Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 29/08/2025

Table of Contents

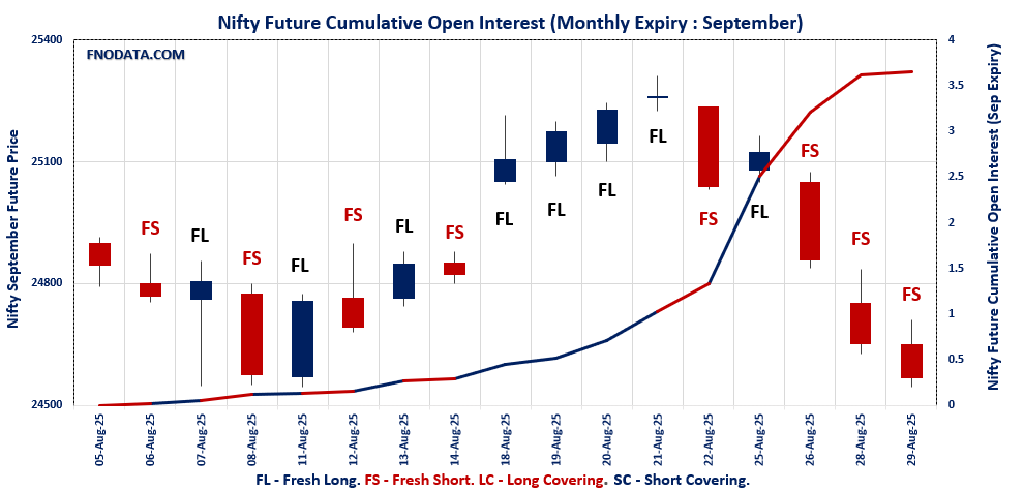

The Open Interest Volume Analysis for 29th August 2025 points to ongoing caution, with traders showing little appetite for a turnaround after the sharp selloff that marked the series’ start. Nifty September futures closed at 24,568.50, down 0.34% as fresh shorts piled in—evidenced by a 3.6% rise in open interest—even as both the premium and trading volume declined. The options landscape reinforces this defensive tone: the weekly Put-Call Ratio (OI) has dropped further to just 0.54, and aggressive call writing is concentrated at 24,500 and 25,000 strikes, both of which now act as resistance barricades. Monthly option trends echo this, with the PCR dipping and max pain parked at 24,900, suggesting an expiry gravitating toward this level and rallies finding a ceiling near 25,000.

BankNifty followed suit, with September futures slipping 0.37%, premium softening, and a 2.2% open interest rise showing ongoing bearish bets. Major call open interest at 55,000–57,000 reinforces the cautious mood, even as put writers defend 54,000 and 52,500 levels. In FINNIFTY, a round of long covering accompanied price decline, but PCR moved higher—hinting that short positions are locking profits and volatility could increase near 25,800. MIDCPNIFTY futures also posted fresh shorts, with monthly PCR easing to 1.19 and max pain shifting down to 12,600. SENSEX showed more of the same, with declining premium and rising open interest confirming traders are not ready to chase upside ahead of September’s expiry cycle.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,426.85 (-0.30%)

NIFTY SEPTEMBER Future closed at: 24,568.50 (-0.34%)

Premium: 141.65 (Decreased by -9.15 points)

Open Interest Change: 3.6%

Volume Change: -43.0%

Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (2/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.541 (Decreased from 0.644)

Put-Call Ratio (Volume): 1.040

Max Pain Level: 24500

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 23500

Highest CALL Addition: 24500

Highest PUT Addition: 23500

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.171 (Decreased from 1.195)

Put-Call Ratio (Volume): 0.872

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24500

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 53,655.65 (-0.31%)

BANKNIFTY SEPTEMBER Future closed at: 54,060.40 (-0.37%)

Premium: 404.75 (Decreased by -34.3 points)

Open Interest Change: 2.2%

Volume Change: -55.9%

Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.859 (Decreased from 0.930)

Put-Call Ratio (Volume): 0.909

Max Pain Level: 55000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55000

Highest PUT Addition: 52500

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,567.70 (-0.28%)

FINNIFTY SEPTEMBER Future closed at: 25,768.30 (-0.34%)

Premium: 200.6 (Decreased by -14.2 points)

Open Interest Change: -2.2%

Volume Change: -72.5%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.128 (Increased from 0.541)

Put-Call Ratio (Volume): 1.053

Max Pain Level: 25800

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 25000

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,450.20 (-0.68%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,515.70 (-0.62%)

Premium: 65.5 (Increased by 6.7 points)

Open Interest Change: 2.4%

Volume Change: -54.0%

Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.191 (Decreased from 1.508)

Put-Call Ratio (Volume): 0.998

Max Pain Level: 12600

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 11800

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 79,809.65 (-0.34%)

SENSEX Monthly Future closed at: 80,384.65 (-0.34%)

Premium: 575 (Decreased by -4.73 points)

Open Interest Change: 4.5%

Volume Change: -13.0%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (4/09/2025) Option Analysis

Put-Call Ratio (OI): 0.539 (Decreased from 0.636)

Put-Call Ratio (Volume): 1.075

Max Pain Level: 80200

Maximum CALL OI: 81000

Maximum PUT OI: 79000

Highest CALL Addition: 81000

Highest PUT Addition: 72400

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 8,312.66 Cr

DIIs Net BUY: ₹ 11,487.64 Cr

FII Derivatives Activity

| FII Trading Stats | 29.08.25 | 28.08.25 | 26.08.25 |

| FII Cash (Provisional Data) | -8,312.66 | -3,856.51 | -6,516.49 |

| Index Future Open Interest Long Ratio | 8.60% | 8.24% | 14.32% |

| Index Future Volume Long Ratio | 41.33% | 45.11% | 48.00% |

| Call Option Open Interest Long Ratio | 45.86% | 45.81% | 47.33% |

| Call Option Volume Long Ratio | 49.75% | 49.94% | 49.96% |

| Put Option Open Interest Long Ratio | 67.80% | 75.15% | 66.34% |

| Put Option Volume Long Ratio | 49.92% | 50.01% | 50.20% |

| Stock Future Open Interest Long Ratio | 62.44% | 62.27% | 62.03% |

| Stock Future Volume Long Ratio | 52.36% | 49.21% | 49.95% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Short | Long Covering | Fresh Long |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Short | Short Covering | Fresh Long |

| BankNifty Futures | Long Covering | Long Covering | Long Covering |

| BankNifty Options | Fresh Long | Long Covering | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Short | Long Covering |

| FinNifty Options | Fresh Short | Long Covering | Fresh Long |

| MidcpNifty Futures | Fresh Long | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Long Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Long Covering | Fresh Short |

| Stock Futures | Fresh Long | Long Covering | Short Covering |

| Stock Options | Fresh Long | Long Covering | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (2/09/2025)

The NIFTY index closed at 24426.85. The NIFTY weekly expiry for SEPTEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.541 against previous 0.644. The 25000CE option holds the maximum open interest, followed by the 24600CE and 24500CE options. Market participants have shown increased interest with significant open interest additions in the 24500CE option, with open interest additions also seen in the 24600CE and 25000CE options. On the other hand, open interest reductions were prominent in the 24800PE, 25000PE, and 24650PE options. Trading volume was highest in the 24500PE option, followed by the 24600CE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,426.85 | 0.541 | 0.644 | 1.040 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,30,97,850 | 9,92,26,350 | 9,38,71,500 |

| PUT: | 10,43,94,525 | 6,38,88,375 | 4,05,06,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,65,61,800 | 69,57,075 | 16,47,199 |

| 24,600 | 1,24,82,175 | 80,71,725 | 57,47,582 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,23,94,950 | 93,32,775 | 56,88,345 |

| 24,600 | 1,24,82,175 | 80,71,725 | 57,47,582 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 2,30,250 | -29,925 | 22,958 |

| 26,050 | 3,80,325 | -2,550 | 48,091 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 1,24,82,175 | 80,71,725 | 57,47,582 |

| 24,500 | 1,23,94,950 | 93,32,775 | 56,88,345 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,03,30,650 | 61,92,900 | 7,20,771 |

| 24,000 | 77,86,200 | 18,82,950 | 12,77,755 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,03,30,650 | 61,92,900 | 7,20,771 |

| 24,400 | 77,38,575 | 49,22,625 | 48,37,133 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 11,51,925 | -5,00,025 | 2,16,378 |

| 25,000 | 12,74,550 | -4,48,650 | 38,080 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 54,94,800 | 6,02,925 | 89,28,752 |

| 24,400 | 77,38,575 | 49,22,625 | 48,37,133 |

SENSEX Weekly Expiry (4/09/2025)

The SENSEX index closed at 79809.65. The SENSEX weekly expiry for SEPTEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.539 against previous 0.636. The 81000CE option holds the maximum open interest, followed by the 83000CE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 80000CE and 82000CE options. On the other hand, open interest reductions were prominent in the 83500CE, 76200PE, and 78100PE options. Trading volume was highest in the 80000PE option, followed by the 80200PE and 80100PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 79809.65 | 0.539 | 0.636 | 1.075 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,31,96,460 | 79,69,540 | 52,26,920 |

| PUT: | 71,12,040 | 50,69,820 | 20,42,220 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,59,560 | 3,49,540 | 1,45,52,720 |

| 83000 | 7,06,080 | 1,35,240 | 55,81,200 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,59,560 | 3,49,540 | 1,45,52,720 |

| 80000 | 4,13,480 | 2,74,460 | 1,31,26,040 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 2,39,560 | -39,660 | 34,97,980 |

| 83400 | 52,440 | -29,600 | 6,09,160 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 5,85,520 | 2,29,220 | 1,78,27,920 |

| 80200 | 3,48,500 | 2,24,080 | 1,55,83,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 4,13,360 | 1,32,540 | 1,14,77,240 |

| 80000 | 3,58,040 | 97,320 | 3,10,36,940 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 72400 | 2,76,720 | 1,91,520 | 8,82,480 |

| 79800 | 2,64,380 | 1,89,240 | 1,32,10,640 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76200 | 19,820 | -33,820 | 6,09,280 |

| 78100 | 36,800 | -32,800 | 20,76,860 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,58,040 | 97,320 | 3,10,36,940 |

| 80200 | 1,39,600 | -18,680 | 2,19,92,180 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24426.85. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.171 against previous 1.195. The 25000CE option holds the maximum open interest, followed by the 24000PE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24500CE and 24500PE options. On the other hand, open interest reductions were prominent in the 25000PE, 25900CE, and 26000CE options. Trading volume was highest in the 24500PE option, followed by the 24000PE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,426.85 | 1.171 | 1.195 | 0.872 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,11,68,925 | 3,74,01,975 | 37,66,950 |

| PUT: | 4,82,03,175 | 4,47,02,625 | 35,00,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,68,550 | 5,79,075 | 65,935 |

| 26,000 | 40,33,950 | -93,525 | 46,385 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,68,550 | 5,79,075 | 65,935 |

| 24,500 | 21,53,175 | 5,29,050 | 61,951 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 4,32,750 | -95,250 | 16,831 |

| 26,000 | 40,33,950 | -93,525 | 46,385 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,68,550 | 5,79,075 | 65,935 |

| 24,500 | 21,53,175 | 5,29,050 | 61,951 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 47,96,625 | 2,10,150 | 74,301 |

| 24,500 | 45,88,950 | 5,05,425 | 87,414 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 45,88,950 | 5,05,425 | 87,414 |

| 24,400 | 8,66,850 | 2,70,750 | 24,524 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 43,33,350 | -2,76,300 | 21,617 |

| 25,200 | 4,88,100 | -34,950 | 2,369 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 45,88,950 | 5,05,425 | 87,414 |

| 24,000 | 47,96,625 | 2,10,150 | 74,301 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 53655.65. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.859 against previous 0.930. The 57000CE option holds the maximum open interest, followed by the 56000CE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 55000CE option, with open interest additions also seen in the 57500CE and 54000CE options. On the other hand, open interest reductions were prominent in the 54700PE, 56500PE, and 57500PE options. Trading volume was highest in the 54000PE option, followed by the 54000CE and 55000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 53,655.65 | 0.859 | 0.930 | 0.909 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,28,62,180 | 1,00,45,230 | 28,16,950 |

| PUT: | 1,10,46,185 | 93,46,920 | 16,99,265 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,39,180 | 1,96,785 | 62,214 |

| 56,000 | 12,23,215 | 1,99,990 | 62,724 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 10,56,475 | 2,67,610 | 1,07,745 |

| 57,500 | 6,45,890 | 2,48,605 | 38,552 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,500 | 4,760 | -1,260 | 90 |

| 62,000 | 60,375 | -1,085 | 2,571 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 8,95,315 | 2,13,250 | 1,34,648 |

| 55,000 | 10,56,475 | 2,67,610 | 1,07,745 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,77,855 | 1,00,770 | 1,63,244 |

| 57,000 | 10,29,345 | 25,655 | 2,602 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 5,67,240 | 1,67,530 | 33,094 |

| 52,000 | 5,85,865 | 1,22,955 | 39,050 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,700 | 39,795 | -5,250 | 2,105 |

| 56,500 | 1,20,050 | -5,145 | 586 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,77,855 | 1,00,770 | 1,63,244 |

| 53,900 | 99,680 | 19,110 | 88,521 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25567.7. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.128 against previous 0.541. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25700PE options. Market participants have shown increased interest with significant open interest additions in the 25000PE option, with open interest additions also seen in the 25700PE and 26000CE options. On the other hand, open interest reductions were prominent in the 24800CE, 24800CE, and 24800CE options. Trading volume was highest in the 25700PE option, followed by the 26000CE and 25000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,567.70 | 1.128 | 0.541 | 1.053 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,72,805 | 52,780 | 2,20,025 |

| PUT: | 3,07,840 | 28,535 | 2,79,305 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 58,630 | 42,055 | 4,206 |

| 26,500 | 48,685 | 28,340 | 2,249 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 58,630 | 42,055 | 4,206 |

| 25,700 | 31,525 | 31,265 | 2,480 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 58,630 | 42,055 | 4,206 |

| 25,700 | 31,525 | 31,265 | 2,480 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 76,375 | 69,160 | 2,989 |

| 25,700 | 51,870 | 51,090 | 4,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 76,375 | 69,160 | 2,989 |

| 25,700 | 51,870 | 51,090 | 4,860 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 51,870 | 51,090 | 4,860 |

| 25,000 | 76,375 | 69,160 | 2,989 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12450.2. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.191 against previous 1.508. The 12000PE option holds the maximum open interest, followed by the 13000CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 11800PE and 12200PE options. On the other hand, open interest reductions were prominent in the 68100PE, 68100PE, and 68100PE options. Trading volume was highest in the 12500PE option, followed by the 13000CE and 12000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,450.20 | 1.191 | 1.508 | 0.998 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 31,84,580 | 16,12,800 | 15,71,780 |

| PUT: | 37,93,020 | 24,31,940 | 13,61,080 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,96,360 | 2,74,960 | 19,241 |

| 14,000 | 4,02,780 | 1,55,680 | 5,139 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,96,360 | 2,74,960 | 19,241 |

| 12,600 | 2,90,920 | 1,82,420 | 14,974 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 30,520 | -1,960 | 511 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,96,360 | 2,74,960 | 19,241 |

| 12,600 | 2,90,920 | 1,82,420 | 14,974 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,89,040 | 51,660 | 16,075 |

| 12,500 | 4,79,920 | 10,780 | 25,084 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 2,23,300 | 1,90,540 | 5,377 |

| 12,200 | 1,86,620 | 1,86,620 | 3,199 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,400 | 1,36,220 | -8,540 | 8,241 |

| 12,300 | 2,22,740 | -2,800 | 3,630 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 4,79,920 | 10,780 | 25,084 |

| 12,000 | 7,89,040 | 51,660 | 16,075 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis confirms that defenders are still in control, with fresh shorts and premium narrowing across Nifty, BankNifty, and most broad indices. For the immediate week, expect rallies to face resistance near 24,500–25,000, and range-based strategies (spreads, condors, or cautiously placed bear calls) remain best suited to capture expiry dynamics. Sharp unwinding in FINNIFTY and MIDCPNIFTY calls for nimble profit booking if volatility spikes, while in BankNifty, keep a close eye on open interest—moves below 54,000 could accelerate downward pressure even further. Through September, let the Open Interest Volume Analysis steer trading: stick to risk-managed setups, fade sudden spikes, and remain agile as the bear trend tries to settle the new range.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]