Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 18/08/2025

Table of Contents

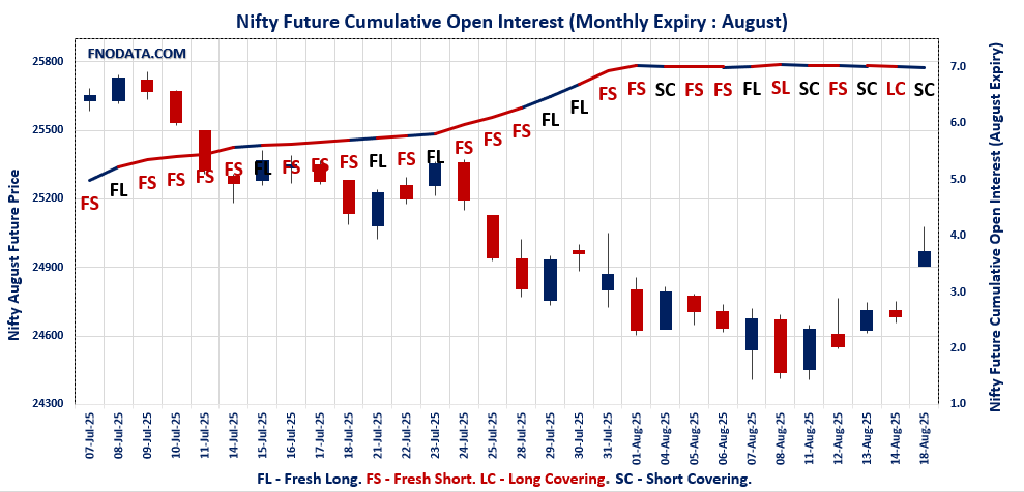

The Open Interest Volume Analysis for 18th August 2025 shines a light on a new surge of optimism and risk-taking in the Indian market. Nifty August futures soared 1.14% to 24,966.80 on robust spot gains, but what stands out most is that open interest actually fell by 1.8% even as volume surged by over 75%. This signals heavy short covering—the rally is being driven by bears rushing to cover their positions rather than fresh big bets from the bulls. The premium expansion of nearly 37 points supports this, indicating there’s still some defensive hedging even as prices rally.

Weekly option data adds context: Put-Call Ratio (OI) slipped a touch to 0.87, but call writers are now most active at 25,000, suggesting the market expects consolidation or resistance at round-number levels. For the monthly expiry, the Put-Call Ratio (OI) is above 1 and max pain (the point of least “option pain” for sellers) stands at 25,000, with heavy open interest both at 25,000 calls and puts—a clear sign of a tug of war unfolding and traders preparing for an eventful expiry week.

BankNifty mirrors this unwind, rising 0.65% even as open interest drops over 6%, with a sharp fall in premium—a sure sign of more covering of short positions than new long commitments. FINNIFTY and MIDCPNIFTY post similar action: both up strongly for the day, but with falling open interest showing the rally is powered by bears stepping aside, not bulls coming in aggressive. SENSEX, too, reflects this pattern—a sharp rise, with big fall in open interest, and much higher volume. Across the board, the Open Interest Volume Analysis spotlights short covering rallies rather than a new bull trend, with liquidity still rushing back after a consolidation phase.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

NIFTY Spot closed at: 24,876.95 (1.00%)

NIFTY AUGUST Future closed at: 24,966.80 (1.14%)

Premium: 89.85 (Increased by 36.45 points)

Open Interest Change: -1.8%

Volume Change: 75.8%

NIFTY Weekly Expiry (21/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.874 (Decreased from 0.879)

Put-Call Ratio (Volume): 0.919

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24800

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.084 (Increased from 0.967)

Put-Call Ratio (Volume): 0.948

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 24800

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,734.90 (0.71%)

BANKNIFTY AUGUST Future closed at: 55,862.80 (0.65%)

Premium: 127.9 (Decreased by -34.05 points)

Open Interest Change: -6.4%

Volume Change: 99.2%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.719 (Increased from 0.716)

Put-Call Ratio (Volume): 0.809

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 59000

Highest PUT Addition: 56000

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,609.10 (1.05%)

FINNIFTY AUGUST Future closed at: 26,683.70 (1.06%)

Premium: 74.6 (Increased by 2.95 points)

Open Interest Change: -6.9%

Volume Change: 92.7%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.916 (Increased from 0.870)

Put-Call Ratio (Volume): 0.693

Max Pain Level: 26500

Maximum CALL Open Interest: 27900

Maximum PUT Open Interest: 26500

Highest CALL Addition: 27500

Highest PUT Addition: 26700

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,811.30 (1.36%)

MIDCPNIFTY AUGUST Future closed at: 12,872.15 (1.62%)

Premium: 60.85 (Increased by 33 points)

Open Interest Change: -5.7%

Volume Change: 117.1%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.056 (Increased from 0.865)

Put-Call Ratio (Volume): 0.973

Max Pain Level: 12800

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12900

Highest PUT Addition: 12800

SENSEX Monthly Expiry (24/08/2025) Future

SENSEX Spot closed at: 81,273.75 (0.84%)

SENSEX Monthly Future closed at: 81,558.10 (0.92%)

Premium: 284.35 (Increased by 70.56 points)

Open Interest Change: -7.7%

Volume Change: 143.3%

SENSEX Weekly Expiry (19/08/2025) Option Analysis

Put-Call Ratio (OI): 0.901 (Increased from 0.886)

Put-Call Ratio (Volume): 0.993

Max Pain Level: 80600

Maximum CALL OI: 83000

Maximum PUT OI: 80000

Highest CALL Addition: 83000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 550.85 Cr

DIIs Net BUY: ₹ 4,103.81 Cr

FII Derivatives Activity

| FII Trading Stats | 18.08.25 | 14.08.25 | 13.08.25 |

| FII Cash (Provisional Data) | 550.85 | -1,926.76 | -3,644.43 |

| Index Future Open Interest Long Ratio | 9.73% | 8.30% | 8.66% |

| Index Future Volume Long Ratio | 64.61% | 49.61% | 56.32% |

| Call Option Open Interest Long Ratio | 47.97% | 47.04% | 46.96% |

| Call Option Volume Long Ratio | 50.03% | 49.85% | 50.29% |

| Put Option Open Interest Long Ratio | 66.80% | 71.87% | 60.21% |

| Put Option Volume Long Ratio | 49.99% | 50.09% | 49.48% |

| Stock Future Open Interest Long Ratio | 62.13% | 61.72% | 61.98% |

| Stock Future Volume Long Ratio | 53.67% | 47.74% | 52.69% |

| Index Futures | Short Covering | Long Covering | Fresh Long |

| Index Options | Fresh Long | Long Covering | Fresh Short |

| Nifty Futures | Short Covering | Short Covering | Fresh Long |

| Nifty Options | Fresh Short | Long Covering | Fresh Short |

| BankNifty Futures | Fresh Long | Short Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Long |

| FinNifty Options | Fresh Long | Fresh Long | Fresh Short |

| MidcpNifty Futures | Short Covering | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Short Covering |

| NiftyNxt50 Futures | Fresh Long | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Long Covering | Short Covering |

| Stock Futures | Fresh Long | Fresh Short | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Long |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (21/08/2025)

The NIFTY index closed at 24876.95. The NIFTY weekly expiry for AUGUST 21, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.874 against previous 0.879. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24800PE option, with open interest additions also seen in the 25000CE and 25200CE options. On the other hand, open interest reductions were prominent in the 24700CE, 24600CE, and 24800CE options. Trading volume was highest in the 25000CE option, followed by the 24900PE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 21-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,876.95 | 0.874 | 0.879 | 0.919 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,98,68,975 | 5,88,23,250 | 6,10,45,725 |

| PUT: | 10,48,18,950 | 5,17,21,725 | 5,30,97,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,06,76,100 | 57,90,150 | 42,01,164 |

| 26,000 | 96,36,975 | 52,05,675 | 7,71,664 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,06,76,100 | 57,90,150 | 42,01,164 |

| 25,200 | 77,70,225 | 54,31,200 | 21,27,386 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 15,57,450 | -19,81,650 | 2,27,426 |

| 24,600 | 12,97,425 | -15,05,700 | 94,058 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,06,76,100 | 57,90,150 | 42,01,164 |

| 24,900 | 47,36,100 | 26,14,950 | 22,57,770 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 80,66,100 | 43,43,250 | 7,54,330 |

| 24,800 | 67,45,200 | 59,87,925 | 20,26,839 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 67,45,200 | 59,87,925 | 20,26,839 |

| 24,900 | 55,44,750 | 50,21,625 | 34,92,117 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 6,15,525 | -4,98,525 | 75,661 |

| 23,300 | 9,38,550 | -4,75,050 | 93,869 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 55,44,750 | 50,21,625 | 34,92,117 |

| 25,000 | 44,76,675 | 36,32,400 | 28,99,444 |

SENSEX Weekly Expiry (19/08/2025)

The SENSEX index closed at 81273.75. The SENSEX weekly expiry for AUGUST 19, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.901 against previous 0.886. The 83000CE option holds the maximum open interest, followed by the 82000CE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 83000CE option, with open interest additions also seen in the 82000CE and 80000PE options. On the other hand, open interest reductions were prominent in the 81000CE, 80700CE, and 80600CE options. Trading volume was highest in the 82000CE option, followed by the 81000PE and 81500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 19-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81273.75 | 0.901 | 0.886 | 0.993 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,53,53,140 | 1,17,50,580 | 1,36,02,560 |

| PUT: | 2,28,38,920 | 1,04,05,280 | 1,24,33,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 24,84,840 | 14,41,180 | 3,99,65,200 |

| 82000 | 17,54,260 | 12,37,560 | 9,00,21,320 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 24,84,840 | 14,41,180 | 3,99,65,200 |

| 82000 | 17,54,260 | 12,37,560 | 9,00,21,320 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,07,380 | -5,55,420 | 65,09,720 |

| 80700 | 77,740 | -3,66,900 | 11,82,100 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 17,54,260 | 12,37,560 | 9,00,21,320 |

| 81500 | 12,17,360 | 7,71,320 | 6,73,87,940 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 16,81,780 | 11,76,940 | 3,27,24,600 |

| 80500 | 15,73,400 | 7,45,620 | 4,75,41,540 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 16,81,780 | 11,76,940 | 3,27,24,600 |

| 79500 | 14,73,960 | 11,59,780 | 1,48,50,320 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76500 | 1,45,780 | -2,99,120 | 17,94,260 |

| 78000 | 7,96,520 | -1,40,620 | 86,97,420 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 11,33,000 | 9,54,200 | 8,81,59,260 |

| 81500 | 8,90,640 | 8,43,020 | 7,67,90,020 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24876.95. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.084 against previous 0.967. The 25000CE option holds the maximum open interest, followed by the 25500CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 24800PE option, with open interest additions also seen in the 25000PE and 26000CE options. On the other hand, open interest reductions were prominent in the 24700CE, 24500CE, and 24600CE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,876.95 | 1.084 | 0.967 | 0.948 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,60,08,075 | 4,56,45,525 | 3,62,550 |

| PUT: | 4,98,93,300 | 4,41,39,675 | 57,53,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 65,37,975 | -2,90,025 | 2,87,264 |

| 25,500 | 47,25,150 | -58,950 | 1,88,582 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 46,95,600 | 5,85,375 | 93,823 |

| 25,300 | 21,24,750 | 5,48,325 | 96,321 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 10,97,700 | -11,31,375 | 47,849 |

| 24,500 | 13,89,675 | -7,25,550 | 31,487 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 65,37,975 | -2,90,025 | 2,87,264 |

| 25,500 | 47,25,150 | -58,950 | 1,88,582 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 45,17,550 | 13,65,075 | 2,09,738 |

| 24,500 | 43,48,650 | 2,84,700 | 1,35,102 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 25,72,575 | 14,71,650 | 1,26,628 |

| 25,000 | 45,17,550 | 13,65,075 | 2,09,738 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 18,00,225 | -2,13,675 | 62,986 |

| 24,300 | 14,15,100 | -1,49,400 | 59,180 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 45,17,550 | 13,65,075 | 2,09,738 |

| 24,500 | 43,48,650 | 2,84,700 | 1,35,102 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55734.9. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.719 against previous 0.716. The 57000CE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 56000PE option, with open interest additions also seen in the 55800PE and 59000CE options. On the other hand, open interest reductions were prominent in the 55500CE, 55000CE, and 55400CE options. Trading volume was highest in the 56000CE option, followed by the 56000PE and 57000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,734.90 | 0.719 | 0.716 | 0.809 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,94,12,295 | 1,88,00,915 | 6,11,380 |

| PUT: | 1,39,57,265 | 1,34,57,640 | 4,99,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 23,61,205 | 85,295 | 1,51,035 |

| 56,000 | 15,75,350 | 79,695 | 3,13,471 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 9,25,855 | 1,84,940 | 66,946 |

| 58,000 | 11,62,035 | 1,49,695 | 86,441 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,02,480 | -3,53,885 | 93,479 |

| 55,000 | 2,67,715 | -2,09,510 | 26,470 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,75,350 | 79,695 | 3,13,471 |

| 57,000 | 23,61,205 | 85,295 | 1,51,035 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,95,770 | -17,290 | 13,653 |

| 56,000 | 10,40,235 | 2,04,050 | 2,24,877 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 10,40,235 | 2,04,050 | 2,24,877 |

| 55,800 | 3,31,135 | 1,93,095 | 1,07,414 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 4,11,390 | -69,230 | 40,121 |

| 54,000 | 7,04,585 | -63,350 | 72,887 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 10,40,235 | 2,04,050 | 2,24,877 |

| 55,000 | 9,88,610 | 29,890 | 1,27,849 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26609.1. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.916 against previous 0.870. The 27900CE option holds the maximum open interest, followed by the 27500CE and 26500PE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 26700PE and 25700PE options. On the other hand, open interest reductions were prominent in the 26000PE, 26500CE, and 26400CE options. Trading volume was highest in the 27000CE option, followed by the 26800CE and 26700CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,609.10 | 0.916 | 0.870 | 0.693 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,29,665 | 11,62,200 | -1,32,535 |

| PUT: | 9,43,670 | 10,11,400 | -67,730 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 1,19,860 | 6,435 | 2,600 |

| 27,500 | 1,07,705 | 31,785 | 6,808 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,07,705 | 31,785 | 6,808 |

| 26,900 | 20,475 | 20,410 | 1,831 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 83,720 | -68,770 | 3,197 |

| 26,400 | 20,800 | -43,485 | 1,617 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 88,465 | -28,080 | 13,430 |

| 26,800 | 89,765 | -11,570 | 8,177 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 90,805 | 13,000 | 5,981 |

| 25,000 | 88,855 | 20,735 | 898 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 34,060 | 22,360 | 5,323 |

| 25,700 | 25,220 | 20,865 | 716 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,410 | -74,425 | 5,892 |

| 26,400 | 25,090 | -39,130 | 2,228 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 90,805 | 13,000 | 5,981 |

| 26,000 | 72,410 | -74,425 | 5,892 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12811.3. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.056 against previous 0.865. The 12000PE option holds the maximum open interest, followed by the 13000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12800PE option, with open interest additions also seen in the 11700PE and 12900CE options. On the other hand, open interest reductions were prominent in the 66000PE, 58000CE, and 58000CE options. Trading volume was highest in the 13000CE option, followed by the 12800PE and 12900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,811.30 | 1.056 | 0.865 | 0.973 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 68,18,980 | 69,98,600 | -1,79,620 |

| PUT: | 71,98,800 | 60,55,280 | 11,43,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,28,280 | -1,36,500 | 29,418 |

| 13,500 | 6,84,320 | 32,060 | 14,023 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 5,12,400 | 1,51,060 | 21,137 |

| 12,800 | 5,14,920 | 1,09,760 | 20,509 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,37,720 | -2,42,200 | 6,704 |

| 13,000 | 7,28,280 | -1,36,500 | 29,418 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,28,280 | -1,36,500 | 29,418 |

| 12,900 | 5,12,400 | 1,51,060 | 21,137 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,71,360 | 52,920 | 12,733 |

| 12,500 | 5,44,880 | 1,15,360 | 16,994 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 4,88,880 | 3,47,620 | 22,179 |

| 11,700 | 3,34,880 | 1,59,460 | 4,248 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 4,49,960 | -84,000 | 3,556 |

| 12,650 | 1,36,920 | -53,340 | 2,405 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 4,88,880 | 3,47,620 | 22,179 |

| 12,500 | 5,44,880 | 1,15,360 | 16,994 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis suggests the market rally is more about shorts unwinding than confident new bullish positions. For Nifty, the 25,000 mark is both a magnet and a battleground—traders should watch for range-bound volatility and sharp swings as both calls and puts dominate open interest near this level. Cautious traders can consider neutral or range-bound strategies like iron condors or straddles around 24,900–25,000, while momentum followers should wait for new open interest and volume adding up on further up-moves before chasing the breakout.

BankNifty and others show a similar picture: until we see open interest rising alongside another price jump, the sustainable uptrend is still not confirmed. For now, let the Open Interest Volume Analysis frame your trading—capitalize on volatility, keep stops tight, and stay nimble as expiry approaches, since another round of tug-of-war between bulls and bears is almost certain.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]