Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 30/07/2025

Table of Contents

The Open Interest Volume Analysis for 30th July 2025 reveals a textbook expiry-eve scenario—marked by sharp position squaring, range-bound price action, and market participants content to step aside ahead of a fresh monthly cycle. Nifty July futures eked out a modest 0.12% gain to 24,869.30, but the headline is the immense 23.5% drop in open interest and a nearly 18% volume decline, exposing a wholesale clean-out of positions rather than conviction-led moves. The premium further compressed to 14.25, underscoring a reluctance to extend risk in either direction.

Options data reflect the expiry tug-of-war: the Put-Call Ratio (OI) nudged up to 0.778 as both calls and puts saw heavy build-up at 24,900, establishing that level as the expiry magnet (max pain). While the sentiment has marginally improved from the previous day’s capitulation, call writers retain the upper hand at 25,000. This indecision and liquidation rhythm echo across BankNifty, FINNIFTY, and MIDCPNIFTY, each reporting striking double-digit OI drops and minimal directional movement—a market content to wait for July’s settlement before sparking fresh trends.

NSE & BSE F&O Market Signals

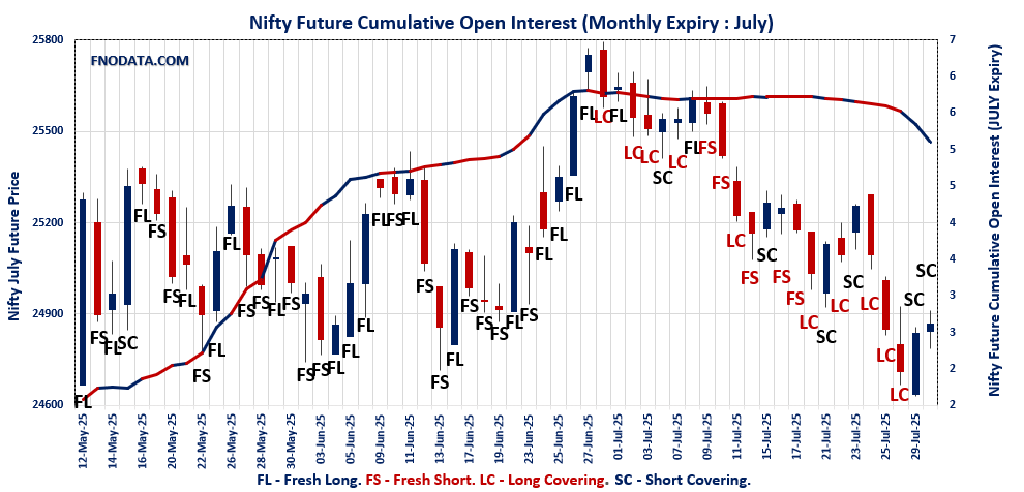

NIFTY JULY Future

NIFTY Spot closed at: 24,855.05 (0.14%)

NIFTY JULY Future closed at: 24,869.30 (0.12%)

Premium: 14.25 (Decreased by -3.45 points)

Open Interest Change: -23.5%

Volume Change: -17.9%

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.778 (Increased from 0.710)

Put-Call Ratio (Volume): 0.833

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24800

Highest CALL Addition: 24900

Highest PUT Addition: 24900

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,150.70 (-0.13%)

BANKNIFTY JULY Future closed at: 56,217.60 (-0.20%)

Premium: 66.9 (Decreased by -42.9 points)

Open Interest Change: -15.4%

Volume Change: -15.8%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.589 (Decreased from 0.590)

Put-Call Ratio (Volume): 0.840

Max Pain Level: 56300

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 56200

Highest PUT Addition: 56200

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,703.50 (0.01%)

FINNIFTY JULY Future closed at: 26,715.60 (-0.13%)

Premium: 12.1 (Decreased by -36.6 points)

Open Interest Change: -23.6%

Volume Change: 60.8%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.698 (Increased from 0.617)

Put-Call Ratio (Volume): 0.800

Max Pain Level: 26700

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26700

Highest CALL Addition: 27400

Highest PUT Addition: 26700

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,009.65 (-0.18%)

MIDCPNIFTY JULY Future closed at: 13,025.00 (-0.25%)

Premium: 15.35 (Decreased by -8.25 points)

Open Interest Change: -27.2%

Volume Change: -35.1%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.740 (Decreased from 0.764)

Put-Call Ratio (Volume): 0.886

Max Pain Level: 13050

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13225

Highest PUT Addition: 12950

SENSEX Weekly Expiry (5/08/2025) Future

SENSEX Spot closed at: 81,481.86 (0.18%)

SENSEX Weekly Future closed at: 81,589.55 (0.17%)

Premium: 107.69 (Decreased by -1.96 points)

Open Interest Change: 17.5%

Volume Change: -23.7%

SENSEX Weekly Expiry (5/08/2025) Option Analysis

Put-Call Ratio (OI): 0.838 (Decreased from 0.883)

Put-Call Ratio (Volume): 0.783

Max Pain Level: 81500

Maximum CALL OI: 84000

Maximum PUT OI: 81500

Highest CALL Addition: 84000

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 850.04 Cr

DIIs Net BUY: ₹ 1,829.11 Cr

FII Derivatives Activity

| FII Trading Stats | 30.07.25 | 29.07.25 | 28.07.25 |

| FII Cash (Provisional Data) | -850.04 | -4,636.60 | -6,082.47 |

| Index Future Open Interest Long Ratio | 14.06% | 13.33% | 14.61% |

| Index Future Volume Long Ratio | 48.72% | 47.26% | 45.10% |

| Call Option Open Interest Long Ratio | 47.38% | 48.62% | 45.98% |

| Call Option Volume Long Ratio | 49.81% | 50.53% | 49.55% |

| Put Option Open Interest Long Ratio | 57.59% | 60.38% | 62.95% |

| Put Option Volume Long Ratio | 49.57% | 49.58% | 50.07% |

| Stock Future Open Interest Long Ratio | 62.16% | 62.28% | 61.84% |

| Stock Future Volume Long Ratio | 49.95% | 50.69% | 50.40% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Options | Fresh Short | Long Covering | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Short | Fresh Short |

| FinNifty Options | Long Covering | Fresh Short | Fresh Long |

| MidcpNifty Futures | Long Covering | Fresh Long | Fresh Short |

| MidcpNifty Options | Long Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Fresh Long | Short Covering |

| Stock Options | Long Covering | Short Covering | Short Covering |

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (5/08/2025)

The SENSEX index closed at 81481.86. The SENSEX weekly expiry for JULY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.838 against previous 0.883. The 84000CE option holds the maximum open interest, followed by the 81500PE and 81500CE options. Market participants have shown increased interest with significant open interest additions in the 84000CE option, with open interest additions also seen in the 81500PE and 86000CE options. On the other hand, open interest reductions were prominent in the 81000CE, 81100CE, and 80700CE options. Trading volume was highest in the 81500CE option, followed by the 81500PE and 81600CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 05-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81481.86 | 0.838 | 0.883 | 0.783 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 53,44,860 | 21,53,389 | 31,91,471 |

| PUT: | 44,77,720 | 19,01,800 | 25,75,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,38,780 | 3,08,560 | 35,91,360 |

| 81500 | 3,66,320 | 2,23,160 | 1,48,07,600 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,38,780 | 3,08,560 | 35,91,360 |

| 86000 | 2,94,960 | 2,31,000 | 15,28,860 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 1,80,720 | -16,360 | 13,09,760 |

| 81100 | 21,600 | -9,840 | 7,77,840 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,66,320 | 2,23,160 | 1,48,07,600 |

| 81600 | 1,54,460 | 1,24,480 | 98,45,500 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,74,160 | 2,60,640 | 1,14,49,960 |

| 81000 | 3,41,680 | 1,03,400 | 75,14,620 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,74,160 | 2,60,640 | 1,14,49,960 |

| 78000 | 2,34,540 | 1,22,140 | 26,18,060 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 11,820 | -260 | 1,800 |

| 82700 | 2,080 | -20 | 480 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,74,160 | 2,60,640 | 1,14,49,960 |

| 81400 | 1,55,580 | 1,21,320 | 93,48,740 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 24855.05. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.778 against previous 0.710. The 25000CE option holds the maximum open interest, followed by the 25500CE and 25200CE options. Market participants have shown increased interest with significant open interest additions in the 24900PE option, with open interest additions also seen in the 24900CE and 24850PE options. On the other hand, open interest reductions were prominent in the 26000CE, 24800CE, and 24000PE options. Trading volume was highest in the 24900CE option, followed by the 24800PE and 24850CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,855.05 | 0.778 | 0.710 | 0.833 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,08,79,825 | 19,59,73,950 | -1,50,94,125 |

| PUT: | 14,07,42,750 | 13,91,15,550 | 16,27,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,51,28,175 | 10,31,250 | 50,10,163 |

| 25,500 | 1,29,74,250 | 14,91,975 | 11,02,822 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,12,80,450 | 32,75,475 | 80,50,882 |

| 25,500 | 1,29,74,250 | 14,91,975 | 11,02,822 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 87,57,975 | -38,92,275 | 5,03,197 |

| 24,800 | 50,96,700 | -29,77,425 | 52,78,999 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,12,80,450 | 32,75,475 | 80,50,882 |

| 24,850 | 47,90,550 | 6,73,800 | 62,55,322 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,00,41,750 | 12,08,550 | 73,23,545 |

| 24,000 | 1,00,32,600 | -20,85,975 | 9,49,157 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 62,44,575 | 33,51,750 | 47,46,228 |

| 24,850 | 57,69,750 | 32,66,700 | 59,55,582 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,00,32,600 | -20,85,975 | 9,49,157 |

| 23,800 | 31,56,000 | -20,72,175 | 4,36,648 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,00,41,750 | 12,08,550 | 73,23,545 |

| 24,850 | 57,69,750 | 32,66,700 | 59,55,582 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56150.7. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.589 against previous 0.590. The 57000CE option holds the maximum open interest, followed by the 57500CE and 58000CE options. Market participants have shown increased interest with significant open interest additions in the 56200CE option, with open interest additions also seen in the 56200PE and 57400CE options. On the other hand, open interest reductions were prominent in the 60000CE, 58500CE, and 59000CE options. Trading volume was highest in the 56000PE option, followed by the 56200CE and 56200PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,150.70 | 0.589 | 0.590 | 0.840 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,78,11,910 | 2,69,05,935 | 9,05,975 |

| PUT: | 1,63,81,785 | 1,58,69,114 | 5,12,671 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 24,99,280 | 1,83,890 | 5,52,854 |

| 57,500 | 17,07,860 | -1,62,400 | 2,88,358 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,200 | 9,60,890 | 5,08,970 | 11,29,554 |

| 57,400 | 6,95,625 | 2,96,170 | 1,49,024 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 13,67,275 | -3,31,170 | 64,476 |

| 58,500 | 12,48,730 | -3,06,915 | 1,42,376 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,200 | 9,60,890 | 5,08,970 | 11,29,554 |

| 56,300 | 8,74,615 | 2,30,055 | 9,24,542 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,53,755 | 2,44,475 | 11,34,838 |

| 55,000 | 10,57,175 | -87,395 | 2,04,406 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,200 | 7,92,855 | 3,14,615 | 11,28,506 |

| 56,000 | 15,53,755 | 2,44,475 | 11,34,838 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 5,05,575 | -1,46,545 | 58,764 |

| 55,500 | 6,67,870 | -1,06,155 | 3,02,276 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,53,755 | 2,44,475 | 11,34,838 |

| 56,200 | 7,92,855 | 3,14,615 | 11,28,506 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26703.5. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.698 against previous 0.617. The 27000CE option holds the maximum open interest, followed by the 26700CE and 27300CE options. Market participants have shown increased interest with significant open interest additions in the 27400CE option, with open interest additions also seen in the 27000CE and 26700CE options. On the other hand, open interest reductions were prominent in the 27600CE, 27700CE, and 25800PE options. Trading volume was highest in the 26700CE option, followed by the 26700PE and 26800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,703.50 | 0.698 | 0.617 | 0.800 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 33,10,060 | 35,76,950 | -2,66,890 |

| PUT: | 23,10,880 | 22,05,320 | 1,05,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 3,44,825 | 64,935 | 40,209 |

| 26,700 | 2,51,615 | 62,400 | 1,02,123 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,400 | 1,97,600 | 1,15,375 | 10,972 |

| 27,000 | 3,44,825 | 64,935 | 40,209 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 44,785 | -1,52,165 | 7,297 |

| 27,700 | 49,595 | -1,16,675 | 6,751 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 2,51,615 | 62,400 | 1,02,123 |

| 26,800 | 1,86,420 | 12,610 | 74,362 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,98,315 | 59,605 | 84,108 |

| 26,500 | 1,61,265 | 55,445 | 40,857 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,98,315 | 59,605 | 84,108 |

| 26,500 | 1,61,265 | 55,445 | 40,857 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 70,265 | -1,11,930 | 8,927 |

| 25,750 | 9,945 | -32,110 | 2,588 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,98,315 | 59,605 | 84,108 |

| 26,650 | 1,26,425 | 47,840 | 62,376 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13009.65. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.740 against previous 0.764. The 13500CE option holds the maximum open interest, followed by the 13300CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 12950PE option, with open interest additions also seen in the 13225CE and 12850PE options. On the other hand, open interest reductions were prominent in the 67600CE, 68900CE, and 72400PE options. Trading volume was highest in the 13000PE option, followed by the 13000CE and 13100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,009.65 | 0.740 | 0.764 | 0.886 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,87,24,720 | 1,86,23,080 | 1,01,640 |

| PUT: | 1,38,56,920 | 1,42,31,700 | -3,74,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 26,07,360 | 1,12,700 | 61,463 |

| 13,300 | 14,87,220 | 34,720 | 87,203 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,225 | 3,09,820 | 2,24,140 | 21,514 |

| 13,250 | 6,05,780 | 1,42,100 | 42,379 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 4,95,740 | -5,09,460 | 22,526 |

| 13,800 | 3,20,740 | -2,83,080 | 8,603 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,97,700 | 1,30,340 | 2,59,515 |

| 13,100 | 9,07,200 | 1,14,800 | 1,67,675 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 12,64,480 | -91,280 | 3,03,179 |

| 12,500 | 11,72,080 | -21,280 | 33,787 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,950 | 6,94,260 | 3,13,460 | 1,35,678 |

| 12,850 | 7,64,540 | 2,19,660 | 54,359 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 8,89,560 | -1,89,000 | 1,38,173 |

| 12,700 | 4,87,200 | -1,67,580 | 38,282 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 12,64,480 | -91,280 | 3,03,179 |

| 12,900 | 8,89,560 | -1,89,000 | 1,38,173 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis signals the classic expiry shakeout, but it leaves traders with valuable tactical cues. Nifty’s max pain at 24,900 is now the centre of gravity—expect expiry settlement to orbit closely around this strike barring an abrupt global disruption. With open interest sharply lower and both calls and puts crowding the same zone, the odds favor a low-volatility expiration, rewarding those who deployed iron condors or short straddles targeting 24,900.

Bulls should resist fresh longs until the series rolls and spot reclaims 25,000 on sustained volume, while bears may find better risk-reward only if settlement shows a clear breakdown under 24,800. In BankNifty and FINNIFTY, similar expiry magnet levels (56,200 and 26,700 respectively) merit attention, while midcaps remain especially sensitive to global cues as aggressive squaring dominates. Into the new series, let this Open Interest Volume Analysis be your trading compass—stay defensive, watch for new open interest to emerge and let cleaner option chains and volumes guide actionable trades in August.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]