Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 4/02/2026

Table of Contents

The Open Interest Volume Analysis for 4th February 2026 clearly highlights a pause-and-build market structure rather than an aggressive trending phase, despite indices closing in the green.

NIFTY, MIDCPNIFTY, and SENSEX show a classic short-covering-led recovery, confirmed by declining futures open interest alongside sharply lower volumes, indicating that the upside is driven more by risk reduction from shorts than fresh conviction buying.

In contrast, BANKNIFTY stands out as the relative strength leader, where rising open interest with falling volumes signals positional long build-up, suggesting institutions are selectively allocating capital into banking names ahead of expiry.

The options data reinforces this cautious optimism—PCR improvement across weekly and monthly expiries reflects gradual sentiment repair, but max pain clustering near current spot levels suggests that markets are still range-bound and expiry-sensitive.

Overall, this Open Interest Volume Analysis sets the tone for a selective, stock- and sector-driven approach, where traders must focus on who is building positions and who is exiting, rather than blindly following index movement.

NSE & BSE F&O Market Signals

NIFTY Future analysis

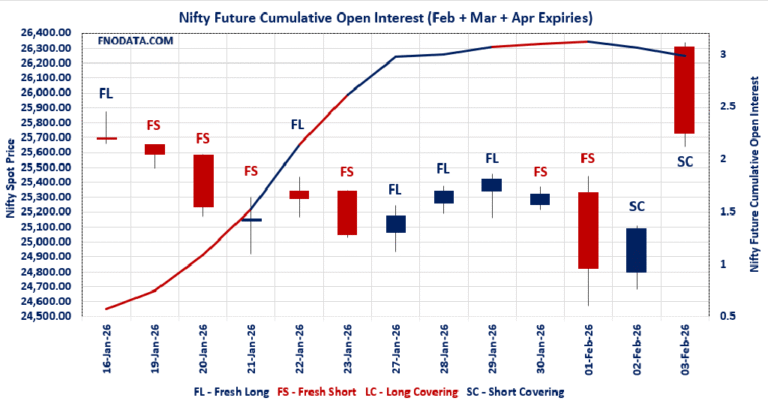

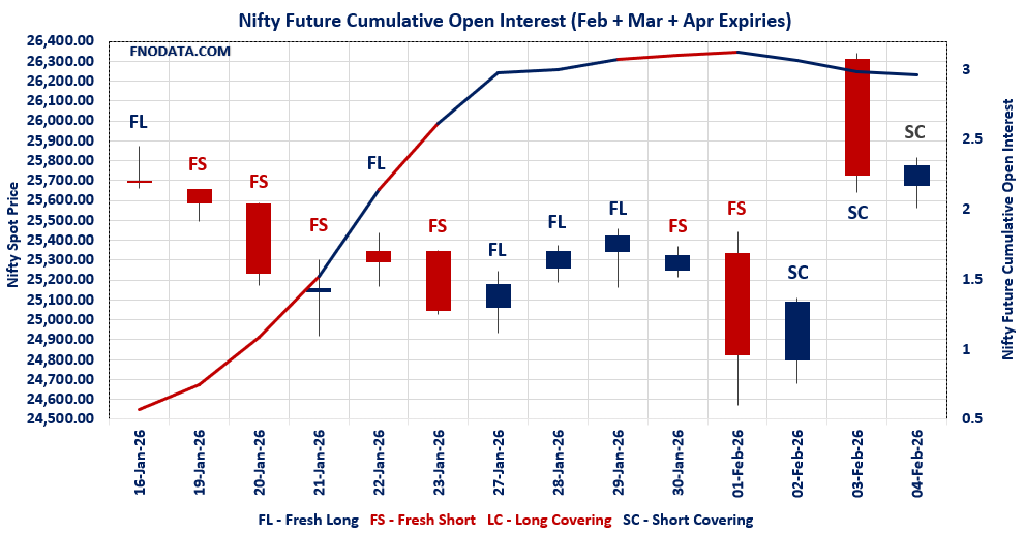

“NIFTY Future Analysis

NIFTY Spot closed at: 25776 (0.188%)

Combined = February + March + April

Combined Fut Open Interest Change: -2.29%

Combined Fut Volume Change: -72.53%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 8%

NIFTY FEBRUARY Future closed at: 25848.8 (0.123%)

February Fut Premium 72.8 (Decreased by -16.75 points)

February Fut Open Interest Change: -2.98%

February Fut Volume Change: -72.79%

February Fut Open Interest Analysis: Short Covering

NIFTY March Future closed at: 26013.1 (0.140%)

March Fut Premium 237.1 (Decreased by -12.05 points)

March Fut Open Interest Change: 5.09%

March Fut Volume Change: -68.81%

March Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (3/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.959 (Increased from 0.845)

Put-Call Ratio (Volume): 0.906

Max Pain Level: 25750

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25800

Highest PUT Addition: 25700

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.173 (Increased from 1.145)

Put-Call Ratio (Volume): 1.108

Max Pain Level: 25700

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26500

Highest PUT Addition: 24700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60238.15 (0.328%)

Combined = February + March + April

Combined Fut Open Interest Change: 11.30%

Combined Fut Volume Change: -59.43%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 10% Previous 10%

BANKNIFTY FEBRUARY Future closed at: 60418 (0.345%)

February Fut Premium 179.85 (Increased by 11.15 points)

February Fut Open Interest Change: 10.8%

February Fut Volume Change: -60.4%

February Fut Open Interest Analysis: Fresh Long

BANKNIFTY MARCH Future closed at: 60767.8 (0.378%)

March Fut Premium 529.65 (Increased by 32.15 points)

March Fut Open Interest Change: 13.94%

March Fut Volume Change: -46.74%

March Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.062 (Increased from 0.983)

Put-Call Ratio (Volume): 0.926

Max Pain Level: 60000

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 60500

Highest PUT Addition: 59000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13721.85 (0.485%)

Combined = February + March + April

Combined Fut Open Interest Change: -1.63%

Combined Fut Volume Change: -70.43%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 4% Previous 3%

MIDCPNIFTY FEBRUARY Future closed at: 13772.65 (0.544%)

February Fut Premium 50.8 (Increased by 8.35 points)

February Fut Open Interest Change: -2.03%

February Fut Volume Change: -70.92%

February Fut Open Interest Analysis: Short Covering

MIDCPNIFTY MARCH Future closed at: 13835.75 (0.561%)

March Fut Premium 113.9 (Increased by 11.05 points)

March Fut Open Interest Change: 7.98%

March Fut Volume Change: -61.73%

March Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.077 (Increased from 0.974)

Put-Call Ratio (Volume): 0.986

Max Pain Level: 13500

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14000

Highest PUT Addition: 13200

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 83,817.69 (0.094%)

SENSEX Monthly Future closed at: 84,206.10 (0.042%)

Premium: 388.41 (Decreased by -43.36 points)

Open Interest Change: 0.29%

Volume Change: -51.41%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (5/02/2026) Option Analysis

Put-Call Ratio (OI): 0.989 (Increased from 0.982)

Put-Call Ratio (Volume): 0.916

Max Pain Level: 83700

Maximum CALL OI: 87000

Maximum PUT OI: 80000

Highest CALL Addition: 87000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 29.79 Cr.

DIIs Net BUY: ₹ 249.54 Cr.

FII Derivatives Activity

| FII Trading Stats | 4.02.26 | 3.02.26 | 2.02.26 |

| FII Cash (Provisional Data) | 29.79 | 5,236.28 | -1,832.46 |

| Index Future Open Interest Long Ratio | 18.67% | 16.85% | 11.67% |

| Index Future Volume Long Ratio | 61.56% | 65.67% | 53.71% |

| Call Option Open Interest Long Ratio | 47.04% | 45.41% | 44.11% |

| Call Option Volume Long Ratio | 50.25% | 49.95% | 50.19% |

| Put Option Open Interest Long Ratio | 58.88% | 62.79% | 63.07% |

| Put Option Volume Long Ratio | 49.46% | 49.82% | 49.89% |

| Stock Future Open Interest Long Ratio | 60.79% | 60.90% | 60.51% |

| Stock Future Volume Long Ratio | 50.05% | 52.41% | 50.80% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Short | Long Covering | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Short | Long Covering | Short Covering |

| BankNifty Futures | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Short Covering | Short Covering | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Short Covering | Short Covering | Fresh Long |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Long | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (5/02/2026)

The SENSEX index closed at 83817.69. The SENSEX weekly expiry for FEBRUARY 5, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.989 against previous 0.982. The 87000CE option holds the maximum open interest, followed by the 85000CE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 87000CE option, with open interest additions also seen in the 84500CE and 83000PE options. On the other hand, open interest reductions were prominent in the 89000CE, 84000PE, and 77500PE options. Trading volume was highest in the 84000CE option, followed by the 83000PE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 05-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83817.69 | 0.989 | 0.982 | 0.916 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,65,72,780 | 2,32,24,100 | 1,33,48,680 |

| PUT: | 3,61,58,100 | 2,27,99,020 | 1,33,59,080 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 23,20,500 | 11,66,260 | 1,72,69,660 |

| 85000 | 22,83,600 | 6,43,400 | 6,69,97,180 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 23,20,500 | 11,66,260 | 1,72,69,660 |

| 84500 | 18,36,220 | 9,65,440 | 10,44,16,540 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 6,01,820 | -2,57,120 | 50,86,600 |

| 90000 | 5,76,620 | -76,580 | 27,41,160 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 19,10,680 | 5,78,540 | 14,11,99,100 |

| 84500 | 18,36,220 | 9,65,440 | 10,44,16,540 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 21,28,760 | 7,70,640 | 1,69,46,160 |

| 83000 | 18,79,920 | 9,61,920 | 11,31,77,620 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 18,79,920 | 9,61,920 | 11,31,77,620 |

| 82000 | 18,70,440 | 8,69,160 | 3,38,90,020 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 7,35,500 | -2,35,220 | 3,20,80,320 |

| 77500 | 2,07,600 | -1,23,180 | 35,00,260 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 18,79,920 | 9,61,920 | 11,31,77,620 |

| 83500 | 14,83,020 | 8,52,760 | 10,25,60,280 |

NIFTY Weekly Expiry (10/02/2026)

The NIFTY index closed at 25776. The NIFTY weekly expiry for FEBRUARY 10, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.959 against previous 0.845. The 27000CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25700PE option, with open interest additions also seen in the 25800PE and 25800CE options. On the other hand, open interest reductions were prominent in the 25500CE, 25000CE, and 25100CE options. Trading volume was highest in the 25800CE option, followed by the 25700PE and 25800PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 10-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,776.00 | 0.959 | 0.845 | 0.906 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,26,66,505 | 8,79,54,815 | 3,47,11,690 |

| PUT: | 11,76,54,095 | 7,43,29,125 | 4,33,24,970 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,07,59,320 | 17,66,700 | 6,69,556 |

| 26,000 | 97,47,270 | 19,54,745 | 23,24,982 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 76,85,015 | 24,28,075 | 34,72,718 |

| 26,100 | 42,41,705 | 20,94,365 | 9,90,766 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 18,07,585 | -3,44,565 | 2,39,150 |

| 25,000 | 9,93,005 | -1,48,590 | 12,248 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 76,85,015 | 24,28,075 | 34,72,718 |

| 25,750 | 27,45,600 | 15,73,260 | 24,10,107 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 78,78,585 | 19,74,440 | 7,39,383 |

| 24,000 | 73,24,200 | 8,78,865 | 4,49,233 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 58,82,500 | 27,63,345 | 32,94,368 |

| 25,800 | 63,63,305 | 26,60,060 | 26,96,375 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 3,80,705 | -95,225 | 25,746 |

| 26,500 | 4,45,380 | -80,080 | 10,639 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 58,82,500 | 27,63,345 | 32,94,368 |

| 25,800 | 63,63,305 | 26,60,060 | 26,96,375 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25776. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.173 against previous 1.145. The 26000CE option holds the maximum open interest, followed by the 25500PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 24700PE option, with open interest additions also seen in the 25000PE and 26500CE options. On the other hand, open interest reductions were prominent in the 25500CE, 26600CE, and 24500PE options. Trading volume was highest in the 26000CE option, followed by the 25500PE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,776.00 | 1.173 | 1.145 | 1.108 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,26,37,270 | 4,23,80,390 | 2,56,880 |

| PUT: | 5,00,22,440 | 4,85,23,670 | 14,98,770 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 60,89,655 | -37,895 | 1,21,341 |

| 26,500 | 40,68,610 | 3,92,405 | 77,365 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 40,68,610 | 3,92,405 | 77,365 |

| 27,050 | 2,09,105 | 1,72,120 | 6,844 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 27,10,500 | -4,59,810 | 36,530 |

| 26,600 | 7,59,200 | -3,35,075 | 30,895 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 60,89,655 | -37,895 | 1,21,341 |

| 25,800 | 20,07,850 | 1,48,980 | 84,926 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 52,49,595 | 41,795 | 1,10,742 |

| 25,000 | 47,90,175 | 3,96,695 | 92,280 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 16,92,925 | 7,00,245 | 36,168 |

| 25,000 | 47,90,175 | 3,96,695 | 92,280 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 28,23,080 | -2,77,875 | 41,283 |

| 24,000 | 23,46,240 | -2,49,275 | 35,988 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 52,49,595 | 41,795 | 1,10,742 |

| 25,000 | 47,90,175 | 3,96,695 | 92,280 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60238.15. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.062 against previous 0.983. The 60000PE option holds the maximum open interest, followed by the 60000CE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 59000PE option, with open interest additions also seen in the 60500PE and 60000PE options. On the other hand, open interest reductions were prominent in the 59400CE, 60000CE, and 56500PE options. Trading volume was highest in the 60000PE option, followed by the 60200CE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,238.15 | 1.062 | 0.983 | 0.926 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,10,06,550 | 1,03,85,640 | 6,20,910 |

| PUT: | 1,16,94,000 | 1,02,14,130 | 14,79,870 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 15,55,980 | -28,020 | 94,205 |

| 61,000 | 6,20,700 | 46,560 | 73,861 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 5,48,100 | 1,01,130 | 90,232 |

| 60,400 | 1,83,600 | 91,950 | 46,288 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,400 | 66,270 | -31,920 | 3,053 |

| 60,000 | 15,55,980 | -28,020 | 94,205 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,200 | 2,73,870 | 46,200 | 95,939 |

| 60,000 | 15,55,980 | -28,020 | 94,205 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,83,180 | 1,58,340 | 1,41,525 |

| 58,000 | 8,07,540 | -10,410 | 42,222 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 7,83,570 | 1,80,570 | 56,003 |

| 60,500 | 3,81,870 | 1,62,180 | 44,705 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 2,20,260 | -26,850 | 13,917 |

| 57,100 | 25,470 | -11,820 | 2,559 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,83,180 | 1,58,340 | 1,41,525 |

| 60,200 | 2,61,150 | 1,23,600 | 91,495 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13721.85. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.077 against previous 0.974. The 14500CE option holds the maximum open interest, followed by the 13000PE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13200PE option, with open interest additions also seen in the 13700PE and 13300PE options. On the other hand, open interest reductions were prominent in the 68000CE, 67000CE, and 68200CE options. Trading volume was highest in the 14000CE option, followed by the 13000PE and 13700CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,721.85 | 1.077 | 0.974 | 0.986 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 63,98,520 | 62,69,400 | 1,29,120 |

| PUT: | 68,93,040 | 61,07,760 | 7,85,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,40,280 | 43,680 | 11,914 |

| 14,000 | 8,60,160 | 54,960 | 19,559 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,60,160 | 54,960 | 19,559 |

| 14,500 | 10,40,280 | 43,680 | 11,914 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 2,50,320 | -45,960 | 3,687 |

| 14,400 | 1,76,880 | -42,240 | 4,762 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,60,160 | 54,960 | 19,559 |

| 13,700 | 3,82,560 | 32,160 | 17,354 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,29,000 | 29,160 | 17,517 |

| 12,000 | 6,32,880 | -49,800 | 2,851 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 3,61,920 | 1,49,880 | 9,828 |

| 13,700 | 3,81,960 | 1,25,160 | 12,961 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 84,960 | -1,10,280 | 3,253 |

| 12,000 | 6,32,880 | -49,800 | 2,851 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,29,000 | 29,160 | 17,517 |

| 13,600 | 2,88,120 | 1,20,240 | 14,493 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The combined Open Interest Volume Analysis across indices signals a non-directional-to-positive bias, but without aggressive momentum, meaning buy-on-dips strategies are preferable over breakout chasing.

NIFTY’s short covering with declining volumes and falling futures premium warns that upside may face resistance near heavy CALL OI zones (25800–26000), making range trading and option-selling strategies more favorable in the near term.

BANKNIFTY remains the strongest derivative structure, with consistent fresh long build-up in both February and March futures, suggesting positional traders should continue to align with strength, especially above the 60000 max pain pivot.

MIDCPNIFTY’s fresh longs in the March series, combined with rising PCR, hint at medium-term accumulation, but low volumes suggest selective participation rather than broad-based risk-on.

SENSEX futures showing fresh longs with a declining premium indicates controlled accumulation, not euphoria—ideal conditions for calendar spreads and hedged positional trades.

From an options perspective, PCR levels hovering near 1 across indices confirm balance, not excess bullishness—traders should stay nimble, respect max pain levels, and avoid over-leveraged directional bets.

In summary, this Open Interest Volume Analysis points toward a market that is repairing sentiment, not accelerating trend, making discipline, position sizing, and expiry-aware strategies the key to navigating the next few sessions successfully.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.