Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 26/08/2025

Table of Contents

The Open Interest Volume Analysis for 26th August 2025 spells caution as the market heads into the final days of expiry. Nifty August futures slipped 1.03% to 24,731.50, with a massive 37% plunge in open interest and fading premiums, revealing that long positions are being aggressively unwound and traders are choosing to lock profits or stay light. Option data shows the Put-Call Ratio (OI) collapsed to just 0.57 for the monthly expiry, with dominant call open interest at the 25,000 strike and fresh put writing flipping down to 24,600—setting up resistance just above spot and support a few points below. Max pain remains anchored at 25,000, making this level the expiry pivot. The trend was echoed across major indices, with BankNifty, FINNIFTY, and MIDCPNIFTY all showing steep OI cuts, surging volumes, and long covering—a clear signal that traders prefer a risk-off approach as settlement nears.

BankNifty saw a 1.33% drop in futures, a 38% nose-dive in open interest, and bearish option activity, with heavy call writing at 57,000 and weaker put defense only at 54,000–55,000; sellers remain dominant here. FINNIFTY and MIDCPNIFTY both posted similar sharp declines in price and OI, with option chains skewed toward calls and max pain indicating limited upside until settlement. SENSEX, however, was a shade different, posting heavy OI build and volume spike, pointing to aggressive fresh shorting as traders hedge positions for September contracts and prepare for a potentially volatile new series.

NSE & BSE F&O Market Signals

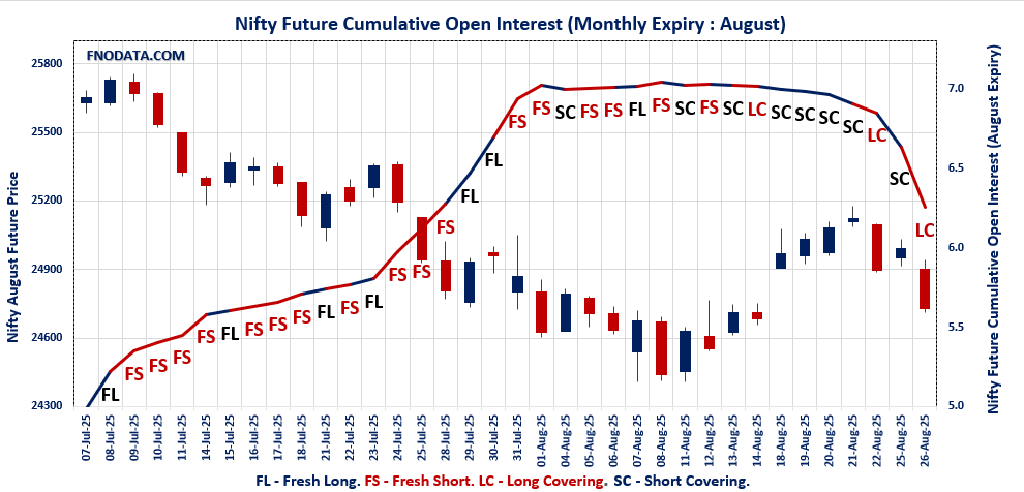

NIFTY AUGUST Future

NIFTY Spot closed at: 24,712.05 (-1.02%)

NIFTY AUGUST Future closed at: 24,731.50 (-1.03%)

Premium: 19.45 (Decreased by -2.5 points)

Open Interest Change: -37.3%

Volume Change: 13.2%

Open Interest Analysis: Long Covering

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.567 (Decreased from 0.773)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24800

Highest PUT Addition: 24600

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 54,450.45 (-1.25%)

BANKNIFTY AUGUST Future closed at: 54,525.60 (-1.33%)

Premium: 75.15 (Decreased by -44.35 points)

Open Interest Change: -38.3%

Volume Change: 119.8%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.415 (Decreased from 0.494)

Put-Call Ratio (Volume): 0.715

Max Pain Level: 55500

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55000

Highest PUT Addition: 52500

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 25,952.60 (-1.35%)

FINNIFTY AUGUST Future closed at: 25,989.90 (-1.42%)

Premium: 37.3 (Decreased by -20.6 points)

Open Interest Change: -57.1%

Volume Change: 235.4%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.674 (Decreased from 0.756)

Put-Call Ratio (Volume): 0.913

Max Pain Level: 26400

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 26000

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,671.75 (-2.17%)

MIDCPNIFTY AUGUST Future closed at: 12,696.10 (-2.11%)

Premium: 24.35 (Increased by 8.5 points)

Open Interest Change: -40.0%

Volume Change: 19.7%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.618 (Decreased from 1.005)

Put-Call Ratio (Volume): 0.886

Max Pain Level: 12950

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12700

Highest CALL Addition: 12800

Highest PUT Addition: 12700

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 80,786.54 (-1.04%)

SENSEX Monthly Future closed at: 81,372.70 (-0.97%)

Premium: 586.16 (Increased by 54.72 points)

Open Interest Change: 237.2%

Volume Change: 248.9%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (4/09/2025) Option Analysis

Put-Call Ratio (OI): 0.766 (Decreased from 0.898)

Put-Call Ratio (Volume): 0.904

Max Pain Level: 81000

Maximum CALL OI: 81000

Maximum PUT OI: 81000

Highest CALL Addition: 81000

Highest PUT Addition: 81000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 6,516.49 Cr

DIIs Net BUY: ₹ 7,060.37 Cr

FII Derivatives Activity

| FII Trading Stats | 26.08.25 | 25.08.25 | 22.08.25 |

| FII Cash (Provisional Data) | -6,516.49 | -2,466.24 | -1,622.52 |

| Index Future Open Interest Long Ratio | 14.32% | 13.42% | 10.70% |

| Index Future Volume Long Ratio | 48.00% | 50.47% | 46.25% |

| Call Option Open Interest Long Ratio | 47.33% | 47.21% | 46.38% |

| Call Option Volume Long Ratio | 49.96% | 50.14% | 49.35% |

| Put Option Open Interest Long Ratio | 66.34% | 65.62% | 69.35% |

| Put Option Volume Long Ratio | 50.20% | 49.61% | 50.48% |

| Stock Future Open Interest Long Ratio | 62.03% | 61.93% | 61.85% |

| Stock Future Volume Long Ratio | 49.95% | 50.17% | 49.63% |

| Index Futures | Fresh Short | Fresh Long | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Long |

| BankNifty Futures | Long Covering | Short Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Short | Long Covering |

| FinNifty Options | Fresh Long | Fresh Long | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Short | Long Covering | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Short |

| Stock Futures | Short Covering | Fresh Long | Long Covering |

| Stock Options | Long Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (4/09/2025)

The SENSEX index closed at 80786.54. The SENSEX weekly expiry for SEPTEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.766 against previous 0.898. The 81000CE option holds the maximum open interest, followed by the 81000PE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 81000PE and 82500CE options. On the other hand, open interest reductions were prominent in the 81600PE, 81700PE, and 81800PE options. Trading volume was highest in the 81000PE option, followed by the 81000CE and 81500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80786.54 | 0.766 | 0.898 | 0.904 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 27,76,880 | 9,74,160 | 18,02,720 |

| PUT: | 21,27,240 | 8,75,180 | 12,52,060 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,67,200 | 3,49,780 | 14,56,320 |

| 82000 | 1,98,740 | 1,04,660 | 7,50,060 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,67,200 | 3,49,780 | 14,56,320 |

| 82500 | 1,87,320 | 1,26,120 | 6,87,420 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 1,24,820 | -1,320 | 7,19,900 |

| 78200 | 40 | -20 | 40 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,67,200 | 3,49,780 | 14,56,320 |

| 81500 | 1,91,440 | 1,18,740 | 9,24,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,06,640 | 2,57,600 | 18,40,380 |

| 77000 | 1,37,800 | 1,12,940 | 2,88,220 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,06,640 | 2,57,600 | 18,40,380 |

| 77000 | 1,37,800 | 1,12,940 | 2,88,220 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81600 | 10,080 | -13,260 | 63,640 |

| 81700 | 11,120 | -8,340 | 45,900 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,06,640 | 2,57,600 | 18,40,380 |

| 80000 | 1,28,240 | 74,360 | 6,20,180 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24712.05. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.567 against previous 0.773. The 25000CE option holds the maximum open interest, followed by the 25200CE and 24800CE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 24900CE and 24750CE options. On the other hand, open interest reductions were prominent in the 25000PE, 24900PE, and 26000CE options. Trading volume was highest in the 24800PE option, followed by the 24800CE and 24700PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,712.05 | 0.567 | 0.773 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,08,88,150 | 17,34,43,950 | 74,44,200 |

| PUT: | 10,26,19,650 | 13,40,57,400 | -3,14,37,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,62,83,100 | 15,67,200 | 25,28,737 |

| 25,200 | 1,14,57,150 | 11,08,650 | 12,80,770 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,12,46,175 | 96,47,400 | 48,99,642 |

| 24,900 | 1,00,81,800 | 57,99,075 | 29,18,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 98,42,475 | -44,71,500 | 7,01,395 |

| 25,400 | 44,53,350 | -37,85,325 | 9,99,693 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,12,46,175 | 96,47,400 | 48,99,642 |

| 24,900 | 1,00,81,800 | 57,99,075 | 29,18,000 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 94,66,200 | -6,67,275 | 9,11,387 |

| 24,500 | 78,39,000 | 53,550 | 14,63,878 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 67,48,800 | 14,74,125 | 20,59,128 |

| 23,850 | 11,81,850 | 8,88,450 | 2,49,130 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 31,69,575 | -77,90,250 | 9,51,296 |

| 24,900 | 23,34,000 | -66,87,300 | 24,55,831 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 41,64,825 | -31,27,050 | 57,98,966 |

| 24,700 | 58,60,050 | 8,84,550 | 36,70,205 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 54450.45. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.415 against previous 0.494. The 57000CE option holds the maximum open interest, followed by the 56000CE and 55500CE options. Market participants have shown increased interest with significant open interest additions in the 55000CE option, with open interest additions also seen in the 54500CE and 54600CE options. On the other hand, open interest reductions were prominent in the 55000PE, 57500CE, and 55500PE options. Trading volume was highest in the 54500PE option, followed by the 55000CE and 54600PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,450.45 | 0.415 | 0.494 | 0.715 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,09,27,645 | 3,12,42,960 | -3,15,315 |

| PUT: | 1,28,49,270 | 1,54,21,980 | -25,72,710 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 24,06,005 | -3,19,130 | 3,10,464 |

| 56,000 | 23,21,725 | -3,00,335 | 3,44,289 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 15,82,455 | 9,71,355 | 4,89,085 |

| 54,500 | 7,90,160 | 7,22,190 | 3,48,330 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 10,90,355 | -4,78,450 | 1,68,285 |

| 60,000 | 8,81,195 | -3,42,335 | 74,332 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 15,82,455 | 9,71,355 | 4,89,085 |

| 55,500 | 21,25,795 | -70,525 | 3,82,388 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 9,17,280 | -1,16,795 | 4,03,188 |

| 53,000 | 7,98,630 | -24,045 | 1,16,827 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 3,97,215 | 1,26,980 | 62,955 |

| 54,400 | 3,06,950 | 1,12,315 | 2,74,957 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 5,85,725 | -7,04,480 | 2,64,629 |

| 55,500 | 4,62,630 | -4,56,645 | 50,939 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 7,18,340 | 97,650 | 6,69,501 |

| 54,600 | 2,73,560 | 1,04,685 | 4,66,466 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 25952.6. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.674 against previous 0.756. The 26500CE option holds the maximum open interest, followed by the 26700CE and 26400CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26100CE and 26000PE options. On the other hand, open interest reductions were prominent in the 27000CE, 25700PE, and 23500PE options. Trading volume was highest in the 26000PE option, followed by the 26200CE and 26100CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,952.60 | 0.674 | 0.756 | 0.913 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 24,54,205 | 24,05,975 | 48,230 |

| PUT: | 16,54,185 | 18,18,505 | -1,64,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 3,05,110 | 16,705 | 18,382 |

| 26,700 | 2,25,095 | -20,735 | 17,215 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,32,795 | 1,24,215 | 17,394 |

| 26,100 | 1,17,585 | 1,00,685 | 22,116 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,40,335 | -91,130 | 9,955 |

| 27,300 | 73,255 | -63,635 | 7,732 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 88,140 | 64,285 | 22,973 |

| 26,100 | 1,17,585 | 1,00,685 | 22,116 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,92,660 | 76,180 | 48,833 |

| 26,500 | 1,54,115 | 5,135 | 1,150 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,92,660 | 76,180 | 48,833 |

| 25,900 | 77,285 | 48,945 | 19,527 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 37,310 | -78,715 | 8,839 |

| 23,500 | 25,740 | -72,475 | 2,428 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,92,660 | 76,180 | 48,833 |

| 26,100 | 57,005 | 13,455 | 21,721 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12671.75. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.618 against previous 1.005. The 13000CE option holds the maximum open interest, followed by the 12800CE and 12700PE options. Market participants have shown increased interest with significant open interest additions in the 12800CE option, with open interest additions also seen in the 12750CE and 12700CE options. On the other hand, open interest reductions were prominent in the 70000CE, 67600PE, and 68000PE options. Trading volume was highest in the 12800CE option, followed by the 12700PE and 12800PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,671.75 | 0.618 | 1.005 | 0.886 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,39,63,040 | 1,01,22,840 | 38,40,200 |

| PUT: | 86,31,140 | 1,01,69,600 | -15,38,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 16,86,020 | 5,50,760 | 74,588 |

| 12,800 | 16,05,520 | 14,60,620 | 1,02,608 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 16,05,520 | 14,60,620 | 1,02,608 |

| 12,750 | 7,75,320 | 7,41,580 | 47,202 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,22,940 | -3,56,720 | 34,044 |

| 13,300 | 5,05,960 | -1,92,360 | 20,313 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 16,05,520 | 14,60,620 | 1,02,608 |

| 12,900 | 8,66,460 | 5,57,060 | 82,857 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 10,15,560 | 5,99,340 | 99,486 |

| 12,600 | 8,62,680 | 2,64,600 | 52,561 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 10,15,560 | 5,99,340 | 99,486 |

| 12,600 | 8,62,680 | 2,64,600 | 52,561 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 2,04,400 | -6,52,680 | 38,484 |

| 13,000 | 3,56,300 | -4,35,820 | 14,071 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 10,15,560 | 5,99,340 | 99,486 |

| 12,800 | 4,91,680 | -3,68,340 | 93,849 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis makes it clear that traders are unwinding previously built positions and choosing caution as expiry approaches. With Nifty’s max pain steady at 25,000 and OI falling sharply, expect low-volume, range-bound action and whipsaws near the expiry pivot; iron condors or neutral spreads around 24,600–25,000 should work best for limited risk. BankNifty, FINNIFTY, and MIDCPNIFTY are all in risk-off mode, so defensive trades or short-biased credits are preferred until new OI trends and price signals surface after rollover.

For those wanting to position for September, watch for SENSEX’s open interest trends—they often lead market sentiment into the new series. Keep risk tight, avoid aggressive trades, and let the Open Interest Volume Analysis steer your actions through expiry, ensuring capital is protected and set for opportunities post-settlement.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]