Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/08/2025

Table of Contents

The Open Interest Volume Analysis for 5th August 2025 shows the market slipping back into caution after a short-lived bounce, with fresh short build-up seen across major indices. Nifty July futures dipped 0.34% to 24,707.80, while open interest crept up 0.6% and the premium remained above 58 points. This signals that sellers are re-entering aggressively, betting on further weakness as support levels are steadily tested. The weekly option data confirms these fears: the Put-Call Ratio (OI) dropped to 0.72, with a sharp rise in fresh call writing at 24,600 and puts added at 24,500. Max pain rests at 24,650, suggesting a tug-of-war but with a negative tilt. Monthly options echo this trend, with the PCR slipping to 0.97 and heavy open interest sitting at 25,000, framing resistance, while put support is now seen a full thousand points lower at 24,000.

BankNifty and FINNIFTY echoed the Nifty tone—both showing significant price declines, strong spikes in open interest (+18.6% in BankNifty), and open interest analysis highlighting new shorts. While both indices saw their premiums compress and fresh call open interest build at resistance zones, the broader midcap space (MIDCPNIFTY) saw long covering and a 1.3% drop in OI, signaling risk is further being trimmed out of high-beta pockets. SENSEX too saw a staggering 104.5% jump in OI, reinforcing the risk-off mood.

NSE & BSE F&O Market Signals

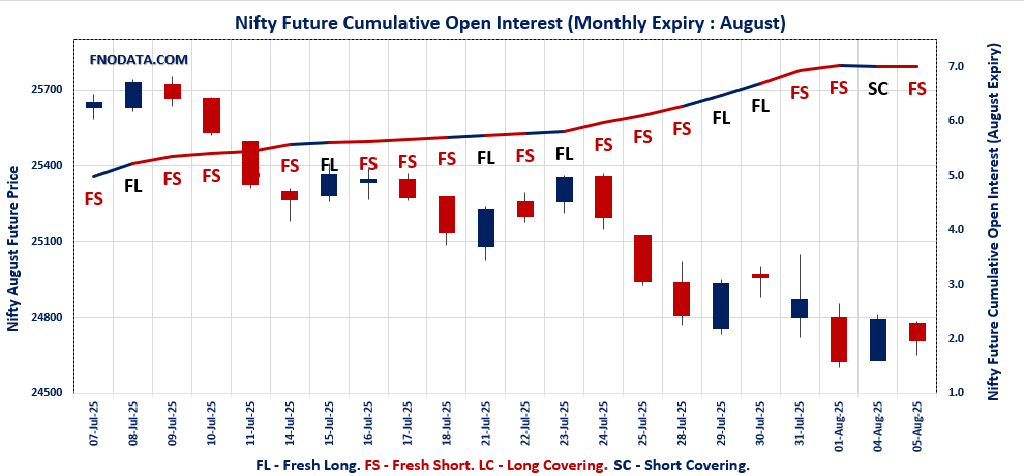

NIFTY AUGUST Future

NIFTY Spot closed at: 24,649.55 (-0.30%)

NIFTY AUGUST Future closed at: 24,707.80 (-0.34%)

Premium: 58.25 (Decreased by -12.1 points)

Open Interest Change: 0.6%

Volume Change: -6.4%

Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (7/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.721 (Decreased from 0.842)

Put-Call Ratio (Volume): 0.979

Max Pain Level: 24650

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24600

Highest PUT Addition: 24500

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.974 (Decreased from 1.018)

Put-Call Ratio (Volume): 0.857

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24700

Highest PUT Addition: 24700

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,360.25 (-0.47%)

BANKNIFTY AUGUST Future closed at: 55,539.20 (-0.57%)

Premium: 178.95 (Decreased by -61.7 points)

Open Interest Change: 18.6%

Volume Change: 34.4%

Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.772 (Decreased from 0.839)

Put-Call Ratio (Volume): 0.905

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 55500

Highest PUT Addition: 55300

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,373.50 (-0.39%)

FINNIFTY AUGUST Future closed at: 26,455.10 (-0.52%)

Premium: 81.6 (Decreased by -35.4 points)

Open Interest Change: 0.1%

Volume Change: -17.8%

Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.715 (Decreased from 0.800)

Put-Call Ratio (Volume): 0.845

Max Pain Level: 26500

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 23500

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,761.05 (-0.78%)

MIDCPNIFTY AUGUST Future closed at: 12,792.15 (-0.87%)

Premium: 31.1 (Decreased by -12.05 points)

Open Interest Change: -1.3%

Volume Change: -15.4%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.160 (Decreased from 1.238)

Put-Call Ratio (Volume): 0.892

Max Pain Level: 12800

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12800

Highest PUT Addition: 12000

SENSEX Weekly Expiry (12/08/2025) Future

SENSEX Spot closed at: 80,710.25 (-0.38%)

SENSEX Weekly Future closed at: 80,817.45 (-0.40%)

Premium: 107.2 (Decreased by -17.38 points)

Open Interest Change: 104.5%

Volume Change: 181.7%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (12/08/2025) Option Analysis

Put-Call Ratio (OI): 0.945 (Increased from 0.906)

Put-Call Ratio (Volume): 0.834

Max Pain Level: 80900

Maximum CALL OI: 81000

Maximum PUT OI: 78000

Highest CALL Addition: 81000

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ -22.48 Cr

DIIs Net BUY: ₹ 3,840.39 Cr

FII Derivatives Activity

| FII Trading Stats | 5.08.25 | 4.08.25 | 1.08.25 |

| FII Cash (Provisional Data) | -22.48 | -2,566.51 | -3,366.40 |

| Index Future Open Interest Long Ratio | 8.42% | 9.00% | 8.60% |

| Index Future Volume Long Ratio | 28.82% | 52.59% | 26.03% |

| Call Option Open Interest Long Ratio | 47.20% | 46.31% | 43.99% |

| Call Option Volume Long Ratio | 50.10% | 50.39% | 49.56% |

| Put Option Open Interest Long Ratio | 63.75% | 63.06% | 66.13% |

| Put Option Volume Long Ratio | 50.36% | 49.60% | 50.18% |

| Stock Future Open Interest Long Ratio | 62.18% | 62.59% | 62.15% |

| Stock Future Volume Long Ratio | 46.07% | 54.18% | 47.13% |

| Index Futures | Fresh Short | Fresh Long | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Long Covering | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Fresh Long | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Long |

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (7/08/2025)

The NIFTY index closed at 24649.55. The NIFTY weekly expiry for AUGUST 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.721 against previous 0.842. The 25000CE option holds the maximum open interest, followed by the 24800CE and 24700CE options. Market participants have shown increased interest with significant open interest additions in the 24600CE option, with open interest additions also seen in the 24700CE and 25000CE options. On the other hand, open interest reductions were prominent in the 23500PE, 24700PE, and 23400PE options. Trading volume was highest in the 24600PE option, followed by the 24700CE and 24600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,649.55 | 0.721 | 0.842 | 0.979 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,90,34,400 | 14,61,20,700 | 2,29,13,700 |

| PUT: | 12,19,11,225 | 12,30,98,400 | -11,87,175 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,33,08,000 | 26,20,800 | 14,98,003 |

| 24,800 | 1,01,91,525 | 21,77,475 | 18,69,298 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 66,31,725 | 43,53,525 | 26,11,358 |

| 24,700 | 1,01,46,900 | 40,35,675 | 33,38,904 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 29,57,775 | -10,73,175 | 3,68,382 |

| 27,000 | 19,42,950 | -9,26,775 | 91,578 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 1,01,46,900 | 40,35,675 | 33,38,904 |

| 24,600 | 66,31,725 | 43,53,525 | 26,11,358 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 91,95,075 | 10,05,600 | 8,09,807 |

| 24,600 | 88,92,675 | 10,69,050 | 39,22,544 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 84,63,525 | 11,99,475 | 22,79,232 |

| 24,600 | 88,92,675 | 10,69,050 | 39,22,544 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 78,48,525 | -19,20,675 | 3,86,723 |

| 24,700 | 45,30,000 | -19,11,375 | 24,64,816 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 88,92,675 | 10,69,050 | 39,22,544 |

| 24,700 | 45,30,000 | -19,11,375 | 24,64,816 |

SENSEX Weekly Expiry (12/08/2025)

The SENSEX index closed at 80710.25. The SENSEX weekly expiry for AUGUST 12, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.945 against previous 0.906. The 78000PE option holds the maximum open interest, followed by the 81000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 78000PE option, with open interest additions also seen in the 81000CE and 80500PE options. On the other hand, open interest reductions were prominent in the 81200PE, 83300PE, and 82800PE options. Trading volume was highest in the 81000CE option, followed by the 83000CE and 80500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80710.25 | 0.945 | 0.906 | 0.834 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 28,48,220 | 11,73,640 | 16,74,580 |

| PUT: | 26,91,980 | 10,63,149 | 16,28,831 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 2,66,060 | 1,73,720 | 14,99,120 |

| 84000 | 2,28,140 | 42,020 | 6,88,040 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 2,66,060 | 1,73,720 | 14,99,120 |

| 82500 | 2,17,180 | 1,38,140 | 8,55,140 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84900 | 1,220 | -20 | 880 |

| 84700 | 160 | – | 20 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 2,66,060 | 1,73,720 | 14,99,120 |

| 83000 | 2,09,500 | 92,140 | 11,74,760 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 2,92,940 | 1,97,300 | 8,15,020 |

| 80500 | 2,25,860 | 1,47,920 | 11,13,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 2,92,940 | 1,97,300 | 8,15,020 |

| 80500 | 2,25,860 | 1,47,920 | 11,13,700 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81200 | 10,660 | -1,300 | 49,600 |

| 83300 | 180 | -240 | 240 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 2,25,860 | 1,47,920 | 11,13,700 |

| 81000 | 1,82,240 | 99,880 | 9,37,100 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24649.55. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.974 against previous 1.018. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24700CE option, with open interest additions also seen in the 24800CE and 24700PE options. On the other hand, open interest reductions were prominent in the 24100PE, 25000PE, and 25900CE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24700PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,649.55 | 0.974 | 1.018 | 0.857 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,80,69,850 | 3,68,64,225 | 12,05,625 |

| PUT: | 3,70,79,925 | 3,75,43,950 | -4,64,025 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 58,21,500 | 1,19,475 | 60,642 |

| 26,000 | 45,68,175 | 2,08,200 | 23,980 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 12,05,325 | 3,61,800 | 43,849 |

| 24,800 | 16,71,750 | 2,52,675 | 29,968 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 4,85,100 | -1,61,250 | 6,750 |

| 26,500 | 13,49,025 | -76,650 | 5,525 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 58,21,500 | 1,19,475 | 60,642 |

| 24,700 | 12,05,325 | 3,61,800 | 43,849 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 39,33,975 | 83,250 | 43,603 |

| 25,000 | 35,76,975 | -1,78,425 | 20,025 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 13,51,200 | 2,35,875 | 43,862 |

| 23,000 | 25,62,750 | 1,04,250 | 15,260 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,100 | 6,27,300 | -5,00,325 | 16,324 |

| 25,000 | 35,76,975 | -1,78,425 | 20,025 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 25,73,475 | -7,200 | 44,528 |

| 24,700 | 13,51,200 | 2,35,875 | 43,862 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55360.25. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.772 against previous 0.839. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 56000CE and 57500CE options. On the other hand, open interest reductions were prominent in the 59500CE, 55600PE, and 56400CE options. Trading volume was highest in the 55500PE option, followed by the 55500CE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,360.25 | 0.772 | 0.839 | 0.905 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,49,75,170 | 1,28,66,814 | 21,08,356 |

| PUT: | 1,15,57,840 | 1,08,00,335 | 7,57,505 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,59,535 | 24,990 | 70,500 |

| 56,000 | 12,41,590 | 2,63,585 | 1,01,285 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,44,030 | 4,11,180 | 1,16,590 |

| 56,000 | 12,41,590 | 2,63,585 | 1,01,285 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 3,44,540 | -48,930 | 22,723 |

| 56,400 | 1,54,175 | -19,215 | 14,480 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,44,030 | 4,11,180 | 1,16,590 |

| 56,000 | 12,41,590 | 2,63,585 | 1,01,285 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,89,010 | -15,260 | 6,546 |

| 56,000 | 9,76,815 | 42,280 | 44,713 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,300 | 1,48,785 | 83,020 | 60,103 |

| 51,500 | 3,54,970 | 78,330 | 14,084 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,600 | 1,65,585 | -23,520 | 76,724 |

| 56,500 | 2,83,850 | -16,170 | 7,830 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,01,575 | 70,525 | 1,54,191 |

| 55,000 | 8,90,225 | 46,200 | 82,480 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26373.5. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.715 against previous 0.800. The 27000CE option holds the maximum open interest, followed by the 26800CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 27500CE and 26500CE options. On the other hand, open interest reductions were prominent in the 26450PE, 26600PE, and 26600CE options. Trading volume was highest in the 27000CE option, followed by the 26500CE and 26400PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,373.50 | 0.715 | 0.800 | 0.845 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,48,830 | 4,88,020 | 1,60,810 |

| PUT: | 4,64,230 | 3,90,390 | 73,840 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,33,185 | 47,970 | 4,847 |

| 26,800 | 79,820 | -2,730 | 1,612 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,33,185 | 47,970 | 4,847 |

| 27,500 | 60,320 | 22,035 | 2,434 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 42,315 | -5,460 | 1,062 |

| 26,550 | 7,800 | -3,770 | 507 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,33,185 | 47,970 | 4,847 |

| 26,500 | 68,510 | 16,705 | 3,008 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,725 | 6,110 | 2,631 |

| 26,500 | 49,140 | 4,355 | 2,545 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 21,060 | 15,340 | 512 |

| 24,800 | 15,470 | 13,260 | 290 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,450 | 4,615 | -8,710 | 1,071 |

| 26,600 | 35,425 | -5,980 | 585 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 14,040 | 3,835 | 2,905 |

| 26,000 | 75,725 | 6,110 | 2,631 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12761.05. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.160 against previous 1.238. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12800CE option, with open interest additions also seen in the 12750CE and 13800CE options. On the other hand, open interest reductions were prominent in the 66700CE, 76500PE, and 76500PE options. Trading volume was highest in the 12800CE option, followed by the 12800PE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,761.05 | 1.160 | 1.238 | 0.892 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 38,62,180 | 36,52,040 | 2,10,140 |

| PUT: | 44,81,540 | 45,20,180 | -38,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,99,520 | -96,880 | 10,789 |

| 13,000 | 4,64,100 | -38,640 | 13,215 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 2,80,980 | 1,02,900 | 20,025 |

| 12,750 | 1,29,920 | 86,240 | 8,147 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,99,520 | -96,880 | 10,789 |

| 13,000 | 4,64,100 | -38,640 | 13,215 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 2,80,980 | 1,02,900 | 20,025 |

| 13,000 | 4,64,100 | -38,640 | 13,215 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,63,980 | 29,680 | 6,218 |

| 12,500 | 6,58,140 | 11,480 | 8,399 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,63,980 | 29,680 | 6,218 |

| 11,800 | 1,59,320 | 24,500 | 1,529 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 1,09,620 | -55,580 | 3,150 |

| 12,850 | 58,800 | -40,880 | 3,078 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,89,700 | -19,320 | 17,557 |

| 12,750 | 94,500 | 5,460 | 9,493 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis points to a market where sellers are once again asserting dominance and options positioning signals more downside risk in the near term. For Nifty, max pain at 24,650 becomes the pivot—range-bound trading is likely, but fails below 24,700 could quickly cascade to 24,500 and below, as both OI and PCR levels show little appetite for aggressive dip buying. For actionable trades, focus on bearish or neutral option spreads near 24,700–25,000 with tight stops, and avoid aggressive bottom-fishing until clear short covering emerges.

BankNifty and FINNIFTY participants should watch the 55,500–56,000 zone for any signs of reversal, but fresh shorts remain the low-risk trade as long as open interest continues to surge on down days. As always, use the Open Interest Volume Analysis to stay in sync with market sentiment—prioritize measured risk, quick profit-taking, and patience, as the August series shapes up to be driven by defensive strategies and tactical plays.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]