Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 28/08/2025

Table of Contents

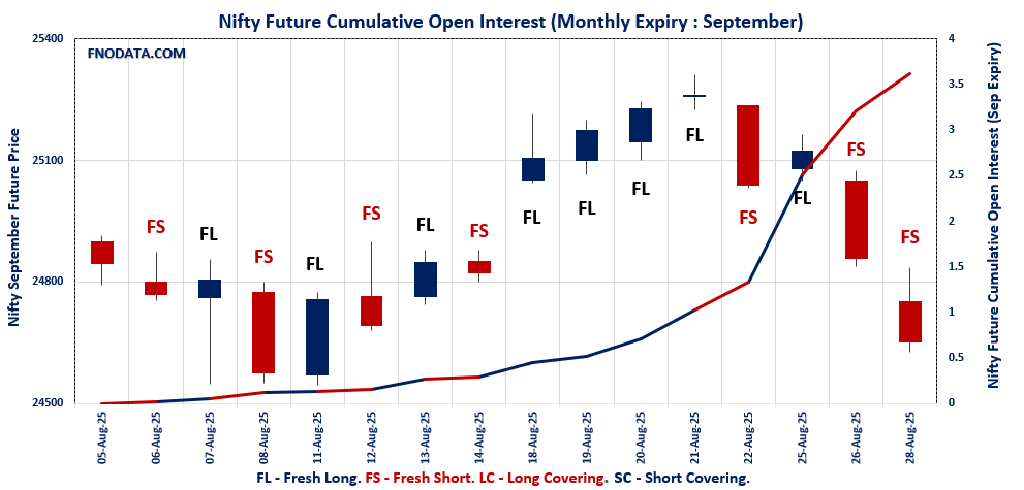

The Open Interest Volume Analysis for 28th August 2025 spotlights a wave of fresh caution as the September series kicks off with aggressive shorting across all major indices. Nifty September futures closed at 24,651.70, down 0.83%, big premium of 150 points and a dramatic 40.5% surge in open interest—clear evidence that traders are initiating fresh short positions rather than exiting old ones. This defensive stance is reinforced by options data: a low weekly Put-Call Ratio (OI) of 0.64 with heavy call writing at 25,000 and strong put writing at 24,000 setups a tight expiry range where rallies are likely to face selling pressure. Monthly options point to a slight bullish lean with PCR at 1.19, but both calls and puts concentrate near 25,000, keeping the expiry anchor and resistance at the same spot.

BankNifty September futures reflected even deeper selling, dropping 1.04% as open interest shot up by over 75%, while the premium ballooned to 439 points. Put-Call Ratio remains subdued at 0.93, with bears pressuring the index near the 54,000–57,000 band. FINNIFTY and MIDCPNIFTY both posted similar stories: prices declined, premiums expanded, and OI rose substantially, all reflecting traders’ conviction in shorting the fresh contracts. SENSEX held the same pattern as all major segments—prices down, open interest up, and weak PCR, confirming broad-based derisking and hedging.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,500.90 (-0.85%)

NIFTY SEPTEMBER Future closed at: 24,651.70 (-0.83%)

Premium: 150.8 (Increased by 5.35 points)

Open Interest Change: 40.5%

Volume Change: 14.3%

Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (2/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.644 (Decreased from 0.693)

Put-Call Ratio (Volume): 0.814

Max Pain Level: 24600

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24000

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.195 (Decreased from 1.283)

Put-Call Ratio (Volume): 0.886

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 24700

Highest PUT Addition: 24700

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 53,820.35 (-1.16%)

BANKNIFTY SEPTEMBER Future closed at: 54,259.40 (-1.04%)

Premium: 439.05 (Increased by 62.5 points)

Open Interest Change: 75.6%

Volume Change: 49.9%

Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.930 (Increased from 0.872)

Put-Call Ratio (Volume): 0.834

Max Pain Level: 55000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 54000

Highest PUT Addition: 57000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,640.30 (-1.20%)

FINNIFTY SEPTEMBER Future closed at: 25,855.10 (-1.03%)

Premium: 214.8 (Increased by 43.7 points)

Open Interest Change: 48.2%

Volume Change: 9.5%

Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.541 (Increased from 0.233)

Put-Call Ratio (Volume): 0.427

Max Pain Level: 26000

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 26000

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,535.15 (-1.08%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,593.95 (-1.00%)

Premium: 58.8 (Increased by 9.9 points)

Open Interest Change: 27.2%

Volume Change: -1.6%

Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.508 (Decreased from 1.595)

Put-Call Ratio (Volume): 1.010

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 12000

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 80,080.57 (-0.87%)

SENSEX Monthly Future closed at: 80,660.30 (-0.88%)

Premium: 579.73 (Decreased by -6.43 points)

Open Interest Change: 30.8%

Volume Change: -4.4%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (4/09/2025) Option Analysis

Put-Call Ratio (OI): 0.636 (Decreased from 0.766)

Put-Call Ratio (Volume): 1.005

Max Pain Level: 80500

Maximum CALL OI: 81000

Maximum PUT OI: 81000

Highest CALL Addition: 83000

Highest PUT Addition: 76000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,856.51 Cr

DIIs Net BUY: ₹ 6,920.34 Cr

FII Derivatives Activity

| FII Trading Stats | 28.08.25 | 26.08.25 | 25.08.25 |

| FII Cash (Provisional Data) | -3,856.51 | -6,516.49 | -2,466.24 |

| Index Future Open Interest Long Ratio | 8.24% | 14.32% | 13.42% |

| Index Future Volume Long Ratio | 45.11% | 48.00% | 50.47% |

| Call Option Open Interest Long Ratio | 45.81% | 47.33% | 47.21% |

| Call Option Volume Long Ratio | 49.94% | 49.96% | 50.14% |

| Put Option Open Interest Long Ratio | 75.15% | 66.34% | 65.62% |

| Put Option Volume Long Ratio | 50.01% | 50.20% | 49.61% |

| Stock Future Open Interest Long Ratio | 62.27% | 62.03% | 61.93% |

| Stock Future Volume Long Ratio | 49.21% | 49.95% | 50.17% |

| Index Futures | Long Covering | Fresh Short | Fresh Long |

| Index Options | Long Covering | Fresh Long | Fresh Short |

| Nifty Futures | Long Covering | Fresh Short | Fresh Short |

| Nifty Options | Short Covering | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Long Covering | Short Covering |

| BankNifty Options | Long Covering | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Short | Long Covering | Fresh Short |

| FinNifty Options | Long Covering | Fresh Long | Fresh Long |

| MidcpNifty Futures | Long Covering | Fresh Short | Fresh Short |

| MidcpNifty Options | Short Covering | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Long Covering | Fresh Short | Long Covering |

| NiftyNxt50 Options | Long Covering | Fresh Short | Fresh Short |

| Stock Futures | Long Covering | Short Covering | Fresh Long |

| Stock Options | Long Covering | Long Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (2/09/2025)

The NIFTY index closed at 24500.9. The NIFTY weekly expiry for SEPTEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.644 against previous 0.693. The 25000CE option holds the maximum open interest, followed by the 24800CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24800CE and 25500CE options. On the other hand, open interest reductions were prominent in the 24800PE, 24850PE, and 25000PE options. Trading volume was highest in the 24500PE option, followed by the 24600PE and 24600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,500.90 | 0.644 | 0.693 | 0.814 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,92,26,350 | 4,09,24,575 | 5,83,01,775 |

| PUT: | 6,38,88,375 | 2,83,63,200 | 3,55,25,175 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 96,04,725 | 55,75,500 | 5,66,374 |

| 24,800 | 77,44,800 | 50,27,700 | 6,24,313 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 96,04,725 | 55,75,500 | 5,66,374 |

| 24,800 | 77,44,800 | 50,27,700 | 6,24,313 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 2,60,175 | -1,90,275 | 17,778 |

| 26,500 | 20,71,275 | -52,875 | 89,109 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 44,10,450 | 40,90,425 | 6,49,169 |

| 24,800 | 77,44,800 | 50,27,700 | 6,24,313 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 59,03,250 | 35,73,600 | 3,40,515 |

| 24,500 | 48,91,875 | 32,34,825 | 7,82,649 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 59,03,250 | 35,73,600 | 3,40,515 |

| 24,500 | 48,91,875 | 32,34,825 | 7,82,649 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 16,51,950 | -5,67,675 | 1,46,157 |

| 24,850 | 1,68,975 | -4,64,925 | 27,468 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 48,91,875 | 32,34,825 | 7,82,649 |

| 24,600 | 23,59,500 | 11,74,125 | 6,72,939 |

SENSEX Weekly Expiry (4/09/2025)

The SENSEX index closed at 80080.57. The SENSEX weekly expiry for SEPTEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.636 against previous 0.766. The 81000CE option holds the maximum open interest, followed by the 83000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 83000CE option, with open interest additions also seen in the 80500CE and 84000CE options. On the other hand, open interest reductions were prominent in the 80800PE, 80900PE, and 81100PE options. Trading volume was highest in the 80500CE option, followed by the 80000PE and 80200PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80080.57 | 0.636 | 0.766 | 1.005 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 79,69,540 | 27,76,880 | 51,92,660 |

| PUT: | 50,69,820 | 21,27,240 | 29,42,580 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 6,10,020 | 2,42,820 | 66,89,600 |

| 83000 | 5,70,840 | 4,16,920 | 43,22,720 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 5,70,840 | 4,16,920 | 43,22,720 |

| 80500 | 3,56,300 | 3,10,100 | 89,86,840 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 780 | -580 | 780 |

| 77500 | 1,760 | -120 | 280 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 3,56,300 | 3,10,100 | 89,86,840 |

| 81000 | 6,10,020 | 2,42,820 | 66,89,600 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,05,400 | -1,240 | 20,16,220 |

| 79000 | 2,80,820 | 1,63,920 | 33,69,480 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 2,35,880 | 1,74,440 | 20,56,820 |

| 79000 | 2,80,820 | 1,63,920 | 33,69,480 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 31,720 | -38,560 | 13,71,460 |

| 80900 | 28,300 | -20,600 | 6,41,000 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 2,60,720 | 1,32,480 | 89,59,600 |

| 80200 | 1,58,280 | 1,28,000 | 84,25,560 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24500.9. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.195 against previous 1.283. The 25000CE option holds the maximum open interest, followed by the 25000PE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 24700CE option, with open interest additions also seen in the 24500CE and 25500CE options. On the other hand, open interest reductions were prominent in the 25300PE, 26300CE, and 26700CE options. Trading volume was highest in the 24500PE option, followed by the 25000CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,500.90 | 1.195 | 1.283 | 0.886 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,74,01,975 | 3,04,87,425 | 69,14,550 |

| PUT: | 4,47,02,625 | 3,91,02,150 | 56,00,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 51,89,475 | 7,21,125 | 71,633 |

| 26,000 | 41,27,475 | 3,63,825 | 54,220 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 13,25,175 | 9,90,975 | 40,838 |

| 24,500 | 16,24,125 | 8,02,950 | 41,242 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 3,04,425 | -71,625 | 4,938 |

| 26,700 | 1,49,925 | -60,600 | 2,663 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 51,89,475 | 7,21,125 | 71,633 |

| 25,500 | 29,55,375 | 7,96,425 | 65,394 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,09,650 | 1,88,625 | 37,237 |

| 24,000 | 45,86,475 | 3,39,525 | 69,605 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 13,34,625 | 5,65,650 | 40,566 |

| 25,500 | 13,14,600 | 5,63,100 | 17,431 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 2,87,925 | -72,300 | 3,255 |

| 25,200 | 5,23,050 | -26,175 | 4,463 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 40,83,525 | 4,43,175 | 77,470 |

| 24,000 | 45,86,475 | 3,39,525 | 69,605 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 53820.35. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.930 against previous 0.872. The 57000CE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 54000CE option, with open interest additions also seen in the 57000PE and 54000PE options. On the other hand, open interest reductions were prominent in the 63000CE, 62000PE, and 48500PE options. Trading volume was highest in the 54000PE option, followed by the 55000CE and 54000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 53,820.35 | 0.930 | 0.872 | 0.834 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,00,45,230 | 67,62,510 | 32,82,720 |

| PUT: | 93,46,920 | 58,93,845 | 34,53,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 16,42,395 | 2,15,880 | 47,497 |

| 56,000 | 10,23,225 | 2,84,515 | 53,277 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 6,82,065 | 5,59,275 | 60,052 |

| 54,500 | 4,77,470 | 3,36,385 | 45,676 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 74,480 | -4,340 | 1,404 |

| 59,200 | 1,960 | -385 | 233 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 7,88,865 | 3,25,675 | 60,382 |

| 54,000 | 6,82,065 | 5,59,275 | 60,052 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,03,690 | 4,80,970 | 16,553 |

| 54,000 | 9,77,085 | 4,41,375 | 87,284 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,03,690 | 4,80,970 | 16,553 |

| 54,000 | 9,77,085 | 4,41,375 | 87,284 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 18,095 | -2,135 | 211 |

| 48,500 | 21,700 | -2,065 | 2,348 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 9,77,085 | 4,41,375 | 87,284 |

| 54,500 | 5,34,030 | 1,76,155 | 39,276 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25640.3. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.541 against previous 0.233. The 26500CE option holds the maximum open interest, followed by the 26000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26000CE and 26500CE options. On the other hand, open interest reductions were prominent in the 28700PE, 28700PE, and 28700PE options. Trading volume was highest in the 26500CE option, followed by the 26000CE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,640.30 | 0.541 | 0.233 | 0.427 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 52,780 | 13,390 | 39,390 |

| PUT: | 28,535 | 3,120 | 25,415 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 20,345 | 11,440 | 695 |

| 26,000 | 16,575 | 13,325 | 490 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 16,575 | 13,325 | 490 |

| 26,500 | 20,345 | 11,440 | 695 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 20,345 | 11,440 | 695 |

| 26,000 | 16,575 | 13,325 | 490 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 14,755 | 14,755 | 309 |

| 25,000 | 7,215 | 5,005 | 185 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 14,755 | 14,755 | 309 |

| 25,000 | 7,215 | 5,005 | 185 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 14,755 | 14,755 | 309 |

| 25,000 | 7,215 | 5,005 | 185 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12535.15. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.508 against previous 1.595. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12000PE option, with open interest additions also seen in the 12500PE and 13000CE options. On the other hand, open interest reductions were prominent in the 66800PE, 66800PE, and 66800CE options. Trading volume was highest in the 13000CE option, followed by the 12500PE and 12000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,535.15 | 1.508 | 1.595 | 1.010 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,12,800 | 9,45,140 | 6,67,660 |

| PUT: | 24,31,940 | 15,07,100 | 9,24,840 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,21,400 | 1,53,300 | 7,589 |

| 14,000 | 2,47,100 | 14,280 | 1,806 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,21,400 | 1,53,300 | 7,589 |

| 12,600 | 1,08,500 | 1,07,240 | 2,064 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 32,480 | -4,060 | 209 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,21,400 | 1,53,300 | 7,589 |

| 13,500 | 2,31,980 | 65,100 | 2,576 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,37,380 | 2,19,800 | 4,359 |

| 12,500 | 4,69,140 | 1,93,060 | 5,562 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,37,380 | 2,19,800 | 4,359 |

| 12,500 | 4,69,140 | 1,93,060 | 5,562 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 1,39,720 | -18,620 | 1,289 |

| 12,800 | 56,280 | -6,860 | 568 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 4,69,140 | 1,93,060 | 5,562 |

| 12,000 | 7,37,380 | 2,19,800 | 4,359 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Open Interest Volume Analysis signals a market driven by fresh shorts and hedged caution as September begins. Nifty’s heavy resistance at 25,000 means any rally may quickly run into supply, while downside moves toward 24,000 could invite brisk covering if volumes spike. For tactical trades, favor bear call spreads above resistance or straddles/condors in the 24,500–25,000 band, with tight stops in case of volatility spikes. In BankNifty, trend-following shorts and hedged strategies remain prudent as sellers have the upper hand.

Watch for volume and open interest surges in FINNIFTY and MIDCPNIFTY, as these indices could lead the next directional move when signs of capitulation or short covering jump in. Across the board, keeping risk light and trades nimble remains the smart approach for now, letting the Open Interest Volume Analysis guide decisions and keep portfolios agile as the new series develops.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]