| 80000 | 2,22,660 | 1,56,860 | 7,93,340 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 4,10,580 | 3,44,380 | 16,97,620 |

| 80000 | 2,22,660 | 1,56,860 | 7,93,340 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83600 | 12,060 | -20 | 4,420 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 4,10,580 | 3,44,380 | 16,97,620 |

| 81000 | 1,88,980 | 1,24,720 | 8,36,720 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25195.8. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.024 against previous 1.018. The 25000PE option holds the maximum open interest, followed by the 25500CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25200PE option, with open interest additions also seen in the 25200CE and 24400PE options. On the other hand, open interest reductions were prominent in the 25500CE, 25000CE, and 24500PE options. Trading volume was highest in the 25000PE option, followed by the 25500CE and 26000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,195.80 | 1.024 | 1.018 | 0.897 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,32,93,825 | 4,40,33,100 | -7,39,275 |

| PUT: | 4,43,30,925 | 4,48,24,350 | -4,93,425 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,52,150 | -3,16,725 | 74,926 |

| 26,000 | 47,28,225 | 84,375 | 57,478 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 13,80,375 | 2,44,050 | 56,515 |

| 26,000 | 47,28,225 | 84,375 | 57,478 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,52,150 | -3,16,725 | 74,926 |

| 25,000 | 33,38,100 | -3,13,425 | 35,589 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,52,150 | -3,16,725 | 74,926 |

| 26,000 | 47,28,225 | 84,375 | 57,478 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,91,750 | -1,62,375 | 77,595 |

| 24,500 | 31,42,125 | -2,99,700 | 41,899 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 15,11,100 | 2,78,850 | 52,535 |

| 24,400 | 8,72,550 | 1,00,500 | 13,449 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 31,42,125 | -2,99,700 | 41,899 |

| 24,800 | 17,84,025 | -2,08,350 | 27,117 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,91,750 | -1,62,375 | 77,595 |

| 25,200 | 15,11,100 | 2,78,850 | 52,535 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 57006.65. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.846 against previous 0.810. The 56000PE option holds the maximum open interest, followed by the 56000CE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 58500CE option, with open interest additions also seen in the 56500PE and 46000PE options. On the other hand, open interest reductions were prominent in the 59000CE, 62000CE, and 56800CE options. Trading volume was highest in the 57000CE option, followed by the 57000PE and 57500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,006.65 | 0.846 | 0.810 | 0.805 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,70,99,460 | 1,72,35,409 | -1,35,949 |

| PUT: | 1,44,58,920 | 1,39,64,055 | 4,94,865 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,76,760 | -7,105 | 10,023 |

| 57,000 | 12,34,870 | -49,000 | 1,68,773 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 6,44,245 | 1,20,750 | 42,861 |

| 57,100 | 3,10,205 | 88,060 | 71,668 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 9,25,400 | -1,48,295 | 47,666 |

| 62,000 | 4,30,535 | -1,03,670 | 17,986 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,34,870 | -49,000 | 1,68,773 |

| 57,500 | 9,96,590 | -61,600 | 74,106 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 22,36,430 | 60,795 | 57,122 |

| 57,000 | 11,62,315 | 33,320 | 1,53,497 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 7,78,540 | 1,13,365 | 60,304 |

| 46,000 | 6,17,645 | 1,09,305 | 15,275 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,800 | 33,040 | -49,070 | 5,298 |

| 55,500 | 4,57,940 | -47,495 | 29,368 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 11,62,315 | 33,320 | 1,53,497 |

| 57,100 | 1,66,740 | 53,130 | 64,068 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26928.95. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.863 against previous 0.745. The 28000CE option holds the maximum open interest, followed by the 28500CE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 26900PE option, with open interest additions also seen in the 26700PE and 27000PE options. On the other hand, open interest reductions were prominent in the 28500CE, 26300PE, and 28200CE options. Trading volume was highest in the 26900PE option, followed by the 26700PE and 27000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,928.95 | 0.863 | 0.745 | 1.090 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,39,415 | 10,34,475 | 4,940 |

| PUT: | 8,96,870 | 7,70,185 | 1,26,685 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 1,13,425 | 8,775 | 1,339 |

| 28,500 | 1,10,955 | -28,145 | 953 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 19,825 | 12,805 | 572 |

| 26,900 | 33,865 | 8,970 | 3,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,500 | 1,10,955 | -28,145 | 953 |

| 28,200 | 14,105 | -8,385 | 353 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 92,885 | 8,060 | 4,169 |

| 27,500 | 1,01,725 | -975 | 3,227 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 82,940 | 17,290 | 680 |

| 27,000 | 65,260 | 19,435 | 2,099 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 54,600 | 38,675 | 5,628 |

| 26,700 | 51,220 | 33,605 | 4,557 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 23,465 | -9,360 | 283 |

| 27,050 | 4,550 | -7,215 | 340 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 54,600 | 38,675 | 5,628 |

| 26,700 | 51,220 | 33,605 | 4,557 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13342.05. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.925 against previous 0.817. The 14000CE option holds the maximum open interest, followed by the 14500CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13300PE option, with open interest additions also seen in the 13200PE and 12800PE options. On the other hand, open interest reductions were prominent in the 68400PE, 66000PE, and 69100PE options. Trading volume was highest in the 13300CE option, followed by the 13500CE and 13200CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,342.05 | 0.925 | 0.817 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 72,89,380 | 77,02,800 | -4,13,420 |

| PUT: | 67,41,000 | 62,96,640 | 4,44,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 10,67,500 | -45,220 | 6,085 |

| 14,500 | 8,06,820 | -2,240 | 2,188 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,200 | 4,03,620 | 48,300 | 1,367 |

| 14,300 | 50,540 | 44,940 | 611 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 7,96,180 | -1,38,600 | 13,871 |

| 13,200 | 1,88,300 | -1,00,660 | 13,224 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 2,55,500 | -420 | 18,050 |

| 13,500 | 7,96,180 | -1,38,600 | 13,871 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,89,920 | -44,520 | 11,580 |

| 12,500 | 5,15,900 | -34,160 | 6,430 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 3,92,980 | 1,97,400 | 10,242 |

| 13,200 | 3,25,500 | 1,16,200 | 13,053 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,75,660 | -69,440 | 4,845 |

| 12,200 | 1,47,560 | -54,460 | 2,052 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 3,25,500 | 1,16,200 | 13,053 |

| 13,000 | 6,89,920 | -44,520 | 11,580 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis highlights a market at an inflection point. For Nifty, the 25,200–25,265 zone is the battleground: max pain, heaviest OI change, and biggest call and put additions are all converging here. If Nifty can decisively hold above 25,200, we could see a squeeze up to 25,400–25,500 where stacked call writers could be forced to cover. On the flip side, a rejection at 25,265 or sharp move below 25,200 may trigger another round of profit-booking and a retest of 25,000—where the put wall remains intact.

For actionable trades, consider neutral or range-bound strategies like iron condors or short straddles around 25,200 until a clear breakout emerges. If momentum builds, traders can look for quick moves above 25,300 for upside targets or below 25,170 for downside. In BankNifty, eyes should stay on the 56,800–57,300 range: a break above 57,300 could open up the 58,000 level, while strong put additions at 56,500 reaffirm it as support. Keep monitoring sector leaders—midcap OI uptick and SENSEX’s surging activity suggest that any upside move could be led by broader participation.

As the week unfolds, this Open Interest Volume Analysis will be invaluable for navigating the next move. Staying nimble, focusing on max pain pivots, and watching for sudden OI changes across indices remain your best edge in the current environment.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]