Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 16/02/2026

Table of Contents

The 16th February 2026 session delivered a risk-on undertone across headline indices, and a detailed Open Interest Volume Analysis confirms that the rally was structurally healthier than it appeared on price alone.

NIFTY, BANKNIFTY, MIDCPNIFTY, and SENSEX all closed higher, but the derivative data clearly differentiates where strength is genuine and where it is merely short covering.

A sharp reduction in near-month futures open interest combined with falling volumes in NIFTY and SENSEX signals forced short exits rather than aggressive fresh longs, while BANKNIFTY stands out with strong fresh long accumulation supported by rising OI and volume.

Options data across weekly and monthly expiries further strengthens the bullish bias, with Put-Call Ratios rising sharply, Max Pain shifting upward, and PUT writing dominating near support zones—a classic sign of smart money positioning ahead of continuation moves.

In this environment, traders must rely less on headlines and more on Open Interest Volume Analysis to identify which indices are poised for follow-through and which may stall after a relief rally.

NSE & BSE F&O Market Signals

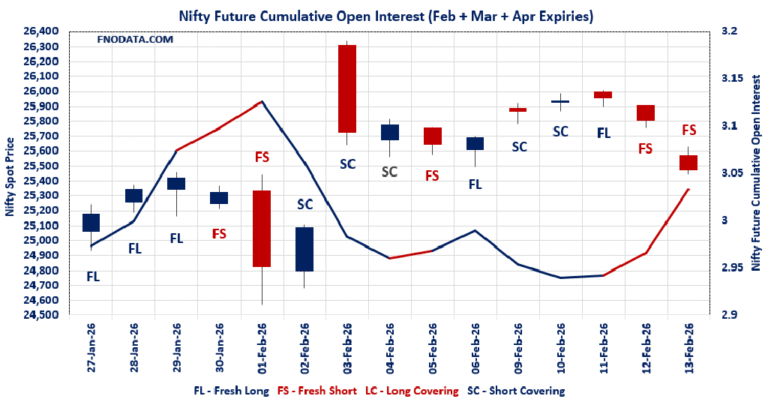

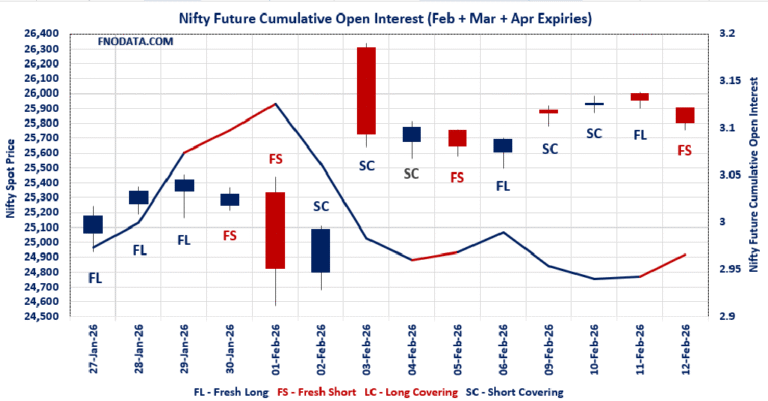

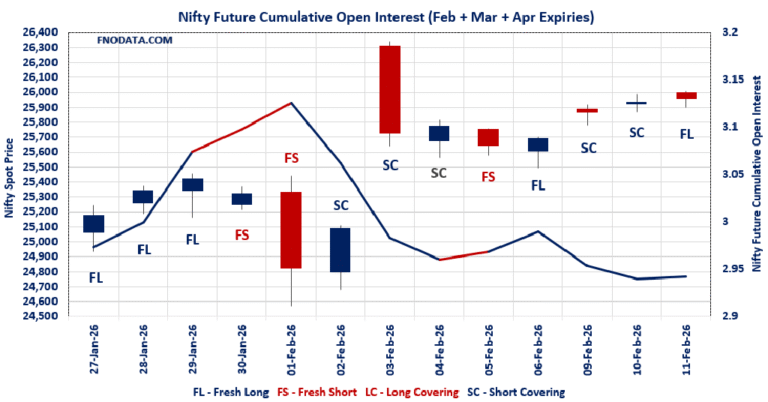

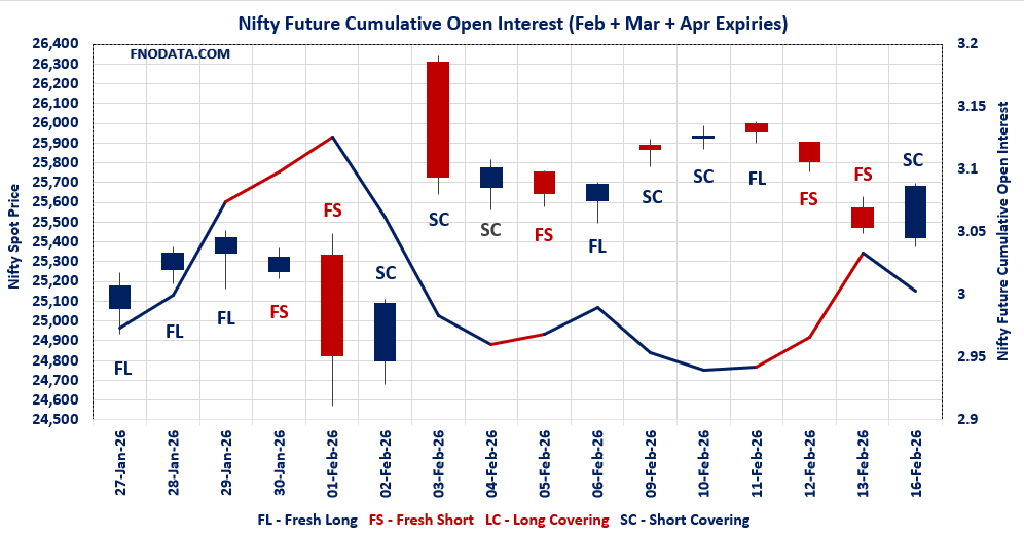

NIFTY Future analysis

NIFTY Spot closed at: 25682.75 (0.831%)

Combined = February + March + April

Combined Fut Open Interest Change: -3.05%

Combined Fut Volume Change: -26.34%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 12% Previous 11%

NIFTY FEBRUARY Future closed at: 25717.2 (0.777%)

February Fut Premium 34.45 (Decreased by -13.25 points)

February Fut Open Interest Change: -3.63%

February Fut Volume Change: -27.42%

February Fut Open Interest Analysis: Short Covering

NIFTY March Future closed at: 25879 (0.741%)

March Fut Premium 196.25 (Decreased by -21.25 points)

March Fut Open Interest Change: 3.00%

March Fut Volume Change: -12.97%

March Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (17/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.079 (Increased from 0.454)

Put-Call Ratio (Volume): 0.821

Max Pain Level: 25650

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 25750

Highest PUT Addition: 25500

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.971 (Increased from 0.927)

Put-Call Ratio (Volume): 0.802

Max Pain Level: 25700

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27300

Highest PUT Addition: 24000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60949.1 (1.267%)

Combined = February + March + April

Combined Fut Open Interest Change: 13.47%

Combined Fut Volume Change: 23.74%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 15% Previous 14%

BANKNIFTY FEBRUARY Future closed at: 60968.8 (1.075%)

February Fut Premium19.7 (Decreased by -114.25 points)

February Fut Open Interest Change: 11.4%

February Fut Volume Change: 18.3%

February Fut Open Interest Analysis: Fresh Long

BANKNIFTY MARCH Future closed at: 61301.8 (0.987%)

March Fut Premium352.7 (Decreased by -163.05 points)

March Fut Open Interest Change: 26.28%

March Fut Volume Change: 72.81%

March Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.146 (Increased from 0.866)

Put-Call Ratio (Volume): 0.789

Max Pain Level: 60400

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 61500

Highest PUT Addition: 61000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13641.75 (0.098%)

Combined = February + March + April

Combined Fut Open Interest Change: -0.37%

Combined Fut Volume Change: -23.17%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 6% Previous 6%

MIDCPNIFTY FEBRUARY Future closed at: 13677.4 (0.345%)

February Fut Premium 35.65 (Increased by 33.65 points)

February Fut Open Interest Change: -0.84%

February Fut Volume Change: -25.24%

February Fut Open Interest Analysis: Short Covering

MIDCPNIFTY MARCH Future closed at: 13750.6 (0.289%)

March Fut Premium 108.85 (Increased by 26.2 points)

March Fut Open Interest Change: 7.41%

March Fut Volume Change: -0.51%

March Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.849 (Decreased from 0.901)

Put-Call Ratio (Volume): 0.608

Max Pain Level: 13600

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13700

Highest PUT Addition: 13600

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 83,277.15 (0.787%)

SENSEX Monthly Future closed at: 83,463.40 (0.765%)

Premium: 186.25 (Decreased by -16.39 points)

Open Interest Change: -11.06%

Volume Change: -22.44%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (19/02/2026) Option Analysis

Put-Call Ratio (OI): 1.148 (Increased from 0.558)

Put-Call Ratio (Volume): 0.818

Max Pain Level: 83100

Maximum CALL OI: 84500

Maximum PUT OI: 83000

Highest CALL Addition: 84500

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 972.13 Cr.

DIIs Net BUY: ₹ 1,666.98 Cr.

FII Derivatives Activity

| FII Trading Stats | 16.02.26 | 13.02.26 | 12.02.26 |

| FII Cash (Provisional Data) | -972.13 | -7,395.41 | 108.42 |

| Index Future Open Interest Long Ratio | 20.06% | 19.37% | 22.01% |

| Index Future Volume Long Ratio | 54.10% | 30.73% | 48.47% |

| Call Option Open Interest Long Ratio | 51.29% | 50.83% | 49.36% |

| Call Option Volume Long Ratio | 50.03% | 50.27% | 49.71% |

| Put Option Open Interest Long Ratio | 59.36% | 62.09% | 58.97% |

| Put Option Volume Long Ratio | 49.80% | 50.72% | 50.18% |

| Stock Future Open Interest Long Ratio | 59.49% | 59.46% | 59.88% |

| Stock Future Volume Long Ratio | 50.49% | 47.51% | 48.99% |

| Index Futures | Fresh Long | Long Covering | Long Covering |

| Index Options | Long Covering | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Short | Fresh Short |

| Nifty Options | Long Covering | Fresh Long | Fresh Long |

| BankNifty Futures | Fresh Long | Long Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Short Covering | Fresh Long |

| FinNifty Options | Short Covering | Short Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Long Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Short Covering | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Short |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (19/02/2026)

The SENSEX index closed at 83277.15. The SENSEX weekly expiry for FEBRUARY 19, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.148 against previous 0.558. The 84500CE option holds the maximum open interest, followed by the 83000PE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 78000PE option, with open interest additions also seen in the 82500PE and 83000PE options. On the other hand, open interest reductions were prominent in the 88000CE, 83000CE, and 82800CE options. Trading volume was highest in the 83000CE option, followed by the 82500PE and 83000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 19-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83277.15 | 1.148 | 0.558 | 0.818 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,10,38,000 | 1,20,83,040 | -10,45,040 |

| PUT: | 1,26,76,280 | 67,47,040 | 59,29,240 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 8,29,820 | 2,05,400 | 62,33,840 |

| 84000 | 6,94,240 | 2,740 | 1,08,94,000 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 8,29,820 | 2,05,400 | 62,33,840 |

| 84600 | 2,54,820 | 1,08,540 | 19,34,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 4,11,380 | -2,93,060 | 31,93,960 |

| 83000 | 6,06,980 | -2,46,700 | 2,62,13,220 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 6,06,980 | -2,46,700 | 2,62,13,220 |

| 82800 | 1,25,780 | -2,02,560 | 1,51,08,400 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,75,440 | 3,55,640 | 1,59,83,260 |

| 81500 | 6,68,560 | 3,45,620 | 51,90,400 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 6,22,180 | 4,40,040 | 30,42,560 |

| 82500 | 6,31,200 | 3,88,600 | 1,70,73,140 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83800 | 49,000 | -16,100 | 1,51,420 |

| 77700 | 9,680 | -4,420 | 77,900 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 6,31,200 | 3,88,600 | 1,70,73,140 |

| 83000 | 7,75,440 | 3,55,640 | 1,59,83,260 |

NIFTY Weekly Expiry (17/02/2026)

The NIFTY index closed at 25682.75. The NIFTY weekly expiry for FEBRUARY 17, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.079 against previous 0.454. The 25500PE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 25600PE and 25400PE options. On the other hand, open interest reductions were prominent in the 27000CE, 25600CE, and 25500CE options. Trading volume was highest in the 25600CE option, followed by the 25500PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 17-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,682.75 | 1.079 | 0.454 | 0.821 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,49,95,275 | 24,79,82,215 | -7,29,86,940 |

| PUT: | 18,87,37,380 | 11,26,10,550 | 7,61,26,830 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,36,89,780 | -30,74,370 | 26,14,893 |

| 26,500 | 1,24,01,480 | -11,25,930 | 17,37,163 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,750 | 52,97,370 | 8,50,200 | 39,89,693 |

| 26,550 | 17,26,075 | 3,10,310 | 3,58,114 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 88,22,840 | -74,68,110 | 12,21,212 |

| 25,600 | 57,53,345 | -70,71,220 | 1,06,26,494 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 57,53,345 | -70,71,220 | 1,06,26,494 |

| 25,500 | 31,76,615 | -61,19,165 | 81,80,009 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,41,39,450 | 75,71,850 | 97,07,544 |

| 24,500 | 1,23,71,190 | 47,94,140 | 16,20,575 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,41,39,450 | 75,71,850 | 97,07,544 |

| 25,600 | 1,05,16,610 | 65,50,700 | 60,34,319 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 10,81,795 | -7,19,225 | 1,16,702 |

| 25,000 | 79,44,690 | -3,48,075 | 15,32,682 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,41,39,450 | 75,71,850 | 97,07,544 |

| 25,400 | 1,01,20,955 | 56,36,930 | 60,63,257 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25682.75. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.971 against previous 0.927. The 26000CE option holds the maximum open interest, followed by the 25000PE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 27300CE option, with open interest additions also seen in the 27000CE and 24000PE options. On the other hand, open interest reductions were prominent in the 25600CE, 25500CE, and 26000PE options. Trading volume was highest in the 25500PE option, followed by the 26000CE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,682.75 | 0.971 | 0.927 | 0.802 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,28,60,775 | 6,04,87,505 | 1,23,73,270 |

| PUT: | 7,07,76,745 | 5,60,97,600 | 1,46,79,145 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 73,10,745 | 3,90,650 | 3,43,801 |

| 27,000 | 56,86,915 | 18,17,985 | 1,33,638 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 29,25,780 | 26,82,680 | 94,779 |

| 27,000 | 56,86,915 | 18,17,985 | 1,33,638 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 22,38,600 | -8,00,670 | 2,76,479 |

| 25,500 | 32,94,785 | -2,70,855 | 2,80,218 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 73,10,745 | 3,90,650 | 3,43,801 |

| 25,500 | 32,94,785 | -2,70,855 | 2,80,218 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 64,18,815 | 14,91,035 | 2,06,326 |

| 25,500 | 60,95,700 | 8,26,995 | 3,76,964 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 37,00,060 | 15,39,915 | 79,450 |

| 25,000 | 64,18,815 | 14,91,035 | 2,06,326 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 28,30,360 | -2,13,980 | 40,242 |

| 25,600 | 29,88,960 | -1,24,800 | 2,14,510 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 60,95,700 | 8,26,995 | 3,76,964 |

| 25,600 | 29,88,960 | -1,24,800 | 2,14,510 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60949.1. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.146 against previous 0.866. The 60000PE option holds the maximum open interest, followed by the 60000CE and 61000CE options. Market participants have shown increased interest with significant open interest additions in the 61000PE option, with open interest additions also seen in the 60500PE and 60800PE options. On the other hand, open interest reductions were prominent in the 60500CE, 62500CE, and 60700CE options. Trading volume was highest in the 60500CE option, followed by the 61000CE and 60000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,949.10 | 1.146 | 0.866 | 0.789 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,37,44,770 | 1,50,68,940 | -13,24,170 |

| PUT: | 1,57,45,440 | 1,30,56,900 | 26,88,540 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,68,920 | -1,02,750 | 96,000 |

| 61,000 | 9,30,750 | 51,840 | 2,18,579 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,500 | 6,08,640 | 1,13,370 | 1,07,788 |

| 61,000 | 9,30,750 | 51,840 | 2,18,579 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 6,74,880 | -2,92,380 | 2,42,110 |

| 62,500 | 6,76,170 | -1,78,260 | 60,019 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 6,74,880 | -2,92,380 | 2,42,110 |

| 61,000 | 9,30,750 | 51,840 | 2,18,579 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 21,80,100 | 84,030 | 2,01,433 |

| 58,000 | 8,93,970 | 51,600 | 41,525 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 5,82,210 | 3,18,930 | 74,174 |

| 60,500 | 8,77,290 | 2,84,580 | 1,60,253 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 1,85,280 | -76,920 | 15,914 |

| 57,300 | 43,620 | -23,700 | 4,868 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 21,80,100 | 84,030 | 2,01,433 |

| 60,500 | 8,77,290 | 2,84,580 | 1,60,253 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13641.75. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.849 against previous 0.901. The 14500CE option holds the maximum open interest, followed by the 13000PE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13700CE option, with open interest additions also seen in the 13600CE and 13600PE options. On the other hand, open interest reductions were prominent in the 72500CE, 69500CE, and 66000PE options. Trading volume was highest in the 13800CE option, followed by the 13600CE and 13700CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,641.75 | 0.849 | 0.901 | 0.608 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 86,70,600 | 81,46,800 | 5,23,800 |

| PUT: | 73,57,200 | 73,36,200 | 21,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,82,520 | -30,720 | 5,632 |

| 14,000 | 9,94,320 | 1,11,000 | 19,121 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 7,28,040 | 2,44,800 | 24,281 |

| 13,600 | 3,29,280 | 1,20,360 | 26,050 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,82,520 | -30,720 | 5,632 |

| 13,650 | 84,960 | -25,560 | 7,355 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 3,29,880 | -10,560 | 39,317 |

| 13,600 | 3,29,280 | 1,20,360 | 26,050 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,38,840 | -79,200 | 11,457 |

| 12,500 | 4,87,560 | 37,080 | 1,720 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 4,57,080 | 1,17,720 | 19,988 |

| 12,500 | 4,87,560 | 37,080 | 1,720 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,38,840 | -79,200 | 11,457 |

| 13,700 | 3,25,320 | -78,000 | 7,330 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,83,240 | 7,320 | 21,387 |

| 13,600 | 4,57,080 | 1,17,720 | 19,988 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

NIFTY:

The index rally is driven primarily by short covering, evident from declining futures OI and sharply lower volumes.

Weekly and monthly PCR expansion above 1 and Max Pain near 25650–25700 indicate strong downside cushioning, but lack of volume warns against aggressive breakout longs.

Action: Prefer buy-on-dips near 25650–25700 rather than chasing above 25800 unless fresh long OI build-up appears.

BANKNIFTY (Clear Leader):

Strong fresh long formation across February and March futures with double-digit OI and volume expansion confirms institutional accumulation.

Monthly PCR above 1.14 and heavy PUT additions near 61000 show confidence in higher levels.

Action: BANKNIFTY remains the best index to trade on the long side, with dips likely to be bought aggressively.

MIDCPNIFTY:

Price stability with short covering in near futures and fresh longs shifting to March suggests selective accumulation, not broad momentum.

Weak PCR and low volume participation imply range-bound behavior.

Action: Ideal for stock-specific trades, avoid index-level aggression until volume expands.

SENSEX:

Futures OI contraction with rising prices confirms a classic short-covering rally, reinforced by a strong jump in weekly PCR.

However, absence of fresh longs means upside may be gradual rather than explosive.

Action: Maintain positional longs with trailing stops, avoid leveraged fresh entries.

Final Market Read:

This session’s Open Interest Volume Analysis clearly shows a rotation-based rally, not a euphoric breakout.

BANKNIFTY is leading, NIFTY is stabilizing, and broader indices are selectively participating.

Traders who align positions with OI + volume confirmation rather than price alone are best positioned to capture the next directional move.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.