Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 24/07/2025

Table of Contents

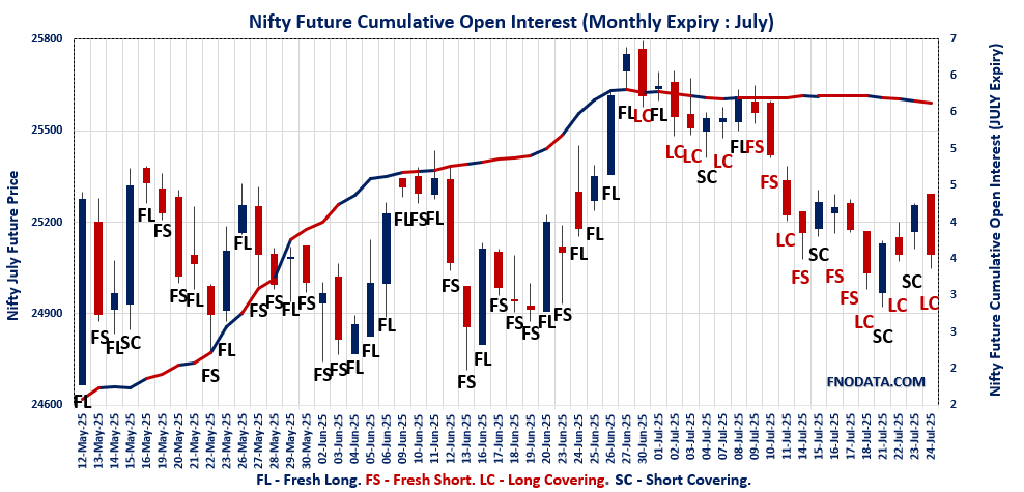

The Open Interest Volume Analysis for 24th July 2025 highlights a session where traders took significant risk off the table as expiry neared, resulting in a clear defensive undertone across the major indices. Nifty July futures closed at 25,095.40, down 0.62%, with open interest dropping by 3.1%. The futures premium barely budged, but the sharp OI decline signals widespread position unwinding instead of a confident change in trend.

The monthly options landscape further confirms this cautious mood: Put-Call Ratio (OI) slumped to 0.757 as hefty call additions clustered at 26,000, while puts gravitated lower to 24,000, making 25,100 the expiry battleground (max pain). With the broad distribution of OI, aggressive up moves will likely be met with sizable resistance, while support levels appear fragile below 25,000. The weekly options for SENSEX echoed this—Put-Call Ratio (OI) fell precipitously and highest call/put concentrations formed a tight range at key strikes, reinforcing a wait-and-watch approach among derivative participants.

Derivative Data Insights

Nifty: Heavy call writing at 26,000 and waning put support at 24,000 show option sellers betting on a capped upside and risk of further downside. PCR (OI) below 0.8 is a bearish sign; a move below 25,000 could see a spike in volatility.

BankNifty: Price fell 0.25%, OI dipped by 3.9%, and the premium rose—a strong sign of shorts running for cover but few takers for fresh longs. Max pain at 57,000 and heavy call additions at 60,000 set clear resistance overhead.

Finnifty: OI unwound and PCR fell below 0.85, with the highest OI at 28,000 call and 26,000 put strikes; bias is similar—limited upside, wary bulls, and reluctant sellers.

MidcpNifty: Persistent OI drop, deepest PCR decline, and sharp price fall signal pronounced midcap caution and little sign of portfolio rotation into risk.

Sensex: Flat performance with soaring OI and a huge premium jump tells of fresh hedges and volatility trades, but a sharply lower PCR (0.67) means major index participants are still not buying strength at current levels.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 25,062.10 (-0.63%)

NIFTY JULY Future closed at: 25,095.40 (-0.62%)

Premium: 33.3 (Increased by 0.4 points)

Open Interest Change: -3.1%

Volume Change: 22.8%

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.757 (Decreased from 0.990)

Put-Call Ratio (Volume): 0.837

Max Pain Level: 25100

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 26000

Highest PUT Addition: 24000

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 57,066.05 (-0.25%)

BANKNIFTY JULY Future closed at: 57,117.60 (-0.21%)

Premium: 51.55 (Increased by 26.2 points)

Open Interest Change: -3.9%

Volume Change: 1.2%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.839 (Decreased from 0.958)

Put-Call Ratio (Volume): 0.995

Max Pain Level: 57000

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 60000

Highest PUT Addition: 54000

FINNIFTY JULY Future

FINNIFTY Spot closed at: 27,046.30 (-0.62%)

FINNIFTY JULY Future closed at: 27,078.60 (-0.59%)

Premium: 32.3 (Increased by 8.55 points)

Open Interest Change: -2.3%

Volume Change: -9.4%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.836 (Decreased from 1.041)

Put-Call Ratio (Volume): 0.973

Max Pain Level: 27000

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 28000

Highest PUT Addition: 26000

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,107.65 (-1.27%)

MIDCPNIFTY JULY Future closed at: 13,139.90 (-1.37%)

Premium: 32.25 (Decreased by -13.9 points)

Open Interest Change: -2.5%

Volume Change: 80.4%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.692 (Decreased from 0.850)

Put-Call Ratio (Volume): 0.842

Max Pain Level: 13200

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13200

Highest PUT Addition: 12500

SENSEX Weekly Expiry (29/07/2025) Future

SENSEX Spot closed at: 82,184.17 (-0.66%)

SENSEX Weekly Future closed at: 82,279.80 (-0.61%)

Premium: 95.63 (Increased by 38.37 points)

Open Interest Change: 7.6%

Volume Change: -25.5%

SENSEX Weekly Expiry (29/07/2025) Option Analysis

Put-Call Ratio (OI): 0.674 (Decreased from 1.153)

Put-Call Ratio (Volume): 1.077

Max Pain Level: 82300

Maximum CALL OI: 82500

Maximum PUT OI: 80000

Highest CALL Addition: 82500

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,133.69 Cr

DIIs Net BUY: ₹ 2,617.14 Cr

FII Derivatives Activity

| FII Trading Stats | 24.07.25 | 23.07.25 | 22.07.25 |

| FII Cash (Provisional Data) | -2,133.69 | -4,209.11 | -3,548.92 |

| Index Future Open Interest Long Ratio | 14.83% | 15.33% | 14.41% |

| Index Future Volume Long Ratio | 50.02% | 59.09% | 40.02% |

| Call Option Open Interest Long Ratio | 52.07% | 50.98% | 48.79% |

| Call Option Volume Long Ratio | 49.80% | 50.34% | 49.71% |

| Put Option Open Interest Long Ratio | 63.39% | 57.17% | 60.12% |

| Put Option Volume Long Ratio | 50.11% | 49.55% | 50.36% |

| Stock Future Open Interest Long Ratio | 61.92% | 61.98% | 61.80% |

| Stock Future Volume Long Ratio | 48.54% | 51.69% | 47.46% |

| Index Futures | Short Covering | Fresh Long | Fresh Short |

| Index Options | Long Covering | Fresh Short | Fresh Long |

| Nifty Futures | Short Covering | Fresh Long | Fresh Short |

| Nifty Options | Long Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Long Covering | Short Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Long | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Short | Short Covering |

| MidcpNifty Futures | Long Covering | Fresh Short | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Short Covering |

| Stock Futures | Long Covering | Fresh Long | Long Covering |

| Stock Options | Fresh Long | Fresh Long | Fresh Long |

NSE & BSE Option market Trends : Options Insights

SENSEX weekly Expiry (29/07/2025)

The SENSEX index closed at 1.05. The SENSEX weekly expiry for JULY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.674 against previous 1.153. The 82500CE option holds the maximum open interest, followed by the 84500CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 82500CE option, with open interest additions also seen in the 84500CE and 83000CE options. On the other hand, open interest reductions were prominent in the 82600PE, 82500PE, and 82400PE options. Trading volume was highest in the 82500CE option, followed by the 82500PE and 82000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 1.05 | 0.674 | 1.153 | 1.077 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,27,39,200 | 56,00,280 | 71,38,920 |

| PUT: | 85,83,680 | 64,59,089 | 21,24,591 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 8,44,360 | 5,68,380 | 1,32,46,260 |

| 84500 | 8,06,120 | 4,15,000 | 49,64,180 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 8,44,360 | 5,68,380 | 1,32,46,260 |

| 84500 | 8,06,120 | 4,15,000 | 49,64,180 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88300 | 680 | -2,820 | 22,360 |

| 87600 | 4,640 | -1,320 | 77,240 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 8,44,360 | 5,68,380 | 1,32,46,260 |

| 83000 | 6,13,320 | 3,68,380 | 90,88,820 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 6,77,980 | 2,72,800 | 50,10,020 |

| 82000 | 4,97,340 | 1,30,020 | 1,16,34,540 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 6,77,980 | 2,72,800 | 50,10,020 |

| 79500 | 3,96,660 | 2,24,340 | 31,85,800 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82600 | 71,920 | -2,34,300 | 72,01,260 |

| 82500 | 3,17,880 | -2,00,820 | 1,30,87,960 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,17,880 | -2,00,820 | 1,30,87,960 |

| 82000 | 4,97,340 | 1,30,020 | 1,16,34,540 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25062.1. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.757 against previous 0.990. The 26000CE option holds the maximum open interest, followed by the 25500CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25200CE and 25100CE options. On the other hand, open interest reductions were prominent in the 27000CE, 24200PE, and 25250PE options. Trading volume was highest in the 25000PE option, followed by the 25200CE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,062.10 | 0.757 | 0.990 | 0.837 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,76,01,125 | 7,19,49,300 | 4,56,51,825 |

| PUT: | 8,90,72,700 | 7,12,65,075 | 1,78,07,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,19,30,475 | 48,70,425 | 3,88,416 |

| 25,500 | 91,36,725 | 26,84,250 | 4,75,872 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,19,30,475 | 48,70,425 | 3,88,416 |

| 25,200 | 80,99,775 | 44,52,150 | 6,10,721 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 52,65,675 | -5,35,725 | 1,01,096 |

| 23,000 | 5,77,425 | -30,000 | 510 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 80,99,775 | 44,52,150 | 6,10,721 |

| 25,500 | 91,36,725 | 26,84,250 | 4,75,872 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 83,47,125 | 29,77,275 | 2,14,092 |

| 25,000 | 76,71,750 | 6,03,000 | 6,39,886 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 83,47,125 | 29,77,275 | 2,14,092 |

| 24,800 | 47,97,075 | 20,89,200 | 3,33,034 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 25,20,225 | -3,39,375 | 1,60,198 |

| 25,250 | 6,25,350 | -2,46,300 | 75,604 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 76,71,750 | 6,03,000 | 6,39,886 |

| 25,100 | 39,57,375 | 4,92,975 | 4,60,331 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 57066.05. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.839 against previous 0.958. The 60000CE option holds the maximum open interest, followed by the 57000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 60000CE option, with open interest additions also seen in the 58300CE and 54000PE options. On the other hand, open interest reductions were prominent in the 57000PE, 56900PE, and 52500PE options. Trading volume was highest in the 57000PE option, followed by the 57000CE and 57100PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,066.05 | 0.839 | 0.958 | 0.995 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,03,97,545 | 1,86,57,730 | 17,39,815 |

| PUT: | 1,71,16,575 | 1,78,74,045 | -7,57,470 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 16,43,250 | 3,91,265 | 83,827 |

| 57,000 | 15,62,435 | 89,495 | 3,97,837 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 16,43,250 | 3,91,265 | 83,827 |

| 58,300 | 4,98,750 | 3,58,330 | 52,417 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 4,76,490 | -70,350 | 27,922 |

| 57,900 | 2,58,615 | -52,815 | 36,262 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 15,62,435 | 89,495 | 3,97,837 |

| 57,100 | 5,84,010 | 1,41,785 | 2,07,283 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,49,460 | -1,79,305 | 4,19,734 |

| 56,000 | 13,47,360 | -33,635 | 1,24,918 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 8,69,925 | 1,41,925 | 50,445 |

| 55,500 | 7,16,520 | 1,25,090 | 64,288 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,49,460 | -1,79,305 | 4,19,734 |

| 56,900 | 3,23,890 | -1,25,370 | 1,38,259 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,49,460 | -1,79,305 | 4,19,734 |

| 57,100 | 4,31,585 | 61,845 | 2,19,651 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 27046.3. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.836 against previous 1.041. The 28000CE option holds the maximum open interest, followed by the 26000PE and 27000PE options. Market participants have shown increased interest with significant open interest additions in the 28000CE option, with open interest additions also seen in the 27200CE and 27100CE options. On the other hand, open interest reductions were prominent in the 26700PE, 27500CE, and 27400CE options. Trading volume was highest in the 27000PE option, followed by the 27100PE and 27300CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,046.30 | 0.836 | 1.041 | 0.973 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,91,695 | 17,22,955 | 1,68,740 |

| PUT: | 15,81,970 | 17,93,229 | -2,11,259 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 3,10,245 | 62,790 | 5,045 |

| 27,300 | 1,39,685 | 10,985 | 10,414 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 3,10,245 | 62,790 | 5,045 |

| 27,200 | 1,32,665 | 54,665 | 7,882 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,13,815 | -31,395 | 5,852 |

| 27,400 | 54,145 | -26,585 | 4,083 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,39,685 | 10,985 | 10,414 |

| 27,100 | 78,390 | 43,485 | 10,126 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,81,545 | 32,630 | 2,677 |

| 27,000 | 1,60,485 | -3,770 | 13,091 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,81,545 | 32,630 | 2,677 |

| 26,600 | 51,935 | 3,770 | 1,436 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 54,925 | -98,865 | 4,192 |

| 27,200 | 34,515 | -22,815 | 4,595 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,60,485 | -3,770 | 13,091 |

| 27,100 | 60,125 | -2,340 | 10,463 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13107.65. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.692 against previous 0.850. The 14000CE option holds the maximum open interest, followed by the 13500CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 13200CE option, with open interest additions also seen in the 13300CE and 12500PE options. On the other hand, open interest reductions were prominent in the 69000CE, 68800CE, and 62200CE options. Trading volume was highest in the 13300CE option, followed by the 13200CE and 13100PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,107.65 | 0.692 | 0.850 | 0.842 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,57,58,680 | 1,17,21,360 | 40,37,320 |

| PUT: | 1,09,11,880 | 99,61,700 | 9,50,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 17,95,080 | 1,74,580 | 11,960 |

| 13,500 | 17,86,260 | 3,60,220 | 31,462 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 12,19,540 | 7,37,800 | 51,717 |

| 13,300 | 12,62,100 | 4,61,720 | 74,292 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 1,49,100 | -80,220 | 6,256 |

| 13,650 | 1,02,340 | -34,860 | 3,451 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 12,62,100 | 4,61,720 | 74,292 |

| 13,200 | 12,19,540 | 7,37,800 | 51,717 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,04,340 | -75,180 | 34,273 |

| 12,500 | 10,01,000 | 3,76,040 | 17,330 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 10,01,000 | 3,76,040 | 17,330 |

| 12,900 | 5,77,640 | 1,61,840 | 11,318 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 5,39,840 | -1,98,520 | 14,803 |

| 13,200 | 8,25,580 | -93,800 | 39,655 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 5,69,100 | 1,06,260 | 43,709 |

| 13,200 | 8,25,580 | -93,800 | 39,655 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis underlines a market increasingly dominated by expiry dynamics, with key support and resistance bands hardening but no visible desire to chase the tape in either direction. For Nifty, the 25,100 mark is now both expiry magnet and technical pivot. A close below 25,000 could open the door to 24,800–24,600 swiftly, while any rally above 25,250–25,300 faces multiple layers of call writing and profit-taking. In BankNifty, watch for moves above 57,500 for bullish confirmation; otherwise, expect range-bound action capped by heavy call OI at 60,000. For actionable trades, range-neutral positions such as short straddles, strangles, or iron condors centered around max pain remain the low-risk play while volatility persists.

Keep stops tight and adapt quickly—until new leadership emerges, this Open Interest Volume Analysis will be your most reliable map for navigating expiry week. Stick with the data and let range-bound setups do the work in this tactically-driven market.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]