Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 14/01/2026

Table of Contents

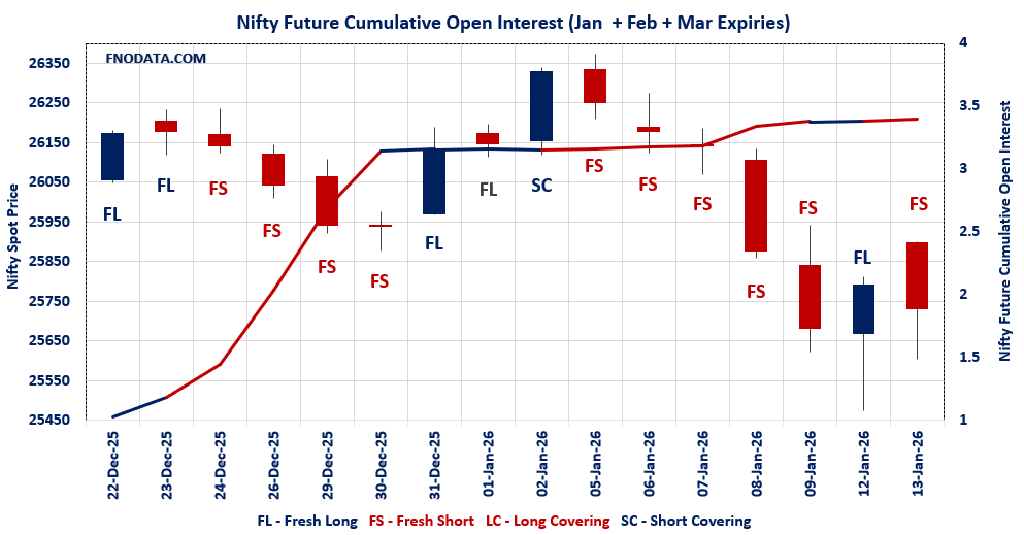

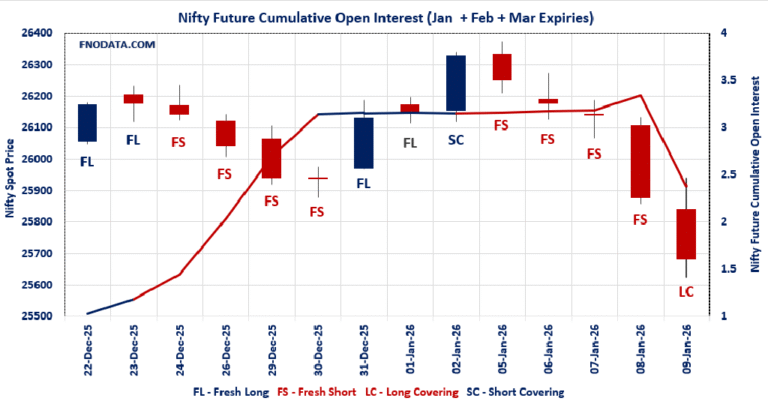

Hey traders, kicking off our Open Interest Volume Analysis for January 14, 2026, we’ve got mixed signals across indices where NIFTY’s combined futures show fresh shorts amid a 0.21% OI bump but sharp -18.03% volume drop—classic sign of bears piling in cautiously after spot’s 0.259% dip to 25665.6, hinting at downside pressure unless volume rebounds.

BANKNIFTY bucks the trend with bullish combined fresh longs (1.02% OI rise, -14.31% volume), spot flat at 59580.15, screaming potential upside if that premium buildup holds—perfect setup for directional plays.

FINNIFTY and MIDCPNIFTY lean covering (OI down -2.4% and -0.40%), high volume in FIN (35.8%) points to profit-taking, while SENSEX combined fresh shorts (8.03% OI) warn of broader caution—let’s unpack what this Open Interest Volume Analysis means for your Tuesday open.

NIFTY Combined (Jan+Feb+Mar): Fresh short build with tiny 0.21% OI gain but brutal -18.03% volume crash screams low conviction bears—spot down 0.259%, Jan rollover at 12% (up from 11%) shows weak hands exiting; reasoning: falling volume + fresh shorts = potential trap for shorts if spot holds 25600 support. Actionable: Avoid fresh shorts, eye 25700 PCR OI support for intraday calls, trail stops below 25500.

BANKNIFTY Combined: Bullish fresh longs shining at 1.02% OI increase despite -14.31% volume dip—spot steady (0.002%), rollover dip to 14% signals confident holders rolling up; reasoning: Premiums exploding (Jan +24pts) amid long build means bulls control, volume fade just digestion. Actionable: Go long futures above 59700, target 60200; options—buy 60000CE if PCR OI climbs past 0.90.

MIDCPNIFTY Combined: Short covering (-0.40% OI, -28.27% volume)—spot up 0.415%, steady 6% rollover; reasoning: Premium decay (Jan -6pts) + covering = bulls testing but fading fast, low volume confirms no follow-through. Actionable: Scalp longs to 13800 max pain, but square off quick—avoid holds with Feb fresh longs (5.89% OI) signaling rotation risk.

SENSEX Monthly: Fresh shorts ramping 8.03% OI with -5.24% volume—spot -0.293%, premium crush -36pts; reasoning: Mirrors NIFTY caution, low volume means big players positioning quietly for weekly expiry pain at 83600. Actionable: Short bias, target 83200 if 83400 breaks; pair with NIFTY for hedged downside.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25665.6 (-0.259%)

Combined = January + February + March

Combined Fut Open Interest Change: 0.21%

Combined Fut Volume Change: -18.03%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 12% Previous 11%

NIFTY JANUARY Future closed at: 25719 (-0.278%)

January Fut Premium 53.4 (Decreased by -5.1 points)

January Fut Open Interest Change: -0.09%

January Fut Volume Change: -19.23%

January Fut Open Interest Analysis: Long Covering

NIFTY FEBRUARY Future closed at: 25867.9 (-0.229%)

February Fut Premium 202.3 (Increased by 7.3 points)

February Fut Open Interest Change: 2.10%

February Fut Volume Change: -10.31%

February Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (20/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.680 (Increased from 0.661)

Put-Call Ratio (Volume): 0.920

Max Pain Level: 25700

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 26000

Highest PUT Addition: 24500

NIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.821 (Decreased from 0.875)

Put-Call Ratio (Volume): 0.837

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59580.15 (0.002%)

Combined = January + February + March

Combined Fut Open Interest Change: 1.02%

Combined Fut Volume Change: -14.31%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 14% Previous 15%

BANKNIFTY JANUARY Future closed at: 59780.6 (0.043%)

January Fut Premium 200.45 (Increased by 24.05 points)

January Fut Open Interest Change: 1.4%

January Fut Volume Change: -15.1%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY FEBRUARY Future closed at: 60108.2 (0.041%)

February Fut Premium 528.05 (Increased by 23.25 points)

February Fut Open Interest Change: -1.16%

February Fut Volume Change: 1.58%

February Fut Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.899 (Increased from 0.889)

Put-Call Ratio (Volume): 0.935

Max Pain Level: 59500

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59500

Highest CALL Addition: 60700

Highest PUT Addition: 59100

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13705.9 (0.415%)

Combined = January + February + March

Combined Fut Open Interest Change: -0.40%

Combined Fut Volume Change: -28.27%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 6% Previous 6%

MIDCPNIFTY JANUARY Future closed at: 13722.05 (0.369%)

January Fut Premium 16.15 (Decreased by -6.25 points)

January Fut Open Interest Change: -0.70%

January Fut Volume Change: -26.82%

January Fut Open Interest Analysis: Short Covering

MIDCPNIFTY FEBRUARY Future closed at: 13781.25 (0.350%)

February Fut Premium 75.35 (Decreased by -8.6 points)

February Fut Open Interest Change: 5.89%

February Fut Volume Change: -44.37%

February Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (27/01/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.842 (Increased from 0.739)

Put-Call Ratio (Volume): 0.788

Max Pain Level: 13800

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14300

Highest PUT Addition: 13100

SENSEX Monthly Expiry (29/01/2026) Future

SENSEX Spot closed at: 83,382.71 (-0.293%)

SENSEX Monthly Future closed at: 83,683.50 (-0.335%)

Premium: 300.79 (Decreased by -35.97 points)

Open Interest Change: 8.03%

Volume Change: -5.24%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (8/01/2026) Option Analysis

Put-Call Ratio (OI): 0.731 (Decreased from 0.793)

Put-Call Ratio (Volume): 1.006

Max Pain Level: 83600

Maximum CALL OI: 86000

Maximum PUT OI: 81000

Highest CALL Addition: 86000

Highest PUT Addition: 83500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,781.24 Cr.

DIIs Net BUY: ₹ 5,217.28 Cr.

FII Derivatives Activity

| FII Trading Stats | 14.01.26 | 13.01.26 | 12.01.26 |

| FII Cash (Provisional Data) | -4,781.24 | -1,499.81 | -3,638.40 |

| Index Future Open Interest Long Ratio | 7.60% | 7.54% | 7.78% |

| Index Future Volume Long Ratio | 47.93% | 44.77% | 45.78% |

| Call Option Open Interest Long Ratio | 47.75% | 48.16% | 49.80% |

| Call Option Volume Long Ratio | 49.83% | 49.92% | 50.05% |

| Put Option Open Interest Long Ratio | 61.47% | 64.85% | 58.82% |

| Put Option Volume Long Ratio | 49.91% | 49.99% | 49.92% |

| Stock Future Open Interest Long Ratio | 61.46% | 61.47% | 61.82% |

| Stock Future Volume Long Ratio | 50.43% | 47.29% | 55.13% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Long Covering | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Long Covering | Fresh Long |

| BankNifty Futures | Short Covering | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Short | Fresh Short |

| FinNifty Options | Fresh Short | Short Covering | Short Covering |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Short Covering | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Fresh Short | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (22/01/2026)

The SENSEX index closed at 83382.71. The SENSEX weekly expiry for JANUARY 22, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.731 against previous 0.793. The 86000CE option holds the maximum open interest, followed by the 87000CE and 83500CE options. Market participants have shown increased interest with significant open interest additions in the 86000CE option, with open interest additions also seen in the 83500CE and 87000CE options. On the other hand, open interest reductions were prominent in the 85200PE, 82300CE, and 77000CE options. Trading volume was highest in the 83500PE option, followed by the 83500CE and 82000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 22-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83382.71 | 0.731 | 0.793 | 1.006 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 46,45,160 | 15,63,420 | 30,81,740 |

| PUT: | 33,96,560 | 12,39,360 | 21,57,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 4,65,080 | 3,59,040 | 17,48,300 |

| 87000 | 3,98,420 | 2,49,120 | 12,64,940 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 4,65,080 | 3,59,040 | 17,48,300 |

| 83500 | 3,47,460 | 2,96,180 | 25,44,980 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82300 | 520 | -40 | 1,140 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 3,47,460 | 2,96,180 | 25,44,980 |

| 84000 | 3,38,980 | 93,300 | 23,29,780 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 2,77,840 | 1,83,880 | 12,08,720 |

| 80000 | 2,73,200 | 1,74,980 | 12,65,300 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 2,67,380 | 1,91,580 | 31,78,280 |

| 81000 | 2,77,840 | 1,83,880 | 12,08,720 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85200 | 1,120 | -60 | 1,360 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 2,67,380 | 1,91,580 | 31,78,280 |

| 82000 | 1,72,700 | 65,900 | 24,08,560 |

NIFTY Weekly Expiry (20/01/2026)

The NIFTY index closed at 25665.6. The NIFTY weekly expiry for JANUARY 20, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.680 against previous 0.661. The 26000CE option holds the maximum open interest, followed by the 27000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 24500PE and 25000PE options. On the other hand, open interest reductions were prominent in the 27700CE, 27300CE, and 25950PE options. Trading volume was highest in the 25700PE option, followed by the 25700CE and 25800CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 20-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,665.60 | 0.680 | 0.661 | 0.920 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,50,90,725 | 9,02,36,770 | 5,48,53,955 |

| PUT: | 9,85,96,160 | 5,96,61,680 | 3,89,34,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,27,65,350 | 56,37,255 | 25,01,347 |

| 27,000 | 95,23,670 | 26,09,685 | 5,25,936 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,27,65,350 | 56,37,255 | 25,01,347 |

| 26,400 | 60,76,720 | 36,04,510 | 7,34,769 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 8,28,620 | -2,33,480 | 59,735 |

| 27,300 | 20,68,625 | -68,510 | 1,25,023 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 62,36,880 | 29,07,515 | 39,62,091 |

| 25,800 | 86,57,090 | 29,76,025 | 36,90,808 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 89,45,170 | 48,87,870 | 4,73,004 |

| 25,000 | 77,05,100 | 37,34,770 | 6,98,763 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 89,45,170 | 48,87,870 | 4,73,004 |

| 25,000 | 77,05,100 | 37,34,770 | 6,98,763 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,950 | 2,09,040 | -66,560 | 83,593 |

| 26,200 | 9,70,190 | -64,480 | 15,356 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 43,79,115 | 10,42,145 | 50,26,342 |

| 25,600 | 45,69,305 | 17,10,865 | 32,17,130 |

NIFTY Monthly Expiry (27/01/2026)

The NIFTY index closed at 25665.6. The NIFTY monthly expiry for JANUARY 27, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.821 against previous 0.875. The 26000CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25800CE and 25700CE options. On the other hand, open interest reductions were prominent in the 27800CE, 26400PE, and 26200PE options. Trading volume was highest in the 26000CE option, followed by the 25700PE and 25500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,665.60 | 0.821 | 0.875 | 0.837 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,20,40,355 | 5,51,89,030 | 68,51,325 |

| PUT: | 5,09,47,910 | 4,82,82,260 | 26,65,650 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,89,590 | 11,69,415 | 2,57,767 |

| 27,000 | 57,06,675 | -15,925 | 59,874 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,89,590 | 11,69,415 | 2,57,767 |

| 25,800 | 25,02,630 | 7,20,265 | 1,66,511 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 4,50,385 | -1,50,540 | 10,960 |

| 27,300 | 4,12,230 | -37,440 | 7,849 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,89,590 | 11,69,415 | 2,57,767 |

| 25,800 | 25,02,630 | 7,20,265 | 1,66,511 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,26,850 | -14,105 | 56,025 |

| 25,000 | 41,03,125 | 1,24,995 | 97,906 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 25,42,280 | 5,49,185 | 1,86,403 |

| 25,800 | 25,19,855 | 3,71,930 | 1,45,885 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 6,38,235 | -82,615 | 2,871 |

| 26,200 | 21,39,475 | -57,070 | 8,430 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 25,42,280 | 5,49,185 | 1,86,403 |

| 25,500 | 30,99,590 | 5,135 | 1,80,553 |

BANKNIFTY Monthly Expiry (27/01/2026)

The BANKNIFTY index closed at 59580.15. The BANKNIFTY monthly expiry for JANUARY 27, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.899 against previous 0.889. The 59500PE option holds the maximum open interest, followed by the 59500CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 60700CE option, with open interest additions also seen in the 59100PE and 60100CE options. On the other hand, open interest reductions were prominent in the 60000CE, 58000PE, and 59500CE options. Trading volume was highest in the 59500PE option, followed by the 59500CE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,580.15 | 0.899 | 0.889 | 0.935 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,39,49,280 | 1,36,61,190 | 2,88,090 |

| PUT: | 1,25,47,350 | 1,21,44,660 | 4,02,690 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,83,310 | -33,870 | 1,63,012 |

| 60,000 | 14,84,010 | -1,06,710 | 1,49,834 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,700 | 3,03,120 | 1,60,140 | 28,292 |

| 60,100 | 3,38,340 | 1,21,680 | 40,485 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,84,010 | -1,06,710 | 1,49,834 |

| 59,500 | 15,83,310 | -33,870 | 1,63,012 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,83,310 | -33,870 | 1,63,012 |

| 60,000 | 14,84,010 | -1,06,710 | 1,49,834 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,16,820 | 32,580 | 2,16,982 |

| 59,000 | 9,84,210 | -23,670 | 1,04,315 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,100 | 2,92,200 | 1,27,740 | 32,754 |

| 59,800 | 2,70,780 | 87,270 | 67,159 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 7,11,450 | -56,820 | 38,502 |

| 57,500 | 4,68,510 | -28,590 | 28,789 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 19,16,820 | 32,580 | 2,16,982 |

| 59,600 | 2,24,250 | 10,320 | 1,39,045 |

MIDCPNIFTY Monthly Expiry (27/01/2026)

The MIDCPNIFTY index closed at 13705.9. The MIDCPNIFTY monthly expiry for JANUARY 27, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.842 against previous 0.739. The 14000CE option holds the maximum open interest, followed by the 14500CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 14300CE option, with open interest additions also seen in the 13100PE and 13700PE options. On the other hand, open interest reductions were prominent in the 68500CE, 69000PE, and 69500CE options. Trading volume was highest in the 14000CE option, followed by the 13700PE and 13700CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,705.90 | 0.842 | 0.739 | 0.788 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 99,81,600 | 1,01,86,080 | -2,04,480 |

| PUT: | 84,08,520 | 75,31,320 | 8,77,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 13,91,520 | -27,600 | 41,961 |

| 14,500 | 10,87,440 | -1,50,120 | 8,650 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 5,51,520 | 2,22,600 | 9,703 |

| 13,700 | 6,11,640 | 80,160 | 22,794 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,87,440 | -1,50,120 | 8,650 |

| 13,800 | 4,59,120 | -1,24,920 | 17,214 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 13,91,520 | -27,600 | 41,961 |

| 13,700 | 6,11,640 | 80,160 | 22,794 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 9,62,880 | 90,840 | 16,555 |

| 13,500 | 6,22,080 | 13,800 | 13,169 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 5,46,480 | 2,14,440 | 7,537 |

| 13,700 | 5,69,760 | 1,53,480 | 24,010 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,58,520 | -11,040 | 11,811 |

| 13,850 | 46,560 | -5,760 | 121 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 5,69,760 | 1,53,480 | 24,010 |

| 13,000 | 9,62,880 | 90,840 | 16,555 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Wrapping this Open Interest Volume Analysis, NIFTY and SENSEX combined fresh shorts with volume crashes yell caution—stay nimble, favor BANKNIFTY longs where OI strength shines amid flat spot, but FIN/MIDCP covering warns of whipsaws; overall market’s rotating to banks, so actionable edge: Load BANKNIFTY calls above 59700, hedge NIFTY with 25700P, and trail everything tight for weekly expiry fireworks on Jan 20.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]