Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 23/07/2025

Table of Contents

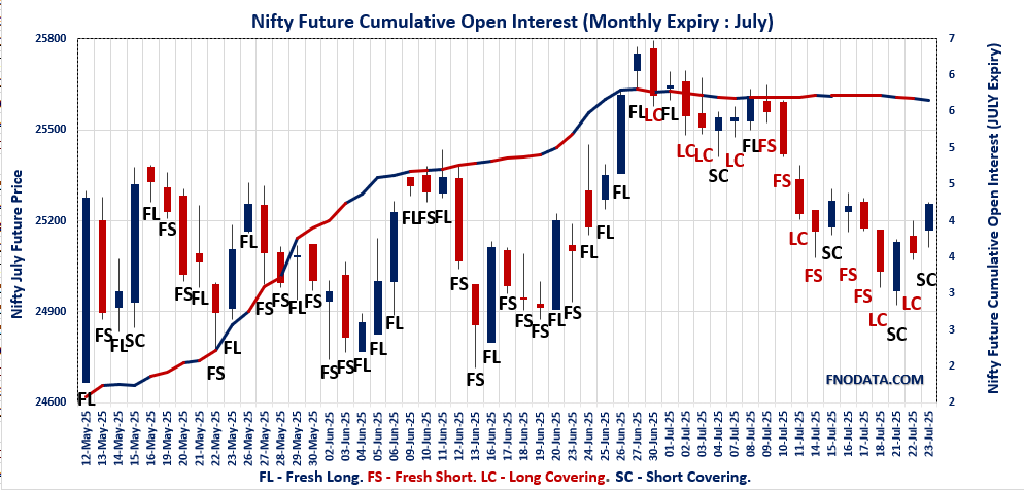

The Open Interest Volume Analysis for 23rd July 2025 shows a robust attempt at recovery in Indian indices, but also underscores continued risk management and a cautious market mood as expiry approaches. Nifty July futures settled at 25,252.80, rising 0.63% in lockstep with the spot, yet open interest dropped sharply by 3.5%. This combination of higher price and falling OI is a textbook sign of short covering, not aggressive fresh buying, as traders square off bearish bets ahead of expiry.

The weekly option chain confirms newfound optimism: the Put-Call Ratio (OI) jumped to 1.176, led by significant put additions at the 25,200–25,100 strikes, while max pain shifted to 25,200. Monthly options also saw the PCR nudge up toward 1, but the concentration of open interest and call additions at 25,600–26,000 means uptrend faces resistance at higher levels. Market participants seem to be repositioning rather than committing to a decisive trend, keeping expiry pivots front and center.

BankNifty mirrored these dynamics, surging 0.8% on the day but with OI down a hefty 6.6%—again, a clear mark of short covering rather than a broad-based reversal. The monthly PCR rebounded to 0.96, and open interest clustered at the 57,000 strike on both sides shows the market is coiling for a move but still reluctant to take on big new risk. In FINNIFTY, a 1% price jump with a modest 1% OI build hints at fresh accumulation, supported by rising put writing near 27,000. MIDCPNIFTY and SENSEX also traded with a firmer tone, but their OI and premium patterns suggest caution, not exuberance, is driving the bids.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 25,219.90 (0.63%)

NIFTY JULY Future closed at: 25,252.80 (0.63%)

Premium: 32.9 (Decreased by -0.1 points)

Open Interest Change: -3.5%

Volume Change: 24.6%

NIFTY Weekly Expiry (24/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.176 (Increased from 0.699)

Put-Call Ratio (Volume): 0.828

Max Pain Level: 25200

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25100

Highest CALL Addition: 25600

Highest PUT Addition: 25200

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.990 (Increased from 0.921)

Put-Call Ratio (Volume): 0.890

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 24200

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 57,210.45 (0.80%)

BANKNIFTY JULY Future closed at: 57,235.80 (0.76%)

Premium: 25.35 (Decreased by -23.25 points)

Open Interest Change: -6.6%

Volume Change: 6.0%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.958 (Increased from 0.742)

Put-Call Ratio (Volume): 0.818

Max Pain Level: 57000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 65000

Highest PUT Addition: 57000

FINNIFTY JULY Future

FINNIFTY Spot closed at: 27,215.85 (0.84%)

FINNIFTY JULY Future closed at: 27,239.60 (0.87%)

Premium: 23.75 (Increased by 9.5 points)

Open Interest Change: 1.0%

Volume Change: 36.3%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.041 (Increased from 0.866)

Put-Call Ratio (Volume): 0.853

Max Pain Level: 27050

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 27000

Highest CALL Addition: 27300

Highest PUT Addition: 26700

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,276.35 (0.53%)

MIDCPNIFTY JULY Future closed at: 13,322.50 (0.77%)

Premium: 46.15 (Increased by 32.7 points)

Open Interest Change: -0.3%

Volume Change: 3.8%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.850 (Increased from 0.780)

Put-Call Ratio (Volume): 0.863

Max Pain Level: 13300

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13300

Highest PUT Addition: 13200

SENSEX Weekly Expiry (29/07/2025) Future

SENSEX Spot closed at: 82,726.64 (0.66%)

SENSEX Weekly Future closed at: 82,783.90 (0.60%)

Premium: 57.26 (Decreased by -43.13 points)

Open Interest Change: 3.6%

Volume Change: 69.2%

SENSEX Weekly Expiry (29/07/2025) Option Analysis

Put-Call Ratio (OI): 1.170 (Increased from 0.701)

Put-Call Ratio (Volume): 0.766

Max Pain Level: 82200

Maximum CALL OI: 85000

Maximum PUT OI: 82500

Highest CALL Addition: 84500

Highest PUT Addition: 82500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,209.11 Cr

DIIs Net BUY: ₹ 4,358.52 Cr

FII Derivatives Activity

| FII Trading Stats | 23.07.25 | 22.07.25 | 21.07.25 |

| FII Cash (Provisional Data) | -4,209.11 | -3,548.92 | -1,681.23 |

| Index Future Open Interest Long Ratio | 15.33% | 14.41% | 15.14% |

| Index Future Volume Long Ratio | 59.09% | 40.02% | 55.10% |

| Call Option Open Interest Long Ratio | 50.98% | 48.79% | 49.90% |

| Call Option Volume Long Ratio | 50.34% | 49.71% | 49.98% |

| Put Option Open Interest Long Ratio | 57.17% | 60.12% | 59.51% |

| Put Option Volume Long Ratio | 49.55% | 50.36% | 49.37% |

| Stock Future Open Interest Long Ratio | 61.98% | 61.80% | 62.07% |

| Stock Future Volume Long Ratio | 51.69% | 47.46% | 49.14% |

| Index Futures | Fresh Long | Fresh Short | Short Covering |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Short | Short Covering |

| FinNifty Options | Fresh Short | Short Covering | Long Covering |

| MidcpNifty Futures | Fresh Short | Short Covering | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Short Covering | Short Covering |

| Stock Futures | Fresh Long | Long Covering | Long Covering |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

NSE & BSE Option market Trends : Options Insights

NIFTY weekly Expiry (24/07/2025)

The NIFTY index closed at 25219.9. The NIFTY weekly expiry for JULY 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.176 against previous 0.699. The 25100PE option holds the maximum open interest, followed by the 25200PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25200PE option, with open interest additions also seen in the 25150PE and 25100PE options. On the other hand, open interest reductions were prominent in the 25100CE, 25150CE, and 26000CE options. Trading volume was highest in the 25200CE option, followed by the 25100PE and 25150CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 24-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,219.90 | 1.176 | 0.699 | 0.828 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,65,04,450 | 16,75,09,650 | -4,10,05,200 |

| PUT: | 14,88,03,600 | 11,71,69,275 | 3,16,34,325 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,05,42,000 | -2,99,025 | 21,37,285 |

| 25,200 | 95,97,150 | -30,46,350 | 80,16,447 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 71,01,600 | 12,07,800 | 10,42,980 |

| 25,700 | 68,49,600 | 6,49,875 | 7,36,307 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 36,89,100 | -90,11,925 | 59,18,208 |

| 25,150 | 25,47,675 | -47,25,600 | 63,41,993 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 95,97,150 | -30,46,350 | 80,16,447 |

| 25,150 | 25,47,675 | -47,25,600 | 63,41,993 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,23,08,475 | 47,97,150 | 66,13,141 |

| 25,200 | 1,17,57,825 | 92,12,625 | 48,24,761 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,17,57,825 | 92,12,625 | 48,24,761 |

| 25,150 | 94,52,100 | 76,97,175 | 53,06,836 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 60,51,225 | -20,82,525 | 4,90,658 |

| 24,300 | 34,07,025 | -11,58,000 | 4,07,722 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,23,08,475 | 47,97,150 | 66,13,141 |

| 25,150 | 94,52,100 | 76,97,175 | 53,06,836 |

SENSEX weekly Expiry (29/07/2025)

The SENSEX index closed at 82726.64. The SENSEX weekly expiry for JULY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.170 against previous 0.701. The 82500PE option holds the maximum open interest, followed by the 85000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 82500PE option, with open interest additions also seen in the 82600PE and 82400PE options. On the other hand, open interest reductions were prominent in the 82200CE, 82300CE, and 82000CE options. Trading volume was highest in the 82500CE option, followed by the 82500PE and 82400CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82726.64 | 1.170 | 0.701 | 0.766 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 56,00,280 | 29,43,289 | 26,56,991 |

| PUT: | 65,51,380 | 20,62,540 | 44,88,840 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,43,260 | 1,39,020 | 44,93,300 |

| 84000 | 4,41,000 | 1,02,220 | 65,59,800 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 3,91,120 | 1,71,820 | 42,75,880 |

| 82700 | 1,94,440 | 1,63,080 | 66,45,600 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82200 | 55,760 | -50,140 | 23,61,580 |

| 82300 | 67,300 | -25,540 | 50,91,740 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 2,75,980 | 59,520 | 1,40,01,220 |

| 82400 | 1,06,280 | 44,480 | 96,13,960 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 5,18,700 | 4,01,060 | 1,06,54,160 |

| 80000 | 4,05,180 | 2,28,280 | 24,94,660 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 5,18,700 | 4,01,060 | 1,06,54,160 |

| 82600 | 3,06,220 | 2,97,420 | 57,93,640 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 5,18,700 | 4,01,060 | 1,06,54,160 |

| 82400 | 3,10,280 | 2,78,960 | 94,21,160 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25219.9. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.990 against previous 0.921. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 24200PE and 24000PE options. On the other hand, open interest reductions were prominent in the 25000CE, 25100CE, and 24800PE options. Trading volume was highest in the 25200CE option, followed by the 25500CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,219.90 | 0.990 | 0.921 | 0.890 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,19,49,300 | 6,05,12,025 | 1,14,37,275 |

| PUT: | 7,12,65,075 | 5,57,23,800 | 1,55,41,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,60,050 | 10,75,050 | 1,61,302 |

| 25,500 | 64,52,475 | 3,32,700 | 2,52,246 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 58,01,400 | 26,97,675 | 94,181 |

| 26,000 | 70,60,050 | 10,75,050 | 1,61,302 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 33,82,125 | -5,89,425 | 92,409 |

| 25,100 | 19,15,725 | -4,22,625 | 1,68,494 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 36,47,625 | 1,09,725 | 2,79,800 |

| 25,500 | 64,52,475 | 3,32,700 | 2,52,246 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 70,68,750 | 14,42,025 | 2,51,816 |

| 24,000 | 53,69,850 | 16,56,600 | 1,04,944 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 28,59,600 | 17,41,800 | 1,18,132 |

| 24,000 | 53,69,850 | 16,56,600 | 1,04,944 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 27,07,875 | -1,88,025 | 1,33,159 |

| 23,500 | 21,77,400 | -1,71,750 | 37,492 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 70,68,750 | 14,42,025 | 2,51,816 |

| 25,100 | 34,64,400 | 12,45,825 | 2,14,186 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 57210.45. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.958 against previous 0.742. The 57000PE option holds the maximum open interest, followed by the 57000CE and 56000PE options. Market participants have shown increased interest with significant open interest additions in the 57000PE option, with open interest additions also seen in the 57200PE and 55000PE options. On the other hand, open interest reductions were prominent in the 57000CE, 56000CE, and 57500CE options. Trading volume was highest in the 57000CE option, followed by the 57000PE and 56800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,210.45 | 0.958 | 0.742 | 0.818 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,86,57,730 | 2,11,87,959 | -25,30,229 |

| PUT: | 1,78,74,045 | 1,57,14,370 | 21,59,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,72,940 | -5,11,595 | 3,67,696 |

| 60,000 | 12,51,985 | -2,44,300 | 62,342 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 7,20,335 | 1,11,230 | 17,271 |

| 58,700 | 1,83,540 | 68,285 | 22,979 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,72,940 | -5,11,595 | 3,67,696 |

| 56,000 | 3,66,275 | -3,49,930 | 27,607 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,72,940 | -5,11,595 | 3,67,696 |

| 57,500 | 11,71,590 | -3,14,475 | 2,04,245 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 15,28,765 | 4,30,500 | 2,64,389 |

| 56,000 | 13,80,995 | -1,45,390 | 1,61,282 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 15,28,765 | 4,30,500 | 2,64,389 |

| 57,200 | 3,83,110 | 1,99,500 | 93,998 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,80,995 | -1,45,390 | 1,61,282 |

| 55,500 | 5,91,430 | -86,170 | 75,979 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 15,28,765 | 4,30,500 | 2,64,389 |

| 56,800 | 4,87,375 | 1,34,400 | 2,07,216 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 27215.85. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 1.041 against previous 0.866. The 28000CE option holds the maximum open interest, followed by the 27000PE and 26700PE options. Market participants have shown increased interest with significant open interest additions in the 27300CE option, with open interest additions also seen in the 26700PE and 26000PE options. On the other hand, open interest reductions were prominent in the 27000CE, 26700CE, and 26800CE options. Trading volume was highest in the 27000PE option, followed by the 27000CE and 27200CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,215.85 | 1.041 | 0.866 | 0.853 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,22,955 | 15,60,845 | 1,62,110 |

| PUT: | 17,93,220 | 13,51,675 | 4,41,545 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 2,47,455 | 37,505 | 4,804 |

| 27,500 | 1,45,210 | 51,350 | 7,297 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,28,700 | 98,150 | 8,409 |

| 27,400 | 80,730 | 58,630 | 4,525 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 60,580 | -92,885 | 11,185 |

| 26,700 | 40,170 | -43,160 | 1,394 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 60,580 | -92,885 | 11,185 |

| 27,200 | 78,000 | 18,200 | 8,981 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,64,255 | 40,365 | 13,665 |

| 26,700 | 1,53,790 | 75,465 | 5,317 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,53,790 | 75,465 | 5,317 |

| 26,000 | 1,48,915 | 68,445 | 4,046 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 51,220 | -33,865 | 1,749 |

| 26,900 | 42,510 | -12,935 | 4,032 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,64,255 | 40,365 | 13,665 |

| 27,100 | 62,465 | 39,325 | 6,045 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13276.35. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.850 against previous 0.780. The 14000CE option holds the maximum open interest, followed by the 13000PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13200PE option, with open interest additions also seen in the 13300PE and 13300CE options. On the other hand, open interest reductions were prominent in the 68700CE, 68400PE, and 56500PE options. Trading volume was highest in the 13200PE option, followed by the 13200CE and 13300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,276.35 | 0.850 | 0.780 | 0.863 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,17,21,360 | 1,17,91,360 | -70,000 |

| PUT: | 99,61,700 | 91,98,560 | 7,63,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 16,20,500 | -72,800 | 11,336 |

| 13,500 | 14,26,040 | 18,760 | 21,948 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 8,00,380 | 1,08,920 | 27,713 |

| 13,800 | 4,90,560 | 1,05,840 | 5,391 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 1,08,360 | -1,32,440 | 3,130 |

| 15,000 | 1,08,920 | -87,780 | 1,318 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,81,740 | 59,780 | 39,813 |

| 13,300 | 8,00,380 | 1,08,920 | 27,713 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,79,520 | -5,880 | 16,215 |

| 13,200 | 9,19,380 | 4,06,560 | 44,947 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 9,19,380 | 4,06,560 | 44,947 |

| 13,300 | 7,38,360 | 1,78,360 | 15,265 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 54,040 | -1,04,020 | 1,028 |

| 12,500 | 6,24,960 | -88,060 | 7,590 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 9,19,380 | 4,06,560 | 44,947 |

| 13,000 | 14,79,520 | -5,880 | 16,215 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis suggests that the bulls have wrested temporary control by pushing out weak shorts, but haven’t mustered enough conviction to propel the market into a strong uptrend. For Nifty, the 25,200–25,300 zone gains prominence with heavy put writing and max pain convergence—any close above 25,300 can spark a swift move to 25,500, but the trap of stacked call OI at higher strikes remains firmly in place. Conversely, should Nifty slip below 25,100, expect positions to unwind quickly toward 24,900–25,000, where the next round of put support is likely to emerge.

Traders should remain nimble, deploying strategies such as credit put spreads above max pain or straddle overlays for potential volatility spikes around expiry. BankNifty’s strong retracement but falling OI signals more short covering than sustained buying; the 57,000 strike is both a magnet and a pivot. If this level is breached with high volumes, a further rally could unfold, but upside will continue to be capped by aggressive call sellers until the series-end. FINNIFTY’s accumulation near 27,000 and SENSEX’s uptick in OI show selective buying interest is returning, particularly if broader sentiment improves. As we head into expiry, let this Open Interest Volume Analysis drive your tactical decisions—focus on pivots, manage risk diligently, and be quick to adapt as the balance of power shifts in this expiry-sensitive environment.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]