Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 19/08/2025

Table of Contents

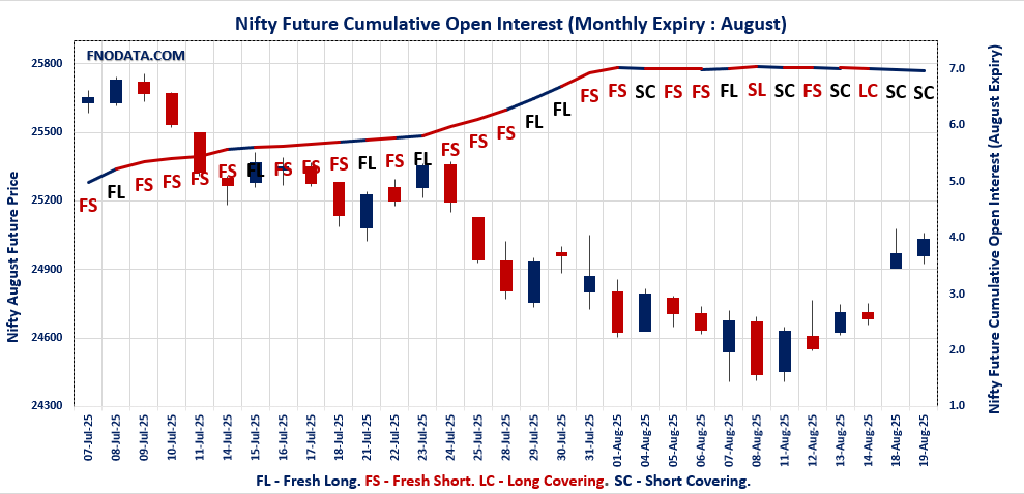

The Open Interest Volume Analysis for 19th August 2025 reveals a market that is beginning to pause after a solid rebound, as traders shift into consolidation mode ahead of expiry. Nifty August futures inched up 0.27% to 25,033.50, but an open interest drop of 1.3% and a big 37-point fall in premium show that the up-move is still being powered by short covering, not new long build-up. Volume dropped nearly 47%, underlining a clear reduction in active trading and suggesting traders are comfortable trimming risk.

Option data highlights this sentiment: the Put-Call Ratio (OI) for the week jumped to 1.11, showing a renewed interest in put writing near 25,000—which is also where max pain sits—and heavy call open interest puts a ceiling at this psychological level as well. The monthly series echoes this range-bound mood, with max pain steady at 25,000 and the Put-Call Ratio (OI) edging higher, so traders are circling this level as a likely expiry magnet.

BankNifty and FINNIFTY data reflect similar caution. In BankNifty, a modest up-move was joined by an open interest drop and shrinking premium, signaling more short covering and little conviction for sustained upside. In FINNIFTY, prices were slightly lower and OI also fell, keeping the index locked in a wait-and-watch zone. MIDCPNIFTY was a quiet outperformer, up 0.67% with rising OI and a strong Put-Call Ratio—suggesting selective bullish interest in the midcap basket. SENSEX, meanwhile, showed a healthy gain but a notable drop in both OI and premium, reinforcing that this is still a cautious, unwinding market.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

NIFTY Spot closed at: 24,980.65 (0.42%)

NIFTY AUGUST Future closed at: 25,033.50 (0.27%)

Premium: 52.85 (Decreased by -37 points)

Open Interest Change: -1.3%

Volume Change: -46.8%

NIFTY Weekly Expiry (21/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.113 (Increased from 0.874)

Put-Call Ratio (Volume): 0.811

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24900

Highest CALL Addition: 25500

Highest PUT Addition: 25000

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.097 (Increased from 1.084)

Put-Call Ratio (Volume): 0.951

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26500

Highest PUT Addition: 22600

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,865.15 (0.23%)

BANKNIFTY AUGUST Future closed at: 55,965.80 (0.18%)

Premium: 100.65 (Decreased by -27.25 points)

Open Interest Change: -3.8%

Volume Change: -52.6%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.776 (Increased from 0.719)

Put-Call Ratio (Volume): 0.811

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 65000

Highest PUT Addition: 55700

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,592.30 (-0.06%)

FINNIFTY AUGUST Future closed at: 26,658.40 (-0.09%)

Premium: 66.1 (Decreased by -8.5 points)

Open Interest Change: -1.1%

Volume Change: -60.3%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.841 (Decreased from 0.916)

Put-Call Ratio (Volume): 0.904

Max Pain Level: 26600

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26600

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,908.30 (0.76%)

MIDCPNIFTY AUGUST Future closed at: 12,958.30 (0.67%)

Premium: 50 (Decreased by -10.85 points)

Open Interest Change: 2.6%

Volume Change: -48.3%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.123 (Increased from 1.056)

Put-Call Ratio (Volume): 0.923

Max Pain Level: 12800

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12950

Highest PUT Addition: 12800

SENSEX Monthly Expiry (24/08/2025) Future

SENSEX Spot closed at: 81,644.39 (0.46%)

SENSEX Monthly Future closed at: 81,780.90 (0.27%)

Premium: 136.51 (Decreased by -147.84 points)

Open Interest Change: -6.1%

Volume Change: -11.4%

SENSEX Weekly Expiry (26/08/2025) Option Analysis

Put-Call Ratio (OI): 1.213 (Increased from 0.989)

Put-Call Ratio (Volume): 1.080

Max Pain Level: 81500

Maximum CALL OI: 81500

Maximum PUT OI: 80000

Highest CALL Addition: 84000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 634.26 Cr

DIIs Net BUY: ₹ 2,261.06 Cr

FII Derivatives Activity

| FII Trading Stats | 19.08.25 | 18.08.25 | 14.08.25 |

| FII Cash (Provisional Data) | -634.26 | 550.85 | -1,926.76 |

| Index Future Open Interest Long Ratio | 9.71% | 9.73% | 8.30% |

| Index Future Volume Long Ratio | 49.35% | 64.61% | 49.61% |

| Call Option Open Interest Long Ratio | 49.14% | 47.97% | 47.04% |

| Call Option Volume Long Ratio | 50.20% | 50.03% | 49.85% |

| Put Option Open Interest Long Ratio | 66.65% | 66.80% | 71.87% |

| Put Option Volume Long Ratio | 50.11% | 49.99% | 50.09% |

| Stock Future Open Interest Long Ratio | 62.41% | 62.13% | 61.72% |

| Stock Future Volume Long Ratio | 53.18% | 53.67% | 47.74% |

| Index Futures | Fresh Short | Short Covering | Long Covering |

| Index Options | Fresh Long | Fresh Long | Long Covering |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Short Covering | Fresh Long | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Long | Long Covering |

| FinNifty Options | Fresh Long | Fresh Long | Fresh Long |

| MidcpNifty Futures | Fresh Short | Short Covering | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Long | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Long Covering |

| Stock Futures | Fresh Long | Fresh Long | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (21/08/2025)

The NIFTY index closed at 24980.65. The NIFTY weekly expiry for AUGUST 21, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.113 against previous 0.874. The 25000CE option holds the maximum open interest, followed by the 25500CE and 24900PE options. Market participants have shown increased interest with significant open interest additions in the 25000PE option, with open interest additions also seen in the 24900PE and 24950PE options. On the other hand, open interest reductions were prominent in the 23900PE, 24900CE, and 25600CE options. Trading volume was highest in the 25000CE option, followed by the 24900PE and 24900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 21-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,980.65 | 1.113 | 0.874 | 0.811 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,96,08,475 | 11,98,68,975 | 97,39,500 |

| PUT: | 14,42,66,250 | 10,48,18,950 | 3,94,47,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,18,19,175 | 11,43,075 | 43,91,169 |

| 25,500 | 1,15,41,900 | 33,40,500 | 11,80,056 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,15,41,900 | 33,40,500 | 11,80,056 |

| 25,300 | 73,04,100 | 29,38,575 | 14,44,419 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 32,88,075 | -14,48,025 | 30,65,168 |

| 25,600 | 43,20,900 | -14,33,550 | 6,56,699 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,18,19,175 | 11,43,075 | 43,91,169 |

| 24,900 | 32,88,075 | -14,48,025 | 30,65,168 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,13,81,775 | 58,37,025 | 35,87,201 |

| 25,000 | 1,04,81,175 | 60,04,500 | 28,59,229 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,04,81,175 | 60,04,500 | 28,59,229 |

| 24,900 | 1,13,81,775 | 58,37,025 | 35,87,201 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,900 | 22,95,825 | -16,37,025 | 2,82,462 |

| 24,400 | 49,78,500 | -5,97,675 | 4,98,899 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,13,81,775 | 58,37,025 | 35,87,201 |

| 25,000 | 1,04,81,175 | 60,04,500 | 28,59,229 |

SENSEX Weekly Expiry (26/08/2025)

The SENSEX index closed at 81644.39. The SENSEX weekly expiry for AUGUST 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.213 against previous 0.989. The 80000PE option holds the maximum open interest, followed by the 81500PE and 79000PE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 81500PE and 78000PE options. On the other hand, open interest reductions were prominent in the 80900CE, 80900CE, and 80800CE options. Trading volume was highest in the 81500PE option, followed by the 81500CE and 82000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 26-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81644.39 | 1.213 | 0.989 | 1.080 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 31,38,000 | 10,84,980 | 20,53,020 |

| PUT: | 38,05,760 | 10,73,280 | 27,32,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,14,840 | 1,58,940 | 17,65,840 |

| 84000 | 3,05,740 | 2,28,340 | 9,01,040 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,05,740 | 2,28,340 | 9,01,040 |

| 82000 | 2,80,820 | 1,82,660 | 13,72,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80900 | 5,760 | -1,900 | 19,080 |

| 80900 | 5,760 | -1,900 | 19,080 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,14,840 | 1,58,940 | 17,65,840 |

| 82000 | 2,80,820 | 1,82,660 | 13,72,120 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,04,160 | 3,18,540 | 13,21,360 |

| 81500 | 3,96,160 | 2,57,680 | 21,72,840 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,04,160 | 3,18,540 | 13,21,360 |

| 81500 | 3,96,160 | 2,57,680 | 21,72,840 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 75600 | 1,900 | -80 | 620 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,96,160 | 2,57,680 | 21,72,840 |

| 80000 | 4,04,160 | 3,18,540 | 13,21,360 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24980.65. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.097 against previous 1.084. The 25000CE option holds the maximum open interest, followed by the 25000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 22600PE option, with open interest additions also seen in the 25000PE and 26500CE options. On the other hand, open interest reductions were prominent in the 23200PE, 25300CE, and 24700CE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,980.65 | 1.097 | 1.084 | 0.951 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,23,06,725 | 4,60,08,075 | 62,98,650 |

| PUT: | 5,73,98,775 | 4,98,93,300 | 75,05,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 68,31,825 | 2,93,850 | 2,67,353 |

| 25,500 | 53,51,025 | 6,25,875 | 1,41,651 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 22,42,425 | 7,92,600 | 31,682 |

| 25,100 | 22,60,350 | 6,44,925 | 1,15,129 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 19,97,625 | -1,27,125 | 1,06,119 |

| 24,700 | 9,78,975 | -1,18,725 | 18,921 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 68,31,825 | 2,93,850 | 2,67,353 |

| 25,200 | 38,32,950 | 4,06,650 | 1,49,967 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,65,050 | 11,47,500 | 2,06,079 |

| 24,500 | 49,11,975 | 5,63,325 | 1,08,363 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,600 | 19,04,400 | 12,74,550 | 36,787 |

| 25,000 | 56,65,050 | 11,47,500 | 2,06,079 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 3,46,500 | -2,06,625 | 10,529 |

| 23,400 | 2,22,825 | -98,475 | 13,183 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,65,050 | 11,47,500 | 2,06,079 |

| 24,900 | 19,69,725 | 6,47,700 | 1,31,445 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55865.15. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.776 against previous 0.719. The 57000CE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 55700PE option, with open interest additions also seen in the 55600PE and 55900PE options. On the other hand, open interest reductions were prominent in the 59000CE, 55500CE, and 51000PE options. Trading volume was highest in the 56000CE option, followed by the 55800CE and 56000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,865.15 | 0.776 | 0.719 | 0.811 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,92,74,395 | 1,94,12,295 | -1,37,900 |

| PUT: | 1,49,53,085 | 1,39,57,265 | 9,95,820 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 23,23,930 | -37,275 | 1,13,052 |

| 56,000 | 16,13,780 | 38,430 | 2,21,381 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 6,87,120 | 99,155 | 13,448 |

| 64,000 | 2,21,830 | 64,120 | 6,818 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 8,28,905 | -96,950 | 50,819 |

| 55,500 | 7,11,165 | -91,315 | 81,130 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,13,780 | 38,430 | 2,21,381 |

| 55,800 | 4,18,110 | 15,435 | 1,68,092 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,92,655 | -3,115 | 4,394 |

| 56,000 | 11,51,290 | 1,11,055 | 1,48,241 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,700 | 4,75,895 | 2,76,535 | 1,37,636 |

| 55,600 | 2,91,130 | 1,25,335 | 91,976 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 3,11,395 | -91,175 | 17,570 |

| 52,500 | 2,98,060 | -60,515 | 18,752 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 11,51,290 | 1,11,055 | 1,48,241 |

| 55,800 | 4,12,300 | 81,165 | 1,40,427 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26592.3. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.841 against previous 0.916. The 27000CE option holds the maximum open interest, followed by the 27900CE and 26600CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26600CE and 26600PE options. On the other hand, open interest reductions were prominent in the 27500CE, 26350PE, and 26300PE options. Trading volume was highest in the 27000CE option, followed by the 26600CE and 26600PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,592.30 | 0.841 | 0.916 | 0.904 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,43,580 | 10,29,665 | 2,13,915 |

| PUT: | 10,46,305 | 9,43,670 | 1,02,635 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,49,825 | 61,360 | 11,384 |

| 27,900 | 1,17,195 | -2,665 | 1,577 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,49,825 | 61,360 | 11,384 |

| 26,600 | 1,02,050 | 59,215 | 10,187 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 91,130 | -16,575 | 3,127 |

| 27,300 | 21,450 | -8,580 | 1,307 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,49,825 | 61,360 | 11,384 |

| 26,600 | 1,02,050 | 59,215 | 10,187 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 98,735 | 26,325 | 7,169 |

| 26,600 | 98,475 | 56,225 | 8,731 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 98,475 | 56,225 | 8,731 |

| 26,000 | 98,735 | 26,325 | 7,169 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,350 | 8,385 | -9,360 | 537 |

| 26,300 | 35,165 | -8,580 | 3,277 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 98,475 | 56,225 | 8,731 |

| 26,000 | 98,735 | 26,325 | 7,169 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12908.3. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.123 against previous 1.056. The 12000PE option holds the maximum open interest, followed by the 13500CE and 12800PE options. Market participants have shown increased interest with significant open interest additions in the 12950CE option, with open interest additions also seen in the 12800PE and 12900PE options. On the other hand, open interest reductions were prominent in the 67000CE, 66000PE, and 66500CE options. Trading volume was highest in the 13000CE option, followed by the 12800PE and 12900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,908.30 | 1.123 | 1.056 | 0.923 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 73,76,180 | 68,18,980 | 5,57,200 |

| PUT: | 82,81,560 | 71,98,800 | 10,82,760 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,83,200 | -1,120 | 12,337 |

| 13,000 | 6,72,000 | -56,280 | 36,190 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,950 | 2,53,260 | 2,07,060 | 5,140 |

| 13,900 | 1,90,540 | 1,33,700 | 2,516 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,72,000 | -56,280 | 36,190 |

| 12,800 | 4,61,160 | -53,760 | 23,371 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,72,000 | -56,280 | 36,190 |

| 12,900 | 4,82,160 | -30,240 | 27,867 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,41,540 | -29,820 | 8,100 |

| 12,800 | 6,72,700 | 1,83,820 | 31,340 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 6,72,700 | 1,83,820 | 31,340 |

| 12,900 | 3,84,440 | 1,78,500 | 16,052 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,700 | 2,35,760 | -99,120 | 3,096 |

| 12,250 | 40,320 | -46,620 | 1,134 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 6,72,700 | 1,83,820 | 31,340 |

| 12,700 | 4,40,020 | 1,04,580 | 18,592 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis points to a market entering a phase of healthy consolidation as expiry nears. For Nifty, the key takeaway is that 25,000 remains both a magnet and resistance—traders should expect choppy action here, with iron condors, straddles, or strangles around this strike likely to be most productive for range-bound setups. Don’t chase breakouts unless fresh open interest is seen adding on rising prices, and keep stops tight if support at 24,900 falters. In BankNifty and FINNIFTY, similar caution is warranted; until OI growth and volumes pick up on the upside, remain tactical and focus on hedged strategies. Midcap bulls can stay alert for momentum as OI trends lean more positive in MIDCPNIFTY. Overall, let this Open Interest Volume Analysis drive your trading plan through expiry week—keep risk light, favor market-neutral structures, and be ready to move quickly as positions get squared and new trends emerge.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]