Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 20/02/2026

Table of Contents

Open Interest Volume Analysis clearly signals a structural shift towards bullish participation across indices, with fresh long build-up dominating March contracts while February positions unwind through aggressive short covering.

NIFTY and BANKNIFTY both show a classic rollover-led up-move, where declining near-month OI + rising far-month OI and premiums confirm institutional money migrating into March series, not speculative bounce trading.

The sharp jump in rollover (NIFTY 33%, BANKNIFTY 52%, MIDCPNIFTY 56%) reinforces that trend traders are committing capital, not exiting—an important confirmation often missed without proper Open Interest Volume Analysis.

Options data complements this view: PCR (OI) expansion across all indices, rising Max Pain levels, and PUT writing closer to spot suggest dip-buying sentiment with defined downside confidence, not reckless upside chasing.

Overall, price + volume + open interest alignment points to a controlled bullish undertone, where momentum is real but selective, demanding strike-wise and index-specific trade planning rather than blanket long exposure.

NSE & BSE F&O Market Signals

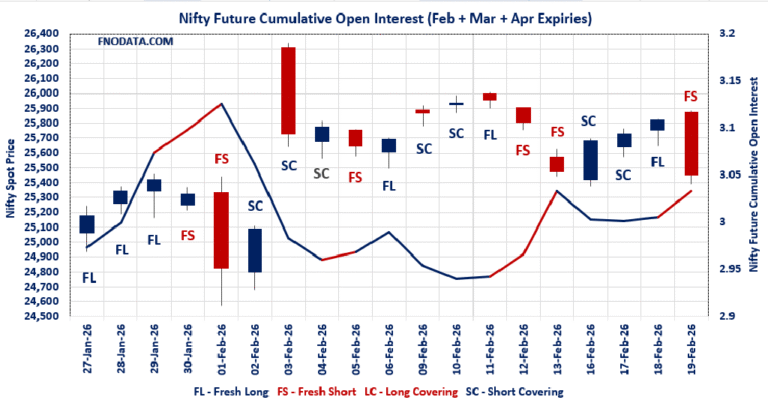

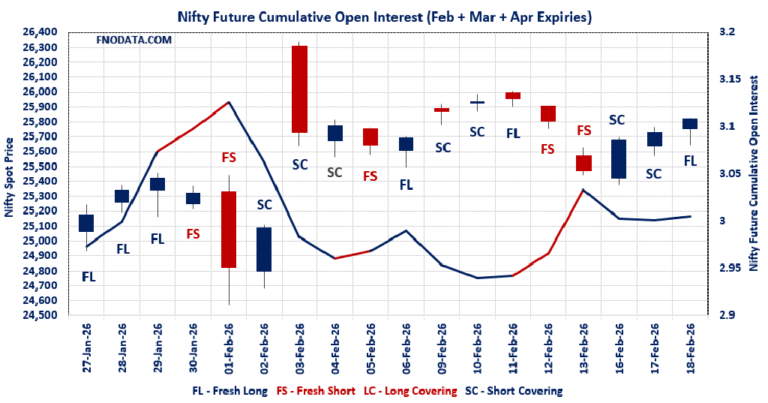

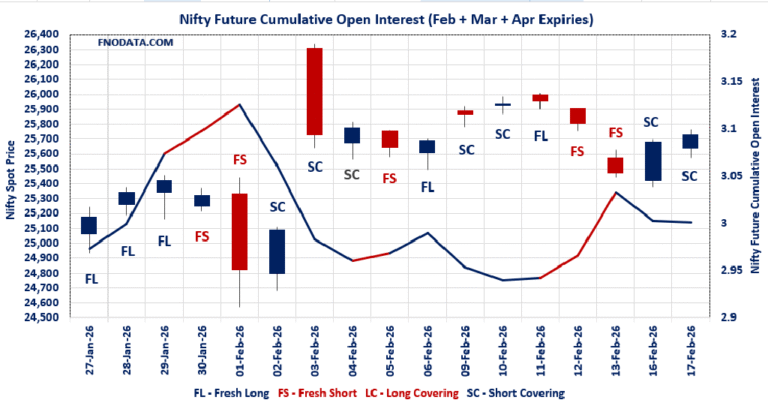

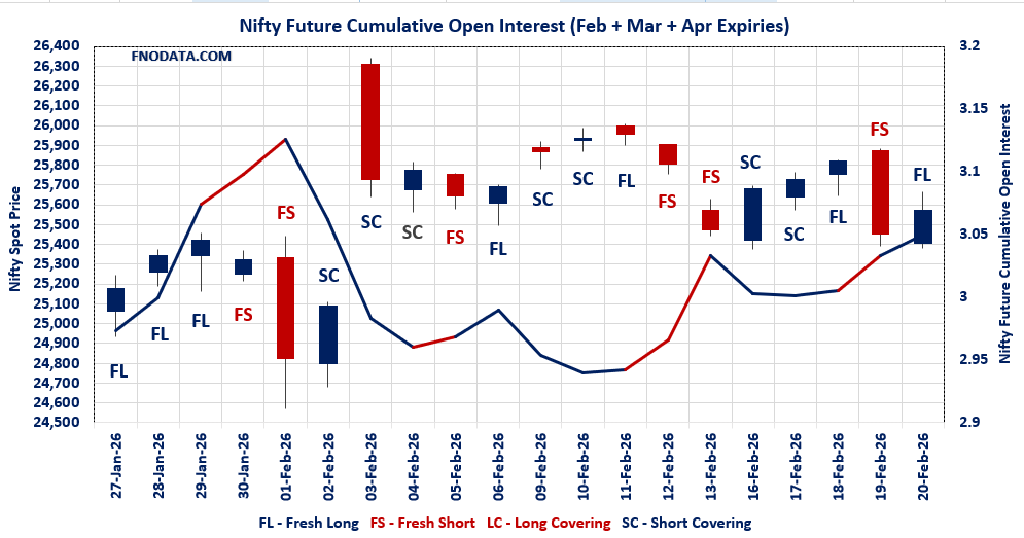

NIFTY Future analysis

NIFTY Spot closed at: 25571.25 (0.459%)

Combined = February + March + April

Combined Fut Open Interest Change: 1.56%

Combined Fut Volume Change: 22.67%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 33% Previous 21%

NIFTY FEBRUARY Future closed at: 25584.7 (0.545%)

February Fut Premium 13.45 (Increased by 21.8 points)

February Fut Open Interest Change: -14.32%

February Fut Volume Change: 11.74%

February Fut Open Interest Analysis: Short Covering

NIFTY March Future closed at: 25742.6 (0.557%)

March Fut Premium 171.35 (Increased by 25.7 points)

March Fut Open Interest Change: 70.85%

March Fut Volume Change: 53.55%

March Fut Open Interest Analysis: Fresh Long

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.872 (Increased from 0.559)

Put-Call Ratio (Volume): 0.831

Max Pain Level: 25600

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26500

Highest PUT Addition: 23100

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 61172 (0.712%)

Combined = February + March + April

Combined Fut Open Interest Change: 1.85%

Combined Fut Volume Change: 17.54%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 52% Previous 36%

BANKNIFTY FEBRUARY Future closed at: 61179.2 (0.762%)

February Fut Premium 7.2 (Increased by 30.15 points)

February Fut Open Interest Change: -23.8%

February Fut Volume Change: 3.5%

February Fut Open Interest Analysis: Short Covering

BANKNIFTY MARCH Future closed at: 61545.8 (0.729%)

March Fut Premium 373.8 (Increased by 12.75 points)

March Fut Open Interest Change: 55.27%

March Fut Volume Change: 52.09%

March Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.992 (Increased from 0.876)

Put-Call Ratio (Volume): 0.735

Max Pain Level: 60800

Maximum CALL Open Interest: 63000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 61200

Highest PUT Addition: 61000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13476 (0.249%)

Combined = February + March + April

Combined Fut Open Interest Change: 16.95%

Combined Fut Volume Change: 64.35%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 56% Previous 27%

MIDCPNIFTY FEBRUARY Future closed at: 13474.8 (0.503%)

February Fut Discount -1.2 (Increased by 33.95 points)

February Fut Open Interest Change: -29.60%

February Fut Volume Change: 34.48%

February Fut Open Interest Analysis: Short Covering

MIDCPNIFTY MARCH Future closed at: 13496.55 (0.254%)

March Fut Discount 20.55 (Increased by 0.7 points)

March Fut Open Interest Change: 150.44%

March Fut Volume Change: 115.40%

March Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.809 (Increased from 0.755)

Put-Call Ratio (Volume): 0.950

Max Pain Level: 13500

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14100

Highest PUT Addition: 13400

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 82,814.71 (0.384%)

SENSEX Monthly Future closed at: 82,888.85 (0.498%)

Premium: 74.14 (Increased by 94.33 points)

Open Interest Change: -24.41%

Volume Change: -24.00%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (26/02/2026) Option Analysis

Put-Call Ratio (OI): 0.906 (Increased from 0.588)

Put-Call Ratio (Volume): 0.868

Max Pain Level: 82900

Maximum CALL OI: 83000

Maximum PUT OI: 82000

Highest CALL Addition: 90000

Highest PUT Addition: 82000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 934.61 Cr.

DIIs Net BUY: ₹ 2,637.15 Cr.

FII Derivatives Activity

| FII Trading Stats | 20.02.26 | 19.02.26 | 18.02.26 |

| FII Cash (Provisional Data) | -934.61 | -880.49 | 1,154.34 |

| Index Future Open Interest Long Ratio | 25.27% | 23.32% | 22.82% |

| Index Future Volume Long Ratio | 51.70% | 47.29% | 58.29% |

| Call Option Open Interest Long Ratio | 52.10% | 49.23% | 51.63% |

| Call Option Volume Long Ratio | 50.35% | 49.66% | 50.04% |

| Put Option Open Interest Long Ratio | 59.22% | 61.44% | 59.48% |

| Put Option Volume Long Ratio | 49.85% | 50.38% | 49.71% |

| Stock Future Open Interest Long Ratio | 59.32% | 58.84% | 59.08% |

| Stock Future Volume Long Ratio | 50.73% | 49.49% | 49.86% |

| Index Futures | Fresh Long | Fresh Short | Fresh Long |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Short | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Long | Long Covering | Fresh Long |

| BankNifty Options | Fresh Short | Short Covering | Long Covering |

| FinNifty Futures | Fresh Short | Long Covering | Fresh Long |

| FinNifty Options | Fresh Long | Long Covering | Fresh Long |

| MidcpNifty Futures | Fresh Long | Fresh Long | Fresh Short |

| MidcpNifty Options | Long Covering | Fresh Long | Short Covering |

| NiftyNxt50 Futures | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Long |

| Stock Options | Short Covering | Short Covering | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Monthly Expiry (26/02/2026)

The SENSEX index closed at 82814.71. The SENSEX weekly expiry for FEBRUARY 26, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.906 against previous 0.588. The 83000CE option holds the maximum open interest, followed by the 82000PE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 82000PE option, with open interest additions also seen in the 82500PE and 80000PE options. On the other hand, open interest reductions were prominent in the 84000CE, 83500CE, and 84500PE options. Trading volume was highest in the 83000CE option, followed by the 82500PE and 82000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 26-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82814.71 | 0.906 | 0.588 | 0.868 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 95,86,720 | 62,15,200 | 33,71,520 |

| PUT: | 86,84,800 | 36,53,500 | 50,31,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 6,01,740 | 23,440 | 2,11,24,880 |

| 87000 | 5,02,000 | 1,64,560 | 46,94,400 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 90000 | 3,84,460 | 2,24,940 | 25,09,240 |

| 86000 | 4,39,200 | 2,21,680 | 48,06,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,89,540 | -23,420 | 1,36,78,480 |

| 83500 | 4,64,280 | -18,940 | 1,32,62,580 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 6,01,740 | 23,440 | 2,11,24,880 |

| 82900 | 2,13,220 | 1,34,200 | 1,37,73,240 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,27,000 | 2,89,760 | 1,39,61,100 |

| 80000 | 5,25,200 | 2,36,040 | 67,48,960 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,27,000 | 2,89,760 | 1,39,61,100 |

| 82500 | 4,96,980 | 2,43,740 | 1,70,02,040 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 58,900 | -6,240 | 26,320 |

| 78800 | 7,820 | -1,980 | 2,66,100 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 4,96,980 | 2,43,740 | 1,70,02,040 |

| 82000 | 5,27,000 | 2,89,760 | 1,39,61,100 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25571.25. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.872 against previous 0.559. The 27000CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 23100PE option, with open interest additions also seen in the 25500PE and 25600PE options. On the other hand, open interest reductions were prominent in the 25800CE, 25600CE, and 25700CE options. Trading volume was highest in the 25600CE option, followed by the 25500PE and 25700CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,571.25 | 0.872 | 0.559 | 0.831 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,89,48,490 | 23,53,43,745 | -3,63,95,255 |

| PUT: | 17,34,99,950 | 13,15,49,730 | 4,19,50,220 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,58,55,125 | -28,71,375 | 10,41,601 |

| 26,000 | 1,41,37,175 | -6,76,845 | 33,63,767 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,36,23,025 | 13,80,600 | 11,71,981 |

| 27,500 | 53,76,800 | 5,67,125 | 3,34,446 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 1,07,52,170 | -39,47,450 | 49,56,900 |

| 25,600 | 76,72,275 | -37,26,840 | 80,48,695 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 76,72,275 | -37,26,840 | 80,48,695 |

| 25,700 | 88,69,965 | -34,39,085 | 66,70,068 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,19,73,715 | 16,95,655 | 21,31,180 |

| 24,000 | 1,15,69,090 | 24,88,005 | 7,66,759 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,100 | 94,55,160 | 45,08,660 | 4,81,749 |

| 25,500 | 91,59,930 | 35,30,280 | 68,85,882 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 25,14,005 | -4,62,670 | 5,76,966 |

| 25,900 | 10,99,020 | -2,83,660 | 1,48,280 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 91,59,930 | 35,30,280 | 68,85,882 |

| 25,600 | 64,04,970 | 25,71,595 | 57,82,959 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 61172. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.992 against previous 0.876. The 60000PE option holds the maximum open interest, followed by the 58000PE and 61000PE options. Market participants have shown increased interest with significant open interest additions in the 61000PE option, with open interest additions also seen in the 61200CE and 61200PE options. On the other hand, open interest reductions were prominent in the 61000CE, 61500CE, and 60000CE options. Trading volume was highest in the 61000PE option, followed by the 61000CE and 61200CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 61,172.00 | 0.992 | 0.876 | 0.735 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,53,11,100 | 1,63,60,290 | -10,49,190 |

| PUT: | 1,51,93,230 | 1,43,34,570 | 8,58,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 9,35,160 | -10,230 | 1,61,102 |

| 62,500 | 8,85,240 | -25,950 | 1,83,232 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,200 | 5,62,800 | 1,88,280 | 6,35,219 |

| 61,300 | 4,60,830 | 1,13,250 | 5,10,740 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 8,71,890 | -2,52,360 | 6,51,628 |

| 61,500 | 7,24,710 | -2,31,600 | 5,73,494 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 8,71,890 | -2,52,360 | 6,51,628 |

| 61,200 | 5,62,800 | 1,88,280 | 6,35,219 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,42,270 | -1,22,640 | 3,42,909 |

| 58,000 | 9,98,070 | -79,470 | 71,942 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 9,47,400 | 3,14,250 | 6,64,667 |

| 61,200 | 3,47,280 | 1,84,830 | 3,68,552 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 4,00,170 | -1,29,840 | 44,260 |

| 60,000 | 12,42,270 | -1,22,640 | 3,42,909 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 9,47,400 | 3,14,250 | 6,64,667 |

| 61,200 | 3,47,280 | 1,84,830 | 3,68,552 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13476. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.809 against previous 0.755. The 14500CE option holds the maximum open interest, followed by the 13700CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 13400PE option, with open interest additions also seen in the 12200PE and 12300PE options. On the other hand, open interest reductions were prominent in the 69700CE, 66000PE, and 69000CE options. Trading volume was highest in the 13500CE option, followed by the 13400PE and 13500PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,476.00 | 0.809 | 0.755 | 0.950 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,26,01,320 | 1,31,88,720 | -5,87,400 |

| PUT: | 1,01,97,120 | 99,56,520 | 2,40,600 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 12,23,160 | -83,520 | 12,686 |

| 13,700 | 11,45,400 | -4,080 | 51,958 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 7,43,880 | 1,09,080 | 12,500 |

| 13,500 | 5,95,920 | 74,520 | 90,323 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 5,49,120 | -1,36,200 | 27,077 |

| 13,900 | 9,97,680 | -1,23,360 | 29,353 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 5,95,920 | 74,520 | 90,323 |

| 13,600 | 8,50,320 | -20,280 | 64,063 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,28,600 | -40,200 | 25,103 |

| 13,400 | 7,82,640 | 1,32,240 | 77,011 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 7,82,640 | 1,32,240 | 77,011 |

| 12,200 | 1,96,080 | 1,26,240 | 2,202 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 3,59,040 | -2,51,280 | 6,970 |

| 13,600 | 4,87,440 | -2,32,560 | 11,806 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 7,82,640 | 1,32,240 | 77,011 |

| 13,500 | 7,11,840 | 83,760 | 66,158 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis confirms a “Buy on Dips” market structure, not a runaway rally—fresh longs in March futures across NIFTY, BANKNIFTY, and MIDCPNIFTY indicate trend continuation, provided key Max Pain and PUT OI zones hold.

NIFTY’s strength is backed by fresh March longs and rising PCR, but heavy CALL OI at 27,000 warns traders to book partial profits near resistance and re-enter on pullbacks toward 25,600–25,500.

BANKNIFTY remains the leader, with rollover acceleration and PUT additions near 61,000 showing strong institutional support—momentum traders can stay long above Max Pain (60,800) with tight trailing stops.

MIDCPNIFTY is the high-beta opportunity, but also the most crowded—massive OI and volume expansion demands strict risk management, as any unwinding could be sharp.

SENSEX short covering with rising premium suggests relief-led upside, but falling volume warns that fresh momentum confirmation is still pending.

In summary, Open Interest Volume Analysis favours positional longs in March series, selective option writing near strong PUT bases, and avoiding aggressive CALL selling until fresh resistance OI decisively builds.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.