Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 3/07/2025

Table of Contents

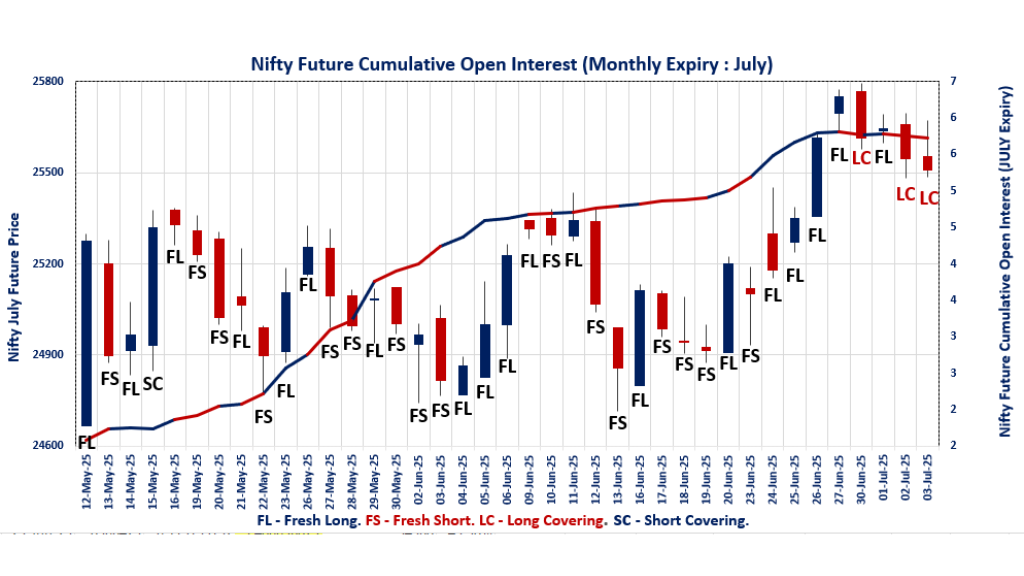

The Open Interest Volume Analysis for 3rd July 2025 shows the weekly expiry day with a defensive tone and clear signs of long unwinding. Nifty July futures slipped 0.15% to 25,508.60, with open interest down 2.7% and a premium that widened to 103.3, reflecting traders rolling over or exiting positions. The weekly Put-Call Ratio (OI) fell to 0.738, confirming a bearish bias as call writers dominated at the 25,500 and 26,000 strikes.

Max pain for the weekly expiry is locked at 25,500, while the highest put additions at 25,000 and calls at 25,500 reinforce this as the key expiry pivot. On the monthly front, PCR (OI) remains above 1.2, suggesting some underlying support, but the highest call and put additions are both at 25,500, highlighting indecision. BankNifty futures mirrored this cautiousness, dropping 0.34% with OI down 3.2% and a premium jump, while call writing at 57,000 and 57,500 and strong put support at 56,000 point to a tight expiry range.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 25,405.30 (-0.19%)

NIFTY JULY Future closed at: 25,508.60 (-0.15%)

Premium: 103.3 (Increased by 10.6 points)

Open Interest Change: -2.7%

Volume Change: 17.4%

NIFTY Weekly Expiry (10/07/2025) Option Analysis

Put-Call Ratio (OI): 0.738 (Decreased from 0.782)

Put-Call Ratio (Volume): 0.798

Max Pain Level: 25500

Maximum CALL OI: 25500

Maximum PUT OI: 25000

Highest CALL Addition: 25500

Highest PUT Addition: 25000

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (OI): 1.206 (Increased from 1.200)

Put-Call Ratio (Volume): 0.985

Max Pain Level: 25400

Maximum CALL OI: 26000

Maximum PUT OI: 25000

Highest CALL Addition: 25500

Highest PUT Addition: 25400

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,791.95 (-0.36%)

BANKNIFTY JULY Future closed at: 57,119.60 (-0.34%)

Premium: 327.65 (Increased by 9.85 points)

Open Interest Change: -3.2%

Volume Change: -30.1%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (OI): 0.927 (Decreased from 0.961)

Put-Call Ratio (Volume): 0.901

Max Pain Level: 56900

Maximum CALL OI: 56000

Maximum PUT OI: 56000

Highest CALL Addition: 57000

Highest PUT Addition: 56800

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,734.90 (-0.47%)

FINNIFTY JULY Future closed at: 26,892.30 (-0.45%)

Premium: 157.4 (Increased by 4.6 points)

Open Interest Change: 8.9%

Volume Change: -39.1%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (OI): 0.895 (Decreased from 0.938)

Put-Call Ratio (Volume): 0.983

Max Pain Level: 27000

Maximum CALL OI: 28000

Maximum PUT OI: 27000

Highest CALL Addition: 27000

Highest PUT Addition: 27000

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,462.55 (0.16%)

MIDCPNIFTY JULY Future closed at: 13,515.80 (0.15%)

Premium: 53.25 (Decreased by -1.8 points)

Open Interest Change: 0.5%

Volume Change: -20.7%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (OI): 0.971 (Decreased from 1.072)

Put-Call Ratio (Volume): 0.840

Max Pain Level: 13450

Maximum CALL OI: 14000

Maximum PUT OI: 13000

Highest CALL Addition: 13800

Highest PUT Addition: 13500

SENSEX Weekly Expiry (8/07/2025) Future

SENSEX Spot closed at: 83,239.47 (-0.20%)

SENSEX Weekly Future closed at: 83,316.15 (-0.17%)

Premium: 76.68 (Increased by 28.87 points)

Open Interest Change: 0.0%

Volume Change: 18.6%

SENSEX Weekly Expiry (8/07/2025) Option Analysis

Put-Call Ratio (OI): 0.617 (Increased from 0.593)

Put-Call Ratio (Volume): 0.870

Max Pain Level: 83500

Maximum CALL OI: 86000

Maximum PUT OI: 81000

Highest CALL Addition: 86000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,481.19 Cr

DIIs Net BUY: ₹ 1,333.06 Cr

FII Derivatives Activity

| FII Trading Stats | 3.07.25 | 2.07.25 | 1.07.25 |

| FII Cash (Provisional Data) | –1,481.19 | -1,561.62 | -1,970.14 |

| Index Future Open Interest Long Ratio | 29.29% | 33.40% | 36.66% |

| Index Future Volume Long Ratio | 35.40% | 32.50% | 48.81% |

| Call Option Open Interest Long Ratio | 55.00% | 46.57% | 51.94% |

| Call Option Volume Long Ratio | 50.62% | 49.49% | 50.41% |

| Put Option Open Interest Long Ratio | 64.03% | 58.91% | 58.02% |

| Put Option Volume Long Ratio | 50.22% | 50.04% | 51.21% |

| Stock Future Open Interest Long Ratio | 64.32% | 64.32% | 64.22% |

| Stock Future Volume Long Ratio | 49.70% | 51.21% | 47.69% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Long Covering | Fresh Short | Fresh Short |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Fresh Short | Long Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Short | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Short | Short Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Short Covering |

| MidcpNifty Options | Fresh Short | Long Covering | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Short Covering |

| Stock Futures | Long Covering | Short Covering | Fresh Short |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

NSE & BSE Option market Trends : Options Insights

NIFTY weekly Expiry (10/07/2025)

The NIFTY index closed at 25405.3. The NIFTY weekly expiry for JULY 10, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.738 against previous 0.782. The 25500CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 26500CE and 25000PE options. On the other hand, open interest reductions were prominent in the 23600PE, 27300CE, and 23250CE options. Trading volume was highest in the 25500CE option, followed by the 25500PE and 26000CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 10-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,405.30 | 0.738 | 0.782 | 0.798 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,90,16,025 | 3,94,65,150 | 3,95,50,875 |

| PUT: | 5,83,02,000 | 3,08,61,450 | 2,74,40,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 63,48,000 | 34,48,875 | 6,75,989 |

| 26,000 | 62,27,625 | 27,38,625 | 5,21,879 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 63,48,000 | 34,48,875 | 6,75,989 |

| 26,500 | 58,68,975 | 30,34,350 | 1,94,359 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 7,81,650 | -33,300 | 20,216 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 63,48,000 | 34,48,875 | 6,75,989 |

| 26,000 | 62,27,625 | 27,38,625 | 5,21,879 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 54,28,425 | 30,27,750 | 3,52,700 |

| 24,000 | 48,02,250 | 26,85,975 | 1,27,838 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 54,28,425 | 30,27,750 | 3,52,700 |

| 24,000 | 48,02,250 | 26,85,975 | 1,27,838 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 1,42,575 | -1,93,800 | 14,521 |

| 27,350 | 450 | 75 | 1 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 45,23,325 | 20,38,950 | 6,36,488 |

| 25,400 | 30,71,775 | 17,39,550 | 3,80,527 |

SENSEX weekly Expiry (08/07/2025)

The SENSEX index closed at 83239.47. The SENSEX weekly expiry for JULY 08, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.617 against previous 0.593. The 86000CE option holds the maximum open interest, followed by the 85000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 86000CE option, with open interest additions also seen in the 84000CE and 85500CE options. On the other hand, open interest reductions were prominent in the 86900CE, 89500CE, and 87400CE options. Trading volume was highest in the 83500PE option, followed by the 83500CE and 83700CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 08-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83239.47 | 0.617 | 0.593 | 0.870 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,41,55,460 | 81,23,129 | 60,32,331 |

| PUT: | 87,39,720 | 48,18,720 | 39,21,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 15,63,200 | 8,29,560 | 92,06,600 |

| 85000 | 9,20,400 | 3,53,520 | 84,28,900 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 15,63,200 | 8,29,560 | 92,06,600 |

| 84000 | 8,70,500 | 4,62,480 | 1,11,99,820 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 86900 | 28,680 | -42,420 | 5,01,060 |

| 89500 | 40,920 | -18,280 | 3,70,900 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 8,07,740 | 3,35,360 | 1,25,09,620 |

| 83700 | 3,45,700 | 1,36,700 | 1,12,47,240 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 8,04,760 | 3,14,180 | 44,28,520 |

| 80000 | 7,17,140 | 4,12,500 | 39,95,640 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 7,17,140 | 4,12,500 | 39,95,640 |

| 81000 | 8,04,760 | 3,14,180 | 44,28,520 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 77500 | 32,300 | -8,320 | 3,56,760 |

| 79100 | 11,800 | -780 | 1,63,340 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 6,29,840 | 2,89,020 | 1,44,67,100 |

| 83600 | 1,86,240 | 1,31,920 | 87,94,260 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25405.3. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.206 against previous 1.200. The 25000PE option holds the maximum open interest, followed by the 26000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 25400PE option, with open interest additions also seen in the 25500PE and 25500CE options. On the other hand, open interest reductions were prominent in the 26000CE, 25200CE, and 25700PE options. Trading volume was highest in the 25500PE option, followed by the 25500CE and 26000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,405.30 | 1.206 | 1.200 | 0.985 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,70,20,225 | 3,65,09,775 | 5,10,450 |

| PUT: | 4,46,37,975 | 4,37,93,775 | 8,44,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 45,44,250 | -1,50,075 | 74,128 |

| 25,500 | 33,55,050 | 1,19,925 | 76,313 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 33,55,050 | 1,19,925 | 76,313 |

| 25,400 | 10,37,925 | 98,400 | 18,795 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 45,44,250 | -1,50,075 | 74,128 |

| 25,200 | 6,04,575 | -51,375 | 4,940 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 33,55,050 | 1,19,925 | 76,313 |

| 26,000 | 45,44,250 | -1,50,075 | 74,128 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 65,37,150 | -21,225 | 51,318 |

| 24,500 | 37,18,050 | 12,675 | 32,181 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 14,39,250 | 2,24,400 | 24,050 |

| 25,500 | 33,32,325 | 1,23,750 | 82,978 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 8,58,600 | -38,550 | 12,793 |

| 22,300 | 8,05,800 | -36,375 | 2,250 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 33,32,325 | 1,23,750 | 82,978 |

| 25,000 | 65,37,150 | -21,225 | 51,318 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56791.95. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.927 against previous 0.961. The 56000PE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 57000CE option, with open interest additions also seen in the 60000CE and 57900CE options. On the other hand, open interest reductions were prominent in the 63000CE, 65000CE, and 56000PE options. Trading volume was highest in the 57000PE option, followed by the 57000CE and 57500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,791.95 | 0.927 | 0.961 | 0.901 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,51,44,290 | 1,45,54,234 | 5,90,056 |

| PUT: | 1,40,42,875 | 1,39,79,840 | 63,035 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 14,03,990 | -7,805 | 7,298 |

| 60,000 | 10,73,485 | 81,515 | 47,490 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,04,815 | 85,785 | 1,05,754 |

| 60,000 | 10,73,485 | 81,515 | 47,490 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 3,91,055 | -50,890 | 13,762 |

| 65,000 | 1,75,560 | -31,325 | 8,060 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,04,815 | 85,785 | 1,05,754 |

| 57,500 | 9,34,535 | 50,050 | 70,753 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 21,27,545 | -30,590 | 47,952 |

| 57,000 | 12,20,485 | 16,030 | 1,40,057 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,800 | 1,95,895 | 41,265 | 32,965 |

| 54,500 | 3,70,440 | 38,045 | 15,009 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 21,27,545 | -30,590 | 47,952 |

| 56,500 | 5,14,395 | -30,415 | 42,674 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,20,485 | 16,030 | 1,40,057 |

| 57,100 | 1,52,215 | -9,100 | 53,608 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26734.9. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.895 against previous 0.938. The 28000CE option holds the maximum open interest, followed by the 27000CE and 27000PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 27000PE and 25000PE options. On the other hand, open interest reductions were prominent in the 28300CE, 26950PE, and 27100PE options. Trading volume was highest in the 27000CE option, followed by the 28000CE and 27000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,734.90 | 0.895 | 0.938 | 0.983 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,85,100 | 5,70,700 | 1,14,400 |

| PUT: | 6,12,885 | 5,35,340 | 77,545 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 1,08,485 | 12,675 | 2,397 |

| 27,000 | 1,02,635 | 39,195 | 3,408 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,02,635 | 39,195 | 3,408 |

| 29,000 | 79,885 | 13,455 | 962 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,300 | 9,425 | -7,085 | 283 |

| 27,250 | 10,790 | -650 | 229 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,02,635 | 39,195 | 3,408 |

| 28,000 | 1,08,485 | 12,675 | 2,397 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 82,095 | 25,675 | 2,328 |

| 25,000 | 67,145 | 17,875 | 2,221 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 82,095 | 25,675 | 2,328 |

| 25,000 | 67,145 | 17,875 | 2,221 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,950 | 4,485 | -5,005 | 695 |

| 27,100 | 15,795 | -3,770 | 414 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 82,095 | 25,675 | 2,328 |

| 26,900 | 11,505 | 1,560 | 2,278 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13462.55. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.971 against previous 1.072. The 14000CE option holds the maximum open interest, followed by the 13500CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 13800CE option, with open interest additions also seen in the 14000CE and 13700CE options. On the other hand, open interest reductions were prominent in the 68700PE, 72300PE, and 72300PE options. Trading volume was highest in the 13500CE option, followed by the 13500PE and 14000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,462.55 | 0.971 | 1.072 | 0.840 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 43,88,300 | 37,21,480 | 6,66,820 |

| PUT: | 42,58,940 | 39,88,180 | 2,70,760 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,76,160 | 1,32,440 | 11,963 |

| 13,500 | 7,75,740 | 73,920 | 16,737 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 2,90,080 | 1,33,420 | 3,872 |

| 14,000 | 7,76,160 | 1,32,440 | 11,963 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 1,66,600 | -42,140 | 3,074 |

| 13,450 | 84,140 | -17,080 | 3,956 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 7,75,740 | 73,920 | 16,737 |

| 14,000 | 7,76,160 | 1,32,440 | 11,963 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,58,240 | -38,640 | 5,735 |

| 12,000 | 4,78,660 | 8,260 | 1,216 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 3,21,720 | 59,640 | 13,534 |

| 13,600 | 66,080 | 43,680 | 2,482 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 72,100 | -43,960 | 903 |

| 13,000 | 7,58,240 | -38,640 | 5,735 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 3,21,720 | 59,640 | 13,534 |

| 13,400 | 2,61,940 | 8,820 | 7,241 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis points to a market in consolidation, with both Nifty and BankNifty showing signs of fatigue after recent highs. For expiry, Nifty’s 25,450–25,500 zone is the battleground—expect volatility if this support cracks, with the next downside at 25,300 and 25,200. Resistance is heavy at 25,700–26,000 due to aggressive call writing. For traders, the setup favors neutral-to-bearish strategies like short straddles or iron condors around 25,500, or quick directional plays on a break of 25,450 or 25,700. BankNifty’s 57,000–57,500 range is key, with strong support at 56,000 and resistance at 57,500. Watch for a pickup in momentum only if Nifty sustains above 25,669 or decisively breaks below 25,437. As expiry unfolds, this Open Interest Volume Analysis will be crucial for navigating the next move and avoiding whipsaws in a choppy market.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]