Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 11/09/2025

Table of Contents

The Open Interest Volume Analysis for 11th September 2025 shows a market marching forward with renewed optimism. Nifty September futures ticked up 0.13% to 25,104.50, with a near-perfect match to spot, while open interest fell 1%—evidence of short covering and profit-booking as the rally continues. Despite the hefty 56% drop in volume and only a minor premium dip, the options landscape now shines brighter for bulls: weekly Put-Call Ratio (OI) spiked to 1.16 and max pain has locked onto 25,000, while both call and put writers build their bets at this expiry anchor.

BankNifty confirms this subtle shift. The September future gained 0.15% with a 3.9% OI decrease—another read of shorts unwinding, fueling the up-move. Put-Call Ratio at 1.01 for expiry and hefty call additions above 54,500 show buyers are testing resistance levels, while puts pile up to protect 54,000 and 54,900. Across FINNIFTY and MIDCPNIFTY, short covering is the flavor of the day with futures barely changing and open interest declining, though MIDCPNIFTY hinted quiet long covering. SENSEX is echoing this trend—up 0.12% with notable short unwinding, as the options data points to growing support around 81,500.

NSE & BSE F&O Market Signals

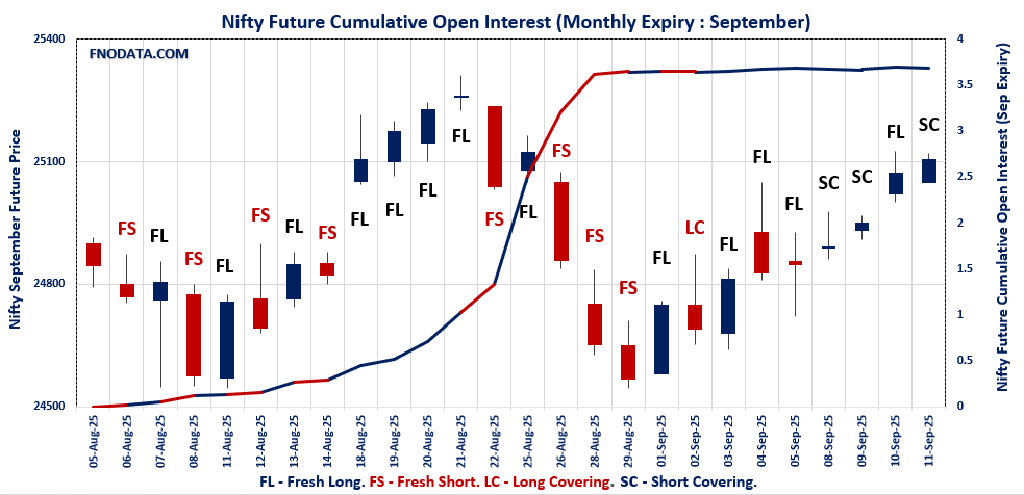

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,005.50 (0.13%)

NIFTY SEPTEMBER Future closed at: 25,104.50 (0.13%)

Premium: 99 (Decreased by -0.2 points)

Open Interest Change: -1.0%

Volume Change: -56.8%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (16/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.157 (Increased from 1.108)

Put-Call Ratio (Volume): 0.932

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25400

Highest PUT Addition: 25000

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.107 (Decreased from 1.118)

Put-Call Ratio (Volume): 1.155

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25500

Highest PUT Addition: 24700

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,669.60 (0.24%)

BANKNIFTY SEPTEMBER Future closed at: 54,875.00 (0.15%)

Premium: 205.4 (Decreased by -50.4 points)

Open Interest Change: -3.9%

Volume Change: -35.7%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.013 (Increased from 0.979)

Put-Call Ratio (Volume): 0.861

Max Pain Level: 54900

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 62000

Highest PUT Addition: 54500

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,178.70 (0.21%)

FINNIFTY SEPTEMBER Future closed at: 26,272.10 (0.13%)

Premium: 93.4 (Decreased by -22.15 points)

Open Interest Change: -5.5%

Volume Change: 26.5%

Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.021 (Decreased from 1.122)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 26000

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 24500

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 13,037.60 (-0.03%)

MIDCPNIFTY SEPTEMBER Future closed at: 13,073.40 (-0.10%)

Premium: 35.8 (Decreased by -10.4 points)

Open Interest Change: -0.2%

Volume Change: -53.8%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.193 (Decreased from 1.259)

Put-Call Ratio (Volume): 1.072

Max Pain Level: 13000

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 12875

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 81,548.73 (0.15%)

SENSEX Monthly Future closed at: 81,853.80 (0.12%)

Premium: 305.07 (Decreased by -24.28 points)

Open Interest Change: -12.3%

Volume Change: 25.4%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (18/09/2025) Option Analysis

Put-Call Ratio (OI): 1.170 (Increased from 1.157)

Put-Call Ratio (Volume): 1.102

Max Pain Level: 81500

Maximum CALL OI: 84000

Maximum PUT OI: 78000

Highest CALL Addition: 84000

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,472.37 Cr.

DIIs Net BUY: ₹ 4,045.54 Cr.

FII Derivatives Activity

| FII Trading Stats | 11.09.25 | 10.09.25 | 9.09.25 |

| FII Cash (Provisional Data) | -3,472.37 | -115.69 | 2,050.46 |

| Index Future Open Interest Long Ratio | 10.78% | 10.22% | 8.71% |

| Index Future Volume Long Ratio | 62.06% | 56.31% | 55.00% |

| Call Option Open Interest Long Ratio | 48.06% | 46.31% | 48.34% |

| Call Option Volume Long Ratio | 50.40% | 49.56% | 50.06% |

| Put Option Open Interest Long Ratio | 64.09% | 64.44% | 71.10% |

| Put Option Volume Long Ratio | 50.29% | 49.49% | 49.83% |

| Stock Future Open Interest Long Ratio | 62.21% | 62.60% | 62.51% |

| Stock Future Volume Long Ratio | 45.63% | 50.83% | 49.97% |

| Index Futures | Short Covering | Fresh Long | Fresh Long |

| Index Options | Fresh Long | Fresh Short | Long Covering |

| Nifty Futures | Fresh Long | Fresh Long | Fresh Long |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Short Covering | Short Covering | Fresh Short |

| BankNifty Options | Long Covering | Fresh Short | Long Covering |

| FinNifty Futures | Long Covering | Fresh Short | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Futures | Short Covering | Fresh Long | Short Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Short |

| Stock Futures | Fresh Short | Fresh Long | Fresh Short |

| Stock Options | Fresh Short | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (16/09/2025)

The NIFTY index closed at 25005.5. The NIFTY weekly expiry for SEPTEMBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.157 against previous 1.108. The 25000PE option holds the maximum open interest, followed by the 24000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25000PE option, with open interest additions also seen in the 24900PE and 24000PE options. On the other hand, open interest reductions were prominent in the 24950CE, 23700PE, and 24800CE options. Trading volume was highest in the 25000PE option, followed by the 25000CE and 25050CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 16-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,005.50 | 1.157 | 1.108 | 0.932 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,51,79,450 | 11,27,79,150 | 3,24,00,300 |

| PUT: | 16,80,17,400 | 12,49,45,725 | 4,30,71,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,22,27,925 | 25,26,450 | 5,43,041 |

| 25,500 | 1,04,47,500 | 27,34,275 | 7,28,422 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 69,83,175 | 30,35,925 | 6,70,368 |

| 25,500 | 1,04,47,500 | 27,34,275 | 7,28,422 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,950 | 19,16,550 | -4,57,275 | 11,26,711 |

| 24,800 | 16,00,800 | -1,81,950 | 1,88,231 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 98,49,675 | 4,71,300 | 34,83,472 |

| 25,050 | 49,22,475 | 8,31,825 | 18,50,138 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,51,23,525 | 56,80,200 | 35,34,191 |

| 24,000 | 1,30,64,475 | 33,18,225 | 6,35,467 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,51,23,525 | 56,80,200 | 35,34,191 |

| 24,900 | 1,05,36,225 | 35,10,225 | 16,57,856 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 30,20,925 | -3,87,750 | 1,81,038 |

| 23,850 | 4,82,250 | -1,41,150 | 57,942 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,51,23,525 | 56,80,200 | 35,34,191 |

| 24,950 | 69,49,425 | 23,69,175 | 18,27,939 |

SENSEX Weekly Expiry (18/09/2025)

The SENSEX index closed at 81548.73. The SENSEX weekly expiry for SEPTEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.170 against previous 1.157. The 78000PE option holds the maximum open interest, followed by the 81500PE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 78000PE option, with open interest additions also seen in the 84000CE and 81500PE options. On the other hand, open interest reductions were prominent in the 81100CE, 80900CE, and 80800CE options. Trading volume was highest in the 81500PE option, followed by the 81500CE and 80000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81548.73 | 1.170 | 1.157 | 1.102 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 33,99,000 | 11,43,760 | 22,55,240 |

| PUT: | 39,76,740 | 13,23,260 | 26,53,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,85,600 | 2,91,640 | 11,03,420 |

| 81500 | 3,50,860 | 2,16,640 | 20,62,340 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,85,600 | 2,91,640 | 11,03,420 |

| 81500 | 3,50,860 | 2,16,640 | 20,62,340 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81100 | 12,960 | -1,840 | 21,100 |

| 80900 | 4,300 | -1,740 | 8,340 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,50,860 | 2,16,640 | 20,62,340 |

| 82000 | 2,57,840 | 1,58,100 | 11,66,740 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 4,43,660 | 3,74,920 | 8,78,000 |

| 81500 | 4,08,900 | 2,88,400 | 23,89,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 4,43,660 | 3,74,920 | 8,78,000 |

| 81500 | 4,08,900 | 2,88,400 | 23,89,860 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 4,08,900 | 2,88,400 | 23,89,860 |

| 80000 | 2,99,220 | 1,89,820 | 12,65,060 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25005.5. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.107 against previous 1.118. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 24700PE and 26000CE options. On the other hand, open interest reductions were prominent in the 25000CE, 22000PE, and 23000PE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,005.50 | 1.107 | 1.118 | 1.155 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,62,44,475 | 4,57,16,775 | 5,27,700 |

| PUT: | 5,12,09,775 | 5,10,90,900 | 1,18,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,21,725 | -1,73,475 | 74,770 |

| 26,000 | 47,56,275 | 2,23,650 | 23,170 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 47,16,975 | 3,60,525 | 45,493 |

| 26,000 | 47,56,275 | 2,23,650 | 23,170 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,21,725 | -1,73,475 | 74,770 |

| 24,800 | 13,00,800 | -58,200 | 7,835 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,21,725 | -1,73,475 | 74,770 |

| 25,500 | 47,16,975 | 3,60,525 | 45,493 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,20,075 | 47,100 | 68,355 |

| 24,500 | 43,87,275 | 1,89,075 | 38,365 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 24,82,350 | 3,09,375 | 24,624 |

| 24,500 | 43,87,275 | 1,89,075 | 38,365 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 22,17,225 | -1,40,925 | 5,179 |

| 23,000 | 29,89,350 | -1,34,025 | 13,441 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,20,075 | 47,100 | 68,355 |

| 24,500 | 43,87,275 | 1,89,075 | 38,365 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54669.6. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.013 against previous 0.979. The 57000CE option holds the maximum open interest, followed by the 54000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 54500PE option, with open interest additions also seen in the 62000CE and 54700PE options. On the other hand, open interest reductions were prominent in the 54500CE, 55000CE, and 54000CE options. Trading volume was highest in the 54500PE option, followed by the 55000CE and 54500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,669.60 | 1.013 | 0.979 | 0.861 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,57,52,940 | 1,57,81,310 | -28,370 |

| PUT: | 1,59,62,650 | 1,54,57,230 | 5,05,420 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,64,945 | 7,665 | 48,286 |

| 56,000 | 12,77,535 | 4,200 | 63,858 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 2,62,570 | 1,01,360 | 5,845 |

| 54,900 | 2,10,630 | 44,625 | 40,459 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 6,93,700 | -1,25,370 | 1,11,350 |

| 55,000 | 12,14,255 | -77,945 | 1,11,773 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,14,255 | -77,945 | 1,11,773 |

| 54,500 | 6,93,700 | -1,25,370 | 1,11,350 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,08,910 | -10,815 | 65,391 |

| 54,500 | 10,52,555 | 1,05,035 | 1,17,960 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 10,52,555 | 1,05,035 | 1,17,960 |

| 54,700 | 2,35,795 | 90,650 | 70,745 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 5,16,110 | -45,500 | 17,708 |

| 52,700 | 72,695 | -29,330 | 6,531 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 10,52,555 | 1,05,035 | 1,17,960 |

| 54,600 | 2,77,620 | 85,050 | 91,810 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26178.7. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.021 against previous 1.122. The 26500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 24500PE and 26600CE options. On the other hand, open interest reductions were prominent in the 25500PE, 26000CE, and 26100PE options. Trading volume was highest in the 26500CE option, followed by the 27000CE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,178.70 | 1.021 | 1.122 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,36,905 | 6,86,335 | 50,570 |

| PUT: | 7,52,635 | 7,70,185 | -17,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,23,565 | 6,305 | 4,070 |

| 27,000 | 88,790 | 21,515 | 2,610 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 88,790 | 21,515 | 2,610 |

| 26,600 | 23,335 | 13,585 | 698 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 56,615 | -8,450 | 1,067 |

| 26,300 | 13,390 | -4,680 | 1,361 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,23,565 | 6,305 | 4,070 |

| 27,000 | 88,790 | 21,515 | 2,610 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 87,035 | 1,170 | 2,522 |

| 24,500 | 70,460 | 14,235 | 1,234 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 70,460 | 14,235 | 1,234 |

| 24,000 | 67,990 | 12,805 | 783 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 44,005 | -45,825 | 2,196 |

| 26,100 | 36,270 | -6,175 | 2,134 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 87,035 | 1,170 | 2,522 |

| 25,500 | 44,005 | -45,825 | 2,196 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 13037.6. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.193 against previous 1.259. The 13500CE option holds the maximum open interest, followed by the 12000PE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13500CE option, with open interest additions also seen in the 12875PE and 13100PE options. On the other hand, open interest reductions were prominent in the 67800CE, 67000CE, and 71000PE options. Trading volume was highest in the 13000PE option, followed by the 13000CE and 13100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,037.60 | 1.193 | 1.259 | 1.072 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 64,37,200 | 59,69,880 | 4,67,320 |

| PUT: | 76,82,220 | 75,13,660 | 1,68,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,66,000 | 1,15,780 | 11,398 |

| 14,000 | 7,27,300 | 20,300 | 3,894 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,66,000 | 1,15,780 | 11,398 |

| 13,100 | 3,74,500 | 76,300 | 14,194 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 2,13,640 | -42,280 | 1,976 |

| 12,800 | 1,81,160 | -18,200 | 1,646 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,25,320 | 42,000 | 16,328 |

| 13,100 | 3,74,500 | 76,300 | 14,194 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,99,400 | -63,840 | 2,950 |

| 12,500 | 7,30,100 | 26,880 | 8,326 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,875 | 1,46,860 | 89,320 | 1,986 |

| 13,100 | 2,01,740 | 87,360 | 9,871 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,99,400 | -63,840 | 2,950 |

| 12,850 | 82,320 | -58,660 | 2,103 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,70,880 | 8,260 | 20,550 |

| 13,050 | 88,760 | -14,840 | 10,581 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis suggests the market is prepping for a decisive push near key expiry levels, with Nifty, BankNifty, and major indices anchoring their risk at round-number strikes. For Nifty, play strategy near the 25,000 magnet using straddles, condors, and tight stop-losses for breakout trades. Tactical traders in BankNifty and FINNIFTY should trail shorts and seize quick profits on upside spurts—watch for renewed long building once profit-booking dries up. In MIDCPNIFTY and SENSEX, position with caution but be ready as open interest shifts could open doors for sharp moves.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]