Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/09/2025

Table of Contents

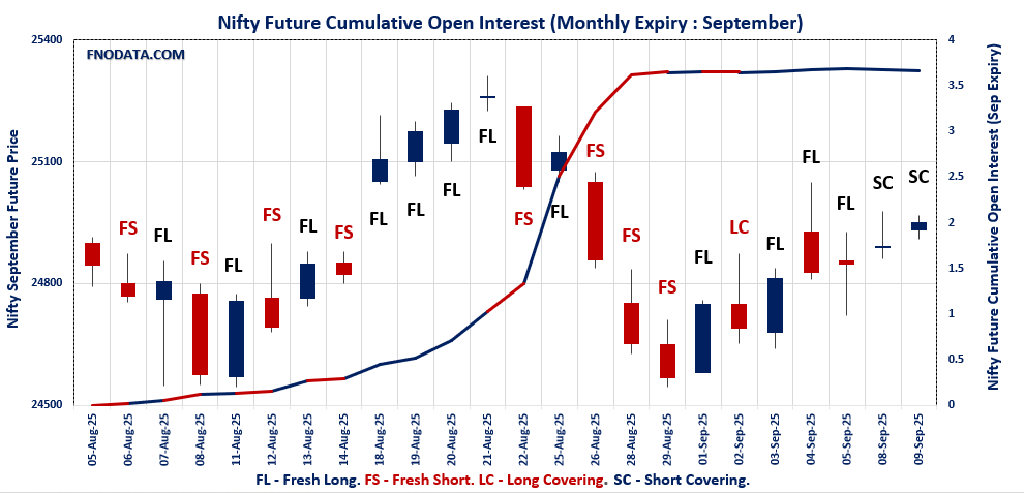

The Open Interest Volume Analysis for 9th September 2025 exposes a market boiling just beneath the surface, as Nifty sees more profit-taking and sideways movement after short covering. Nifty September futures climbed a mild 0.23% to 24,950.30, yet open interest fell by 0.2% and premium slashed by almost 38 points—a sign that bulls are booking profits and not piling on new positions. Weekly option data reveals a balanced Put-Call Ratio (OI) of 0.93, with call writers dominating 25,000 strikes to cap upside, while put support at 24,900 keeps the index from slipping too far below the max pain level at 24,850.

BankNifty painted a cautionary picture, barely moved in price but open interest added 1.1%, showing fresh shorts coming in. Options data highlights that sellers continue to build above 54,600, while buyers cling to put strength around 54,000—for now, ranges are firm but bias favors bears. FINNIFTY matches the tone, shedding ground and seeing new shorts, while MIDCPNIFTY and SENSEX only propped up mildly on short covering rather than new bullish power. Overall, the expiry landscape looks range-bound with bursts of tactical trading.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,868.60 (0.39%)

NIFTY SEPTEMBER Future closed at: 24,950.30 (0.23%)

Premium: 81.7 (Decreased by -37.85 points)

Open Interest Change: -0.2%

Volume Change: -37.9%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (16/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.932 (Decreased from 0.936)

Put-Call Ratio (Volume): 0.914

Max Pain Level: 24850

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25700

Highest PUT Addition: 24900

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.125 (Increased from 1.095)

Put-Call Ratio (Volume): 1.057

Max Pain Level: 24950

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 25000

Highest PUT Addition: 24350

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,216.10 (0.05%)

BANKNIFTY SEPTEMBER Future closed at: 54,468.40 (-0.06%)

Premium: 252.3 (Decreased by -60.6 points)

Open Interest Change: 1.1%

Volume Change: -42.9%

Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.911 (Decreased from 0.922)

Put-Call Ratio (Volume): 1.025

Max Pain Level: 54600

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55000

Highest PUT Addition: 51000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,961.95 (0.07%)

FINNIFTY SEPTEMBER Future closed at: 26,070.90 (-0.03%)

Premium: 108.95 (Decreased by -27.15 points)

Open Interest Change: 0.2%

Volume Change: -36.4%

Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.890 (Decreased from 0.900)

Put-Call Ratio (Volume): 1.355

Max Pain Level: 25900

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 24000

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,883.50 (0.33%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,927.05 (0.37%)

Premium: 43.55 (Increased by 5.4 points)

Open Interest Change: -1.0%

Volume Change: -37.1%

Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.289 (Increased from 1.217)

Put-Call Ratio (Volume): 0.853

Max Pain Level: 12850

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13200

Highest PUT Addition: 12500

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 81,101.32 (0.39%)

SENSEX Monthly Future closed at: 81,383.70 (0.22%)

Premium: 282.38 (Decreased by -131.52 points)

Open Interest Change: -2.0%

Volume Change: -29.7%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (11/09/2025) Option Analysis

Put-Call Ratio (OI): 0.983 (Increased from 0.842)

Put-Call Ratio (Volume): 0.982

Max Pain Level: 81000

Maximum CALL OI: 83000

Maximum PUT OI: 81000

Highest CALL Addition: 83000

Highest PUT Addition: 81000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 2,050.46 Cr.

DIIs Net BUY: ₹ 83.08 Cr.

FII Derivatives Activity

| FII Trading Stats | 9.09.25 | 8.09.25 | 5.09.25 |

| FII Cash (Provisional Data) | 2,050.46 | -2,170.35 | -1,304.91 |

| Index Future Open Interest Long Ratio | 8.71% | 7.99% | 7.43% |

| Index Future Volume Long Ratio | 55.00% | 50.12% | 44.05% |

| Call Option Open Interest Long Ratio | 48.34% | 50.34% | 47.92% |

| Call Option Volume Long Ratio | 50.06% | 50.34% | 50.11% |

| Put Option Open Interest Long Ratio | 71.10% | 62.90% | 64.88% |

| Put Option Volume Long Ratio | 49.83% | 50.01% | 50.08% |

| Stock Future Open Interest Long Ratio | 62.51% | 62.52% | 62.38% |

| Stock Future Volume Long Ratio | 49.97% | 51.99% | 49.75% |

| Index Futures | Fresh Long | Fresh Long | Fresh Short |

| Index Options | Long Covering | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Long | Fresh Short | Fresh Short |

| Nifty Options | Long Covering | Fresh Long | Fresh Long |

| BankNifty Futures | Fresh Short | Fresh Long | Short Covering |

| BankNifty Options | Long Covering | Fresh Long | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Short | Short Covering |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Futures | Short Covering | Fresh Long | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Long | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Fresh Long | Fresh Short |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (16/09/2025)

The NIFTY index closed at 24868.6. The NIFTY weekly expiry for SEPTEMBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.932 against previous 0.936. The 25000CE option holds the maximum open interest, followed by the 25500CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 25700CE option, with open interest additions also seen in the 25500CE and 24900PE options. On the other hand, open interest reductions were prominent in the 24750CE, 24700CE, and 26550CE options. Trading volume was highest in the 25000CE option, followed by the 24800PE and 24900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 16-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,868.60 | 0.932 | 0.936 | 0.914 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,58,78,275 | 3,52,88,550 | 3,05,89,725 |

| PUT: | 6,13,90,725 | 3,30,25,050 | 2,83,65,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,00,500 | 22,69,425 | 4,70,951 |

| 25,500 | 49,65,450 | 24,48,525 | 2,07,015 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 37,28,475 | 26,68,275 | 1,30,061 |

| 25,500 | 49,65,450 | 24,48,525 | 2,07,015 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,750 | 2,60,850 | -81,900 | 43,661 |

| 24,700 | 8,64,300 | -45,375 | 70,587 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,00,500 | 22,69,425 | 4,70,951 |

| 24,900 | 39,39,300 | 24,27,375 | 4,45,733 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 45,82,875 | 21,79,125 | 1,48,189 |

| 24,800 | 41,28,975 | 22,79,625 | 4,55,802 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 33,48,900 | 24,33,075 | 3,60,557 |

| 24,800 | 41,28,975 | 22,79,625 | 4,55,802 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 41,28,975 | 22,79,625 | 4,55,802 |

| 24,900 | 33,48,900 | 24,33,075 | 3,60,557 |

SENSEX Weekly Expiry (11/09/2025)

The SENSEX index closed at 81101.32. The SENSEX weekly expiry for SEPTEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.983 against previous 0.842. The 83000CE option holds the maximum open interest, followed by the 82500CE and 81000PE options. Market participants have shown increased interest with significant open interest additions in the 83000CE option, with open interest additions also seen in the 82500CE and 81000PE options. On the other hand, open interest reductions were prominent in the 80800CE, 88000CE, and 77100PE options. Trading volume was highest in the 81000PE option, followed by the 81000CE and 81100CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 11-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81101.32 | 0.983 | 0.842 | 0.982 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,10,35,060 | 1,16,69,440 | 93,65,620 |

| PUT: | 2,06,73,860 | 98,25,300 | 1,08,48,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 17,64,080 | 10,86,340 | 69,28,100 |

| 82500 | 16,70,820 | 10,46,160 | 64,10,060 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 17,64,080 | 10,86,340 | 69,28,100 |

| 82500 | 16,70,820 | 10,46,160 | 64,10,060 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 1,49,080 | -67,080 | 50,19,160 |

| 88000 | 1,06,680 | -50,360 | 4,09,680 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,92,460 | 1,79,260 | 2,87,08,140 |

| 81100 | 7,05,120 | 3,41,840 | 2,35,82,880 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 14,19,180 | 8,80,260 | 3,61,52,560 |

| 79000 | 13,47,820 | 8,24,620 | 49,41,760 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 14,19,180 | 8,80,260 | 3,61,52,560 |

| 79000 | 13,47,820 | 8,24,620 | 49,41,760 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 77100 | 24,460 | -32,460 | 2,91,180 |

| 76900 | 18,100 | -12,860 | 1,50,380 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 14,19,180 | 8,80,260 | 3,61,52,560 |

| 81100 | 6,77,760 | 5,56,080 | 2,12,10,900 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24868.6. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.125 against previous 1.095. The 25000CE option holds the maximum open interest, followed by the 24500PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 24350PE option, with open interest additions also seen in the 25000CE and 25000PE options. On the other hand, open interest reductions were prominent in the 24500CE, 23000PE, and 23500PE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24800PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,868.60 | 1.125 | 1.095 | 1.057 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,66,39,725 | 4,66,82,550 | -42,825 |

| PUT: | 5,24,61,150 | 5,11,25,400 | 13,35,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 61,15,725 | 2,34,975 | 62,411 |

| 26,000 | 42,70,875 | -44,625 | 18,322 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 61,15,725 | 2,34,975 | 62,411 |

| 25,200 | 20,94,225 | 65,325 | 20,584 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 16,44,675 | -1,65,450 | 12,361 |

| 24,700 | 16,83,675 | -92,325 | 10,288 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 61,15,725 | 2,34,975 | 62,411 |

| 25,500 | 40,18,425 | 24,750 | 37,097 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,67,625 | 1,13,625 | 44,450 |

| 25,000 | 43,48,275 | 2,12,400 | 38,264 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,350 | 4,35,750 | 3,44,025 | 7,799 |

| 25,000 | 43,48,275 | 2,12,400 | 38,264 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 31,90,950 | -1,51,500 | 11,883 |

| 23,500 | 21,32,700 | -1,26,075 | 11,091 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,67,625 | 1,13,625 | 44,450 |

| 24,800 | 19,42,500 | 73,500 | 39,043 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54216.1. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.911 against previous 0.922. The 57000CE option holds the maximum open interest, followed by the 55000CE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 55000CE option, with open interest additions also seen in the 54200CE and 54500CE options. On the other hand, open interest reductions were prominent in the 57000CE, 42000PE, and 55800CE options. Trading volume was highest in the 54000PE option, followed by the 54200PE and 54200CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,216.10 | 0.911 | 0.922 | 1.025 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,61,11,375 | 1,55,00,385 | 6,10,990 |

| PUT: | 1,46,84,300 | 1,42,97,225 | 3,87,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,84,280 | -84,035 | 33,979 |

| 55,000 | 14,25,830 | 1,02,935 | 79,066 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 14,25,830 | 1,02,935 | 79,066 |

| 54,200 | 2,93,930 | 96,635 | 96,854 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,84,280 | -84,035 | 33,979 |

| 55,800 | 1,93,970 | -24,395 | 9,545 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,200 | 2,93,930 | 96,635 | 96,854 |

| 54,500 | 7,79,030 | 80,780 | 87,575 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,97,220 | 7,700 | 1,15,822 |

| 57,000 | 10,49,785 | -3,290 | 189 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 6,55,660 | 60,455 | 20,999 |

| 54,100 | 1,98,030 | 47,180 | 59,768 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 42,000 | 1,30,725 | -27,510 | 2,163 |

| 53,500 | 7,10,185 | -21,560 | 41,555 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,97,220 | 7,700 | 1,15,822 |

| 54,200 | 2,79,440 | 28,980 | 1,14,958 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25961.95. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.890 against previous 0.900. The 26500CE option holds the maximum open interest, followed by the 26000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 24000PE and 25950CE options. On the other hand, open interest reductions were prominent in the 25500PE, 27500CE, and 26050PE options. Trading volume was highest in the 26500CE option, followed by the 26000PE and 25500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,961.95 | 0.890 | 0.900 | 1.355 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,92,770 | 6,52,145 | 40,625 |

| PUT: | 6,16,460 | 5,86,950 | 29,510 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,47,615 | 18,070 | 4,129 |

| 26,000 | 93,080 | 9,945 | 2,356 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,47,615 | 18,070 | 4,129 |

| 25,950 | 22,230 | 12,675 | 1,444 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 51,155 | -5,655 | 380 |

| 28,000 | 12,870 | -2,535 | 156 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,47,615 | 18,070 | 4,129 |

| 26,000 | 93,080 | 9,945 | 2,356 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 95,615 | 12,090 | 3,111 |

| 23,000 | 61,490 | 910 | 300 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 39,065 | 15,990 | 1,112 |

| 26,000 | 95,615 | 12,090 | 3,111 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 44,590 | -24,050 | 2,667 |

| 26,050 | 6,175 | -4,940 | 775 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 95,615 | 12,090 | 3,111 |

| 25,500 | 44,590 | -24,050 | 2,667 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12883.5. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.289 against previous 1.217. The 12500PE option holds the maximum open interest, followed by the 12000PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12500PE option, with open interest additions also seen in the 11500PE and 12875PE options. On the other hand, open interest reductions were prominent in the 64200PE, 64200PE, and 64200CE options. Trading volume was highest in the 12900CE option, followed by the 13000CE and 12900PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,883.50 | 1.289 | 1.217 | 0.853 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 52,06,880 | 51,75,940 | 30,940 |

| PUT: | 67,09,220 | 62,97,760 | 4,11,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,21,320 | -11,620 | 5,081 |

| 14,000 | 5,23,600 | 5,740 | 1,799 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 5,08,060 | 38,640 | 10,797 |

| 13,700 | 1,70,240 | 28,840 | 1,095 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,950 | 71,680 | -38,640 | 2,448 |

| 12,850 | 74,760 | -29,540 | 9,836 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,81,640 | 19,320 | 20,048 |

| 13,000 | 5,07,360 | 7,420 | 12,675 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 8,92,780 | 1,67,720 | 6,045 |

| 12,000 | 7,16,660 | -18,200 | 2,965 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 8,92,780 | 1,67,720 | 6,045 |

| 11,500 | 3,53,780 | 66,360 | 1,080 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 1,74,020 | -50,960 | 1,126 |

| 12,400 | 2,31,840 | -22,120 | 1,979 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,46,080 | 44,660 | 11,316 |

| 12,850 | 1,60,580 | 52,220 | 10,206 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

“How Do YOU Trade This? Open Interest Volume Analysis Offers an Edge.”

This session’s Open Interest Volume Analysis makes clear that smart traders should lean toward option strategies that thrive in consolidation—credit spreads, iron condors, and straddles between 24,500 and 25,000 for Nifty. For BankNifty and FINNIFTY, trail shorts using open interest cues and keep stops tight. In midcaps, play quick scalps off short covering as the real momentum might wait until after expiry. Lean on this week’s open interest volume trends for triggers—watch for fresh OI additions alongside price moves to jump in when conviction returns.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]