Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/02/2026

Table of Contents

Today’s Open Interest Volume Analysis clearly shows a divergent derivative structure across indices, with NIFTY and SENSEX attracting fresh long participation, while BANKNIFTY shows profit booking through long covering and MIDCPNIFTY remains structurally weak with fresh shorts.

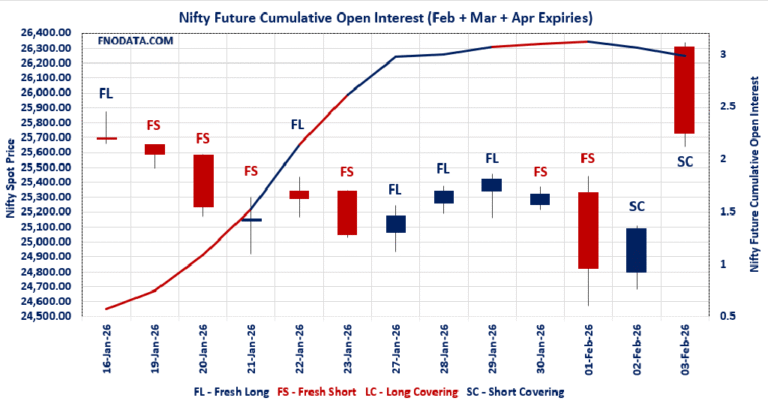

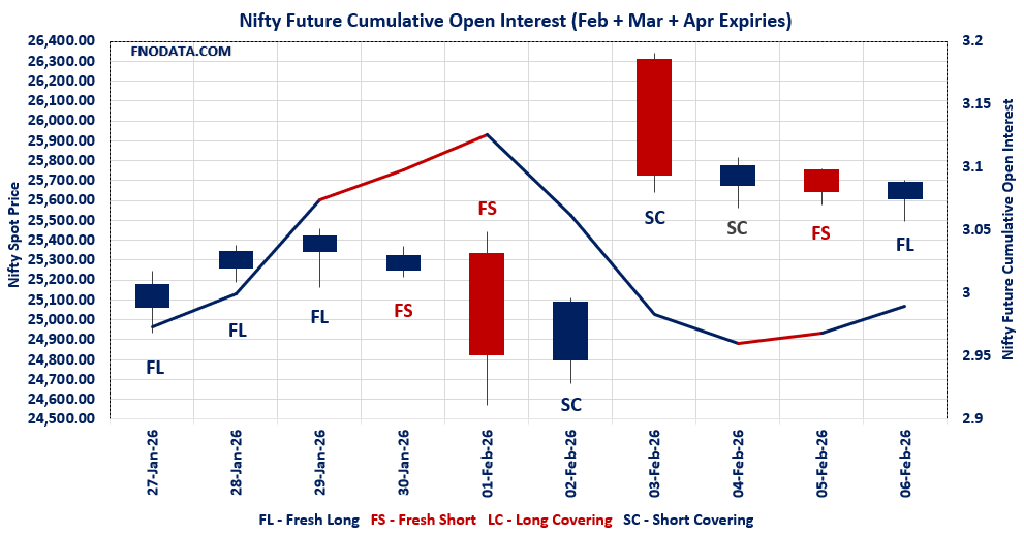

In NIFTY, rising combined futures open interest (+2.09%) along with strong volume expansion (+24.13%) confirms genuine fresh long build-up, not a short squeeze. However, the sharp fall in futures premium signals that longs are cautious and not aggressive, indicating a grind-up move rather than a runaway rally.

Weekly and monthly option data reinforces this view, where a rising Put-Call Ratio, strong PUT additions near 25500–25600, and Max Pain clustering around 25650–25700 suggest institutional players are building a solid base rather than chasing upside.

BANKNIFTY, on the other hand, reflects classic short-term distribution, as falling open interest with rising volumes confirms long unwinding, especially near the psychological 60000 zone, making it a range-bound and stock-specific trading index for now.

MIDCPNIFTY remains the weakest link, with fresh shorts across both February and March futures, rising open interest, falling prices, and poor volume support — a textbook bearish continuation setup from an Open Interest Volume Analysis perspective.

SENSEX stands out positively, where fresh long build-up despite lower volumes indicates positional accumulation by strong hands, likely in heavyweight stocks, offering stability to the broader market even if intraday volatility persists.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25693.7 (0.198%)

Combined = February + March + April

Combined Fut Open Interest Change: 2.09%

Combined Fut Volume Change: 24.13%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 9% Previous 9%

NIFTY FEBRUARY Future closed at: 25735.1 (0.039%)

February Fut Premium 41.4 (Decreased by -40.8 points)

February Fut Open Interest Change: 2.31%

February Fut Volume Change: 25.84%

February Fut Open Interest Analysis: Fresh Long

NIFTY March Future closed at: 25891.9 (0.002%)

March Fut Premium 198.2 (Decreased by -50.5 points)

March Fut Open Interest Change: -0.18%

March Fut Volume Change: 6.66%

March Fut Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (10/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.858 (Increased from 0.649)

Put-Call Ratio (Volume): 0.953

Max Pain Level: 25650

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 25600

Highest PUT Addition: 25500

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.143 (Increased from 1.123)

Put-Call Ratio (Volume): 0.981

Max Pain Level: 25700

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 25700

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60120.55 (0.095%)

Combined = February + March + April

Combined Fut Open Interest Change: -2.83%

Combined Fut Volume Change: 34.91%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 10% Previous 10%

BANKNIFTY FEBRUARY Future closed at: 60252.4 (-0.004%)

February Fut Premium 131.85 (Decreased by -59.3 points)

February Fut Open Interest Change: -2.9%

February Fut Volume Change: 34.4%

February Fut Open Interest Analysis: Long Covering

BANKNIFTY MARCH Future closed at: 60587.4 (-0.031%)

March Fut Premium 466.85 (Decreased by -75.7 points)

March Fut Open Interest Change: -2.57%

March Fut Volume Change: 44.51%

March Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.912 (Decreased from 0.996)

Put-Call Ratio (Volume): 0.947

Max Pain Level: 60000

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 61300

Highest PUT Addition: 59500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13644.9 (-0.406%)

Combined = February + March + April

Combined Fut Open Interest Change: 1.75%

Combined Fut Volume Change: -4.90%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 4% Previous 4%

MIDCPNIFTY FEBRUARY Future closed at: 13655.7 (-0.562%)

February Fut Premium 10.8 (Decreased by -21.6 points)

February Fut Open Interest Change: 1.55%

February Fut Volume Change: -7.38%

February Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY MARCH Future closed at: 13726.65 (-0.552%)

March Fut Premium 81.75 (Decreased by -20.65 points)

March Fut Open Interest Change: 6.73%

March Fut Volume Change: 60.16%

March Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.084 (Decreased from 1.097)

Put-Call Ratio (Volume): 0.755

Max Pain Level: 13500

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13600

Highest PUT Addition: 12500

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 83,580.40 (0.320%)

SENSEX Monthly Future closed at: 83,822.45 (0.074%)

Premium: 242.05 (Decreased by -204.57 points)

Open Interest Change: 2.68%

Volume Change: -42.69%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (12/02/2026) Option Analysis

Put-Call Ratio (OI): 1.104 (Increased from 0.732)

Put-Call Ratio (Volume): 1.010

Max Pain Level: 83500

Maximum CALL OI: 83500

Maximum PUT OI: 83500

Highest CALL Addition: 87000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 1,950.77 Cr.

DIIs Net SELL: ₹ 1,265.06 Cr.

FII Derivatives Activity

| FII Trading Stats | 6.02.26 | 5.02.26 | 4.02.26 |

| FII Cash (Provisional Data) | 1,950.77 | -2,150.51 | 29.79 |

| Index Future Open Interest Long Ratio | 18.32% | 18.50% | 18.67% |

| Index Future Volume Long Ratio | 39.79% | 54.00% | 61.56% |

| Call Option Open Interest Long Ratio | 48.94% | 47.34% | 47.04% |

| Call Option Volume Long Ratio | 50.20% | 49.96% | 50.25% |

| Put Option Open Interest Long Ratio | 59.57% | 60.46% | 58.88% |

| Put Option Volume Long Ratio | 50.11% | 50.56% | 49.46% |

| Stock Future Open Interest Long Ratio | 60.19% | 60.49% | 60.79% |

| Stock Future Volume Long Ratio | 47.47% | 46.99% | 50.05% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Long Covering | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Short Covering | Long Covering | Short Covering |

| FinNifty Options | Short Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Short | Short Covering | Short Covering |

| MidcpNifty Options | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Short Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Short |

| Stock Futures | Long Covering | Long Covering | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (12/02/2026)

The SENSEX index closed at 83580.4. The SENSEX weekly expiry for FEBRUARY 12, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.104 against previous 0.732. The 83500CE option holds the maximum open interest, followed by the 83500PE and 83000PE options. Market participants have shown increased interest with significant open interest additions in the 83000PE option, with open interest additions also seen in the 87000CE and 80000PE options. On the other hand, open interest reductions were prominent in the 89000CE, 87500CE, and 83400CE options. Trading volume was highest in the 83000PE option, followed by the 83500CE and 83200PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83580.4 | 1.104 | 0.732 | 1.010 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 87,78,640 | 54,73,960 | 33,04,680 |

| PUT: | 96,88,940 | 40,08,740 | 56,80,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 7,25,940 | 1,48,420 | 2,00,32,060 |

| 87000 | 6,19,040 | 3,99,380 | 50,91,440 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 6,19,040 | 3,99,380 | 50,91,440 |

| 86000 | 4,28,480 | 2,09,600 | 37,02,360 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 1,80,600 | -70,180 | 24,85,300 |

| 87500 | 2,06,320 | -32,780 | 23,64,720 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 7,25,940 | 1,48,420 | 2,00,32,060 |

| 83300 | 1,93,360 | 17,220 | 1,54,07,820 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 7,22,140 | 2,56,600 | 1,00,02,060 |

| 83000 | 7,12,140 | 4,52,720 | 2,96,79,540 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,12,140 | 4,52,720 | 2,96,79,540 |

| 80000 | 4,79,580 | 2,86,120 | 35,42,900 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,480 | -80 | 1,140 |

| 72300 | 180 | -40 | 8,960 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,12,140 | 4,52,720 | 2,96,79,540 |

| 83200 | 3,73,900 | 2,83,200 | 1,79,87,840 |

NIFTY Weekly Expiry (10/02/2026)

The NIFTY index closed at 25693.7. The NIFTY weekly expiry for FEBRUARY 10, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.858 against previous 0.649. The 27000CE option holds the maximum open interest, followed by the 26000CE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 25600PE and 25550PE options. On the other hand, open interest reductions were prominent in the 24850PE, 26100CE, and 26400CE options. Trading volume was highest in the 25600PE option, followed by the 25500PE and 25600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 10-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,693.70 | 0.858 | 0.649 | 0.953 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,57,21,760 | 19,19,18,285 | 38,03,475 |

| PUT: | 16,79,30,555 | 12,46,43,740 | 4,32,86,815 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,84,54,150 | 7,28,260 | 11,26,796 |

| 26,000 | 1,44,61,005 | -1,05,430 | 25,56,522 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 54,39,005 | 16,18,435 | 80,87,242 |

| 25,950 | 44,88,380 | 14,70,495 | 12,36,034 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 55,31,760 | -17,33,095 | 12,37,348 |

| 26,400 | 41,59,480 | -17,16,650 | 8,76,005 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 54,39,005 | 16,18,435 | 80,87,242 |

| 25,700 | 95,62,085 | 6,48,050 | 61,83,197 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,20,13,105 | 57,02,255 | 82,50,130 |

| 24,000 | 1,06,24,900 | 22,11,625 | 8,84,323 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,20,13,105 | 57,02,255 | 82,50,130 |

| 25,600 | 1,00,59,530 | 54,02,150 | 83,49,834 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,850 | 15,89,705 | -23,26,220 | 4,08,842 |

| 25,800 | 33,97,745 | -7,60,305 | 7,61,119 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 1,00,59,530 | 54,02,150 | 83,49,834 |

| 25,500 | 1,20,13,105 | 57,02,255 | 82,50,130 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25693.7. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.143 against previous 1.123. The 26000CE option holds the maximum open interest, followed by the 25500PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25700CE option, with open interest additions also seen in the 25700PE and 25600CE options. On the other hand, open interest reductions were prominent in the 26000CE, 25800PE, and 25000CE options. Trading volume was highest in the 26000CE option, followed by the 25500PE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,693.70 | 1.143 | 1.123 | 0.981 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,37,95,570 | 4,40,09,875 | -2,14,305 |

| PUT: | 5,00,59,035 | 4,94,09,165 | 6,49,870 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 59,71,875 | -5,59,520 | 1,72,195 |

| 26,500 | 36,05,745 | 63,050 | 70,244 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 17,12,360 | 3,29,550 | 85,472 |

| 25,600 | 10,65,480 | 2,17,425 | 74,971 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 59,71,875 | -5,59,520 | 1,72,195 |

| 25,000 | 24,03,570 | -1,57,040 | 12,896 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 59,71,875 | -5,59,520 | 1,72,195 |

| 25,700 | 17,12,360 | 3,29,550 | 85,472 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,77,540 | -93,795 | 1,42,486 |

| 25,000 | 48,53,810 | 1,54,245 | 1,09,127 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 19,26,795 | 3,16,485 | 68,083 |

| 24,700 | 22,16,370 | 1,92,140 | 27,657 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 15,02,930 | -1,94,935 | 42,709 |

| 24,800 | 12,73,935 | -1,55,805 | 24,086 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,77,540 | -93,795 | 1,42,486 |

| 25,000 | 48,53,810 | 1,54,245 | 1,09,127 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60120.55. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.912 against previous 0.996. The 60000PE option holds the maximum open interest, followed by the 60000CE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 61300CE option, with open interest additions also seen in the 62500CE and 61000CE options. On the other hand, open interest reductions were prominent in the 57000PE, 60500PE, and 60300PE options. Trading volume was highest in the 60000PE option, followed by the 60000CE and 61000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,120.55 | 0.912 | 0.996 | 0.947 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,27,33,920 | 1,13,61,810 | 13,72,110 |

| PUT: | 1,16,11,470 | 1,13,19,420 | 2,92,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 16,73,880 | 64,920 | 2,23,421 |

| 61,000 | 6,99,210 | 87,240 | 1,11,702 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,300 | 3,42,840 | 2,82,030 | 28,253 |

| 62,500 | 5,66,190 | 2,21,670 | 41,579 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 65,500 | 59,040 | -19,290 | 7,391 |

| 64,500 | 1,29,120 | -11,250 | 9,525 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 16,73,880 | 64,920 | 2,23,421 |

| 61,000 | 6,99,210 | 87,240 | 1,11,702 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,35,240 | 24,330 | 2,71,326 |

| 58,000 | 8,39,310 | 34,650 | 52,751 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 4,59,090 | 54,390 | 84,868 |

| 59,700 | 1,45,770 | 50,640 | 64,150 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 4,79,970 | -33,900 | 26,698 |

| 60,500 | 2,90,820 | -30,510 | 35,715 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,35,240 | 24,330 | 2,71,326 |

| 59,900 | 1,70,190 | 44,310 | 1,04,975 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13644.9. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.084 against previous 1.097. The 13000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 12500PE option, with open interest additions also seen in the 13600CE and 12800PE options. On the other hand, open interest reductions were prominent in the 67500PE, 66000PE, and 66000PE options. Trading volume was highest in the 14000CE option, followed by the 13600CE and 13500PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,644.90 | 1.084 | 1.097 | 0.755 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 63,61,560 | 62,55,120 | 1,06,440 |

| PUT: | 68,98,680 | 68,63,040 | 35,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 9,14,040 | -39,000 | 7,171 |

| 14,000 | 7,87,560 | 32,400 | 49,347 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 2,70,600 | 76,920 | 22,512 |

| 13,900 | 1,33,800 | 43,920 | 7,528 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 1,55,040 | -45,240 | 7,086 |

| 14,500 | 9,14,040 | -39,000 | 7,171 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,87,560 | 32,400 | 49,347 |

| 13,600 | 2,70,600 | 76,920 | 22,512 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,36,080 | 5,640 | 14,955 |

| 12,500 | 6,45,240 | 99,840 | 5,822 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 6,45,240 | 99,840 | 5,822 |

| 12,800 | 1,69,080 | 45,240 | 5,137 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 2,79,840 | -69,480 | 8,284 |

| 13,500 | 3,56,400 | -50,640 | 20,259 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 3,56,400 | -50,640 | 20,259 |

| 13,600 | 2,84,160 | 25,080 | 17,860 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis confirms a “selective bullish but cautious” market, not a broad-based risk-on environment. NIFTY and SENSEX are accumulation-driven, while BANKNIFTY and MIDCPNIFTY demand defensive positioning.

For NIFTY traders:

Bias remains positive above 25650, supported by PUT writers and rising PCR.

Upside may stay gradual, as falling futures premium shows no leverage-heavy longs yet.

Buy-on-dip strategies near 25600–25550 remain favorable, while aggressive breakout trades should be avoided.

For BANKNIFTY traders:

Long covering near 60000 Max Pain warns against positional longs.

Best suited for range trading or option selling strategies, with tight risk management.

Any upside without fresh OI addition should be treated as short-term pullback moves.

For MIDCPNIFTY traders:

Open Interest Volume Analysis is decisively bearish.

Fresh shorts, weak volumes, and declining premiums indicate sell-on-rise remains the dominant strategy.

Positional longs should be strictly avoided until open interest contraction appears.

For SENSEX traders:

Fresh long build-up confirms underlying strength in large caps.

Ideal for long exposure, especially via futures with strict trailing stops.

Overall market takeaway:

This is a structure-driven market, not a headline-driven one.

Follow open interest and volume — not price alone.

Traders aligned with Open Interest Volume Analysis will stay ahead of false breakouts and emotional trades.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.