Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 8/09/2025

Table of Contents

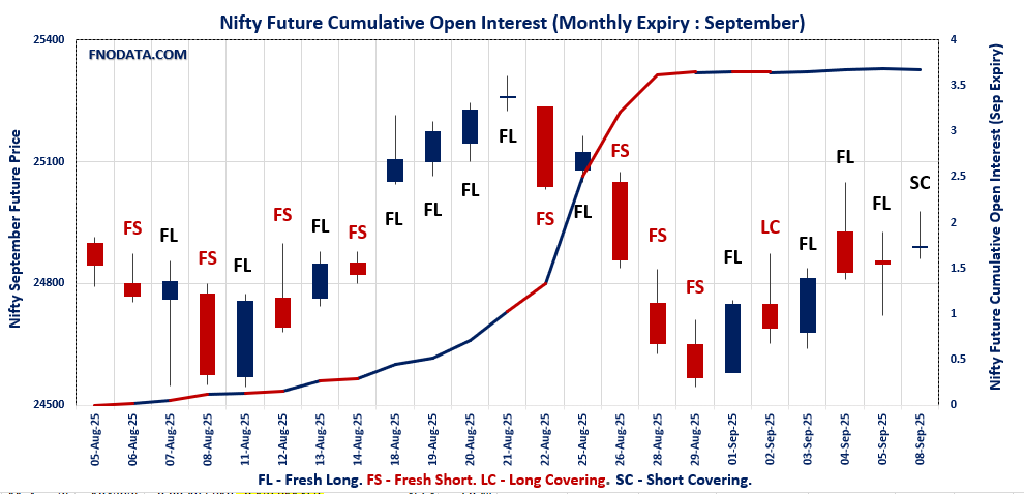

The Nifty Open Interest Volume Analysis for 8th September 2025 signals a market transition as profit-taking gives way to cautious optimism. Nifty September futures posted a slight 0.18% gain, and short covering led to a 0.7% drop in open interest, while premium expanded by nearly 13 points—showing that bears are stepping aside and bulls are regaining control.

The weekly option chain is now more supportive for buyers, with the Put-Call Ratio (OI) rising to 0.87 and max pain at 24,800. Call writers added size at 24,900 while puts stacked up at 24,800, suggesting the index is anchored in a tight expiry band. Monthly options bring even more cheer for the bulls: PCR is above 1, with heavy call resistance at 25,400 and firm put additions at 24,400, setting clear battlegrounds for the weeks ahead.

BANKNIFTY is echoing Nifty’s script. Short covering lifted futures by 0.25% with open interest falling 1.8%, while options data shows renewed put writing at 54,000 and 54,800 strikes, and aggressive call additions at 57,000. FINNIFTY stands out with fresh longs, as both price and OI ticked up mildly. MIDCPNIFTY joined the short covering camp, posting a modest price rise with a softening premium and an uptick in the Put-Call Ratio to 1.22. SENSEX futures were also buoyed by short covering; options activity now suggests a potential move toward max pain at 80,900.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,773.15 (0.13%)

NIFTY SEPTEMBER Future closed at: 24,892.70 (0.18%)

Premium: 119.55 (Increased by 12.85 points)

Open Interest Change: -0.7%

Volume Change: -19.2%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (9/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.868 (Increased from 0.756)

Put-Call Ratio (Volume): 0.960

Max Pain Level: 24800

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 24900

Highest PUT Addition: 24800

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.095 (Increased from 1.089)

Put-Call Ratio (Volume): 1.066

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 25400

Highest PUT Addition: 24400

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,186.90 (0.13%)

BANKNIFTY SEPTEMBER Future closed at: 54,499.80 (0.25%)

Premium: 312.9 (Increased by 62.85 points)

Open Interest Change: -1.8%

Volume Change: -5.4%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.922 (Increased from 0.867)

Put-Call Ratio (Volume): 0.841

Max Pain Level: 54800

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 57000

Highest PUT Addition: 54000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,942.70 (0.21%)

FINNIFTY SEPTEMBER Future closed at: 26,078.80 (0.29%)

Premium: 136.1 (Increased by 21.3 points)

Open Interest Change: 0.4%

Volume Change: 4.3%

Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.900 (Increased from 0.871)

Put-Call Ratio (Volume): 0.645

Max Pain Level: 25900

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 24500

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,841.40 (0.49%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,879.55 (0.46%)

Premium: 38.15 (Decreased by -4.1 points)

Open Interest Change: -1.2%

Volume Change: -41.3%

Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.217 (Increased from 1.167)

Put-Call Ratio (Volume): 0.928

Max Pain Level: 12800

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12900

Highest PUT Addition: 12900

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 80,787.30 (0.09%)

SENSEX Monthly Future closed at: 81,201.20 (0.14%)

Premium: 413.9 (Increased by 35.21 points)

Open Interest Change: -0.6%

Volume Change: -33.1%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (11/09/2025) Option Analysis

Put-Call Ratio (OI): 0.842 (Increased from 0.816)

Put-Call Ratio (Volume): 0.940

Max Pain Level: 80900

Maximum CALL OI: 81000

Maximum PUT OI: 80000

Highest CALL Addition: 84000

Highest PUT Addition: 77000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,170.35 Cr

DIIs Net BUY: ₹ 3,014.30 Cr

FII Derivatives Activity

| FII Trading Stats | 8.09.25 | 5.09.25 | 4.09.25 |

| FII Cash (Provisional Data) | -2,170.35 | -1,304.91 | -106.34 |

| Index Future Open Interest Long Ratio | 7.99% | 7.43% | 8.04% |

| Index Future Volume Long Ratio | 50.12% | 44.05% | 40.30% |

| Call Option Open Interest Long Ratio | 50.34% | 47.92% | 46.64% |

| Call Option Volume Long Ratio | 50.34% | 50.11% | 50.03% |

| Put Option Open Interest Long Ratio | 62.90% | 64.88% | 65.76% |

| Put Option Volume Long Ratio | 50.01% | 50.08% | 50.42% |

| Stock Future Open Interest Long Ratio | 62.52% | 62.38% | 62.40% |

| Stock Future Volume Long Ratio | 51.99% | 49.75% | 47.24% |

| Index Futures | Fresh Long | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Long |

| BankNifty Futures | Fresh Long | Short Covering | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Long | Long Covering |

| FinNifty Futures | Fresh Short | Short Covering | Fresh Long |

| FinNifty Options | Fresh Long | Fresh Short | Short Covering |

| MidcpNifty Futures | Fresh Long | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Long Covering |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Fresh Long | Fresh Short | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (9/09/2025)

The NIFTY index closed at 24773.15. The NIFTY weekly expiry for SEPTEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.868 against previous 0.756. The 25000CE option holds the maximum open interest, followed by the 24900CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 24800PE option, with open interest additions also seen in the 24700PE and 24850PE options. On the other hand, open interest reductions were prominent in the 26000CE, 22600PE, and 26100CE options. Trading volume was highest in the 24800PE option, followed by the 24800CE and 24900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,773.15 | 0.868 | 0.756 | 0.960 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,30,59,350 | 20,16,55,275 | 14,04,075 |

| PUT: | 17,62,64,175 | 15,24,75,750 | 2,37,88,425 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 2,12,62,725 | 25,79,850 | 70,61,816 |

| 24,900 | 1,67,84,925 | 37,52,025 | 94,75,008 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,67,84,925 | 37,52,025 | 94,75,008 |

| 24,950 | 1,05,12,375 | 34,80,750 | 50,88,216 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,07,375 | -37,63,875 | 4,11,720 |

| 26,100 | 16,70,250 | -22,13,175 | 1,40,712 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,19,14,500 | 4,71,975 | 98,93,977 |

| 24,900 | 1,67,84,925 | 37,52,025 | 94,75,008 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,40,93,925 | 17,08,425 | 24,75,744 |

| 24,700 | 1,21,02,975 | 44,09,175 | 63,72,719 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,06,65,675 | 44,63,250 | 1,23,14,203 |

| 24,700 | 1,21,02,975 | 44,09,175 | 63,72,719 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,600 | 47,56,350 | -22,93,650 | 1,82,670 |

| 24,000 | 1,13,81,250 | -18,15,825 | 12,78,847 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,06,65,675 | 44,63,250 | 1,23,14,203 |

| 24,850 | 55,40,925 | 43,27,800 | 73,82,064 |

SENSEX Weekly Expiry (11/09/2025)

The SENSEX index closed at 80787.3. The SENSEX weekly expiry for SEPTEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.842 against previous 0.816. The 81000CE option holds the maximum open interest, followed by the 81500CE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 77000PE option, with open interest additions also seen in the 84000CE and 80900PE options. On the other hand, open interest reductions were prominent in the 80700CE, 80500CE, and 80800CE options. Trading volume was highest in the 81000CE option, followed by the 81000PE and 80900PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 11-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80787.3 | 0.842 | 0.816 | 0.940 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,16,69,440 | 90,91,000 | 25,78,440 |

| PUT: | 98,25,300 | 74,14,640 | 24,10,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 8,13,200 | 50,520 | 3,15,36,520 |

| 81500 | 7,69,380 | 1,71,600 | 1,83,80,900 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 6,13,100 | 2,09,400 | 25,41,820 |

| 83600 | 2,06,740 | 1,81,780 | 8,11,440 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80700 | 1,19,380 | -66,740 | 55,47,200 |

| 80500 | 1,67,080 | -41,860 | 25,69,060 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 8,13,200 | 50,520 | 3,15,36,520 |

| 80900 | 2,69,820 | 34,640 | 1,85,91,960 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 7,04,860 | 1,27,120 | 1,25,38,760 |

| 80500 | 5,97,860 | 1,71,480 | 1,54,94,900 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 4,78,200 | 2,13,880 | 23,38,600 |

| 80900 | 2,75,260 | 1,82,720 | 2,21,07,480 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 1,87,560 | -28,460 | 11,71,840 |

| 78900 | 62,320 | -25,700 | 8,78,520 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 5,38,920 | 1,75,180 | 2,76,67,040 |

| 80900 | 2,75,260 | 1,82,720 | 2,21,07,480 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24773.15. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.095 against previous 1.089. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 25400CE option, with open interest additions also seen in the 24400PE and 25300CE options. On the other hand, open interest reductions were prominent in the 23800PE, 23000PE, and 24000PE options. Trading volume was highest in the 25000CE option, followed by the 24800PE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,773.15 | 1.095 | 1.089 | 1.066 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,66,82,550 | 4,64,13,300 | 2,69,250 |

| PUT: | 5,11,25,400 | 5,05,37,400 | 5,88,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 58,80,750 | -43,275 | 90,605 |

| 26,000 | 43,15,500 | -79,950 | 29,587 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 14,74,725 | 4,40,325 | 25,105 |

| 25,300 | 18,15,000 | 2,63,025 | 25,148 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 17,76,000 | -1,67,700 | 16,554 |

| 24,800 | 17,15,325 | -1,61,025 | 53,971 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 58,80,750 | -43,275 | 90,605 |

| 24,800 | 17,15,325 | -1,61,025 | 53,971 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 42,54,000 | 1,73,775 | 55,627 |

| 24,000 | 41,81,700 | -1,91,850 | 56,365 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 14,87,475 | 4,05,975 | 26,400 |

| 24,300 | 14,38,875 | 1,75,275 | 28,973 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 12,30,375 | -2,23,425 | 16,317 |

| 23,000 | 33,42,450 | -2,00,775 | 16,243 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 18,69,000 | -1,41,750 | 56,507 |

| 24,000 | 41,81,700 | -1,91,850 | 56,365 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54186.9. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.922 against previous 0.867. The 57000CE option holds the maximum open interest, followed by the 54000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 54000PE option, with open interest additions also seen in the 54200PE and 57000CE options. On the other hand, open interest reductions were prominent in the 57500CE, 54000CE, and 52500PE options. Trading volume was highest in the 54000PE option, followed by the 55000CE and 54500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,186.90 | 0.922 | 0.867 | 0.841 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,55,00,385 | 1,56,66,200 | -1,65,815 |

| PUT: | 1,42,97,820 | 1,35,85,065 | 7,12,755 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 19,68,315 | 83,215 | 46,933 |

| 56,000 | 13,68,500 | -6,160 | 77,749 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 19,68,315 | 83,215 | 46,933 |

| 55,200 | 2,05,555 | 49,980 | 25,466 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 5,51,530 | -1,40,910 | 31,138 |

| 54,000 | 8,99,140 | -1,22,815 | 83,395 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 13,22,895 | -17,605 | 1,26,828 |

| 54,500 | 6,98,250 | -22,715 | 1,23,414 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,89,520 | 95,750 | 1,41,883 |

| 57,000 | 10,53,075 | -4,515 | 709 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,89,520 | 95,750 | 1,41,883 |

| 54,200 | 2,50,460 | 89,495 | 1,08,528 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 6,66,385 | -47,150 | 37,027 |

| 50,000 | 5,80,055 | -39,480 | 29,896 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,89,520 | 95,750 | 1,41,883 |

| 54,200 | 2,50,460 | 89,495 | 1,08,528 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25942.7. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.900 against previous 0.871. The 26500CE option holds the maximum open interest, followed by the 26000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 27500CE and 27000CE options. On the other hand, open interest reductions were prominent in the 26000CE, 25600PE, and 25650PE options. Trading volume was highest in the 26500CE option, followed by the 26000CE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,942.70 | 0.900 | 0.871 | 0.645 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,52,145 | 6,58,580 | -6,435 |

| PUT: | 5,86,950 | 5,73,690 | 13,260 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,29,545 | 17,030 | 21,205 |

| 26,000 | 83,135 | -37,505 | 9,986 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,29,545 | 17,030 | 21,205 |

| 27,500 | 56,810 | 14,820 | 1,143 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 83,135 | -37,505 | 9,986 |

| 26,100 | 13,260 | -12,220 | 1,471 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,29,545 | 17,030 | 21,205 |

| 26,000 | 83,135 | -37,505 | 9,986 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 83,525 | 5,070 | 6,585 |

| 25,500 | 68,640 | -325 | 6,540 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 33,280 | 10,985 | 549 |

| 26,050 | 11,115 | 8,385 | 1,109 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 17,095 | -16,510 | 495 |

| 25,650 | 14,495 | -13,520 | 397 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 83,525 | 5,070 | 6,585 |

| 25,500 | 68,640 | -325 | 6,540 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12841.4. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.217 against previous 1.167. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12900PE option, with open interest additions also seen in the 12900CE and 13300CE options. On the other hand, open interest reductions were prominent in the 67000CE, 56000CE, and 56000CE options. Trading volume was highest in the 12900CE option, followed by the 12900PE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,841.40 | 1.217 | 1.167 | 0.928 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 51,75,940 | 49,92,120 | 1,83,820 |

| PUT: | 62,97,760 | 58,26,380 | 4,71,380 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,32,940 | 24,220 | 8,081 |

| 14,000 | 5,17,860 | 61,880 | 2,748 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,62,320 | 1,79,620 | 17,078 |

| 13,300 | 2,97,500 | 99,680 | 5,206 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,40,480 | -1,15,780 | 7,824 |

| 13,000 | 4,99,940 | -97,720 | 14,724 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,62,320 | 1,79,620 | 17,078 |

| 13,000 | 4,99,940 | -97,720 | 14,724 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,34,860 | 20,440 | 5,128 |

| 12,500 | 7,25,060 | 13,580 | 8,456 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,01,420 | 2,21,620 | 14,728 |

| 12,600 | 2,98,760 | 83,020 | 4,679 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,400 | 2,53,960 | -70,840 | 4,183 |

| 11,000 | 3,19,620 | -57,680 | 1,226 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,01,420 | 2,21,620 | 14,728 |

| 12,800 | 3,95,920 | -20,440 | 10,559 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Nifty Open Interest Volume Analysis shows the market is resetting for a potential upside move, but there’s resistance ahead and volatility is likely to stay high. For Nifty, the best trades lie in range-based option plays focusing on the 24,800–25,000 window—think straddles, condors, or credit spreads as expiry pressure intensifies. In BankNifty and midcaps, follow short covering cues but stay nimble with protective stops as resistance zones are just above spot prices. FINNIFTY calls for quick long trades with exits at predefined targets; MIDCPNIFTY shows a balanced setup ideal for iron condors.

Let this Nifty Open Interest Volume Analysis guide your trading game—embrace discipline, watch the premium and open interest cues, and be ready to move fast as the market sentiment shifts in September’s early innings.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]