Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 22/07/2025

Table of Contents

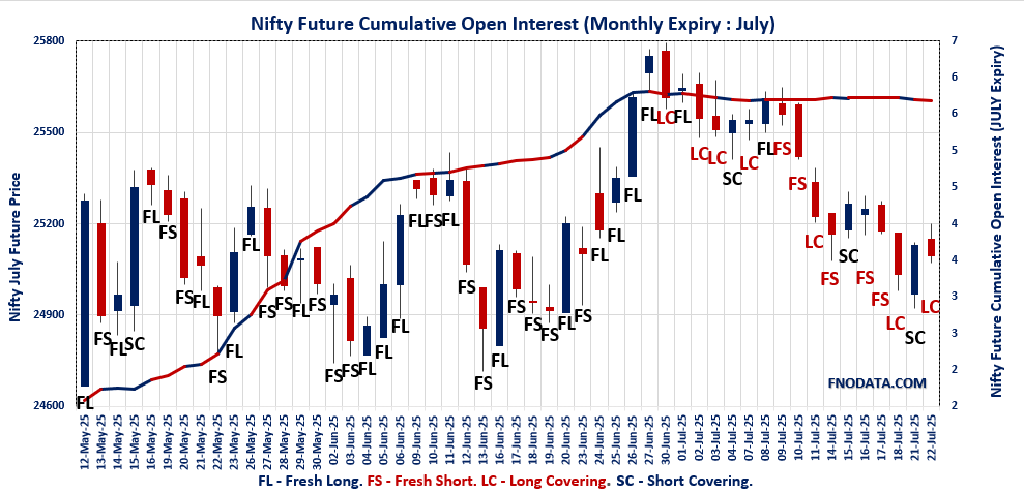

The Open Interest Volume Analysis for 22nd July 2025 clearly reflects a market struggling to gain momentum, with bulls lacking conviction and bears growing bolder ahead of expiry. Nifty July futures inched up just 0.25% to 25,093.90, but open interest tumbled 3.8%—signs of heavy position unwinding as the index hovers close to support. The premium collapsed by nearly 31 points, further highlighting the unwinding theme and a reluctance from traders to pay up for long exposure.

Options data reinforces the sense of caution: the weekly Put-Call Ratio (OI) plunged to 0.699, as call writers piled in at 25,200 and above, while the highest put addition formed a new support zone at 24,500. Max pain remains stationary at 25,100 for expiry, with the bulk of open interest also packed in around the same levels—expect choppy settlement. The monthly Nifty options chain echoes these stress signals: lower PCR, weak put additions, and substantial call writing up at 27,000 confirm that the market is still consolidating and unable to ignite a sustainable bounce.

BankNifty and the broader indices see a similar script—BankNifty futures rallied nearly 0.7% but open interest fell by almost 10% and premiums were slashed dramatically, proof of short-covering rather than new bullish bets. Monthly options suggest a ceiling at 57,000 and little appetite for a risk-on move, with PCR dropping to 0.74. FINNIFTY and MIDCPNIFTY, while up on the day, saw net open interest and volume slide, and premiums cratered, all pointing to defensive activity and a lack of participation on the long side. SENSEX, meanwhile, remained largely flat but registered a strong 38% surge in open interest, likely driven by fresh hedges or range-bound positioning rather than directional bets, as the weekly PCR for SENSEX also fell close to 0.70.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 25,060.90 (0.37%)

NIFTY JULY Future closed at: 25,093.90 (0.25%)

Premium: 33 (Decreased by -30.9 points)

Open Interest Change: -3.8%

Volume Change: -40.9%

NIFTY Weekly Expiry (24/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.699 (Decreased from 0.857)

Put-Call Ratio (Volume): 0.987

Max Pain Level: 25100

Maximum CALL Open Interest: 25100

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25200

Highest PUT Addition: 24500

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.921 (Decreased from 0.951)

Put-Call Ratio (Volume): 0.890

Max Pain Level: 25150

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 25100

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,756.00 (0.84%)

BANKNIFTY JULY Future closed at: 56,804.60 (0.69%)

Premium: 48.6 (Decreased by -84 points)

Open Interest Change: -9.6%

Volume Change: -39.6%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.742 (Decreased from 0.831)

Put-Call Ratio (Volume): 0.888

Max Pain Level: 56800

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 57000

Highest PUT Addition: 53000

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,990.45 (1.64%)

FINNIFTY JULY Future closed at: 27,004.70 (1.49%)

Premium: 14.25 (Decreased by -37.6 points)

Open Interest Change: -1.6%

Volume Change: -55.8%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.866 (Increased from 0.859)

Put-Call Ratio (Volume): 0.903

Max Pain Level: 26900

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 27000

Highest CALL Addition: 28000

Highest PUT Addition: 27000

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,206.60 (0.27%)

MIDCPNIFTY JULY Future closed at: 13,220.05 (0.13%)

Premium: 13.45 (Decreased by -18.05 points)

Open Interest Change: -2.1%

Volume Change: -28.2%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.780 (Decreased from 0.874)

Put-Call Ratio (Volume): 0.847

Max Pain Level: 13300

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13500

Highest PUT Addition: 13000

SENSEX Weekly Expiry (29/07/2025) Future

SENSEX Spot closed at: 82,186.81 (-0.02%)

SENSEX Weekly Future closed at: 82,287.20 (-0.03%)

Premium: 100.39 (Decreased by -7.57 points)

Open Interest Change: 38.0%

Volume Change: 60.6%

SENSEX Weekly Expiry (29/07/2025) Option Analysis

Put-Call Ratio (OI): 0.701 (Decreased from 0.836)

Put-Call Ratio (Volume): 0.699

Max Pain Level: 82200

Maximum CALL OI: 84000

Maximum PUT OI: 82000

Highest CALL Addition: 84000

Highest PUT Addition: 82000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,548.92 Cr

DIIs Net BUY: ₹ 5,239.77 Cr

FII Derivatives Activity

| FII Trading Stats | 22.07.25 | 21.07.25 | 18.07.25 |

| FII Cash (Provisional Data) | -3,548.92 | -1,681.23 | 374.74 |

| Index Future Open Interest Long Ratio | 14.41% | 15.14% | 15.02% |

| Index Future Volume Long Ratio | 40.02% | 55.10% | 35.56% |

| Call Option Open Interest Long Ratio | 48.79% | 49.90% | 50.01% |

| Call Option Volume Long Ratio | 49.71% | 49.98% | 49.39% |

| Put Option Open Interest Long Ratio | 60.12% | 59.51% | 63.82% |

| Put Option Volume Long Ratio | 50.36% | 49.37% | 50.28% |

| Stock Future Open Interest Long Ratio | 61.80% | 62.07% | 62.04% |

| Stock Future Volume Long Ratio | 47.46% | 49.14% | 48.10% |

| Index Futures | Fresh Short | Short Covering | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Short | Short Covering | Long Covering |

| FinNifty Options | Short Covering | Long Covering | Fresh Long |

| MidcpNifty Futures | Short Covering | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Long Covering | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Short Covering | Short Covering | Fresh Short |

| Stock Futures | Long Covering | Long Covering | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE & BSE Option market Trends : Options Insights

NIFTY weekly Expiry (24/07/2025)

The NIFTY index closed at 25060.9. The NIFTY weekly expiry for JULY 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.699 against previous 0.857. The 25100CE option holds the maximum open interest, followed by the 25200CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25200CE option, with open interest additions also seen in the 25100CE and 25150CE options. On the other hand, open interest reductions were prominent in the 24900PE, 23500PE, and 23700PE options. Trading volume was highest in the 25100PE option, followed by the 25100CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 24-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,060.90 | 0.699 | 0.857 | 0.987 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,75,09,650 | 13,28,08,950 | 3,47,00,700 |

| PUT: | 11,71,69,275 | 11,38,44,375 | 33,24,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,27,01,025 | 51,80,025 | 39,67,374 |

| 25,200 | 1,26,43,500 | 54,76,350 | 27,20,887 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,26,43,500 | 54,76,350 | 27,20,887 |

| 25,100 | 1,27,01,025 | 51,80,025 | 39,67,374 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 31,07,325 | -5,68,875 | 2,09,019 |

| 26,300 | 18,39,450 | -4,89,300 | 1,48,472 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,27,01,025 | 51,80,025 | 39,67,374 |

| 25,200 | 1,26,43,500 | 54,76,350 | 27,20,887 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 84,25,650 | 4,58,325 | 28,38,989 |

| 24,000 | 81,33,750 | -79,500 | 3,90,903 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 70,22,025 | 12,54,900 | 7,20,379 |

| 24,700 | 49,38,750 | 12,51,825 | 9,54,056 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 63,32,250 | -11,08,425 | 16,26,299 |

| 23,500 | 27,61,875 | -9,00,300 | 1,55,187 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 75,11,325 | 4,92,675 | 40,96,985 |

| 25,000 | 84,25,650 | 4,58,325 | 28,38,989 |

SENSEX weekly Expiry (29/07/2025)

The SENSEX index closed at 82186.81. The SENSEX weekly expiry for JULY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.701 against previous 0.836. The 84000CE option holds the maximum open interest, followed by the 85000CE and 84500CE options. Market participants have shown increased interest with significant open interest additions in the 84000CE option, with open interest additions also seen in the 85000CE and 84500CE options. On the other hand, open interest reductions were prominent in the 78000PE, 88100CE, and 81600CE options. Trading volume was highest in the 85000CE option, followed by the 84000CE and 82500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82186.81 | 0.701 | 0.836 | 0.699 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 29,43,580 | 9,77,080 | 19,66,500 |

| PUT: | 20,62,540 | 8,17,089 | 12,45,451 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,38,780 | 2,46,620 | 13,56,080 |

| 85000 | 3,04,240 | 1,79,040 | 14,12,840 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,38,780 | 2,46,620 | 13,56,080 |

| 85000 | 3,04,240 | 1,79,040 | 14,12,840 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88100 | 240 | -940 | 2,040 |

| 81600 | 2,460 | -380 | 8,700 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 3,04,240 | 1,79,040 | 14,12,840 |

| 84000 | 3,38,780 | 2,46,620 | 13,56,080 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 2,02,180 | 1,19,940 | 10,63,160 |

| 80000 | 1,76,900 | 1,07,660 | 6,88,140 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 2,02,180 | 1,19,940 | 10,63,160 |

| 79000 | 1,65,700 | 1,08,640 | 4,90,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 32,960 | -3,960 | 1,80,700 |

| 83900 | 540 | -60 | 240 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 2,02,180 | 1,19,940 | 10,63,160 |

| 80000 | 1,76,900 | 1,07,660 | 6,88,140 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25060.9. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.921 against previous 0.951. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 25100CE and 25100PE options. On the other hand, open interest reductions were prominent in the 24950PE, 25300PE, and 23400PE options. Trading volume was highest in the 25000PE option, followed by the 25500CE and 25100CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,060.90 | 0.921 | 0.951 | 0.890 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,05,12,025 | 5,40,48,675 | 64,63,350 |

| PUT: | 5,57,23,800 | 5,14,10,025 | 43,13,775 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 61,19,775 | 1,94,100 | 1,38,243 |

| 26,000 | 59,85,000 | 3,55,500 | 1,02,589 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 31,03,725 | 14,09,925 | 43,359 |

| 25,100 | 23,38,350 | 9,10,125 | 1,37,622 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 5,71,725 | -73,950 | 10,099 |

| 25,900 | 10,62,675 | -57,150 | 39,837 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 61,19,775 | 1,94,100 | 1,38,243 |

| 25,100 | 23,38,350 | 9,10,125 | 1,37,622 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,26,725 | 3,74,325 | 2,03,794 |

| 24,500 | 38,80,050 | 2,66,775 | 76,929 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 22,18,575 | 8,08,725 | 1,32,108 |

| 24,900 | 20,10,075 | 3,93,600 | 1,25,064 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,950 | 3,64,575 | -1,27,125 | 38,804 |

| 25,300 | 9,66,300 | -1,07,325 | 19,579 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,26,725 | 3,74,325 | 2,03,794 |

| 25,100 | 22,18,575 | 8,08,725 | 1,32,108 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56756. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.742 against previous 0.831. The 57000CE option holds the maximum open interest, followed by the 56000PE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 57000CE option, with open interest additions also seen in the 60000CE and 57500CE options. On the other hand, open interest reductions were prominent in the 56000PE, 56000CE, and 61000CE options. Trading volume was highest in the 57000CE option, followed by the 57000PE and 57500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,756.00 | 0.742 | 0.831 | 0.888 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,11,88,230 | 1,89,29,540 | 22,58,690 |

| PUT: | 1,57,14,370 | 1,57,38,284 | -23,914 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 19,84,535 | 3,06,145 | 3,24,595 |

| 60,000 | 14,96,285 | 2,24,700 | 62,562 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 19,84,535 | 3,06,145 | 3,24,595 |

| 60,000 | 14,96,285 | 2,24,700 | 62,562 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 7,16,205 | -2,88,155 | 24,886 |

| 61,000 | 6,40,500 | -99,225 | 21,632 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 19,84,535 | 3,06,145 | 3,24,595 |

| 57,500 | 14,86,065 | 2,16,405 | 1,56,004 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,26,385 | -3,91,475 | 1,33,728 |

| 57,000 | 10,98,265 | 74,025 | 2,43,229 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 9,44,895 | 94,640 | 28,383 |

| 57,100 | 2,09,615 | 88,515 | 87,207 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,26,385 | -3,91,475 | 1,33,728 |

| 56,500 | 7,79,695 | -65,100 | 1,05,238 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,98,265 | 74,025 | 2,43,229 |

| 56,000 | 15,26,385 | -3,91,475 | 1,33,728 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26990.45. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.866 against previous 0.859. The 28000CE option holds the maximum open interest, followed by the 27000CE and 27000PE options. Market participants have shown increased interest with significant open interest additions in the 28000CE option, with open interest additions also seen in the 27000PE and 26000PE options. On the other hand, open interest reductions were prominent in the 26700PE, 27100CE, and 26900CE options. Trading volume was highest in the 27000PE option, followed by the 27000CE and 27100CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,990.45 | 0.866 | 0.859 | 0.903 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,60,845 | 14,90,450 | 70,395 |

| PUT: | 13,51,675 | 12,80,240 | 71,435 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 2,09,950 | 30,420 | 2,740 |

| 27,000 | 1,53,465 | 24,245 | 10,864 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 2,09,950 | 30,420 | 2,740 |

| 27,000 | 1,53,465 | 24,245 | 10,864 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,100 | 50,440 | -22,685 | 8,083 |

| 26,900 | 38,155 | -12,155 | 1,934 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,53,465 | 24,245 | 10,864 |

| 27,100 | 50,440 | -22,685 | 8,083 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,23,890 | 28,990 | 10,938 |

| 25,000 | 1,05,755 | 17,225 | 1,263 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,23,890 | 28,990 | 10,938 |

| 26,000 | 80,470 | 24,635 | 2,412 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 78,325 | -32,175 | 3,772 |

| 26,900 | 55,445 | -7,475 | 3,728 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,23,890 | 28,990 | 10,938 |

| 26,700 | 78,325 | -32,175 | 3,772 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13206.6. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.780 against previous 0.874. The 14000CE option holds the maximum open interest, followed by the 13000PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13500CE option, with open interest additions also seen in the 14000CE and 13250CE options. On the other hand, open interest reductions were prominent in the 70000CE, 69000CE, and 68500PE options. Trading volume was highest in the 13400CE option, followed by the 13200PE and 13300PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,206.60 | 0.780 | 0.874 | 0.847 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,17,91,360 | 1,01,01,560 | 16,89,800 |

| PUT: | 91,98,560 | 88,30,080 | 3,68,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 16,93,300 | 2,32,680 | 10,450 |

| 13,500 | 14,07,280 | 2,39,960 | 19,800 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 14,07,280 | 2,39,960 | 19,800 |

| 14,000 | 16,93,300 | 2,32,680 | 10,450 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,750 | 2,08,600 | -68,040 | 2,402 |

| 13,700 | 5,27,800 | -43,820 | 8,880 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 6,31,260 | 1,17,040 | 24,316 |

| 13,300 | 6,91,460 | 1,45,040 | 21,574 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,85,400 | 1,67,440 | 18,486 |

| 12,500 | 7,13,020 | 1,56,940 | 5,359 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,85,400 | 1,67,440 | 18,486 |

| 12,500 | 7,13,020 | 1,56,940 | 5,359 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 5,60,000 | -51,660 | 21,637 |

| 13,100 | 4,52,340 | -46,340 | 8,979 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 5,12,820 | -41,440 | 24,019 |

| 13,300 | 5,60,000 | -51,660 | 21,637 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis sends a clear warning—the market remains rangebound and under pressure, with expiry support and resistance lines hardening but no breakout impulse in sight. For Nifty, the 25,100 zone is now max pain and the gravity point for expiry, with a close below 25,000 likely to invite another wave of selling, targeting the next big support at 24,500. On the upside, any rallies will be met with aggressive call writing between 25,200 and 27,000—making it tough for bulls to claw back lost ground without a powerful catalyst. BankNifty’s tumble in OI suggests that today’s bounce is more about covering shorts than genuine bottom fishing; unless 57,000 is reclaimed with strong volumes, expect sellers to re-emerge on every uptick.

Traders would do well to stick to range-bound strategies near max pain—short straddles, iron condors, or cautious scalps around expiry pivots—rather than betting big on reversals. Only a decisive move above 25,200 in Nifty or above 57,000 in BankNifty should be chased for upside; otherwise, extra vigilance is warranted, with stops kept tight and risk managed aggressively. As the series unfolds, let this Open Interest Volume Analysis be your compass for navigating sideways markets—protecting capital and staying tactical as both buyers and sellers fight for short-term control.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]