Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 4/08/2025

Table of Contents

The Open Interest Volume Analysis for 4th August 2025 shows early signs of a cautious rebound after last week’s selloff. Nifty July futures climbed 0.67% to 24,793.10 as traders covered shorts—a move reflected in the 2.3% drop in open interest and lower volumes. The premium rose by 8.5 points, signaling some renewed hedging as the spot lifts above 24,700. Looking at options, the weekly Put-Call Ratio (OI) climbed to 0.84, with big put additions at 24,600 and 24,700 showing a tentative safety net forming below. Max pain remains at 24,700, keeping the expiry zone tight, while monthly option data suggests market participants see a potential base near 24,000–25,000.

Banks and midcaps added to the cautious optimism. BankNifty August futures saw a minor price bump but a healthy 5.6% OI gain, with open interest analysis flagging fresh long creation. In contrast, FINNIFTY showed mild price changes and a 3.5% OI rise, but open interest suggests more fresh shorts—the sector remains under pressure. MIDCPNIFTY futures spiked 1.7% with a 4.5% OI drop, confirming short covering is at play in the midcap segment. SENSEX followed a similar pattern, rising 0.58% with a nearly 10% cut in OI and a sharp jump in premium, marking a shift from risk-off to slightly positive positioning.

NSE & BSE F&O Market Signals

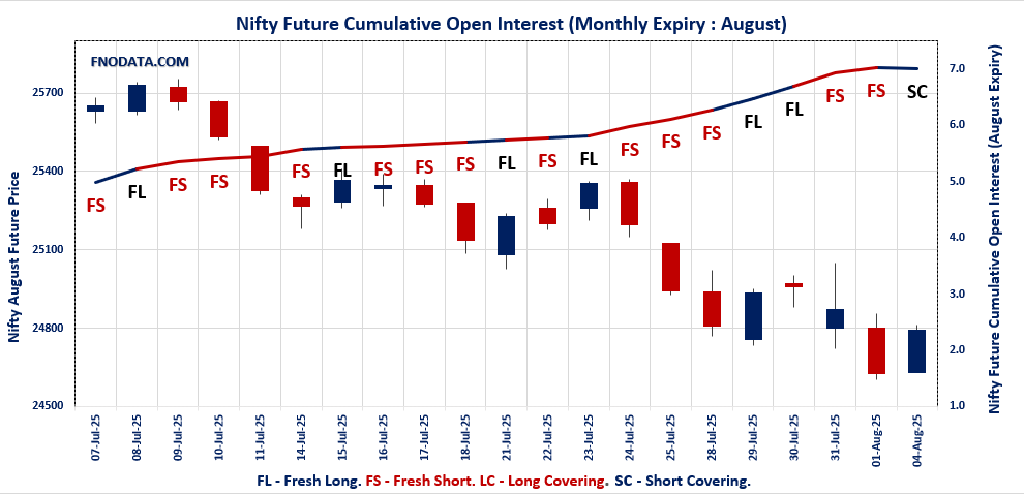

NIFTY AUGUST Future

NIFTY Spot closed at: 24,722.75 (0.64%)

NIFTY AUGUST Future closed at: 24,793.10 (0.67%)

Premium: 70.35 (Increased by 8.5 points)

Open Interest Change: -2.3%

Volume Change: -30.7%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (7/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.842 (Increased from 0.570)

Put-Call Ratio (Volume): 0.846

Max Pain Level: 24700

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 23500

Highest CALL Addition: 25500

Highest PUT Addition: 24600

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.018 (Decreased from 1.023)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25500

Highest PUT Addition: 22800

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,619.35 (0.003%)

BANKNIFTY AUGUST Future closed at: 55,860.00 (0.12%)

Premium: 240.65 (Increased by 64.05 points)

Open Interest Change: 5.6%

Volume Change: -37.7%

Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.839 (Decreased from 0.879)

Put-Call Ratio (Volume): 0.908

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 59000

Highest PUT Addition: 51500

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,476.60 (-0.06%)

FINNIFTY AUGUST Future closed at: 26,593.60 (0.09%)

Premium: 117 (Increased by 39.9 points)

Open Interest Change: 3.5%

Volume Change: -11.8%

Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.800 (Decreased from 1.271)

Put-Call Ratio (Volume): 0.648

Max Pain Level: 26600

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26800

Highest PUT Addition: 26450

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,861.10 (1.52%)

MIDCPNIFTY AUGUST Future closed at: 12,904.25 (1.71%)

Premium: 43.15 (Increased by 23.6 points)

Open Interest Change: -4.5%

Volume Change: 8.0%

Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.238 (Increased from 1.010)

Put-Call Ratio (Volume): 0.750

Max Pain Level: 12900

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 12500

SENSEX Weekly Expiry (5/08/2025) Future

SENSEX Spot closed at: 81,018.72 (0.52%)

SENSEX Weekly Future closed at: 81,064.45 (0.58%)

Premium: 45.73 (Increased by 49.44 points)

Open Interest Change: -9.7%

Volume Change: -9.2%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (5/08/2025) Option Analysis

Put-Call Ratio (OI): 0.912 (Increased from 0.543)

Put-Call Ratio (Volume): 0.979

Max Pain Level: 81000

Maximum CALL OI: 82500

Maximum PUT OI: 78000

Highest CALL Addition: 82500

Highest PUT Addition: 79500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,566.51 Cr

DIIs Net BUY: ₹ 4,386.29 Cr

FII Derivatives Activity

| FII Trading Stats | 4.08.25 | 1.08.25 | 31.07.25 |

| FII Cash (Provisional Data) | -2,566.51 | -3,366.40 | -5,588.91 |

| Index Future Open Interest Long Ratio | 9.00% | 8.60% | 9.59% |

| Index Future Volume Long Ratio | 52.59% | 26.03% | 47.41% |

| Call Option Open Interest Long Ratio | 46.31% | 43.99% | 45.45% |

| Call Option Volume Long Ratio | 50.39% | 49.56% | 50.05% |

| Put Option Open Interest Long Ratio | 63.06% | 66.13% | 69.51% |

| Put Option Volume Long Ratio | 49.60% | 50.18% | 50.03% |

| Stock Future Open Interest Long Ratio | 62.59% | 62.15% | 62.50% |

| Stock Future Volume Long Ratio | 54.18% | 47.13% | 49.09% |

| Index Futures | Fresh Long | Fresh Short | Long Covering |

| Index Options | Fresh Short | Fresh Short | Short Covering |

| Nifty Futures | Short Covering | Fresh Short | Long Covering |

| Nifty Options | Fresh Short | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Short | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Short Covering |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Long Covering |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Long Covering |

| Stock Futures | Fresh Long | Long Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Long | Long Covering |

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (7/08/2025)

The NIFTY index closed at 24722.75. The NIFTY weekly expiry for AUGUST 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.842 against previous 0.570. The 25000CE option holds the maximum open interest, followed by the 23500PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 24600PE option, with open interest additions also seen in the 23500PE and 22800PE options. On the other hand, open interest reductions were prominent in the 24200PE, 24800CE, and 24700CE options. Trading volume was highest in the 24700CE option, followed by the 24600PE and 24800CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,722.75 | 0.842 | 0.570 | 0.846 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,61,20,700 | 14,38,00,950 | 23,19,750 |

| PUT: | 12,30,98,400 | 8,19,69,450 | 4,11,28,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,06,87,200 | -2,33,100 | 21,18,588 |

| 26,000 | 92,31,525 | -3,33,825 | 4,84,127 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 88,00,725 | 15,90,750 | 7,42,173 |

| 25,300 | 58,14,600 | 14,13,525 | 5,76,433 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 80,14,050 | -14,42,625 | 26,44,398 |

| 24,700 | 61,11,225 | -13,78,125 | 36,91,945 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 61,11,225 | -13,78,125 | 36,91,945 |

| 24,800 | 80,14,050 | -14,42,625 | 26,44,398 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 97,69,200 | 36,22,725 | 5,34,032 |

| 24,000 | 81,89,475 | 25,81,425 | 9,45,240 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 78,23,625 | 38,71,500 | 30,90,195 |

| 23,500 | 97,69,200 | 36,22,725 | 5,34,032 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 46,49,700 | -16,05,675 | 9,30,282 |

| 23,300 | 15,50,175 | -4,28,475 | 1,93,056 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 78,23,625 | 38,71,500 | 30,90,195 |

| 24,700 | 64,41,375 | 29,50,500 | 25,38,348 |

SENSEX Weekly Expiry (5/08/2025)

The SENSEX index closed at 81018.72. The SENSEX weekly expiry for AUGUST 5, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.912 against previous 0.543. The 82500CE option holds the maximum open interest, followed by the 82000CE and 78000PE options. Market participants have shown increased interest with significant open interest additions in the 82500CE option, with open interest additions also seen in the 79500PE and 80000PE options. On the other hand, open interest reductions were prominent in the 81000CE, 77000PE, and 84500CE options. Trading volume was highest in the 81000CE option, followed by the 81500CE and 80500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 05-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81018.72 | 0.912 | 0.543 | 0.979 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,58,14,160 | 2,13,29,920 | 44,84,240 |

| PUT: | 2,35,53,360 | 1,15,73,309 | 1,19,80,051 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 22,10,980 | 12,03,220 | 2,25,80,040 |

| 82000 | 21,54,860 | 7,29,580 | 5,88,51,400 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 22,10,980 | 12,03,220 | 2,25,80,040 |

| 82000 | 21,54,860 | 7,29,580 | 5,88,51,400 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 11,96,080 | -4,34,220 | 9,19,13,880 |

| 84500 | 4,01,960 | -2,24,140 | 44,71,920 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 11,96,080 | -4,34,220 | 9,19,13,880 |

| 81500 | 13,99,500 | 4,58,140 | 7,52,19,280 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 15,84,660 | 5,48,760 | 1,08,65,460 |

| 79000 | 14,83,920 | 6,52,640 | 2,40,67,060 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79500 | 13,42,180 | 9,40,700 | 3,28,56,000 |

| 80000 | 14,27,620 | 8,59,020 | 7,05,42,620 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 5,59,620 | -2,24,880 | 53,03,340 |

| 76800 | 13,840 | -68,660 | 3,83,720 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 13,95,240 | 8,15,420 | 7,24,17,440 |

| 80000 | 14,27,620 | 8,59,020 | 7,05,42,620 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24722.75. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.018 against previous 1.023. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 22800PE and 26000CE options. On the other hand, open interest reductions were prominent in the 24700PE, 24700CE, and 24500CE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,722.75 | 1.018 | 1.023 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,68,64,225 | 3,62,45,550 | 6,18,675 |

| PUT: | 3,75,43,950 | 3,70,84,800 | 4,59,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,02,025 | 1,38,450 | 61,094 |

| 26,000 | 43,59,975 | 2,09,775 | 25,593 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 40,97,775 | 2,65,050 | 43,099 |

| 26,000 | 43,59,975 | 2,09,775 | 25,593 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 8,43,525 | -1,91,025 | 40,947 |

| 24,500 | 8,27,475 | -1,81,200 | 21,896 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,02,025 | 1,38,450 | 61,094 |

| 25,500 | 40,97,775 | 2,65,050 | 43,099 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 38,50,725 | -39,750 | 45,730 |

| 25,000 | 37,55,400 | -1,48,200 | 27,867 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 11,89,650 | 2,48,475 | 11,459 |

| 23,000 | 24,58,500 | 1,31,175 | 18,897 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 11,15,325 | -2,04,675 | 41,312 |

| 25,000 | 37,55,400 | -1,48,200 | 27,867 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 25,80,675 | -62,850 | 57,544 |

| 24,000 | 38,50,725 | -39,750 | 45,730 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55619.35. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.839 against previous 0.879. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 51500PE option, with open interest additions also seen in the 55500PE and 59000CE options. On the other hand, open interest reductions were prominent in the 56500PE, 56200PE, and 54500PE options. Trading volume was highest in the 55500PE option, followed by the 55600PE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,619.35 | 0.839 | 0.879 | 0.908 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,28,72,475 | 1,12,59,229 | 16,13,246 |

| PUT: | 1,08,00,335 | 98,92,015 | 9,08,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,34,545 | 47,285 | 69,775 |

| 56,000 | 9,78,005 | 72,065 | 1,03,740 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 6,37,980 | 1,17,250 | 29,666 |

| 55,600 | 1,81,090 | 1,15,325 | 91,846 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,900 | 86,380 | -9,695 | 10,855 |

| 52,000 | 92,225 | -7,735 | 283 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 9,78,005 | 72,065 | 1,03,740 |

| 55,600 | 1,81,090 | 1,15,325 | 91,846 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,04,270 | -14,315 | 12,791 |

| 56,000 | 9,34,535 | -5,040 | 57,769 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 2,76,640 | 1,39,755 | 15,996 |

| 55,500 | 6,31,050 | 1,22,920 | 1,17,499 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 3,00,020 | -26,880 | 9,099 |

| 56,200 | 73,430 | -20,510 | 5,081 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 6,31,050 | 1,22,920 | 1,17,499 |

| 55,600 | 1,89,105 | 96,985 | 1,06,369 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26476.6. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.800 against previous 1.271. The 27000CE option holds the maximum open interest, followed by the 26800CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26800CE option, with open interest additions also seen in the 26500CE and 27000CE options. On the other hand, open interest reductions were prominent in the 26000PE, 26200PE, and 26650CE options. Trading volume was highest in the 26800CE option, followed by the 27000CE and 26500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,476.60 | 0.800 | 1.271 | 0.648 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,88,020 | 2,72,740 | 2,15,280 |

| PUT: | 3,90,390 | 3,46,775 | 43,615 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 85,215 | 22,230 | 5,113 |

| 26,800 | 82,550 | 66,820 | 12,720 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 82,550 | 66,820 | 12,720 |

| 26,500 | 51,805 | 29,770 | 4,451 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,650 | 4,550 | -4,485 | 641 |

| 30,000 | 12,935 | -2,665 | 198 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 82,550 | 66,820 | 12,720 |

| 27,000 | 85,215 | 22,230 | 5,113 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,615 | -11,050 | 3,447 |

| 26,500 | 44,785 | 9,620 | 4,419 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,450 | 13,325 | 12,935 | 1,798 |

| 26,500 | 44,785 | 9,620 | 4,419 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,615 | -11,050 | 3,447 |

| 26,200 | 11,960 | -6,435 | 1,250 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 44,785 | 9,620 | 4,419 |

| 26,400 | 10,205 | 8,645 | 3,769 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12861.1. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.238 against previous 1.010. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12500PE option, with open interest additions also seen in the 13500CE and 13000PE options. On the other hand, open interest reductions were prominent in the 71400PE, 71400PE, and 71400CE options. Trading volume was highest in the 13200CE option, followed by the 12800CE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,861.10 | 1.238 | 1.010 | 0.750 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 36,52,040 | 32,38,480 | 4,13,560 |

| PUT: | 45,20,180 | 32,71,660 | 12,48,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 5,96,400 | 2,32,960 | 12,669 |

| 13,000 | 5,02,740 | 69,720 | 14,857 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 5,96,400 | 2,32,960 | 12,669 |

| 13,000 | 5,02,740 | 69,720 | 14,857 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,78,080 | -57,120 | 16,422 |

| 12,750 | 43,680 | -31,360 | 5,190 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 2,17,840 | -11,060 | 18,088 |

| 12,800 | 1,78,080 | -57,120 | 16,422 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,34,300 | -11,620 | 8,639 |

| 12,500 | 6,46,660 | 2,34,640 | 9,970 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 6,46,660 | 2,34,640 | 9,970 |

| 13,000 | 4,02,500 | 1,63,520 | 3,296 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,34,300 | -11,620 | 8,639 |

| 12,150 | 6,580 | -3,920 | 116 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 1,81,860 | 1,09,200 | 13,617 |

| 12,800 | 2,09,020 | 77,140 | 11,171 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis signals a shift from aggressive selling to a more measured, range-bound setup. For Nifty, the 24,700–24,900 zone is crucial—if the index holds this area, expect more short covering and a possible push to 25,000 where calls are crowded. Bulls should stay nimble, as any turn below 24,700 might see new shorts returning and downside support tested near 24,500. BankNifty’s data supports a gradual turn as well; as long as spot holds 55,600 and OI rises on up days, the stage is set for more upside attempts. Caution is still warranted in FINNIFTY, while midcaps could see more tactical buying if short covering persists. Going forward, let this Open Interest Volume Analysis be your guide—stick to options and hedged trades around key OI zones, and stay adaptable as the index finds its footing in the early days of this new expiry series.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]