Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 22/08/2025

Table of Contents

The Open Interest Volume Analysis for 22nd August 2025 reveals a clear risk-off mood as the market heads into the final stretch before expiry. Nifty August futures slid 0.89% to 24,898.20, while open interest tumbled by 5.6%, marking a significant round of position unwinding and profit booking. The premium narrowed by nearly 11 points, underscoring fading upside conviction. On the options front, the Put-Call Ratio (OI) collapsed to a weak 0.61, with heavy call writing at the 25,000 strike and new puts only slightly defending 24,900—showing bears are gradually taking charge and positioning for a possible test of lower support. Max pain has now drifted to 24,950, making it the key expiry anchor for the coming week.

BankNifty showed an even sharper contrast: futures lost more than 1%, but open interest actually rose over 3.5%, clearly suggesting fresh short positions as bears increase their grip on financials. Put-Call ratios here also dropped sharply, with 57,000 call OI vastly outnumbering put support—setting up for more near-term turbulence. FINNIFTY echoed Nifty’s story, falling by nearly 1% as open interest fell and premium stayed near recent highs; here too, put-call ratios slipped and max pain sits at 26,500. MIDCPNIFTY managed to stay flat but open interest shrank, a signal that the recent outperformance in midcaps may pause as expiry and volatility spike. SENSEX reflected the overall nervousness, posting a 0.85% fall along with a dip in open interest, showing broader caution and rotation ahead of monthly settlement.

NSE & BSE F&O Market Signals

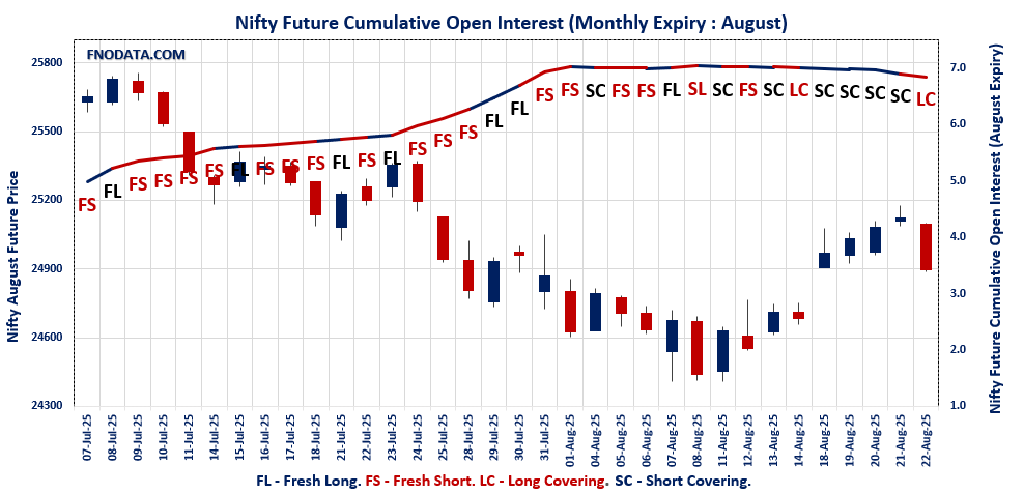

NIFTY AUGUST Future

NIFTY Spot closed at: 24,870.10 (-0.85%)

NIFTY AUGUST Future closed at: 24,898.20 (-0.89%)

Premium: 28.1 (Decreased by -10.65 points)

Open Interest Change: -5.6%

Volume Change: 30.3%

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.610 (Decreased from 1.004)

Put-Call Ratio (Volume): 0.980

Max Pain Level: 24950

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24900

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,149.40 (-1.09%)

BANKNIFTY AUGUST Future closed at: 55,270.60 (-1.11%)

Premium: 121.2 (Decreased by -13.35 points)

Open Interest Change: 3.5%

Volume Change: 69.3%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.522 (Decreased from 0.703)

Put-Call Ratio (Volume): 0.931

Max Pain Level: 55500

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 55500

Highest PUT Addition: 54000

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,317.05 (-0.96%)

FINNIFTY AUGUST Future closed at: 26,377.50 (-0.96%)

Premium: 60.45 (Increased by 1.2 points)

Open Interest Change: -3.2%

Volume Change: 96.5%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.674 (Decreased from 0.831)

Put-Call Ratio (Volume): 0.942

Max Pain Level: 26500

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26500

Highest CALL Addition: 26500

Highest PUT Addition: 26400

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,935.80 (0.11%)

MIDCPNIFTY AUGUST Future closed at: 12,945.90 (-0.03%)

Premium: 10.1 (Decreased by -17.95 points)

Open Interest Change: -7.0%

Volume Change: 31.1%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.030 (Decreased from 1.034)

Put-Call Ratio (Volume): 0.972

Max Pain Level: 12925

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12800

Highest CALL Addition: 13100

Highest PUT Addition: 12900

SENSEX Monthly Expiry (24/08/2025) Future

SENSEX Spot closed at: 81,306.85 (-0.85%)

SENSEX Monthly Future closed at: 81,409.25 (-0.85%)

Premium: 102.4 (Decreased by -3.64 points)

Open Interest Change: -2.5%

Volume Change: 25.4%

SENSEX Weekly Expiry (26/08/2025) Option Analysis

Put-Call Ratio (OI): 0.637 (Decreased from 1.145)

Put-Call Ratio (Volume): 1.134

Max Pain Level: 81500

Maximum CALL OI: 83000

Maximum PUT OI: 80000

Highest CALL Addition: 83000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,622.52 Cr

DIIs Net SELL: ₹ 329.25 Cr

FII Derivatives Activity

| FII Trading Stats | 22.08.25 | 21.08.25 | 20.08.25 |

| FII Cash (Provisional Data) | -1,622.52 | 1,246.51 | -1,100.09 |

| Index Future Open Interest Long Ratio | 10.70% | 10.46% | 9.90% |

| Index Future Volume Long Ratio | 46.25% | 56.67% | 46.50% |

| Call Option Open Interest Long Ratio | 46.38% | 48.69% | 47.65% |

| Call Option Volume Long Ratio | 49.35% | 49.88% | 49.78% |

| Put Option Open Interest Long Ratio | 69.35% | 70.94% | 61.57% |

| Put Option Volume Long Ratio | 50.48% | 50.17% | 49.46% |

| Stock Future Open Interest Long Ratio | 61.85% | 62.12% | 62.28% |

| Stock Future Volume Long Ratio | 49.63% | 48.73% | 49.20% |

| Index Futures | Fresh Short | Short Covering | Fresh Short |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Fresh Short |

| Nifty Options | Fresh Long | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Short | Long Covering |

| FinNifty Options | Fresh Short | Fresh Long | Short Covering |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Fresh Short | Fresh Short |

| Stock Options | Short Covering | Fresh Long | Fresh Long |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (26/08/2025)

The SENSEX index closed at 81306.85. The SENSEX weekly expiry for AUGUST 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.637 against previous 1.145. The 83000CE option holds the maximum open interest, followed by the 82000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 83000CE option, with open interest additions also seen in the 81500CE and 82000CE options. On the other hand, open interest reductions were prominent in the 82000PE, 82100PE, and 79500PE options. Trading volume was highest in the 81500PE option, followed by the 81000PE and 82000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 26-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81306.85 | 0.637 | 1.145 | 1.134 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,08,64,880 | 1,25,31,560 | 83,33,320 |

| PUT: | 1,32,80,780 | 1,43,42,680 | -10,61,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 15,31,540 | 8,20,280 | 1,63,34,220 |

| 82000 | 12,96,140 | 6,04,940 | 3,51,37,760 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 15,31,540 | 8,20,280 | 1,63,34,220 |

| 81500 | 9,48,120 | 6,63,640 | 3,37,63,400 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 9,03,920 | -2,01,840 | 73,67,620 |

| 83900 | 1,35,660 | -76,580 | 21,16,040 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 12,96,140 | 6,04,940 | 3,51,37,760 |

| 81500 | 9,48,120 | 6,63,640 | 3,37,63,400 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 12,04,720 | 1,90,420 | 1,58,71,420 |

| 79000 | 11,36,820 | -11,100 | 83,12,480 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 12,04,720 | 1,90,420 | 1,58,71,420 |

| 81300 | 3,39,460 | 1,42,020 | 2,45,15,320 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 3,68,040 | -4,96,100 | 1,14,84,560 |

| 82100 | 77,400 | -2,82,140 | 25,42,120 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 6,94,440 | -1,20,020 | 4,97,33,460 |

| 81000 | 6,73,560 | 57,400 | 3,78,13,480 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24870.1. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.610 against previous 1.004. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25100CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24900CE and 25100CE options. On the other hand, open interest reductions were prominent in the 25100PE, 25000PE, and 24150PE options. Trading volume was highest in the 24900PE option, followed by the 25000CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,870.10 | 0.610 | 1.004 | 0.980 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,01,66,475 | 9,47,60,100 | 9,54,06,375 |

| PUT: | 11,60,44,125 | 9,50,96,850 | 2,09,47,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,73,76,825 | 1,13,83,425 | 34,48,788 |

| 26,000 | 1,52,83,350 | 43,67,625 | 7,88,852 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,73,76,825 | 1,13,83,425 | 34,48,788 |

| 24,900 | 75,75,225 | 64,86,975 | 20,81,234 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 6,51,525 | -1,84,725 | 2,867 |

| 24,000 | 5,57,325 | -83,400 | 4,347 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,73,76,825 | 1,13,83,425 | 34,48,788 |

| 24,900 | 75,75,225 | 64,86,975 | 20,81,234 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 80,98,275 | 8,45,250 | 5,11,274 |

| 25,000 | 73,34,775 | -10,66,575 | 29,28,028 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 64,49,100 | 26,72,175 | 36,53,440 |

| 24,400 | 44,65,500 | 21,80,625 | 5,02,735 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 26,72,025 | -11,64,900 | 9,36,185 |

| 25,000 | 73,34,775 | -10,66,575 | 29,28,028 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 64,49,100 | 26,72,175 | 36,53,440 |

| 25,000 | 73,34,775 | -10,66,575 | 29,28,028 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55149.4. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.522 against previous 0.703. The 57000CE option holds the maximum open interest, followed by the 56000CE and 55500CE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 56000CE and 55300CE options. On the other hand, open interest reductions were prominent in the 55800PE, 56000PE, and 55500PE options. Trading volume was highest in the 55000PE option, followed by the 55500PE and 55500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,149.40 | 0.522 | 0.703 | 0.931 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,86,08,790 | 2,19,42,655 | 66,66,135 |

| PUT: | 1,49,34,115 | 1,54,24,185 | -4,90,070 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 26,03,300 | 1,24,460 | 1,76,861 |

| 56,000 | 25,95,530 | 5,52,825 | 3,24,664 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 16,47,485 | 9,39,085 | 3,41,015 |

| 56,000 | 25,95,530 | 5,52,825 | 3,24,664 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,700 | 79,660 | -1,95,335 | 24,867 |

| 57,400 | 1,19,735 | -35,840 | 20,289 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 16,47,485 | 9,39,085 | 3,41,015 |

| 56,000 | 25,95,530 | 5,52,825 | 3,24,664 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,00,920 | -68,635 | 5,323 |

| 55,000 | 10,84,790 | 6,090 | 4,08,754 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,01,840 | 1,49,625 | 1,42,862 |

| 53,500 | 5,32,175 | 1,08,220 | 60,976 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,800 | 2,88,995 | -3,51,050 | 93,542 |

| 56,000 | 9,70,550 | -2,82,135 | 90,829 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 10,84,790 | 6,090 | 4,08,754 |

| 55,500 | 9,55,745 | -2,15,600 | 3,52,274 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26317.05. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.674 against previous 0.831. The 26500CE option holds the maximum open interest, followed by the 27000CE and 26800CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 27300CE and 26700CE options. On the other hand, open interest reductions were prominent in the 26600PE, 27900CE, and 27800CE options. Trading volume was highest in the 26700CE option, followed by the 26300PE and 26500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,317.05 | 0.674 | 0.831 | 0.942 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,92,220 | 15,09,430 | 5,82,790 |

| PUT: | 14,10,370 | 12,54,370 | 1,56,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 2,38,030 | 1,34,615 | 17,889 |

| 27,000 | 2,35,495 | 85,865 | 9,362 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 2,38,030 | 1,34,615 | 17,889 |

| 27,300 | 1,29,415 | 98,670 | 5,507 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 66,170 | -53,235 | 2,984 |

| 27,800 | 12,805 | -16,965 | 1,484 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,77,580 | 89,115 | 23,297 |

| 26,500 | 2,38,030 | 1,34,615 | 17,889 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,53,335 | 5,330 | 12,896 |

| 25,500 | 1,22,135 | -7,800 | 3,749 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 1,01,660 | 49,595 | 17,600 |

| 26,350 | 41,535 | 29,965 | 11,708 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 45,045 | -70,330 | 5,791 |

| 26,550 | 12,220 | -8,255 | 1,501 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 71,565 | 22,165 | 19,207 |

| 26,400 | 1,01,660 | 49,595 | 17,600 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12935.8. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.030 against previous 1.034. The 13000CE option holds the maximum open interest, followed by the 12800PE and 13100CE options. Market participants have shown increased interest with significant open interest additions in the 13100CE option, with open interest additions also seen in the 12900PE and 12800PE options. On the other hand, open interest reductions were prominent in the 68400CE, 68400CE, and 67000CE options. Trading volume was highest in the 13000CE option, followed by the 12900PE and 12950CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,935.80 | 1.030 | 1.034 | 0.972 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,02,17,620 | 94,48,180 | 7,69,440 |

| PUT: | 1,05,20,160 | 97,70,740 | 7,49,420 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 12,99,620 | 1,69,820 | 89,451 |

| 13,100 | 9,81,540 | 4,31,760 | 41,709 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 9,81,540 | 4,31,760 | 41,709 |

| 13,000 | 12,99,620 | 1,69,820 | 89,451 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 2,87,140 | -1,69,960 | 3,105 |

| 13,400 | 4,63,680 | -82,460 | 14,735 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 12,99,620 | 1,69,820 | 89,451 |

| 12,950 | 2,58,020 | 32,760 | 47,367 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 10,76,600 | 2,29,180 | 42,017 |

| 13,000 | 8,43,080 | 69,580 | 44,342 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 8,22,640 | 3,13,180 | 73,073 |

| 12,800 | 10,76,600 | 2,29,180 | 42,017 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,24,540 | -1,31,040 | 5,600 |

| 12,300 | 1,96,280 | -79,380 | 6,428 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 8,22,640 | 3,13,180 | 73,073 |

| 12,950 | 2,32,680 | 1,02,900 | 46,488 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis signals that sellers are back in control as traders lock in profits and avoid new risk heading into expiry. For Nifty, expect expiry action to center around the 24,900–25,000 zone, with further downside likely if 24,900 consistently gives way—look to bear call spreads and credit call strategies above 25,000 as the preferred play. BankNifty is flashing even stronger warning signs—stay defensive until open interest and put support start to revive. In FINNIFTY and MIDCPNIFTY, keep positions light and take profits actively as volatility and uncertain sentiment dominate. As the contract winds down, let this Open Interest Volume Analysis be your guide: focus on risk control, consider range and short-side setups, and be wary of chasing late upside in a market that’s turning cautious as expiry pressure mounts.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]