Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/08/2025

Table of Contents

The Open Interest Volume Analysis for 6th August 2025 highlights a continuation of cautious trading and a renewal of short positions across Indian market indices as expiry approaches. Nifty July futures slipped 0.3% to 24,634.90, with open interest nudging up by 0.5% on the back of fresh short build-up and a modest rise in premium—pointing to traders expecting more pressure ahead. Weekly options data confirms this defensive stance: the Put-Call Ratio (OI) fell to just 0.60 as sellers ramped up call writing at the 25,000 strike, while put support moved lower to 24,500. Max pain is anchored at 24,600, suggesting settlement gravitates toward this level unless there’s a surprise move. The monthly options put-call ratio bounced slightly to 0.99 but still shows heavier call open interests at 25,000, capping upside and leaving strong resistance overhead.

Across other key indices, BankNifty held marginal gains but saw 1.8% OI drop, reflecting some short covering after prior selling, yet the PCR remains below 0.80 and new calls keep building at 57,000. FINNIFTY continues to see weakness, marked by a 9.7% jump in OI driven by fresh shorts and a significant collapse in its put-call ratio to 0.66—clear signals that the financial segment is under pressure. MIDCPNIFTY futures also fell and OI expanded by 1.6%, confirming the arrival of new shorts and less appetite for buying risk in the midcap space. SENSEX saw another day of price slippage and almost a 10% OI spike, with the lowest PCR among the indices (0.62) as heavy call writing dominates.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

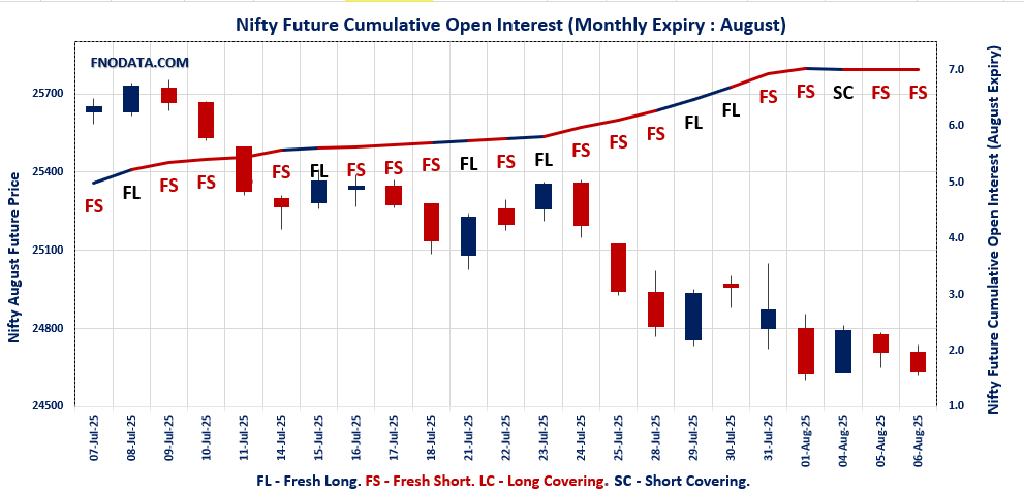

NIFTY Spot closed at: 24,574.20 (-0.31%)

NIFTY AUGUST Future closed at: 24,634.90 (-0.30%)

Premium: 60.7 (Increased by 2.45 points)

Open Interest Change: 0.5%

Volume Change: -2.5%

Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (7/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.603 (Decreased from 0.721)

Put-Call Ratio (Volume): 0.986

Max Pain Level: 24600

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24550

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.987 (Increased from 0.974)

Put-Call Ratio (Volume): 0.865

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24600

Highest PUT Addition: 24500

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,411.15 (0.09%)

BANKNIFTY AUGUST Future closed at: 55,580.80 (0.07%)

Premium: 169.65 (Decreased by -9.3 points)

Open Interest Change: -1.8%

Volume Change: -4.8%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.774 (Decreased from 0.786)

Put-Call Ratio (Volume): 0.830

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 57000

Highest PUT Addition: 54000

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,371.15 (-0.01%)

FINNIFTY AUGUST Future closed at: 26,454.40 (0.00%)

Premium: 83.25 (Increased by 1.65 points)

Open Interest Change: 9.7%

Volume Change: 19.6%

Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.663 (Decreased from 0.715)

Put-Call Ratio (Volume): 0.429

Max Pain Level: 26500

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26800

Highest PUT Addition: 23500

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,636.40 (-0.98%)

MIDCPNIFTY AUGUST Future closed at: 12,678.00 (-0.89%)

Premium: 41.6 (Increased by 10.5 points)

Open Interest Change: 1.6%

Volume Change: -12.5%

Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.934 (Decreased from 1.160)

Put-Call Ratio (Volume): 0.837

Max Pain Level: 12800

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 12600

SENSEX Weekly Expiry (12/08/2025) Future

SENSEX Spot closed at: 80,543.99 (-0.21%)

SENSEX Weekly Future closed at: 80,608.20 (-0.26%)

Premium: 64.21 (Decreased by -42.99 points)

Open Interest Change: 9.3%

Volume Change: -8.0%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (12/08/2025) Option Analysis

Put-Call Ratio (OI): 0.625 (Decreased from 0.943)

Put-Call Ratio (Volume): 1.011

Max Pain Level: 80600

Maximum CALL OI: 83000

Maximum PUT OI: 78000

Highest CALL Addition: 83500

Highest PUT Addition: 76000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,999.10 Cr

DIIs Net BUY: ₹ 6,794.28 Cr

FII Derivatives Activity

| FII Trading Stats | 6.08.25 | 5.08.25 | 4.08.25 |

| FII Cash (Provisional Data) | -4,999.10 | -22.48 | -2,566.51 |

| Index Future Open Interest Long Ratio | 8.58% | 8.42% | 9.00% |

| Index Future Volume Long Ratio | 53.88% | 28.82% | 52.59% |

| Call Option Open Interest Long Ratio | 46.88% | 47.20% | 46.31% |

| Call Option Volume Long Ratio | 49.88% | 50.10% | 50.39% |

| Put Option Open Interest Long Ratio | 66.33% | 63.75% | 63.06% |

| Put Option Volume Long Ratio | 50.53% | 50.36% | 49.60% |

| Stock Future Open Interest Long Ratio | 61.94% | 62.18% | 62.59% |

| Stock Future Volume Long Ratio | 47.92% | 46.07% | 54.18% |

| Index Futures | Short Covering | Fresh Short | Fresh Long |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Long Covering | Fresh Short | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Long Covering | Long Covering | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (7/08/2025)

The NIFTY index closed at 24574.2. The NIFTY weekly expiry for AUGUST 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.603 against previous 0.721. The 25000CE option holds the maximum open interest, followed by the 24700CE and 24800CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24600CE and 24700CE options. On the other hand, open interest reductions were prominent in the 26500CE, 24650PE, and 23500PE options. Trading volume was highest in the 24600PE option, followed by the 24600CE and 24700CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,574.20 | 0.603 | 0.721 | 0.986 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,78,87,050 | 16,90,34,400 | 2,88,52,650 |

| PUT: | 11,93,83,125 | 12,19,11,225 | -25,28,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,83,46,725 | 50,38,725 | 25,37,125 |

| 24,700 | 1,41,08,700 | 39,61,800 | 57,53,965 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,83,46,725 | 50,38,725 | 25,37,125 |

| 24,600 | 1,14,65,175 | 48,33,450 | 68,09,961 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 25,17,450 | -18,38,250 | 1,34,930 |

| 25,600 | 42,56,250 | -12,27,000 | 3,53,954 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 1,14,65,175 | 48,33,450 | 68,09,961 |

| 24,700 | 1,41,08,700 | 39,61,800 | 57,53,965 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,05,25,050 | 13,29,975 | 13,86,680 |

| 24,600 | 83,42,700 | -5,49,975 | 80,80,224 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,550 | 52,08,900 | 19,24,125 | 52,02,067 |

| 24,000 | 1,05,25,050 | 13,29,975 | 13,86,680 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,650 | 23,54,550 | -17,80,500 | 40,62,735 |

| 23,500 | 61,09,500 | -17,39,025 | 4,58,793 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 83,42,700 | -5,49,975 | 80,80,224 |

| 24,500 | 81,03,675 | -3,59,850 | 56,82,354 |

SENSEX Weekly Expiry (12/08/2025)

The SENSEX index closed at 80543.99. The SENSEX weekly expiry for AUGUST 5, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.625 against previous 0.943. The 83000CE option holds the maximum open interest, followed by the 83500CE and 82500CE options. Market participants have shown increased interest with significant open interest additions in the 83500CE option, with open interest additions also seen in the 83000CE and 82500CE options. On the other hand, open interest reductions were prominent in the 90000CE, 78500PE, and 81500PE options. Trading volume was highest in the 80500PE option, followed by the 80600PE and 80700PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80543.99 | 0.625 | 0.943 | 1.011 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 85,39,680 | 28,48,220 | 56,91,460 |

| PUT: | 53,35,020 | 26,86,649 | 26,48,371 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 5,95,240 | 3,85,740 | 67,60,040 |

| 83500 | 5,57,440 | 4,24,160 | 39,97,600 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 5,57,440 | 4,24,160 | 39,97,600 |

| 83000 | 5,95,240 | 3,85,740 | 67,60,040 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 90000 | 23,920 | -15,040 | 2,01,520 |

| 76000 | 1,460 | -40 | 200 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 5,17,260 | 2,51,200 | 1,07,06,560 |

| 80700 | 2,46,260 | 1,75,880 | 97,97,540 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 4,15,480 | 1,22,540 | 42,94,900 |

| 80500 | 3,63,640 | 1,37,780 | 1,40,97,780 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 3,03,020 | 1,94,560 | 17,46,080 |

| 77000 | 2,72,100 | 1,70,100 | 30,31,760 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 78500 | 1,73,420 | -14,460 | 29,18,260 |

| 81500 | 84,660 | -5,600 | 2,97,180 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 3,63,640 | 1,37,780 | 1,40,97,780 |

| 80600 | 1,56,360 | 97,960 | 1,23,96,400 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24574.2. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.987 against previous 0.974. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 24600PE and 24600CE options. On the other hand, open interest reductions were prominent in the 23500PE, 25800CE, and 25500CE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,574.20 | 0.987 | 0.974 | 0.865 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,86,58,225 | 3,80,69,850 | 5,88,375 |

| PUT: | 3,81,42,750 | 3,70,79,925 | 10,62,825 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,40,075 | 1,18,575 | 70,046 |

| 26,000 | 45,40,125 | -28,050 | 27,823 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 7,75,350 | 2,84,625 | 28,994 |

| 24,500 | 9,62,250 | 1,25,925 | 26,409 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 7,19,625 | -1,86,975 | 16,686 |

| 25,500 | 39,22,425 | -1,82,025 | 42,711 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,40,075 | 1,18,575 | 70,046 |

| 25,500 | 39,22,425 | -1,82,025 | 42,711 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 39,82,275 | 48,300 | 50,241 |

| 24,500 | 35,06,850 | 9,33,375 | 65,949 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 35,06,850 | 9,33,375 | 65,949 |

| 24,600 | 11,91,450 | 3,07,875 | 42,783 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 12,89,250 | -2,21,550 | 28,231 |

| 24,100 | 4,93,875 | -1,33,425 | 13,110 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 35,06,850 | 9,33,375 | 65,949 |

| 24,000 | 39,82,275 | 48,300 | 50,241 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55411.15. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.774 against previous 0.786. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 54000PE option, with open interest additions also seen in the 55500PE and 57000CE options. On the other hand, open interest reductions were prominent in the 51500PE, 52000PE, and 57500CE options. Trading volume was highest in the 55500CE option, followed by the 55500PE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,411.15 | 0.774 | 0.786 | 0.830 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,53,73,365 | 1,47,08,339 | 6,65,026 |

| PUT: | 1,18,97,760 | 1,15,57,840 | 3,39,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,30,795 | 71,260 | 95,209 |

| 56,000 | 12,13,730 | -27,860 | 1,47,413 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,30,795 | 71,260 | 95,209 |

| 65,000 | 2,76,325 | 63,420 | 9,567 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 6,47,255 | -53,970 | 56,616 |

| 60,000 | 7,20,020 | -34,650 | 23,256 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,59,675 | 15,645 | 1,81,869 |

| 56,000 | 12,13,730 | -27,860 | 1,47,413 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,84,775 | -4,235 | 4,703 |

| 56,000 | 9,61,275 | -15,540 | 35,038 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 9,08,915 | 1,03,320 | 66,838 |

| 55,500 | 7,77,770 | 76,195 | 1,71,121 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 2,22,355 | -1,32,615 | 24,599 |

| 52,000 | 4,73,865 | -76,895 | 37,114 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,77,770 | 76,195 | 1,71,121 |

| 55,400 | 1,86,410 | 60,270 | 1,34,545 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26371.15. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.663 against previous 0.715. The 27000CE option holds the maximum open interest, followed by the 26800CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 26800CE option, with open interest additions also seen in the 26400CE and 23500PE options. On the other hand, open interest reductions were prominent in the 27500CE, 26000PE, and 26700PE options. Trading volume was highest in the 26800CE option, followed by the 26400CE and 27000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,371.15 | 0.663 | 0.715 | 0.429 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,01,450 | 6,48,830 | 1,52,620 |

| PUT: | 5,31,375 | 4,64,230 | 67,145 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,39,425 | 6,240 | 6,293 |

| 26,800 | 1,20,900 | 41,080 | 19,351 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,20,900 | 41,080 | 19,351 |

| 26,400 | 52,000 | 31,785 | 6,759 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 51,805 | -8,515 | 2,592 |

| 29,500 | 1,625 | -845 | 59 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,20,900 | 41,080 | 19,351 |

| 26,400 | 52,000 | 31,785 | 6,759 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 73,385 | -2,340 | 3,067 |

| 26,500 | 55,965 | 6,825 | 1,437 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 40,040 | 18,980 | 494 |

| 24,800 | 25,675 | 10,205 | 187 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 73,385 | -2,340 | 3,067 |

| 26,700 | 11,310 | -1,430 | 188 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 21,515 | 7,475 | 4,718 |

| 26,350 | 10,400 | -195 | 3,187 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12636.4. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.934 against previous 1.160. The 12000PE option holds the maximum open interest, followed by the 13000CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 12900CE and 12650CE options. On the other hand, open interest reductions were prominent in the 64600CE, 64600CE, and 64600CE options. Trading volume was highest in the 13000CE option, followed by the 12700CE and 12700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,636.40 | 0.934 | 1.160 | 0.837 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 50,19,420 | 38,62,180 | 11,57,240 |

| PUT: | 46,88,460 | 44,81,540 | 2,06,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,99,860 | 2,35,760 | 21,821 |

| 13,500 | 4,98,540 | -980 | 8,054 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,99,860 | 2,35,760 | 21,821 |

| 12,900 | 2,37,580 | 1,04,020 | 6,765 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,750 | 1,01,780 | -28,140 | 5,005 |

| 13,900 | 60,620 | -4,200 | 287 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,99,860 | 2,35,760 | 21,821 |

| 12,700 | 2,24,560 | 94,640 | 17,631 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,77,420 | 13,440 | 9,687 |

| 12,500 | 5,89,400 | -68,740 | 12,171 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 1,30,480 | 47,600 | 13,156 |

| 12,650 | 69,160 | 38,500 | 9,496 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 5,89,400 | -68,740 | 12,171 |

| 12,750 | 42,140 | -52,360 | 3,173 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 1,99,780 | 13,300 | 15,939 |

| 12,600 | 1,30,480 | 47,600 | 13,156 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis delivers a clear message: bears remain in control, with shorts gaining ground at every bounce and options data making further downside the path of least resistance. In Nifty, the 24,600–24,650 band acts as a pivot for settlement; if spot falls below this support, traders should brace for a quick drop toward 24,500 or even lower, as option sellers and put writers clear out. Upside rallies will face selling at 25,000 due to thick call open interest, so bulls should avoid chasing unless a breakout is confirmed on high volume. On BankNifty and FINNIFTY, the technical setup still leans bearish, supporting strategies like bear call spreads or protective puts. For midcaps, look for selective opportunities only if open interest drops and price stabilizes around support. Let this Open Interest Volume Analysis guide your stance: trade in sync with data, keep risk tight, and prioritize quick, tactical plays while the market remains range-bound and sellers keep the upper hand.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]