Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 8/08/2025

Table of Contents

The Open Interest Volume Analysis for 8th August 2025 reveals a notable shift toward bearish sentiment as Indian markets continue to face selling pressure amid retreating volumes. Nifty August futures fell nearly 1% to 24,441.10, while open interest inched up 2.9%, indicating fresh short positions building despite a marked decline in trading activity. The substantial drop in the weekly Put-Call Ratio (OI) to 0.48 signals aggressive call writing and underlying caution among bulls, with call open interest clustered near 25,000 and puts gathering around 24,300–24,500—key levels that are likely to govern near-term price action. Monthly options reflect a similar stance, with max pain hovering near 24,900, as traders brace for a possible continuation of the downward trend.

BankNifty also saw a sharp drop, down over 1%, with open interest rising substantially by 11.4%, emphasizing strong new short interest building at the 55,500–57,000 strikes. The Put-Call Ratio decline to 0.71 further confirms growing bearish pressure. FINNIFTY and MIDCPNIFTY followed suit, posting 0.9% and 1.8% declines, respectively, alongside increased open interest, underlining fears of sustained downside in both financials and midcaps. Meanwhile, SENSEX experienced a similar near 1% pullback but with a strong surge of over 21% in open interest, signaling heightened hedging and defensive positioning as price approaches the 80,100 max pain level.

NSE & BSE F&O Market Signals

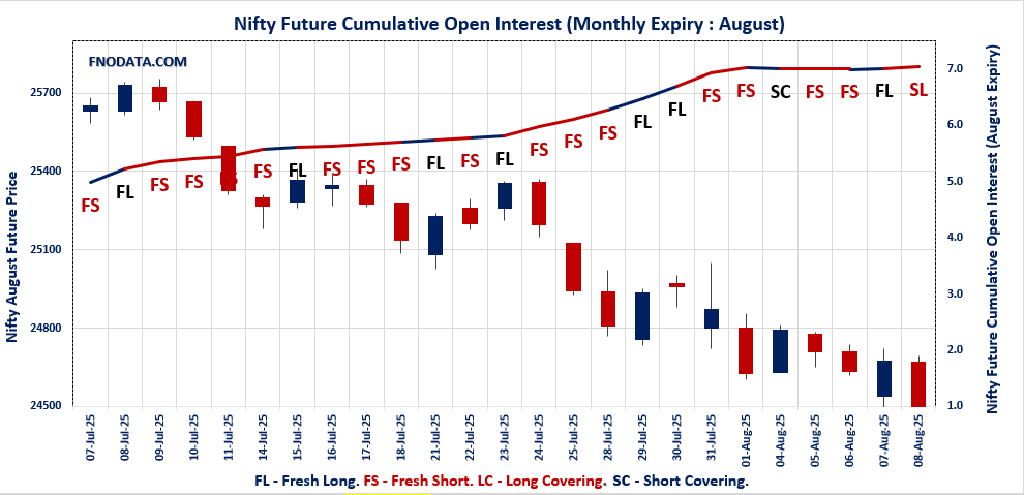

NIFTY AUGUST Future

NIFTY Spot closed at: 24,363.30 (-0.95%)

NIFTY AUGUST Future closed at: 24,441.10 (-0.94%)

Premium: 77.8 (Increased by 0.55 points)

Open Interest Change: 2.9%

Volume Change: -18.6%

NIFTY Weekly Expiry (14/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.476 (Decreased from 1.020)

Put-Call Ratio (Volume): 1.119

Max Pain Level: 24500

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 22800

Highest CALL Addition: 24500

Highest PUT Addition: 24300

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.936 (Decreased from 0.986)

Put-Call Ratio (Volume): 0.879

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 24400

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,004.90 (-0.93%)

BANKNIFTY AUGUST Future closed at: 55,166.00 (-1.06%)

Premium: 161.1 (Decreased by -75.35 points)

Open Interest Change: 11.4%

Volume Change: -14.0%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.707 (Decreased from 0.796)

Put-Call Ratio (Volume): 1.019

Max Pain Level: 55700

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 55500

Highest PUT Addition: 53500

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,167.35 (-0.90%)

FINNIFTY AUGUST Future closed at: 26,242.50 (-1.00%)

Premium: 75.15 (Decreased by -29.85 points)

Open Interest Change: 1.5%

Volume Change: -19.1%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.603 (Decreased from 0.683)

Put-Call Ratio (Volume): 0.881

Max Pain Level: 26500

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26500

Highest CALL Addition: 26500

Highest PUT Addition: 26250

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,506.30 (-1.72%)

MIDCPNIFTY AUGUST Future closed at: 12,556.15 (-1.82%)

Premium: 49.85 (Decreased by -14.9 points)

Open Interest Change: 3.3%

Volume Change: -11.8%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.840 (Decreased from 1.038)

Put-Call Ratio (Volume): 0.971

Max Pain Level: 12675

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 12600

SENSEX Weekly Expiry (12/08/2025) Future

SENSEX Spot closed at: 79,857.79 (-0.95%)

SENSEX Weekly Future closed at: 79,985.60 (-0.92%)

Premium: 127.81 (Increased by 23.37 points)

Open Interest Change: 21.3%

Volume Change: -10.6%

SENSEX Weekly Expiry (12/08/2025) Option Analysis

Put-Call Ratio (OI): 0.551 (Decreased from 1.108)

Put-Call Ratio (Volume): 1.244

Max Pain Level: 80100

Maximum CALL OI: 81000

Maximum PUT OI: 77000

Highest CALL Addition: 81000

Highest PUT Addition: 77000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 1,932.81 Cr

DIIs Net BUY: ₹ 7,723.66 Cr

FII Derivatives Activity

| FII Trading Stats | 8.08.25 | 7.08.25 | 6.08.25 |

| FII Cash (Provisional Data) | 1,932.81 | -4,997.19 | -4,999.10 |

| Index Future Open Interest Long Ratio | 8.28% | 8.59% | 8.58% |

| Index Future Volume Long Ratio | 36.17% | 42.00% | 53.88% |

| Call Option Open Interest Long Ratio | 44.40% | 45.57% | 46.88% |

| Call Option Volume Long Ratio | 49.47% | 50.20% | 49.88% |

| Put Option Open Interest Long Ratio | 70.86% | 70.48% | 66.33% |

| Put Option Volume Long Ratio | 50.40% | 49.88% | 50.53% |

| Stock Future Open Interest Long Ratio | 61.54% | 61.97% | 61.94% |

| Stock Future Volume Long Ratio | 46.60% | 51.07% | 47.92% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Fresh Short | Short Covering | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Long Covering |

| Nifty Options | Fresh Long | Short Covering | Fresh Long |

| BankNifty Futures | Fresh Short | Fresh Long | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Long Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Long Covering |

| Stock Futures | Long Covering | Fresh Long | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (14/08/2025)

The NIFTY index closed at 24363.3. The NIFTY weekly expiry for AUGUST 14, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.476 against previous 1.020. The 25000CE option holds the maximum open interest, followed by the 24500CE and 24600CE options. Market participants have shown increased interest with significant open interest additions in the 24500CE option, with open interest additions also seen in the 24600CE and 25000CE options. On the other hand, open interest reductions were prominent in the 24600PE, 24650PE, and 24550PE options. Trading volume was highest in the 24400PE option, followed by the 24500PE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 14-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,363.30 | 0.476 | 1.020 | 1.119 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,96,17,000 | 6,36,81,300 | 10,59,35,700 |

| PUT: | 8,07,42,750 | 6,49,62,225 | 1,57,80,525 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,24,20,075 | 70,80,075 | 13,17,263 |

| 24,500 | 1,10,56,050 | 84,94,350 | 29,90,671 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,10,56,050 | 84,94,350 | 29,90,671 |

| 24,600 | 1,04,48,850 | 73,72,875 | 26,07,479 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,650 | 1,125 | -375 | 11 |

| 23,400 | 3,375 | -300 | 18 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,10,56,050 | 84,94,350 | 29,90,671 |

| 24,600 | 1,04,48,850 | 73,72,875 | 26,07,479 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 70,81,875 | 19,44,675 | 3,66,840 |

| 24,000 | 56,94,000 | 10,75,725 | 16,84,085 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 47,12,250 | 22,17,450 | 21,34,856 |

| 22,800 | 70,81,875 | 19,44,675 | 3,66,840 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 21,29,025 | -8,21,100 | 12,82,932 |

| 24,650 | 4,64,925 | -5,11,275 | 3,17,402 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 38,90,025 | 3,01,275 | 40,65,095 |

| 24,500 | 47,86,125 | 1,59,450 | 33,76,565 |

SENSEX Weekly Expiry (12/08/2025)

The SENSEX index closed at 79857.79. The SENSEX weekly expiry for AUGUST 12, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.551 against previous 1.108. The 81000CE option holds the maximum open interest, followed by the 82500CE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 80500CE and 82500CE options. On the other hand, open interest reductions were prominent in the 80500PE, 80000PE, and 80400PE options. Trading volume was highest in the 80000PE option, followed by the 80100PE and 80500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 79857.79 | 0.551 | 1.108 | 1.244 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,63,29,760 | 1,23,76,849 | 1,39,52,911 |

| PUT: | 1,45,06,140 | 1,37,09,720 | 7,96,420 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 17,15,960 | 11,49,260 | 4,05,21,880 |

| 82500 | 16,29,300 | 8,16,440 | 1,18,79,520 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 17,15,960 | 11,49,260 | 4,05,21,880 |

| 80500 | 13,91,260 | 9,51,980 | 4,36,74,420 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83900 | 63,440 | -1,00,980 | 11,06,820 |

| 84400 | 15,100 | -19,960 | 3,06,660 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 13,91,260 | 9,51,980 | 4,36,74,420 |

| 81000 | 17,15,960 | 11,49,260 | 4,05,21,880 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 10,63,840 | 2,82,880 | 94,03,460 |

| 78000 | 10,11,000 | -63,760 | 1,55,07,660 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 10,63,840 | 2,82,880 | 94,03,460 |

| 76500 | 5,01,620 | 1,68,320 | 38,89,100 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 4,76,000 | -2,95,980 | 2,25,31,440 |

| 80000 | 8,48,620 | -1,90,560 | 6,89,73,360 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 8,48,620 | -1,90,560 | 6,89,73,360 |

| 80100 | 3,31,700 | 69,120 | 4,47,70,140 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24363.3. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.936 against previous 0.986. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24500CE option, with open interest additions also seen in the 24400CE and 25000CE options. On the other hand, open interest reductions were prominent in the 26500CE, 26700CE, and 24300PE options. Trading volume was highest in the 24500PE option, followed by the 25000CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,363.30 | 0.936 | 0.986 | 0.879 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,41,89,925 | 3,97,52,100 | 44,37,825 |

| PUT: | 4,13,48,400 | 3,91,85,700 | 21,62,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 66,03,900 | 5,17,200 | 1,06,890 |

| 26,000 | 45,53,850 | -5,100 | 35,195 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 25,56,300 | 9,65,175 | 94,771 |

| 24,400 | 8,34,975 | 5,75,400 | 33,597 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 11,87,925 | -1,35,300 | 10,103 |

| 26,700 | 1,37,100 | -58,125 | 3,070 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 66,03,900 | 5,17,200 | 1,06,890 |

| 24,500 | 25,56,300 | 9,65,175 | 94,771 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 40,98,375 | 1,98,075 | 98,630 |

| 24,500 | 37,29,825 | 2,98,050 | 1,09,614 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 15,67,575 | 4,08,450 | 52,847 |

| 25,500 | 20,82,375 | 3,36,750 | 8,234 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 13,08,825 | -43,725 | 31,376 |

| 24,700 | 11,49,300 | -37,575 | 17,599 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 37,29,825 | 2,98,050 | 1,09,614 |

| 24,000 | 40,98,375 | 1,98,075 | 98,630 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55004.9. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.707 against previous 0.796. The 57000CE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 55000CE and 56000CE options. On the other hand, open interest reductions were prominent in the 53000PE, 56700PE, and 55700PE options. Trading volume was highest in the 55000PE option, followed by the 55500CE and 55500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,004.90 | 0.707 | 0.796 | 1.019 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,75,28,140 | 1,52,04,184 | 23,23,956 |

| PUT: | 1,23,83,665 | 1,20,95,685 | 2,87,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,96,420 | 1,01,465 | 90,413 |

| 56,000 | 14,27,335 | 1,79,795 | 1,16,186 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,27,390 | 3,02,470 | 1,32,470 |

| 55,000 | 5,08,865 | 2,11,960 | 61,477 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 7,17,080 | -26,530 | 18,026 |

| 59,500 | 2,87,210 | -14,840 | 12,304 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,27,390 | 3,02,470 | 1,32,470 |

| 56,000 | 14,27,335 | 1,79,795 | 1,16,186 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,32,590 | -19,670 | 5,655 |

| 54,000 | 9,83,640 | 49,910 | 72,557 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 4,61,265 | 1,02,480 | 39,279 |

| 55,500 | 8,47,945 | 67,095 | 1,23,088 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 4,75,090 | -40,670 | 50,311 |

| 56,700 | 33,915 | -40,355 | 2,431 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,33,205 | 15,050 | 1,67,042 |

| 55,500 | 8,47,945 | 67,095 | 1,23,088 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26167.35. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.603 against previous 0.683. The 26500CE option holds the maximum open interest, followed by the 27900CE and 26800CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 26600CE and 27900CE options. On the other hand, open interest reductions were prominent in the 27000CE, 26000PE, and 26350PE options. Trading volume was highest in the 27000CE option, followed by the 26500CE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,167.35 | 0.603 | 0.683 | 0.881 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,20,110 | 8,82,635 | 1,37,475 |

| PUT: | 6,15,225 | 6,02,940 | 12,285 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,56,325 | 54,210 | 5,600 |

| 27,900 | 1,26,815 | 17,680 | 654 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,56,325 | 54,210 | 5,600 |

| 26,600 | 87,945 | 27,885 | 1,889 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 78,845 | -31,005 | 6,830 |

| 26,850 | 16,770 | -3,705 | 185 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 78,845 | -31,005 | 6,830 |

| 26,500 | 1,56,325 | 54,210 | 5,600 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 71,435 | 715 | 1,277 |

| 26,000 | 70,330 | -16,640 | 4,711 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 17,680 | 10,140 | 2,575 |

| 25,900 | 8,840 | 8,840 | 264 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,330 | -16,640 | 4,711 |

| 26,350 | 5,525 | -4,615 | 1,222 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,330 | -16,640 | 4,711 |

| 26,200 | 8,515 | -3,445 | 3,295 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12506.3. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.840 against previous 1.038. The 13000CE option holds the maximum open interest, followed by the 12000PE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 12600CE and 12800CE options. On the other hand, open interest reductions were prominent in the 66700CE, 77000PE, and 77000PE options. Trading volume was highest in the 12600PE option, followed by the 13000CE and 12600CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,506.30 | 0.840 | 1.038 | 0.971 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 62,51,980 | 46,41,840 | 16,10,140 |

| PUT: | 52,49,160 | 48,18,660 | 4,30,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,38,040 | 2,67,680 | 15,219 |

| 13,500 | 5,14,080 | 66,220 | 4,494 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,38,040 | 2,67,680 | 15,219 |

| 12,600 | 3,40,900 | 1,93,060 | 13,122 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 1,07,940 | -16,240 | 801 |

| 14,500 | 1,11,160 | -3,780 | 634 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,38,040 | 2,67,680 | 15,219 |

| 12,600 | 3,40,900 | 1,93,060 | 13,122 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,16,060 | 92,820 | 10,340 |

| 12,500 | 5,34,940 | 36,680 | 12,038 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 3,15,280 | 98,980 | 20,914 |

| 12,000 | 8,16,060 | 92,820 | 10,340 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,66,320 | -56,000 | 3,504 |

| 11,900 | 67,760 | -32,060 | 1,042 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 3,15,280 | 98,980 | 20,914 |

| 12,500 | 5,34,940 | 36,680 | 12,038 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis clearly points to a market that remains under pressure, with fresh shorts accumulating across Nifty, BankNifty, FINNIFTY, and MIDCPNIFTY futures and options. The sharp drop in weekly Put-Call Ratios and rising open interest highlight growing bearish conviction, especially as key expiry-level max pain zones hold firm below current spot prices. For Nifty, watch the 24,300–24,500 band closely; a breakdown here could accelerate the slide toward 24,000, while resistance near 25,000 is fortified by heavy call open interest. BankNifty’s 55,500–57,000 range similarly acts as a battleground, where traders should expect volatile swings and aggressive selling on rallies.

Traders are advised to lean into protective and short-biased strategies, focusing on credit call spreads and short puts around max pain strikes to manage risk effectively. Range-bound plays like iron condors may also suit the choppy environment, but caution is warranted given the subdued volumes and heightened option activity signaling uncertainty. Let this Open Interest Volume Analysis guide tactical positioning, emphasizing discipline and quick reaction to breaking support or resistance, as the market decides its near-term trajectory amid this cautious and defensive backdrop.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]