Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/09/2025

Table of Contents

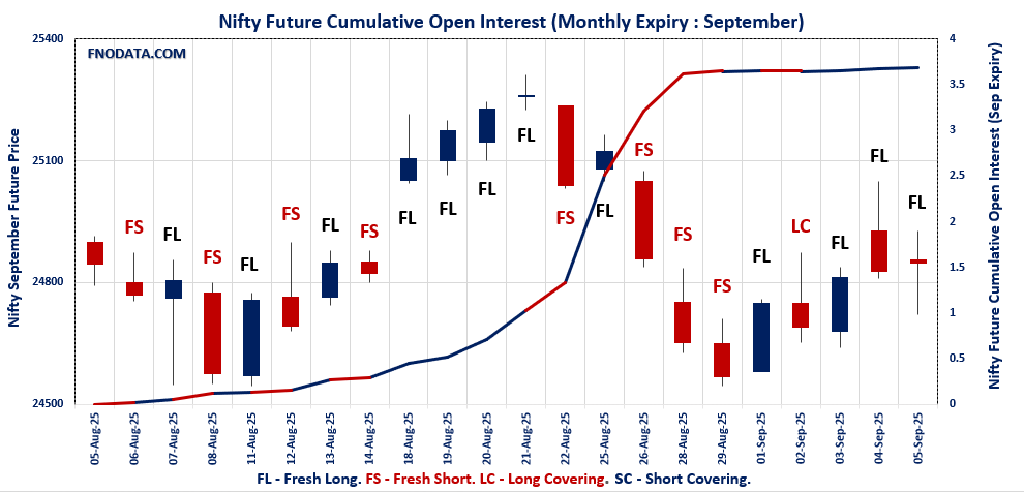

The Nifty Open Interest Volume Analysis for 5th September 2025 highlights a market that’s quietly gaining strength, with bullish undertones returning after a spell of hesitation. Nifty September futures inched up 0.08% to 24,847.70, with a small 0.8% rise in open interest and a premium that expanded by 13.5 points—signs that fresh long positions are entering as conviction grows. The weekly options landscape remains mixed: Put-Call Ratio (OI) is below 1 at 0.76, but incremental put writing and a max pain level at 24,750 anchor support just below current levels. Monthly data looks even more promising for bulls, with PCR over 1 and highest call and put open interest stacked at 25,000 and 24,000—defining the current range and expiry battleground.

BANKNIFTY told a nuanced story: the September future moved up a touch, but short covering dominated, with OI down 1.4% as traders rushed to exit bearish bets. Options data is split between 54,000 puts and persistent call writing at 57,000, setting a well-defined expiry range. FINNIFTY saw similar short covering, posting a mild gain and OI drop, while MIDCPNIFTY outperformed with a 0.4% rise and new longs, confirmed by a fresh 2.3% OI build and a strong PCR of 1.17—evidence that midcaps are on watch for further upside. SENSEX traded flat, but ongoing short covering means any upside could spark quick squeezes, with the max pain zone now near 80,800.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,741.00 (0.03%)

NIFTY SEPTEMBER Future closed at: 24,847.70 (0.08%)

Premium: 106.7 (Increased by 13.5 points)

Open Interest Change: 0.8%

Volume Change: -11.0%

Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (9/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.756 (Increased from 0.732)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 24750

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25100

Highest PUT Addition: 24000

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.089 (Increased from 1.085)

Put-Call Ratio (Volume): 1.016

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25300

Highest PUT Addition: 23000

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,114.55 (0.07%)

BANKNIFTY SEPTEMBER Future closed at: 54,364.60 (0.13%)

Premium: 250.05 (Increased by 32.5 points)

Open Interest Change: -1.4%

Volume Change: -6.2%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.867 (Decreased from 0.872)

Put-Call Ratio (Volume): 0.905

Max Pain Level: 54600

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 56000

Highest PUT Addition: 50000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,889.30 (0.14%)

FINNIFTY SEPTEMBER Future closed at: 26,004.10 (0.26%)

Premium: 114.8 (Increased by 30.7 points)

Open Interest Change: -0.6%

Volume Change: -55.2%

Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.871 (Increased from 0.751)

Put-Call Ratio (Volume): 1.164

Max Pain Level: 25900

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 25500

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,778.15 (0.31%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,820.40 (0.40%)

Premium: 42.25 (Increased by 11.45 points)

Open Interest Change: 2.3%

Volume Change: 10.7%

Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.167 (Increased from 1.048)

Put-Call Ratio (Volume): 0.743

Max Pain Level: 12800

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13100

Highest PUT Addition: 12300

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 80,710.76 (-0.01%)

SENSEX Monthly Future closed at: 81,089.45 (0.02%)

Premium: 378.69 (Increased by 25.8 points)

Open Interest Change: -1.4%

Volume Change: -39.3%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (11/09/2025) Option Analysis

Put-Call Ratio (OI): 0.816 (Increased from 0.719)

Put-Call Ratio (Volume): 1.050

Max Pain Level: 80800

Maximum CALL OI: 81000

Maximum PUT OI: 80000

Highest CALL Addition: 81500

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,304.91 Cr

DIIs Net BUY: ₹ 1,821.23 Cr

FII Derivatives Activity

| FII Trading Stats | 5.09.25 | 4.09.25 | 3.09.25 |

| FII Cash (Provisional Data) | -1,304.91 | -106.34 | -1,666.46 |

| Index Future Open Interest Long Ratio | 7.43% | 8.04% | 8.08% |

| Index Future Volume Long Ratio | 44.05% | 40.30% | 44.84% |

| Call Option Open Interest Long Ratio | 47.92% | 46.64% | 45.63% |

| Call Option Volume Long Ratio | 50.11% | 50.03% | 49.71% |

| Put Option Open Interest Long Ratio | 64.88% | 65.76% | 63.36% |

| Put Option Volume Long Ratio | 50.08% | 50.42% | 49.07% |

| Stock Future Open Interest Long Ratio | 62.38% | 62.40% | 62.71% |

| Stock Future Volume Long Ratio | 49.75% | 47.24% | 47.00% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Long | Long Covering | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Long | Long Covering |

| FinNifty Options | Fresh Short | Short Covering | Fresh Long |

| MidcpNifty Futures | Fresh Short | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Long | Long Covering | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Short | Long Covering | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (9/09/2025)

The NIFTY index closed at 24741. The NIFTY weekly expiry for SEPTEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.756 against previous 0.732. The 25000CE option holds the maximum open interest, followed by the 25500CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 25100CE and 24650PE options. On the other hand, open interest reductions were prominent in the 24900CE, 23700PE, and 23900PE options. Trading volume was highest in the 24800CE option, followed by the 24700PE and 24600PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,741.00 | 0.756 | 0.732 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,16,55,275 | 18,71,85,300 | 1,44,69,975 |

| PUT: | 15,24,75,750 | 13,70,88,975 | 1,53,86,775 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,86,82,875 | 7,74,900 | 45,02,764 |

| 25,500 | 1,45,23,750 | 12,51,075 | 15,97,218 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 96,59,850 | 23,18,100 | 24,23,736 |

| 25,400 | 72,85,725 | 17,18,175 | 9,65,840 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,30,32,900 | -15,06,900 | 52,28,462 |

| 25,700 | 48,72,075 | -8,79,900 | 6,81,408 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,14,42,525 | 14,27,100 | 80,99,985 |

| 24,700 | 60,23,325 | 15,95,850 | 56,81,290 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,31,97,075 | 28,21,200 | 15,73,977 |

| 24,500 | 1,23,85,500 | -2,51,700 | 47,24,180 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,31,97,075 | 28,21,200 | 15,73,977 |

| 24,650 | 52,96,950 | 19,97,250 | 51,07,586 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 28,89,825 | -13,86,075 | 7,05,140 |

| 23,900 | 29,53,200 | -10,20,675 | 11,27,639 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 76,93,800 | 10,39,425 | 75,78,868 |

| 24,600 | 98,47,500 | 12,06,225 | 59,15,467 |

SENSEX Weekly Expiry (11/09/2025)

The SENSEX index closed at 80710.76. The SENSEX weekly expiry for SEPTEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.816 against previous 0.719. The 81000CE option holds the maximum open interest, followed by the 83000CE and 81500CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 81500CE and 83000CE options. On the other hand, open interest reductions were prominent in the 81500PE, 81600PE, and 82500PE options. Trading volume was highest in the 81000CE option, followed by the 80500PE and 80000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 11-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80710.76 | 0.816 | 0.719 | 1.050 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 90,91,000 | 41,19,260 | 49,71,740 |

| PUT: | 74,14,640 | 29,62,080 | 44,52,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 7,62,680 | 2,88,740 | 2,45,33,000 |

| 83000 | 6,56,280 | 3,55,820 | 52,28,120 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 5,97,780 | 3,62,740 | 1,37,26,060 |

| 83000 | 6,56,280 | 3,55,820 | 52,28,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 1,220 | -300 | 960 |

| 77600 | 140 | -180 | 200 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 7,62,680 | 2,88,740 | 2,45,33,000 |

| 81500 | 5,97,780 | 3,62,740 | 1,37,26,060 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,77,740 | 3,63,420 | 1,71,89,820 |

| 80500 | 4,26,380 | 2,94,500 | 2,23,36,460 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,77,740 | 3,63,420 | 1,71,89,820 |

| 80500 | 4,26,380 | 2,94,500 | 2,23,36,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 72,620 | -6,460 | 6,55,540 |

| 81600 | 2,820 | -840 | 91,940 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 4,26,380 | 2,94,500 | 2,23,36,460 |

| 80000 | 5,77,740 | 3,63,420 | 1,71,89,820 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24741. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.089 against previous 1.085. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 23000PE option, with open interest additions also seen in the 25300CE and 24400PE options. On the other hand, open interest reductions were prominent in the 25800CE, 24000PE, and 25000PE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,741.00 | 1.089 | 1.085 | 1.016 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,64,13,300 | 4,67,05,275 | -2,91,975 |

| PUT: | 5,05,37,400 | 5,06,94,525 | -1,57,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,24,025 | -17,850 | 96,445 |

| 26,000 | 43,95,450 | -63,450 | 35,867 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 15,51,975 | 2,02,425 | 28,893 |

| 24,700 | 19,43,700 | 88,875 | 36,768 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 14,48,625 | -4,21,500 | 29,555 |

| 25,700 | 7,95,525 | -67,425 | 18,660 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,24,025 | -17,850 | 96,445 |

| 25,500 | 39,58,875 | -43,950 | 59,382 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 43,73,550 | -3,50,850 | 77,132 |

| 24,500 | 40,80,225 | -1,70,100 | 80,684 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 35,43,225 | 2,02,875 | 16,164 |

| 24,400 | 10,81,500 | 1,24,125 | 22,988 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 43,73,550 | -3,50,850 | 77,132 |

| 25,000 | 40,19,025 | -2,55,900 | 46,049 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 40,80,225 | -1,70,100 | 80,684 |

| 24,000 | 43,73,550 | -3,50,850 | 77,132 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54114.55. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.867 against previous 0.872. The 57000CE option holds the maximum open interest, followed by the 56000CE and 55000CE options. Market participants have shown increased interest with significant open interest additions in the 56000CE option, with open interest additions also seen in the 50000PE and 54000CE options. On the other hand, open interest reductions were prominent in the 57500CE, 51500PE, and 53000PE options. Trading volume was highest in the 54000PE option, followed by the 54000CE and 55000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,114.55 | 0.867 | 0.872 | 0.905 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,56,66,200 | 1,54,65,035 | 2,01,165 |

| PUT: | 1,35,85,065 | 1,34,85,290 | 99,775 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,85,100 | -28,525 | 50,659 |

| 56,000 | 13,74,660 | 84,210 | 73,429 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,74,660 | 84,210 | 73,429 |

| 54,000 | 10,21,955 | 66,345 | 1,58,447 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 6,92,440 | -87,220 | 31,636 |

| 55,500 | 8,81,050 | -39,550 | 51,346 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,21,955 | 66,345 | 1,58,447 |

| 55,000 | 13,40,500 | 64,785 | 1,14,312 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 12,93,770 | 21,425 | 2,00,639 |

| 57,000 | 10,57,590 | 910 | 301 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 6,19,535 | 70,875 | 24,942 |

| 55,000 | 7,54,145 | 58,905 | 15,620 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 3,32,675 | -57,435 | 22,151 |

| 53,000 | 8,35,415 | -39,725 | 70,132 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 12,93,770 | 21,425 | 2,00,639 |

| 53,800 | 1,80,950 | 1,330 | 73,416 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25889.3. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.871 against previous 0.751. The 26000CE option holds the maximum open interest, followed by the 26500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25500PE and 26100CE options. On the other hand, open interest reductions were prominent in the 26500CE, 27000CE, and 28000CE options. Trading volume was highest in the 26500CE option, followed by the 26000CE and 25500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,889.30 | 0.871 | 0.751 | 1.164 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,58,580 | 6,16,590 | 41,990 |

| PUT: | 5,73,690 | 4,62,800 | 1,10,890 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,20,640 | 38,610 | 4,299 |

| 26,500 | 1,12,515 | -15,470 | 5,642 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,20,640 | 38,610 | 4,299 |

| 26,100 | 25,480 | 21,645 | 1,167 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,12,515 | -15,470 | 5,642 |

| 27,000 | 34,385 | -12,545 | 986 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,12,515 | -15,470 | 5,642 |

| 26,000 | 1,20,640 | 38,610 | 4,299 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 78,455 | 18,200 | 2,164 |

| 25,500 | 68,965 | 24,765 | 4,093 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 68,965 | 24,765 | 4,093 |

| 23,000 | 58,175 | 19,175 | 586 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,950 | 10,595 | -1,690 | 526 |

| 25,550 | 14,885 | -1,300 | 246 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 68,965 | 24,765 | 4,093 |

| 25,000 | 39,520 | 12,870 | 3,584 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12778.15. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.167 against previous 1.048. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12300PE option, with open interest additions also seen in the 13100CE and 11800PE options. On the other hand, open interest reductions were prominent in the 67500CE, 66500CE, and 79000CE options. Trading volume was highest in the 12800CE option, followed by the 13000CE and 12800PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,778.15 | 1.167 | 1.048 | 0.743 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 49,92,120 | 50,51,200 | -59,080 |

| PUT: | 58,26,380 | 52,95,500 | 5,30,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,08,720 | 71,400 | 12,419 |

| 13,000 | 5,97,660 | -63,000 | 27,806 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 2,66,700 | 1,14,520 | 19,880 |

| 13,500 | 6,08,720 | 71,400 | 12,419 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 5,05,120 | -68,880 | 14,549 |

| 13,000 | 5,97,660 | -63,000 | 27,806 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 4,56,260 | 22,260 | 30,091 |

| 13,000 | 5,97,660 | -63,000 | 27,806 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,14,420 | 71,260 | 10,526 |

| 12,500 | 7,11,480 | 70,840 | 11,209 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,300 | 3,43,420 | 1,16,480 | 6,279 |

| 11,800 | 2,31,280 | 1,10,460 | 2,730 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 3,77,300 | -71,120 | 1,709 |

| 11,200 | 37,380 | -17,780 | 335 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 4,16,360 | 31,780 | 23,472 |

| 12,700 | 2,76,220 | 26,460 | 14,263 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Nifty Open Interest Volume Analysis makes one thing clear: bulls are tiptoeing back in, but the fight between buyers and sellers is far from over. With Nifty’s expiry battleground settled between 24,000 and 25,000, traders should favor range-based option plays like calendar spreads or condors for limited risk, while active longs could build above 24,800 if OI confirms strength. In BankNifty, FINNIFTY, and MIDCPNIFTY, the game is about playing flips—track short covering and OI changes for tactical moves, and stay nimble as expiry pressure intensifies.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]