Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 13/02/2026

Table of Contents

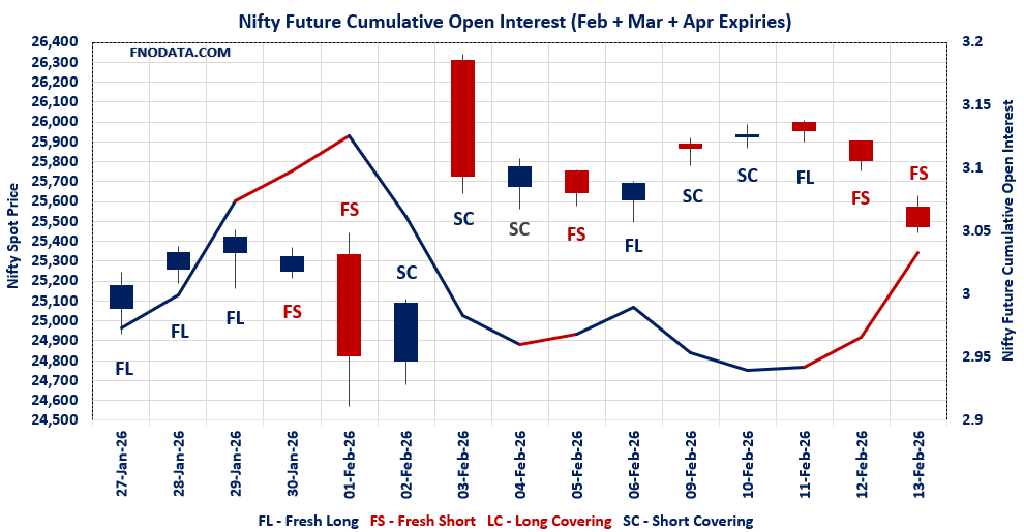

Open Interest Volume Analysis clearly signals rising risk-off sentiment across Indian equity derivatives, as NIFTY, MIDCPNIFTY and SENSEX all witnessed price decline accompanied by aggressive Open Interest build-up, a textbook case of fresh short formation.

In NIFTY, the combination of 6.79% OI expansion and 56.78% volume surge alongside a 1.3% price drop confirms institutional short aggression, not panic selling — this is positional, not emotional.

Weekly and Monthly PCRs collapsing sharply below 1 indicate call writers gaining control, while Max Pain clustering near 25550–25600 suggests traders are positioning for sell-on-rise behaviour rather than bottom fishing.

BANKNIFTY stands out as a relative outperformer, where long covering (OI down, price down) hints that downside momentum is losing steam, making it a potential mean-reversion candidate rather than a fresh shorting opportunity.

MIDCPNIFTY reflect structural weakness, with fresh shorts in longer expiries, signaling broader market discomfort beyond frontline indices.

Overall, Open Interest Volume Analysis reveals smart money reducing long exposure and actively hedging downside, keeping volatility elevated and intraday pullbacks vulnerable to renewed selling.

NSE & BSE F&O Market Signals

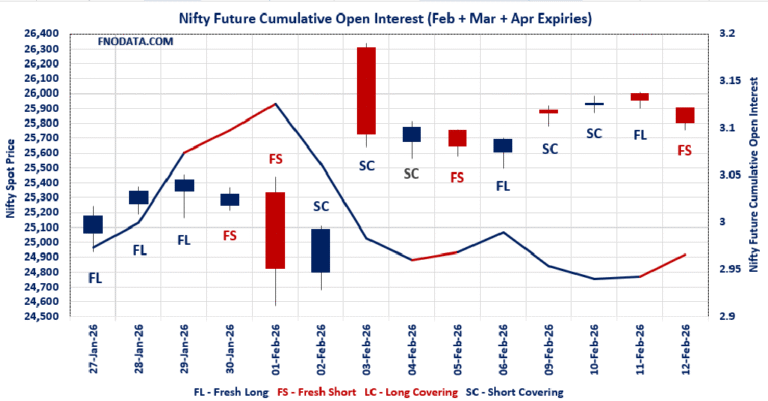

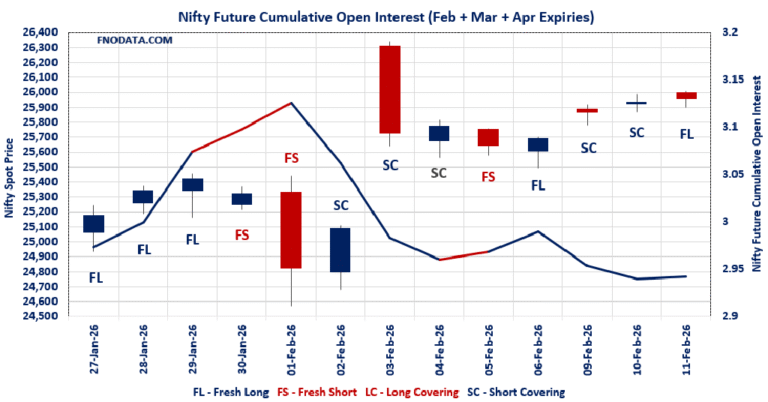

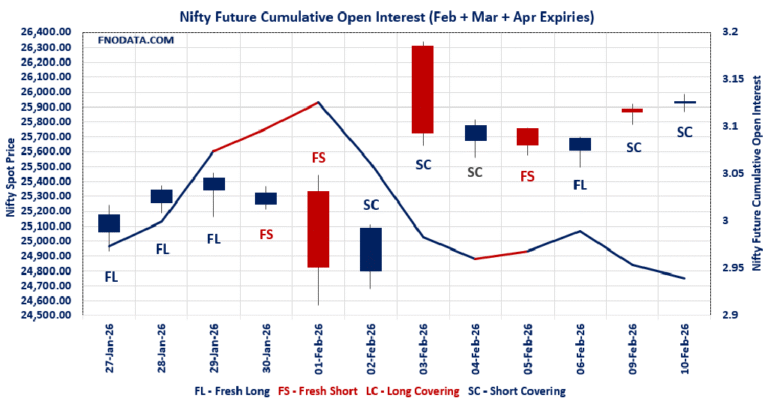

NIFTY Future analysis

NIFTY Spot closed at: 25471.1 (-1.302%)

Combined = February + March + April

Combined Fut Open Interest Change: 6.79%

Combined Fut Volume Change: 56.78%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 11% Previous 11%

NIFTY FEBRUARY Future closed at: 25518.8 (-1.313%)

February Fut Premium 47.7 (Decreased by -3.3 points)

February Fut Open Interest Change: 5.72%

February Fut Volume Change: 48.56%

February Fut Open Interest Analysis: Fresh Short

NIFTY March Future closed at: 25688.6 (-1.294%)

March Fut Premium 217.5 (Decreased by -0.6 points)

March Fut Open Interest Change: 16.30%

March Fut Volume Change: 97.93%

March Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (17/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.454 (Decreased from 0.611)

Put-Call Ratio (Volume): 1.123

Max Pain Level: 25550

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 25000

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.927 (Decreased from 1.113)

Put-Call Ratio (Volume): 0.952

Max Pain Level: 25600

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 25600

Highest PUT Addition: 25600

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60186.65 (-0.911%)

Combined = February + March + April

Combined Fut Open Interest Change: -11.28%

Combined Fut Volume Change: 33.10%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 14% Previous 13%

BANKNIFTY FEBRUARY Future closed at: 60320.6 (-0.783%)

February Fut Premium 133.95 (Increased by 77.1 points)

February Fut Open Interest Change: -12.0%

February Fut Volume Change: 27.0%

February Fut Open Interest Analysis: Long Covering

BANKNIFTY MARCH Future closed at: 60702.4 (-0.721%)

March Fut Premium 515.75 (Increased by 112.3 points)

March Fut Open Interest Change: -5.77%

March Fut Volume Change: 110.53%

March Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.866 (Decreased from 1.094)

Put-Call Ratio (Volume): 1.283

Max Pain Level: 60000

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 60500

Highest PUT Addition: 56500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13628.35 (-1.908%)

Combined = February + March + April

Combined Fut Open Interest Change: 0.22%

Combined Fut Volume Change: 22.68%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 6% Previous 5%

MIDCPNIFTY FEBRUARY Future closed at: 13630.35 (-1.913%)

February Fut Premium 2 (Decreased by -0.7 points)

February Fut Open Interest Change: -0.65%

February Fut Volume Change: 16.32%

February Fut Open Interest Analysis: Long Covering

MIDCPNIFTY MARCH Future closed at: 13711 (-1.786%)

March Fut Premium 82.65 (Increased by 15.85 points)

March Fut Open Interest Change: 21.34%

March Fut Volume Change: 161.61%

March Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.901 (Decreased from 1.118)

Put-Call Ratio (Volume): 0.995

Max Pain Level: 13650

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13700

Highest PUT Addition: 13300

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 82,626.76 (-1.253%)

SENSEX Monthly Future closed at: 82,829.40 (-1.276%)

Premium: 202.64 (Decreased by -22.49 points)

Open Interest Change: 18.68%

Volume Change: 15.09%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (19/02/2026) Option Analysis

Put-Call Ratio (OI): 0.558 (Decreased from 0.723)

Put-Call Ratio (Volume): 1.360

Max Pain Level: 83000

Maximum CALL OI: 83000

Maximum PUT OI: 80000

Highest CALL Addition: 83000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 7,395.41 Cr.

DIIs Net BUY: ₹ 5,553.96 Cr.

FII Derivatives Activity

| FII Trading Stats | 13.02.26 | 12.02.26 | 11.02.26 |

| FII Cash (Provisional Data) | -7,395.41 | 108.42 | 943.81 |

| Index Future Open Interest Long Ratio | 19.37% | 22.01% | 22.14% |

| Index Future Volume Long Ratio | 30.73% | 48.47% | 52.50% |

| Call Option Open Interest Long Ratio | 50.83% | 49.36% | 50.53% |

| Call Option Volume Long Ratio | 50.27% | 49.71% | 49.90% |

| Put Option Open Interest Long Ratio | 62.09% | 58.97% | 58.72% |

| Put Option Volume Long Ratio | 50.72% | 50.18% | 49.63% |

| Stock Future Open Interest Long Ratio | 59.46% | 59.88% | 60.08% |

| Stock Future Volume Long Ratio | 47.51% | 48.99% | 49.34% |

| Index Futures | Long Covering | Long Covering | Fresh Long |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Long |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Short Covering | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Short Covering | Fresh Long | Short Covering |

| FinNifty Options | Short Covering | Fresh Short | Short Covering |

| MidcpNifty Futures | Long Covering | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Short | Long Covering | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Options | Short Covering | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Fresh Short | Fresh Short |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (19/02/2026)

The SENSEX index closed at 82626.76. The SENSEX weekly expiry for FEBRUARY 19, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.558 against previous 0.723. The 83000CE option holds the maximum open interest, followed by the 87000CE and 88000CE options. Market participants have shown increased interest with significant open interest additions in the 83000CE option, with open interest additions also seen in the 87000CE and 88000CE options. On the other hand, open interest reductions were prominent in the 83800PE, 84000PE, and 83700PE options. Trading volume was highest in the 83000PE option, followed by the 83000CE and 82800PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 19-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82626.76 | 0.558 | 0.723 | 1.360 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,20,83,040 | 51,74,700 | 69,08,340 |

| PUT: | 67,47,040 | 37,40,400 | 30,06,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 8,53,680 | 7,71,140 | 2,20,27,420 |

| 87000 | 7,62,820 | 5,48,160 | 43,38,760 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 8,53,680 | 7,71,140 | 2,20,27,420 |

| 87000 | 7,62,820 | 5,48,160 | 43,38,760 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 86200 | 44,600 | -16,800 | 4,82,900 |

| 84700 | 1,01,280 | -7,120 | 14,62,560 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 8,53,680 | 7,71,140 | 2,20,27,420 |

| 82900 | 3,21,300 | 3,11,620 | 1,21,62,640 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,82,520 | 3,33,680 | 36,99,120 |

| 83000 | 4,19,800 | 1,89,560 | 2,58,47,820 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,82,520 | 3,33,680 | 36,99,120 |

| 82600 | 2,39,680 | 2,11,620 | 91,09,200 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83800 | 65,100 | -1,10,360 | 4,99,660 |

| 84000 | 2,01,800 | -1,00,280 | 5,72,620 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,19,800 | 1,89,560 | 2,58,47,820 |

| 82800 | 1,89,460 | 1,62,360 | 2,14,90,400 |

NIFTY Weekly Expiry (17/02/2026)

The NIFTY index closed at 25471.1. The NIFTY weekly expiry for FEBRUARY 17, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.454 against previous 0.611. The 26000CE option holds the maximum open interest, followed by the 27000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 25500CE and 25700CE options. On the other hand, open interest reductions were prominent in the 25800PE, 25700PE, and 25900PE options. Trading volume was highest in the 25500PE option, followed by the 25600PE and 25550PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 17-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,471.10 | 0.454 | 0.611 | 1.123 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 24,79,82,215 | 17,58,12,130 | 7,21,70,085 |

| PUT: | 11,26,10,550 | 10,73,68,495 | 52,42,055 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,67,64,150 | 2,54,995 | 18,42,271 |

| 27,000 | 1,62,90,950 | 23,03,795 | 11,78,502 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 1,28,24,565 | 1,21,59,095 | 61,05,752 |

| 25,500 | 92,95,780 | 85,40,740 | 35,28,388 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,150 | 27,55,090 | -19,96,150 | 5,82,149 |

| 26,250 | 27,97,340 | -7,59,590 | 5,20,679 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 1,28,24,565 | 1,21,59,095 | 61,05,752 |

| 25,550 | 54,60,520 | 53,50,085 | 36,54,187 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 82,92,765 | 27,45,405 | 13,98,332 |

| 24,500 | 75,77,050 | -9,18,385 | 8,33,716 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 82,92,765 | 27,45,405 | 13,98,332 |

| 25,300 | 60,98,300 | 17,36,280 | 23,36,105 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 22,19,360 | -39,21,970 | 6,67,994 |

| 25,700 | 18,30,725 | -30,41,220 | 17,88,007 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 65,67,600 | 12,23,820 | 83,67,890 |

| 25,600 | 39,65,910 | 3,94,680 | 67,18,873 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25471.1. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.927 against previous 1.113. The 26000CE option holds the maximum open interest, followed by the 25500PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 25500CE and 25700CE options. On the other hand, open interest reductions were prominent in the 25900PE, 25700PE, and 25800PE options. Trading volume was highest in the 25500PE option, followed by the 26000CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,471.10 | 0.927 | 1.113 | 0.952 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,04,87,505 | 5,07,04,160 | 97,83,345 |

| PUT: | 5,60,97,600 | 5,64,20,390 | -3,22,790 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,20,095 | 7,12,725 | 2,95,037 |

| 26,500 | 41,51,420 | -6,37,260 | 1,08,818 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 30,39,270 | 22,87,805 | 2,06,059 |

| 25,500 | 35,65,640 | 14,19,600 | 1,57,672 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 41,51,420 | -6,37,260 | 1,08,818 |

| 26,350 | 2,83,270 | -2,90,290 | 25,507 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,20,095 | 7,12,725 | 2,95,037 |

| 25,600 | 30,39,270 | 22,87,805 | 2,06,059 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 52,68,705 | -1,83,755 | 3,23,734 |

| 25,000 | 49,27,780 | -36,465 | 2,11,022 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 31,13,760 | 9,36,390 | 2,01,702 |

| 24,500 | 32,17,045 | 6,56,565 | 85,006 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 11,18,000 | -8,11,655 | 38,638 |

| 25,700 | 17,66,570 | -7,41,715 | 96,757 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 52,68,705 | -1,83,755 | 3,23,734 |

| 25,000 | 49,27,780 | -36,465 | 2,11,022 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60186.65. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.866 against previous 1.094. The 60000PE option holds the maximum open interest, followed by the 60000CE and 60500CE options. Market participants have shown increased interest with significant open interest additions in the 60500CE option, with open interest additions also seen in the 62500CE and 60400CE options. On the other hand, open interest reductions were prominent in the 60700PE, 60500PE, and 57000PE options. Trading volume was highest in the 60500PE option, followed by the 60000PE and 60500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,186.65 | 0.866 | 1.094 | 1.283 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,50,68,940 | 1,39,61,640 | 11,07,300 |

| PUT: | 1,30,56,900 | 1,52,78,490 | -22,21,590 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 15,71,670 | 86,310 | 60,700 |

| 60,500 | 9,67,260 | 2,95,590 | 1,85,188 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 9,67,260 | 2,95,590 | 1,85,188 |

| 62,500 | 8,54,430 | 1,97,610 | 44,304 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,300 | 3,83,520 | -65,190 | 27,804 |

| 63,900 | 20,430 | -51,210 | 4,298 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 9,67,260 | 2,95,590 | 1,85,188 |

| 61,000 | 8,78,910 | 49,110 | 98,078 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 20,96,070 | -1,57,410 | 2,08,013 |

| 58,000 | 8,42,370 | -46,050 | 39,476 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 2,84,700 | 28,590 | 18,226 |

| 58,500 | 6,01,290 | 27,390 | 38,074 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,700 | 3,24,780 | -2,44,860 | 63,642 |

| 60,500 | 5,92,710 | -2,35,890 | 2,27,194 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 5,92,710 | -2,35,890 | 2,27,194 |

| 60,000 | 20,96,070 | -1,57,410 | 2,08,013 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13628.35. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.901 against previous 1.118. The 13000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13700CE option, with open interest additions also seen in the 14100CE and 13900CE options. On the other hand, open interest reductions were prominent in the 69000PE, 71000CE, and 67500PE options. Trading volume was highest in the 13500PE option, followed by the 13900CE and 13700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,628.35 | 0.901 | 1.118 | 0.995 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 81,46,800 | 71,33,520 | 10,13,280 |

| PUT: | 73,36,200 | 79,76,520 | -6,40,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 11,13,240 | 25,680 | 8,782 |

| 14,000 | 8,83,320 | 15,600 | 21,808 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 4,83,240 | 3,12,000 | 25,495 |

| 14,100 | 5,61,720 | 1,62,480 | 16,527 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 3,95,520 | -25,920 | 2,311 |

| 14,250 | 23,160 | -20,640 | 715 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 5,00,760 | 1,18,080 | 30,763 |

| 13,700 | 4,83,240 | 3,12,000 | 25,495 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,18,040 | 14,040 | 16,788 |

| 13,500 | 4,75,920 | -18,240 | 31,826 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 3,75,480 | 73,080 | 10,889 |

| 13,650 | 89,160 | 56,400 | 12,039 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 2,85,720 | -1,53,600 | 12,460 |

| 13,900 | 1,88,520 | -1,10,880 | 4,237 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,75,920 | -18,240 | 31,826 |

| 13,700 | 4,03,320 | 12,720 | 30,244 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The dominant derivative theme remains “sell on rise”, especially in NIFTY, MIDCPNIFTY and SENSEX, where fresh shorts + falling PCR + heavy call writing confirm bearish control.

NIFTY resistance is firmly placed near 25600–26000, backed by highest Call OI and fresh call additions, making bullish breakouts low probability unless short covering emerges.

BANKNIFTY requires a different lens — sustained OI reduction with price stability suggests short-term downside exhaustion, favoring range trades rather than momentum shorts.

Weekly expiry traders should respect Max Pain levels, as deviation from these zones is being quickly neutralized by option writers.

Positional traders: Stay defensive, hedge longs aggressively, or deploy bear spreads.

From a strategy standpoint:

Intraday traders: Favor short rallies near resistance, avoid bottom fishing.

Options writers: Call writing remains dominant but should be actively risk-managed due to rising volumes.

In summary, Open Interest Volume Analysis confirms that institutions are not betting on a V-shaped recovery yet. Until OI contraction or short covering appears, the market remains fragile, reactive, and volatility-driven.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.