Turning Complex Derivative Data into Clear Market Insights

NSE Indices Futures and Options Open Interest Volume Analysis for 19/02/2026

Table of Contents

Open Interest Volume Analysis clearly signals a risk-off environment across NIFTY, BANKNIFTY, and MIDCPNIFTY as all three indices witnessed sharp price erosion coupled with aggressive volume expansion, a classic signature of institutional participation on the short side.

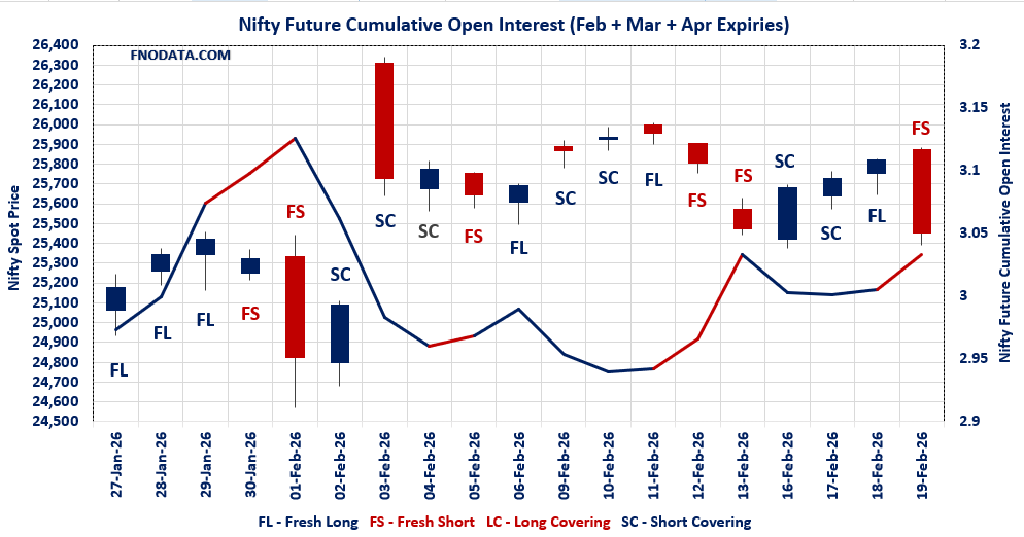

In NIFTY, despite February witnessing long covering, the massive 51.61% OI surge in March futures confirms that fresh shorts are being rolled forward, not exited — reinforcing a bearish positional bias ahead of the monthly expiry.

The Put-Call Ratio (OI) collapse from 1.139 to 0.559 is a strong sentiment reset, indicating that Put writers are unwinding while Call writers gain dominance, a setup that historically favors sell-on-rise strategies.

BANKNIFTY tells a slightly different story — heavy long liquidation in February combined with fresh March shorts suggests trend weakening rather than panic selling, often seen before range expansion or breakdown.

The real warning sign emerges from MIDCPNIFTY, where explosive volume (958%) and OI (393%) in March futures confirms aggressive short positioning, highlighting that risk appetite has decisively moved away from midcaps.

Overall, this Open Interest Volume Analysis confirms that smart money is not hedging anymore — it is positioning directionally, and the direction is clearly cautious to bearish heading into expiry.

NSE & BSE F&O Market Signals

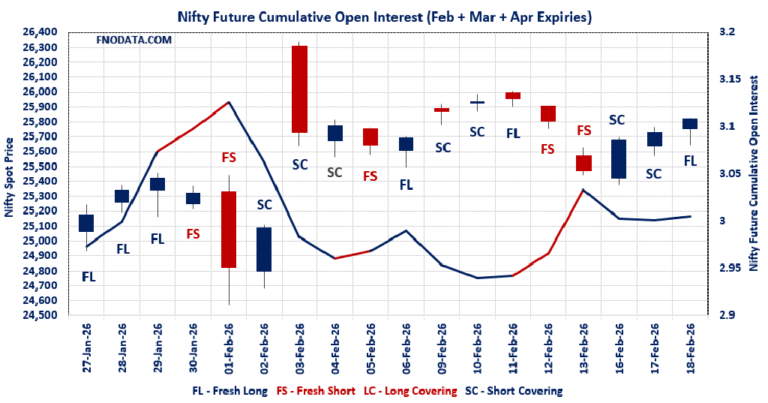

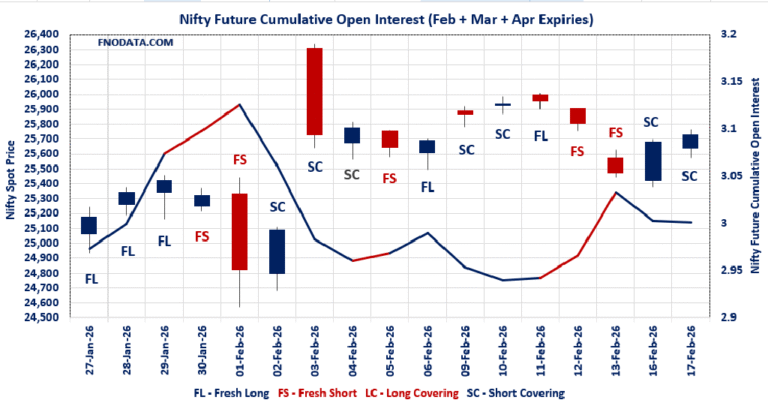

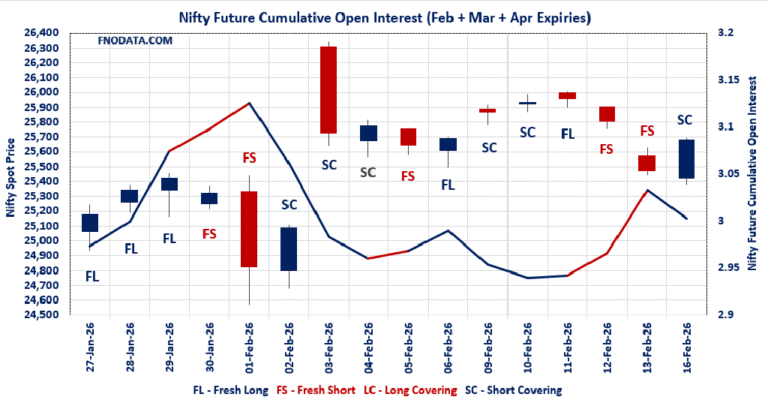

NIFTY Future analysis

NIFTY Spot closed at: 25454.35 (-1.414%)

Combined = February + March + April

Combined Fut Open Interest Change: 2.83%

Combined Fut Volume Change: 86.27%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 21% Previous 15%

NIFTY FEBRUARY Future closed at: 25446 (-1.478%)

February Fut Discount -8.35 (Decreased by -16.8 points)

February Fut Open Interest Change: -4.55%

February Fut Volume Change: 63.57%

February Fut Open Interest Analysis: Long Covering

NIFTY March Future closed at: 25600 (-1.478%)

March Fut Discount 145.65 (Decreased by -19 points)

March Fut Open Interest Change: 51.61%

March Fut Volume Change: 162.24%

March Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.559 (Decreased from 1.139)

Put-Call Ratio (Volume): 1.060

Max Pain Level: 25600

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 24800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60739.55 (-1.318%)

Combined = February + March + April

Combined Fut Open Interest Change: -7.32%

Combined Fut Volume Change: 66.75%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 36% Previous 25%

BANKNIFTY FEBRUARY Future closed at: 60716.6 (-1.274%)

February Fut Discount -22.95 (Increased by 27.45 points)

February Fut Open Interest Change: -20.6%

February Fut Volume Change: 54.5%

February Fut Open Interest Analysis: Long Covering

BANKNIFTY MARCH Future closed at: 61100.6 (-1.218%)

March Fut Discount 361.05 (Increased by 58.05 points)

March Fut Open Interest Change: 34.49%

March Fut Volume Change: 100.45%

March Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.876 (Decreased from 1.449)

Put-Call Ratio (Volume): 1.290

Max Pain Level: 60500

Maximum CALL Open Interest: 61000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 61000

Highest PUT Addition: 54400

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13442.5 (-2.091%)

Combined = February + March + April

Combined Fut Open Interest Change: 2.56%

Combined Fut Volume Change: 269.43%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 27% Previous 7%

MIDCPNIFTY FEBRUARY Future closed at: 13407.35 (-2.425%)

February Fut Discount -35.15 (Decreased by -46.15 points)

February Fut Open Interest Change: -20.03%

February Fut Volume Change: 158.09%

February Fut Open Interest Analysis: Long Covering

MIDCPNIFTY MARCH Future closed at: 13462.35 (-2.513%)

March Fut Discount 19.85 (Decreased by -60 points)

March Fut Open Interest Change: 393.00%

March Fut Volume Change: 958.08%

March Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.755 (Decreased from 0.855)

Put-Call Ratio (Volume): 0.813

Max Pain Level: 13600

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13600

Highest PUT Addition: 13600

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 880.49 Cr.

DIIs Net SELL: ₹ 596.28 Cr.

FII Derivatives Activity

| FII Trading Stats | 19.02.26 | 18.02.26 | 17.02.26 |

| FII Cash (Provisional Data) | -880.49 | 1,154.34 | 995.21 |

| Index Future Open Interest Long Ratio | 23.32% | 22.82% | 21.27% |

| Index Future Volume Long Ratio | 47.29% | 58.29% | 57.33% |

| Call Option Open Interest Long Ratio | 49.23% | 51.63% | 51.61% |

| Call Option Volume Long Ratio | 49.66% | 50.04% | 49.93% |

| Put Option Open Interest Long Ratio | 61.44% | 59.48% | 62.17% |

| Put Option Volume Long Ratio | 50.38% | 49.71% | 49.76% |

| Stock Future Open Interest Long Ratio | 58.84% | 59.08% | 59.19% |

| Stock Future Volume Long Ratio | 49.49% | 49.86% | 47.78% |

| Index Futures | Fresh Short | Fresh Long | Fresh Long |

| Index Options | Fresh Long | Fresh Short | Long Covering |

| Nifty Futures | Fresh Short | Short Covering | Fresh Long |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Long Covering | Fresh Long | Fresh Long |

| BankNifty Options | Short Covering | Long Covering | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Long Covering |

| FinNifty Options | Long Covering | Fresh Long | Fresh Short |

| MidcpNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Fresh Long | Fresh Short |

| Stock Options | Short Covering | Long Covering | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE Option market Trends : Options Insights

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25454.35. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.559 against previous 1.139. The 27000CE option holds the maximum open interest, followed by the 26000CE and 25800CE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 25800CE and 25700CE options. On the other hand, open interest reductions were prominent in the 25700PE, 25500PE, and 25600PE options. Trading volume was highest in the 25800CE option, followed by the 25600PE and 25500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,454.35 | 0.559 | 1.139 | 1.060 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 23,53,43,745 | 12,79,53,930 | 10,73,89,815 |

| PUT: | 13,15,49,730 | 14,56,99,320 | -1,41,49,590 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,87,26,500 | 77,73,740 | 8,80,925 |

| 26,000 | 1,48,14,020 | 40,46,965 | 19,65,258 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 1,13,99,115 | 91,20,735 | 21,03,719 |

| 25,800 | 1,46,99,620 | 85,02,975 | 32,95,800 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,400 | 13,17,550 | -1,59,445 | 75,889 |

| 24,000 | 6,80,550 | -1,18,690 | 2,343 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 1,46,99,620 | 85,02,975 | 32,95,800 |

| 25,700 | 1,23,09,050 | 77,84,790 | 24,87,890 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,02,78,060 | 17,43,430 | 11,69,980 |

| 24,000 | 90,81,085 | 57,395 | 5,63,437 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 62,63,010 | 28,15,280 | 5,49,745 |

| 25,000 | 1,02,78,060 | 17,43,430 | 11,69,980 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 33,34,565 | -55,60,360 | 28,23,006 |

| 25,500 | 56,29,650 | -33,78,180 | 29,74,406 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 38,33,375 | -29,49,115 | 30,26,185 |

| 25,500 | 56,29,650 | -33,78,180 | 29,74,406 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60739.55. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.876 against previous 1.449. The 60000PE option holds the maximum open interest, followed by the 61000CE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 61000CE option, with open interest additions also seen in the 63000CE and 61500CE options. On the other hand, open interest reductions were prominent in the 60000PE, 61000PE, and 60000CE options. Trading volume was highest in the 61000PE option, followed by the 61500CE and 61000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,739.55 | 0.876 | 1.449 | 1.290 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,63,60,290 | 1,41,83,610 | 21,76,680 |

| PUT: | 1,43,34,570 | 2,05,46,280 | -62,11,710 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 11,24,250 | 5,23,200 | 2,71,906 |

| 61,500 | 9,56,310 | 1,61,550 | 3,14,178 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 11,24,250 | 5,23,200 | 2,71,906 |

| 63,000 | 9,45,390 | 1,69,080 | 1,06,079 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 8,97,810 | -3,77,700 | 35,517 |

| 62,300 | 1,16,370 | -56,280 | 41,468 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 61,500 | 9,56,310 | 1,61,550 | 3,14,178 |

| 61,000 | 11,24,250 | 5,23,200 | 2,71,906 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 13,64,910 | -9,05,850 | 2,69,478 |

| 58,000 | 10,77,540 | -1,26,870 | 1,15,926 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,400 | 6,210 | 3,060 | 235 |

| 59,800 | 1,88,190 | 2,790 | 38,742 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 13,64,910 | -9,05,850 | 2,69,478 |

| 61,000 | 6,33,150 | -5,53,710 | 3,86,190 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 6,33,150 | -5,53,710 | 3,86,190 |

| 60,000 | 13,64,910 | -9,05,850 | 2,69,478 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13442.5. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.755 against previous 0.855. The 14500CE option holds the maximum open interest, followed by the 13000PE and 13700CE options. Market participants have shown increased interest with significant open interest additions in the 13600CE option, with open interest additions also seen in the 13500CE and 13600PE options. On the other hand, open interest reductions were prominent in the 68000CE, 70000PE, and 68000CE options. Trading volume was highest in the 13700CE option, followed by the 13600PE and 13600CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,442.50 | 0.755 | 0.855 | 0.813 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,31,88,720 | 1,02,50,640 | 29,38,080 |

| PUT: | 99,56,520 | 87,66,720 | 11,89,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 13,06,680 | 1,36,800 | 12,927 |

| 13,700 | 11,49,480 | 1,79,040 | 52,574 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 8,70,600 | 6,04,320 | 43,616 |

| 13,500 | 5,21,400 | 3,00,000 | 17,499 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 10,31,160 | -1,21,080 | 38,167 |

| 14,200 | 5,12,400 | -51,360 | 14,168 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 11,49,480 | 1,79,040 | 52,574 |

| 13,600 | 8,70,600 | 6,04,320 | 43,616 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,68,800 | -4,560 | 20,710 |

| 13,600 | 7,20,000 | 2,93,040 | 46,124 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 7,20,000 | 2,93,040 | 46,124 |

| 13,250 | 2,95,680 | 1,94,760 | 16,438 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 6,10,320 | -2,41,080 | 31,132 |

| 13,800 | 1,92,840 | -40,920 | 5,436 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 7,20,000 | 2,93,040 | 46,124 |

| 13,500 | 6,28,080 | 1,33,080 | 36,382 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis suggests that the market is not done correcting yet — the shift of OI from near-month to far-month contracts across all indices indicates bearish conviction, not profit booking.

NIFTY below Max Pain (25600) with rising Call additions at the same strike tells us that any pullback towards 25550–25600 is likely to face supply, making Call writing or short futures on bounce the preferred approach.

BANKNIFTY’s Max Pain at 60500 with heavy Call OI at 61000 clearly defines the upper ceiling, while long covering in February warns traders not to chase shorts at lows, but instead sell rallies near resistance.

MIDCPNIFTY is the weakest pocket, and Open Interest Volume Analysis confirms that shorts are being built, not trapped — positional traders should avoid long exposure until OI unwinds or PCR stabilizes above 1.

The sharp PCR (OI) breakdown across all indices is a red flag — historically, such moves precede either continuation of downside or high-volatility consolidation, not immediate reversals.

Actionable Strategy:

Prefer sell-on-rise trades

Focus on Call spreads or bear put spreads near Max Pain zones

Avoid aggressive bottom fishing until OI contraction + price stabilization appear together

In summary, this Open Interest Volume Analysis confirms that the market narrative has shifted from “buy dips” to “protect capital”, and traders should align with data-driven positioning rather than hope-driven trades.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.